Fees for Trading Warrants and Structured Products on Euronext

Euronext's fee thresholds on structured products and how it impacts clients' trading, for both fixed and tiered commission models

Clients that place orders and trade for more than EUR 6'000 in Warrants and Structured Products will be charged a 2.5 basis points fee with a maximum of EUR 20.

The table below displays the exchange fees for warrants and structured products when trading on Euronext:

|

Product Group |

Fee |

Minimum per Trade |

Maximum per Trade |

|

Warrants & Structured Products – trade value up to EUR 6’000 |

0.00 |

N/A |

N/A |

|

Warrants & Structured Products – trade value more than EUR 6’000 |

2.50 bps |

N/A |

EUR 20 per Trade |

Calculations:

For Cost Plus (Tiered) Clients:

Example: Client wishes to trade structured products on Euronext for a total trade value of EUR 10’000.

Scenario A:

Trade value = EUR 10’000

Fee = 2.5 Bps

As the trade value is above EUR 6’000, the fee of 2.50 bps applies and therefore an additional EUR 2.50 will have to be paid for the trade.

Scenario B:

Order 1:

Trade Value = EUR 5’000

Fee = 0.00

Order 2:

Trade Value = EUR 5’000

Fee = 0.00

As the trade value of each trade is below EUR 6’000, no additional fees apply.

Note: This calculation does not impact clients on the Fixed commission schedule.

外匯(FX)入門

IB提供的交易場所和交易平臺既適用於專注外匯交易的交易者也適用於因多幣種股票和/或衍生品交易需要偶爾進行外匯交易的交易者。下方文章概述了在TWS平臺上下達外匯定單的基本要點以及報價管理和頭寸報告相關信息。

外匯(FX)交易涉及同時買入一種貨幣並賣出另一種貨幣,兩種貨幣組合在一起通常被稱為交叉貨幣對。在下方例子中,EUR.USD交叉貨幣對中的前一種貨幣(EUR)為交易者想買入或賣出的交易貨幣,後一種貨幣(USD)則為結算貨幣。

跳轉至指定主題;

外匯報價

貨幣對即外匯市場上一種貨幣單位相對於另一種貨幣單位的相對價值的報價。用以作為參考的貨幣被稱為報價貨幣,而參考該貨幣給出報價的貨幣則被稱為基礎貨幣。在TWS中,每個貨幣對有一個交易代碼。您可以使用外匯交易者(FXTrader)調換報價方向。交易者買入或賣出基礎貨幣的同時在賣出或買入報價貨幣。例如,EUR/USD貨幣對的代碼為:

EUR.USD

其中:

- EUR為基礎貨幣

- USD為報價貨幣

上方貨幣對的價格表示需要多少單位的USD(報價貨幣)能交易一個單位的EUR(基礎貨幣)。也就是說,1 EUR是在按USD報價。

EUR.USD的買單表示買入EUR並賣出同等金額的USD,具體取決於交易價格。

創建報價行

在TWS添加外匯報價行具體步驟如下:

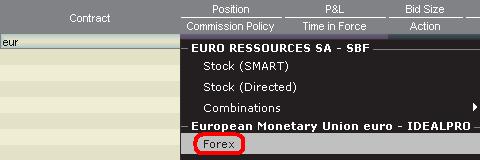

1. 輸入交易貨幣(如EUR),然後按回車鍵(enter)。

2. 選擇產品類型——外匯

3. 選擇結算貨幣(如USD),然後選擇外匯交易場所。

.jpg)

注:

IDEALFX對於超過其最低數量要求(通常為25,000美元)的定單可直接接入銀行間外匯報價。傳遞到IDEALFX但未達到其最低數量要求的定單基本會被自動傳遞到小額定單交易場所進行外匯轉換。點擊此處瞭解IDEALFX的最低數量要求和最高數量限制相關信息。

