Fizikai szállítási szabályokkal kapcsolatos információk

Az IBKR nem rendelkezik a legtöbb termék fizikai szállításának fogadásához szükséges létesítményekkel. A mögöttes áru tényleges fizikai szállítása útján elszámolt határidős szerződések esetén a számlatulajdonosok nem teljesíthetik illetve fogadhatják a mögöttes áru szállításait.

A számlatulajdonos köteles tájékozódni az egyes termékek lejárati idejéről. Amennyiben a számlatulajdonos a lejáratig nem zárt le egy fizikai szállítású határidős pozíciót, az IBKR jogosult külön értesítés nélkül likvidálni a számlatulajdonos lejáró szerződésben fennálló pozícióját. Felhívjuk a figyelmet, hogy a likvidációk más módon nem érintik a folyamatban lévő megbízásokat. A számlatulajdonosok kötelesek a pozíciózárási megbízásaikat hozzáigazítani a tényleges, valós idejű pozícióhoz.

A lejáró határidős szerződésekből eredő fizikai szállítások elkerülése érdekében a számlatulajdonosok kötelesek a lejárati határidőt megelőzően megújítani vagy lezárni a pozícióikat.

Az alábbiakban áttekintjük a határidős és határidős opciós ügyletek releváns zárási határidejeit. A releváns Első értesítési nap, Pozíció első napja, és Utolsó kereskedési nap információk elérhetők az IBKR weboldalán, az IBKR támogatás oldalon a Szerződés keresése menüpont kiválasztásával. Az alább közölt dátumok a legjobb tudásunkon alapulnak, ezért azokat célszerű ellenőrizni a tőzsde honlapján elérhető szerződési feltételek áttekintésével.

A fizikai szállítású határidős szerződésekre vonatkozó szabályok összefoglalása

|

Szerződés |

Engedélyezett szállítás |

Lejárati határidő |

|

ZB, ZN, ZF (CBOT) |

Nem |

2 órával az Első értesítési napot (long pozíciók), illetve az Utolsó kereskedési napot (short pozíciók) megelőző munkanap nyílt tőzsdei kereskedésének a vége előtt. |

|

Határidős ZT (CBOT), határidős japán államkötvény (JGB) |

Nem |

A Pozíció első napját (long pozíciók), illetve az Utolsó kereskedési napot (short pozíciók) megelőző második munkanap vége. |

|

Határidős EUREXUS |

Nem |

A Pozíció első napját (long pozíciók), illetve az Utolsó kereskedési napot (short pozíciók) megelőző munkanap vége. |

|

Határidős EUREXUS 2 éves Jumbo kötvény (FTN2) és 3 éves kötvény (FTN3) |

Nem |

A Pozíció első napját (long pozíciók), illetve az Utolsó kereskedési napot (short pozíciók) megelőző második munkanap vége. |

|

IPE szerződések (GAS, NGS) |

Nem |

A Pozíció első napját (long pozíciók) megelőző második munknap vége, illetve az Utolsó kereskedési napot (short pozíciók) megelőző nap vége. |

|

CME ÉLŐ SZARVASMARHA (LE) |

Nem |

A Szándék első napját (long pozíciók), illetve az Utolsó kereskedési napot (short pozíciók) megelőző második munkanap vége. |

|

CME NOK, SEK, PLZ, CZK, ILS, KRW és HUF, valamint a kapcsolódó euró árfolyamok |

Nem |

Az Utolsó kereskedési napot megelőző ötödik munkanap vége mind long, mind short pozíciók esetén. |

|

GBL, GBM, GBS, GBX (Eurex), CONF (Eurex) |

Nem |

2 órával a kereskedési időszak vége előtt az Utolsó kereskedési napon. |

|

Határidős CME devizák (EUR, GBP, CHF, AUD, CAD, JPY, HKD) |

Igen* |

Nem értelmezhető* |

|

Határidős CME etanol (ET) |

Nem |

A Pozíció első napját (long pozíciók), illetve az Utolsó Kereskedési napot (short pozíciók) megelőző ötödik munkanap vége. |

| Határidős NG (NYMEX) | Nem | A Pozíció első napját vagy az Utolsó kereskedési napot (amelyik korábban bekövetkezik) (long pozíciók), illetve az Utolsó kereskedési napot (short pozíciók) megelőző munkanap vége. |

|

Minden más kontraktus |

Nem |

A Pozíció első napját vagy az Utolsó kereskedési napot (amelyik korábban bekövetkezik) (long pozíciók), illetve az Utolsó kereskedési napot (short pozíciók) megelőző második munkanap vége. |

* Mivel a Készpénzes és IRA számlákon nem lehet külföldi devizát tartani, a Minden más szerződésre vonatkozó fenti likvidációs ütemterv a Készpénzes és IRA számlákra is vonatkozik az ilyen külföldi devizás termékek esetében.

