Fees for Trading Warrants and Structured Products on Euronext

Euronext's fee thresholds on structured products and how it impacts clients' trading, for both fixed and tiered commission models

Clients that place orders and trade for more than EUR 6'000 in Warrants and Structured Products will be charged a 2.5 basis points fee with a maximum of EUR 20.

The table below displays the exchange fees for warrants and structured products when trading on Euronext:

|

Product Group |

Fee |

Minimum per Trade |

Maximum per Trade |

|

Warrants & Structured Products – trade value up to EUR 6’000 |

0.00 |

N/A |

N/A |

|

Warrants & Structured Products – trade value more than EUR 6’000 |

2.50 bps |

N/A |

EUR 20 per Trade |

Calculations:

For Cost Plus (Tiered) Clients:

Example: Client wishes to trade structured products on Euronext for a total trade value of EUR 10’000.

Scenario A:

Trade value = EUR 10’000

Fee = 2.5 Bps

As the trade value is above EUR 6’000, the fee of 2.50 bps applies and therefore an additional EUR 2.50 will have to be paid for the trade.

Scenario B:

Order 1:

Trade Value = EUR 5’000

Fee = 0.00

Order 2:

Trade Value = EUR 5’000

Fee = 0.00

As the trade value of each trade is below EUR 6’000, no additional fees apply.

Note: This calculation does not impact clients on the Fixed commission schedule.

關於使用止損單的更多信息

美股市場偶爾會發生極端波動和價格混亂。 有時這類情況持續時間很長,有時又很短。止損單可能會對價格施加下行壓力、加劇市場波動,且可能使委託單在大幅偏離觸發價格的位置上成交。.

市價委托單處理

如果交易數量較大或涉及流動性不足的産品,我們會鼓勵客戶考慮使用限價委托單代替市價委托單,因爲市價委托單很容易以遠低于/遠高于當前顯示買價/賣價的價格成交,在劇烈波動的市場行情下更是如此。 爲保護客戶和IB免遭劇烈且快速的價格波動帶來的損失,IB會將客戶的市價委托單模擬成有保護的市價委托單,確定超過內部買價/賣價的百分點執行上限。儘管這一上限是在提高執行確定性和最小化價格風險之間取了平衡,但仍存在極小的可能性執行會延遲或無法執行。

此外,還應注意,某些交易所出于保護目的會對市價委托單實施其自己的價格上限或檔次限制,這些限制可能比IB的限制更嚴格,也可能更寬鬆,但都同樣會對委托單執行的速度和確定性産生影響。

添加/消耗流動性

本文旨在對交易所費用、添加/消耗流動性費用以及非組合佣金提供正確的理解。

添加或消耗流動性的概念既適用於股票,也適用於股票/指數期權。一個定單是消耗流動性還是添加流動性,取決於定單是適銷還是非適銷。

適銷定單會消耗流動性。

適銷定單要么是市價定單,要么是限價等於或高於/低於當前市價的買入/賣出限價定單。

1. 對於適銷的買入限價定單,限價等於或高於賣價。

2. 對於適銷的賣出限價定單,限價等於或低於買價。

舉例:

XYZ股票當前賣價尺寸/價格為400股/46.00。您輸入一個買入限價定單,即以46.01的價格買入100股XYZ股票。由於定單馬上就能執行,其將被視為適銷定單。如果交易所會對消耗流動性收費,則客戶將需繳納該費用。

非適銷定單是限價低於/高於當前市價的買入/賣出限價定單。

1. 對於非適銷的買入限價定單,限價低於賣價。

2. 對於非適銷的賣出限價定單,限價高於買價。

舉例:

XYZ股票當前賣價尺寸/價格為400股/46.00。您輸入一個買入限價定單,即以45.99的價格買入100股XYZ股票。由於定單將被作為最佳買價發布至市場,而不會立即執行,其將被視為非適銷定單。

