Special risk relating to offsets between options and futures

Account holders hedging or offsetting the risk of futures contracts with option contracts are encouraged to pay particular attention to a potential scenario whereby a change in the underlying price may subject the account to a forced liquidation even if the account remains in margin compliance. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. options contracts coupled with IB's requirement that the commodity segment of one's account maintain a positive cash balance at all times.

Gains and losses in a futures contract, by design, are settled in cash and IB updates the account holder's cash balance through the TWS on a real-time basis for any changes in the futures contract price. An option contract is also marked-to-the-market on a real-time basis but this change in value represents an unrealized (i.e., non-cash) profit or loss with the actual cash proceeds not reflected in the account until such time the contract is either sold, exercised or expires.

To illustrate this scenario, assume, for example, at time 'X' a hypothetical portfolio consisting of a credit cash balance of $6,850, 2 short Sep ES futures contracts, 2 Long Sep ES $1,000 strike call options on the futures contract marked at $31.50 each, with the cash index at $1,006. Also assume that at time 'X+1' the cash index increases by 100 points or approximately 10%. A snapshot of the account equity and margin balances for each date is reflected in the table below.

| Portfolio | Time 'X' | Time 'X+1' | Change |

| Cash | $6,850 | ($3,150) | ($10,000) |

| 2 Long Sep ES $1,000 Calls* | $3,150 | $10,300 | $7,150 |

| 2 Short Sep ES Futures* | - | - | - |

| Total Equity | $10,000 | $7,150 | ($2,850) |

| Margin Requirement | $2,712 | $666 | ($2,046) |

| Margin Excess | $7,288 | $6,484 | ($804) |

*Note: the contract multiplier for the ES future and option is 50.

As reflected in the table above, the projected effect of this market move would be to decrease the cash balance to a deficit level based upon the mark-to-market or variation on the futures contracts of $10,000 (100 * 50 * 2). While the effect of this upon equity would be largely offset by a $7,150 increase in the market value of the long calls, the unrealized gain on the options has no effect upon cash until such time they are either sold, exercised or expire. In this instance, IB would act to liquidate positions in an amount sufficient to eliminate the cash deficit while maintaining margin compliance and attempting to preserve the greatest level of account equity.

While hypothetical in nature, this sample portfolio is intended to be illustrative of the liquidity risk associated with any portfolio containing futures and long options where the funding of any variation on the futures position must be supported by available cash or buying power from the securities segment of the account and not unrealized option gains.

Mutual Offset System

A special arrangement between CME Group and the Singapore Exchange (SGX), referred to as the Mutual Offset System (MOS), allows traders of both the Yen and USD denominated Nikkei 225 futures to take positions in the products at one exchange and offset them at the other one. The effect of this arrangement is to create one marketplace crossing different time zones as well as fungibility of contracts between the exchanges.

IBKR account holders may avail themselves of the MOS functionality by specifying at the point of trade entry both the proper underlying symbol and exchange. In the case of the Yen Denominated Nikkei 225 Index contract the IB underlying symbol is 'NIY' and the exchange either 'CME' (for contracts listed at and trading during CME hours) or 'SGXCME' (for contracts listed at and trading during SGX hours). In the case of the USD Denominated Nikkei 225 Index contract the IB underlying symbol is 'NKD' and the exchange either 'CME' (for contracts listed at the CME) or 'SGXCME' (for contracts listed at the SGX).

To illustrate the concept of fungibility, were an account holder to enter into a long futures position on the CME exchange and thereafter enter into a short futures position having the same underlying symbol and expiration date but listed on the SGXCME exchange, the effect would be the same as if that short position was executed on the CME exchange and that is to close the long position.

MOS also provides margin offset for positions entered into on either of the two exchanges in the manner noted above. Here, for example, a long futures position entered into from the CME exchange would be afforded spread margin treatment against a short position having the same underlying but a different expiration month which was entered into from the the SGXCME exchange. This effect is intended to be similar to that which would take place if both the long and short position were entered into from the same exchange.

IMPORTANT NOTE

IBKR also offers trading in the identical SGX-listed futures contracts but without the MOS features of fungibility and margin offset as outlined above. In the case of the Yen Denominated Nikkei 225 Index, the contract having the underlying symbol 'SGXNK' and exchange of SGX is the functional equivalent of the 'NIY' contract having the exchange of SGXCME. Similarly, in the case of the USD Denominated Nikkei 225 Index, the contract having the underlying symbol 'N225U' and exchange of SGX is the functional equivalent of the 'NKD' contract having the exchange of SGXCME. It should be noted, however, that a long (short) position of a given expiration entered into on SGX exchange will not close out a short (long) position entered into on the SGXCME, or the CME for that matter. In addition, there is no margin offset provided between SGX-listed and SGXCME or CME contracts.