A fizikai szállítású határidős opciós szerződésekre vonatkozó szabályok összefoglalása

| Szerződés | Engedélyezett szállítás | Lejárati határidő |

| Minden szerződés | Igen | Az opciók határidős ügyletekké válnak (illetve, ha pénzen kívüliek, akkor érték nélkül lejárnak), ha az opció lejárati dátuma megelőzi a mögöttes határidős Pozíció első napját. Ha a fentiek következtében létrejön egy határidős pozíció, akkor arra fognak vonatkozni a fent részletezett Lejárati határidők. |

Mi történik az amerikai értékpapír-opciókkal, ha a mögöttes értékpapír teljes körű készpénzes összeolvadás tárgyává válik?

Minden olyan, összeolvadással kapcsolatos részvényopció esetében, ahol a mögöttes értékpapír 100%-ban átváltásra került készpénzre 2007. december 31-ét követően, az OCC felgyorsítja az opció lejáratát. Az ilyen opciók új lejárati ideje előrehozásra kerül a legközelebbi sztenderd részvénylejáratra, kivéve, ha a készpénzre történő átváltásra a lejárat hetének keddje után kerül sor, amely esetben az adott héten le nem járó szerződések lejárati ideje elhalasztásra kerül a következő havi lejáratig.

Felhívjuk a figyelmet, hogy a lejárat előrehozása nem változtat az automatikus lehívási küszöbön, amely alapján az OCC automatikusan elvégzi minden, legalább 0,01 USD-vel pénzen belül lévő opció lehívását. Szintén nem befolyásolja az előrehozás a lehíváshoz kapcsolódó készpénz-elszámolás időpontját, ami továbbra is T+2 marad.

Felhívjuk a figyelmet továbbá, hogy a 2007. december 31-én vagy azt megelőzően készpénzre átváltott opciókra a fenti gyorsítás nem vonatkozik, így ezek az eredeti lejárati dátumig érvényben maradnak.

Ha egy opciós spread short lábára kapok kötelezést, lehívásra kerül-e automatikusan a long opciós láb, hogy ellentételezze a kötelezésből eredő részvénypozíciót?

A válasz attól függ, hogy az opció szerinti kötelezésre a lejáratkor vagy azt megelőzően (azaz amerikai stílusú opció) került sor. A lejáratkor számos elszámolóház kivétel alapú lehívási eljárást alkalmaz a klíringtagoknál a lehívási utasítások benyújtásával kapcsolatban felmerülő általános üzemeltetési költségek csökkentése érdekében. Például amerikai értékpapír-opciók esetén az OCC automatikusan lehív minden, legalább 0,01 USD-vel pénzen belül lévő részvény- vagy index opciót, kivéve, ha az ügyfél ezzel ellentétes lehívási utasítást ad a klíringtagnak. Ennek megfelelően ha a long opció a short opcióval azonos napon jár le, és a lejáratkor pénzen belül van legalább a kivétel alapú lehívási küszöb szerinti összeggel, az elszámolóház automatikusan lehívja az opciót, ezáltal lényegében ellentételezve a kötelezés miatt felmerülő részvény-kötelezettséget. Az opció lehívási árfolyamától függően ez nettó készpénz terhelést vagy jóváírást eredményez a számlán.

Ha az opció szerinti kötelezésre a lejáratot megelőzően kerül sor, sem az IBKR, sem az elszámolóház nem hívja le a számlán tartott long opciót, mivel egyik fél sem ismeri a long opció tulajdonosának szándékát, és a long opció lejárat előtti lehívása valószínűleg az opció eladása útján realizálható időérték elvesztésével járna.

