Fees for Trading Warrants and Structured Products on Euronext

Euronext's fee thresholds on structured products and how it impacts clients' trading, for both fixed and tiered commission models

Clients that place orders and trade for more than EUR 6'000 in Warrants and Structured Products will be charged a 2.5 basis points fee with a maximum of EUR 20.

The table below displays the exchange fees for warrants and structured products when trading on Euronext:

|

Product Group |

Fee |

Minimum per Trade |

Maximum per Trade |

|

Warrants & Structured Products – trade value up to EUR 6’000 |

0.00 |

N/A |

N/A |

|

Warrants & Structured Products – trade value more than EUR 6’000 |

2.50 bps |

N/A |

EUR 20 per Trade |

Calculations:

For Cost Plus (Tiered) Clients:

Example: Client wishes to trade structured products on Euronext for a total trade value of EUR 10’000.

Scenario A:

Trade value = EUR 10’000

Fee = 2.5 Bps

As the trade value is above EUR 6’000, the fee of 2.50 bps applies and therefore an additional EUR 2.50 will have to be paid for the trade.

Scenario B:

Order 1:

Trade Value = EUR 5’000

Fee = 0.00

Order 2:

Trade Value = EUR 5’000

Fee = 0.00

As the trade value of each trade is below EUR 6’000, no additional fees apply.

Note: This calculation does not impact clients on the Fixed commission schedule.

Introduzione alla negoziazione di valute (forex)

IB offre sedi e piattaforme di trading rivolte sia agli operatori specializzati nel mercato forex sia a coloro che negoziano occasionalmente valute in relazione ad operazioni in titoli azionari o derivati denominati in diverse monete. Questo articolo presenta le nozioni fondamentali legate all'invio di ordini per la negoziazione di valute nella piattaforma TWS e fornisce alcune considerazioni in merito alle convenzioni sull'espressione delle quotazioni e alla presentazione delle informazioni relative alle posizioni.

Un'operazione in valute implica l'acquisto di una valuta e la contestuale vendita di un'altra; la combinazione delle due valute coinvolte è nota come "coppia valutaria". Gli esempi di seguito presentati sono basati sulla coppia EUR.USD; in ogni coppia la prima valuta (in questo caso EUR) è detta valuta di negoziazione, mentre la seconda (USD) è nota come valuta di regolamento.

Indice:

- Quotazione delle valute

- Creare una riga per le quotazioni

- Creare un ordine

- Il valore di un "pip"

- Presentazione delle informazioni sulle posizioni (post-negoziazione)

Quotazione delle valute

La quotazione di una coppia di valute indica il valore di mercato relativo di una valuta rispetto a quello di un'unità dell'altra valuta. La valuta utilizzata come riferimento è detta valuta quotata, mentre quella il cui valore relativo viene espresso è la valuta base. TWS fornisce un "ticker" per ogni coppia di valute. Lo strumento FXTrader consente poi di invertire la quotazione. I trader possono quindi acquistare la valuta base e vendere quella quotata e viceversa. Il simbolo della coppia EUR/USD è ad esempio:

EUR.USD

Laddove:

- EUR è la valuta base

- USD è la valuta quotata

La quotazione di questa coppia di valute indica quanti USD (la valuta quotata) occorrono per acquistare un'unità di EUR (la valuta base). Si tratta, in altre parole, del prezzo di 1 EUR espresso in USD.

Inviare un ordine di acquisto sulla coppia EUR.USD vuol dire quindi acquistare 1 EUR e vendere un importo equivalente in USD.

Creare una riga per le quotazioni

È possibile aggiungere una riga per le quotazioni in TWS seguendo questi passaggi:

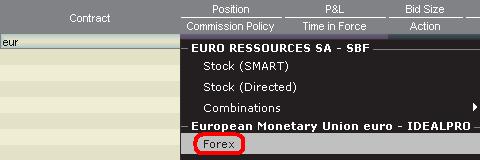

1. Inserire la valuta di negoziazione (es. EUR) e premere "Invio".

2. Scegliere il tipo di prodotto "Forex".

3. Selezionare la valuta di regolamento (es. USD) e scegliere la sede di negoziazione.

.jpg)

N.B.:

La sede IDEALFX fornisce accesso diretto alle quotazioni del mercato valutario intebancario ed è disponibile solo per ordini con una certa quantità minima (pari generalmente a 25,000 USD). Gli ordini con una quantità inferiore a quella minima richiesta trasmessi comunque a IDEALFX saranno automaticamente ritrasmessi a una sede di esecuzione più piccola deputata principalmente alla conversione di valute. Clicchi QUI per sapere di più sulle quantità minime e massime associate alla sede IDEALFX.

