Shareholders Rights Directive II

On 3 September 2020, a new European Directive, the Shareholders Rights Directive II ("SRD II"), will enter into force introducing important regulatory changes for intermediaries. SRD II aims to encourage long-term shareholder engagement in European shares by introducing new requirements, including:

- Obligations for all intermediaries in the chain of custody to provide shareholders information to issuers on demand and no later than the business day immediately following the date of receipt of the request;

- Requirements for intermediaries to make available meeting announcements or any other information which an issuer is required to provide to shareholders to enable a shareholder to exercise its rights

- Requirements for intermediaries to facilitate the ability of shareholders to participate in meetings by passing on a shareholder's participation instructions (for example a vote or request to attend the meeting), without delay.

Note that the Directive applies to any intermediary, whether based in the EEA or not. Accordingly, IBKR may in the future forward any request to provide shareholders information that IBKR may receive from issuers (or other appointed entities) whose share is owned through the IBKR accounts of an intermediary or their clients.

Upon receipt of these requests, intermediaries will be required to provide shareholders information directly to the issuers no later than the business day immediately following the date of receipt of the request.

Information to Disclose

- Full name;

- Contact details (address, email address);

- Unique identifiers;

- Number of shares held;

- Category/classes of shares held (Only if explicitly requested);

- Dates from which the shares are held (Only if explicitly requested);

- Depository location;

- Vote-eligible shares.

Requests Thresholds

Member states can establish that the right of the issuer to obtain the shareholders information is only effective with regard to holding of a minimum percentage of voting rights, which where set cannot exceed 0.5%.

Requests Handling

IBKR will send these requests in a standardised electronic format. Shareholders information shall be provided directly to the issuer (or other third party entity appointed) in the format prescribed by SRD II. We recommend that intermediaries review the Commission Implementing Regulation (EU) 2018 1212, which details the regulatory formats.

IBKR has appointed a third party provider, Mediant, to facilitate the requests handling. To use their services, they can be contacted directly at SRDTabulations@mediantonline.com.

Alternatively, intermediaries should ensure that they have alternative ways to reply to these requests for information after 3 September 2020.

SFTR: Reporting to Trade Repository Obligations and Interactive Brokers Delegated Service to help meet your obligations

Background: Securities Financing Transactions Regulation (“SFTR”) is a European regulation aimed at mitigating the risk of shadow banking. SFT's have been identified as being one of the central causes of the financial crisis and during and post crisis, regulators have struggled with anticipating the risks associated with securities financing. This led to the introduction of a reporting requirement for these SFTs.

Transactions that are reportable under SFTR: Repurchase agreements (repos), stock loans, margin loans, sell/buy-back transactions and collateral management transactions.

Whom do SFTR reporting obligations apply to: Reporting obligations normally apply to all clients established in the EU with the exception of natural persons. They apply to:

- Financial counterparties ("FC"): include investment firms, credit institutions, insurance and reinsurance undertakings, UCITS and UCITS management companies, Alternative Investment Fund managed by an AIFM authorised under the Alternative Investment Fund Managers Directive ("AIFMD"), institutions for occupational retirement provision, central counterparties and central securities depositories.

- Non-Financial Counterparty ("NFC"): Undertakings established in the Union or in a third country that do not fall under the definition of financial counterparty.

- Small Non- Financial Counterparty ("NFC-"): A small non-financial counterparty is one which does not exceed the limits of at least two of three criteria: a balance sheet total of EUR 20m, net turnover of EUR 40m, and average number of 250 employees during the financial year. Under SFTR, small NFC's reporting obligations are automatically delegated to the financial counterparty with which they execute an SFT.

What must be reported?

The types of SFTs in scope of the requirements include:

Transaction level reporting:

- Securities and commodities lending / borrowing transactions

- Buy-sell backs / sell-buy backs

- Repo transactions

Position Level reporting:

- Margin lending

In-scope entities will be required to report details of an SFT which is in scope if that SFT:

- is concluded after the date on which the Regulatory Technical Standards apply to the entity

- has a remaining maturity of over 180 days on the date on which the RTS apply to the entity

- is an open / rolling transaction that has been outstanding for more than 180 days on the date on which the RTS apply to the entity

When must it be reported?

SFTR is a two-sided reporting requirement, with both collateral provider (borrower) and collateral receiver (lender) required to report their side of the SFT to an approved Trade Repository on trade date +1 (T+1).

All new SFTs, modifications of open SFT’s and terminations of existing SFTs must be reported daily. Collateral is reported on T+1 or value date +1 (S+1) dependent on the method of collateralisation used.

What do reports include?

Reporting will be done using a combination of 153 fields, depending on product and report type.

