Expiration & Corporate Action Related Liquidations

In addition to the policy of force liquidating client positions in the event of a real-time margin deficiency, IBKR will also liquidate positions based upon certain expiration or corporate action related events which, after giving effect to, would create undue risk and/or operational concerns. Examples of such events are outlined below.

Option Exercise

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full (in the case of a call exercised in a cash account or stock subject to 100% margin) or finance the long/short stock position (in the case of a call/put exercised in a margin account). Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. This uncollateralized risk can be especially pronounced and may far exceed any in-the-money value the long option may have held, particularly at expiration when clearinghouses automatically exercise options at in-the-money levels as low as $0.01 per share.

Take, for example, an account whose equity on Day 1 consists solely of 20 long $50 strike call options in hypothetical stock XYZ which have closed at expiration at $1 per contract with the underlying at $51. Assume under Scenario 1 that the options are all auto-exercised and XYZ opens at $51 on Day 2. Assume under Scenario 2 that the options are all auto-exercised and XYZ opens at $48 on Day 2.

| Account Balance | Pre-Expiration | Scenario 1 - XYZ Opens @ $51 | Scenario 2 - XYZ Opens @ $48 |

|---|---|---|---|

| Cash | $0.00 | ($100,000.00) | ($100,000.00) |

| Long Stock | $0.00 | $102,000.00 | $96,000.00 |

|

Long Option* |

$2,000.00 | $0.00 | $0.00 |

| Net Liquidating Equity/(Deficit) | $2,000.00 | $2,000.00 | ($4,000.00) |

| Margin Requirement | $0.00 | $25,500.00 | $25,500.00 |

| Margin Excess/(Deficiency) | $0.00 | ($23,500.00) | ($29,500.00) |

*Long option has no loan value.

To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either: 1) liquidate options prior to expiration; 2) allow the options to lapse; and/or 3) allow delivery and liquidate the underlying at any time. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

IBKR also reserves the right to liquidate positions on the afternoon before settlement if IBKR’s systems project that the effect of settlement would result in a margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. For instance, if IBKR projects that positions will be removed from the account as a result of settlement (e.g., if options will expire out of the money or cash-settled options will expire in the money), IBKR’s systems will evaluate the margin effect of those settlement events.

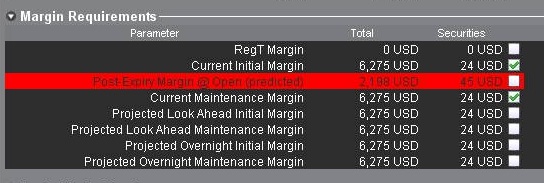

If IBKR determines the exposure is excessive, IBKR may liquidate positions in the account to resolve the projected margin deficiency. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. The projected margin excess will be displayed on the line titled “Post-Expiry Margin” (see below) which, if negative and highlighted in red indicates that your account may be subject to forced position liquidations. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Note that certain account types which employ a hierarchy structure (e.g., Separate Trading Limit account) will have this information presented only at the master account level where the computation is aggregated.

Note that IBKR generally initiates expiration related liquidations 2 hours prior to the close, but reserves the right to begin this process sooner or later should conditions warrant. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying.

Call Spreads in Advance of Ex-Dividend Date

In the event that you are holding a call spread (long and short calls having the same underlying) prior to an ex-dividend date in the underlying, and if you have not liquidated the spread or exercised the long call(s), IBKR reserves the right to: i) exercise some or all of the long call(s); and/or ii) liquidate (i.e., close out) some or all of the spreads - if IBKR, in its sole discretion, anticipates that: a) the short call(s) is (are) likely to be assigned; and b) your account would not ave sufficient equity to satisfy the liability to pay the dividend or to satisfy margin requirements generally. In the event that IBKR exercises the long call(s) in this scenario and you are not assigned on the short call(s), you could suffer losses. Likewise, if IBKR liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective.

In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly.

Physically Delivered Futures

With the exception of certain futures contracts having currencies or metals as their underlying, IBKR generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract (a list of which is provided on the website).

