PRIIP概述

背景

2018年,一項歐盟新規生效,該新規旨在對“零售”客戶進行保護,確保其在買入某種產品時能夠獲得充分的披露信息。該法規被稱為零售及保險投資產品組合法規(MiFID II指令2014/65/EU)或PRIIP,其覆蓋了所有應付給客戶的金額會受參考值或一種或多種并非由該等零售投資者直接買入之資產的業績表現影響而波動的投資。常見列子包括期權、期貨、差價合約、ETF、ETN和其它結搆性產品。

值得注意的是,經紀商不得允許零售客戶購買PRIIP覆蓋的產品,除非該產品的發行機搆已經備好了要求的披露文件讓經紀商提供給客戶。這種披露文件被稱為關鍵信息文件(“KID”),包括產品描述、成本、風險回報情況及可能的業績情境等信息。美國客戶不受PRIIP影響,因此,某些美國掛牌ETF的發行機搆通常不會創建關鍵信息文件。這就意味著,歐洲經濟區(“EEA”)的零售客戶可能無法購買此類產品。

客戶分類

IBKR默認將所有個人客戶分類為“零售”客戶,因為這樣可以給與客戶MiFID提供的最廣泛的保護。被分類為“專業”客戶的客戶無法享受“零售”客戶級別的保護,但同時也不需要受KID文件要求的限制。根據MiFID II的定義,“專業”客戶包括受監管的實體、大型客戶和要求被重新分類為“選擇性專業客戶”并且在知識、經驗和財務實力方面滿足MiFID II要求的個人。

IB提供了線上程序可供“零售”客戶申請將其分類更改為“專業”。重新分類的資格要求以及申請重新分類的步驟,請參見KB3298,如果要直接申請更改分類,可通過客戶端/賬戶管理中的相關問卷進行。

PRIIPs Overview

BACKGROUND

In 2018, an EU regulation, intended to protect “Retail” clients by ensuring that they are provided with adequate disclosure when purchasing certain products took effect. This disclosure document is referred to as a Key Information Document, or KID, and it contains information such as product description, cost, risk-reward profile and possible performance scenarios.

This regulation is known as the Packaged Retail and Insurance-based Investment Product Regulation (MiFID II, Directive 2014/65/EU), or PRIIPs, and it covers any investment where the amount payable to the client fluctuates because of exposure to reference values or to the performance of one or more assets not directly purchased by such retail investor. Common examples of such products include options, futures, CFDs, ETFs, ETNs and other structured products.

The UK Financial Conduct Authority (FCA) has equivalent requirements for UK residents.

It’s important to note that a broker cannot allow a Retail client to purchase a product covered by PRIIPs unless the issuer of that product has prepared the required disclosure document for the broker to provide to the client. U.S. clients are not impacted by PRIIPs, so the issuers of U.S. listed ETFs do not as a rule create KIDs. This means that EEA and UK Retail clients may not purchase the product. Clients nevertheless have several options:

- Many US ETF issuers have equivalent ETFs issued by their European entities. European-issued ETFs have KIDs and are therefore freely tradable.

- Clients can trade most large US ETFs as CFDs. The CFDs are issued by IBKRs European entities and as such meet all KID requirements.

- Clients may be eligible for re-classification as a professional client, for whom KIDs are not required.

CLIENT CATEGORISATION

We categorize all individual clients as “Retail” by default as this affords clients the broadest level of protection afforded by MiFID. Client who are categorised as “Professional” do not receive the same level of protection as “Retail” but are not subject to the KIDs requirement. As defined under MiFID II rules, “Professional” clients include regulated entities, large clients and individuals who have asked to be re-categorised as “elective professional clients” and meet the MiFID II requirements based on their knowledge, experience and financial capability.

We provide an online step-by-step process that allows “Retail” to request that their categorisation be changed to “Professional". The qualifications for re-categorisation along with the steps for requesting that one’s categorisation be considered are outlined in KB3298 or, to directly apply for a change in categorisation, the questionnaire is available in the Client Portal/Account Management.

