U.S. Microcap Stock Restrictions

Introduction

To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U.S. Microcap Stocks. A list of those restrictions, along with other FAQs relating to this topic are provided below.

Microcap Restrictions

- IBKR will only accept transfers of blocks of U.S. Microcap stocks from Eligible Clients. Eligible Clients include accounts that: (1) maintain equity (pre or post-transfer) of at least $5 million or, clients of financial advisors with aggregate assets under management of at least $20 million; and (2) have less than half of their equity in U.S. Microcap Stocks.

- IBKR will only accept transfers1 of blocks of U.S. Microcap Stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC;

- IBKR will not accept transfers1 of or opening orders for U.S. Microcap Stocks designated by OTC as Caveat Emptor or Grey Market from any client. Clients with existing positions in these stocks may close the positions;

- IBKR will not accept transfers of U.S. Microcap Stocks to cover a short position established at IBKR;

- Execution-only clients (i.e., execute trades through IBKR, but clear those trades elsewhere) may not trade U.S. Microcap Stocks within their IBKR account. (IBKR may make exceptions for U.S.-registered brokers);

Microcap FAQs

What is a U.S. Microcap Stock?

The term “Microcap Stock” refers to shares (1) traded over the counter or (2) that are listed on Nasdaq and NYSE American that have a market capitalization of between $50 million to $300 million and are trading at or below $5. For purposes of this policy, the term Microcap Stock will include the shares of U.S. public companies which have a market capitalization at or below $50 million, which are sometimes referred to as nanocap stocks or trade on a market generally associated with Microcap Stocks.

To avoid situations where minor, short-term fluctuations in a stock price cause repeated reclassification, any stock classified as U.S. Microcap will remain in that classification until both its market capitalization and share price exceed $300 million and $5, respectively, for a 30 consecutive calendar day period.

As Microcap Stocks are often low-priced, they are commonly referred to as penny stocks. IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. In addition, IBKR will not consider ADRs on non-US companies to be Micro-Cap stocks.

Where do Microcap Stocks trade?

Microcap Stocks typically trade in the OTC market, rather than on a national securities exchange. They are often electronically quoted by market makers on OTC systems such as the OTC Bulletin Board (OTCBB) and the markets administered by the OTC Markets Group (e.g., OTCQX, OTCQB & Pink). Also included in this category are stocks which may not be publicly quoted and which are designated as Caveat Emptor, Other OTC or Grey Market.

In addition, U.S. regulators also consider stocks listed on Nasdaq or NYSE American trading at or below $5 with a market capitalization at or less than $300 million to be Microcap Stocks.

What happens if IBKR receives a transfer from an Eligible Client where one or more of the positions transferred is a Microcap Stock?

If IBKR receives a transfer containing a block of a Microcap stock, IBKR reserves the right to restrict the sale of any Microcap position(s) included in the transfer unless the Eligible Client provides appropriate documentation establishing that the shares were either purchased on the open market (i.e., on a public exchange through another broker) or were registered with the SEC pursuant to an S-1 or similar registration statement.

Eligible Clients can prove that shares were purchased on the open market by providing a brokerage statement or trade confirm from a reputable broker reflecting the purchase of the shares on a public exchange. Eligible Clients can establish that the shares are registered by providing the SEC (Edgar system) File number under which their shares were registered by the company (and any documents necessary to confirm the shares are the ones listed in the registration statement).

NOTE: All customers are free to transfer out any shares we have restricted at any time.

What restrictions will IBKR apply to Prime accounts?

Clients whose activities include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. However, while Prime accounts may clear U.S. Microcap Stocks at IBKR, those shares will be restricted until such time IBKR confirms that the shares are eligible for re-sale under the procedures discussed above.

To remove the restriction for shares purchased on the open market, please have the executing broker provide a signed letter on company letterhead or an official Account Statement stating that the shares were purchased in the open market. The letter or statement must also include the below required criteria. Alternatively, if the shares were acquired through an offering the letter or statement must provide documents or links to the relevant registration statement and state that the shares were part of it.

Required Broker Letter Criteria:

1) IBKR Account Number

2) IBKR Account Title

3) Trade Date

4) Settlement Date

5) Symbol

6) Side

7) Price

8) Quantity

9) Time of Execution

10) Exchange

11) Must be signed

12) Must be on Firm's official letterhead

To summarize: Sell Long trades will be accepted if the long position is no longer restricted. Sell Short trades will be accepted. Buy Long trades will be accepted and the position will be restricted until Compliance is provided with sufficient information to remove the restriction. Buy Cover trades and intraday round trip trades will not be accepted.

