卖空的操作风险

费率风险

卖出看涨期权的持有者可能会在期权到期前被行权。期权多头持有者输入提早行权请求时,期权清算公司(OCC)会将其随机分配给其会员(包括盈透证券)。期权清算公司将在多头看涨期权行权当天(T)的美国收市后将其报给IBKR。因此,期权被行权将在下一个工作日(T+1)反映在IBKR客户账户之中,并于T+2结算。被行权会导致底层股票在T日卖出,如果在那之前没有持有相应的底层股票,则会导致出现空头仓位。已结算空头仓位持有者需缴纳借券费用,且费用可能会很高。此外,如果IBKR因为没有足够的可供借用证券库存而无法在结算日履行卖空交付义务,则空头仓位可能会面临被迫补进平仓。

由于上文提到的T+2结算机制,传统的在T+1买入股票填平空头仓位的操作会使账户至少有1个晚上(如果碰上周末或节假日可能更长)会持有已结算的空头股票持仓。

多头价内看跌期权会在到期日自动行权。行权产生的空头仓位与被行权的空头看涨期权具有同样的风险。

| 日期 | 卖空 | 买入回补 | 已结算空头仓位 | 有无借券费用? | |

| 周一 | 期权清算公司盘后向IBKR报告空头看涨期权被行权。 | -100股XYZ股票 交易日(T) |

不变 | 否 | |

| 周二 | 看涨期权被行权和股票卖出反映在IBKR客户账户中 | T+1 | +100股XYZ股票 交易日(T) |

不变 | 否 |

| 周三 | T+2结算日 | T+1 | -100 | 是 | |

| 周四 | T+2结算日 | 不变 | 否 |

卖空股票收入的贷方利息

如何确定与股票借入仓位相关的贷方利息或费用

账户持有人卖空股票时,IBKR会代账户持有人借入相应数量的股票,以履行向买方交付股票的义务。根据借入股票的股票借贷协议,IBKR需向股票出借方提供现金抵押品。现金抵押品的金额基于股票价值的行业标准计算,称为抵押品标记。

股票出借方就现金抵押品向IBKR提供利息,利率通常会低于现金抵押存款的现行市场利率(通常与美元计价现金存款的联邦基金有效利率挂钩),其中的差额即作为出借方提供此服务收取的费用。对于难以借入的股票,出借方所收取的费用会相应提高,可能会导致净利率变为负,IBKR反而被倒扣费用。

许多经纪商只会向机构客户提供部分利息返还,但所有IBKR客户其卖空股票收入超出10万美元或等值其它货币的部分都可以获得利息。当某证券可供借用的供应量高于借用需求时,账户持有人可就其卖空股票余额获得的利息利率相当于基准利率(例如,美元余额采用联邦基金有效隔夜利率)减去一个利差(目前介于1.25%(10万美元档的余额)至0.25%(300万美元以上的余额)之间)。利率可能会在无事先通知的情况下发生变化。

当某特定证券的供求不平衡导致其难以借入时,借出方提供的利息返还将会减少,甚至可能导致向账户倒扣费用。该等利息返还或倒扣费用会以更高的借券费用的形式转嫁给账户持有人,这可能会超过卖空收入所得的利息,导致账户最终算下来还付出了费用。由于利率因证券和日期而异,IBKR建议客户通过客户端/账户管理中的支持部分,访问〝可供卖空股票〞工具,查看卖空的指示性利率。请注意,该等工具中反映的指示性利率对应的是IBKR向第三等级余额支付的卖空收入利息,即卖空收入为300万美元或以上。对于较低的余额,其利率将根据余额等级和交易货币对应的基准利率进行调整。可使用“对卖空收益现金余额向您支付的利息”计算器计算适用的利率。

请参阅证券融资(融券)页面的更多范例和计算机。

重要提示

“可供卖空股票”工具和TWS中关于可供借用股票和指示性利率的信息,是在尽最大努力的基础上提供,不保证其准确性或有效性。 “可供卖空股票”包括来自第三方的信息,不会实时更新。利率信息仅为指示性质。在当前交易时段执行的交易通常在2个工作日内结算,实际供应和借入成本在结算日确定。交易者应注意,在交易和结算日之间,利率和供应可能会发生重大变化,尤其是交易稀少的股票、小盘股和即将发生公司行动(包括股息)的股票。详情请参阅卖空的操作风险(Operational Risks of Short Selling。

