Внебиржевые фьючерсы IBKR на металлы LME – Факты и частые вопросы

Введение

OTC-фьючерсы LME IBKR обеспечивают клиентов синтетическим доступом к Лондонской бирже металлов (англ. London Metal Exchange или LME), поддерживающей социальную ссуду и, как правило, закрытой для инвесторов, не являющихся ее членами.

Фьючерсы LME на металлы являются внебиржевыми (OTC) производными контрактами, контрагентом для которых выступает IBUK. OTC-фьючерсы LME сопоставляются с котируемыми на LME сопряженными фьючерсами в плане цены, размера лота, типа и характеристик, но при этом не являются зарегистрированными контрактами. Физическая доставка по ним не поддерживается.

Торговля OTC-фьючерсами LME IBKR происходит с Вашего маржевого счета, а поэтому Вы можете устанавливать длинные и короткие позиции с кредитными плечом. Ставки маржи соразмерны установленным LME. Как и у других фьючерсов они основываются на рисках (метод SPAN), а поэтому могут варьироваться. Текущая маржа находится в диапазоне 6-9% в зависимости от контракта.

Контракты

IBKR предлагает внебиржевые фьючерсы на следующие металлы с истечением в третью среду:

| Металл | Символ IB | Цена USD/ | Множитель |

| Высококачественный первичный алюминий | AH | Метрическая тонна | 25 |

| Первоклассная медь | CA | Метрическая тонна | 25 |

| Первичный никель | NI | Метрическая тонна | 6 |

| Стандартный свинец | PB | Метрическая тонна | 25 |

| Олово | SNLME | Метрическая тонна | 5 |

| Высококачественный цинк | ZSLME | Метрическая тонна | 25 |

Истечение в третью среду

LME поддерживает целый ряд контрактов, отвечающих нуждам физических трейдеров и субъектов хеджирования. Их принцип заключается в трехмесячных форвардах, используемых физическими тредейрами для точного сопоставления сделок хеджирования с их потребностями.

Контракты "третьей среды" являются месячными, как и фьючерсы, и поэтому лучше подходят финансовым трейдерам. Как следует из названия, эти контракты истекают в третью среду каждого календарного месяца, и, хоть они и рассчитываются на LME физически, IBKR осуществляет исключительно денежный расчет. Популярность контрактов "третьей среды" продолжает расти - они составляют 65% открытого интереса на LME.

Котировки и рыночные данные

IBKR получает котировки от LME (рыночные данные 2-го уровня) и не расширяет их. Каждый клиентский ордер сначала хеджируется на бирже, и OTC-ордер LME исполняется по цене сделки хеджирования.

Движение денежных средств

Суточная вариационная маржа и реализованная ПиУ по OTC-фьючерсам LME IBKR рассчитывается ежедневно как у стандартного фьючерса. В то же время движение денежных средств по андерлаингу на LME рассчитывается только по истечении контракта.

Маржа

Маржинальные требования OTC-фьючерсов LME IBKR равны требованиям базового контракта на бирже LME. LME применяет стандартный анализ риска портфеля (англ. Standard Portfolio Analysis или SPAN) для расчета маржи.

Как и для других фьючерсов, ставки маржи устанавливаются в виде абсолютной величины за контракт и обновляются ежемесячно.

Торговые разрешения

Вам потребуется активировать разрешение на торговлю металлами Великобритании в "Управлении счетом".

Рыночные данные

Вам потребуется подписка на London Metal Exchange 2-го уровня, цена которой сейчас составляет GBP 1.00.

Материалы по LME OTC

Списки продуктов и ссылки на детали контрактов

Комиссии

Маржинальные требования

Часто задаваемые вопросы

Что мне нужно, чтобы начать торговать фьючерсами LME OTC?