Note that it is the client’s responsibility to be aware of the Close-Out Deadline and physically delivered contracts which are not closed out within the specified time frame may be liquidated by IBKR without prior notification.

Overview of SEC Fees

Under Section 31 of the Securities Exchange Act of 1934, U.S. national securities exchanges are obligated to pay transaction fees to the SEC based on the volume of securities that are sold on their markets. Exchange rules require their broker-dealer members to pay a share of these fees who, in turn, pass the responsibility of paying the fees to their customers.

This fee is intended to allow the SEC to recover costs associated with its supervision and regulation of the U.S. securities markets and securities professionals. It applies to stocks, options and single stock futures (on a round turn basis); however, IB does not pass on the fee in the case of single stock futures trades. Note that this fee is assessed only to the sale side of security transactions, thereby applying to the grantor of an option (fee based upon the option premium received at time of sale) and the exerciser of a put or call assignee (fee based upon option strike price).

For the fiscal year 2016 the fee was assessed at a rate of $0.0000218 per $1.00 of sales proceeds, however, the rate is subject to annual and,in some cases, mid-year adjustments should realized transaction volume generate fees sufficiently below or in excess of targeted funding levels.1

Examples of the transactions impacted by this fee and sample calculations are outlined in the table below.

|

Transaction |

Subject to Fee? |

Example |

Calculation |

|

Stock Purchase |

No |

N/A |

N/A |

|

Stock Sale (cost plus commission option) |

Yes |

Sell 1,000 shares MSFT@ $25.87 |

$0.0000218 * $25.87 * 1,000 = $0.563966 |

|

Call Purchase |

No |

N/A |

N/A |

|

Put Purchase |

No |

N/A |

N/A |

|

Call Sale |

Yes |

Sell 10 MSFT June ’11 $25 calls @ $1.17 |

$0.0000218 * $1.17 * 100 * 10 = $0.025506 |

|

Put Sale |

Yes |

Sell 10 MSFT June ’11 $25 puts @ $0.41 |

$0.0000218 * $0.41 * 100 * 10 = $0.008938 |

|

Call Exercise |

No |

N/A |

N/A |

|

Put Exercise |

Yes |

Exercise of 10 MSFT June ’11 $25 puts |

$0.0000218 * $25.00 * 100 * 10 = $0.545 |

|

Call Assignment |

Yes |

Assignment of 10 MSFT June ’11 $25 calls |

$0.0000218 * $25.00 * 100 * 10 = $0.545 |

|

Put Assignment |

No |

N/A |

N/A |

1Information regarding current Section 31 fees may be found on the SEC's Frequently Requested Documents page located at: http://www.sec.gov/divisions/marketreg/mrfreqreq.shtml#feerate

FAQs - U.S. Securities Option Expiration

The following page has been created in attempt to assist traders by providing answers to frequently asked questions related to US security option expiration, exercise, and assignment. Please feel free to contact us if your question is not addressed on this page or to request the addition of a question and answer.

Click on a question in the table of contents to jump to the question in this document.

Table Of Contents:

How do I provide exercise instructions?

Do I have to notify IBKR if I want my long option exercised?

What if I have a long option which I do not want exercised?

What can I do to prevent the assignment of a short option?

Is it possible for a short option which is in-the-money not to be assigned?

What happens if I have a spread position with an in-the-money option and an out-of-the-money option?

Am I charged a commission for exercise or assignments?

Q&A:

How do I provide exercise instructions?

Instructions are to be entered through the TWS Option Exercise window. Procedures for exercising an option using the IBKR Trader Workstation can be found in the TWS User's Guide.

![]() Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management Message Center click on "Compose" followed by "New Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management Message Center click on "Compose" followed by "New Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Do I have to notify IBKR if I want my long option exercised?

In the case of exchange listed U.S. securities options, the clearinghouse (OCC) will automatically exercise all cash and physically settled options which are in-the-money by at least $0.01 at expiration (e.g., a call option having a strike price of $25.00 will be automatically exercised if the stock price is $25.01 or more and a put option having a strike price of $25.00 will be automatically exercised if the stock price is $24.99 or less). In accordance with this process, referred to as exercise by exception, account holders are not required to provide IBKR with instructions to exercise any long options which are in-the-money by at least $0.01 at expiration.