- 18 counterparty data fields - which includes information about the counterparty such as LEI and country of legal residence.

- 99 Transaction fields – which includes the loan and collateral data information on the type of SFT which has been involved in the transaction

- 20 Margin fields – which includes information on margin such as the portfolio code and currency.

- 18 Reuse fields – which includes cash reinvestment and funding source data

What must match between reports?

The SFTR reporting format includes 153 reportable fields, some of which must match between reports of the two counterparties. There will be two phases of the trade repositories’ reconciliation process, with the first phase consisting of 62 matching fields which are required for the initial SFTR implementation. A second phase, starting 2 years after the start of the reporting obligation, will contain another 34 fields which are required to match, bringing the total number of matching fields to 96.

In this context, it is particularly important that the globally unique transaction identifier - a UTI, be used and shared between the parties to the trade. The parties should agree who is to generate the UTI. If no such agreement is in place, the regulation describes a waterfall model for who would be the generating party. The generating party is obligated to share the UTI with the counterpart in an electronic format in a timely manner for both parties to be able to fulfil their T+1 reporting obligation.

INTERACTIVE BROKERS DELEGATED REPORTING SERVICE TO HELP MEET YOUR REPORTING OBLIGATIONS

FCs, NFCs and NFC-s must report details of their transactions to authorised Trade Repositories. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party (who submits reports on their behalf).

As mentioned above, when executing an SFT with an FC, an NFC- does not have to submit relevant reports, as these are submitted by the FC on the NFC-‘s behalf.

However, NFC-s who do not execute SFTs with an FC are required to submit reports.

Depending on the different setups available, Interactive Brokers clients’ may not be executing an SFT with an FC, and therefore Interactive Brokers offers a delegated reporting service, to ensure its clients can report all SFTs they execute.

As mentioned above, SFTR reports submitted by the two counterparties of an SFT must contain the same UTI. To ensure this requirement is satisfied, Interactive Brokers suggests that all of its clients in scope delegate reporting to Interactive Brokers.

Interactive Brokers will take care of generating matching UTIs when submitting its own reports and those of its clients on whose behalf it submits reports.

Validating Explicit Permissions - The European Securities and Markets Authority (ESMA) have introduced a mandate whereby trade repositories need to confirm a delegated reporting agreement is in place between the two parties before accepting and sending on any reports to the regulator. Due to this, the Trade Repository that Interactive Brokers works with - Depository Trust and Clearing Corporation ("DTCC"), has introduced a process to collect this information. As a client of Interactive Brokers, if you opt for delegated reporting, this mandate will apply.

DTCC will collect this information by sending clients an email asking for confirmation from the client that they have delegated their SFTR reporting to Interactive Brokers. – This will be a one-time process for each client. Once confirmed, DTCC will accept the reports and send them onto the regulator.

Securities Financing Transactions: Currently, Interactive Brokers clients can execute two types of SFTs: margin lending and stock loans. SFTR also requires reporting information on funding sources and collateral reuse.

Trade repository Interactive Brokers use: Interactive Brokers (U.K.) Limited will use the services of Depository Trust and Clearing Corporation ("DTCC") Trade Repository.

Timetable to report to Trade repositories: The reporting start date is 13 July 2020:

July 2020: Report Phase 1 – July 13 2020 reporting go-live for banks, investment firms & Credit Institutions and CCPs & CSDs

Oct 2020: Report Phase 2 - Insurance, UCITS, AIF & Pensions

Jan 2021: Report phase 3 - Reporting go-live for Non-Financial Companies

THIS INFORMATION IS GUIDANCE FOR INTERACTIVE BROKERS CLEARED CUSTOMERS ONLY.

NOTE: THE INFORMATION ABOVE IS NOT INTENDED TO BE A COMPREHENSIVE OR EXHAUSTIVE NOR A DEFINITIVE INTERPRETATION OF THE REGULATION, BUT A SUMMARY OF ESMA'S SFTR REGULATION AND RESULTING TRADE REPOSITORY REPORTING OBLIGATIONS

IBKR Australia Short Position Reporting

Introduction

You can request IBKR Australia perform your Australian short position reporting obligations on your behalf.

What is a short position?

A short position arises where the quantity of an eligible product that you hold is less than the quantity of the eligible product that you have an obligation to deliver, such as when you engaged in short selling an ASX-listed security and borrowed securities from IBKR to cover your delivery obligation.

When do I have a reporting obligation?

