Ex-Ante Costs and Charges Disclosures

What is this Disclosure?

MIFID II rules require that Interactive Brokers in Europe and the UK provide its retail clients with a reasonable estimate of the costs and charges related to products and services offered.

Retail clients of Interactive Brokers in Europe can view a per-transaction costs and charges disclosure at the time of the order entry (‘ex-ante’). The disclosure is personalized and corresponds to the conditions applicable to the client account.

While clients have the option to view the disclosure, it is not a mandatory step before the order submission.

The disclosure content and format are largely prescribed by the rules to enable retail clients to compare costs and charges across providers. This article aims to clarify the meaning of these standardized terms.

In addition to Interactive Brokers costs and charges, the disclosure must show implicit costs and costs embedded in the product price itself (and not charged by Interactive Brokers separately).

A per transaction costs and charges disclosure is required for:

- All futures and options globally, including futures options

- ETFs of all types

- Funds, including closed-end funds

- CFDs

- Warrants and structured products

A disclosure is not required for other products such as vanilla stocks and bonds.

Where to Find the Per-transaction Costs and Charges Disclosure?

Access to the disclosure is via a link embedded in the primary order-entry dialog.

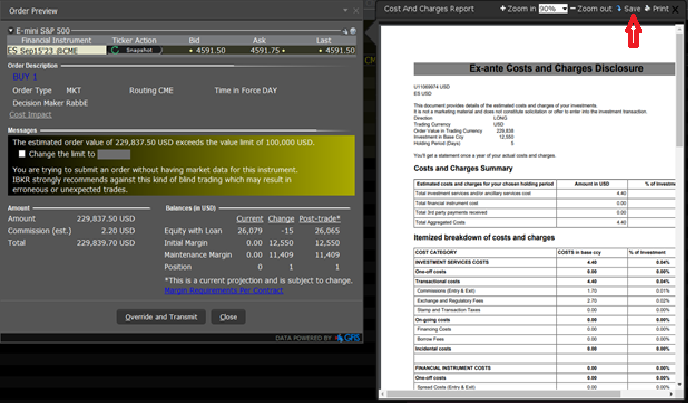

TWS Classic:

.png)

The presence of the link does not interrupt the standard order entry workflow if a client chooses not to click it. A client can click the transmit button in the usual way and skip viewing the disclosure.

Clicking the “Cost Impact” link brings up a pop-up with the ex-ante per transaction costs and charges disclosure, with the option to download it as a PDF:

Other Trading Applications:

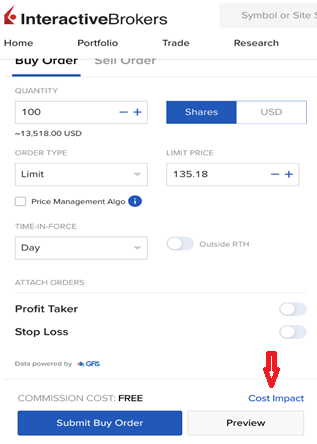

The other order entry interfaces such as Mosaic, Client Portal and Mobile likewise include a link to the costs and charges disclosure, again without interrupting the standard workflow unless a client expressly wants to see the disclosure.

Below is an example of the order ticket in the Client Portal. Order tickets in TWS Mosaic and Mobile are similar.