外匯交易商會按特定方向對外匯貨幣對進行報價。因此,交易者需通過調整輸入的貨幣代碼來查找想要的貨幣對。例如,如果輸入貨幣代碼CAD,交易者會發現合約選擇窗口中沒有結算貨幣USD。這是因為,該貨幣對是按USD.CAD報價的,只能先輸入底層代碼USD,然後再選擇貨幣對。

下單

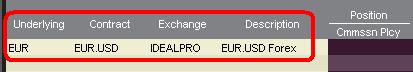

具體取決於顯示的欄標頭,貨幣對將顯示如下:

合約(Contract)和描述(Description)欄將按交易貨幣.結算貨幣的形式顯示貨幣對(如EUR.USD)。底層代碼(Underlying)欄則只顯示交易貨幣。

點擊此處瞭解如何更改更改顯示的數據欄標頭。

1. 要輸入定單,左鍵點擊買價(下賣單)或賣價(下買單).

2. 指定想要買入或賣出的交易貨幣的數量。定單的數量按基礎貨幣(即貨幣對中的前一種貨幣)顯示。

盈透證券在外匯交易上沒有代表固定金額基礎貨幣的合約的概念,您的交易尺寸便是所需交易的基礎貨幣金額。

例如,100,000單位EUR.USD的買單會買入100,000單位EUR,並根據顯示的匯率賣出等值USD。

3. 指定想使用的定單類型、匯率(價格),然後傳遞定單。

注:下達的定單必須是完整的貨幣單位,除上述交易場所最低數量要求外,沒有最低合約或手數要求。

點值

點(pip)是貨幣對變化的衡量單位,對於大多數貨幣對來說其代表最小變化,但有時也允許存在非整點的變化。

例如,在EUR.USD中,1個點是0.0001,而在USD.JPY中,1個點事0.01。

要計算報價貨幣1個點的點值,可採用以下公式:

(名義金額) x (1個點)

例如:

- 代碼 = EUR.USD

- 金額 = 100,000 EUR

- 1個點 = 0.0001

1個點點值 = 100’000 x 0.0001= 10 USD

- 代碼 = USD.JPY

- 金額 = 100’000 USD

- 1個點 = 0.01

1個點點值 = 100’000 x (0.01)= JPY 1000

要計算基礎貨幣1個點的點值,可採用以下公式:

(名義金額) x (1個點/匯率)

例如:

- 代碼 = EUR.USD

- 金額 = 100’000 EUR

- 1個點 = 0.0001

- 匯率 = 1.3884

1個點點值 = 100’000 x (0.0001/1.3884)= 7.20 EUR

- 代碼 = USD.JPY

- 金額 = 100’000 USD

- 1個點 = 0.01

- 匯率 = 101.63

1個點點值 = 100’000 x (0.01/101.63)= 9.84 USD

頭寸(交易後)報告

外匯頭寸信息是在IB進行交易的一個重要方面,在真實賬戶中開始交易之前需對其進行充分瞭解。IB的交易軟件在兩個不同的地方反映了外匯頭寸,二者均可在賬戶窗口查看。

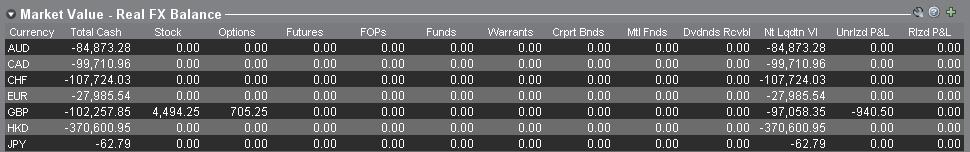

1. 市場價值

賬戶窗口的市場價值部分反映的是實時貨幣頭寸,按貨幣(而非貨幣對)顯示。

賬戶窗口的市場價值部分是唯一一個可供交易者查看實時外匯頭寸信息的地方。持有多種貨幣頭寸的交易者不一定要使用開倉時用的貨幣對來平倉。例如,買了EUR.USD(買EUR賣USD)還買了USD.JPY(買USD賣JPY)的交易者也可以通過交易EUR.JPY(賣EUR買JPY)來平倉頭寸。

