Linking Accounts

Account linkage allows for individual account holders maintaining multiple existing accounts or seeking to open a new account the ability to group those accounts together. In the case of a new account, linkage affords the opportunity to open the account without having to complete a full application, with the account holder providing solely that additional information which is specific to the new account. New account linkages are initiated either from the Client Portal of the existing account (via the User menu (head and shoulders icon in the top right corner) > Settings > Account Settings > Trading > Open an Additional Account) or automatically when initiating a new application from the website. The following article outlines the steps for linking one or more existing accounts.

1. Log into Client Portal and click the User menu (head and shoulders icon in the top right corner) followed by Settings > Trading > Link Account to Advisor/Broker/Administrator.

.png)

2. Select the radio button next to Link All of My Existing Account Under a Single Username and Password, and then click CONTINUE.

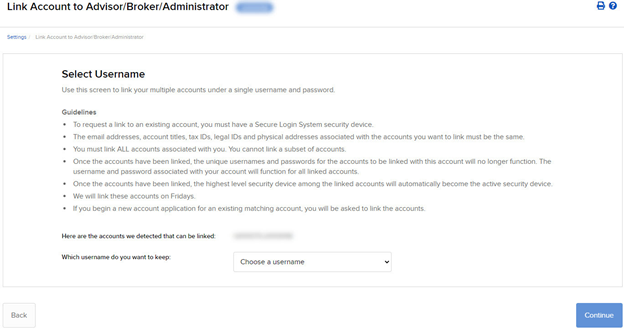

The Select Username screen opens.

3. The screen shows all of your accounts that can be linked under a single username and password. Select which username you want to keep. Once your accounts are linked, you will use the selected username to log in to any of the linked accounts.

4. The screen updates to display the security device for the selected username. Click CONTINUE.

5. A series of pages appears to prompt you to enter the username and password for each account to be linked, followed by additional authentication using your Secure Login device.

6. Enter the username, password and authentication values for each account to be linked on the next screens, clicking CONTINUE to advance to the next screen.

7. We aggregate the financial information and trading experience info for all accounts to be linked. Verify your financial information and trading experience for the accounts to be linked, and then click CONTINUE.

8. Verify your account information and click CONTINUE.

9. If you need to update your financial information, trading experience or account information, wait for those updates to be approved and then restart this linking procedure.

10. Verify any saved bank information you may have and click CONTINUE.

11. Click CONTINUE.

12. Click Ok.

For information on how to cancel a linkage request, see Canceling a Pending Link Request.

IMPORTANT NOTES

* Once linked, account access to Client Portal and the trading platform is accomplished using a single user name and password each of which will contain a drop-down window for selecting the account that the owner wishes to act upon.

* As market data subscriptions are billed at a session level (i.e., user name) and only a single TWS session can be open for any one user at a given time, account holders previously maintaining subscriptions for multiple users have the opportunity to consolidate subscriptions to a single user. Account holders wishing to view multiple TWS sessions simultaneously may add additional users (subject to separate market data subscriptions). In addition, only those market data subscriptions already associated with the surviving user name will remain in effect following consolidation. Account holders maintaining different subscriptions across multiple users are advised to review those subscriptions subject to cancellation in order to determine which they wish to resubscribe to under the surviving user name. Also note that the market data subscriptions either terminated or initiated mid-month are subject to billing as if they were provided for the entire month (i.e., fees are not prorated).

Message Center User Guide

- every inquiry is assigned a case number ("ticket"). This reference number can be used to efficiently track the progress of the inquiry.

- the real-time status of an inquiry is always available via an overview screen. You will know if the issue has been picked up by an IB service expert, which expert is handling your issue, and whether it is being addressed by our main help team or by a specialty team.

- both customers and IB staff can refine or add information to the ticket, permitting easy clarifications or follow up to the original inquiry. In addition, customers can cancel or close tickets once the issue has been addressed giving them greater control.

- History Overview of both open and completed inquiries

- Fast Response: Tickets will be assigned to an IB representative usually within a few minutes and always within 2 hours during European and North American trading hours. During Asian trading hours, response times may be longer.

- Open tickets are presented in the default view with date/time of submission, a brief description of the question, the most recent response from IB staff, the name of the IB Expert handling the inquiry, and a status indicator.