The Disclosure Content and Structure

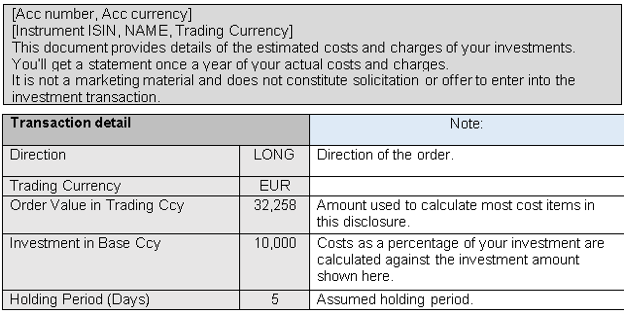

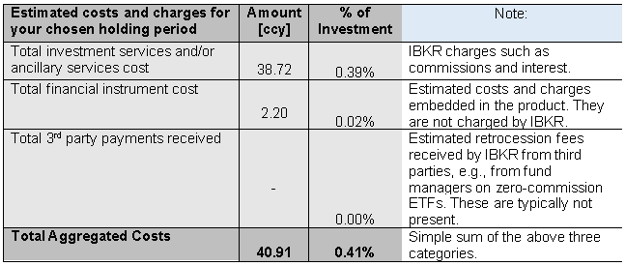

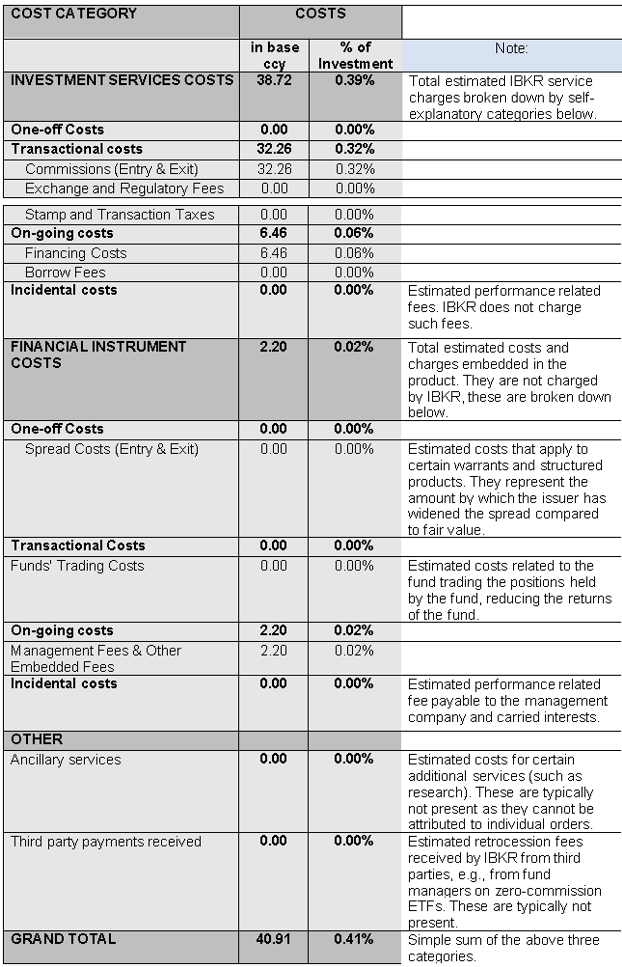

The per transaction costs and charges disclosure includes a summary-section followed by an itemized costs and charges breakdown. The various cost items are presented using headings and terms that are mandated by the regulation to make the disclosures comparable across investment service providers. The example below illustrates the statement structure and contains explanatory notes.

Ex-ante Costs and Charges Disclosure - Illustrative Example

(1) Account detail

(2) Costs and Charges Summary

Please note that the “Financial Instrument Cost” is embedded in the product, and not a cost charged by Interactive Brokers. We are required to source or estimate such costs so you could better understand all of the costs that are associated with some of your securities.

(3) Itemized Breakdown of Costs and Charges

Crédito de juros sobre recursos de ações short

Como determinar o crédito de juros ou a taxa associada a uma posição de tomada de empréstimo de ações.

Quando um titular da conta vende ações a descoberto (short), a IBKR toma emprestadas ações equivalentes em nome do titular da conta para satisfazer a obrigação de entregar ações para o comprador. O contrato que rege a tomada de empréstimo dessas ações obriga a IBKR a oferecer ao emprestador das ações uma garantia em dinheiro para o empréstimo. O valor da garantia em dinheiro tem como base um cáculo padrão do setor sobre o valor das ações chamado de Marcação da garantia.

O emprestador das ações fornece juros à IBKR sobre a garantia em dinheiro e também cobra uma taxa para oferecer esse serviço ao ajustar os juros pagos a um valor inferior à taxa de juros do mercado vigente. Geralmente, a taxa é indexada à taxa efetiva dos recursos disponíveis do FED para depósitos em dinheiro denominados em dólares americanos (USD). Para ações em que a tomada de empréstimo é difícil de ser realizada, a taxa do emprestador pelo fornecimento das ações pode resultar na cobrança de uma taxa de juros negativa para a IBKR.

Enquanto muitas corretoras repassam a parte desse reembolso somente para clientes institucionais, todos os clientes da IBKR receberão um crédito de juros sobre os recursos das vendas de ações a descoberto (short) que excederem USD 100.000 ou um valor equivalente em outra moeda. Quando a oferta de um determinado título disponível para tomada de empréstimo é alta com relação à demanda de tomada de empréstimo, os titulares da conta podem esperar receber um crédito de juros sobre o saldo de ações short equivalente à taxa de referência (benchmark rate). Por exemplo, a taxa overnight efetiva dos recursos disponíveis do FED para saldos denominados em dólares americanos (USD). Desse valor, é subtraído um spread (que, no momento, varia de 1,25% sobre os saldos de USD 100.000 a 0,25% para saldos superiores a USD 3.000.000). As taxas estão sujeitas a alterações sem aviso prévio.