PRIIP Order Reject Translations

Clients entering opening orders for products covered by the PRIIPs Regulation where the issuer has not provided the required disclosure documents or Key Information Documents (KIDS) will have their order rejected and will receive the following reject message:

English

This product is currently unavailable to clients classified as 'retail clients'.

Note: Individual clients and entities that are not large institutions generally are classified as 'retail' clients.

There may be other products with similar economic characteristics that are available for you to trade.

French

Ce produit n’est pas actuellement disponible pour les clients considérés comme des clients “Particuliers/de détail”. Remarque : les clients particuliers et entreprises de détail qui ne sont pas de larges établissements sont classifiés comme des clients “de détail”.

D’autres produits aux caractéristiques similaires peuvent exister mais ne vous sont pas proposés au trading.

German

Dieses Produkt ist derzeit für Kunden, die als „Retail-Kunden” eingestuft werden, nicht verfügbar. Hinweis: Einzelkunden und Körperschaften, bei denen es sich nicht um große Institutionen handelt, werden grundsätzlich als „Retail”-Kunden bezeichnet.

Es ist möglich, dass Ihnen andere Produkte mit ähnlichen wirtschaftlichen Merkmalen zum Handel zur Verfügung stehen.

Italian

Questo prodotto al momento non è disponibile per i clienti “retail”. Nota: i clienti privati e le organizzazioni di non grandi dimensioni sono in genere classificati come clienti “retail”.

Potrebbero esserci altri prodotti con simili caratteristiche disponibili per le negoziazioni.

Spanish

Este producto no está actualmente disponible para clientes clasificados como “clientes minoristas”. Nota: los clientes individuales y las entidades que no sean grandes instituciones son clasificados, generalmente, como clientes “minoristas”.

Podría haber otros productos con características económicas similares que estén disponibles para que usted opere en ellos.

Russian

На данный момент этот продукт недоступен для розничных клиентов. Примечание: Частные лица и юридические структуры, не являющиеся крупными предприятиями, как правило, относятся к числу розничных клиентов.

Вам могут быть доступны другие продукты с похожими экономическими характеристиками.

Japanese

こちらの商品は現在「リテール・クライアント」として分類されるお客様にはご利用いただけません。注意:大きな機関ではない個人のお客様および事業体のお客様は、通常「リテール」クライアントとして分類されます。

似た経済特性を持つその他の商品で、お客様にお取引いただくことのできる商品がある可能性があります。

Chinese Simplified

该产品目前不适用于"零售客户"。 请注意:个人用户和非大型机构实体通常均被划分为"零售"客户。

可能有其他具有类似经济特征的产品适用于您的交易。

Chinese Traditional

該產品目前不適用於"零售客戶"。請注意: 個人用戶和非大型機構實體通常均被劃分為"零售"客戶。

可能有其他具有類似經濟特徵的產品適用於您的交易。

Please note, it is possible to be reclassified from Retail to Professional once certain qualitative, quantitative and procedural requirements are met. For more information on requirements, please see: How can I update my MiFID client category?

How to update the US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on your account

If you have been informed or believe that your account profile contains an incorrect US SSN/ITIN, you may simply log into your Account Management to update this information. Depending on your taxpayer status, you can update your US SSN/ITIN by modifying one of the following documents:

1) IRS Form W9 (if you are a US tax resident and/or US citizen holding a US SSN/ITIN)

2) IRS Form W-8BEN (if you are a Non-US tax resident holding a US SSN/ITIN)

Please note, if your SSN/ITIN has already been verified with the IRS you will be unable to update the information. If however the IRS has not yet verified the ID, you will have the ability to update through Account Management.