有关向净现金余额为正的账户收取利息的说明

在以下情况下,尽管账户保持整体净多头或贷方现金余额,但仍需支付利息:

1. 该账户持有特定币种的空头或借方余额。

例如,某账户有相当于5,000美元的净现金贷方余额,这其中包括8,000美元的多头余额和相当于3,000美元的欧元空头余额,需要对欧元空头余额支付利息。 由于账户所持有的多头美元余额低于10,000美元的第一阶梯水平,不会获得利息,因此无法冲抵要支付的利息。

账户持有人应注意,如其买入的证券是以账户未持有的货币计价,则IBKR会创建相应币种的贷款,以便与清算所结算交易。如希望避免此类贷款和相关利息费用,客户需在进行交易前存入以该特定货币计价的资金,或通过Ideal Pro(余额25,000美元或以上)或散股(余额低于25,000美元)交易场所兑换现有的现金余额。

2. 贷方余额主要来自于卖空证券所得。

例如,某账户的净现金余额为12,000美元,其中包括证券子账户中的6,000美元借方余额(减去空头股票持仓的市场价值)和18,000美元的股票空仓价值。账户需就第一阶梯借记余额6,000美元支付利息,同时,由于空头股票贷记低于100,000美元的第一阶梯水平,不会从空头股票贷记中获得利息。

3. 贷方余额包含未结算的资金。

IBKR仅根据已结算资金决定要收取和支付利息。正如账户持有人在买入交易结算之前,无需对用来买入证券的借款支付利息一样,在卖出交易结算之前(而清算所已向IBKR存入资金),账户持有人也不会就卖出证券所得资金获得利息或借方余额冲抵。

IBKR股票收益提升计划

计划概览

股票收益提升计划(Stock Yield Enhancement Program)让客户有机会用账户中全额支付的股票赚取额外收益。该计划允许IBKR通过抵押(美国国债或现金)从您那里借入股票,然后将股票借给希望做空股票并愿意支付借券利息的交易者。有关股票收益提升计划的更多信息,请参见此处或查看常见问题页面。