若有人發送了一個適銷的賣出定單,從而使您的買入限價定單得以執行,則如果有添加流動性返點,您會收到一定折扣(返點)。

請注意:

1. 所有交易期權的賬戶均需就消耗/添加流動性繳納/享受期權交易所費用或返點。

2. 根據IB網站,消耗/添加流動性費用表下只有負數才是折扣(返點)。

https://www.interactivebrokers.com.hk/cn/index.php?f=2356

IEX Discretionary Peg Order

IEX offers a Discretionary Peg™ (D-Peg™) order type which is a non-displayed order that is priced at either the National Best Bid (NBB for buys) or National Best Offer (NBO for sells). D-Peg™ orders passively rest on the book while seeking to access liquidity at a more aggressive price up to Midpoint of the NBBO, except when IEX determines that the quote is transitioning to less aggressive price

How to Place a D-Peg Order

Please note, the IEX D-Peg order type is only available via the TWS version 961 and above. Instructions for entering this order type are outlined below:

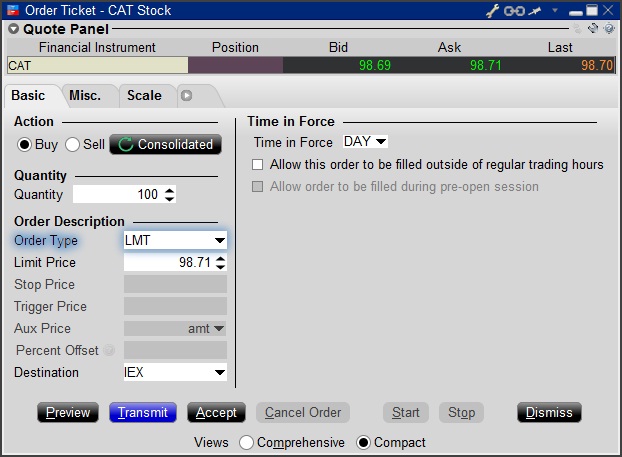

Step 1

Enter a symbol and choose a directed quote, selecting IEX as the destination. Right click on the data line and select Trade followed by Order Ticket to open the Order Ticket window.

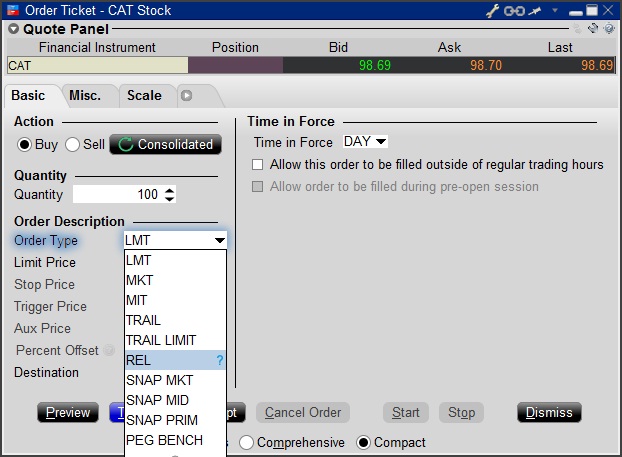

Step 2

Select the REL order type from the Order Type drop down menu.

Step 3

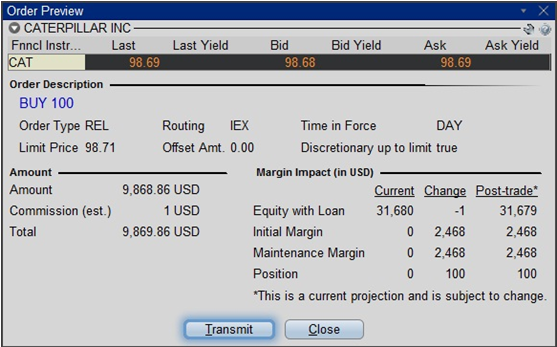

Click on the Miscellaneous tab (Misc.) and at the bottom there will be a checkbox for "Discretionary up to limit". Check this box. The price that you set in the Limit Price field will be used at the discretionary price on the order.