Вам требуется активировать разрешение на торговлю металлами Великобритании в "Управлении счетом". Если Ваш счет находится в IB LLC или в IB UK (и обслуживается IB LLC), то мы создадим новый сегмент счета (с тем же номером и дополнительной приставкой “F”). Получив подтверждение, Вы сможете начать торговлю. F-счет не нужно финансировать отдельно - средства для соответствия маржинальным требованиям будут автоматически переводиться с основного сегмента.

Как мои сделки и позиции по фьючерсам LME OTC отражаются в выписках?

Позиции находятся на обособленном сегменте, отличающемся от номера Вашего основного счета приставкой “F”.. Наша система поддерживает как раздельные, так и совмещенные выписки. Вы можете изменить настройки в соответствующем разделе "Управления счетом".

Какие меры по защите счета распространяются на торговлю фьючерсами LME OTC?

Фьючерсы LME OTC - это контракты, контрагентом которых является IB UK. Торговля ими не ведется на регулируемой бирже, а клиринг не производится в центральной клиринговой палате. Имея IB UK в качестве второй стороны Ваших сделок, Вы подвергаетесь финансовым и деловым рискам, включая кредитный риск, характерный торговле через IB UK. Стоит помнить, что средства клиентов, в том числе и институциональных, всегда полностью сегрегируются. Компания IB UK участвует в Программе Великобритании по компенсации в сфере финансовых услуг ("FSCS"), а также не является участницей Корпорации защиты фондовых инвесторов (“SIPC”).

Можно ли торговать фьючерсами LME OTC по телефону?

Нет. В исключительных случаях мы можем согласиться обработать ордер на закрытие по телефону, но ни в коем случае не открытие.

IBKR OTC Futures on LME Metals – Facts and Q&A

Introduction

IBKR LME OTC Futures provide clients synthetic access to the London Metal Exchange, a peer to peer exchange not generally available to non-member investors.

The LME OTC Futures are OTC derivative contracts with IBUK as the counterparty. The LME OTC Futures reference the corresponding LME future in terms of price, lot size, type and specification but are themselves not registered contracts. Physical delivery is not permitted.

IBKR LME OTC Futures are traded through your margin account, and you can therefore enter long as well as short leveraged positions. Margin rates equal those established by the LME. Like other futures they are risk-based (SPAN), and therefore variable. Current margins range between 6 and 9% depending on the contract.

Contracts

IBKR offers OTC Futures on the 3rd Wednesday expirations for the following metals:

| Metal | IBKR Symbol | Price USD/ | Multiplier |

| High Grade Primary Aluminium | AH | Metric Ton | 25 |

| Copper Grade A | CA | Metric Ton | 25 |

| Primary Nickel | NI | Metric Ton | 6 |

| Standard Lead | PB | Metric Ton | 25 |

| Tin | SNLME | Metric Ton | 5 |

| Special High Grade Zinc | ZSLME | Metric Ton | 25 |

3rd Wednesday Expirations

The LME features a range of contracts adapted to the needs of physical traders and hedgers. The principal among them are daily 3-month forwards used by physical traders to precisely match their hedges to their needs.

The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the needs of financial traders. As the name suggests, they expire on the 3rd Wednesday of each month and, although physically settled on the LME, are strictly cash-settled at IBKR. The 3rd Wednesday contracts have become increasingly popular and account for 65% of open interest on the LME.

Quotes and Market Data

IBKR streams quotes from the LME (L2 market data) and does not widen the quote. Every client order is first hedged on exchange and the LME OTC order filled at the price of the hedge.

Cash Flows

Daily variation margin and realized P&L for the IBKR LME OTC Futures are cash-settled daily, like a standard future. By contrast, cash flows for the underlying LME contract are only settled after the contract has expired.

Margins

The margin requirements for the IBKR LME OTC Futures equal the requirement for the underlying contract on the LME. LME uses Standard Portfolio Analysis of Risk (SPAN) to calculate Initial Margin.

Like for other futures, the margin rates are established as an absolute value per contract and usually updated monthly.

Trading Permissions

You will need to set up permissions for United Kingdom Metals in Client Portal.