I dealer del mercato valutario esprimono le quotazioni in una specifica direzione. Di conseguenza, per trovare una certa coppia valutaria potrebbe essere necessario modificare il simbolo inserito. Inserendo il simbolo CAD, ad esempio, la valuta USD non sarà selezionabile come valuta di regolamento. Ciò dipende dal fatto che tale coppia è espressa come USD.CAD, ed è dunque selezionabile solo inserendo il simbolo USD e scegliendo il prodotto "Forex".

Creare un ordine

A seconda delle colonne mostrate, le coppie valutarie sono presentate nel modo descritto di seguito.

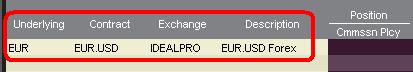

Le colonne Contratto e Descrizione mostreranno la coppia nel formato [valuta di negoziazione].[valuta di regolamento] (es. EUR.USD). La colonna Sottostante mostrerà solo la valuta di negoziazione.

Clicchi QUI per scoprire come modificare le colonne mostrate.

1. Cliccare con il tasto sinistro sul prezzo denaro (per vendere) o sul prezzo lettera (per acquistare).

2. Inserire la quantità della valuta di negoziazione che si intende acquistare o vendere. Il quantitativo dell'ordine è espresso nella valuta base, ovvero la prima valuta della coppia in TWS.

Il modello adottato da Interactive Brokers non prevede lo scambio di contratti che rappresentano un valore fisso della valuta base espresso nell'altra valuta, bensì il quantitativo dell'ordine è costituito dall'importo richiesto nella valuta base.

Immettendo un ordine per acquistare 100,000 EUR.USD, ad esempio, si acquisteranno 100,000 EUR vendendo al contempo un importo in USD equivalente calcolato in base al tasso di cambio mostrato.

3. Specificare il tipo di ordine desiderato, l'eventuale prezzo (ovvero il tasso di cambio) che si intende conseguire e trasmettere l'ordine.

Nota: Il quantitativo dell'ordine può essere pari a un numero qualsiasi di unità e non vi è alcun lotto/importo minimo da tenere in considerazione salvo per i quantitativi minimi stabiliti dalle sedi di negoziazione menzionati in alto.

Domande frequenti: Come si immette un ordine tramite FX Trader?

Il valore di un "pip"

Il "pip" è un'unità di misura della variazione di prezzo di una coppia valutaria; per la maggior parte delle coppie esso rappresenta la variazione minima, ma per alcune di esse sono possibili variazioni di una frazione di pip.

Per la coppia EUR.USD 1 pip è ad esempio pari a 0.0001, mentre per USD.JPY è pari a 0.01.

È possibile calcolare il valore di 1 PIP nella valuta quotata tramite la seguente formula:

(importo nozionale) x (1 pip)

Esempi:

- Ticker: EUR.USD

- Importo = 100,000 EUR

- 1 pip = 0.0001

Valore di 1 pip = 100,000 x 0.0001 = 10 USD

- Ticker: USD.JPY

- Importo = 100,000 USD

- 1 pip = 0.01

Valore di 1 pip = 100,000 x 0.0001 = 1000 JPY

È possibile calcolare il valore di 1 PIP in unità della valuta base tramite la seguente formula:

(importo nozionale) x (1 pip/tasso di cambio)

Esempi:

- Ticker: EUR.USD

- Importo = 100,000 EUR

- 1 pip = 0.0001

- Tasso di cambio = 1.3884

Valore di 1 pip = 100,000 x (0.0001/1.3884) = 7.20 EUR

- Ticker: USD.JPY

- Importo = 100,000 USD

- 1 pip = 0.01

- Tasso di cambio = 101.63

Valore di 1 pip = 100,000 x (0.01/101.63) = 9.84 USD

Presentazione delle informazioni sulle posizioni (post-negoziazione)

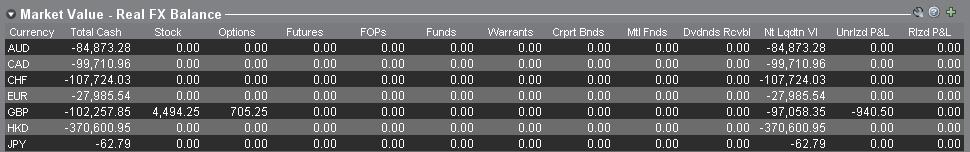

Prima di eseguire delle operazioni in un conto reale è essenziale comprendere le principali informazioni relative alle posizioni in valute. Nella piattaforma di trading di IB le posizioni in valute sono mostrate in due diverse sezioni, accessibili entrambi tramite la finestra "Conto".