- A second tab shows closed or resolved inquiries going back 1 month. This allows customers to refer to the solutions or information provided by IB and save them on their computers in a document system of their choice (simple cut-and-paste). Status indicators allow customers to know at a glance where their inquiry is in the process. A key for the meanings of the various states are provided at the bottom of the overview screen. Action buttons (edit/view, close, cancel) permit customers to manage their inquiries directly.

- Resolve/Close

: use this when you are satisfied with the response provided by the IB service expert. This will move the ticket onto the "Closed" tab. Please note that IB staff may also close a ticket if they feel the inquiry has been completely addressed.

: use this when you are satisfied with the response provided by the IB service expert. This will move the ticket onto the "Closed" tab. Please note that IB staff may also close a ticket if they feel the inquiry has been completely addressed. - Cancel Ticket

: allows customers to retract an inquiry even if it has not yet been fully addressed.

: allows customers to retract an inquiry even if it has not yet been fully addressed. - Edit/View: customers can add additional information to an inquiry or respond back to an IB Expert's request for more detail.

- Click New Ticket in the menu bar. This will open a new window (you must allow pop-ups on your browser).

- Select the main Category and a SubCategory for the inquiry. The category will allow us to route your inquiry to the IB Expert who is specialized or is most experienced for your issue. We recommend choosing the category accurately to get the highest quality and speed of response.

- Enter a brief summary of the question. This is the text you will see in the overview screen.

- Enter details about the problem as needed. Please be as specific and complete as possible (for example, exact dates/times, TWS version, etc) , as this will allow us to accurately research your inquiry to give you the best / fastest response.

- Click "Next". This will take you to a confirmation screen that will allow you to review and submit your inquiry

- You will get a confirmation of receipt along with a ticket reference number. Note this reference number (it is also viewable on the Overview Screen) and please use it in any follow up to your inquiry (for example, over chat or by phone).

- The inquiry will show in the Overview Screen with the status=New.

- On the Overview Screen, select the open ticket you wish to update, and click on the Edit icon at the end of the row.

- A new window will open showing the history of the "conversation" to date, along with a text entry box for the new information to be added.

- Click "Send" to submit. After some seconds, you will get a confirmation from IB that the update has been received by our system.

- On the Overview Screen, select the open ticket you wish to update, and click on the paperclip

icon.

icon. - A new window will open showing the history of the "conversation" to date, along with a text entry box to add information about the attachment(s). Below the text box there is a section called "Attach Files" with the possibility of adding 3 attachments. Click "Browse" to find the file to be attached. Please note the max upload size is 2Mb per file with a 6Mb cap for all files.

- Click "Send" to submit. After some seconds you will be fowarded to the preview ticket mode where the attached file(s) name will be visible in the comment section.

- Use this when your inquiry has been resolved outside of the IB CIMS environment (for example, an exchange access problem that has already been fixed). This will move the ticket to a "Closed" state (CLS) immediately and will inform IB staff that there is no further need to investigate the issue.

- Just click on the Cancel

icon on the appropriate ticket row. A confirmation page will be provided.

icon on the appropriate ticket row. A confirmation page will be provided.

- Use this when you have received a satisfactory answer to your inquiry. This will change the ticket state to "Closed" (CLS). We request that you close tickets as soon as possible once you are satisfied. IB Customer Service managers may close tickets in cases where the ticket appears to be fully answered but has not been closed by the customer.

- Just click on the Close icon on the appropriate ticket row. A confirmation page will be provided.

- The IB-Expert might close a ticket after responding if he/she believes the inquiry was fully and satisfactorily resolved. It may be the case thaat the Client does not agree that the question was properly answered so we provide a way to reopen recently closed tickets. Just click on the Re-Open link on the appropriate line of the overview page. The ticket status should show LV1 and the IB-Expert who handled the ticket will be notified.

- Just click on the "Reopen" link on the appropriate ticket row. A confirmation page will be provided.