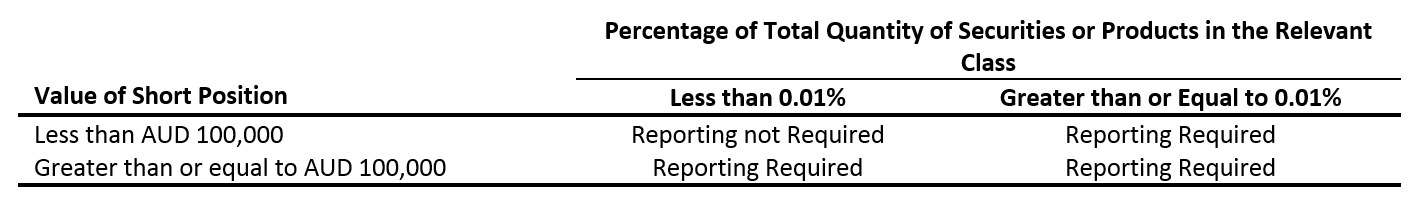

Short sellers have an obligation to report certain short positions to the Australian Securities & Investments Commission (ASIC). Reporting on short positions that are below the thresholds set by ASIC is optional. A short position does not need to be reported to ASIC when:

- The value of the position is AUD 100,000 or less; and

- The position is 0.01% or less of the total quantity of securities or products on issue for that security or product.

Otherwise, the short position must be reported.

The following table provides a convenient summary of when a short position must be reported (“Reportable Short Position”):

What you need to know about short position reporting:

It is important that any clients trading or wishing to trade eligible products understand that they may have an obligation to report their Reportable Short Positions to ASIC daily.

This obligation applies to any short sellers with a Reportable Short Position under the rules whether inside or outside of Australia. By default, IBKR Australia does not report Reportable Short Positions on your behalf, so you must arrange for the reporting of your short positions (if required).

IBKR Australia, along with many third-party firms, can provide this service to you subject to applicable terms and conditions.

If you would like IBKR Australia to perform your short position reporting for eligible products held in your IBKR account, please enrol in the service via Client Portal. Currently, this service is offered at no additional cost to IBKR Australia clients.

Please note:

- If your account does not allow shorting of securities, there is no need to sign up for this service.

- IBKR Australia will only offer the option to report all short positions and not only your Reportable Short Positions.

If you enroll in the IBKR short position reporting service:

- You must not hold any other eligible products with any other bank, broker or custodian because our systems use the positions in your IBKR account to determine whether you have a reportable short position. We cannot accurately calculate your short position if you hold eligible positions elsewhere.

- You must ensure that the information you provide us is complete and accurate in all respects, as we are required to provide ASIC with certain personal information about you.

- The obligation to report your short positions is always yours and is not transferred to IBKR under any circumstance (i.e. IBKR does not become responsible for your short position reporting obligations);

- If, for any reason, we are unable to report your short positions to ASIC before the deadline or at all, we will endeavour to inform you as early as possible so that you can make alternative arrangements. However, we make no warranties that you will receive the notification prior to the reporting deadline.

How do I apply?

To apply, all you need to do is log in to your account via the Client Portal, navigate to the Settings > Account Settings menu, click on the “ASIC Short Position Reporting” icon and follow the prompts.

As part of this process, you will need a unique identifier. For Australian applicants, this can be your ACN or ARBN. For overseas clients this can be your SWIFT BIC. Alternatively, you may register with ASIC to obtain a unique identity code.

Upon electing IBKR Australia to perform this short position reporting obligation on your behalf, you must warrant that the reportable short positions held with IBKR Australia represent your entire portfolio in applicable Reportable Short Positions and acknowledge that IBKR Australia will rely on this representation and warranty in good faith on each occasion that it makes a short position report to ASIC on your behalf.

Where can I get more information?

Clients seeking more information on their short position reporting obligations should refer to the following resources:

- ASIC Regulatory Guide 196, which contains an overview of the applicable short selling rules and disclosure requirements.

- ASIC Info Sheet 98, which provides an overview of how to submit short position reports to ASIC via FIX and a list of vendors who may be able to assist you with your short position reporting obligations if you don’t elect to enrol in the IBKR short position reporting service.

PRIIPs Overview

BACKGROUND

In 2018, an EU regulation, intended to protect “Retail” clients by ensuring that they are provided with adequate disclosure when purchasing certain products took effect. This disclosure document is referred to as a Key Information Document, or KID, and it contains information such as product description, cost, risk-reward profile and possible performance scenarios.

This regulation is known as the Packaged Retail and Insurance-based Investment Product Regulation (MiFID II, Directive 2014/65/EU), or PRIIPs, and it covers any investment where the amount payable to the client fluctuates because of exposure to reference values or to the performance of one or more assets not directly purchased by such retail investor. Common examples of such products include options, futures, CFDs, ETFs, ETNs and other structured products.