.jpg)

Step 4

Hit Preview to view the Order Preview window.

For additional information concerning this order type, please review the following exchange website link: https://www.iextrading.com/trading/dpeg/

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

中華通—滬港通/深港通

滬港通與深港通(統稱“中華通”) 是一項互聯互通機制,香港和國際投資者可以通過香港聯合交易所有限公司(以下簡稱“香港聯交所”)及其清算所交易并清算上海證券交易所(以下簡稱“上交所”)和深圳證券交易所(以下簡稱“深交所”)的上市股票。

上交所/深交所有不同類型的掛牌證券,但滬港通和深港通目前階段只能交易A股(在中國證券交易所交易的大陸公司股票)。

滬股通股票包括所有上證180指數與上證380指數的成分股,以及不在上述指數成份股內但有H股同時在聯交所上市及買賣的上交所A股。

深港通股票包括深證成份指數和深證中小創新指數成份股中所有市值不少於60億元人民幣的成份股,以及有相關H股在聯交所上市的所有深交所上市A股。

盈透交易上交所/深交所證券的佣金

與交易港股的佣金相同,盈透只向客戶收取交易額的0.08%作為佣金費用,每筆定單的最低佣金為15元人民幣。交易所要求的交易所費用、清算費用和印花稅將另行徵收。費用詳情請參見滬港通及深港通–北向交易費用表。

每日額度

通過滬港通和深港通達成的交易設有每日額度限制。每日額度根據“淨買槃”計算,會限制滬港通和深港通下每日跨境交易的最高買槃淨額。

如果北向每日額度余額在開市集合競價時段降至零或交易已超過余額,則新的買槃將被駁回。如果北向每日額度余額在持續競價時段或收槃集合競價時段降至零或交易已超過余額,則當天都不會再接受買槃。聯交所將於下一交易日再恢復北向買槃服務。

聯交所也會公布總額度和每日額度的余額情況。

詳情請參見聯交所滬港通/深港通常見問題或聯交所滬港通/深港通規則1407

滬港通/深港通交易信息

|

交易貨幣 |

人民幣 |

|

定單類型 |

盈透提供多種定單類型,但會以限價定單的形式執行交易。詳情請參見我們的網站。

|

|

最低上落價位/價差d |

統一為人民幣0.01元 |

|

每手單位 |

100股(僅適用於買槃) |

|

碎股 |

僅限賣槃(應只在一個定單中出現碎股) |

|

最大買賣槃 |

100萬股 |

|

價格限制 |

前一日收槃價的±10%(對於被納入風險警示版的股票,即ST和*ST股票,則為前一日收槃價的±5%) |

|

日內(回轉)交易 |

不允許 |

|

大宗交易 |

不支持 |

|

非自動對槃交易 |

不支持 |

|

定單修改 |

盈透會取消并替換定單 |

|

結算周期 |

證券:T 滬港通/深港通交易的現金款項:T+1 外匯*:T+2 |

*由於結算周期不同步,交易離岸人民幣的客戶應於股票交易的前一日(T-1)執行外匯交易,以避免不必要的利息(在不涉及假日的證券結算程序下)。

交易時段(香港時間)

|

上交所/深交所交易時段 |

交易時間 |

|

開市集合競價 |

09:15 - 09:25 |

|

連續競價(早市) |

09:30 – 11:30 |

|

連續競價(午市) |

13:00 – 14:57 |

|

收市集合競價 |

14:57 – 15:00 |

注:上交所和深交所在上午09:20到09:25和下午14:57到15:00之間不受理取消定單的請求。

半日市

若某一北向交易日為香港市場的半日市,則北向交易將繼續開放直至相關中華通市場收市。有關滬股通及深股通的節假日交易安排和其它信息,請參見香港交易所網站。

披露責任

如果客戶持有或控制中國內地上市發行人已發行股份達5%,則其必須於達到5%的三個工作日內以書面形式向中國證監會及相關交易所上報,并通知該上市發行人。

在這一三個工作日的通知期內,客戶不得繼續買賣有關上市發行人的股份。更多信息請訪問IBKR知識庫。

持股限制

單個境外投資者在一家中國內地上市公司的持股比例不得超過該公司已發行股份總數的10%;所有境外投資者在一家上市公司A股的持股比例總和不得超過該公司已發行股份總數的30%。更多信息請訪問IBKR知識庫。