How to Modify Your W9/W8

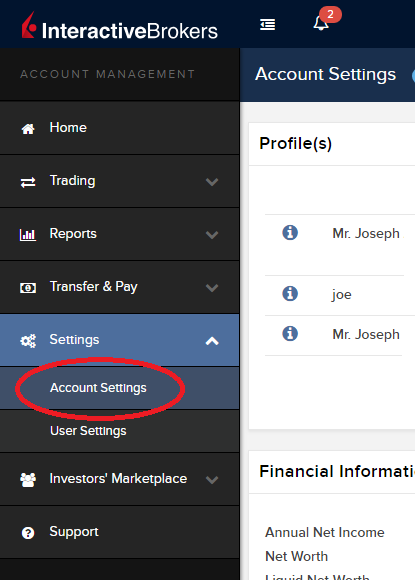

1) To submit this information change request, first login to Account Management

2) Click on the Settings section followed by Account Settings

3) Find the Profile(s) section. Locate the User you wish to update and click on the Info button (the "i" icon) to the left of the User's name

.png)

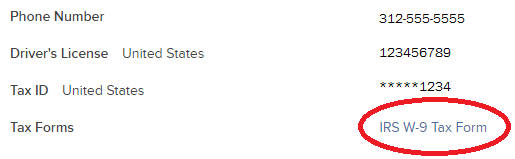

4) Scroll down to the bottom where you will see the words Tax Forms. Next to it will be a link with the current tax form we have for the account. Click on this tax form to open it

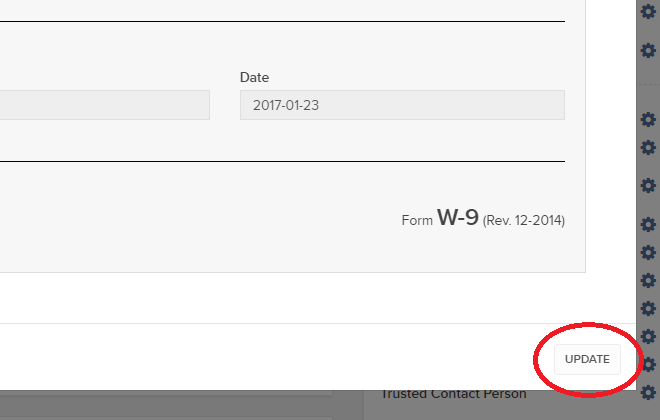

5) Review the form. If your US SSN/ITIN is incorrect, click on the UPDATE button at the bottom of the page

6) Make the requisite changes and click the CONTINUE button to submit your request.

7) If supporting documentation is required to approve your information change request, you will receive a message. Otherwise, your information change request should be approved within 24-48 hours.

SEC Tick Size Pilot Program

Background

Effective October 3, 2016, securities exchanges registered with the SEC will operate a Tick Size Pilot Program ("Pilot") intended to determine what impact, if any, widening of the minimum price change (i.e., tick size) will have on the trading, liquidity, and market quality of small cap stocks. The Pilot will last for 2 years and it will include approximately 1,200 securities having a market capitalization of $3 billion or less, average daily trading volume of 1 million shares or less, and a volume weighted average price of at least $2.00.

For purposes of the Pilot, these securities will be organized into groups that will determine a minimum tick size for both quote display and trading purposes. For example, Test Group 1 will consist of securities to be quoted in $0.05 increments and traded in $0.01 increments and Test Group 2 will include securities both quoted and traded in $0.05 increments. Test Group 3 will include also include securities both quoted and traded in $0.05 increments, but subject to Trade-at rules (more fully explained in the Rule). In addition, there will be a Control Group of securities that will continue to be quoted and traded in increments of $0.01. Details as to the Pilot and securities groupings are available on the FINRA website.