How to configure Client Services message delivery and notification

To configure your Message Center preferences:

1. Log in to Client Portal

2. Click the User menu (head and shoulders icon in the top right corner) followed by Secure Message Center.

3. Click on the Preferences (gear) icon next to the Compose button.

4. The message Preferences window will appear

5. Select a Primary and Secondary Preferred Language for messages using the drop-downs

6. Select your preferred delivery options in the Secure Message Delivery section.

7. Click SAVE to save your changes.

Please note, for security reasons, it is not possible to receive the entire message via E-mail or SMS/Text Message. It is only possible to receive a summary of the notification via E-mail or SMS/Text Message.

Find more information on Message Center preferences in the Client Portal Users' Guide.

2009 Gain/Loss Summary Worksheet: General Explanation

Important Note: The Worksheet has been prepared using IRS guidelines for information purposes only. It is not intended to replace any official IRS tax forms or schedules; and should not be regarded as an IRS Form Schedule D.

Interactive Broker's 2009 Gain/Loss Summary Worksheet ("Worksheet") provides the capital gains and losses for your account's year-end review. Investors of a limited number of securities will find the pairing of 2009 sell trades useful. Designed to aid with your year end reconciliation, the following securities and trades are included: Bonds, Equity Options, Fractional Shares, Index Futures*, Mutual Funds, Short Sale, T-Bills, Tender Offers, and WHIFITs.

A general explanation of the Worksheet is organized below by Parts, Columns, and Totals.

*Only cash-settled

Worksheet Parts

The Worksheet is divided into two parts. The period in which you held the position determines whether or not Short-Term or Long-Term applies.

Part 1 - Short Term Capital Gains and Losses - Assets Held One Year or Less

Part 2 - Long Term Capital Gains and Losses - Assets Held More Than One Year

Worksheet Columns

Each section contains the following seven columns to identify your trades.

| (a) Description of property | (b) Date acquired | (c) Date sold | (d) Sales price | (e) Cost or other basis | (f) Gain or (loss) | Codes |

1. (a) Description of property...shows the security symbol, name, quantity, and other information to identify the asset sold.

Example: 500 sh. DB - DEUTSCHE BANK AG-REGISTERED

2. (b) Date acquired...shows the trade date of your security's purchase.

Asset Transfers: IB has entered the date supplied by you through Position Transfer Basis. If an update was not received by year-end, then the asset transfer settlement date appears. See your monthly or annual summary for details.

Short Sales: The box is left blank if the closing trade has not been completed. For short sales included on a prior year Worksheet or 1099-B, the code ADJ is entered.

3. (c) Date sold...shows the trade date of your security's sale.

4. (d) Sales price...shows the gross security sale price, net of commissions.

Option Adjustments: For exercised call options, the writer's sale proceeds have been increased by the amount received for the call. For exercised put options, the holder's sale proceeds have been reduced by the cost of the put. See IRS Pub. 550, page 57, for details. For expired options, an amount of 0.00 is entered, followed by the Code "Ep".

5. (e) Cost or other basis...shows the total price paid for your security, plus commissions.

Corporate Actions: Adjustments have not been made for any stock splits or non-dividend distributions. See IRS Pub. 550, page 44, for details.

Mutual Funds: IB does not use an average basis for mutual funds. The First In, First Out (FIFO) method is used.

Original Issue Discount: The basis has not been increased by the amount of OID included in your income. See IRS Pub. 550, page 13, for details.

Option Adjustments: For exercised put options, the writer's basis has been increased by the amount received for the put. For exercised call options, the holder's basis has been increased by the cost of the call. See IRS Pub. 550, page 57, for details.

6. (f) Gain or (loss)...shows the calculation for each security using the tax execution methods First-In, First Out (FIFO), Last In, First Out (LIFO), or Maximize Losses (ML).

Loss: Negative amounts are identified in parentheses. For example, a loss of $2,000.00 displays as (2,000.00).

Tax Method: If no code appears in the Codes column, then FIFO applies. The other methods are noted by either LI = LIFO or ML = Maximize Losses.

7. Codes...shows various trade designations, such as: corporate actions, asset transfers, or option assignments.

Codes and Meanings Table: The last page of the Worksheet contains a table to identify each non-security symbol used.

Worksheet Totals

1. Subtotal adjustment from option assignment...shows the total amount of all sale proceeds increases or decreases made from option assignments to the assigned stock sale proceeds (see Cost or other basis details above).