1. Valore di mercato

La sezione "Valore di mercato" della finestra "Conto" mostra i dati in tempo reale sulle posizioni in valute, esprimendo i valori relativi alle valute prese separatamente (ovvero non come coppia).

La sezione "Valore di mercato" è l'unica in cui è possibile consultare i dati relativi alle posizioni in cambi in tempo reale. Per chiudere una posizione in una certa valuta non è affatto necessario sfruttare la stessa coppia utilizzata per aprirla. Dopo aver acquistato EUR.USD (ovvero acquistato EUR e venduto USD) e USD.JPY (cioè acquistato USD e venduto JPY) è ad esempio possibile chiudere la posizione risultante tramite la coppia EUR.JPY (ovvero vendendo EUR e acquistando JPY).

N.B.:

La sezione "Valore di mercato" può essere espansa o compressa. È consigliabile verificare che vi sia un segno "meno" di colore verde sopra la colonna "Valore di liquidazione netto". Un simbolo "più" potrebbe indicare la presenza di posizioni attive nascoste.

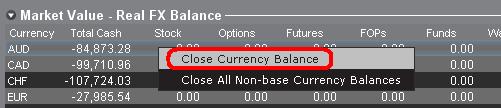

È possibile immettere ordini per chiudere un saldo in una certa valuta tramite la sezione "Valore di mercato" cliccando con il tasto destro del mouse sulla valuta prescelta e selezionando "Chiudere saldo valutario" o "Chiudi tutti i saldi in valuta non di base".

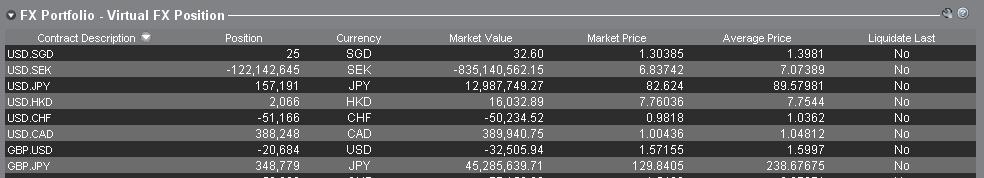

2. Portafoglio FX

La sezione "Portafoglio FX" della finestra "Conto" fornisce informazioni sulle Posizioni virtuali e mostra dati sulle posizioni espressi in relazione alle coppie valutarie (piuttosto che alle singole valute, come nel caso della sezione "Valore di mercato"). Questa particolare modalità di visualizzazione viene incontro alle convenzioni vigenti tra i trader di valute istituzionali e può generalmente essere ignorata dai trader di valute al dettaglio od occasionali. I valori associati alle posizioni in questa sezione non riflettono tutte le operazioni in valute; i clienti hanno tuttavia la possibilità di modificare tali quantità e i costi medi mostrati. La capacità di modificare queste informazioni senza dover eseguire delle operazioni reali può risultare utile a coloro che negoziano valute come attività aggiuntiva rispetto alla negoziazione di prodotti denominati in valute diverse da quella di base. Questa funzionalità consente di separate manualmente le conversioni automatiche (che vengono effettuate quando si negoziano prodotti denominati in valute diverse da quella di base) dalla negoziazione di valute in senso stretto.

La sezione "Portafoglio FX" aggrega le informazioni relative alle posizioni in valute, nonché i profitti e le perdite da esse derivanti, provenienti da tutte le altre finestre. Ciò a volte genera confusione nel cercare di determinare quali siano le informazioni corrette e aggiornate relative alle proprie posizioni. È possibile ridurre o eliminare tale confusione nei modi seguenti:

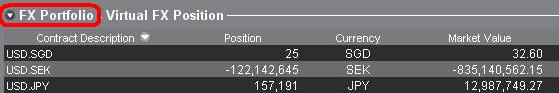

a. Comprimere la sezione "Portafoglio FX"

È possibile comprimere tale sezione cliccando sulla freccia a sinistra della dicitura "Portafoglio FX". Una volta compressa questa sezione le informazioni relative alle posizioni virtuali saranno rimosse da tutte le pagine. Nota: questa operazione non consente di mostrare le informazioni contenute nella sezione "Valore di mercato", bensì solamente di nascondere quelle contenute nella sezione "Portafoglio FX".