Impact to IB Account Holders

In order to comply with the SEC Rules associated with this Pilot, IB will change the way that it accepts orders in stocks included in the Pilot. Specifically, starting October 3, 2016 and in accordance with the phase-in schedule, IB will reject the following orders associated with Pilot Securities assigned to Test Groups:

- Limit orders having an explicit limit that is not entered in an increment of $0.05;

- Stop or Stop Limit orders having an explicit limit that is not entered in an increment of $0.05; and

- Orders having a price offset that is not entered in an increment of $0.05. Note that this does not apply to offsets which are percentage based and which therefore allow IB to calculate the permissible nickel increment

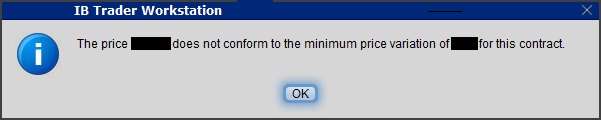

Clients submitting orders via the trading platform that are subject to rejection will receive the following pop-up message:

The following order types will continue to be accepted for Pilot Program Securities:

- Market orders;

- Benchmark orders having no impermissible offsets (e.g., VWAP, TVWAP);

- Pegged orders having no impermissible offsets ;

- Retail Price Improvement Orders routed to the NASDAQ-BX and NYSE as follows:

- Test Group 1 in .001

- Test Group 2 and 3 in .005

Other Items of Note

- GTC limit and stop orders entered prior to the start of the Pilot will be adjusted as allowed (e.g., a buy limit order at $5.01 will be adjusted to $5.00 and a sell limit at $5.01 adjusted to $5.05).

- Clients generating orders via third-party software (e.g., signal provider), order management system, computer to computer interfaces (CTCI) or through the API, should contact their vendor or review their systems to ensure that all systems recognize the Pilot restrictions.

- Incoming orders to IB that are marked with TSP exception codes from other Broker Dealers will not be acted upon by IB. For example, IB will not accept incoming orders marked with the Retail Investor Order or Trade-At ISO exception codes.

- The SEC order associated with this Pilot is available via the following link: https://www.sec.gov/rules/sro/nms/2015/34-74892-exa.pdf

- For a list of Pilot Program related FAQs, please see KB2750

Please note that the contents of this article are subject to revision as further regulatory guidance or changes to the Pilot Program are issued.

SEC Tick Size Pilot Program FAQs

Tick Size Pilot ("TSP" or "Pilot") Program:

Under the TSP Program, if IBKR receives any order in a Pilot Security that does not conform to the designated pricing increment (e.g., a limit price in a $0.01 increment for a security designated as trading $0.05 increments), IBKR will REJECT that order, subject to limited exceptions. IBKR strongly encourages a thorough review of your software or your vendor’s software to understand the criteria for what causes an order in a Pilot Security to be rejected to permit you or your vendor to make changes to correctly handle orders in Test Group Pilot Securities.

FREQUENTLY ASKED QUESTIONS:

Q: What is the Tick Size Pilot?

A: On May 6, 2015, the SEC approved an amended TSP NMS Plan. The Pilot will be two years in length. Data collection for the Pilot began on April 4, 2016, 6 months prior to the implementation of the trading and quoting rules for the Pilot. Implementation of the trading and quoting rules for the Pilot will begin on October 3, 2016.

The Pilot will be conducted using a Control Group and three Test Groups where variations in quoting and trading rules exist between each group. Please see the TSP NMS Plan for additional information.

Q: Will the Pilot quoting and trading rules apply during regular market hours, pre-market hours and post market hours?

A: The Pilot rules apply during all operational hours (pre-market, regular hours, and post market hours trading).

Q: Will the Pilot quoting and trading rules apply to odd-lot and mixed-lot sizes?

A: Yes, the Pilot rules to all order sizes.

Q: Will orders in Control Group Securities be accepted in price increments of less than $0.05?

A: Yes, orders submitted in price increments of less than $0.05 will continue to be accepted in Control Group securities.

Q: Will orders in a Test Group 1, 2 or 3 Pilot Securities be accepted in price increments of less than $0.05?

A: No, unless covered by an exception, orders submitted in price increments of less than $0.05 will be rejected.

Q: Which Pilot Security Orders in Test Groups will Interactive Brokers accept at other than $0.05 increments?

![]() Midpoint orders with no explicitly stated limit price or impermissible offsets will be accepted

Midpoint orders with no explicitly stated limit price or impermissible offsets will be accepted

![]() VWAP orders that do not have an explicitly stated limit price or impermissible offsets will be accepted.