The UK Financial Conduct Authority (FCA) has equivalent requirements for UK residents.

It’s important to note that a broker cannot allow a Retail client to purchase a product covered by PRIIPs unless the issuer of that product has prepared the required disclosure document for the broker to provide to the client. U.S. clients are not impacted by PRIIPs, so the issuers of U.S. listed ETFs do not as a rule create KIDs. This means that EEA and UK Retail clients may not purchase the product. Clients nevertheless have several options:

- Many US ETF issuers have equivalent ETFs issued by their European entities. European-issued ETFs have KIDs and are therefore freely tradable.

- Clients can trade most large US ETFs as CFDs. The CFDs are issued by IBKRs European entities and as such meet all KID requirements.

- Clients may be eligible for re-classification as a professional client, for whom KIDs are not required.

CLIENT CATEGORISATION

We categorize all individual clients as “Retail” by default as this affords clients the broadest level of protection afforded by MiFID. Client who are categorised as “Professional” do not receive the same level of protection as “Retail” but are not subject to the KIDs requirement. As defined under MiFID II rules, “Professional” clients include regulated entities, large clients and individuals who have asked to be re-categorised as “elective professional clients” and meet the MiFID II requirements based on their knowledge, experience and financial capability.

We provide an online step-by-step process that allows “Retail” to request that their categorisation be changed to “Professional". The qualifications for re-categorisation along with the steps for requesting that one’s categorisation be considered are outlined in KB3298 or, to directly apply for a change in categorisation, the questionnaire is available in the Client Portal/Account Management.

Interactive Brokers (U.K.) Limited – MiFID Categorisation

Introduction

The European Union legislative act known as the Markets in Financial Instruments Directive, or MiFID, as amended by MiFID II, requires Interactive Brokers (U.K.) Limited (IBUK) to classify each Client according to their knowledge, experience and expertise: "Retail", "Professional" or "Eligible Counterparty".

In accordance with the Financial Conduct Authority rules, IBUK categorises most clients as Retail clients, providing them with a higher degree of protection.

Only those clients that are either regulated entities or funds managed by regulated fund managers, are categorised as Per Se Professional Clients.

Professional Clients are entitled to a lower degree of protection under the UK regulatory regimes than Retail Clients. This notice contains, for information purposes only, a summary of the protections that a Retail Client might lose if they are to be treated as a Professional Client.

1. Description of the nature and risks of packaged investments: A firm that offers an investment service with another service or product or as a condition of the same agreement with a Retail Client must: (i) inform Retail Clients if the risks resulting from the agreement are likely to be different from the risks associated with the components when taken separately; and (ii) provide Retail Clients with an adequate description of the different components of the agreement and the way in which its interaction modifies the risks. The above requirements do not apply in respect of Professional Clients. However, IBUK will not make such differentiation apart from the case specified under point 3 below.

2. Retail investor protection measures on the provision of Contracts for Differences (“CFDs”): The regulatory measures include: (i) Leverage limits on the opening of a position, which vary according to the volatility of the underlying; (ii) A margin close out rule on a per account basis that standardises the percentage of margin (at 50%of the minimum required margin) at which providers are required to close out one or more open CFDs; (iii) Negative balance protection on a per account basis;(iv) A restriction on the incentives offered to trade CFDs; and (v) A standardised risk warning, including the percentage of losses on a CFD provider’s Retail investor accounts. These measures do not apply in respect of Professional Clients.

3. Communication with clients, including financial promotions: A firm must ensure that its communications with all clients are, and remain, fair, clear and not misleading. However, the simplicity and frequency in which a firm may communicate with Professional Clients (about itself, its services and products, and its remuneration) may be different to the way in which the firm communicates with Retail Clients. Regulations relating to restrictions on, and the required contents of, direct offer financial promotions do not apply to promotions to Professional Clients and such promotions need not contain sufficient information for Professional Clients to make an informed assessment of the investment to which they relate. A firm’s obligations in respect of the level of details, medium and timing of the provision of information are different depending on whether the client is a Retailor Professional Client. The requirements to deliver certain product-specific documents, such as Key Information Documents (“KIDs”) for Packaged Retail and Insurance-based Investment Products (“PRIIPs”), are not applied to Professional Clients.

4. Depreciation in value reporting to clients: A firm that holds a Retail Client account that includes positions in leveraged financial instruments or contingent liability transactions must inform the Retail Client, where the initial value of each instrument depreciates by 10 per cent and thereafter at multiples of 10 per cent. The above reporting requirements do not apply in respect of Professional Clients (i.e., these reports do not have to be produced for Professional Clients).