What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor?

If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or transfer the position but will not be able to increase your position.

What are some of the reasons why Microcap Stock trading may be restricted in my account?

There are two primary reasons why you might be restricted from trading in a Microcap Stock:

- Potential Affiliation to Issuer: U.S. Securities and Exchange Commission (“SEC”) Rule 144 places certain limitations on trading of stocks (including Microcap Stocks) by an “affiliate” of the issuer. If IBKR observes trading activity or holdings in a Microcap Stock that are close to the trading volume thresholds under Rule 144 (“Rule 144 Thresholds”), IBKR may restrict the customer from trading the Microcap Stock until a compliance review is completed.

- Transfer of Microcap Stock: If the customer has recently transferred a Microcap Stock into their IBKR account, IBKR may restrict the customer from trading in that security until a compliance review is completed.

If one of the above reasons apply, trading will be restricted in the security and a notification will be sent to the customer’s message center in Account Management. This notification will describe the reason for the restriction and the steps the customer must take before IBKR will consider lifting the restriction.

Why does IBKR consider me to be a potential affiliate of a Microcap Stock issuer?

An “affiliate” is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

Rule 144 applies to all securities, including Microcap Stocks. However, given the heightened risks associated with trading Microcap Stocks, if a customer’s trading and/or holdings in a Microcap Stock are close to the Rule 144 Thresholds, IBKR will restrict the customer’s trading in the Microcap Stock. This restriction will remain in effect pending a compliance review into the customer’s potential affiliate status.

For the Potential Affiliate review, why do I need to ask for a new review every two weeks?

A customer’s affiliate status may change soon after IBKR completes the above-referenced Potential Affiliate review. As such, IBKR believes it is appropriate to refresh a Potential Affiliate review every two weeks if a customer’s trading activity and/or holdings in the Microcap Stock remain close to the Rule 144 Thresholds.

Where can I find a list of stocks that IBKR has designated as U.S. Microcaps?

A list of stocks designated as U.S. Microcaps by IBKR is available via the following link: www.ibkr.com/download/us_microcaps.csv

Note that this list is updated daily.

Where can I find additional information on Microcap Stocks?

Additional information on Microcap Stocks, including risks associated with such stocks may be found on the SEC website: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1This includes transfers by any method (e.g., ACATS, DWAC, FOP), conversion of Canadian listings to their U.S. equivalent via “Southbound” transfer, transfers to cover existing short positions, IB Prime customers executing with other brokers and clearing to IBKR, etc.

How to update the US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on your account

If you have been informed or believe that your account profile contains an incorrect US SSN/ITIN, you may simply log into your Account Management to update this information. Depending on your taxpayer status, you can update your US SSN/ITIN by modifying one of the following documents:

1) IRS Form W9 (if you are a US tax resident and/or US citizen holding a US SSN/ITIN)

2) IRS Form W-8BEN (if you are a Non-US tax resident holding a US SSN/ITIN)

Please note, if your SSN/ITIN has already been verified with the IRS you will be unable to update the information. If however the IRS has not yet verified the ID, you will have the ability to update through Account Management.

How to Modify Your W9/W8

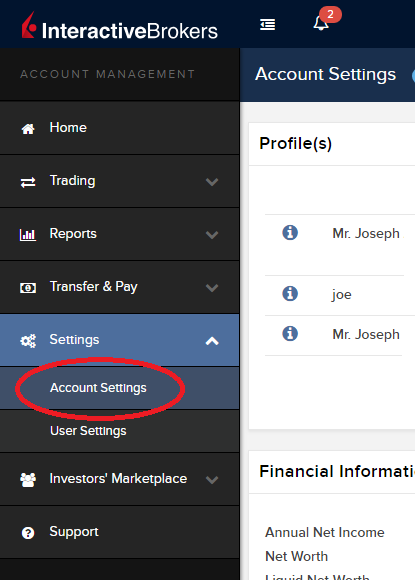

1) To submit this information change request, first login to Account Management

2) Click on the Settings section followed by Account Settings

3) Find the Profile(s) section. Locate the User you wish to update and click on the Info button (the "i" icon) to the left of the User's name

.png)