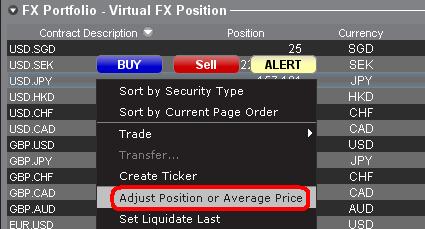

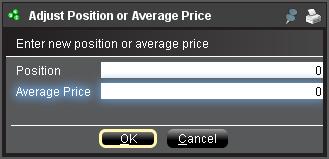

b. Modificare posizione o prezzo medio

Cliccando con il tasto destro su una delle posizioni nella sezione "Portafoglio FX" è possibile modificare la posizione o il prezzo medio. Una volta chiuse tutte le posizioni in valute diverse da quella di base e verificato che esse risultino chiuse anche nella sezione "Valore di mercato", è possibile reimpostare i campi "Posizione" e "Prezzo medio" su "0". Questa operazione ripristinerà tutti i valori relativi ai quantitativi delle posizioni in "Portafoglio FX" e consentirà di visualizzare informazioni più accurate su posizioni, profitti e perdite in tutte le schermate di trading. Nota: quello descritto è un processo manuale che deve essere ripetuto di volta in volta dopo aver chiuso una posizione in una certa valuta. È consigliabile verificare sempre le informazioni relative alle posizioni mostrate nella sezione "Valore di mercato" per assicurarsi che gli ordini trasmessi consentano di raggiungere gli obiettivi desiderati dal punto di vista dell'apertura o della chiusura delle posizioni.

Prima di eseguire delle operazioni vere e proprie tramite un conto di trading reale esortiamo i nostri clienti ad acquisire familiarità con la negoziazione di valute tramite un conto di trading simulato o approfittando della versione di prova gratuita. Non esiti a mettersi in contatto con noi per ricevere ulteriori informazioni sugli argomenti presentati in questo articolo.

Altre domande frequenti:

Order Rejection on the Tel Aviv Stock Exchange (TASE)

According to the TASE regulations each stock has a minimum order size for regular trading. The size is a stock specific calculation of a minimal monetary value at the beginning of each month. Where the value for a stock in the TA-35 index is 5000 NIS and anything outside of this is 2’000.

- Example

- Minimum Size Calculation Example:

- Bank Leumi share's closing price is 1000 NIS on the 1st of the Month

- Min Size is 5000/1000 = 5

- Order Placement

- Successful order: 5 LEUMI Shares

- Unsuccessful order: 4 LEUMI Shares

- Minimum Size Calculation Example:

|

|

Sunday

|

Mon - Thu

|

|

Pre-Opening start

|

9:00

|

|

|

Theoretical Price start

|

9:10

|

|

|

Opening Auction start

|

9:45-9:46

|

|

|

Continuous Trade Phase Start

|

9:45-9:46

|

|

|

Pre-closing & theoretical prices start

|

16:14 -16:15

|

17:14-17:15

|

|

Closing Auction & end of trade

|

16:24 -16:25

|

17:24-17:25

|

Intermarket Sweep

An intermarket sweep order is generally a large quantity limit order that is sent to multiple exchanges simultaneously. The trader submitting this type of order is required to fulfill Regulation NMS order protection obligations and exchange rules by simultaneously sending orders to market centers with better prices than the defined order limit.

Traders may see, on occasion, execution prices reported to time and sales that are at price levels through an order that they may have had working at the time. Some time and sales service providers reflect these prints with a special designation (intermarket sweep). The TWS software does not display these designations, therefore, it may appear as if a order was due an execution when it may not have been.

This article is being written in attempt to assist traders in understanding intermarket sweep transactions.

When an intermarket sweep order is being executed, only the inside quote (NBBO) at each available exchange is "protected". This means that orders resting on an exchange at prices that are inferior to the best bid or ask prices at the time of the intermarket sweep print are not considered to be "protected" and may be traded through.