注:

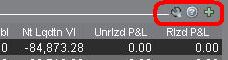

市場價值部分可展開/收起。交易者應點擊淨清算價值欄上方的符號確保顯示出綠色“減號”。如果是綠色“加號“,某些頭寸可能被隱藏。

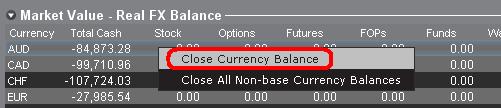

交易者可以從市場價值部分發起平倉交易:右鍵點擊想要平倉的貨幣,選擇”平倉貨幣餘額“或”平倉所有非基礎貨幣餘額“。

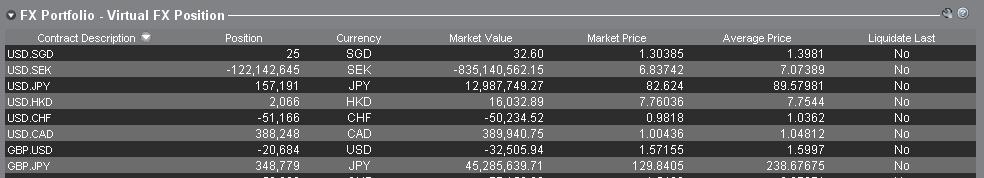

2. 外匯投資組合

賬戶窗口的外匯投資組合部分展示的是虛擬頭寸,以貨幣對的形式顯示頭寸信息,這與市場價值部分按貨幣顯示不同。這種特定的顯示形式是為了考慮機構外匯交易者的常用慣例,零售或非頻繁外匯交易者基本上可以無視該部分信息。外匯投資組合的頭寸數量並不反映所有外匯活動,但是,交易者可以對此部分顯示的頭寸數量和平均成本進行修改。這一無需執行交易便可隨意調整頭寸和平均成本信息的功能對於除交易非基礎貨幣產品外還參與其它貨幣交易的交易者可能會有幫助。其可讓交易者手動將自動貨幣轉換(交易非基礎貨幣產品時會自動發生)與單純的外匯交易活動分隔開來。

外匯投資組合部分的外匯頭寸和盈虧信息均來自所有其它交易窗口顯示的信息。這在確定真實的實時頭寸信息時可能會造成一定困惑。為減少或消除此類困惑,交易者可以選擇以下操作:

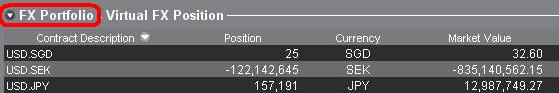

a. 收起外匯投資組合部分

點擊外匯投資組合(FX Portfolio)文字左邊的箭頭可收起外匯投資組合部分。收起該部分後,虛擬頭寸信息便不再在各交易頁面顯示。(注:這並不會讓市場價值信息顯示出來,其只會阻止外匯投資組合信息顯示。)

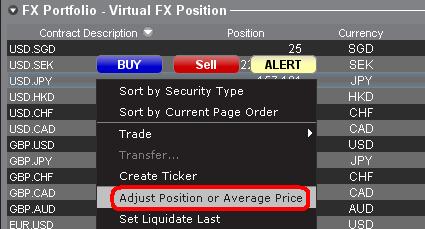

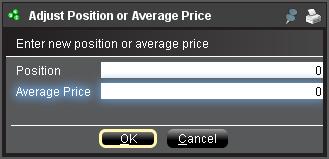

b. 調整頭寸或平均價格

右鍵點擊賬戶窗口的外匯投資組合部分,交易者可以選擇調整頭寸或平均價格。交易者平倉掉所有非基礎貨幣頭寸並確定市場價值部分反映了被平倉的所有非基礎貨幣頭寸後,便可將頭寸和平均價格區域重置為0。此操作會重置外匯投資組合部分的頭寸數量,可讓交易者在交易界面看到更加準確的頭寸和盈虧信息。(注:這是手動操作,每次貨幣頭寸平倉後都需進行一次)。交易者應隨時對市場價值部分的頭寸信息進行確認,確保傳遞的定單達到開倉或平倉頭寸想要的結果)