Market Data

You will need a subscription for Level II London Metal Exchange, currently GBP 1.00.

LME OTC Resources

Product Listings & Links to Contract Details

Commissions

Margin Requirements

Frequently asked Questions

What do I need to do to start trading LME OTC Futures?

You need to set up trading permission for United Kingdom Metals in Client Portal. If you have an IB LLC or an IB UK account carried by IB LLC we will set up a new account segment (identified with your existing account number plus the suffix “F”). Once the set-up is confirmed you can begin to trade. You do not need to fund the F segment separately; funds will be automatically transferred from your main account to meet margin requirements.

How are my LME OTC Futures trades and positions reflected in my statements?

Your positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Client Portal.

What account protections apply when trading LME OTC Futures?

LME OTC Futures are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Since IB UK is the counterparty to your trades, you are exposed to the financial and business risks, including credit risk, associated with dealing with IB UK. Please note however that all client funds are always fully segregated, including for institutional clients. IB UK is a participant in the UK Financial Services Compensation Scheme ("FSCS"). IB UK is not a member of the U.S. Securities Investor Protection Corporation (“SIPC”).

Can I trade LME OTC Futures over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

MIFID II Commodity Position Limits

Background

On 3 January 2018, a new Directive 2014/65/EC (“MiFID II”) and Regulation (EU) No 600/2014 (“MiFIR”) will become effective, introducing new requirements on position limits and position reporting for commodity derivatives and emission allowances.

National Competent Authorities (“NCAs”) (i.e. regulators) of each European Economic Area (“EEA”) Country will calculate the limits on the size of the net position that a person can hold in commodity derivatives traded on an EU venue or its “economically equivalent contracts” (“EEOTC”).

The European Securities and Markets Authority (“ESMA”) intends to publish approved position limits on its website.

Limits will be set for the spot month and all other months, for both physically settled and cash settled commodities.

Investment firms trading in commodity derivatives and emissions allowances are obliged, on a daily basis, to report

their own positions in commodity derivatives traded on a trading venue and EEOTC contracts, as well as those of

their clients and the clients of those clients until the end client is reached, to the NCA.

Clients holding positions have to be identified using specified National Identifiers for individuals and LEIs for

organisations under MiFID II.

Interactive Brokers’ Implementation of the Requirements

In order to comply with its reporting obligations, IB will not allow its clients to trade if they have not provided the

specific National Identifier or LEI that is necessary for reporting positions of in scope financial products.

Whenever possible, IB will act to prevent account holders from entering transactions that may result in a position

limit violation. This process will include monitoring account activity, sending a series of notifications intended to

allow the account holder to self-manage exposure and placing trading restrictions on accounts approaching a limit.

Examples of notifications which are sent via email, TWS bulletin and Message Center are as follows:

- Information Level: sent when the position exceeds 50% of the limit. Intended to inform as to the existence of the position limit and its level.

- Warning Level: sent when the position exceeds 70% of the limit. Intended to provide advance warning that account will be subject to trading restrictions should exposure increase to 90%.

- Restriction Level: sent when the position exceeds 90% of the limit. Provides notice that account is restricted to closing transactions until exposure has been reduced to 85%.

Торговля фьючерсами на криптовалюту через IBKR

Какой торговый символ?

CME (фьючерсы на Bitcoin): для загрузки фьючерсов введите базовый символ BRR.

CME (фьючерсы на Ether): для загрузки фьючерсов введите базовый символ ETHUSDRR.

ICE (фьючерсы на Bitcoin Bakkt®): для загрузки фьючерсов введите базовый символ BAKKT.