Quando os atributos de oferta e demanda de um título específico tornam a tomada de empréstimo difícil de ser realizada, o reembolso oferecido pelo emprestador é recusado e pode até mesmo resultar em uma cobrança na conta. O reembolso ou a cobrança será passado para o titular da conta no formato de uma taxa de tomada de empréstimo mais alta, que poderá exceder os créditos de juros dos recursos de venda a descoberto (short) e resultar em uma cobrança líquida para a conta. Como as taxas variam por título e data, a IBKR recomenda que os clientes usem a ferramenta de disponibilidade de ações short que pode ser acessada na seção Suporte no Portal do cliente/Gerenciamento da conta. Nessa seção, é possível ver as taxas indicativas das vendas a descoberto (short). Observe que as taxas indicativas dessas ferramentas têm o objetivo de corresponder aos juros dos recursos de venda a descoberto (short) que a IBKR paga sobre os saldos de Nível III, ou seja, os recursos de venda a descoberto adicionais a partir de USD 3 milhões. Para saldos inferiores, a taxa é ajustada com base no nível e na taxa de referência (benchmark rate) associada à moeda de negociação. É possível ver a taxa exata ao usar a calculadora Juros pagos para você sobre os saldos disponíveis dos recursos de venda a descoberto.

Veja mais exemplos e uma calculadora na página Financiamento de valores mobiliários.

OBSERVAÇÃO IMPORTANTE

As informações da ferramenta de disponibilidade de ações short e do TWS relacionadas a ações disponíveis para tomada de empréstimo e taxas indicativas são oferecidas na medida do possível sem garantia de precisão ou validade. A disponibilidade de ações inclui informações de terceiros que não são atualizadas em tempo real. As informações sobre a taxa são somente indicativas. As negociações executadas na sessão de negociação atual são liquidadas em até dois dias úteis e a disponibilidade real, além dos custos da tomada de empréstimo, são determinados no dia da liquidação. Os traders devem levar em consideração que as taxas e a disponibilidade podem variar significativamente entre a data de negociação e a data de liquidação, especialmente em ações com pouca liquidez, ações de capitalização baixa (small cap) e classes de ações que tenham uma futura operação societária (incluindo dividendos). Acesse Riscos operacionais de vendas a descoberto (short) para ver mais detalhes.

Explicação sobre cobranças de juros quando um saldo disponível líquido é um crédito

As contas ficam sujeitas a cobranças de juros mesmo com um saldo disponível geral de crédito ou long líquido nas seguintes circunstâncias:

1. Quando a conta mantém um saldo de débito ou short em uma determinada moeda.

Por exemplo, uma conta que mantém um saldo de crédito disponível líquido equivalente a USD 5.000 composto de um saldo long de USD 8.000 e um saldo short em EUR equivalente a USD 3.000 fica sujeita a um débito de juros sobre o saldo short em EUR. Não há crédito de compensação algum no saldo long em USD tendo em vista que ele é inferior ao Nível I de USD 10.000, acima do qual há juros.

Os titulares da conta devem observar que, ao comprar um título denominado em uma moeda não mantida na conta, a IBKR realiza um empréstimo nessa moeda para poder liquidar a negociação na câmara de compensação. Caso o investidor deseje evitar esses empréstimos e as cobranças de juros associadas a eles, é necessário realizar um depósito de recursos denominados na moeda específica ou converter os saldos disponíveis existentes por meio do Ideal Pro (para saldos a partir de USD 25.000) ou de um lote fracionário (para saldos inferiores a USD 25.000) antes de iniciar a negociação.

2. Quando o saldo de crédito é composto principalmente de recursos da venda a descoberto (short) dos títulos.

Por exemplo, uma conta que mantém um saldo de crédito disponível líquido de USD 12.000 composto de um débito de USD 6.000 na subconta do título (menos o valor de mercado de qualquer posição de ação short) e um crédito com valor de mercado de ações short de USD 18.000 recebe uma cobrança de juros no débito de Nível 1 de USD 6.000 e não recebe juros algum sobre o crédito de ações short por ficar abaixo do Nível 1 de USD 100.000.

3. Quando o saldo de crédito inclui recursos não liquidados.

A IBKR determina débitos de juros e créditos exclusivamente com base nos recursos liquidados. Como os titulares da conta não recebem cobranças de juros sobre os recursos tomados em empréstimos para a compra de títulos até que a transação da compra seja liquidada, o titular da conta não recebe crédito de juros, ou uma compensação contra um saldo de débito, sobre os recursos originários da venda de um título até que a transação seja liquidada (e até que a câmara de compensação credite os recursos para a IBKR).