Miért csak másnap kapok értesítést az amerikai értékpapír opciós pozícióm lehívásáról?

Amerikai stílusú opciók esetén az Options Clearing Corporation (OCC) a lehívási értesítések feldolgozását a lejárat napjától eltérő napokon nem valós időben, hanem éjszaka, egy kötegelt folyamat részeként végzi el. Az érintett ügyfélnek küldött értesítés kézbesítését jellegéből adódóan legalább egy nappal késleltető feldolgozási folyamat az alábbi lépésekből áll:

- Az OCC általában lehetővé teszi a klíringtagoknak, hogy a nap folyamán, de általában legkésőbb az esti kritikus feldolgozási időszak kezdetéig (Day E), elektronikus úton benyújtsák a lehívási értesítéseket a long pozíciókat tartó ügyfeleik nevében.

- Az esti pozíciófeldolgozási folyamat során az OCC véletlenszerűen felosztja a beérkezett lehívási értesítéseket a klíringtagok nyitott pozíciói között. A következő napon korán reggel (Day E+1) az OCC elérhetővé teszi ezeket az információkat a klíringtagok számára

- Az adatok közzétételének időpontjára az elszámolóházak, mint például az IBKR, már elvégezték az aznapi ügyletek feldolgozását annak érdekében, hogy ügyfeleikhez időben eljuttathassák a kimutatásokat, fedezeti és elszámolási adatokat. Emellett, mivel az OCC a klíringtagok ügyfeleinek pozícióját gyűjtőszámla-szerűen kezeli (azaz ő maga nem, csak a klíringtagok ismerik az ügyfelek kilétét), a klíringtagok kötelesek saját maguk véletlenszerűen felosztani a kérdéses lehívási értesítéseket azon ügyfeleik között, akik rendelkeznek short pozícióval az adott opciósorozatban.

- Amint az IBKR megkapja az értesítést az OCC-től, és elvégzi a véletlenszerű felosztási folyamatot, arról a Trader Workstation alkalmazáson keresztül haladéktalanul értesíti az érintett számlák tulajdonosait, és ugyanezen információ megjelenik az aznapi záráskor (E+1) kiadott Napi Tevékenységkimutatásban is.

Továbbá, a fenti feldolgozási folyamat, illetve azon tény miatt, hogy a long opció még rendelkezhet fennmaradó időértékkel, az IBKR nem tud automatikusan lehívási értesítést benyújtani az OCC-nek minden long opció spreadre a lehívott short opcióval szemben az ebből eredő kézbesítési kötelezettség teljesítése fejében.

A számlatulajdonosok kötelesek elolvasni a számlanyitás alkalmával minden opciós kereskedésre jogosult ügyfélnek bemutatott Characteristics and Risks of Standardized Options (Standard opciók tulajdonságai és kockázatai) című közzétételi dokumentumot, amely világosan leírja a fenti felosztással járó kockázatokat. A dokumentum online formában is elérhető az OCC weboldalán.

Physical Delivery of US Spot Gold FAQs

Who is IB Global Investments (IBGI)?

IBGI is a wholly owned subsidiary of the IBKR Group that operates as a market maker, facilitating physical unallocated gold transactions on behalf of IBLLC for its clients. IBGI facilitates these transactions by taking delivery of gold warrants from exchange-listed futures contracts. Neither IBLLC nor IBGI engages in proprietary trading, and the inventory of warrants IBGI holds to facilitate client purchases are hedged with short futures contracts.

What does the term “unallocated” gold mean?

When you purchase unallocated gold, you own an undivided, fractional interest in the physical gold that IBGI has allocated to IBLLC. In other words, the warrants, which reference gold bars that are specifically identifiable by number, are held in the name of IBLLC who, in turn, records clients’ ownership interests on its books and records (similar to how stock is held in “street name”).

How does the gold get “allocated”?

The gold remains “unallocated” until the account holder takes physical possession of it via the delivery process.

What is the trading symbol for unallocated gold?

The symbol is USGOLD.

What is the minimum order size for unallocated gold?

The minimum order size is 1 ounce.

What is the minimum price increment for unallocated gold?

$0.001

What is the settlement time for an unallocated gold transaction?

Transactions settle in 2 business days.