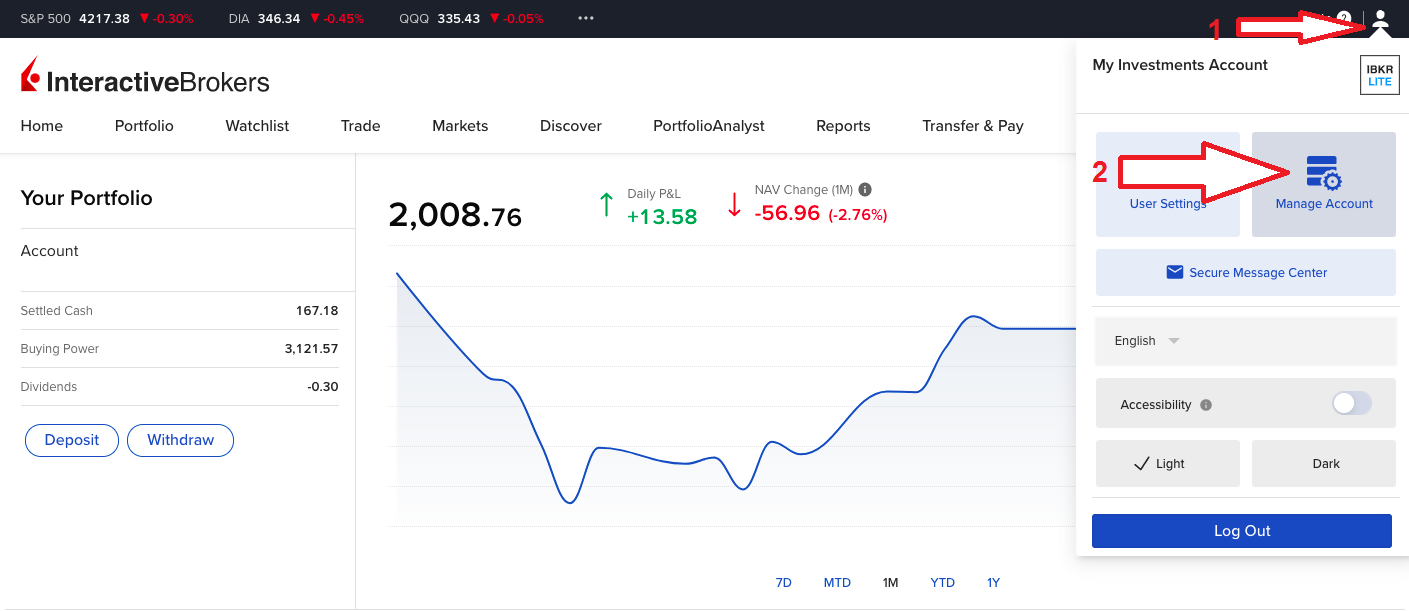

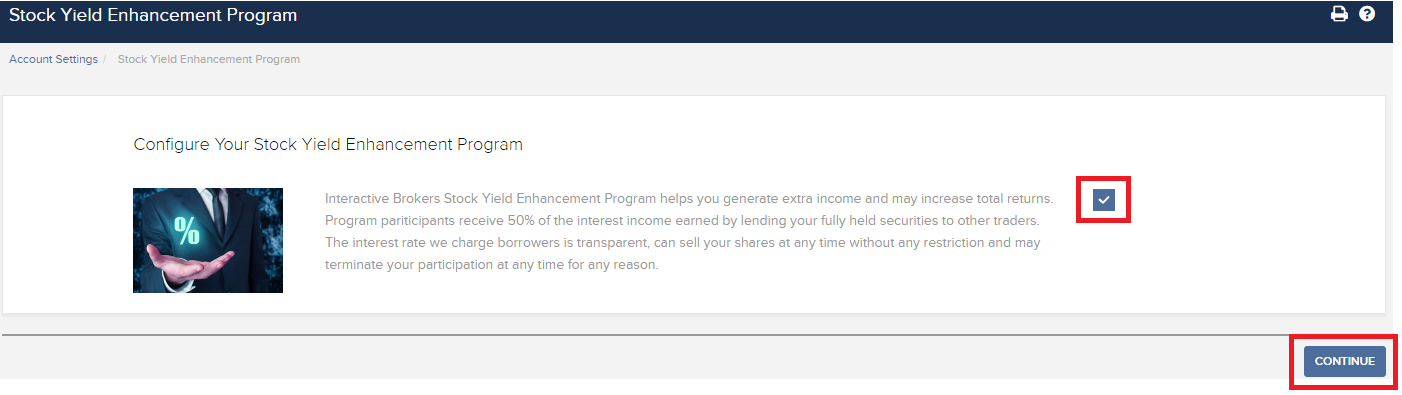

要参加计划,请登录客户端。登录后,点击使用者菜单(右上角的头像图标),然后点击管理账户。在配置部分,点击股票收益提升计划旁边的配置(齿轮)图标。在下一个界面勾选复选框然后点击继续。您将会看到参加计划必需的表格和披露。查看并签署表格后,您的申请便会提交处理。需要24到48小时才会激活生效。

.png)

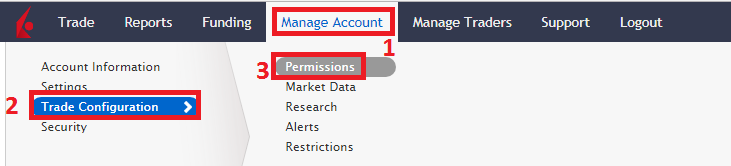

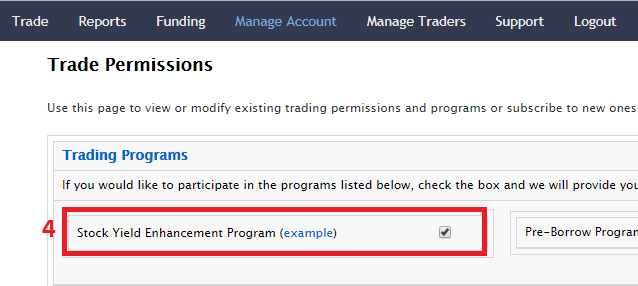

For enrollment via Classic Account Management, please click on the below buttons in the order specified.

为什么难以借到的股票其“价格”与收盘价不一致?