強制出售

根據現行中國內地法規,每位盈透客戶在一家上交所/深交所掛牌公司的持股不得超過該公司已發行股份總數的指定百分比。如果持股超出以下指定比例, 香港交易所將要求客戶執行強制出售安排

|

情境 |

持股 |

|

單個境外投資者 |

大於等於掛牌公司已發行股份總數的10% |

|

所有境外投資者 |

大於等於掛牌公司已發行股份總數的30% |

保證金融資

中華通證券的保證金交易將受到限制,僅部分A股可以進行保證金交易。上交所和深交所會不時更新可以使用保證金的證券名單,詳情請參見香港交易所網站。

根據上交所和深交所相關規定,如果某只A股保證金交易活動的交易量超出規定的上限,則上交所和深交所可暫停該股票在其市場的保證金交易活動。保證金交易量降至規定上限以下時,市場會再恢復該股票的保證金交易活動。

可供借貸股票

中華通證券的股票借貸受上交所和深交所的限制規限,有關內容已納入聯交所的《交易所規則》之中。

盈透暫時不提供此項服務。

合資格賣空證券

供賣空用的證券借貸將僅限於可通過滬港通和深港通同時買入和賣出的中華通證券,即不包括只可賣出的中華通證券。

盈透暫時不提供此項服務。

深圳交易所創業版股票及上海交易所科創版股票之交易

僅機構投資者可買賣深圳交易所創業版股票及上海交易所科創版股票。

節假日安排

客戶只能在香港及內地市場均開放交易且兩地銀行於相應的結算日均開放服務的工作日交易中華通。此安排將確保兩地市場投資者和經紀商可在相關結算日通過銀行收發相關款項。

下表列舉了上交所/深交所證券北向交易的節假日安排:

|

|

內地 |

香港 |

是否開放北向交易 |

|

第一天 |

工作日 |

工作日 |

開放 |

|

第二天 |

工作日 |

工作日 |

不開放,款項結算日當天香港市場不開市 |

|

第三天 |

工作日 |

公共假日 |

不開市,交易日當天香港市場不開市 |

|

第四天 |

公共假日 |

工作日 |

不開放,內地市場不開市 |

惡劣天氣情況

惡劣天氣情況下的交易安排可參見香港交易所網站。

在哪里可以了解更多信息?

要了解有關滬港通和深港通的更多信息,請點擊下方的交易所網站鏈接:

如關於滬港通/深港通有任何疑問,請聯系盈透客戶服務獲取更多信息。

Hong Kong - China Stock Connect

Hong Kong – China Stock Connect (“China Connect”) is a mutual market access program through which Hong Kong and international investors can trade shares listed on the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) via the Stock Exchange of Hong Kong (SEHK) and their existing clearinghouse. As a member of SEHK, IBKR provides you with direct access to trade with eligible listed products on the Shanghai and Shenzhen Stock Exchange. IBKR clients with China Connect trading permissions will be eligible to trade SSE/SZSE securities through Shanghai and Shenzhen - Stock Connect.

Among the different types of SSE/SZSE-listed securities, only A shares (shares in mainland China-based companies that trade on Chinese stock exchange) are included in the Shanghai and Shenzhen Stock Connect.

Shanghai Connect includes all the constituent stocks of the SSE 180 Index, SSE 380 Index and all the SSE-listed A shares that have corresponding H shares listed on the SEHK.

