How can I exercise long options?

Account holders have the ability to exercise equity options they hold long in their account.

From Trader Workstation, go to the Trade menu and select Option Exercise.

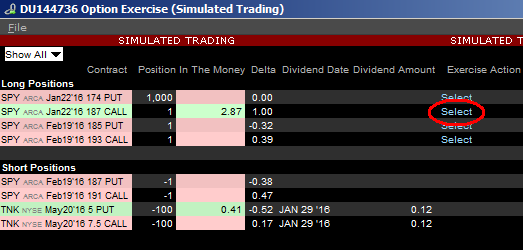

The Option Exercise window will appear and any long options you are holding will populate under the Long Positions column header. To exercise one of them, left-click on the light blue “Select” link under the Exercise Option column header for that particular option.

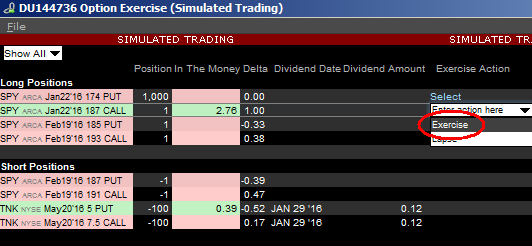

Select "Exercise" from the drop down menu.

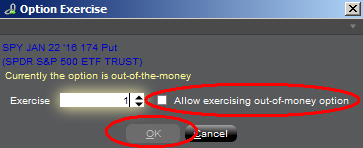

Your Exercise request will now show as an order line on your Trader Workstation until the clearinghouse processes the request. If the option is out-of-the-money, a warning message will appear. To submit the Exercise request, check the box to “Allow exercising out-of-money option” and click OK.

Please note, you have the option of selecting whether you would like your option exercise request to be final and unable to be cancelled, or editable until cutoff time (varies by clearing house). If you select "final and cannot be cancelled", some contracts will not follow this rule and will remain revocable up until the clearing house deadline. You can make this selection in Trader Workstation by going to Edit followed by Global Configuration and selecting Orders from the configuration tree on the left side.

In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Client Portal window. In the Client Portal window, click on "Inquiry/Problem Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Option Exercise Requests (whether received through the TWS Option Exercise window or by a ticket sent via Client Portal / Message Center) must be submitted as follows:

| For Equity Option Contracts Traded Upon: | IBKR must receive an Exercise Request by: | ||||||

| North America | US Options Exchanges | 17:25 EST | |||||

| Montreal Exchange | 16:30 EST | ||||||

| Europe | Euronext | 17h50 CET | |||||

| Eurex (German and Swiss) | 17h50 CET | ||||||

| IDEM | 17h50 CET | ||||||

| LIFFE | 17h50 CET | ||||||

| MEFF | 17h50 CET | ||||||

| Sweden | 17h50 CET | ||||||

| Asia Pacific | Australia | 16:25 Australia/NSW | |||||

| Japan | 15:30 JST | ||||||

| (Send a ticket and call Client Services) | |||||||

If I am assigned on the short leg of an option spread, will the long option leg be automatically exercised so as to offset the resulting stock position from the assignment?

The answer depends upon whether the assignment occurred at expiration or prior to expiration (i.e., an American Style option). At expiration, many clearinghouses employ an exercise by exception process intended to ease the operational overhead associated with the provision of exercise instructions by clearing members. In the case of US securities options, for example, the OCC will automatically exercise any equity or index option which is in-the-money by at least $0.01 unless contrary exercise instructions are provided by the client to the clearing member. Accordingly, if the long option has the same expiration date as the short and at expiration is in-the-money by a minimum of the stated exercise by exception threshold, the clearinghouse it will be automatically exercised, effectively offsetting the stock obligation on the assignment. Depending upon the option strike prices, this may result in a net cash debit or credit to the account.

If the assignment takes place prior to expiration neither IBKR nor the clearinghouse will act to exercise a long option held in the account as neither party can presume the intentions of the long option holder and the exercise of the long option prior to expiration is likely result in the forfeiture of time value which could be realized via the sale of the option.

Are there commissions associated with option exercise or assignment?

The answer depends upon the option type and its region of listing. There is no IBKR commission associated with an exercise or assignment of US stock and index security options and out-of-the-money non-US index options. A commission is charged for an exercise or assignment of an in-the-money non-US index option and for options on futures. Please refer to the Other Fees section of the IBKR website for details.

Why am I not informed of the assignment on my US securities option position until the following day?

The processing of exercise notices for American style options on days other than the expiration date is not performed on a real-time basis, but rather as part of a nightly batch process by the Options Clearing Corporation (OCC). The processing sequence, which by definition results in a notification lag of at least one day to the assigned client, is as follows:

- OCC generally allows its clearing members to submit exercise notices on behalf of the clients holding a long position electronically throughout the day, but generally no later than the start of their critical processing in the evening (Day E).

- As part of its evening position processing sequence, OCC randomly assigns the exercise notices it has received to the open interest of its clearing members. That information is then made available by OCC to its clearing members early in the morning on the following day (Day E+1).

- At the point in which that information has been made available, clearing firms such as IBKR have already completed their processing of that day’s trade activity in order to provide timely statements, margin and settlement information to their clients. Also, since OCC carries the client positions of its clearing members in an omnibus manner (i.e., they do not know the identity of the clients, only the clearing firm), the clearing member must, in turn, execute a random process to assign those exercise notices to clients holding a short position in that particular option series.

- Once IBKR receives notice of the assignment from OCC and completes its random assignment process, the assignments will be readily posted to the Trader Workstation of the impacted accounts and reflected on the Daily Activity Statement as of that day’s close (E+1).

In addition, due to this processing sequence and the fact that a long option may have remaining time value, IBKR cannot automatically provide an exercise notice to OCC for any long option spread against the assigned short option as a means of offsetting the ensuing delivery obligation.

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at OCC's web site.

My account was debited for a dividend payment (Payment in Lieu) for a short stock position which I don’t recognize. How did this occur?

A short stock position may originate from an option position which you held in your account. For example, if you hold a long put position in your account, that position may be subject to automatic exercise by the clearinghouse if it is in-the-money by a defined threshold at expiration. This put exercise will generate a short stock position in your account (assuming you do not have an offsetting long position), and you are obligated to pay any dividends should you maintain a short stock position on the ex-dividend date.

Similarly, a short call position in your account is subject to assignment should a call purchaser elect to exercise their right to purchase the stock and your account be allocated through the random clearinghouse and broker assignment process. This call assignment will generate a short stock position in your account (assuming you do not have an offsetting long position), and you are obligated to pay any dividends should you maintain a short stock position on the ex-dividend date.

These payments will be reflected on your Activity Statement as a 'Payment In Lieu Of Dividend'.

- « first

- ‹ previous

- 1

- 2

- 3