Alternative Streaming Quotes for European Equities

Alternative Streaming Quotes for EU Equities

On August 1st, 2022, clients with non-professional or non-commercial market data subscriber status will receive complimentary real-time streaming Best Bid and Offer and last sale quotes on European Equities. These quotes will be aggregated from exchanges such as Cboe Europe, Gettex, Tradegate and Turquoise. The data will display in the SMART quote line and can be used to generate a chart as well.

Eligible users will see a no charge service called 'Alternative European Equities (L1)' added to their account on or before August 1, 2022. Please note this will be a default Market Data service that cannot be removed.

Users who would like to receive the full EBBO (European Best Bid and Offer) will need to subscribe to the individual exchange subscriptions.

FAQs for February 23, 2022 messages regarding CME exchange fee credits

Why did I receive this message?

You received a message from IBKR on February 23, 2022 because your account traded spread trades on CME in (1) one or more of the following products between January 1, 2015 and late September 2021: E-Mini Equity index Futures (including Housing Index Futures); Micro E-Mini Index Futures; Micro E-Mini Index Options; and Nikkei Equity Futures, and/or (2) certain FX futures products between February 1, 2018 and mid-December 2021.

Why did I receive a credit?

As set forth in the message, certain spread trades in those products (see response #1) are subject to discounted CME exchange fees (as compared to outright trades in those products). Your account traded spread trades in one or more of those products between January 1, 2015 and late September 2021 (or FX futures between February 1, 2018 and mid-December 2021) and, as a result of an inadvertent error, overpaid associated CME exchange fees. IBKR has credited your account for the overpaid CME exchange fees.

What do I need to do?

You will need to log into your account and withdrawal the funds.

Am I owed money for other trades?

Not that we have identified.

How long do I have to withdraw the funds?

Please withdraw the funds within 30 days of the date of the message you received (by March 25, 2022).

The message I received says something about owing an outstanding debt to IBKR. What does that mean?

This means that your account owed an outstanding debt to IBKR, and the amount you received in reimbursement was credited against the outstanding debt amount. If the reimbursement amount exceeded the outstanding debt about, you received a credit and may withdraw the difference.

Sending Funds to IBKR Post Migration

If your account has recently migrated to IBKR Ireland (IBIE) or IBKR Central Europe (IBCE), it is likely that you have outdated bank instructions saved in your Client Portal or with your bank. When transferring funds to IBKR after migration, you will want to enter a new deposit notification/bank instruction within Client Portal and update any saved IBKR bank information that you have with your bank.

Should you inadvertently use outdated bank instructions to send funds to IBKR and they arrive at the incorrect IBKR entity, as a courtesy we will attempt to forward the funds to the correct IBKR entity. Please note that this transfer will be done free of charge for the first instance. For subsequent transfers, IBKR will charge your account a processing fee of EUR 50 (or equivalent). You will also receive a message notifying you of the transfer and advising you to update your bank information.

Summary of Third Party Transaction Fees

United Kingdom

- 0.5% of trade value Stamp Tax

- Panel of Takeovers and Mergers Levy of GBP 1.00 on all orders over GBP 10,000 on shares of companies registered in the United Kingdom, Isle of Man or Channel Islands

Ireland

- 1% of trade value Stamp Tax

Switzerland

- The Swiss transaction tax is not charged automatically by Interactive Brokers on individual accounts. Clients who are subject to the tax should consult a local tax advisor for support with their tax obligations.

France

- French Financial Transaction Tax: 0.30% of trade value applied to shares of companies whose head office is located in France and whose market capitalisation exceeds EUR 1 billion

Italy

- Italian Financial Transaction Tax: 0.10% for shares transacted on regulated markets and MTFs and 0.20% for those transacted outside of these markets.

Spain

- Spanish Financial Transaction Tax: 0.20% or trade value applied to shares of Spanish companies whose market capitalisation exceeds EUR 1,000 million as of December 1 of the year preceding the date of acquisition.

Belgium

- The Belgian Tax on stock-exchange transactions (TST) is not charged automatically by Interactive Brokers on individual accounts. Clients who are subject to the tax should consult a local tax advisor for support with their tax obligations.