Example:

- An order is submitted in the pre market to sell at a price of 40.80 and is sent to exchange A.

- The best offer price on exchagne A is 40.63.

- Exchange B receives an intermarket sweep order to buy 800 shares of the stock at a limit price of 40.88.

- The best offer price on exchange B is 40.88

The trader that enters the intermarket sweep order would be required to fulfill their Regulation NMS requirement by executing the maximum available quantity on exchange A at 40.63 and then may execute the balance of the order on exchange B at 40.88 even though it is at a price that is inferior to the 40.80 order resting in the book on exchagne A. The 40.80 price is not the inside quote and is therefore not "protected" in terms of the balance of the sweep order executing at exchange B at a price of 40.88.

A wealth of information is available on the web regarding intermarket sweep orders and SEC regulation NMS. The following are some links that may be useful in terms of providing additional information on these topics;

Each exchange has rules that define how intermarket sweep orders are handled. The following are reference links to the rulebooks of the primary exchanges where traders can find more informaiton on intermarket sweep order handling;

An Introduction to Forex (FX)

IB offers market venues and trading platforms which are directed towards both forex-centric traders as well as traders whose occasional forex activity originates from multi-currency stock and/or derivative transactions. The following article outlines the basics of forex order entry on the TWS platform and considerations relating to quoting conventions and position (post-trade) reporting.

A forex (FX) trade involves a simultaneous purchase of one currency and the sale of another, the combination of which is commonly referred to as a cross pair. In the examples below the EUR.USD cross pair will be considered whereby the the first currency in the pair (EUR) is known as the transaction currency that one wishes to buy or sell and the second currency (USD) the settlement currency.

Jump to a specific topic in this article;

- Forex Price Quotes

- Creating a quote line

- Creating an order

- Pip Value

- Position (Post-Trade) Reporting

Forex Price Quotes

A currency pair is the quotation of the relative value of a currency unit against the unit of another currency in the foreign exchange market. The currency that is used as reference is called quote currency, while the currency that is quoted in relation is called base currency. In TWS we offer one ticker symbol per each currency pair. You could use FXTrader to reverse the quoting. Traders buy or sell the base currency and sell or buy the quote currency. For ex. the EUR/USD currency pair’s ticker symbol is:

EUR.USD

where:

- EUR is the base currency

- USD is the quote currency

The price of the currency pair above represents how many units of USD (quote currency) are required to trade one unit of EUR (base currency). Said in other words, the price of 1 EUR quoted in USD.

A buy order on EUR.USD will buy EUR and sell an equivalent amount of USD, based on the trade price.

Creating a quote line

The steps for adding a currency quote line on the TWS are as follows:

1. Enter the transaction currency (example: EUR) and press enter.

2. Choose the product type forex

3. Select the settlement currency (example: USD) and choose the forex trading venue.

.jpg)

Notes:

The IDEALFX venue provides direct access to interbank forex quotes for orders that exceed the IDEALFX minimum quantity requirement (generally 25,000 USD). Orders directed to IDEALFX that do not meet the minimum size requirement will be automatically rerouted to a small order venue principally for forex conversions. Click HERE for information regarding IDEALFX minimum and maximum quantities.

Currency dealers quote the FX pairs in a specific direction. As a result, traders may have to adjust the currency symbol being entered in order to find the desired currency pair. For example, if the currency symbol CAD is used, traders will see that the settlement currency USD cannot be found in the contract selection window. This is because this pair is quoted as USD.CAD and can only be accessed by entering the underlying symbol as USD and then choosing Forex.

Creating an order

Depending on the headers that are shown, the currency pair will be displayed as follows;

The Contract and Description columns will display the pair in the format Transaction Currency.Settlement Currency (example: EUR.USD). The Underlying column will display only the Transaction Currency.

Click HERE for information regarding how to change the shown column headers.

1. To enter an order, left click on the bid (to sell) or the ask (to buy).

2. Specify the quantity of the trading currency you wish to buy or sell. The quantity of the order is expressed in base currency, that is the first currency of the pair in TWS.

Interactive Brokers does not know the concept of contracts that represent a fixed amount of base currency in Foreign exchange, rather your trade size is the required amount in base currency.

For example, an order to buy 100,000 EUR.USD will serve to buy 100,000 EUR and sell the equivalent number of USD based on the displayed exchange rate.

