FATCA FAQs - Issues Involving U.S. Address or Telephone Number

FATCA related FAQs involving U.S. address or telephone number. See KB2601 for other FATCA related FAQ topics.

Q1: I received a notification that a review of my file indicated a U.S. address or telephone and additional information is required. What additional information do I need to provide?

A1: You need to provide one document from Category (A) AND one document from Category (B) from the table below AND a written explanation explaining the U.S. address.

|

Category (A)

|

AND

|

Category (B)

|

AND

|

Category (C)

|

|

ANY OF the following documents issued by a non-US country:

|

ANY OF the following documents that match your foreign address:

|

A reasonable written explanation supporting your claim of non-US status.

|

||

|

· Driver’s license

|

· Driver’s license

|

|||

|

· Passport

|

· Bank or brokerage statement*

|

|||

|

· National identity card

|

· Utility bill*

|

*Bank or brokerage statements and utility bills must be less than 12 months old.

Q2: The day count table on the account application says I am a U.S. tax resident and will not let me complete IRS Form W-8. What should I do?

A2: The US Internal Revenue Service generally considers individuals who spend a significant number of days in the United States each year to be U.S. taxpayers. The table flags customers who exceed those IRS rules for U.S. income tax residency and requires a W-9. Alternatively, it may be possible for you to satisfy the “closer connection test” or utilize a U.S. tax treaty to avoid U.S. tax residency. Please refer to IRS Publication 519 for details or consult a tax professional regarding IRS rules for counting days, the closer connection test and U.S. tax treaties.

Q3: I am a studying in the U.S. and present on an F-1 visa. I responded to your email and provided a copy of my F-1 visa. I received an email saying my response was insufficient to resolve the issue. Why?

A3: Please check the expiration date of your visa. If your visa has expired, please provide other evidence of your status, such as an Optional Practical Training (OPT) card, a copy of Form I-20 endorsed by the DSO for your school or another Employment Authorization Document (EAD). Also confirm you submitted the necessary proof of identify and address documentation.

Q4: I use my daughter’s address to receive all mail. She lives in the United States. What should I do?

A4: In this case, you can probably satisfy the substantial presence test noted in the notification you've received . Please provide the number of days you spent or plan to spend in the U.S. in the current and prior two years (e.g., 2015, 2014 and 2013). Also refer to the documentation requirements outlined in FAQ#1 above.

Q5: The address or telephone you noted in your email is out-of-date. I have since moved out of the United States. What should I do?

A5: The fastest and most effective way to remedy the situation is to provide the information as requested in the notification you've received (see FAQ#1 above), so that our records are complete. You should also log into Account Management and make any required changes to your personal information of record.

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

FATCA FAQs - Issues Involving U.S. Passport or Other Evidence of U.S. Citizenship

FATCA related FAQs involving U.S. passport or other evidence of U.S. citizenship . See KB2601 for other FATCA related FAQ topics.

Q1: I received a notification saying a review of my file indicated I am a U.S. citizen. I am being asked to complete IRS Form W-9 and provide a U.S. Social Security Number. I am not a U.S. citizen. What should I do?

A1: In most cases you received this message because our review of your file indicated you had U.S. citizenship or a U.S. place of birth, which likely infers automatic U.S. citizenship and U.S. taxpayer status even if you do not live in the U.S. or hold a U.S. passport. US citizens are required to provide us with IRS Form W-9 and a valid social security number. Nevertheless, we may accept IRS Form W-8 from you to establish your status as a non-U.S. taxpayer if you provide us with a copy of your Certificate of Loss of Nationality of the United States (Form DS-4083) and a copy of your passport evidencing citizenship in another country. Alternatively, you may provide us with a written explanation of why you are not a U.S. citizen (for instance, you were born in the United States to parents who were fully-accredited foreign diplomats). We may request further information from you depending on the explanation provided.

Q2: I gave up my U.S. citizenship. What should I do?

A2: Please provide us with a copy of your Certificate of Loss of Nationality of the United States (Form DS-4083) and a copy of your passport from another country.

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

FATCA FAQs - Issues Involving U.S. Green Card Holders

FATCA related FAQs involving U.S. Green Card Holders. See KB2601 for other FATCA related FAQ topics.

Q1: I have a U.S. Green Card but am not a U.S. taxpayer. What additional information or documentation do I need to provide to ensure you can accept my Form W-8BEN?