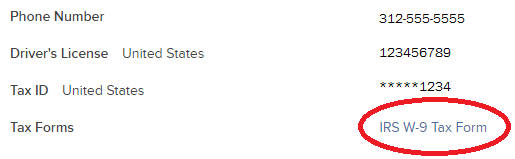

4) Scroll down to the bottom where you will see the words Tax Forms. Next to it will be a link with the current tax form we have for the account. Click on this tax form to open it

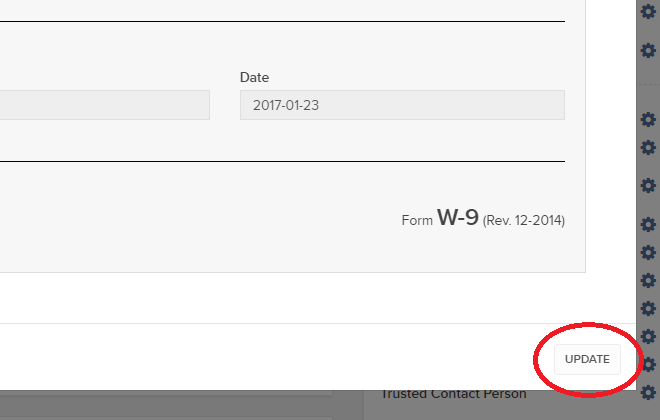

5) Review the form. If your US SSN/ITIN is incorrect, click on the UPDATE button at the bottom of the page

6) Make the requisite changes and click the CONTINUE button to submit your request.

7) If supporting documentation is required to approve your information change request, you will receive a message. Otherwise, your information change request should be approved within 24-48 hours.

Depositing Shares Held in the Direct Registration System (DRS)

Overview

The Direct Registration System (DRS) allows shareholders to register their U.S. share holdings on the books and records of the issuer in an electronic rather than paper certificate form through the issuer’s designated transfer agent. Once held in a DRS account, the shares may then be transferred electronically via the Depository Trust Company (DTC) to your IB account where transactions may take place or where the shares may be afforded margin loan value.

It should be noted that not all shares are DRS eligible. In general, most U.S. exchange traded securities are, but many OTC shares, as well as shares subject to a restriction and therefore held in certificate form, are not.

Transfer Process

To deposit shares held in your DRS account to your IB account you will need to log into Account Management and create transfer instructions. These instructions require that you provide IB with certain information regarding your DRS account (e.g., account number and taxpayer ID) which you will need to obtain from and/or confirm with your transfer agent. It’s important that you provide IB with information which matches that of your DRS account, otherwise your transfer agent will reject the request and you will be charged a rejection fee. Information regarding fees for rejected as well as settled transactions are posted on the website.

Once the DRS account information has been confirmed, log into Account Management and proceed as follows:

1. Select the Funding and then Position Transfers menu options;

2. From the Position Transfer screen, select a transfer method of DRS-Direct Registration System and transfer type of Deposit via the drop-down menus;

3. You’ll be directed to the DRS Transfer screen where the taxpayer ID you’ve provided to IB is displayed. If this does not match that which you maintain for your DRS account, you will first need to reconcile and correct the information so it matches prior to proceeding with the transfer request. Requests submitted with a mismatched taxpayer ID will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee;

4. Enter your DRS account number and click the Continue button. Note that requests submitted with an account number that doesn't match that of your DRS account will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee;

5. Enter the symbol of the security you intend to transfer as well as the share quantity. Note that requests submitted with a symbol not held within or a share quantity which exceeds that held in your DRS account will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee;

6. Enter your electronic signature and click the “Continue” button to confirm your transfer request.

IB will then notify DTC who will match the security to its associated transfer agent and send them notification of your request. Assuming the DRS account and share information you’ve provided is correct, the transfer agent will post the shares for delivery to IB. Note that while transfer requests typically settle within 2 -5 business days, the transfer agent may take longer to respond to the notification and, if no response is received within 30 days, the request will be canceled.

IMPORTANT NOTE

If you are transferring shares from a joint account or are a non-US person, special consideration needs to be provided to the taxpayer ID you provide to IB for matching to your DRS account. In the case of a joint account, the ID will generally be one of the SSNs of the joint account holders or a default value of 999999999. In the case of a non-US person, where no US taxpayer ID exists, a default value of 111111111 is often used. In either case, you will need to verify with the transfer agent the identifier they will recognize for matching purposes. If the transfer agent requests an identifier which doesn’t match one of the elections provided within Account Management, please contact Customer Service for transfer assistance.