3. Specify the desired order type, exchange rate (price) and transmit the order.

Note: Orders may be placed in terms of any whole currency unit and there are no minimum contract or lot sizes to consider aside from the market venue minimums as specified above.

Common Question: How is an order entered using the FX Trader?

Pip Value

A pip is measure of change in a currency pair, which for most pairs represents the smallest change, although for others changes in fractional pips are allowed.

For ex. in EUR.USD 1 pip is 0.0001, while in USD.JPY 1 pip is 0.01.

To calculate 1 pip value in units of quote currency the following formula can be applied:

(notional amount) x (1 pip)

Examples:

- Ticker symbol = EUR.USD

- Amount = 100,000 EUR

- 1 pip = 0.0001

1 pip value = 100’000 x 0.0001= 10 USD

- Ticker symbol = USD.JPY

- Amount = 100’000 USD

- 1 pip = 0.01

1 pip value = 100’000 x (0.01)= JPY 1000

To calculate 1 pip value in units of base currency the following formula can be applied:

(notional amount) x (1 pip/exchange rate)

Examples:

- Ticker symbol = EUR.USD

- Amount = 100’000 EUR

- 1 pip = 0.0001

- Exchange rate = 1.3884

1 pip value = 100’000 x (0.0001/1.3884)= 7.20 EUR

- Ticker symbol = USD.JPY

- Amount = 100’000 USD

- 1 pip = 0.01

- Exchange rate = 101.63

1 pip value = 100’000 x (0.01/101.63)= 9.84 USD

Position (Post-Trade) Reporting

FX position information is an important aspect of trading with IB that should be understood prior to executing transactions in a live account. IB's trading software reflects FX positions in two different places both of which can be seen in the account window.

1. Market Value

The Market Value section of the Account Window reflects currency positions in real time stated in terms of each individual currency (not as a currency pair).

The Market Value section of the Account view is the only place that traders can see FX position information reflected in real time. Traders holding multiple currency positions are not required to close them using the same pair used to open the position. For example, a trader that bought EUR.USD (buying EUR and selling USD) and also bought USD.JPY (buying USD and selling JPY) may close the resulting position by trading EUR.JPY (selling EUR and buying JPY).

Notes:

The Market Value section is expandable/collapsible. Traders should check the symbol that appears just above the Net Liquidation Value Column to ensure that a green minus sign is shown. If there is a green plus symbol, some active positions may be concealed.

Traders can initiate closing transactions from the Market Value section by right clicking on the currency that they wish to close and choosing "close currency balance" or "close all non-base currency balances".

2. FX Portfolio

The FX Portfolio section of the account window provides an indication of Virtual Positions and displays position information in terms of currency pairs instead of individual currencies as the Market Value section does. This particular display format is intended to accommodate a convention which is common to institutional forex traders and can generally be disregarded by the retail or occasional forex trader. FX Portfolio position quantities do not reflect all FX activity, however, traders have the ability to modify the position quantities and average costs that appear in this section. The ability to manipulate position and average cost information without executing a transaction may be useful for traders involved in currency trading in addition to trading non-base currency products. This will allow traders to manually segregate automated conversions (which occur automatically when trading non base currency products) from outright FX trading activity.

The FX portfolio section drives the FX position & profit and loss information displayed on all other trading windows. This has a tendency to cause some confusion with respect to determining actual, real time position information. In order to reduce or eliminate this confusion, traders may do one of the following;

a. Collapse the FX Portfolio section

By clicking the arrow to the left of the word FX Portfolio, traders can collapse the FX Portfolio section. Collapsing this section will eliminate the Virtual Position information from being displayed on all of the trading pages. (Note: this will not cause the Market Value information to be displayed it will only prevent FX Portfolio information from being shown.)

b. Adjust Position or Average Price

By right clicking in the FX portfolio section of the account window, traders have the option to Adjust Position or Average Price. Once traders have closed all non base currency positions and confirmed that the market value section reflects all non base currency positions as closed, traders can reset the Position and Average Price fields to 0. This will reset the position quantity reflected in the FX portfolio section and should allow traders to see a more accurate position and profit and loss information on the trading screens. (Note: this is a manual process and would have to be done each time currency positions are closed out. Traders should always confirm position information in the Market Value section to ensure that transmitted orders are achieving the desired result of opening or closing a position.

We encourage traders to become familiar with FX trading in a paper trade or DEMO account prior to executing transactions in their live account. Please feel free to Contact IB for additional clarification on the above information.