Торговая сессия

CME: Вс–Пт 17:00–16:00 по чикагскому времени

ICE: Вс–Пт 19:00–17:00 по чикагскому времени

Обращаем внимание, что если Вы хотите торговать или активировать ордер за пределами стандартной биржевой сессии, то Вам следует установить соответствующие настройки. Это можно сделать следующим образом:

- В предустановках фьючерсных ордеров. В классическом TWS выберите "Правка", а затем "Глобальная конфигурация". В Mosaic нажмите "Файл" и "Глобальная конфигурация". Разверните "Предустановки" слева и выберите "Фьючерсы". Сначала в разделе "Временные рамки" отметьте поле "Разрешить активацию, срабатывание по триггеру или выполнение ордера за пределами биржевой сессии" галочкой. Затем нажмите "Применить" и "ОК".

- В строке ордера. В TWS (классической раскладке и Mosaic) щелкните по полю "Время действия" и поставьте галочку в поле "Срабатывание триггера вне биржевой сессии" внизу. В WebTrader отметьте пункт "Выполнять за пределами биржевой сессии" в конце строки ордера.

- В тикете ордера. В разделе "Время действия" поставьте галочку в пункте "Разрешить исполнение этого ордера за пределами биржевой сессии".

Узнать подробнее о торговле фьючерсами вне стандартной биржевой сессии можно по ссылке ниже:

https://www.interactivebrokers.com/ru/index.php?f=29319

Где можно найти информацию о характеристиках контрактов?

CME (фьючерсы на Bitcoin): http://www.cmegroup.com/trading/bitcoin-futures.html?itm_source=cmegroup&itm_medium=flyout&itm_campaign=bitcoin&itm_content=tech_flyout

CME (фьючерсы на Ether): https://www.cmegroup.com/trading/ether-futures.html

ICE (фьючерсы на Bitcoin Bakkt®): https://www.theice.com/products/72035464/Bakkt-Bitcoin-USD-Monthly-Futures-Contact

Есть ли какие-то ограничения?

Торговля фьючерсами на криптовалюту не доступна для пенсионных счетов (например, IRA, SIPP) и резидентов Японии.

Каковы маржинальные требования?

Маржинальное требование полностью длинных позиций будет составлять 50% от расчетной цены ведущего месяца за прошлый день. Для полностью коротких позиций ставка маржи составит 100% от дневной расчетной цены.

Маржа спреда: чистая разница между минимальными маржинальными требованиями клиента по каждому длинному и короткому контракту (используя 50% как для длинной, так и для короткой составляющей) плюс плата за спред, которая равна 25% от наибольшей дневной расчетной цены среди всех фьючерсных контрактов XBT, доступных для торговли.

Напоминаем, что IBKR не рассылает клиентам запросы для пополнения маржи и может в любой момент менять требования на свое усмотрение.

Актуальные маржинальные требования для всех продуктов доступны в следующем разделе сайта IBKR: https://www.interactivebrokers.com/en/index.php?f=24176

Какая комиссия?

Ставка комиссии для криптовалютных фьючерсов для продуктов на CME и ICE составит 10 USD за контракт. Также на клиентов возлагаются все биржевые, регуляторные и клиринговые сборы.

Дополнительная информация о комиссиях, а также биржевых, регуляторных и клиринговых сборах доступна на нашем сайте на странице "Комиссии":

https://www.interactivebrokers.com/ru/index.php?f=commission&p=futures1

Какие торговые разрешения требуются?

Для операций с криптовалютными фьючерсами необходимо разрешение на торговлю фьючерсами на криптовалюту США. Чтобы запросить торговое разрешение, зайдите на "Портал клиентов" и откройте меню пользователя (значок силуэта в правом верхнем углу) и выберите "Настройки счета". Нажмите на значок шестеренки в правом верхнем углу раздела "Торговый опыт и разрешения". Перейдите в раздел "Фьючерсы" и выберите "Соединенные Штаты (Crypto)".

Какие подписки на рыночные данные доступны?