![]() Important Note: in certain situations (e.g., underlying stock halt, corporate action), OCC may elect to remove a particular class of options from the exercise by exception process, thereby requiring the account holder to provide positive notice of their intent to exercise their long option contracts regardless of the extent they may be in-the-money. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice.

Important Note: in certain situations (e.g., underlying stock halt, corporate action), OCC may elect to remove a particular class of options from the exercise by exception process, thereby requiring the account holder to provide positive notice of their intent to exercise their long option contracts regardless of the extent they may be in-the-money. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice.

What if I have a long option which I do not want exercised?

If a long option is not in-the-money by at least $0.01 at expiration it will not be automatically exercised by OCC. If it is in-the-money by at least that amount and you do not wish to have it exercised, you would need to provide IBKR with contrary instructions to let the option lapse. These instructions would need to be entered through the TWS Option Exercise window prior to the deadline as stated on the IBKR website.

What can I do to prevent the assignment of a short option?

The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading day (for equity options this is usually the Friday preceding the expiration date although there may also be weekly expiring options for certain classes). When you sell an option, you provided the purchaser with the right to exercise which they generally will do if the option is in-the-money at expiration.

Is it possible for a short option which is in-the-money not to be assigned?

While is unlikely that holders of in-the-money long options will elect to let the option lapse without exercising them, certain holders may do so due to transaction costs or risk considerations. In conjunction with its expiration processing, OCC will assign option exercises to short position holders via a random lottery process which, in turn, is applied by brokers to their customer accounts. It is possible through these random processes that short positions in your account be part of those which were not assigned.

What happens if I have a spread position with an in-the-money option and an out-of-the-money option?

Spread positions can have unique expiration risks associated with them. For example, an expiring spread where the long option is in-the-money by less than $0.01 and the short leg is in-the-money more than $0.01 may expire unhedged. Account holders are ultimately responsible for taking action on such positions and responsible for the risks associated with any unhedged spread leg expiring in-the-money.

Can IBKR exercise the out-of-the-money long leg of my spread position only if my in-the-money short leg is assigned?

No. There is no provision for issuing conditional exercise instructions to OCC. OCC determines the assignment of options based upon a random process which is initiated only after the deadline for submitting all exercise instructions has ended. In order to avoid the delivery of a long or short underlying stock position when only the short leg of an option spread is in-the-money at expiration, the account holder would need to either close out that short position or consider exercising an at-the-money long option.

What happens to my long stock position if a short option which is part of a covered write is assigned?

If the short call leg of a covered write position is assigned, the long stock position will be applied to satisfy the stock delivery obligation on the short call. The price at which that long stock position will be closed out is equal to the short call option strike price.

Am I charged a commission for exercise or assignments?

There is no commissions charged as the result of the delivery of a long or short position resulting from option exercise or assignment of a U.S. security option (note that this is not always the case for non-U.S. options).

What happens if I am unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment?

You should review your positions prior to expiration to determine whether you have adequate equity in your account to exercise your options. You should also determine whether you have adequate equity in the account if an in-the-money short option position is assigned to your account. You should also be aware that short options positions may be exercised against you by the long holder even if the option is out-of-the-money.

If you anticipate that you will be unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment, you should either close positions or deposit additional funds to your account to meet the anticipated post-delivery margin requirement.

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either:

- Liquidate options prior to expiration. Please note: While IBKR retains the right to liquidate at any time in such situations, liquidations involving US security positions will typically begin at approximately 9:40 AM ET as of the business day following expiration;

- Allow the options to lapse; and/or

- Allow delivery and liquidate the underlying at any time.

In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

For more information, please see Expiration & Corporate Action Related Liquidations

Overview of Fees

Clients and as well as prospective clients are encouraged to review our website where fees are outlined in detail.

An overview of the most common fees is provided below:

1. Commissions - vary by product type and listing exchange and whether you elect a bundled (all in) or unbundled plan. In the case of US stocks, for example, we charge $0.005 per share with a minimum per trade of $1.00.