NON A.C.A.T. US TRANSFERS

To request an inbound or outbound transfer of positions, use the Transfer Positions page in Account Management. Position transfers allow us to efficiently identify your incoming funds for proper credit to your account.

NON A.C.A.T. US TRANSFERS

|

Transfer Methods |

Description |

Time to Arrive |

Applicable Fee(s) |

Limitation |

|

Free of Payment (FOP)

|

Delivery of long US stock positions, US Warrant positions, and Corporate and Municipal Bond positions from another US bank or broker that is a member of the Depository Trust Company (DTC).

|

Transfers are generally completed during the same business day as initiated, but this depends on your third-party broker.

|

None |

Only available for long US Stock positions, US Warrant positions, and Corporate Municipal Bond positions.

|

|

FOP is not available for IRA accounts.

|

||||

|

FOP notices are valid for five business days before expiring. Once the notice has expired IB will not accept the shares. |

||||

|

|

An electronic system for registering stock with an issuer/company's transfer agent. These shares are in electronic book-entry format and can be transferred to and from a brokerage account. DRS shares are already issued and held electronically in book-entry format at the transfer agent. You can also upload positions in a .CSV file for a partial DRS transfer.

|

Once a customer request is submitted via Account Management, the IB system creates a notification. Upon receipt or delivery of shares from or to the transfer agent, the IB system will generate a transaction that will cause the shares to settle into or out of the customer's account.

|

Note that a processing fee may apply. For details, see the Other Fees page. |

DRS requests can pend up to 30 days, although agents typically respond to a request within two to five days. |

|

Deposit/Withdrawal at Custodian (DWAC) |

An electronic method of transferring shares registered in the customer's name on the books of the transfer agent between participating broker/dealers with the transfer agent serving as a custodian. DWAC usually refers to new or certified paper shares to be electronically transferred.

|

DWAC requests settle or are rejected on the same day that the request is made. Transfer agents must approve all requests transmitted to them by the participating broker. Requests that are not approved by the end of the day are rejected. Once a DWAC request is rejected, a new customer-initiated request must be submitted by the stock holder in order to process the transfer. |

Note that a processing fee may apply. For details, see the Other Fees page. |

Since transfer agents must actively approve DWACs, these kinds of requests require prior coordination between the client and the transfer agent. Any requests not previously communicated will be rejected by the transfer agent.

|

|

US Futures Transfer |

Print the transfer form from the Transfer Positions page in Account Management and fax it to Interactive Brokers. |

Allow five to seven business days from time of fax, under normal circumstances, for positions and funds to arrive. From time of fax, five to seven business days under normal circumstances.

|

N/A |

Futures positions and cash will be transferred separately. The cash must be transferred via wire transfer.

|

IRA: Rollover Rules & Conditions

This information is for general educational purposes only. Individuals should consult with their financial adviser or legal counsel to determine how rollover regulations affect their unique situations.

Generally, an IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. The contribution to the second retirement plan is called a rollover contribution.

This article outlines the types of IRA rollover transactions, rules and conditions, IB's Rollover Certification form, and rollover transaction details. Select from list below for details:

Eligible Rollover Transactions

Rules & Conditions

Prior to completing an IRA Rollover transaction, we recommend that you review the rules and conditions surrounding eligibility. Interactive Brokers can accept as a tax-free transaction an eligible rollover distribution as defined under the Internal Revenue Code. Included in this article is information about eligible transactions, as well as the Interactive Brokers IRA Rollover Certification form.

IRA Rollover Certification

Before accepting an IRA rollover transaction into an Interactive Brokers LLC IRA, we require that you review your eligibility for the rollover and certify your understanding of the rollover rules and conditions. The IRA Rollover Form includes the IRA Rollover Certification.

The Transfer Funds page within the Client Portal lets you notify IB of an IRA Rollover deposit of funds into your account. From the Transfer & Pay menu select Transfer Funds and then Make a Deposit. Select one of the saved deposit instructions and follow the prompts on the screen or create a new deposit instruction by selecting the Currency of the deposit from the drop-down menu. Click Connect or Get Instructions for the method you will use to transfer funds. And finally follow the remaining instructions provided to initiate the transfer with your bank.

Rollover Transactions

Two types of IRA rollover transactions exist with different guidelines and delivery methods:

- Direct Rollover - a transfer of assets from an employer-sponsored retirement plan directly to an eligible IRA. If you choose to receive the distribution first, then you may roll over the funds to the IRA within 60 days.