Does IBGI or IB LLC add a mark up to physical gold transactions?

No. There is no markup or hidden price spreads added by IBGI to IBLLC or IBLLC to the client. IBLLC acts as a riskless principal, transacting with the client at the same price it transacts with IBGI, and charges the client a commission for the transaction, which is disclosed on our website.

Does IBKR allow short sales of unallocated gold?

No; only purchases are allowed. Clients seeking to profit from falling gold prices may obtain this exposure via futures contracts, options on futures contracts and/or short sales of various gold ETFs.

Does IBKR provide any loan value for unallocated gold positions?

No. Unallocated gold will be subject to a 100% margin requirement. This means that IBKR will not allow you to borrow money using unallocated gold as collateral. Similarly, your fully-paid unallocated gold positions cannot be used as collateral to purchase or maintain securities positions.

Is unallocated gold SIPC protected?

No. SIPC only offers protection for securities and cash held in a securities account.

In what forms of gold is delivery offered?

Clients may convert their unallocated gold and take physical delivery of one of the following products:

- Gold Bullion Bar (.999) 1 kg

- Gold Bullion Bar ISO Accredited (.9999) - 1 oz

- Gold Bullion Bar ISO Accredited (.9999) - 10 oz

- Gold American Eagle Coin - 1 oz

- Gold American Buffalo Coin - 1 oz

- Gold Canadian Maple Leaf Coin -1 oz

Delivery will be transacted through FideliTrade Incorporated, a full-service precious metals investment company that specializes in delivery and custody services. See https://www.fidelitrade.com/

Is partial delivery offered?

Yes, you may take delivery of only a portion of your unallocated gold position.

How do I request delivery?

Clients requesting physical delivery must submit their request via the Message Center using the topic "Physical Gold Delivery". The request should include the number of ounces and the form of delivery. IBKR will then confirm the cost and fees and, once approved by the client, instruct FideliTrade to deliver. Please note that delivery is only supported to the account holder’s address of record.

What is the cost of taking delivery (and do I pay a premium)?

The cost of physical delivery of US Spot Gold is the sum of:

- The differential between the spot price of gold and the cost of the physical product.

- Physical metals products are provided by Fidelitrade Inc. Estimated cost of the physical product can be found on their website.

- The cost of the product is the indicative ASK price displayed by FideliTrade.

- A $25 delivery fee

- A $500 IBKR processing fee

What trading permissions are required?

The exchange and permission bundle is United States Metals.

What are the eligibility requirements for obtaining IBMETAL trading permissions?

US Spot Gold is only available to legal residents of the United States. US Spot Gold is not available to legal residents of Arizona, Montana, New Hampshire, and Rhode Island.

Clients must also meet the following requirements

- Investment Objective: Trading, or Speculation, or Hedging, or Growth (Cash account)

- Financials: Must meet Futures financial requirements

- No minimum years trading experience

- No minimum trades

- Available in all account types (CASH, MRGN, PMRGN)

- Not available for UGMA/UTMA accounts

- Not available for IRA accounts

- FA/Broker Sub accounts: master account (FA or Broker) must be approved for Commodities trading

Physical Delivery of COMEX Precious Metals Futures

About Physical Delivery of COMEX Precious Metals Futures

Clients of IBLLC will be able to make and take delivery of COMEX Precious Metals Futures, specifically Gold (GC), Silver (SI) and the corresponding micro contracts for Gold (MGC) and Silver (SIL).

Physical delivery, in this context, is represented by the delivery-versus-payment of a registered electronic warrant or an Accumulated Certificate of Exchange (“ACE”) for each full size or E-micro futures contract.

About Gold and Silver Warrants

- Each Gold (GC) and Silver (SI) future will deliver one warrant representing deliverable grade gold or silver associated with the contract unit.

- Gold (GC): one hundred (100) troy ounces of gold with a weight tolerance of 5% either higher or lower with a minimum of 995 fineness. Additional information is available via COMEX Rulebook Chapter 113.

- Silver (SI): five thousand (5,000) troy ounces of silver with a weight tolerance of 10% either higher or lower with a minimum of 999 fineness. Additional information is available via COMEX Rulebook Chapter 112.

- Warrants are electronic documents that are issued by COMEX approved depositories.