A1: In general, all U.S. Green Card holders are U.S. taxpayers, even if they do not live in the United States (and even if their Green Card has expired or is otherwise invalid). In general, a U.S. Green Card holder cannot provide Form W-8BEN, and must provide Form W-9 instead. If you are a former U.S. Green Card holder who gave up your U.S. Green Card, you will need to provide a copy of your Form I-407 (Record of Abandonment of Lawful Permanent Resident Status.

Q2: I used to have a U.S. Green Card but gave it up. What additional information or documentation do I need to provide to ensure you can accept my Form W-8BEN?

A2: You will need to provide a copy of your Form I-407 (Record of Abandonment of Lawful Permanent Resident Status).

Q3: I have a U.S. Green Card but it expired. I received notification asking me provide a reasonable written explanation as to why I am a non-U.S. taxpayer despite having a Green Card. I responded that my Green Card is expired but received an email saying my response was insufficient to resolve the issue. Why?

A3: Even if your Green Card has expired for immigration purposes (that is, you cannot use it to enter the United States), tax rules, generally, provide you remain a U.S. taxpayer until you formally renounce your U.S. Green Card. Generally, a U.S. Green Card holder cannot provide Form W-8BEN, and must provide Form W-9 instead. If you did formally renounce your US Green Card, please provide a copy of your Form I-407 (Record of Abandonment of Lawful Permanent Resident Status).

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

FATCA FAQs - Issues Involving U.S. Place of Birth

FATCA related FAQs involving U.S. Place of Birth. See KB2601 for other FATCA related FAQ topics.

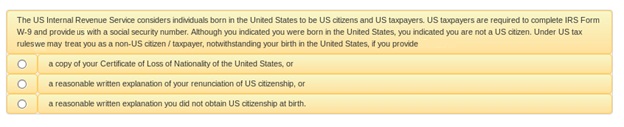

Q1: I was born in the United States but I do not have a U.S. passport and am not a U.S. taxpayer. Why am I being asked for additional documentation?

A1: In most cases, you automatically acquired U.S. citizenship when you were born in the United States even if you have never applied for a passport. U.S. tax rules designate all U.S. citizens as U.S. taxpayers, even those that did not live in the U.S. or receive a U.S. passport. U.S. citizens are required to provide us with IRS Form W-9 and a valid taxpayer ID (e.g. Social Security Number). Nevertheless, we may accept IRS Form W-8 from you to establish your status as a non-U.S. taxpayer if you provide us with a copy of your Certificate of Loss of Nationality of the United States (Form DS-4083) and a copy of your passport evidencing citizenship in another country.

Alternatively, you may provide us with a written explanation of why you are not a U.S. citizen (for instance, you were born in the United States to parents who were fully-accredited foreign diplomats). We may request further information from you depending on the explanation provided.

Q2: I was born in the United States but I am not a U.S. taxpayer. I do not have a Certificate of Loss of Nationality of the United States (Form DS-4083). What should I do?

A2: In general, you are a U.S. citizen and U.S. taxpayer if you were born in the United States. Unlike many jurisdictions, the U.S. taxes its citizens regardless of where they live (or even if they have never lived in the United States). We cannot accept IRS Form W-8 from a U.S. citizen, and must receive a Form W-9 instead. If you are a former U.S. citizen who gave up your citizenship, please refer to the FAQ above for the additional information and documentation you may need to provide to establish your status as a former U.S. citizen.

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

FATCA FAQs - General

General FAQs involving FATCA . See KB2601 for other FATCA related FAQ topics.

Index of FATCA Related FAQs

Outlined below are links to a series of FATCA related FAQs organized by topic. For a general overview of FATCA, please see KB1986.

1. General (See KB2602)

2. Issues Involving U.S. Place of Birth (See KB2603)

3. Issues Involving U.S. Green Card Holders (See KB2604)

4. Issues Involving U.S. Passport or Other Evidence of U.S. Citizenship (See KB2605)

5. Issues Involving U.S. Address or Telephone Number (See KB2606)

6. Issues Involving Mismatch Between Tax Treaty Country and Address (See KB2607)

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

IB Tax Form Users Guide

Introduction

Client should hit “Submit” button after all personal information is completed. Assuming no entry errors have been made, the client will be directed to Page 2 (tax form).