我們鼓勵交易者在真實賬戶中開始交易前,先在模擬交易或演示賬戶中熟悉一下外匯交易。如關於以上信息仍有任何疑問,請聯繫IB。

其它常見問題:

Order Rejection on the Tel Aviv Stock Exchange (TASE)

According to the TASE regulations each stock has a minimum order size for regular trading. The size is a stock specific calculation of a minimal monetary value at the beginning of each month. Where the value for a stock in the TA-35 index is 5000 NIS and anything outside of this is 2’000.

- Example

- Minimum Size Calculation Example:

- Bank Leumi share's closing price is 1000 NIS on the 1st of the Month

- Min Size is 5000/1000 = 5

- Order Placement

- Successful order: 5 LEUMI Shares

- Unsuccessful order: 4 LEUMI Shares

- Minimum Size Calculation Example:

|

|

Sunday

|

Mon - Thu

|

|

Pre-Opening start

|

9:00

|

|

|

Theoretical Price start

|

9:10

|

|

|

Opening Auction start

|

9:45-9:46

|

|

|

Continuous Trade Phase Start

|

9:45-9:46

|

|

|

Pre-closing & theoretical prices start

|

16:14 -16:15

|

17:14-17:15

|

|

Closing Auction & end of trade

|

16:24 -16:25

|

17:24-17:25

|

Intermarket Sweep

An intermarket sweep order is generally a large quantity limit order that is sent to multiple exchanges simultaneously. The trader submitting this type of order is required to fulfill Regulation NMS order protection obligations and exchange rules by simultaneously sending orders to market centers with better prices than the defined order limit.

Traders may see, on occasion, execution prices reported to time and sales that are at price levels through an order that they may have had working at the time. Some time and sales service providers reflect these prints with a special designation (intermarket sweep). The TWS software does not display these designations, therefore, it may appear as if a order was due an execution when it may not have been.

This article is being written in attempt to assist traders in understanding intermarket sweep transactions.

When an intermarket sweep order is being executed, only the inside quote (NBBO) at each available exchange is "protected". This means that orders resting on an exchange at prices that are inferior to the best bid or ask prices at the time of the intermarket sweep print are not considered to be "protected" and may be traded through.

Example:

- An order is submitted in the pre market to sell at a price of 40.80 and is sent to exchange A.

- The best offer price on exchagne A is 40.63.

- Exchange B receives an intermarket sweep order to buy 800 shares of the stock at a limit price of 40.88.

- The best offer price on exchange B is 40.88

The trader that enters the intermarket sweep order would be required to fulfill their Regulation NMS requirement by executing the maximum available quantity on exchange A at 40.63 and then may execute the balance of the order on exchange B at 40.88 even though it is at a price that is inferior to the 40.80 order resting in the book on exchagne A. The 40.80 price is not the inside quote and is therefore not "protected" in terms of the balance of the sweep order executing at exchange B at a price of 40.88.

A wealth of information is available on the web regarding intermarket sweep orders and SEC regulation NMS. The following are some links that may be useful in terms of providing additional information on these topics;

Each exchange has rules that define how intermarket sweep orders are handled. The following are reference links to the rulebooks of the primary exchanges where traders can find more informaiton on intermarket sweep order handling;

An Introduction to Forex (FX)

IB offers market venues and trading platforms which are directed towards both forex-centric traders as well as traders whose occasional forex activity originates from multi-currency stock and/or derivative transactions. The following article outlines the basics of forex order entry on the TWS platform and considerations relating to quoting conventions and position (post-trade) reporting.

A forex (FX) trade involves a simultaneous purchase of one currency and the sale of another, the combination of which is commonly referred to as a cross pair. In the examples below the EUR.USD cross pair will be considered whereby the the first currency in the pair (EUR) is known as the transaction currency that one wishes to buy or sell and the second currency (USD) the settlement currency.