A table of trading hours for the MOS eligible products is provided below:

| Symbol | Description | Exchange | Trading Hours (ET)* |

| NIY | Yen Denominated Nikkei 225 Index | CME |

Mon-Fri 16:30 - 16:15 the next day (closing at 15:15 Friday); Daily maintenance shutdown 17:30 - 18:00 |

| NIY | Yen Denominated Nikkei 225 Index | SGXCME | Mon - Fri 18:30 - 01:30 |

| NKD | USD Denominated Nikkei 225 Index | CME | Mon-Fri 03:00 - 16:15; 16:30 - 17:30 & 18:00 - 19:00 |

| NKD | USD Denominated Nikkei 225 Index | SGXCME | Mon - Fri 02:15 - 09:55 & 18:30 - 01:30 |

*Please refer to the respective websites of each exchange for adjustments which take place during periods when US Daylight Savings Time is in effect.

Currency Margin Calculation (Withdrawals)

The following provides an example of how currency margins are calculated when determining the funds available for withdrawal.

Margin for Withdrawal Example

In the following example, assume the base currency for the account is USD and the net asset value positions (the sum of the values of all stock, cash, option, etc positions in each currency) are as follows:

- USD 50,000

- EUR 30,000

- CHF -39,000

- MXN -100,000

- Determine the net asset value (net liquidation value) for each currency. In this example, this is shown in columns 1 and 2 of the example table.

- Convert all non-base currency positions to base currency using prevailing market rates between the asset currency and base currency, here, USD. (column 3). This result is shown in column 4.

- Apply the margin rate for each currency (column 5).

- Calculate the margin in base currency as the net asset value from each original currency converted to USD multiplied by the margin for that currency (column 4 times column 5). The result is shown in column 6.

- The total margin requirement is the sum of each currency sourced margin requirement. In our example, the total margin requirement in base currency, USD, is $2,126. As the total net liquidating value expressed in USD is $46,476, the available funds is the difference, $44,350.

|

1

|

2

|

3

|

4

|

5

|

6

|

|

Currency

|

Net Asset Value (local currency)

|

Currency Rate

|

Net Asset Value

(converted to base currency, USD) |

Margin Rate

|

Margin Requirement

(in base currency, USD) |

| USD | 50,000 | 1.0000 USD/USD | 50,000 | 0% | 0.00 |

| EUR | 30,000 | 1.2000 USD/EUR | 36,000 | 2.5% | 900 |

| CHF | -39,000 | 1.3000 CHF/USD | -30,000 | 2.5% | 750 |

| MXN | -100,000 | 10.500 MXN/USD | -9,524 | 5% | 476 |

| TOTAL | US $ 46,476 | US $2,126 | |||

| Available Funds | US $ 44,350 |

Currency Margin Calculation

The following provides an example of how currency margins are calculated.

Margin for Trading Example

Assume base currency is USD for the below example

1. Determine the base-currency equivalent of net liq values in the account

NetLiq USD Equivalent

EUR: -14,362.69 -19,712.723

KRW: 6,692,613.37 5032.04

USD: 15,073.07 15,073.07

Using exchange rates as follows

EUR USD 0.72860

KRW USD 1330.00000

2. Determine the haircut rates for each currency pair

HairCut Rates

USD EUR .025

USD KRW .10

EUR KRW .10

3. Determine the largest negative currency balance

4. Sort the haircut rates from smallest to largest

EUR USD 0.025

EUR KRW 0.10

5. Starting with the positive net liq base-currency equivalent with the lowest haircut rate, calculate the margin requirement on that portion which may be used to off-set the negative net liq value

Consume 15,073.07 USD equivalent against the EUR

Margin1 = (15,073.07) x 0.025 = 376.82

6. Repeat step (5) until all negative net liq values have been covered

Remaining negative net liq

-19,712.723 + 15,073.07 = -4,639.65

Consume remaining negative net liq with 4,639.65 USD equivalent of KRW

Margin2 = (4,639.65) x 0.10 = 463.97

Remaining negative net liq

-4,639.65 + 4,639.65 = 0.00

Total margin requirement = Margin1 + Margin2 = 376.82 + 463.97 = 840.79

Availability of proceeds in a 'Cash' type account

Accounts which have been set up as a 'Cash' type do not have access to the proceeds from the sale of securities until such time the transaction has settled at the clearinghouse and proceeds have been issued to IBKR. Securities settlement generally takes place on the third business day following the sale transaction. Providing access to the funds prior to settlement would constitute a loan, a transaction which is precluded from taking place within this account type.