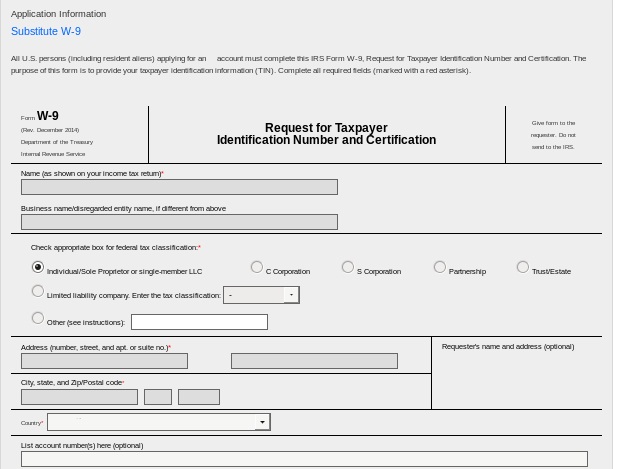

Screen 1

Important: To change the pre-populated information on the W-9, the client MUST hit the back button and change the relevant information on the prior page for the tax form to be updated.

Important: The first 3 boxes on the W-9 under certification must be checked to avoid having the client subject to back up withholding.

.jpg)

Next, the client will need to provide an electronic signature by typing their name (i.e., account title) exactly as it appears on the screen and select the “Save and Continue” button. The client will then be taken to the confirmation screen which will list any documents that they need to send to the broker.

.jpg)

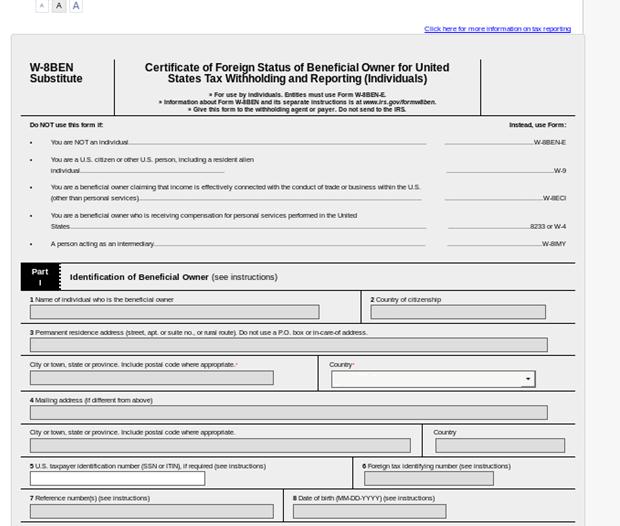

On Part II of the W-8BEN the client will be prompted to specify whether they are a resident of a country which maintains a tax treaty with the U.S. Only those countries with which the U.S. maintains a treaty will be shown on the drop-down list and if the client does not see his or her treaty country, the client should select “N/A” or “I am not resident in a treaty country.”

.jpg)

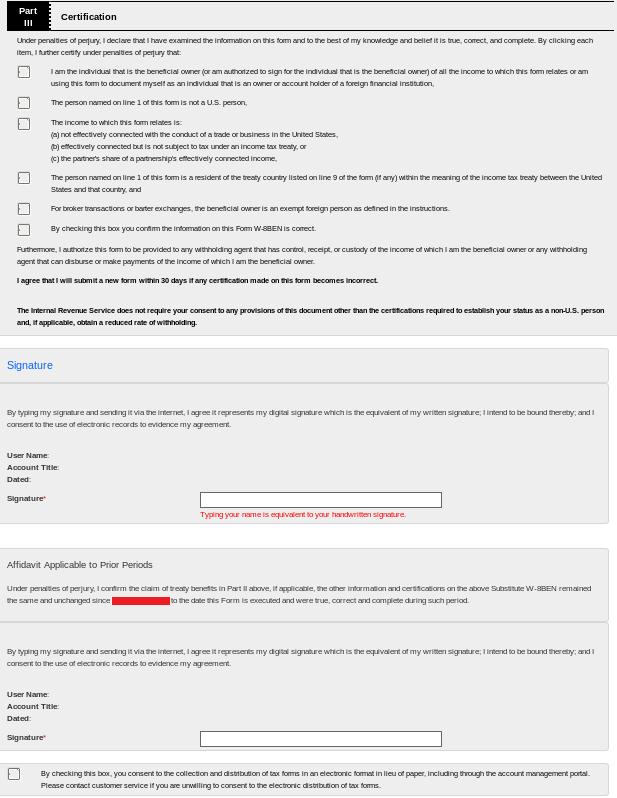

On Part III of the W-8BEN the client will be prompted to certify that the information provided on the form is accurate by checking the boxes and providing an electronic signature by typing their name (i.e., account title) exactly as it appears on the screen.