5. Appropriateness: For transactions where a firm does not provide the client with investment advice or discretionary management services (such as an execution-only trade), it may be required to assess whether the transaction is appropriate. When assessing appropriateness for non-advised services, a firm may be required to determine whether the client has the necessary experience and knowledge in order to understand the risks involved in relation to the product or service offered or demanded. Where such an appropriateness assessment requirement applies in respect of a Retail Client, there is a specified test for ascertaining whether the client has the requisite investment knowledge and experience to understand the risks associated with the relevant transaction. However, in respect of a Professional Client the firm is entitled to assume that a Professional Client has the necessary level of experience, knowledge and expertise in order to understand the risks involved in relation to those particular investment services or transactions, or types of transaction or product, for which the client is classified as a Professional Client. IBUK provides non-advised services and is not required to request information or adhere to the assessment procedures for a Professional Client when assessing the appropriateness of a given service or product as with a Retail Client, and IBUK may not be required to give warnings to the Professional Client if it cannot determine appropriateness with respect to a given service or product.

6. Information about costs and associated charges: A firm must provide clients with information on costs and associated charges for its services and/or products. The information provided may not be as comprehensive for Professional Clients as it must be for Retail Clients.

7. Dealing: When undertaking transactions for Retail Clients, the total consideration, representing the price of the financial instrument and the costs relating to execution, should be the overriding factor in any execution. For Professional Clients a range of factors may be considered in order to achieve best execution –price is an important factor, but the relative importance of other different factors, such as speed, costs and fees may vary. However, IBUK will not make such differentiation.

8. Difficulty in carrying out orders: In relation to order execution, firms must inform Retail Clients about any material difficulty relevant to the proper carrying out of orders promptly on becoming aware of the difficulty. This is not required in respect of Professional Clients. The timeframe for providing confirmation that an order has been carried out is more rigorous for Retail Clients’ orders than Professional Clients’ orders.

9. Share trading obligation: In respect of shares admitted to trading on a regulated market or traded on a trading venue, the firm may, in relation to the investments of Retail Clients, only arrange for such trades to be carried out on a regulated market, a multilateral trading facility, a systematic internaliser or a third-country trading venue. This is a restriction which may not apply in respect of trading carried out for Professional Clients (i.e., this restriction can be disapplied where trades in such shares are carried out for Professional Clients in certain circumstances).

10. Exclusion of liability: Firms’ ability to exclude or restrict any duty or liability owed to clients is narrower under the FCA rules in the case of Retail Clients than in respect of Professional Clients.

11. The Financial Services Ombudsman: The services of the Financial Ombudsman Service in the UK may not be avail-able to Professional Clients, unless they are, for example, consumers, small businesses or individuals acting outside of their trade, business, craft or profession.

12. Compensation: IBUK is a member of the UK Financial Services Compensation Scheme. You may be entitled to claim compensation from that scheme if IBUK cannot meet its obligations to you. This will depend on the type of business and the circumstances of the claim; compensation is only available for certain types of claimants and claims in respect of certain types of business. Eligibility for compensation from the Financial Services Compensation Scheme is not contingent on your categorisation but on how the firm is constituted. Eligibility for compensation from the scheme is determined under the rules applicable to the scheme (more information is available at https://www.fscs.org.uk/).

13. Transfer of financial collateral arrangements: As a Professional Client, the firm may conclude title transfer financial collateral arrangements with you for the purpose of securing or covering your present or future, actual or contingent or prospective obligations, which would not be possible for Retail Clients.

14. Client money: The requirements under the client money rules in the FCA Handbook (CASS) are more prescriptive and provide more protection in respect of Retail Clients than in respect of Professional Clients.

Re-categorisation as Professional Client

IBUK allows its Retail Clients to request to be re-categorised as Professional Clients. Clients are notified of their Client Category and can check it at any time from Account Management, under Settings> Account Settings> MiFID Client Category. From this same screen, Clients can also request to change their MiFID Category.

IBUK will consider re-categorising Retail Clients to Professional Clients in two instances:

1. Per Se Professional Clients can notify IBUK that they consider that they should have been categorised as Per Se Professionals under the FCA rules, because at least one of the following conditions applies:

(i) authorised or regulated to operate in the financial markets; or

(ii) a large undertaking meeting two of the following size requirements on a company basis:

(a) balance sheet total of EUR 20,000,000;

(b) net turnover of EUR 40,000,000;

(c) own funds of EUR 2,000,000;

(iii) an institutional investor whose main activity is to invest in financial instruments. This includes entities dedicated to the securitisation of assets or other financing transactions.