Котировки в реальном времени по криптовалютным фьючерсам доступны на платной основе на "Портале клиентов". Предлагаются следующие подписки (размер платы за месяц публикуется на сайте IBKR):

CME (биржа = CME, биржа IB = CME)

Непрофессиональные данные

- Уровень 1: данные CME в реальном времени [CME Real-Time] (неПРО, Ур.1)

- Уровень 1: фьючерсы и сводки по ценным бумагам США [US Securities Snapshot and Futures Value Bundle] (неПРО, Ур.1)

- Уровень 2: данные CME II уровня в реальном времени для непрофессионалов [CME Real-Time Non-Professional Level 2]

- Уровень 2: пакет данных для США ПЛЮС [US Value Bundle PLUS] (неПРО, Ур.2).

- Требует подписки на US Securities Snapshot and Futures Value Bundle

- Только для углубленных данных

Профессиональные данные

- Уровень 2: данные CME II уровня в реальном времени для профессионалов [CME Real-Time Professional Level 2] (пакет данных CME I уровня для профессионалов не предлагается).

ICE (биржа = ICE, биржа IB = ICECRYPTO)

- Уровень 2: ICE фьючерсы США – фьючерсы цифровых активов (Ур.2) [ICE Futures US - Digital Asset Futures Level 2] (данные I уровня не предоставляются).

Вернуться к оглавлению: Bitcoin и другие криптовалютные продукты в IBKR

Trading Cryptocurrency Futures with IBKR

What is the trading symbol?

CME (Bitcoin Futures): Enter the underlying symbol BRR in order to bring up the futures

CME (Ether Futures): Enter the underlying symbol ETHUSDRR to bring up the futures

ICE (Bakkt® Bitcoin Futures): Enter the underlying symbol BAKKT to bring up the futures

What are the trading hours?

CME: 17:00 – 16:00 Chicago Time, Sunday – Friday

ICE: 19:00-17:00 Chicago Time, Sunday – Friday

Please note, if you wish to trade outside of regular trading hours or have your order triggered outside of regular trading hours you must configure your order accordingly. You can do so using the following steps:

- Through Futures Order Presets. In Classic TWS, click Edit followed by Global Configuration. In Mosaic, click File followed by Global Configuration. Expand the Presets section on the left side and select Futures. The first section will be Timing, and you will want to check the box that says "Allow order to be activated, triggered, or filled outside of regular trading hours (if available)". Click Apply and OK once finished.

- Through the order line. In both Classic TWS as well as Mosaic, click on the Time in Force field and check the box at the bottom that says "Trigger outside RTH". In WebTrader, check the box at the end of the order line that says "Fill Outside RTH".

- Through the Order Ticket. In the Time in Force section, check the box that says "Allow this order to be filled outside of regular trading hours".

Please see the following link for more information on trading futures outside of regular trading hours:

https://www.interactivebrokers.com/en/index.php?f=719

Where can I find information about the contract specifications?

CME (Bitcoin Futures): http://www.cmegroup.com/trading/bitcoin-futures.html?itm_source=cmegroup&itm_medium=flyout&itm_campaign=bitcoin&itm_content=tech_flyout

CME (Ether Futures): https://www.cmegroup.com/trading/ether-futures.html

ICE (Bakkt® Bitcoin Futures): https://www.theice.com/products/72035464/Bakkt-Bitcoin-USD-Monthly-Futures-Contact

Will there be any restrictions on trading?

Trading will not be offered in retirement accounts (e.g., IRA, SIPP) or for residents of Japan.

What is the Margin Requirement?

The margin requirement for outright long positions will be set at 50% of the prior day's lead month settlement price. In the case of outright short positions, the margin rate will be 100% of the daily settlement price.

Spread Margin: The net difference between the outright customer maintenance margin requirements on each long and short contracts (using 50% for both the long and the short leg) plus, for each spread, a spread charge equal to 25% of the daily settlement price that is the greatest among all XBT futures contracts available for trading.

Clients are reminded that IBKR does not issue margin calls and may modify margin requirements at any time, at IBKR's sole discretion.

Please refer to the following section of the IBKR website for current margin requirements for all products: https://www.interactivebrokers.com/en/index.php?f=24176

What are the commissions?