- Indirect Rollover - a distribution from an IRA paid to you, followed by a rollover into another IRA within 60 days. The IRS allows an indirect rollover of each IRA's funds once during a twelve-month period.

(Note: A distributions directly from one IRA trustee to another IRA trustee is a Trustee-to-Trustee transfer. It is not affected by the twelve-month waiting period.)

For additional information about rollovers, visit Understanding Rollovers. See also IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) for more specific guidelines on moving retirement plan assets.

Eligible Rollover Transactions

Almost any distribution from a qualified plan can be rolled over to an IRA. Your retirement account may be eligible for one of the following eligible rollover transactions.

Traditional IRA or SIMPLE IRA to Traditional IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- During the preceding 12 months, no other distributions from the distributing IRA were rolled over

- The assets involved in the transaction have not been rolled over in the past 12 months

- Required Minimum Distribution satisfied (if over 73)

- For SIMPLE IRAs, after two years from the first contribution

Roth IRA to Roth IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- During the preceding 12 months, no other distributions from the distributing IRA were rolled over

- The assets involved in the transaction have not been rolled over in the past 12 months

Rollover or Direct Rollover from Qualified Plan into a Traditional IRA

- Eligible participant (participant, spouse beneficiary, or former spouse due to divorce)

- Funds or property deposited less than 60 days of receipt by the participant from the previous plan

- Funds received from an eligible qualified retirement plan

- Required Minimum Distribution satisfied (if over 73)

- Consists of funds, property, or proceeds from the sale of property distributed from the qualified plan

- All of the funds are eligible to be rolled over

Roth IRA to Roth IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- Required Minimum Distribution satisfied (if over 73)

Ineligible Rollover Transactions

Some funds distributed from a retirement plan are not eligible for rollover into an IRA. The following transactions are not eligible rollover transactions.

- Any portion of a distribution from a retirement plan not rolled over

- Required Minimum Distributions

- Distribution of excess contributions and related earnings

- Retirement plan loan treated as a distribution

- Hardship distributions

- Distributions part of substantially equal payments (73-t)

- Dividends on employer securities

- Non-spousal death benefit distributions

- The cost of life insurance coverage

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

Cost Basis Reporting

1099 Reporting

Statement and Year End Reporting for US persons and entities comprises the following:

1. Cost Basis: While the required reporting schedule was staggered, the primary cost basis that will be reported to the IRS includes equities bought and sold after December 31, 2010. This includes the adjusted cost basis resulting from wash sales and corporate actions.

The future phase-in period for broker reporting includes the assets sold on or after the following dates:

--- Mutual Funds and ETFS - 1/1/2012

--- Simple debt instruments (i.e. treasuries, fixed-rate bonds & municipal bonds) and options, - 1/1/2014

--- Other debt instruments - 1/1/2016

2. Tax Basis Method: Brokers are required to use the method first in, first out (FIFO), unless given other instructions by an investor. Changes to your tax basis method may be submitted through the Tax Optimizer. The Tax Optimizer is launched from within Account Management and is available for stock, option, bond, warrant and single-stock future trades.

IB offers multiple tax basis methods, including three basic options:

● First In, First Out (FIFO) - This is the default option. FIFO assumes that the oldest security in inventory is matched to the most recently sold security.

● Last In, First Out (LIFO) - LIFO assumes that the newest security acquired is sold first.

● Specific Lot - Lets you see all of your tax lots and closing trades, then manually match lots to trades. Specific Lot is not available as the Account Default Match Method.

Tax Optimizer also lets you select the following additional derivatives of the specific identification method.

● Highest Cost (HC), Maximize Long-Term Gain (MLTG), Maximize Long-Term Loss (MLTG), Maximize Short-Term Gain (MSTG), and Maximize Short-Term Loss(MSTL).

For complete instructions on using the Tax Optimizer and details on the lot-matching algorithms for each method, see the Tax Optimizer Users Guide.

Note: Changing your tax basis is effective immediately. The basis selected will be applied to all subsequent trades on the account statements and tax reports. Updates will not affect previously closed trades nor the TWS profit and loss data displayed.

3. Gain & Loss Categories: An additional requirement to the cost basis reporting is the capital gain or loss category. The gain or loss category of equities is determined by the length of time in which the security was held, known as the "holding period."