The client will then be prompted to check the box through which they consent to electronic collection and delivery of tax forms and then select the “Save and Continue” button. The client will then be taken to the confirmation screen which will list any documents that they need to send to the broker.

Final Review & Document Request

Once the form has been completed, it is subject to review by IB for purposes of verifying the client’s stated tax residency. This review may generate discrepancies in one of the following three areas: U.S. Connection, Treaty Claim or U.K. Crown Connection. If a client account is flagged for any discrepancy, you will need to contact them and request documents to resolve. The steps for resolving each of these is as follows:

IB will send a periodic report listing clients who have tasks which need to be completed so that you may contact them to act. This will include those accounts who have not logged into Account Management to complete the Tax Form or who have completed the form but need to send in documentation.

EXHIBIT 1 – Tax Form Prompt – U.S.

Confirming your information is essential to ensure that you will not become subject to backup withholding, including withholding on trade proceeds.

We appreciate your prompt attention to this matter.

Confirming your information is essential to ensure that (a) we can give you the most favorable rate on normal dividend and interest withholding as defined by standard international tax treaties; and (b) you will not become subject to any exceptional U.S. tax withholding.

We appreciate your prompt attention to this matter.

Documenting Taxpayer Status - Non U.S. Persons with U.S. Addresses

The U.S. Internal Revenue Service generally considers individuals with certain U.S. connections to be U.S. resident taxpayers who are required to complete IRS Form W-9 and provide IB with a U.S. taxpayer ID (e.g., social security number).

One common indicator of a U.S. connection for individuals is the presence of a U.S. residential or mailing address. In these cases, the individual is assumed to be a U.S. taxpayer and required to submit Form W-9 unless they can demonstrate that the address falls under one of the permissible explanations for a U.S. connection. These include:

(A) You do not meet the “substantial presence test” for U.S. tax residency as found in U.S. Treasury Regulation 301.7701(b)-1(c) and the address in the U.S. is

(B) You meet the closer connection exception described in US Treasury Regulation § 301.7701(b)-2 and the address in the United States is

(C) You are present in the United States as a student, teacher or trainee at a US institution. Here you will need to provide a copy of your F, J, M or Q visa from U.S. Immigration and Customs Enforcement.

(D) You are present in the United States as a foreign diplomat. Here you will need to provide a copy of your A or G visa (other than A-3 or G-3 visa) from U.S. Immigration and Customs Enforcement.

(E) You are present in the United States and are a spouse or unmarried child under the age of 21 of a person described in (C) or (D) above. Here you will need to provide a copy of your visa.

Note: the examples above are not the only permissible explanations for US connections. If none of the examples apply to your situation but you still believe you are a non-US taxpayer, you will need to provide a written explanation supporting your claim of non-US status

1099-B Proceeds From Broker and Barter Exchange Transaction

Proceeds from broker and barter exchange provides the sales proceeds from multiple transactions, including sales, exchanges, covered options, and tender offers on page 2 of the Consolidate Forms 1099.

1099-B Proceeds from broker and barter exchange reporting is made up of four separate sub-sections on the 1099-B Summary Page. The first three sections are separated based upon cost basis reporting regulations, while the fourth section includes Regulated Futures, Section 1256 contracts.

- Covered Securities with Short-Term gains or losses.

- Covered Securities with Long-Term gains or losses.

- Noncovered Securities.

- Regulated Future Contracts and Options.

IRS regulations classify covered and noncovered securities as outlined in the table below:

| Covered Securities | Uncovered Securities | |

| Broker/dealer vs. Tax Payer Responsibility | Brokers/dealers report cost basis to IRS and taxpayer on Form 1099-B. Taxpayer will use From 1099-B data to prepare their tax returns. | Taxpayer to maintain and report cost basis to IRS. Includes assets designated as noncovered due to asset type or incomplete cost basis information. |

| Equities | Acquired on or after January 1, 2011 | Acquired prior to January 1, 2011 |

| Mutual Funds | Acquired on or after January 1, 2012 | Acquired prior to January 1, 2012 |

| Fixed Income and options | Acquired on or after January 1, 2014 | Acquired prior to January 1, 2014 |

1099-B Summary Page

Transaction details appear following the Consolidated Forms 1099- Summary page. Boxes 1d to 1g of the 1099-B report the combined total for securities classified within sections one through three. Interactive Brokers includes cost basis reporting to the IRS for covered securities. Noncovered securities are exempt from broker cost basis reporting due to either designation or unknown information.