2. IBUK may treat Clients as Elective Professional Clients if, based on an assessment of the Client’s expertise, experience, and knowledge, IBUK is reasonably assured that, in light of the nature of the transactions or services envisaged, the Client is capable of making its own investment decisions and understand the risks involved. Clients who do not meet the requirements to be categorised as Per Se Professional Clients can still request to be categorised as Elective Professional Clients.

To obtain such re-categorisation, Retail Clients must provide evidence that they satisfy at least two (2) of the following criteria:

1. Over the last four (4) quarters, the Client conducted trades in financial instruments in significant size at an average frequency of ten (10) per quarter.

To determine the significant size IBUK considers the following:

a. During the last four quarters, there were at least forty (40) trades; and

b. During each of the last four (4) quarters, there was at least one (1) trade; and

c. The total notional value of the top forty (40) trades of the last four (4) quarters is greater than EUR 200,000; and

d. The account has a net asset value greater than EUR 50,000.

Trades in Spot FX and Unallocated OTC Metals are not considered for the purpose of this calculation.

2. The Client holds a portfolio of financial instruments (including cash) that exceeds EUR 500,000 (or equivalent);

3. The Client is an individual account holder or a trader of an organisation account who works or has worked in the financial sector for at least one year in a professional position which requires knowledge of products it trades in.

Upon review and verification of the information and supporting evidence provided, IBUK will re-categorise clients if all relevant conditions are met to satisfaction.

Retail Clients requesting to be re-categorised as Professional Accounts must read and understand the warning provided by IBUK before the relevant request is submitted.

Re-categorisation as Retail Client

Professional Clients can request IBUK to be re-categorised as Retail Clients, from the same Account Management page described above (under Settings> Account Settings> MiFID Client Category).

With the sole exception of regulated entities or funds managed by regulated fund managers, which are categorised as Per Se Professional Clients, IBUK accepts all such requests.

THIS INFORMATION IS GUIDANCE FOR INTERACTIVE BROKERS FULLY DISCLOSED CLEARED CUSTOMERS ONLY.

NOTE: THE INFORMATION ABOVE IS NOT INTENDED TO BE A COMPREHENSIVE, EXHAUSTIVE NOR A DEFINITIVE INTERPRETATION OF THE REGULATION, BUT A SUMMARY OF IBUK’S APPROACH TO CLIENT CATEGORISATION AND RE-CATEGORISATION POLICY.

Information Regarding Australian Regulatory Status Under IBKR Australia

Introduction

Australian resident customers maintaining an account with Interactive Brokers Australia Pty Ltd (IBKR

Australia), which holds an Australian Financial Services License, number 453554, are initially

classified as a retail investor, unless they satisfy one or more of the requirements to be classified as a

wholesale or professional investor according to the relevant provisions of the Corporations Act 2001.

This article outlines how this process is handled by IBKR Australia.

Australian Regulatory Status

All new customers of IBKR Australia default to being classified as a retail investor unless they produce to

IBKR Australia the required documentary evidence to allow IBKR Australia to treat them as a wholesale or

professional investor. Investors of IBKR Australia will only have their regulatory status change from

retail investor to either wholesale or professional investor subsequent to the required

documentation being received and approved by IBKR Australia.

What is a Wholesale Investor?

The most common way to be classified as a wholesale investor is to obtain a qualified accountant’s

certificate stating that you have net assets or net worth of at least $2.5 million AUD OR have a gross

annual income of at least $250,000 AUD in each of the last two financial years. The qualified

accountant’s certificate is only valid for two years before it needs to be renewed. We have prepared a

wholesale investor booklet, including a pro forma certificate for your accountant to complete, that

can be downloaded [here].

What is a Professional Investor?

In order to qualify as a professional investor, you must have an AFSL, be a body regulated by APRA, be a superannuation fund (but not a SMSF) and/or have net worth or liquid net worth of at least $10 million AUD. If you meet ONLY the financial criteria (i.e. net worth or liquid net worth of at least $10 million AUD), you will need to complete and submit to IBKR Australia the professional investor declaration contained within the professional investor booklet that we have prepared, which can be downloaded [here]. However, if you meet the criteria by virtue of having an AFSL, being a body regulated by APRA, or as a listed company (but not a SMSF), no booklet needs to be submitted.

What about Self-Managed Super Funds (SMSF’s)?

IBKR Australia have decided to treat all SMSF’s as retail investors, notwithstanding that they may meet the requirements to otherwise be classified as a wholesale or professional investor.

What about trusts?

For a trust to be considered as a wholesale investor, all trustees must be considered a wholesale

investor based on the tests described above.

Similarly, for a trust to be considered as a professional investor, all trustees must be considered a

professional investor based on the tests described above.

As a result, if at least one trustee is considered retail, the trust is considered a retail trust, regardless

of the status of any other trustees (if applicable).