2. Interest - interest is charged on margin debit balances and IBKR uses internationally recognized benchmarks on overnight deposits as a basis for determining interest rates. We then apply a spread around the benchmark interest rate (“BM”) in tiers, such that larger cash balances receive increasingly better rates, to determine an effective rate. For example, in the case of USD denominated loans, the benchmark rate is the Fed Funds effective rate and a spread of 1.5% is added to the benchmark for balances up to $100,000. In addition, individuals who short stock should be aware of special fees expressed in terms of daily interest where the stock borrowed to cover the short stock sale is considered 'hard-to-borrow'.

3. Exchange Fees - again vary by product type and exchange. For example, in the case of US securities options, certain exchanges charge a fee for removing liquidity (market order or marketable limit order) and provide payments for orders which add liquidity (limit order). In addition, many exchanges charge fees for orders which are canceled or modified.

4. Market Data - you are not required to subscribe to market data, but if you do you may incur a monthly fee which is dependent upon the vendor exchange and their subscription offering. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. To access, log in to Portal click on the Support section and then the Market Data Assistant link.

5. Minimum Monthly Activity Fee - there is no monthly minimum activity requirement or inactivity fee in your IBKR account.

6. Miscellaneous - IBKR allows for one free withdrawal per month and charges a fee for each subsequent withdrawal. In addition, there are certain pass-through fees for trade bust requests, options and futures exercise & assignments and ADR custodian fees.

For additional information, we recommend visiting our website and selecting any of the options from the Pricing menu option.

Information Regarding Physical Delivery Rules

IBKR does not have the facilities necessary to accommodate physical delivery for most products. For futures contracts that are settled by actual physical delivery of the underlying commodity (physical delivery futures), account holders may not make or receive delivery of the underlying commodity.

It is the responsibility of the account holder to make themselves aware of the close-out deadline of each product. If an account holder has not closed out a position in a physical delivery futures contract by the close-out deadline, IBKR may, without additional prior notification, liquidate the account holder’s position in the expiring contract. Please note that liquidations will not otherwise impact working orders; account holders must ensure that open orders to close positions are adjusted for the actual real-time position.

To avoid deliveries in expiring futures contracts, account holders must roll forward or close out positions prior to the Close-Out Deadline.

Below provides an overview of the relevant close-out deadlines of futures and futures options contracts. The relevant First Notice Date, First Position Date and Last Trading Date information may be obtained through the IBKR website by navigating to the IBKR Support page and selecting Contract Search. Any date information provided is on a best-efforts basis and should be verified by reviewing the contract specifications available on the exchange's website.

Summary of Physical Delivery Futures Policies

|

Contract |

Delivery Permitted |

Close-Out Deadline |

|

ZB, ZN, ZF (CBOT) |

No |

2 hours before the end of open outcry trading on the business day prior to First Notice Day (longs) or Last Trading Day (shorts) |

|

ZT (CBOT) futures, Japanese Govt Bond Futures (JGB) |

No |

End of second business day prior to the First Position Day (longs) or end of second business day prior to Last Trading Day (shorts) |

|

EUREXUS futures |

No |

End of business day prior to the First Position Day (longs) or Last Trading Day (shorts) |

|

EUREXUS 2 yr Jumbo bond (FTN2) and 3 yr bond (FTN3) futures |

No |

End of the second business day prior to the First Position Day (longs) or Last Trading Day (shorts) |

|

IPE contracts (GAS, NGS) |

No |

End of the second business day prior to the First Position Day (longs) or day prior to Last Trading Day (shorts) |

|

CME LIVE CATTLE (LE) |

No |

End of the second business day prior to the First Intent Day (longs) or Last Trading Day (shorts) |

|

CME NOK, SEK, PLZ, CZK, ILS, KRW and HUF, and correspondent Euro rates |

No |

End of the fifth business day prior to the Last Trading Day for both longs and shorts |

|

GBL, GBM, GBS, GBX (Eurex), CONF (Eurex) |

No |

2 hours before the end of trading on the last trading day |

|

CME currency futures (EUR, GBP, CHF, AUD, CAD, JPY, HKD) |

Yes* |

Not applicable* |

|

CME Ethanol futures (ET) |

No |

End of the fifth business day prior to the First Position Day (longs) or Last Trading Day (shorts) |

| NG futures (NYMEX) | No | End of the business day prior to the First Position Day or last trading day (whichever comes first) (longs) or end of business day prior to Last Trading Day (shorts) |

|

All other contracts |

No |

End of the second business day prior to the sooner of First Position Day or Last Trading Day (longs) or end of the second business day prior to the Last Trading Day (shorts) |