- Each warrant is registered at COMEX and linked to specific deliverable grade bars with identifiable and unique warrant numbers traceable to each COMEX depository.

- Warrants will be registered to Interactive Brokers as the COMEX Clearing Member.

- Storage fees apply.

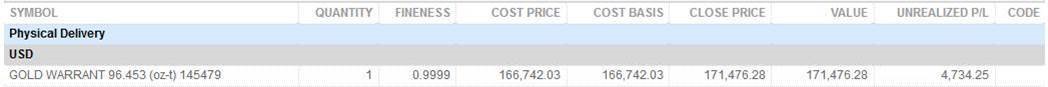

- Clients will see warrants in their "U" accounts:

- The symbol will contain the unique certificate number for the registered warrant.

- The quantity will always be 1.

- The net weight and fineness of the bars associated to the warrant will be visible. Below is an example of a client statement.

About Accumulated Certificate of Exchange (“ACE”)

- Micro Gold and Silver contracts deliver an Accumulated Certificate of Exchange (“ACE”), issued by the Clearing House.

- Micro Gold (MGC): An ACE represents a 10% ownership in a 100-troy ounce gold bar held in the form of a Warrant. Additional information is available via COMEX Rulebook Chapter 120.

- Micro Silver (SIL): An ACE represents a 20% ownership in a 5000-troy ounce silver bar held in the form of a Warrant. Additional information is available via COMEX Rulebook Chapter 121.

- Warrants can be converted to ACES.

- ACES can be redeemed for warrants once the correct multiples are accumulated (10 for gold and 5 for silver).

- Storage fees apply.

About Delivery Intents

In order to take or make delivery, an intent must be entered for the corresponding future. In the absence of an intent, futures positions will be subject to the relevant delivery period restrictions and positions may be liquidated. Refer to the delivery period liquidation schedule.

- Long Futures – Intent to Receive must be entered, for the corresponding number of long futures, a minimum of 2 business days prior to First Position Date of the corresponding delivery month. Clients can also enter Intents to Receive during the delivery period in order to place a buy order on a future in the current delivery month.

- Intent to Receive orders will be accepted only if the account has sufficient funds to take delivery of the declared amount of warrants. If there are insufficient funds, Intent to Receive orders will be rejected.

- Short Futures – Intent to Deliver must be entered for the corresponding number of short futures, a minimum 2 business days prior to the Last Trade Date of the corresponding delivery month. Clients can also enter Intents to Receive on the day preceding Last Trade Date, and Last Trade Date, in order to place a sell order on a future in the current delivery month.

- Intent to Deliver orders will be accepted only if the account has a sufficient number of warrant/ACE certificates to satisfy the delivery. If there are insufficient certificates, Intent to Deliver orders will be rejected.

Placing Delivery Intents

- To access the Physical Delivery tool from Trader Workstation (TWS):

- Right click on the eligible futures contract > Delivery OR

- Select Trade > Physical Delivery

- To access the Physical Delivery tool from Client Portal:

- Tap an eligible futures contract > Your Position > Row Action button (3 dots at end) > Delivery

- From the Positions page, tap the Row Action (3 dots at end) > Delivery

- IBKR Mobile App:

- Navigate to Main Menu > Trade > Delivery

- Tap an eligible futures contract to open the Contract Details > Positions > Delivery tool

To declare your intent for these precious metals you must follow one of the workflows below:

Intent to Receive

Submitting intent to receive not only indicates the desire to take delivery of the product at the end of the delivery window (in the form of a certified Warrant or ACE), it is also REQUIRED to open new Futures positions during the delivery window (i.e. it is not possible to open a physically deliverable futures position, during the delivery window, without first submitting the Intent to Receive for that Future).

Any Intents to Receive that do not have a corresponding Futures position at the end of the delivery window will be cancelled.

Intent to Deliver

Submitting intent to deliver indicates the desire to make delivery of a product (e.g. Warrant or ACE). It is also REQUIRED that the account is both short an eligible Future position and has the corresponding certificate to provide.

Any Intents to Deliver that do not have corresponding Future positions at the end of the delivery window will be canceled.