● Short-Term - Holding periods of one year or less are categorized as "short-term."

● Long-Term - Holding periods over one year are categorized as "long-term."

Year End Reports

The following statements and reports display cost basis information that will be reported on Form 1099-B for eligible accounts.

- Monthly Account Statements

- Annual Account Statements

- Worksheet for Form 8949

For a complete review of the tax information and year end reporting available, click here.

Note: Unlike the Account Statements, the Gain & Loss Worksheet for Form 8949 may consolidate sell trades. The cost basis will be adjusted, as required for 1099-B reporting.

Asset Transfers

U.S. legislation from 2008 included new guidelines for tax reporting by U.S. financial institutions. Effective January 2011, U.S. Brokers are required to report cost basis on sold assets, whether or not a gain/loss is short-term (held one year or less) or long-term (held more than one year). U.S. brokerage firms, Interactive Brokers LLC (IB) included, implemented changes to comply with the legislation.

For more information on cost basis with asset transfers, see Cost Basis & Asset Transfers.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

ACATS Transfer Guide (US brokerage account transfers)

ACATS Transfer Guide

Introduction

Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Through this article and other Knowledge Database resources, Interactive Brokers seeks to assist with your incoming and outgoing ACATS requests.

US brokerage firms utilize a standardized system to transfer customer accounts from one firm to another. Known as the Automated Customer Account Transfer Service or ACATS, the process allows assets to move seamlessly between brokerage firms in a unified time frame. ACATS transfers are facilitated by a third party, the National Securities Clearing Corporation (NSCC), to assist participating members with timely asset transfers.

ACATS Transfer Benefits

The majority of assets may be transferred between US brokerage firms and some banks through ACATS. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. Information on assets eligible for transfer is provided at "Assets Eligible..." Though impacted by multiple factors and time constraints, the accepted or rejected transfers finalize within 10 business days in most cases.

Navigating The Process

4 simple steps of the ACATS process will help you understand the flow and minimize delays. Familiarizing yourself with the transfer process helps to ensure a successful transition.

1. Incoming or Outgoing

Incoming ACATS Transfers

The financial institution that is receiving your assets and account transfer is known as the "receiving firm." Investors always work with and through the "receiving firm" to move full or partial account assets into a new broker.

Contact the "receiving firm" (Interactive Brokers) to review the firm's trading policies and requirements. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Not all ACATS transferable assets are acceptable for trading at every brokerage firm.

Outgoing ACATS Transfers

All outgoing ACATS transfers, full or partial, must be approved by the "delivering firm." Investors, however, should work with and through the "receiving firm" in order to begin the the transfer process or to status the progress of the request.

2. Initiating Your Transfer

Investors must always begin the ACATS transfer with the "receiving firm." An ACATS transfer form or Transfer Initiation Form (TIF) must be submitted. The "receiving firm" takes your reqeust and communicates with the "delivering firm" via ACATS. The process begins with this request for transfer of the account.

For your Interactive Brokers Account, the transfer is usually submitted online. Video instruction on submitting the transfer is provided at "How to deposit funds via a full ACATS/ATON Transfer." or through Step-by-step instructions.

Note: Outgoing account transfers from your IB account should be directed to the other broker. Your request will be submitted to IB from the other broker through the ACATS electronically.

3. What to Expect

Your Account

Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:

- Same Account Title

- Same Tax ID Number

- Same Account Type

Transfer Approval

Ultimately responsible for validating the transfer, the "delivering firm" may accept information from the "receiving firm" correcting data originally entered. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. Assets may not be accepted by the "receiving firm" for the following:

- Non-marginable or Margin (credit) violation

- Not Tradable

- DTC Chill

Note: The most common reasons for ACATS rejections are outlined by clicking here.

Processing Time-frame

The processing time for each transfer request is fixed. In general, approved transfers complete within 4 to 8 business days. Almost all transfers complete within 10 business days. Each firm is required to perform certain steps at specific intervals in the process. Feel free to review the Full ACATS transfer process flow.

Fees

While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge.

4. Who To Contact For Help

Interactive Brokers Customer Service stands poised to assist with your incoming ACATS transfer reqeust. Click here for Customer Service contact resources.

Note: Outgoing or ACATS transfers sending accounts to another broker should be directed to the "receiving firm." Their Account Transfer Group will work with Interactive Brokers directly to complete your outgoing request.