在确定借用股票头寸所需存入的现金抵押金额时,通用的行业惯例是用股票前一个交易日**的收盘价乘以102%,向上取整到最近的美元,然后再乘以所借股数。由于借股费用根据现金抵押金额确定,这一惯例直接影响到维持空头头寸的成本,尤其是对那些股价不高但难以借到的股票。注意,不是以美元计价的股票,计算会有所不同。下表为各个币种对应的行业惯例:

| 币种 | 计算方法 |

| USD | 102%;向上取整到最近的元 |

| CAD | 102%;向上取整到最近的元 |

| EUR | 105%;向上取整到最近的分 |

| CHF | 105%;向上取整到最近的生丁 |

| GBP | 105%;向上取整到最近的便士 |

| HKD | 105%;向上取整到最近的分 |

账户持有人可在每日账户报表的“非直接难以借用股票详情(Non-Direct Hard to Borrow Details)”部分查看借股价格。下方通过举例说明了现金抵押金额的计算及其对借股费用的影响。

例 1

以$1.50美元的价格卖空100,000股ABC

卖空所得 = $150,000.00美元

假设ABC股价跌至$0.25美元,股票借贷费率为50%

卖空股票抵押金额计算

价格 = 0.25 x 102% = 0.255; 向上取整至$1.00美元

总金额 = 100,000股 x $1.00 = $100,000.00美元

借股费用 = $100,000 x 50% / 360天 = $138.89美元/天

假设账户持有人的现金余额中没有任何其它卖空交易所得,由于余额没有超过可以开始计息的最低门槛要求$100,000美元,将不会有任何卖空收益的利息收入可用于冲抵此借股费用。

例 2(以欧元计价的股票)

以1.50欧元的价格卖空100,000股ABC

假设前一个交易日收盘价为1.55欧元,股票借贷费率为50%

卖空股票抵押金额计算

价格 = 1.55欧元 x 105% = 1.6275; 向上取整至1.63欧元

总金额 = 100,000股 x 1.63 = 163,000.00欧元

借股费用 = 163,000欧元 x 50% / 360天 = 226.38欧元/天

** 请注意,周六和周天与周五一样将采用周四的收盘价计算抵押金额。

股票收益提升计划(SYEP)常见问题

股票收益提升计划推出的目的是什么?

股票收益提升计划可供客户通过允许IBKR将其账户内原本闲置的证券头寸(即全额支付和超额保证金证券)出借给第三方来赚取额外收益。参与此计划的客户会收到用以确保股票在借贷终止时顺利归还的抵押(美国国债或现金)。

什么是全额支付和超额保证金证券?

全额支付证券是客户账户中全款付清的证券。超额保证金证券是虽然没有全款付清但本身市场价值已超过保证金贷款余额的140%的证券。

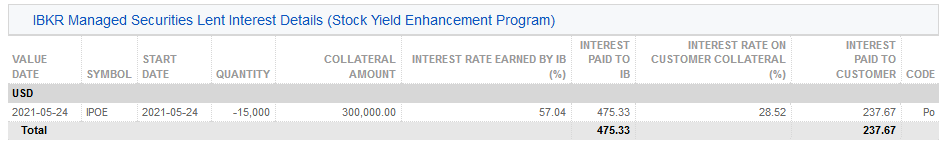

客户股票收益提升计划的借出交易收益如何计算?

客户借出股票的收益取决于场外证券借贷市场的借贷利率。借出的股票不同,出借的日期不同,都会对借贷利率造成很大差异。通常,IBKR会按自己借出股票所得金额的大约50%向参与计划的客户支付利息。

借贷交易的抵押金额如何确定?

证券借贷的抵押(美国国债或现金)金额采用行业惯例确定,即用股票的收盘价乘以特定百分比(通常为102-105%),然后向上取整到最近的美元/分。每个币种的行业惯例不同。例如,借出100股收盘价为$59.24美元的美元计价股票,现金抵押应为$6,100 ($59.24 * 1.02 = $60.4248;取整到$61,再乘以100)。下表为各个币种的行业惯例:

| 美元 | 102%;向上取整到最近的元 |

| 加元 | 102%;向上取整到最近的元 |

| 欧元 | 105%;向上取整到最近的分 |

| 瑞士法郎 | 105%;向上取整到最近的生丁 |

| 英镑 | 105%;向上取整到最近的便士 |

| 港币 | 105%;向上取整到最近的分 |

更多信息,请参见KB1146。

股票收益提升计划下的抵押如何保管以及保管在何处?