*As Cash and IRA accounts are restricted from holding foreign currencies, the liquidation schedule outlined above for All other contracts will also apply to Cash and IRA accounts for these foreign currency products.

Summary of Physical Delivery Future Options Policies

| Contract | Delivery Permitted | Close-Out Deadline |

| All contracts | Yes | Options will be allowed to expire into futures (or, if out-of-the-money, expire worthless), if the options expiration date is prior to the underlying futures’ First Position Day. If there is a resulting futures position, it will then be subject to the respective Close-Out Deadlines, as detailed above. |

What happens to US security options if the underlying becomes the subject of a full cash merger?

In the case of any stock option associated with a merger in which the underlying security has been converted to 100% cash after December 31, 2007, the OCC will accelerate its expiration. The new expiration date for such options will be accelerated to the nearest standard equity expiration, unless the cash conversion takes place after the Tuesday within an expiration week, in which case the expiration date for all contracts not already expiring that week will be deferred until the following month’s expiration.

Note that this acceleration does not impact the automatic exercise threshold, through which all options having a strike price that is in-the-money by at least $0.01 will be automatically exercised by OCC. Nor does it impact the date of the cash settlement attributable to the exercise which remains at T+2.

Also note that this acceleration does not affect options which were converted to cash on or before December 31, 2007 which will remain valid series until their original expiration date has been reached.

Can I take delivery on my futures contract?

With the exception of certain currency futures contracts carried in an account eligible to hold foreign currency cash balances, IB does not allow customers to make or receive delivery of the commodity underlying a futures contract.

IB does not have the facilities necessary to accommodate physical delivery. For futures contracts that are settled by actual physical delivery of the underlying commodity (physical delivery futures), account holders may not make or receive delivery of the underlying commodity.

It is the responsibility of the account holder to make themselves aware of the close-out deadline of each product. If an account holder has not closed out a position in a physical delivery futures contract by the close-out deadline, IB may, without additional prior notification, liquidate the account holder’s position in the expiring contract. Please note that liquidations will not otherwise impact working orders; account holders must ensure that open orders to close positions are adjusted for the actual real-time position.

To avoid deliveries in expiring futures contracts, account holders must roll forward or close out positions prior to the Close-Out Deadline indicated on www.interactivebrokers.com. From the home page, choose the Trading menu, and then select Delivery, Exercise & Actions. From the Delivery, Exercise and Corporate Actions page, read the information governing Futures and Future Options Physical Delivery Liquidation Rules. Also listed are the few futures in which delivery can be taken, such as currency futures.

Will open futures contracts roll over automatically at expiration?

Please note that futures contracts, by default, do not roll over at expiration. The TWS trading platform, however, does provide a feature to "Auto Roll Data for Expiring Futures Contracts". When specified in Global Configuration, the system automatically rolls soon-to-expire futures data lines to the next lead month. Approximately three days prior to expiration, the new lead month contract will be added to quote monitor. Approximately one day after the contract expires it will automatically be removed from the display.

Additionally, you can instruct TWS to cancel open orders on expiring contracts. If you have the auto-roll option selected, anytime there are open orders on expiring futures contracts you will receive a pop-up message asking if you want TWSto cancel the listed open orders in anticipation of expiration. Once the contracts expire the orders will be canceled automatically.

The following steps are to be performed in order to activate this feature:

1. Click the Configure wrench icon in the trading window

2. In the left pane of Global Configuration, select General;

3. In the right pane, check Auto Roll Date for Expiring Futures Contracts

Also note that with the exception of certain currency futures contracts, IBKR does not allow for the actual physical delivery of underlying commodities. Contracts which settle by physical delivery must be rolled over or closed out prior to a close-out deadline or face forced liquidation by IBKR. Please refer to the website under Delivery, Exercise & Corporate Actions for additional details as this deadline will vary by product.