The adjustments, in accordance with IRS guidelines, are added or subtracted in order for the next Subtotal line to equal the amount reported by IB on the 1099-B, box 2. Please keep in mind that IB does not report any option proceeds or adjustments to sales proceeds from assignments on the 1099s.

2. Subtotal for stocks, bonds and T-bills...shows the total non-adjusted proceeds reported for each trade under column (d) Sales price for stocks, bonds, and T-bills only. This amount should equal the 1099-B, box 2, amount.

1099-B, box 2: In general, this 1099 figure should equal the combined Parts 1 & 2 Subtotal for stocks, bonds and T-bills figure.

3. Total...shows the combined proceeds for all trades under column (d) Sales price, including option sale proceeds.

Total Option Sale Proceeds: Subtract the Total amount of column (d) from the Subtotal for stocks, bonds and T-bills of column (d) to obtain the total proceeds from all option sales.

Click here to go back to the main 2009 Worksheet article.

Note: Securities classified by the IRS as IRC Section 1256 contracts are included on the Gain/Loss Worksheet for 1256 Contracts.

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

What’s New for the 2009 Gain/Loss Summary Worksheet

Wash Sales – If you sold a stock or security at a loss, but re-purchased within 30 days the same or substantially the same security, the Worksheet identifies the sale using code “WS” (Disallowed loss from wash sale).

Social Security Number – For security purposes, the first 5 digits of the tax identification number have been removed.

Tax Basis Declaration – Two new tax basis methods, made available January 2009, help identify gain/loss methods for trades. The optional methods Last In, First Out (LIFO) and Maximize Losses (ML) join the default First In, First Out (FIFO) on the Worksheet.

Select Gain/Loss Summary Worksheet: Considerations for details about the new features.

Click here to go back to the main 2009 Worksheet article.

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

Username and password management for the IBKR Online Features

IBKR Online Features provides several forums where clients can express their opinion and vote for their favorite commercial or freelance software tools, programming features and third-party tutors. In addition, the Features Poll forum allows clients to submit suggestions for future technology and service enhancements and to vote and make comments on the suggestions provided by others. While there's no assurance that any one suggestion will be enacted, those which generate the widest support via this system tend to receive the highest priority in our programming queue.

To participate in a forum, clients must first establish a username and password combination unique from that established for Account Management and trading platform access. To add, delete or modify a username or password, you'll first need to log into Account Management and go to the Settings section followed by User Settings. Once there, click the gear icon next to the words "Online Features" in the Login section. From there enter a username and password which differs from that which you use to log into your account. Then enter your account username and password to confirm.

If you have forgotten your Online Features password and/or wish to reset your username, you may do so through this same screen by re-entering your choices, then entering your account username and password to confirm and clicking on the Change button. As clients have the availability to self-manage their password in this manner there is no process in place to supply a forgotten password.

How do I determine which market data subscription is applicable for a given security?

IBKR provides account holders with a Market Data Assistant tool which assists in selecting the subscription services available for a given security (stock, option or warrant) they wish to trade. The search results show all exchanges upon which the product trades, the subscription offering and its monthly fee for both Professional and Non-Professional clients as well as the depth of market variations associated with each subscription.

To access the Market Data Assistant:

- Log in to Client Portal

- Click on the Help menu (question mark icon in the top right corner) followed by Support Center

- Scroll down and select Market Data Assistant

- Enter the Symbol or ISIN and the Exchange

- Choose a value for the optional filters: Professional/Non Professional subscriber status, Currency and Asset

- Click Search

- Review the available options and decide which subscription best meets your needs.

Find more information on the market data selections page of the IBKR website.

How to Deposit Funds Via a Full ACATS/ATON Transfer

How to deposit funds to your Interactive Brokers account via a full ACATS/ATON Transfer

For information on how to initiate a partial ACATS/ATON transfer/ please click here

For Interactive Brokers tradeable products please visit the Contract Search Engine

For a detailed description of the Full ACATS/ATON process flow please click here

For a list of the most common causes for ACATS/ATON rejects, please click here

How to Deposit Funds Via a Check

How to deposit funds to your Interactive Brokers account via a Check