对于IBLLC的客户,抵押将采用现金或美国国债的形式,并将转入IBLLC的联营公司IBKR Securities Services LLC (“IBKRSS”)进行保管。您在该计划下借出股票的抵押会由IBKRSS以您为受益人保管在一个账户中,您将享有第一优先级担保权益。如果IBLLC违约,您将可以直接从IBKRSS取得抵押,无需经过IBLLC。请参见 此处的《证券账户控制协议》了解更多信息。对于非IBLLC的客户,抵押将由账户所在实体保管。例如,IBIE的账户其抵押将由IBIE保管。例如,IBIE的账户其抵押将由IBIE保管。

退出IBKR股票收益提升计划或卖出/转账通过此计划借出的股票会对利息造成什么影响?

交易日的下一个工作日(T+1)停止计息。对于转账或退出计划,利息也会在发起转账或退出计划的下一个工作日停止计算。

参加IBKR股票收益提升计划有什么资格要求?

| 可参加股票收益提升计划的实体* |

| 盈透证券有限公司(IB LLC) |

| 盈透证券英国有限公司(IB UK)(SIPP账户除外) |

| 盈透证券爱尔兰有限公司(IB IE) |

| 盈透证券中欧有限公司(IB CE) |

| 盈透证券香港有限公司(IB HK) |

| 盈透证券加拿大有限公司(IB Canada)(RRSP/TFSA账户除外) |

| 盈透证券新加坡有限公司(IB Singapore) |

| 可参加股票收益提升计划的账户类型 |

| 现金账户(申请参加时账户资产超过$50,000美元) |

| 保证金账户 |

| 财务顾问客户账户* |

| 介绍经纪商客户账户:全披露和非披露* |

| 介绍经纪商综合账户 |

| 独立交易限制账户(STL) |

*参加的账户必须是保证金账户或满足上述现金账户最低资产要求的现金账户。

盈透证券日本、盈透证券卢森堡、盈透证券澳大利亚和盈透证券印度公司的客户不能参加此计划。账户开在IB LLC下的日本和印度客户可以参加。

此外,满足上方条件的财务顾问客户账户、全披露介绍经纪商客户和综合经纪商可以参加此计划。如果是财务顾问和全披露介绍经纪商,必须由客户自己签署协议。综合经纪商由经纪商签署协议。

IRA账户可以参加股票收益提升计划吗?

可以。

IRA账户由盈透证券资产管理公司(Interactive Brokers Asset Management)管理的账户分区可以参加股票收益提升计划吗?

不能。

英国SIPP账户可以参加股票收益提升计划吗?

不能。

如果参加计划的现金账户资产跌破最低资产要求$50,000美元会怎么样?

现金账户只有在申请参加计划当时必须满足这一最低资产要求。之后资产跌破此要求并不会对现有借贷造成任何影响,也不影响您继续借出股票。

如何申请参加IBKR股票收益提升计划?

要参加股票收益提升计划,请登录客户端。登录后,点击使用者菜单(右上角的小人图标),然后点击设置。然后,在账户设置内,寻找交易板块并点击股票收益提升计划以申请参加。 您将会看到参加该计划所需填写的表格和披露。阅读并签署表格后,您的申请便会提交处理。可能需要24到48小时才能完成激活。

如何终止股票收益提升计划?

要退出股票收益提升计划,请登录客户端。登录后,点击使用者菜单(右上角的小人图标),然后点击设置。在账户 设置板块内会找到交易,然后点击股票 收益 提升 计划,然后参照所需步骤。您的申请便会提交处理。 中止参加的请求通常会在当日结束时进行处理。

如果一个账户参加了计划然后又退出,那么该账户多久可以重新参加计划?

退出计划后,账户需要等待90天才能重新参加。

哪些证券头寸可以出借?

| 美国市场 | 欧洲市场 | 香港市场 | 加拿大市场 |

| 普通股(交易所挂牌、粉单和OTCBB) | 普通股(交易所挂牌) | 普通股(交易所挂牌) | 普通股(交易所挂牌) |

| ETF | ETF | ETF | ETF |

| 优先股 | 优先股 | 优先股 | 优先股 |

| 公司债券* |

*市政债券不适用。

借出IPO后在二级市场交易的股票有什么限制吗?