The commission rate for Crypocurrency futures will be USD 10 per contract for the CME and ICE products. IBKR will pass through exchange, regulatory and clearing fees.

For more information on commission as well as exchange, regulatory and clearing fees, please visit the Commission page of our website:

https://www.interactivebrokers.com/en/index.php?f=commission&p=futures1

What trading permissions are required?

To trade Crypocurrency futures, you must have trading permissions for US Crypto Futures. You can request US Crypto Futures trading permission in Client Portal by clicking the User menu (head and shoulders icon in the top right corner) followed by Manage Account. Click the gear icon in the top right corner of the Trading Experience & Permissions section. Go to the "Futures" section and check off "United States (Crypto)".

What are the market data subscription options?

Live quotes for Crypocurrency futures are available on a paid subscription basis through Client Portal. The following subscriptions are offered (monthly subscription fees are posted to the IBKR website):

CME (Exchange = CME. IB Exchange = CME)

Non-Professional

- Level 1: CME Real-Time Non-Professional Level 1

- Level 1: US Securities Snapshot and Futures Value Bundle (NP,L1)

- Level 2: CME Real-Time Non-Professional Level 2

- Level 2: US Value Bundle PLUS (NP,L2)

- Requires US Securities Snapshot and Futures Value Bundle

- This is only for depth of book

Professional

- Level 2: CME Real-Time Professional Level 2 (There is no CME Pro level 1 product)

ICE (Exchange = ICE, IB Exchange = ICECRYPTO)

- Level 2: ICE Futures US - Digital Asset Futures Level 2 (There is no level 1 available for either professional or professional)

Back to Table of Contents: Bitcoin and Other Cryptocurrency Products @ IBKR

Risks of Volatility Products

Trading and investing in volatility-related Exchange-Traded Products (ETPs) is not appropriate for all investors and presents different risks than other types of products. Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities (such as futures and swaps) and risks associated with the effects of leveraged investing in geared funds. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. We have summarized several risk factors (as identified in prospectuses for ETPs and in other sources) and included links so you can conduct further research. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. By providing this information, Interactive Brokers (IB) is not offering investment or trading advice regarding ETPs to any customer. Customers (and/or their independent financial advisors) must decide for themselves whether ETPs are an appropriate investment for their portfolios.

Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

"EMIR": Reporting to Trade Repository Obligations and Interactive Brokers Delegated Service to help meet your obligations

Determining Tick Value

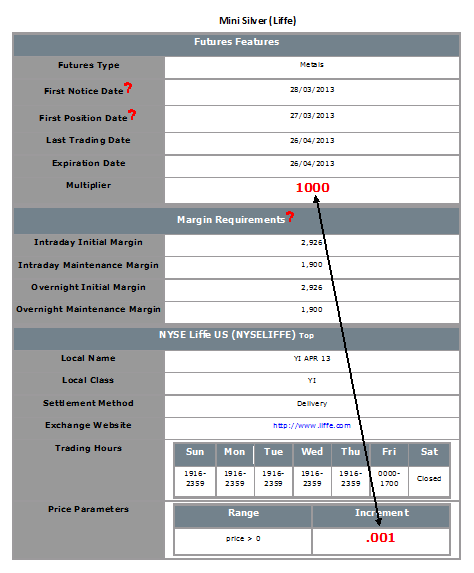

Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Tick values vary by instrument and are determined by the listing exchange. IB provides this information directly from the Contract Search tool on the website or via the Trader Workstation (TWS). To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. The contract specifications window for the instrument will then be displayed (Exhibit 1).

To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. As illustrated in the example below, the LIFFE Mini Silver futures contact has a tick value or minimum increment of .001 which, when multiplied by the contract multiplier of 1,000 ounces, results in a minimum tick value of $1.00 per contract. Accordingly, every tick change up or down results in a profit or loss of $1.00 per LIFFE Mini Silver futures contract.

Exhibit 1