Hong Kong

- For stocks, warrants and structured products traded on the SEHK:

- Government stamp duty: 0.13%, rounded up to the nearest 1.00 for SEHK stocks, normally applies only to stocks

- SFC transaction levy: 0.0027%, normally applies to stocks, warrants and CBBCs

- FRC Transaction levy: 0.00015%, normally applies to stocks, warrants and CBBCs

- For products traded on the Shanghai-Hong Kong Stock Connect Northbound Trading Link and Shenzhen-Hong Kong Stock Connect:

- 0.1% Sale Proceeds Stamp Duty

Shares Subject To The Spanish Financial Transaction Tax

The following table lists the companies included in the scope of the Spanish Financial Transaction Tax as of December 2020. Based on the Spanish declaration, companies meeting the following qualifications would fall within the scope of the FTT:

- The shares must have been admitted to trading on a regulated market which may be the Spanish market, a market of another European Union Member state or an equivalent market in a third country

- The company's market capitalization must exceed EUR 1,000 million as of December 1 of the year preceding the year that the acquisition takes place (reviewed annually)

The list of companies provided below is being done on a best efforts basis and may be subject to ammendments at any time and without notification.

The list of ADRs which are subject to the Spanish Financial Transaction Tax are detailed at the bottom of this page.

| Company Name | Symbol | Exchange |

| ACS ACTIVIDADES CONS Y SERV | ACS | BM |

| ACERINOX SA | ACX | BM |

| ACERINOX SA | ACXN | MEXI |

| AENA SME SA | AENA | BM |

| AENA SME SA | AENAN | MEXI |

| CORPORACION FINANCIERA ALBA | ALB | BM |

| ALMIRALL SA | ALM | BM |

| AMADEUS IT GROUP SA | AMS2 | BM |

| ACCIONA SA | ANA | BM |

| APPLUS SERVICES SA | APPS | BM |

| BANCO BILBAO VIZCAYA ARGENTA | BBVA | BM |

| BANCO BILBAO VIZCAYA ARGENTA | BBVA | MEXI |

| BANKIA SA | BKIA | BM |

| BANKIA SA | BKIAN | MEXI |

| BANKINTER SA | BKT | BM |

| BANKINTER SA | BKTN | MEXI |

| BANCO SANTANDER SA | BNC | LSE |

| CAIXABANK S.A | CABK | BM |

| CONSTRUCC Y AUX DE FERROCARR | CAF | BM |

| CONSTRUCC Y AUX DE FERROCARR | CAFEN | MEXI |

| PROSEGUR CASH SA | CASH2 | BM |

| PROSEGUR CASH SA | CASHN | MEXI |

| CIE AUTOMOTIVE SA | CIE | BM |

| CIE AUTOMOTIVE SA | CIEAN | MEXI |

| CELLNEX TELECOM SA | CLNX | BM |

| CELLNEX TELECOM SA | CLNXN | MEXI |

| INMOBILIARIA COLONIAL SOCIMI | COL | BM |

| AMREST HOLDINGS SE | EAT | WSE |

| AMREST HOLDINGS SE | EAT | BM |

| AMREST HOLDINGS SE | EATN | MEXI |

| EBRO FOODS SA | EBRO | BM |

| EDP RENOVAVEIS SA | EDPR | BVL |

| EUSKALTEL SA | EKT1 | BM |

| EUSKALTEL SA | EKTN | MEXI |

| ENDESA SA | ELE | BM |

| ENDESA SA | ELE1N | MEXI |

| ENAGAS SA | ENG | BM |

| FAES FARMA SA - | FAE | BM |

| FOMENTO DE CONSTRUC Y CONTRA | FCC | BM |

| FLUIDRA SA | FDR | BM |

| FLUIDRA SA | FDRN | MEXI |

| FERROVIAL SA | FER | BM |

| SIEMENS GAMESA RENEWABLE ENE | GAM | BM |

| NATURGY ENERGY GROUP SA | GAS | BM |

| GRUPO CATALANA OCCIDENTE SA | GCO | BM |

| GRUPO CATALANA OCCIDENTE SA | GCON | MEXI |

| GESTAMP AUTOMOCION SA | GEST | BM |

| GESTAMP AUTOMOCION SA | GESTN | MEXI |

| GRIFOLS SA | GRF | BM |

| GRIFOLS SA - B | GRF.P | BM |

| INTL CONSOLIDATED AIRLINE-DI | IAG | LSE |

| INTL CONSOLIDATED AIRLINE-DI | IAG | BM |