1099-B Sub Sections

1. Covered Securities with Short-Term gains or losses

Section one reports proceeds and cost basis information for covered securities with a short-term gain or loss. Grouped by their unique security identification number (CUSIP or ISIN), these covered securities correspond with the Worksheet for Form 8949 Part I Short-Term Capital Gains and Losses - Assets Held One Year or Less, Box A.

Box 1e reflects the original or adjusted cost basis. If applicable, a cost basis adjustment code may appears under Box 1f within the section's transaction details that follow the Summary.

2. Covered Securities with Long-Term gains or losses

Section two reports information for transactions of covered securities with a long-term gain or loss. Also grouped by security identification number, these assets correspond with the Worksheet for Form 8949 Part II Long-Term Capital Gains and Losses - Assets Held More Than One Year, Box D.

3. Noncovered Securities

Section three reports transaction of non-covered securities including index options without determination of holding period. Securities under this section include transactions for which the cost basis is not known or not reportable by Interactive Brokers to the IRS. Based on personal records, the taxpayer must report the cost basis and determine the short or long term.

These assets correspond with the Worksheet for Form 8949 Part I Short-Term Capital Gains and Losses, Box B, as well as Part II Long-Term Capital Gains and Losses, Box E.

4. Regulated Future Contracts and Options

We are required to report the aggregate profit/loss in four components under Boxes 8 to 11, even though taxpayers only report the aggregate profit/loss from regulated futures.

All settled or closed contracts during the tax year are displayed in Box 8. Any unrealized profit or loss at the beginning of the year (Box 9) and at the end of the year (Box 10) is adjusted from Box 8 to report an aggregate profit or loss on all contracts, open or closed, in Box 11.

For a contract level profit and loss summary, we include a Gain/Loss Worksheet for 1256 Contracts as part of our Year End Reports. There is one section for Futures and one section for Options.

Important Points

- Wash Sales: Brokers take into wash sales with calculating cost basis and holding period for covered securities within an account. The amount of the disallowed loss and the subsequent cost basis adjustment will be reported. For an understanding of wash sale basics, click here.

- Bond/Option: Bond and option purchases became covered securities as of January 1, 2014.

- Form 8949 Worksheet: Transactions not reported to the IRS on Form 1099-B may be included on your 8949 Worksheet, along with details for each 1099-B transaction.

- Multiple Trading Account: Each of these reports is specific to the account associated with the report, however the tax code requires you to report on your tax return across all of your trading accounts. If you hold the same security in multiple accounts and sell it, the gain or loss calculated and reported to the IRS may be different than presented on an account level and must be adjusted.

- Tax ID Numbers: An IRS identity protection ruling allows truncated reporting of tax ID numbers on 1099s. Account tax ID numbers display the last four digits (XXX-XX-0123) on Interactive Brokers tax forms.

Note:

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

1099-MISC Miscellaneous Income

Miscellaneous Income represents those amounts not reportable on any of the other 1099 forms. In addition to royalty trust and payments in lieu, amounts may include reimbursements.

Royalties

Box 2 reports income credited to your account from royalty trusts. Payments of royalties are generally from investments in natural resource companies.Supplemental tax information is furnished for this income on the WHFIT Tax Information Statement by March 15.

Other income

Box 3 reports income credits classified as "other income" for tax purposes. This includes stock loan fees earned.

Non-Employee Compensation

Box 7 reports reports asset management fees earned.

Substitute Payments in Lieu of Dividends or Interest (PIL)

Box 8 reports PIL payments credited to your account during the previous calendar year. The amounts were credited in lieu of the normal interest or dividend payment when your security is lent. As disclosed within your margin disclosure, your broker is authorized to loan your shares from an account with an outstanding margin debit balance. (Note: PIL payments are not eligible to be treated as qualified dividends, except under specific circumstances.)

Important Points on PIL Income:

- The PIL income (credited to your IB account) cannot be “netted” with PIL paid (debited from your IB account) on stocks you have borrowed.

- PIL is not eligible to be treated as qualified dividends, except under specific circumstances

- PIL income is not an interest or dividend payment, but miscellaneous income and should be treated as such on your tax return.

Note:

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.