Request to Deliver

Submitting a request to deliver is ONLY available during the delivery window and indicates a desire to deliver the product that day (instead of at the end of the delivery window, as with the intent to deliver). It is REQUIRED that to submit this request an account must have an existing, eligible product (e.g. Warrant or ACE) and corresponding short Future position (e.g. GC, MGC etc.).

Physical Delivery of US Spot Gold

Physical Delivery of US Spot Gold

Unallocated US Spot Gold (symbol: USGOLD) can be converted into any of the following products:

- Gold Bullion Bar (.999) - 1 kg

- Gold Bullion Bar ISO Accredited (.9999) - 1 oz

- Gold Bullion Bar ISO Accredited (.9999) - 10 oz

- Gold American Eagle Coin - 1 oz

- Gold American Buffalo Coin - 1 oz

- Gold Canadian Maple Leaf Coin - 1 oz

Requesting a Delivery

If you would like to convert your unallocated US Spot Gold position into a physical metal:

- Log in to Client Portal

- Navigate to the Message Center

- Click “Compose > New Ticket”

- Select “Physical Gold Delivery” as the Topic

Delivery Costs and Shipping

The cost of physical delivery of US Spot Gold is the sum of:

- The differential between the spot price of gold and the cost of the physical product.

- Physical metals products are provided by Fidelitrade Inc. Estimated cost of the physical product can be found on their website.

- The cost of the product is the indicative ASK price displayed by FideliTrade.1

- A $20 delivery fee plus an additional $2.50 per ounce delivered 2

- A $500 IBKR processing fee

FideliTrade Shipping Policy:

- Bullion is shipped via Federal Express, the US Postal Service or armored carrier.

- Bullion is insured to $100,000 per package when shipped via Federal Express or USPS and to higher levels when shipped via armored carrier.

- Bullion is shipped only to address on record for your IBKR Account to ensure the highest level of security.

- Individual shipments of bullion via Federal Express or USPS have a maximum value of $100,000. Deliveries for bullion values larger than $100,000 will be broken up into multiple deliveries. 2

Trading Permissions

To trade US Spot Gold you need US Metals trading permission on your account. You can request permission by:

- logging in to Portal

- selecting the Settings > Account Settings menu item from the bottom of the window

- clicking the “Configure” (gear) icon for Trading Experience & Permissions.

- Click the drop down menu for "Additional Products"

- Select "Metals"

- In the pop-up, select "United States" and click Save

- clicking Continue

US Spot Gold is only available to legal residents of the United States. US Spot Gold is not available to legal residents of Arizona, Montana, New Hampshire and Rhode Island.

U.S. Securities Options Exercise Limits

INTRODUCTION

Option exercise limits, along with position limits (See KB1252), have been in place since the inception of standardized trading of U.S. securities options. Their purpose is to prevent manipulative actions in underlying securities (e.g., corners or squeezes) as well as disruptions in option markets where illiquidity in a given option class exists. These limits serve to prohibit an account, along with its related accounts, from cumulatively exercising within any five consecutive business day period, a number of options contracts in excess of the defined limit for a given equity options class (i.e., option contracts associated with a particular underlying security). This includes both early exercises and expiration exercises.

OVERVIEW

U.S. securities option exercise limits are established by FINRA and the U.S. options exchanges. The exercise limits are generally the same as position limits and they can vary by option class as they take into consideration factors such as the number of shares outstanding and trading volume of the underlying security. Limits are also subject to adjustment and therefore can vary over time. The Options Clearing Corporation (OCC), the central clearinghouse for U.S. exchange traded securities options, publishes a daily file with these limits on its public website. The link is as follows: http://www.optionsclearing.com/webapps/position-limits. FINRA Rule 2360(b)(4) addresses exercise limits and can be found via the following website link: http://finra.complinet.com/en/display/display.html?rbid=2403&record_id=16126&element_id=6306&highlight=2360#r16126).

Note that exercise limits are applied based upon the the side of the market represented by the option position. Accordingly, all exercises of call options over the past five business days are aggregated for purposes of determining the limit for the purposes of purchasing the underlying security. Similarly, a separate computation whereby all put exercises over the past five business days are aggregated is required for purposes of determining sales of the underlying.

IMPORTANT INFORMATION

It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. This is because exercise limits are cumulative and one could conceivably purchase options up to the position limit, exercise those options and purchase additional options which, if allowed to be exercised within the five business day window, would exceed the limit.