Jump to a specific topic in this article;

- Forex Price Quotes

- Creating a quote line

- Creating an order

- Pip Value

- Position (Post-Trade) Reporting

Forex Price Quotes

A currency pair is the quotation of the relative value of a currency unit against the unit of another currency in the foreign exchange market. The currency that is used as reference is called quote currency, while the currency that is quoted in relation is called base currency. In TWS we offer one ticker symbol per each currency pair. You could use FXTrader to reverse the quoting. Traders buy or sell the base currency and sell or buy the quote currency. For ex. the EUR/USD currency pair’s ticker symbol is:

EUR.USD

where:

- EUR is the base currency

- USD is the quote currency

The price of the currency pair above represents how many units of USD (quote currency) are required to trade one unit of EUR (base currency). Said in other words, the price of 1 EUR quoted in USD.

A buy order on EUR.USD will buy EUR and sell an equivalent amount of USD, based on the trade price.

Creating a quote line

The steps for adding a currency quote line on the TWS are as follows:

1. Enter the transaction currency (example: EUR) and press enter.

2. Choose the product type forex

3. Select the settlement currency (example: USD) and choose the forex trading venue.

.jpg)

Notes:

The IDEALFX venue provides direct access to interbank forex quotes for orders that exceed the IDEALFX minimum quantity requirement (generally 25,000 USD). Orders directed to IDEALFX that do not meet the minimum size requirement will be automatically rerouted to a small order venue principally for forex conversions. Click HERE for information regarding IDEALFX minimum and maximum quantities.

Currency dealers quote the FX pairs in a specific direction. As a result, traders may have to adjust the currency symbol being entered in order to find the desired currency pair. For example, if the currency symbol CAD is used, traders will see that the settlement currency USD cannot be found in the contract selection window. This is because this pair is quoted as USD.CAD and can only be accessed by entering the underlying symbol as USD and then choosing Forex.

Creating an order

Depending on the headers that are shown, the currency pair will be displayed as follows;

The Contract and Description columns will display the pair in the format Transaction Currency.Settlement Currency (example: EUR.USD). The Underlying column will display only the Transaction Currency.

Click HERE for information regarding how to change the shown column headers.

1. To enter an order, left click on the bid (to sell) or the ask (to buy).

2. Specify the quantity of the trading currency you wish to buy or sell. The quantity of the order is expressed in base currency, that is the first currency of the pair in TWS.

Interactive Brokers does not know the concept of contracts that represent a fixed amount of base currency in Foreign exchange, rather your trade size is the required amount in base currency.

For example, an order to buy 100,000 EUR.USD will serve to buy 100,000 EUR and sell the equivalent number of USD based on the displayed exchange rate.

3. Specify the desired order type, exchange rate (price) and transmit the order.

Note: Orders may be placed in terms of any whole currency unit and there are no minimum contract or lot sizes to consider aside from the market venue minimums as specified above.

Common Question: How is an order entered using the FX Trader?

Pip Value

A pip is measure of change in a currency pair, which for most pairs represents the smallest change, although for others changes in fractional pips are allowed.

For ex. in EUR.USD 1 pip is 0.0001, while in USD.JPY 1 pip is 0.01.

To calculate 1 pip value in units of quote currency the following formula can be applied:

(notional amount) x (1 pip)

Examples:

- Ticker symbol = EUR.USD

- Amount = 100,000 EUR

- 1 pip = 0.0001

1 pip value = 100’000 x 0.0001= 10 USD

- Ticker symbol = USD.JPY

- Amount = 100’000 USD

- 1 pip = 0.01

1 pip value = 100’000 x (0.01)= JPY 1000

To calculate 1 pip value in units of base currency the following formula can be applied:

(notional amount) x (1 pip/exchange rate)

Examples:

- Ticker symbol = EUR.USD

- Amount = 100’000 EUR

- 1 pip = 0.0001

- Exchange rate = 1.3884

1 pip value = 100’000 x (0.0001/1.3884)= 7.20 EUR

- Ticker symbol = USD.JPY

- Amount = 100’000 USD

- 1 pip = 0.01

- Exchange rate = 101.63

1 pip value = 100’000 x (0.01/101.63)= 9.84 USD

Position (Post-Trade) Reporting

FX position information is an important aspect of trading with IB that should be understood prior to executing transactions in a live account. IB's trading software reflects FX positions in two different places both of which can be seen in the account window.