Product List and Stock Codes for SSE

Shenzhen Connect includes all the constituent stocks of the SZSE Component Index, the SZSE Small/Mid Cap Innovation Index that have a market capitalization of not less than RMB 6 billion and all the SZSE-listed A shares that have corresponding H shares listed on SEHK.

Product List and Stock Codes for SZSE

IBKR Commission for Trading SSE/SZSE Securities

Same as trading Hong Kong stocks, IBKR charges only 0.08% of trade value as a commission with a minimum CNH 15 per order. Detailed fee rates can be found in the Hong Kong – China Stock Connect Northbound fee table.

Daily Quota

Trading under Shanghai Connect and Shenzhen Connect is subject to a Daily Quota. The Daily Quota is applied on a “net buy” basis. The Daily Quota limits the maximum net buy value of cross-boundary trades under Shanghai Connect and Shenzhen Connect each day.

If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected. Or if it happens during a continuous auction session or closing call auction session, no further buy orders will be accepted for the remainder of the day. SEHK will resume the Northbound buying service on the following trading day.

SEHK will also publish the remaining balance of the Aggregate Quota and Daily Quota.

For details, please refer to HKEX Stock Connect FAQ or HKEX Stock Connect Rule 1407

Trading Information of Shanghai and Shenzhen Connect

|

Trading currency |

RMB |

|

Order Type |

IBKR offers various order types but will stimulate the order into limit order for execution. More information can be referred to our website.

|

|

Tick Size / Spread |

Uniform at RMB 0.01 |

|

Board Lot |

100 shares (applicable for buyers only) |

|

Odd Lot |

Sell orders only (odd lot should be made in one single order) |

|

Max Order Size |

1 million shares |

|

Price Limit |

±10% on previous closing price (±5% for stocks under special treatment under risk alert, i.e. ST and *ST stocks) |

|

Day (Turnaround) Trading |

Not allowed |

|

Block Trade |

Not available |

|

Manual Trade |

Not available |

|

Order Modification |

IBKR will cancel and replace the order for any order modification |

|

Settlement cycle |

Securities: Settlement on T day Cash from China Connect trades: Settlement on T+1 day Forex*: Settlement on T+2 day |

*Due to the unsynchronized settlement cycle, clients who exchange CNH themselves should execute the Forex trade one day prior to the stock trade (T-1) to avoid the extra day’s interest payment (considering normal settlement without involving holidays).

Trading Hours

|

SSE/SZSE Trading Sessions |

SSE/SZSE Trading Hours |

|

Opening Call Auction |

09:15 - 09:25 |

|

Continuous Auction (Morning) |

09:30 – 11:30 |

|

Continuous Auction (Afternoon) |

13:00 – 14:57 |

|

Closing Call Auction |

14:57 – 15:00 |

Half-day Trading

If a Northbound trading day is a half-trading day in the Hong Kong market, it will continue until respective Connect Market is closed. Refer to the exchange website for holiday trading arrangements and additional information.

Disclosure Obligation

If client holds or controls up to 5% of the issued shares of China Connect, the client is required to report in writing to the China Securities Regulatory Commission (“CSRC”) and the relevant exchange, and inform the Mainland listed company within three working days of reaching 5%.

The client is not allowed to continue purchasing or selling shares in that Mainland listed company during the three days notification period. Visit the IBKR Knowledge Base for more information.

Shareholding Restriction

A single foreign investor’s shareholding in a Mainland listed company is not allowed to exceed 10% of the company’s total issued shares, while all foreign investors’ shareholding in the A shares of the listed company is not allowed to exceed 30% of its total issued shares. Visit the IBKR Knowledge Base for more information.

Forced-sale Arrangement

Each IBKR client is not allowed to hold more than a specific percentage of the China Connect listing company's total issued shares. HKEX requires the client to follow the forced-sell requirements if the shares exceed the limit:

|

Situation |

Shareholding (in a listed company) |

|

A single foreign investor |

> = 10% of the company’s total issued shares |

|

All foreign investors |

> = 30% of the company’s total issued shares |

Margin Financing

Margin trading in China Connect securities will subject to restrictions and only certain A shares will be eligible for margin trading. Eligible Securities, as determined by SSE and SZSE from time to time, are listed on the HKEX website.