Account holders are responsible for monitoring their cumulative options exercises as well as the exercise limit quantities to ensure compliance. In addition, IB reserves the right to prohibit the exercise of any options, regardless of their intrinsic value or remaining maturity, if the effect of that exercise would be to violate the exercise limit rule.

How Can I Lapse Long Options?

Account holders have the ability to lapse equity options (also known as providing contrary intentions) they hold long in their account.

From Trader Workstation, go to the Trade menu and select Option Exercise.

The Option Exercise window will appear and any long options you are holding will populate under the Long Positions column header. To lapse one of them, left-click on the light blue “Select” link under the Exercise Option column header for that particular option.

.bmp)

Select “Lapse” from the drop down menu.

.bmp)

Review the request, and click the blue “ T” Transmit button to submit the lapse request.

.bmp)

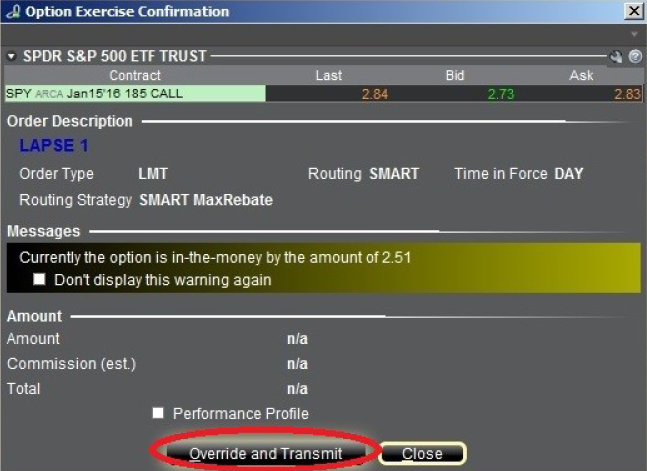

The Option Exercise Confirmation window will appear and will show how much the option is in-the-money. If the option is out-of-the-money, a warning message will appear. To submit the Lapse request, click the Override and Transmit button.

Your Lapse request will now show as an order line on your Trader Workstation until the clearinghouse processes the request.

Unless the lapse request is final it is still considered a position in the credit system and subject to the expiration exposure calculations. The Orders page of Global Configuration provides a selection box where you can specify that an option exercise request be final, and therefore cannot be canceled or editable until the cutoff time (default), which varies by clearing house. To specify this parameter, from the Mosaic File menu or Classic Edit menu, select Global Configuration and go to Orders followed by Settings from the configuration tree on the left side. Make your selection using the “Option exercise requests are” drop down menu. Please note that some contracts will not follow this rule and will remain revocable up until the clearing house deadline.

In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management window, click on "Inquiry/Problem Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

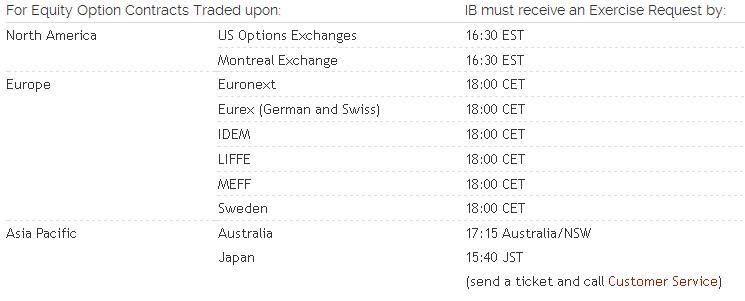

Option Lapse Requests (whether received through the TWS Option Exercise window or by a ticket sent via Account Management/Message Center) must be submitted as follows:

Note: "Contrary intentions" are handled on a best efforts basis.

Considerations for Exercising Call Options Prior to Expiration

INTRODUCTION

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:

- It results in a forfeiture of any remaining option time value;

- Requires a greater commitment of capital for the payment or financing of the stock delivery; and

- May expose the option holder to greater risk of loss on the stock relative to the option premium.