| INTL CONSOLIDATED AIRLINE-DI | IAGN | MEXI |

| IBERDROLA SA | IBE | BM |

| IBERDROLA SA | IBEN | MEXI |

| INDRA SISTEMAS S.A. | IDR | BM |

| INDUSTRIA DE DISENO TEXTIL | ITX | BM |

| INDUSTRIA DE DISENO TEXTIL | ITXN | MEXI |

| CIA DE DISTRIBUCION INTEGRAL | LOG | BM |

| MAPFRE SA | MAP | BM |

| MELIA HOTELS INTERNATIONAL | MEL | BM |

| MELIA HOTELS INTERNATIONAL | MELN | MEXI |

| MERLIN PROPERTIES SOCIMI SA | MRL | BM |

| NH HOTEL GROUP SA | NHH | BM |

| PHARMA MAR SA | PHM | BM |

| PHARMA MAR SA | PHM1N | MEXI |

| PROSEGUR COMP SEGURIDAD | PSG | BM |

| RED ELECTRICA CORPORACION SA | REE | BM |

| RED ELECTRICA CORPORACION SA | REEN | MEXI |

| REPSOL SA | REP | BM |

| REPSOL SA | REPSN | MEXI |

| LABORATORIOS FARMACEUTICOS R | ROVI | BM |

| BANCO DE SABADELL SA | SAB2 | BM |

| BANCO SANTANDER SA | SAN | MEXI |

| BANCO SANTANDER SA | SAN | WSE |

| BANCO SANTANDER SA | SAN1 | BM |

| SACYR SA | SCYR | BM |

| SIEMENS GAMESA RENEWABLE ENE | SGREN | MEXI |

| SOLARIA ENERGIA Y MEDIO AMBI | SLR | BM |

| TELEFONICA SA | TEF | BM |

| TELEFONICA SA | TEF1N | MEXI |

| TELEFONICA SA | TEFOF | PINK |

| MEDIASET ESPANA COMUNICACION | TL5 | BM |

| MEDIASET ESPANA COMUNICACION | TL5N | MEXI |

| UNICAJA BANCO SA | UNI2 | BM |

| VIDRALA SA | VID | BM |

| VISCOFAN SA | VIS | BM |

| VISCOFAN SA | VISCN | MEXI |

| ZARDOYA OTIS SA | ZOT | BM |

| ZARDOYA OTIS SA | ZOTN | MEXI |

The following is a list of ADRs which are subject to the Spanish Financial Transaction Tax.

| Company Name | Symbol | Exchange |

| ACERINOX SA-UNSPON ADR | ANIOY | PINK |

| ACS ACTIVIDADES CONS-UNS ADR | ACSAY | PINK |

| AENA SME SA-ADR | ANYYY | PINK |

| AMADEUS IT GROUP-UNSP ADR | AMADY | PINK |

| BANCO BILBAO VIZCAYA-SP ADR | BBVA | NYSE |

| BANCO DE SABADELL-UNSPON ADR | BNDSY | PINK |

| BANCO SANTANDER SA-SPON ADR | SAN | NYSE |

| BANKIA SA-UNSP ADR | BNKXY | PINK |

| BANKINTER SA-SPONS ADR | BKNIY | PINK |

| CAIXABANK- UNSPON ADR | CAIXY | PINK |

| CELLNEX TELECOM SAU-UNSP ADR | CLLNY | PINK |

| EBRO FOODS SA -UNSP ADR | EBRPY | PINK |

| ENAGAS-UNSPONSORED ADR | ENGGY | PINK |

| ENDESA SA-UNSP ADR | ELEZY | PINK |

| FERROVIAL SA-UNSPONSORED ADR | FRRVY | PINK |

| FOMENTO DE CONST-UNSPON ADR | FMOCY | PINK |

| GRIFOLS SA-ADR | GRFS | NASDAQ |

| GRIFOLS SA-SPON ADR | GIKLY | PINK |

| IBERDROLA SA-SPONSORED ADR | IBDRY | PINK |

| INDITEX-UNSPON ADR | IDEXY | PINK |

| INDRA SISTEMAS SA-UNSP ADR | ISMAY | PINK |

| MAPFRE SA-UNSP ADR | MPFRY | PINK |

| NATURGY ENERGY GROUP SA-ADR | GASNY | PINK |

| PROSEGUR CASH SA - UNSP ADR | PGUCY | PINK |

| RED ELECTRICA COR-UNSPON ADR | RDEIY | PINK |

| REPSOL SA-SPONSORED ADR | REPYY | PINK |

| TELEFONICA SA-SPON ADR | TEF | NYSE |

| TELEFONICA SA-SPON ADR | TNE2 | IBIS |

| TELEFONICA SA-SPON ADR | TEFN | MEXI |

| ABENGOA SA-UNSPON ADR | ABGOY | PINK |

| ABERTIS INFRAESTR-UNSPON ADR | ABRTY | VALUE |

| ATRESMEDIA CORP DE -UNSP ADR | ATVDY | PINK |

| BOLSAS Y MERCADOS ESP-UN ADR | BOLYY | VALUE |

| DISTRIBUIDORA INT-UNSP ADR | DIDAY | PINK |

| GAMESA CORP TECN-UNSPON ADR | GCTAY | PINK |

| PROMOTORA DE INFORMA-ADR | PRISY | PINK |

Information Regarding the Spanish Financial Transaction Tax

Overview

This document provides an overview of how the Spanish Financial Transaction Tax (FTT) will be handled by Interactive Brokers.