1. Market Value

The Market Value section of the Account Window reflects currency positions in real time stated in terms of each individual currency (not as a currency pair).

The Market Value section of the Account view is the only place that traders can see FX position information reflected in real time. Traders holding multiple currency positions are not required to close them using the same pair used to open the position. For example, a trader that bought EUR.USD (buying EUR and selling USD) and also bought USD.JPY (buying USD and selling JPY) may close the resulting position by trading EUR.JPY (selling EUR and buying JPY).

Notes:

The Market Value section is expandable/collapsible. Traders should check the symbol that appears just above the Net Liquidation Value Column to ensure that a green minus sign is shown. If there is a green plus symbol, some active positions may be concealed.

Traders can initiate closing transactions from the Market Value section by right clicking on the currency that they wish to close and choosing "close currency balance" or "close all non-base currency balances".

2. FX Portfolio

The FX Portfolio section of the account window provides an indication of Virtual Positions and displays position information in terms of currency pairs instead of individual currencies as the Market Value section does. This particular display format is intended to accommodate a convention which is common to institutional forex traders and can generally be disregarded by the retail or occasional forex trader. FX Portfolio position quantities do not reflect all FX activity, however, traders have the ability to modify the position quantities and average costs that appear in this section. The ability to manipulate position and average cost information without executing a transaction may be useful for traders involved in currency trading in addition to trading non-base currency products. This will allow traders to manually segregate automated conversions (which occur automatically when trading non base currency products) from outright FX trading activity.

The FX portfolio section drives the FX position & profit and loss information displayed on all other trading windows. This has a tendency to cause some confusion with respect to determining actual, real time position information. In order to reduce or eliminate this confusion, traders may do one of the following;

a. Collapse the FX Portfolio section

By clicking the arrow to the left of the word FX Portfolio, traders can collapse the FX Portfolio section. Collapsing this section will eliminate the Virtual Position information from being displayed on all of the trading pages. (Note: this will not cause the Market Value information to be displayed it will only prevent FX Portfolio information from being shown.)

b. Adjust Position or Average Price

By right clicking in the FX portfolio section of the account window, traders have the option to Adjust Position or Average Price. Once traders have closed all non base currency positions and confirmed that the market value section reflects all non base currency positions as closed, traders can reset the Position and Average Price fields to 0. This will reset the position quantity reflected in the FX portfolio section and should allow traders to see a more accurate position and profit and loss information on the trading screens. (Note: this is a manual process and would have to be done each time currency positions are closed out. Traders should always confirm position information in the Market Value section to ensure that transmitted orders are achieving the desired result of opening or closing a position.

We encourage traders to become familiar with FX trading in a paper trade or DEMO account prior to executing transactions in their live account. Please feel free to Contact IB for additional clarification on the above information.

Other common questions:

Equity & Index Option Position Limits

Equity option exchanges define position limits for designated equity options classes. These limits define position quantity limitations in terms of the equivalent number of underlying shares (described below) which cannot be exceeded at any time on either the bullish or bearish side of the market. Account positions in excess of defined position limits may be subject to trade restriction or liquidation at any time without prior notification.

Position limits are defined on regulatory websites and may change periodically. Some contracts also have near-term limit requirements (near-term position limits are applied to the side of the market for those contracts that are in the closest expiring month issued). Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. The following information defines how position limits are calculated;

Option position limits are determined as follows:

- Bullish market direction -- long call & short put positions are aggregated and quantified in terms of equivalent shares of stock.