Other common questions:

Equity & Index Option Position Limits

Equity option exchanges define position limits for designated equity options classes. These limits define position quantity limitations in terms of the equivalent number of underlying shares (described below) which cannot be exceeded at any time on either the bullish or bearish side of the market. Account positions in excess of defined position limits may be subject to trade restriction or liquidation at any time without prior notification.

Position limits are defined on regulatory websites and may change periodically. Some contracts also have near-term limit requirements (near-term position limits are applied to the side of the market for those contracts that are in the closest expiring month issued). Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. The following information defines how position limits are calculated;

Option position limits are determined as follows:

- Bullish market direction -- long call & short put positions are aggregated and quantified in terms of equivalent shares of stock.

- Bearish market direction -- long put & short call positions are aggregated and quantified in terms of equivalent shares of stock.

The following examples, using the 25,000 option contract limit, illustrate the operation of position limits:

- Customer A, who is long 25,000 XYZ calls, may at the same time be short 25,000 XYZ calls, since long and short positions in the same class of options (i.e., in calls only or in puts only) are on opposite sides of the market and are not aggregated

- Customer B, who is long 25,000 XYZ calls, may at the same time be long 25,000 XYZ puts. Rule 4.11 does not require the aggregation of long call and long put (or short call and short put) positions, since they are on opposite sides of the market.

- Customer C, who is long 20,000 XYZ calls, may not at the same time be short more than 5,000 XYZ puts, since the 25,000 contract limit applies to the aggregate position of long calls and short puts in options covering the same underlying security. Similarly, if Customer C is also short 20,000 XYZ calls, he may not at the same time have a long position of more than 5,000 XYZ puts, since the 25,000 contract limit applies separately to the aggregation of short call and long put positions in options covering the same underlying security.

Notifications and restrictions:

IB will send notifications to customers regarding the option position limits at the following times:

- When a client exceeds 85% of the allowed limit IB will send a notification indicating this threshold has been exceeded

- When a client exceeds 95% of the allowed limit IB will place the account in closing only. This state will be maintained until the account falls below 85% of the allowed limit. New orders placed that would increase the position will be rejected.

Notes:

Position limits are set on the long and short side of the market separately (and not netted out).

Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side (index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge).

Position information is aggregated across related accounts and accounts under common control.

Definition of related accounts:

IB considers related accounts to be any account in which an individual may be viewed as having influence over trading decisions. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account (and accounts under common control), joint accounts with individual accounts for the joint parties and organization accounts (where an individual is listed as an officer or trader) with other accounts for that individual.

Position limit exceptions:

Regulations permit clients to exceed a position limit if the positions under common control are hedged positions as specified by the relevant exchange. In general the hedges permitted by the US regulators that are recognized in the IB system include outright stock position hedges, conversions, reverse conversions and box spreads. Currently collar and reverse collar strategies are not supported hedges in the IB system. For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product.

OCC posts position limits defined by the option exchanges. They can be found here.

http://www.optionsclearing.com/webapps/position-limits

Rule 611 of SEC Regulation NMS

Executions in equities will sometimes be listed as R6, which is short for Rule 611 of SEC Regulation NMS. This condition code indicates that the execution(s) in question is not subject to trade-through rules. R6 trades are given an SEC exemption.

Rule 611, which is the Trade Through Exemption of SEC Regulation NMS, is very lengthy to cover in detail. Parties interested in reading the rule in its entirely should type "SEC Rule 611" into an internet search engine. This is the portion of the document that is pertinent to IB traders, in a nutshell:

Typically the trades involved are a multi-component trade involving orders for a security and a related derivative, or, in the alternative, orders for related securities, that are executed at or near the same time. The SIA (Securities Industry Association) notes that the economics of a contingent trade are based on the relationship between the prices of the security and the related derivative or security, and that the execution of one order is contingent upon the execution of the other order.

The bottom line is that when a trade is ruled R6 the SEC has granted a trade-through exemption. This means that these execution reports do not affect the resting orders in-between the market at the time, and the R6 execution. For example, the real market is quoting 10.50 at 10.51, and an execution is reported at 10.90. This execution was given an R6 exemption. A sell limit order at 10.75, an an example, would not be executed because the 10.90 execution was given an R6 status.

What is an "Odd Lot" in stocks?