How to Deposit Funds Via a Full ACATS/ATON Transfer

How to deposit funds to your Interactive Brokers account via a full ACATS/ATON Transfer

For information on how to initiate a partial ACATS/ATON transfer/ please click here

For Interactive Brokers tradeable products please visit the Contract Search Engine

For a detailed description of the Full ACATS/ATON process flow please click here

For a list of the most common causes for ACATS/ATON rejects, please click here

European Assets Transfers

European Position Transfers

IB can accommodate transfers in the following countries on a manual basis:

- Belgium: options, futures

- France: stocks, options, futures

- Germany: stocks, warrants, options, futures

- Italy: options, futures

- The Netherlands: stocks, options, futures

- Spain: stocks, options, futures

- Switzerland: stocks, options, futures

- United Kingdom: stocks, options, futures

- Austria: stocks

- Sweden: stocks, options, futures

Customers wishing to transfer positions to an IB account must fill out the Interactive Brokers Transfer of Assets in Europe form and provide the following additional information:

- customer contact information (phone number and e-mail address)

- delivering broker contact information (contact person, phone number and e-mail address)

- approximate value of the securities to be transferred

- desired settlement date of the transaction(s)

The request is to be made either

- by attaching the form to a Ticket via the Message Center in Account Management.

- or by fax at +41-41-726-9599.

Upon receipt of the Transfer of Assets form, IB will verify the request to insure that we are able to support the transfer.

Once done, we will send a confirmation to the customer. And if we are able to support the transfer, we will thereafter contact the customer’s clearing broker to organize it.

Please note the following points:

- All transfers to an IB account from another clearing broker must be delivered free of payment, FOP.

- Interactive Brokers only accepts products that are available for trading on the IB system. Certain products cannot be held in your IB account including: money market deposits, many bonds and similar fixed income instruments, many mutual funds, limited partnership units and certain classes of stock. IB holds all positions in the firm accounts in non-registered form. We do not support individual registration of positions. Positions in registered shares will be converted to non-registered form by default.

- For initial account funding, your transfer must meet our Minimum Initial Deposit requirements or the transfer will be rejected.

- You will not be able to withdraw any funds or transfer any assets to another broker for ten business days after an account transfer is received.

Free of Payment (FOP) Transfers

Free of Payment (FOP) is term used by IB to refer to a process of transferring long US securities between IB and another financial institution (e.g. bank, broker or transfer agent) through the Depository Trust Company (DTC).

The FOP transfer method is often used when:

1. The delivering form is not a DTC ACAT (Automated Customer Account Transfer) Participant.

2. The customer would like to expedite the delivery of their securities. The processing time frame for securities transferred via FOP may, in certain instances, be less than that associated with an ACATS transfer.

The following steps are to be followed in order to create a FOP notice:

1. Log into Account Management.

2. Select Funding or Funds Management and then Position Transfers.

3. From the drop-down list, select the Transfer Method: Free of Payment.

4. Select the applicable transaction Type: Deposit or Withdraw.

5. In the case of a FOP Withdrawal, the steps are as follows:

- Select the Destination to whom the securities are being transferred.

- Enter your account number of the Third Party Broker Acount Information.

- Specify the security (Stock, Warrants or US Bonds).

- Enter the Symbol, Shares and the Exchange (optional) and click Add.

- Provide your electronic signature authorizing the transfer request and clicking on the Continue button.

- Verify your identity by entering your password and clicking on the Confirm Request button;

- If your account is enrolled in the Secure Transaction Program (STP), the processing of your request will take place once you enter your confirmation code and click on the Confirm Request button. If not STP enrolled, your request will be subject to security verification, requiring that you contact our Customer Service Center to validate your identity and request.

6. In the case of a FOP Deposit, the steps are as follows:

- Select the Source to whom the securities are being transferred.

- Enter your account number of the Third Party Broker Acount Information.

- Specify the security (Stocks, Warrants or US Bonds).

- Enter the Symbol, Shares and the Exchange (optional) and click Add.

- Provide your electronic signature authorizing the transfer request and clicking on the Continue button.

- A printable version of the FOP request is made available should your transferring firm require an authorization form.

7. Transfer requests are typically completed within five business days.

IMPORTANT NOTE:

While IB does not assess a fee to process FOP transfers, other firms may and we therefore recommend that you confirm with the contra-firm their policies in this regard prior to submitting a request. In the event a contra-firm does charge a fee to IB, the fee will be passed to the IB account holder.