- Bearish market direction -- long put & short call positions are aggregated and quantified in terms of equivalent shares of stock.

The following examples, using the 25,000 option contract limit, illustrate the operation of position limits:

- Customer A, who is long 25,000 XYZ calls, may at the same time be short 25,000 XYZ calls, since long and short positions in the same class of options (i.e., in calls only or in puts only) are on opposite sides of the market and are not aggregated

- Customer B, who is long 25,000 XYZ calls, may at the same time be long 25,000 XYZ puts. Rule 4.11 does not require the aggregation of long call and long put (or short call and short put) positions, since they are on opposite sides of the market.

- Customer C, who is long 20,000 XYZ calls, may not at the same time be short more than 5,000 XYZ puts, since the 25,000 contract limit applies to the aggregate position of long calls and short puts in options covering the same underlying security. Similarly, if Customer C is also short 20,000 XYZ calls, he may not at the same time have a long position of more than 5,000 XYZ puts, since the 25,000 contract limit applies separately to the aggregation of short call and long put positions in options covering the same underlying security.

Notifications and restrictions:

IB will send notifications to customers regarding the option position limits at the following times:

- When a client exceeds 85% of the allowed limit IB will send a notification indicating this threshold has been exceeded

- When a client exceeds 95% of the allowed limit IB will place the account in closing only. This state will be maintained until the account falls below 85% of the allowed limit. New orders placed that would increase the position will be rejected.

Notes:

Position limits are set on the long and short side of the market separately (and not netted out).

Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side (index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge).

Position information is aggregated across related accounts and accounts under common control.

Definition of related accounts:

IB considers related accounts to be any account in which an individual may be viewed as having influence over trading decisions. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account (and accounts under common control), joint accounts with individual accounts for the joint parties and organization accounts (where an individual is listed as an officer or trader) with other accounts for that individual.

Position limit exceptions:

Regulations permit clients to exceed a position limit if the positions under common control are hedged positions as specified by the relevant exchange. In general the hedges permitted by the US regulators that are recognized in the IB system include outright stock position hedges, conversions, reverse conversions and box spreads. Currently collar and reverse collar strategies are not supported hedges in the IB system. For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product.

OCC posts position limits defined by the option exchanges. They can be found here.

http://www.optionsclearing.com/webapps/position-limits

Rule 611 of SEC Regulation NMS

Executions in equities will sometimes be listed as R6, which is short for Rule 611 of SEC Regulation NMS. This condition code indicates that the execution(s) in question is not subject to trade-through rules. R6 trades are given an SEC exemption.

Rule 611, which is the Trade Through Exemption of SEC Regulation NMS, is very lengthy to cover in detail. Parties interested in reading the rule in its entirely should type "SEC Rule 611" into an internet search engine. This is the portion of the document that is pertinent to IB traders, in a nutshell:

Typically the trades involved are a multi-component trade involving orders for a security and a related derivative, or, in the alternative, orders for related securities, that are executed at or near the same time. The SIA (Securities Industry Association) notes that the economics of a contingent trade are based on the relationship between the prices of the security and the related derivative or security, and that the execution of one order is contingent upon the execution of the other order.

The bottom line is that when a trade is ruled R6 the SEC has granted a trade-through exemption. This means that these execution reports do not affect the resting orders in-between the market at the time, and the R6 execution. For example, the real market is quoting 10.50 at 10.51, and an execution is reported at 10.90. This execution was given an R6 exemption. A sell limit order at 10.75, an an example, would not be executed because the 10.90 execution was given an R6 status.

What is an "Odd Lot" in stocks?

Simply stated, an "Odd Lot" is a stock order comprised of less than 100 shares of stock. So any stock order from 1 share to 99 shares is considered to be an odd lot.