Simply stated, an "Odd Lot" is a stock order comprised of less than 100 shares of stock. So any stock order from 1 share to 99 shares is considered to be an odd lot.

This is the pertinent information traders should know about odd lot orders:

- An odd lot is a number of shares less than 100 (1-99)

- A "Round Lot" is 100 shares of stock

- Any number of shares that is a multiple of 100 is a round lot (i.e. 100, 600, 1,600, etc)

- An order for a number of shares greater than 100, but not a multiple of 100 (i.e. 142, 373, 1,948, etc) is a "Mixed Lot" (AKA PRL, or partial round lot, order)

- Odd-Lot orders are not posted to the bid/ask data on exchanges

- Odd-Lot orders are taken into the order book at the exchange they are routed to. When the exchange is able to match an order from the other side of the book with the odd-lot, it will be filled. This could lead to delay on execution of an odd-lot.

- There are numerous guidelines for the routing of odd-lot orders: Odd-Lot orders to initiate positions will not be routed to primary exchanges; Odd-Lot orders can be routed to primary exchanges, but only if the order in question is to close out a preexisting position; IB will not direct-route odd-lot orders which initiate positions to primary exchanges, therefore these type of orders should be Smart Routed so that IB's routing system can send the order to an ECN for execution. The exception is that odd lots can be routed to NYSE/ARCA/AMEX, but only as part of a basket order or as a market-on-close (MOC) order.

- A mixed lot or PRL (i.e. 257 shares) direct-routed to NYSE/AMEX will be submitted in whole to the exchange (applies to both market and limit orders). If the order is direct-routed to NYSE/ARCA, only the round lot portion of the order will be submitted and, if it is executed, the IB system will cancel the remaining odd-lot portion of the order. If the order is routed via IB Smart Routing, all market centers are eligible to receive the order according to the Smart Routing logic (including NYSE/ARCA, but only for the round lot portion of the order).

- IB will not route odd-lot orders for HOLDRS. The odd-lot portion of a PRL order for HOLDRS will be rejected by the IB system after the round lot portion of the order is executed.

- Individual exchanges may impose certain restrictions on odd lot orders, in addition to any of the restrictions mentioned above

Combo orders with stock and option legs.

Combo orders which involve a stock and an option leg are accepted natively only at ISE. So if you would like to create a covered call position, and wish to buy the stock and sell the option simultaneously, ISE is the exchange to which these orders will be sent if, in fact, the specific options trade at the ISE.

In the event that the option in question does not trade at ISE, the order can't be sent to that exchange. These orders will stay on IB's system until the point at which the possibility exists that both legs may be executed simultaneously.

For example, if you are long XYZ stock and short an XYZ call against it, you might choose to close this position using a combo order. This order will be sent to ISE since it has a stock and option component. However, if XYZ options don't trade at ISE, they can't accept the order. In this case the order will stay on IB's server until the system reads that the XYZ stock can be sold and the XYZ option bought, at which point the system will send the orders simultaneously to the respective exchanges. Please note that although it is possible that both orders will be executed simultaneously at the combo price, there is no guarantee of fill simply because the displayed quotes from each exchange indicate the combo price is available.

How can I remove a canceled order that is stuck on my screen in pink status?

The pink status indicates that you have sent a request to cancel the order, but have not yet received cancel confirmation from the order destination. At this point your order is not confirmed canceled. You may still receive an execution while your cancellation request is pending.

The most frequent cause of this issue is sending a cancel request to an exchange that is not currently open. For example, you have an open limit order that is at the NYSE. You send a cancel on that order at 16:05 EST, when the NYSE is closed. Their computers do not electronically respond, therefore IB can't confirm the cancel or clear the order. This example holds true for nearly all exchanges.

Another cause is an order being "stuck" electronically on your TWS system. In these cases traders will have to wait for the system to go through its "daily reset" for the order to disappear from the trading application.

*If you have an order in this status on your screen, you should contact IB immediately. If we are able to see the order in our system (and for orders that have been requested canceled by the account holder, but not acknowledged by the exchange, IB can usually see the orders in our system) we can attempt to call the exchange and request a confirmation of cancellation. Unfortunately in many cases, most notably with the NYSE, the exchanges will not answer their phones after they are officially closed for trading. If the exchange can't be contacted, the order will remain in this status until their computers send the cancel confirmation. As stated above: At this point your order is not confirmed canceled. You may still receive an execution while your cancellation request is pending.