Options Assignment Prior to Expiration

An American-Style option seller (writer) may be assigned an exercise at any time until the option expires. This means that the option writer is subject to being assigned at any time after he or she has written the option until the option expires or until the option contract writer closes out his or her position by buying it back to close. Early exercise happens when the owner of a call or put invokes his or her rights before expiration. As the option seller, you have no control over assignment, and it is impossible to know exactly when this could happen. Generally, assignment risk becomes greater closer to expiration, however even with that being said, assignment can still happen at any time when trading American-Style Options.

Short Put

When selling a put, the seller has the obligation to buy the underlying stock or asset at a given price (Strike Price) within a specified window of time (Expiration date). If the strike price of the option is below the current market price of the stock, the option holder does not gain value putting the stock to the seller because the market value is greater than the strike price. Conversely, If the strike price of the option is above the current market price of the stock, the option seller will be at assignment risk.

Short Call

Selling a call gives the right to the call owner to buy or “call” stock away from the seller within a given time frame. If the market price of the stock is below the strike price of the option, the call holder has no advantage to call stock away at higher than market value. If the market value of the stock is greater than the strike price, the option holder can call away the stock at a lower than market value price. Short calls are at assignment risk when they are in the money or if there is a dividend coming up and the extrinsic value of the short call is less than the dividend.

What happens to these options?

If a short call is assigned, the short call holder will be assigned short shares of stock. For example, if the stock of ABC company is trading at $55 and a short call at the $50 strike is assigned, the short call would be converted to short shares of stock at $50. The account holder could then decide to close the short position by purchasing the stock back at the market price of $55. The net loss would be $500 for the 100 shares, less credit received from selling the call initially.

If a short put is assigned, the short put holder would now be long shares of stock at the put strike price. For example, with the stock of XYZ trading at $90, the short put seller is assigned shares of stock at the strike of $96. The put seller is responsible for buying shares of stock above the market price at their strike of $96. Assuming, the account holder closes the long stock position at $90, the net loss would be $600 for 100 shares, less credit received from selling the put originally.

Margin Deficit from the option assignment

If the assignment takes place prior to expiration and the stock position results in a margin deficit, then consistent with our margin policy accounts are subject to automated liquidation in order to bring the account into margin compliance. Liquidations are not confined to only shares that resulted from the option position.

Additionally, for accounts that are assigned on the short leg of an option spread, IBKR will NOT act to exercise a long option held in the account. IBKR cannot presume the intentions of the long option holder, and the exercise of the long option prior to expiration will forfeit the time value of the option, which could be realized via the sale of the option.

Post Expiration Exposure, Corporate Action and Ex-Dividend Events

Interactive Brokers has proactive steps to mitigate risk, based upon certain expiration or corporate action related events. For more information about our expiration policy, please review the Knowledge Base Article "Expiration & Corporate Action Related Liquidations".

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at the OCC's web site.

What happens to the USD equity option that I am long at expiration?

There are two scenarios which could occur if a long option is taken to expiration. If the option is out-of-the-money at expiration and you do not choose to exercise it, the option will expire worthless, and your losses will consist of the premium that was paid to acquire the option. If the option is in-the-money at expiration by 0.01 or more, it will be automatically exercised on your behalf (unless you previously chose to lapse the option) by the Options Clearing Corporation (OCC). The OCC processes monthly expiration options on the third Saturday of the month, or the day after Friday expiration. The resulting long or short position will be put into the account, effective on the Friday trade date. If the account has sufficient margin to satisfy the requirement on the resulting position, it will then be up to the account holder to decide what they want to do with the position. If the resulting position causes a margin deficit, the account will be subject to liquidation at a time which is defined by the holdings within the account. Please be aware that any positions could be liquidated as a result of the account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. For example, if the account holds currency, futures, future options positions or and non-USD product, the account may begin to liquidate to meet the margin deficit as soon as a corresponding market opens.

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at OCC's web site.