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

BACKGROUND

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:

1. The option is deep-in-the-money and has a delta of 100;

2. The option has little or no time value;

3. The dividend is relatively high and its Ex-Date precedes the option expiration date.

EXAMPLES

To illustrate the impact of these conditions upon the early exercise decision, consider an account maintaining a long cash balance of $9,000 and a long call position in hypothetical stock “ABC” having a strike price of $90.00 and time to expiration of 10 days. ABC, currently trading at $100.00, has declared a dividend of $2.00 per share with tomorrow being the Ex-Dividend date. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date.

Here, we will review the exercise decision with the intent of maintaining the 100 share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

SCENARIO 1: Option Price At Parity - $10.00

In the case of an option trading at parity, early exercise will serve to maintain the position delta and avoid the loss of value in long option when the stock trades ex-dividend, to preserve equity. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock (net of dividend) and dividend receivable are credited to the account. If you aim for the same end result by selling the option prior to the Ex-Dividend date and purchasing the stock, remember to factor in commissions/spreads:

| SCENARIO 1 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $0 |

| Option | $1,000 | $0 | $800 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,000 | $10,000 | $9,800 | $10,000 less commissions/spreads |

SCENARIO 2: Option Price Above Parity - $11.00

In the case of an option trading above parity, early exercise to capture the dividend may not be economically beneficial. In this scenario, early exercise would result in a loss of $100 in option time value, while selling the option and buying the stock, after commissions, may be less beneficial than taking no action. In this scenario, the preferable action would be No Action.

| SCENARIO 2 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $100 |

| Option | $1,100 | $0 | $1,100 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,100 | $10,000 | $10,100 | $10,100 less commissions/spreads |

![]() NOTE:

NOTE:

Options have two components that make up their total premium value - intrinsic value and time value. The intrinsic value is the amount by which the option is in-the-money, while the time value represents the possibility that the option could become even more profitable before expiration as the underlying asset price fluctuates while providing protection against adverse moves.

Many options are American-style, which means they can be exercised early, ahead of their expiration date. Early exercise of an option eliminates the remaining time value component from the option's premium, since the option holder loses protection against unfavorable movements in the underlying asset’s price.

This makes early exercise suboptimal in most situations, as the option holder is willingly forfeiting a portion of the option's value.

There are a few specific circumstances where early exercise could make sense, such as:

- For call options on a stock that will pay dividends soon, where the dividend amount exceeds the remaining time value (and only if the exercise will settle on or prior to the record date for the dividend).

- For deep in-the-money options where the time value is negligible compared to the intrinsic value, and the option is expected to drop in value due to interest rate effects (PUTS), or expected stock loan benefits (CALLS).

The first case, exercising an in the money call immediately ahead of a dividend payment, is the most common economically-sensible early exercise. In most cases, it is advisable to hold or sell the option instead of exercising it early, in order to capture the remaining time value. An option should only be exercised early after carefully considering all factors and determining that the benefits of early exercise outweigh the time value being surrendered.

Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

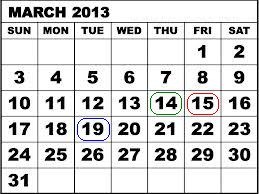

As example, consider a credit call (bear) spread on the SPDR S&P 500 ETF Trust (SPY) consisting of 100 short contracts in the March '13 $146 strike and 100 long contracts in the March '13 $147 strike. On 3/14/13, with the SPY Trust declared a dividend of $0.69372 per share, payable 4/30/13 to shareholders of record as of 3/19/13. Given the 3 business day settlement time frame for U.S. stocks, one would have had to buy the stock or exercise the call no later than 3/14/13 in order receive the dividend, as the next day the stock began trading Ex-Dividend.

On 3/14/13, with one trading day left prior to expiration, the two option contracts traded at parity, suggesting maximum risk of $100 per contract or $10,000 on the 100 contract position. However, the failure to exercise the long contract in order to capture the dividend and protect against the likely assignment on the short contracts by others seeking the dividend created an additional risk of $67.372 per contract or $6,737.20 on the position representing the dividend obligation were all short calls assigned. As reflected on the table below, had the short option leg not been assigned, the maximum risk when the final contract settlement prices were determined on 3/15/13 would have remained at $100 per contract.

| Date | SPY Close | March '13 $146 Call | March '13 $147 Call |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

Please note that if your account is subject to tax withholding requirements of the US Treasure rule 871(m), it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.