VWAP orders that do not have an explicitly stated limit price or impermissible offsets will be accepted.

![]() Interactive Brokers will accept Exchange operated Retail Price Improvement orders as follows:

Interactive Brokers will accept Exchange operated Retail Price Improvement orders as follows:

![]() Test Group 1 in $0.001 price increments

Test Group 1 in $0.001 price increments

![]() Test Groups 2 and 3 in $0.005 price increments.

Test Groups 2 and 3 in $0.005 price increments.

Q: Will there be any changes to the Opening / Closing processes on Exchanges?

A: Please refer to each of the exchange rules for details but in general, there will be no changes to the Opening / Closing process. All orders entered and eligible to participate in Exchange Opening / Closing Cross will be accepted in increments of $0.05. The Exchanges will begin publishing all quotes in increments of $0.05; however, Net Order Imbalance Indicator prices may be published in increments of $0.025.

Q: What will happen to my GTC order that was placed prior to October 3rd in a Pilot Stock that was priced in impermissible tick increments?

A: Interactive Brokers will adjust outstanding limit and stop GTC orders in Pilot stocks in Test Groups that are not in permissible tick increments (e.g., a buy limit order at $5.01 will be adjusted to $5.00 and a sell limit at $5.01 adjusted to $5.05).

Q: What will happen to my GTC order placed after October 3rd that was placed and accepted in a nickel tick increment but the Pilot Stock moves from a Test Group to the Control Group that permits non-nickel increments?

A: The GTC order will automatically be able to be revised by the user in non-nickel increments on the date the Pilot stock moves from the Test Group to the Control Group. Similarly, if a stock is added to Test Group due to a corporate action, IBKR will cancel the GTC order if it is priced in impermissible increments.

Q: Where can I find out more information?

A: See KB2752 or the FINRA website for additional details regarding the Pilot Program: http://www.finra.org/industry/tick-size-pilot-program

Information regarding restrictions on Swiss Warrants

Interactive Brokers supports cash settled standard warrants listed for trading on the SWX Swiss exchange. This includes a number of share warrants and all index, commodity and currency warrants.

Share Warrants with physical delivery are not supported at this time.

TWS Messages - Your account is restricted from placing orders at this time

Account holders receiving the following message 'Your account is restricted from placing orders at this time' are not allowed to place any opening or closing orders without prior assistance from the IB Trade Desk. Questions regarding this restriction should be addressed to the Trade Desk via Customer Service (see contact information link below).

TWS Messages - Your account has been restricted to closing orders only

Account holders receiving the following message 'Your account has been restricted to placing closing orders only' are limited to placing orders which serve to close or reduce existing positions (i.e., sell orders which close out or reduce existing long positions or buy orders which which close out or reduce existing short positions). The basis for this restriction varies and often involves pending documentation, compliance and/or risk issues. Regardless of its basis, the restriction affords account holders the ability to manage and reduce the market exposure of their positions while in effect. Questions regarding this restriction should be addressed to Customer Service (see contact information link below).

TWS Messages - Order quantity must be fully displayed for this instrument

Order types which provide privacy by either hiding the entire order quantity (i.e., Hidden Orders) or allowing the display of only a specified portion of the submitted order quantity (i.e., Iceberg/Reserves) are not supported for all product types and venues.

Examples of venues for which Hidden and Iceberg/Reserve stock orders are not supported are Pink Sheet and OTCBB. Hidden or Iceberg/Reserve orders submitted to these venues will be rejected and will generate the following message: "Order quantity must be fully displayed for this instrument". Orders receiving this rejection message will require the removal of any hidden or display size attribute prior to resubmission.

Additional information regarding product types and venues for which these order types are supported is available through the links below:

Iceberg/Reserve:

http://individuals.interactivebrokers.com/en/trading/orders/iceberg.php?ib_entity=llc

Hidden :

http://individuals.interactivebrokers.com/en/trading/orders/hidden.php?ib_entity=llc