Other

- For a full list of the disclosure documents and legal terms which govern the services IBKR Australia will make available please refer to the IBKR website.

- For further information on IBKR Australia, click on our Financial Services Guide.

- For more information or assistance, please contact IBKR Investor Services.

Clearinghouse Restrictions on Cannabis Securities

Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Consequently, those securities will no longer trade on the Stuttgart (SWB) or Frankfurt (FWB) stock exchanges. Effective as of the 19 September 2018 close, IBKR will take the following actions:

- Force close any impacted positions which clients have not acted to close and that are not eligible for transfer to a U.S. listing; and

- Force transfer to a U.S. listing any impacted positions which clients have not acted to close and that are eligible for such transfer.

Outlined in the table below are impacted issues as announced by the Boerse Stuttgart and Clearstream Banking as of 7 August 2018. This table includes a notation as to whether the impacted issue is eligible for transfer to a U.S. listing. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information.

| ISIN | NAME | EXCHANGE | U.S. TRANSFER ELIGIBLE? | U.S. SYMBOL |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | YES |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | YES |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | YES |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | YES |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | YES |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | YES |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | YES |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | YES |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | YES |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | YES |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | YES |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | YES |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | YES |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

IMPORTANT NOTES:

- Note that the U.S. listings generally trade over-the-counter (PINK) and are denominated in USD not EUR thereby exposing you to exchange rate risk in addition to market risk.

- Account holders maintaining PINK Sheet securities require United States (Penny Stocks) trading permissions in order to enter opening orders.

- All users on accounts maintaining United States (Penny Stocks) trading permissions are required use 2 Factor login protection when logging into the account.

Legal Entity Identifier Overview

BACKGROUND

The Legal Entity Identifier (LEI) is a 20-digit reference code that uniquely identifies legally distinct entities engaging in financial transactions globally, and across markets and jurisdictions. The LEI system was developed by the G-20 in accordance with ISO standards and the issuers of LEIs, referred to as Local Operating Units (LOU), supply registration and renewal services. Providing a unique identifier for each legal entity (along with key reference information associated with the entity) participating in financial transactions is intended to promote transparency.

DTC, in collaboration with SWIFT, operate as the local (U.S.) source provider of LEIs and maintains a website for the assignment of new and search of existing LEIs. See: http://www.gmeiutility.org/

SITUATIONS REQUIRING A LEI

In certain instances, brokers are required by regulation to report information regarding a client and include in that information a client identifier. For entities such as trusts and organizations, that identifier is referred to an a LEI. Examples of these reporting instances include the following:

CFTC Ownership and Control Reporting

MiFIR Transaction Reporting

China Stock Connect

EMIR reporting to trade repository

OBTAINING THE LEI

A LEI can be obtained by contacting an authorized LEI issuer, also referred to as a Local Operating Unit (LOU). The DTC, in collaboration with SWIFT, operates as a U.S. LOU and maintains a website for purposes of LEI registration and renewal. Note that LEI applicants can use the services of any accredited LOU and are not limited to using an LEI issuer in their own country.

In addition, as a service to its clients, IBKR will send an invite via Account Management to those who are required to obtain a LEI for trading or other regulatory reporting functions. Through this invite, the client can authorize IBKR to request an LEI through DTC on an accelerated basis (24 hours) and debit the client's account for the application fee and the annual renewal fee thereafter.

PRIIP Order Reject Translations

Clients entering opening orders for products covered by the PRIIPs Regulation where the issuer has not provided the required disclosure documents or Key Information Documents (KIDS) will have their order rejected and will receive the following reject message:

English

This product is currently unavailable to clients classified as 'retail clients'.

Note: Individual clients and entities that are not large institutions generally are classified as 'retail' clients.

There may be other products with similar economic characteristics that are available for you to trade.

French

Ce produit n’est pas actuellement disponible pour les clients considérés comme des clients “Particuliers/de détail”. Remarque : les clients particuliers et entreprises de détail qui ne sont pas de larges établissements sont classifiés comme des clients “de détail”.

D’autres produits aux caractéristiques similaires peuvent exister mais ne vous sont pas proposés au trading.

German

Dieses Produkt ist derzeit für Kunden, die als „Retail-Kunden” eingestuft werden, nicht verfügbar. Hinweis: Einzelkunden und Körperschaften, bei denen es sich nicht um große Institutionen handelt, werden grundsätzlich als „Retail”-Kunden bezeichnet.

Es ist möglich, dass Ihnen andere Produkte mit ähnlichen wirtschaftlichen Merkmalen zum Handel zur Verfügung stehen.