Effective January 16, 2021, a new tax will be implemented on the purchase of certain Spanish securities.

Tax Rate

The announced tax is 0.20%.

Scope

The FTT will be applied to shares of Spanish companies whose market capitalisation exceeds EUR 1,000 million as of December 1 of the year preceding the year that the acquisition takes place. The shares must have been admitted to trading on a regulated market which may be the Spanish market, a market of another European Union Member state or an equivalent market in a third country. The Spanish Ministry of Finance will publish a list of Spanish companies with a market cap exceeding this threshold by December 31 each year. The Ministry of Finance will review and republish the list the first month the FTT is in place.

The following cases are subject to the Spanish FTT:

- Shares acquired on an exchange transaction

- Shares acquired on the execution or settlement of fixed-income securities which may be converted or exchanged for shares

- Shares acquired as a result of execution or settlement of financial derivatives (i.e. stock option exercise/assignment)

- Shares acquired from the execution of finance contracts defined in article 2.1 of Order EHA3537/2005 (contracts not traded on official secondary markets for which a credit institution receives money or securities from customers assuming a repayment obligation)

Accrual

Tax becomes payable on the settlement date of the transaction

Tax Base

There will be a special calculation for intra-day transactions. Therefore, only the net settlement will be taxed.

Exposure Fee Calculations Overview

Introduction

IBKR's global risk management routine includes a daily execution of computations through which each client’s portfolio is stress tested to determine its exposure to a series of prices changes beyond that protected by margin. These stress tests serve to identify accounts that, while margin compliant, project losses which exceed the account’s equity were these scenarios to be realized and which IBKR regards as excessive. In an effort to increase client awareness as to their potential exposure, IBKR has implemented a daily Exposure Fee, that is assessed to any account reporting end of day uncovered risk in excess of specified levels.

Current Exposure Fee Overview

The current Exposure Fee calculation is intended to reflect a more comprehensive set of market scenarios in addition to price dependencies among all products types. The calculation is based upon a Monte Carlo simulation which incorporates thousands of market scenarios and projects the exposure of your portfolio assuming sector-based price changes (e.g., individual stock and sectors such as oil, gas, meat, sugar, cocoa, metals, foreign exchange & crypto-currencies), and then applying this evaluation to all other products based upon their respective sector correlation.

Managing the Exposure Fee

At the initial point an account is detected as being subject to the Exposure Fee, a communication will be sent out explaining the fee and affording the account holder one week to adjust positions and equity before the Fee, if still applicable, will take effect. To assist with avoidance or mitigation of the Fee, IBKR provides a daily Exposure Fee Calculation report via Account Management which details the Fee and provides examples of hypothetical adjustments to existing positions which, if implemented, are projected to reduce the Fee given information then available.

Primary Risk Factors

Each portfolio will be re-valued based upon stressing each primary risk factor, which is represented by a future contract, index or ETF, and all other product(s) in the portfolio will adjusted based upon their correlation associated with that primary risk factor.

Below is a summary of each risk factor, the representing Future Contract, Index or ETF, and the upper and lower range in which we stress each risk factor.

| Risk Factors | Product | Lower Bound | Upper Bound |

| Equity | S&P 500 Index (SPX) | -30.00% | 20.00% |

| Australia Equity | S&P 500 / ASX 200 Index Australia Index (AP) | -30.00% | 20.00% |

| United Kingdom Equity | FTSE 100 Index (Z) | -30.00% | 20.00% |

| European Equity | Dow Jones Euro STOXX50 Index (ESTX50) | -30.00% | 20.00% |

| Hong Kong Equity | Hang Seng Index (HSI) | -30.00% | 20.00% |

| Japanese Equity | Nikkei 225 Index (N225) | -30.00% | 20.00% |

| Korean Equity | Korean Stock Exchange KOSPI 200 Index (K200) | -30.00% | 20.00% |