According to the relevant rules of SSE and SZSE, either market may suspend margin trading activities in specific A shares when the volume of margin trading activities for a specific A share exceeds the prescribed threshold. The market will resume margin trading activities in the affected A share when its volume drops below a prescribed threshold.

Stock Borrowing and Lending (SBL)

SBL in China Stock Connect Securities is subject to restrictions set by the SSE or SZSE and stated in the Rules of the Exchange.

IBHK does not offer this service at the moment.

Eligible Short Selling Securities

SBL for the purpose of short selling will be limited to those China Stock Connect Securities that are eligible for both buy orders and sell orders through Shanghai and Shenzhen Connect (i.e., excluding Connect Securities that are only eligible for sell orders).

IBHK does not offer this service at the moment.

Trading Shenzhen ChiNext and Shanghai Star shares

Trading Shenzhen ChiNext and Shanghai Star shares are limited to institutional professional investors.

Holidays

Clients will only be allowed to trade China Connect on days where Hong Kong and Mainland markets are both open for trading and banking services are available in both Hong Kong and Mainland markets on the corresponding settlement days. This arrangement is essential in ensuring that investors and brokers will have the necessary banking support on the relevant settlement days when they will be required to make payments.

The following table illustrates the holiday arrangement of Northbound trading of SSE/SZSE Securities:

|

|

Mainland |

Hong Kong |

Open for Northbound Trading |

|

Day 1 |

Business Day |

Business Day |

Yes |

|

Day 2 |

Business Day |

Business Day |

No, HK market closes on money settlement day |

|

Day 3 |

Business Day |

Public Holiday |

No, HK market closes on trading day |

|

Day 4 |

Public Holiday |

Business Day |

No, Mainland market closes |

Severe Weather Conditions

Information on the trading arrangement available under severe weather conditions can found on the HKEx website.

Where to Learn More?

Please refer to the following exchange website links for additional information regarding Hong Kong China Stock Connect:

If you have any questions regarding Hong Kong-China Stock Connect, please contact IBKR Client Services for further information.

IPO Considerations

An Initial Public Offering, or IPO, is defined as the first sale of stock by a company to the public. As IB generally does not operate as an underwriter or selling agent of IPO shares, the first opportunity customers have to transact in such shares does not take place until the issue begins trading in the secondary market. Outlined below are key issues which customers should consider when transacting in shares on their first day of listing:

1. Margin

As IPOs are inherently subject to a high degree of uncertainty as to price and liquidity once secondary market trading begins, each new issue is subject to a review to determine whether initial and maintenance margin requirements above the minimum which is required by regulation is warranted. Current margin information is made available through the "Check Margin" feature on the trading platform. Customers should also note that IB reserves the right to change margin on an intraday basis and without advance notice when warranted.

2. Order Entry

IB monitors for upcoming IPOs and makes every effort to provide customers the ability to enter orders in advance of the day at which trading begins in the secondary market. In certain circumstances, either IB and/or the exchange may impose restrictions on the type of orders which may be accepted as well as the time in force conditions associated with such orders. It should also be noted that orders not direct-routed to the primary exchange may be subject to special auction handling and therefore may receive a different opening print from that of the primary exchange. In addition, as the price at which the issue trades once available in the secondary market may differ significantly from the IPO price, customers are strongly encouraged to use limit orders when.

3. Short Availability

Customers should assume that IPO issues will not be available for shorting immediately upon trading in the secondary market. This limitation is a function of regulations which require the broker to locate and make a good faith determination that shares are available to borrow at settlement coupled with the likelihood that such shares will not be available (due to underwriter lending restrictions and the fact that secondary market transactions have not yet settled).