This is the pertinent information traders should know about odd lot orders:

- An odd lot is a number of shares less than 100 (1-99)

- A "Round Lot" is 100 shares of stock

- Any number of shares that is a multiple of 100 is a round lot (i.e. 100, 600, 1,600, etc)

- An order for a number of shares greater than 100, but not a multiple of 100 (i.e. 142, 373, 1,948, etc) is a "Mixed Lot" (AKA PRL, or partial round lot, order)

- Odd-Lot orders are not posted to the bid/ask data on exchanges

- Odd-Lot orders are taken into the order book at the exchange they are routed to. When the exchange is able to match an order from the other side of the book with the odd-lot, it will be filled. This could lead to delay on execution of an odd-lot.

- There are numerous guidelines for the routing of odd-lot orders: Odd-Lot orders to initiate positions will not be routed to primary exchanges; Odd-Lot orders can be routed to primary exchanges, but only if the order in question is to close out a preexisting position; IB will not direct-route odd-lot orders which initiate positions to primary exchanges, therefore these type of orders should be Smart Routed so that IB's routing system can send the order to an ECN for execution. The exception is that odd lots can be routed to NYSE/ARCA/AMEX, but only as part of a basket order or as a market-on-close (MOC) order.

- A mixed lot or PRL (i.e. 257 shares) direct-routed to NYSE/AMEX will be submitted in whole to the exchange (applies to both market and limit orders). If the order is direct-routed to NYSE/ARCA, only the round lot portion of the order will be submitted and, if it is executed, the IB system will cancel the remaining odd-lot portion of the order. If the order is routed via IB Smart Routing, all market centers are eligible to receive the order according to the Smart Routing logic (including NYSE/ARCA, but only for the round lot portion of the order).

- IB will not route odd-lot orders for HOLDRS. The odd-lot portion of a PRL order for HOLDRS will be rejected by the IB system after the round lot portion of the order is executed.

- Individual exchanges may impose certain restrictions on odd lot orders, in addition to any of the restrictions mentioned above

Combo orders with stock and option legs.

Combo orders which involve a stock and an option leg are accepted natively only at ISE. So if you would like to create a covered call position, and wish to buy the stock and sell the option simultaneously, ISE is the exchange to which these orders will be sent if, in fact, the specific options trade at the ISE.

In the event that the option in question does not trade at ISE, the order can't be sent to that exchange. These orders will stay on IB's system until the point at which the possibility exists that both legs may be executed simultaneously.

For example, if you are long XYZ stock and short an XYZ call against it, you might choose to close this position using a combo order. This order will be sent to ISE since it has a stock and option component. However, if XYZ options don't trade at ISE, they can't accept the order. In this case the order will stay on IB's server until the system reads that the XYZ stock can be sold and the XYZ option bought, at which point the system will send the orders simultaneously to the respective exchanges. Please note that although it is possible that both orders will be executed simultaneously at the combo price, there is no guarantee of fill simply because the displayed quotes from each exchange indicate the combo price is available.

How can I remove a canceled order that is stuck on my screen in pink status?

The pink status indicates that you have sent a request to cancel the order, but have not yet received cancel confirmation from the order destination. At this point your order is not confirmed canceled. You may still receive an execution while your cancellation request is pending.

The most frequent cause of this issue is sending a cancel request to an exchange that is not currently open. For example, you have an open limit order that is at the NYSE. You send a cancel on that order at 16:05 EST, when the NYSE is closed. Their computers do not electronically respond, therefore IB can't confirm the cancel or clear the order. This example holds true for nearly all exchanges.

Another cause is an order being "stuck" electronically on your TWS system. In these cases traders will have to wait for the system to go through its "daily reset" for the order to disappear from the trading application.

*If you have an order in this status on your screen, you should contact IB immediately. If we are able to see the order in our system (and for orders that have been requested canceled by the account holder, but not acknowledged by the exchange, IB can usually see the orders in our system) we can attempt to call the exchange and request a confirmation of cancellation. Unfortunately in many cases, most notably with the NYSE, the exchanges will not answer their phones after they are officially closed for trading. If the exchange can't be contacted, the order will remain in this status until their computers send the cancel confirmation. As stated above: At this point your order is not confirmed canceled. You may still receive an execution while your cancellation request is pending.