The one exception is under the Free-Riding rule. Clients with a cash account can use the proceeds from the sale of a security to purchase a different security under the condition that the second security is held until settlement of the initial sale. If the client sells the second security prior to settlement of the initial trade, they will be in violation of the Free-Riding rule and will be locked for 90 days from utilizing this exception.

Account holders who wish to have access to settled funds prior to the settlement day may do so by electing an account type of 'Margin'. Under this account type unsettled funds may be used for trading purposes but may not be withdrawn until settlement. Account holders maintaining a 'Cash' account may request an upgrade to a 'Margin' type account by logging in to Client Portal and selecting the Settings > Account Settings menu item and Account Type from the Configuration panel. Upgrade requests are subject to a compliance review to ensure that the account holder maintains the appropriate qualifications.

Can mutual funds be purchased on margin?

Preview Order / Check Margin

The Preview Order/Check Margin feature offers the ability to review the projected cost, commission and margin impact of an order prior to its transmission. This feature is made available in both the TWS and WebTrader, with the TWS version providing greater detail.

Trader Workstation (TWS)

The TWS Check Margin feature provides the ability to isolate the margin impact of the proposed order from one's existing positions and also displays the new margin requirement on the assumption the order is executed. Key margin balances including the Initial and Maintenance Requirements are reported as is the Equity With Loan Value. To use this feature, place your cursor on the order line, right-click on the mouse button and select Check Margin from the drop-down menu.

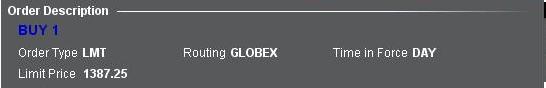

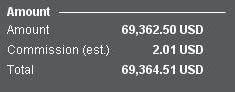

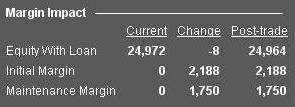

Example: Buy 1 ES June 2012 Future @ 1387.25

The first section of the Order Preview displays the bid, ask, and last trade price for the security.

The second section displays the basic order details

The Amount section shows the value of the order as well as the applicable commission estimate.

The Margin Impact section displays a breakdown of the following;

Current = The current account values, excluding the order being transmitted.

Change = The effect of the order being submitted ignoring any positions in the account.

Post-Trade = The anticipated account values when the order being transmitted has been executed and incorporated into the account portfolio.

WebTrader

The WebTrader order preview displays the equivalent of the TWS Post-Trade values only.

What is the margin on a Butterfly option strategy?

In order for the software utilized by IB to recognize a position as a Butterfly, it must match the definition of a Butterfly exactly. These are the 3 different types of Butterfly spreads recognized by IBKR, and the margin calculation on each:

Long Butterfly:

Two short options of the same series (class, multiplier, strike price, expiration) offset by one long option of the same type (put or call) with a higher strike price, and one long option of the same type with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

There is no margin requirement on this position. The long option cost is subtracted from cash and the short option proceeds are applied to cash.

Short Butterfly Put:

Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

The margin requirement for this position is (Aggregate put option highest exercise price - aggregate put option second highest exercise price). Long put cost is subtracted from cash and short put proceeds are applied to cash.

Short Butterfly Call:

Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

The margin requirement for this position is (Aggregate call option second lowest exercise price - aggregate call option lowest exercise price). Long option cost is subtracted from cash and short option proceeds are applied to cash.

*Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Other option positions in the account could cause the software to create a strategy you didn't originally intend, and therefore would be subject to a different margin equation.

What is the margin on an Iron Condor option strategy?

If an iron condor strategy exists in the account, the margin requirement will be the short put strike - the long put strike.

Example:

10 SPY Dec19 160P

-10 SPY Dec19 170P

-10 SPY Dec19 180C

10 SPY Dec19 190C

The margin requirement is determined by taking the strike of the short put (170) and subtracting the strike of the long put (160)

170-160 = 10

Take the difference and multiply by the number of contracts (10) and the multiplier (100)

10*10*100 = 10,000

In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the puts and the calls must be equal. If the distance between the puts and calls is different the position will be margined as two separate spreads with two separate margin requirements.

*Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as such.

Overview of the SPAN margining system

The Standard Portfolio Analysis of Risk (SPAN) is a methodology developed by the CME and used by many clearinghouses and exchanges around the world to calculate the Performance Bond (i.e., margin requirement) on futures and options on futures which the clearinghouse collects from the carrying FCM and the FCM, in turn, from the client.

SPAN establishes margin by determining what the potential worst-case loss a portfolio will sustain over a given time frame (typically set to one day), using a set of 16 hypothetical market scenarios which reflect changes to the underlying price of the future or option contract and, in the case of options, time decay and a change in implied volatility.

The first step in calculating the SPAN requirement is to organize all positions which share the same ultimate underlying into grouping referred to as a Combined Commodity group. Next, SPAN calculates and aggregates, by like scenario, the risk of each position within a Combined Commodity, with that scenario generating the maximum theoretical loss being the Scan Risk. The 16 scenarios are determined based upon that Combined Commodity’s Price Scan Range (the maximum underlying price movement likely to occur for the given timeframe) and Volatility Scan Range (the maximum implied volatility change likely to occur for options).

Assume a hypothetical portfolio having one long future and a one long put on stock index ABC having an underlying price of $1,000, a multiplier of 100 and a Price Scan Range of 6%. For this given portfolio, the Scan Risk would be $1,125 scenario 14.

|

# |

1 Long Future |

1 Long Put |

Sum |

Scenario Description |

|

1 |

$0 |

$20 |

$20 |

Price unchanged; Volatility up the Scan Range |

|

2 |

$0 |

($18) |

($18) |

Price unchanged; Volatility down the Scan Range |

|

3 |

$2,000 |

($1,290) |

$710 |

Price up 1/3 Price Scan Range; Volatility up the Scan Range |

|

4 |

$2,000 |

($1,155) |

$845 |

Price up 1/3 Price Scan Range; Volatility down the Scan Range |

|

5 |

($2,000) |

$1,600 |

($400) |

Price down 1/3 Price Scan Range; Volatility up the Scan Range |

|

6 |

($2,000) |

$1,375 |

($625) |

Price down 1/3 Price Scan Range; Volatility down the Scan Range |

|

7 |

$4,000 |

($2,100) |

$1,900 |

Price up 2/3 Price Scan Range; Volatility up the Scan Range |

|

8 |

$4,000 |

($2,330) |

$1,670 |

Price up 2/3 Price Scan Range; Volatility down the Scan Range |

|

9 |

($4,000) |

$3,350 |

($650) |

Price down 2/3 Price Scan Range; Volatility up the Scan Range |

|

10 |

($4,000) |

$3,100 |

($900) |

Price down 2/3 Price Scan Range; Volatility down the Scan Range |

|

11 |

$6,000 |

($3,100) |

$2,900 |

Price up 3/3 Price Scan Range; Volatility up the Scan Range |

|

12 |

$6,000 |

($3,375) |

$2,625 |

Price up 3/3 Price Scan Range; Volatility down the Scan Range |

|

13 |

($6,000) |

$5,150 |

($850) |

Price down 3/3 Price Scan Range; Volatility up the Scan Range |

|

14 |

($6,000) |

$4,875 |

($1,125) |

Price down 3/3 Price Scan Range; Volatility down the Scan Range |

|

15 |

$5,760 |

($3,680) |

$2,080 |

Price up extreme (3 times the Price Scan Range) * 32% |

|

16 |

($5,760) |

$5,400 |

($360) |

Price down extreme (3 times the Price Scan Range) * 32% |

The Scan Risk charge is then added to any Intra-Commodity Spread Charges (an amount that accounts for the basis risk of futures calendar spreads) and Spot Charges (A charge that covers the increased risk of positions in deliverable instruments near expiration) and is reduced by any offset from an Inter-Commodity Spread Credit (a margin credit for offsetting positions between correlated products). This sum is then compared to the Short Option Minimum Requirement (ensures that a minimum margin is collected for portfolios containing deep-out-of-the-money options) with the greater of the two being the risk of the Combined Commodity. These calculations are performed for all Combined Commodities with the Total Margin Requirement for a portfolio equal to the sum of the risk of all Combined Commodities less any credit for risk offsets provided between the different Combined Commodities.

The software for computing SPAN margin requirements, known as PC-SPAN is made available by the CME via its website.