| Mainland China Equity | FTSE China A50 Index (XINA50) | -30.00% | 20.00% |

| Indian Equity | CNX NIFTY Index (NIFTY) | -30.00% | 20.00% |

| Individual Stocks | -50.00% | 50.00% | |

| Oil (Crude Oil) | Light Sweet Crude Oil Futures | -32.00% | 62.00% |

| Oil (Brent Oil) | Brent Crude Oil Futures | -30.00% | 60.00% |

| CO2 | ICE ECX EUA Futures (ECF) | -74.30% | 59.50% |

| Treasury | iShares 20+ Year Treasury Bond ETF (TLT) | -19.80% | 15.60% |

| Treasury1 | iShares 1-3 Year Treasury Bond ETF (SHY) | -1.80% | 1.20% |

| Treasury2 | iShares 1-3 Year International Treasury Bond ETF (ISHG) | -9.80% | 10.00% |

| Italian Govt Bond | Euro-BTP Italian Government Bond | -13.00% | 13.00% |

| BAX | 3 Month Canadian Bankers' Acceptance Futures | -0.40% | 0.40% |

| EuroBund | Euro Fund (10 Year Bond - GBL) | -7.60% | 8.60% |

| JGB | Japanese Government Bonds (JGB) | -2.20% | 2.20% |

| Live Cattle | Live Cattle (LE) | -30.00% | 30.00% |

| Feeder Cattle | Feeder Cattle (GF) | -30.00% | 30.00% |

| Hogs | Lean Hogs Index (HE) | -30.00% | 30.00% |

| Ind. Metals. | COMEX Copper Index (HG) | -25.30% | 22.10% |

| Prec. Metals | SPDR Gold Shars (GLD) | -20.70% | 34.50% |

| Silver | COMEX Silver Index (SI) | -26.20% | 28.80% |

| Wheat | ETFS Wheat (OD7S) | -40.90% | 64.70% |

| Corn | Teucrium Corn Fund (CORN) | -23.50% | 41.50% |

| Soybean | Teucrium Soybean Fund (SOYB) | -22.60% | 27.40% |

| Rice | Rough Rice Futures (ZR) | -22.60% | 27.40% |

| Cocoa | iPath Bloomberg Cocoa Subindex Total Return (NIB) | -28.60% | 37.40% |

| Gas | United States Natural Gas Fund (UNG) | -18.80% | 62.00% |

| Crypto | The NYSE bitcoin Index (NYXBT) | -100.00% | 93.90% |

| Sugar | iPath Bloomberg Sugar Subindex Total Return (SGGFF) | -34.50% | 52.30% |

| Cotton | ETFS Cotton (COTN) | -50.00% | 50.00% |

| Coffee | iPath Bloomberg Coffee Subindex Total Return (JJOFF) | -30.00% | 50.00% |

| Lumber | Random Length Lumber (LB) | -30.00% | 30.00% |

| Milk | Milk Class III Index (DA) | -15.00% | 15.00% |

| Orange Juice | FC Orange Juice "A" (OJ) | -35.00% | 35.00% |

| Forex Risk Factor | Lower Bound | Upper Bound |

| AUD | -18.10% | 18.10% |

| BGN | -6.80% | 6.80% |

| BRL | -17.00% | 17.00% |

| CAD | -13.70% | 13.70% |

| CHF | -13.90% | 13.90% |

| CNH | -8.20% | 8.20% |

| CNY | -6.70% | 6.70% |

| CYP | -7.20% | 7.20% |

| CZK | -9.50% | 9.50% |

| DKK | -7.90% | 7.90% |

| EEK | -5.50% | 5.50% |

| EUR | -9.90% | 9.90% |

| GBP | -13.00% | 13.00% |

| HKD | -8.00% | 8.00% |

| HRK | -7.00% | 7.00% |

| HUF | -20.50% | 20.50% |

| ILS | -8.80% | 8.80% |

| INR | -12.40% | 12.40% |

| ISK | -9.90% | 9.90% |

| JPY | -16.80% | 16.80% |

| KRW | -18.00% | 18.00% |

| LTL | -7.20% | 7.20% |

| LVL | -7.00% | 7.00% |

| MTL | -7.20% | 7.20% |

| MXN | -16.70% | 16.70% |

| NOK | -12.90% | 12.90% |

| NZD | -14.60% | 14.60% |

| PLN | -31.40% | 31.40% |

| RON | -6.90% | 6.90% |

| RUB | -40.00% | 40.00% |

| SEK | -13.20% | 13.20% |

| SGD | -6.30% | 6.30% |

| SIT | -7.20% | 7.20% |

| SKK | -7.20% | 7.20% |

| TRY | -40.10% | 40.10% |

| TWD | -14.20% | 14.20% |

| USD | -9.30% | 9.30% |

| ZAR | -19.00% | 19.00% |

For additional information concerning this Exposure Fee Calculation report, please see KB3113.