Italian

Questo prodotto al momento non è disponibile per i clienti “retail”. Nota: i clienti privati e le organizzazioni di non grandi dimensioni sono in genere classificati come clienti “retail”.

Potrebbero esserci altri prodotti con simili caratteristiche disponibili per le negoziazioni.

Spanish

Este producto no está actualmente disponible para clientes clasificados como “clientes minoristas”. Nota: los clientes individuales y las entidades que no sean grandes instituciones son clasificados, generalmente, como clientes “minoristas”.

Podría haber otros productos con características económicas similares que estén disponibles para que usted opere en ellos.

Russian

На данный момент этот продукт недоступен для розничных клиентов. Примечание: Частные лица и юридические структуры, не являющиеся крупными предприятиями, как правило, относятся к числу розничных клиентов.

Вам могут быть доступны другие продукты с похожими экономическими характеристиками.

Japanese

こちらの商品は現在「リテール・クライアント」として分類されるお客様にはご利用いただけません。注意:大きな機関ではない個人のお客様および事業体のお客様は、通常「リテール」クライアントとして分類されます。

似た経済特性を持つその他の商品で、お客様にお取引いただくことのできる商品がある可能性があります。

Chinese Simplified

该产品目前不适用于"零售客户"。 请注意:个人用户和非大型机构实体通常均被划分为"零售"客户。

可能有其他具有类似经济特征的产品适用于您的交易。

Chinese Traditional

該產品目前不適用於"零售客戶"。請注意: 個人用戶和非大型機構實體通常均被劃分為"零售"客戶。

可能有其他具有類似經濟特徵的產品適用於您的交易。

Please note, it is possible to be reclassified from Retail to Professional once certain qualitative, quantitative and procedural requirements are met. For more information on requirements, please see: How can I update my MiFID client category?

China Connect Northbound Investor ID Model

In November 2017, the Securities and Futures Commission (SFC) and China Securities Regulatory Commission (CSRC) announced an agreement to introduce an investor identification regime for Northbound trading under Mainland-Hong Kong Stock Connect. This regime is intended to enhance regulatory surveillance of mainland-listed stock trading from Hong Kong and requires brokers to report the identity of clients submitting orders to either the Shanghai or Shenzhen Stock Exchange. This regulation will be effective as of September 26, 2018. Additional information is provided in the series of FAQs below.

The Stock Connect is a collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges which allows international and Mainland Chinese investors to trade securities in each other's markets through the trading and clearing facilities of their home exchange.

Northbound trading refers to the trading of mainland-listed stocks (e.g., Shanghai and Shenzhen Stock Exchanges) from the Hong Kong Stock Exchange.

The information collected and reported depends upon the client classification. In the case of individuals, the information is as follows:

- Name in English and Chinese

- ID issuing country/jurisdiction

- ID type (Hong Kong ID card, ID card issued by the government authority of relevant country/region, passport, or any other official identity document e.g. driver's license)

- ID number (number of ID document)

- Entity name

- Other official incorporation documents (IBKR will attempt to us the documents clients provided at the point of account opening, whenever possible).

- Legal Entity Identifier (if you do not already have an LEI, you can order one through IBKR when requesting trading permissions for China Connect. Note that obtaining a LEI can take up to three days, is associated with an application fee imposed by the LEI issuing organization, and an annual renewal fee thereafter).

Clients who wish to access the Stock Connect must provide IBKR with consent to provide their information to the Hong Kong Exchanges and Clearing Ltd and the Chinese regulatory bodies such as:

- Shanghai and Shenzhen Stock Exchanges

- China Securities Depository and Clearing (Hong Kong) Company Limited

- Mainland regulatory authorities and law enforcement agencies

Clients with existing Northbound trading permissions will be presented with the online form upon log in to Client Portal. This form will allow IBKR to collect the required information and consent to submit this information upon order submission.

The Northbound Investor ID model will be effective as of October 22, 2018.

The SFC and the CSRC also agreed to introduce a similar investor identification regime for Southbound trading as soon as possible after the regime for Northbound trading is implemented.

Once the Northbound Investor ID model is in effect, clients who either fail to provide the required information or elect not to provide consent to report the required information will not be allowed to submit opening Northbound orders but will be allowed to close existing positions.

In order to trade China Connect stocks clients are required to login to Client Portal and request the necessary trading permissions. To do so:

- Log into Client Portal

- Click the User menu (head and shoulders icon in the top right corner) followed by Manage Account

- If you manage multiple accounts, select an account by clicking on the account number to popup the Account Selector

- Click the Configure (gear) icon next to Trading Experience & Permissions

- Click on "Stocks" and check the box next to "Hong Kong/China Stock Connect"

- Click CONTINUE and follow the prompts on screen.