没有,只要账户本身没有就相应的证券受到限制就可以。

IBKR如何确定可以借出的股票数量?

第一步是确定IBKR有保证金扣押权从而可以在没有客户参与的情况下通过股票收益提升计划借出的证券的价值(如有)。根据规定,通过保证金贷款借钱给客户购买证券的经纪商可以将该客户的证券借出或用作抵押,金额最高不超过贷款金额的140%。例如,如果客户现金余额为$50,000美元,买入市场价值为$100,000美元的证券,则贷款金额为$50,000美元,那么经纪商对$70,000美元($50,000的140%)的证券享有扣押权。客户持有的证券超出这一金额的部分被称为超额保证金证券(此例子中为$30,000),需要记在隔离账户,除非客户授权IBKR通过股票收益提升计划将其借出。

计算贷款金额首先要将所有非美元计价的现金余额转换成美元,然后减去股票卖空所得(转换成美元)。如果结果为负数,则我们最高可抵押此数目的140%。此外,商品账户段中持有的现金余额和现货金属和差价合约相关现金不纳入考虑范围。 详细说明请参见此处。

例1: 客户在基础货币为美元的账户内持有100,000欧元,欧元兑美元汇率为1.40。客户买入价值$112,000美元(相当于80,000欧元)的美元计价股票。由于转换成美元后现金余额为正数,所有证券被视为全额支付。

| 项目 | 欧元 | 美元 | 基础货币(美元) |

| 现金 | 100,000 | (112,000) | $28,000 |

| 多头股票 | $112,000 | $112,000 | |

| 净清算价值 | $140,000 |

例2: 客户持有80,000美元、多头持有价值$100,000美元的美元计价股票并且做空了价值$100,000美元的美元计价股票。总计$28,000美元的多头证券被视为保证金证券,剩余的$72,000美元为超额保证金证券。计算方法是用现金余额减去卖空所得($80,000 - $100,000),所得贷款金额再乘以140% ($20,000 * 1.4 = $28,000)

| 项目 | 基础货币(美元) |

| 现金 | $80,000 |

| 多头股票 | $100,000 |

| 空头股票 | ($100,000) |

| 净清算价值 | $80,000 |

IBKR会把所有符合条件的股票都借出去吗?

不保证账户内所有符合条件的股票都能通过股票收益提升计划借出去,因为某些证券可能没有利率有利的市场,或者IBKR无法接入有意愿的借用方所在的市场,也有可能IBKR不想借出您的股票。

通过股票收益提升计划借出股票是否都要以100为单位?

不能。只要是整股都可以,但是借给第三方的时候我们只以100为倍数借出。这样,如果有第三方需要借用100股,就可能发生我们从一个客户那里借出75股、从另一个客户那里借出25股的情况。

如果可供借出的股票超过借用需求,如何在多个客户之间分配借出份额?

如果我们股票收益提升计划的参与者可用以借出的股票数量大于借用需求,则借出份额将按比例分配。例如,可供借出XYZ数量为20,000股,而对于XYZ的需求只有10,000股的情况下,每个客户可以借出其所持股数的一半。

股票是只借给其它IBKR客户还是也会借给其它第三方?

股票可以借给IBKR客户和第三方。

股票收益提升计划的参与者可以自行决定哪些股票IBKR可以借出吗?

不能。此计划完全由IBKR管理,IBKR在确定了自己因保证金贷款扣押权可以借出的证券后,可自行决定哪些全额支付或超额保证金证券可以借出,并发起借贷。

通过股票收益提升计划借出去的证券其卖出是否会受到限制?

借出去的股票可随时卖出,没有任何限制。卖出交易的结算并不需要股票及时归还,卖出收益会按正常结算日记入客户的账户。此外,借贷会于证券卖出的下一个工作日开盘终止。

客户就通过股票收益提升计划借出去的股票沽出持保看张期权还能享受持保看涨期权保证金待遇吗?

可以。由于借出去的股票其盈亏风险仍然在借出方身上,借出股票不会对相关保证金要求造成任何影响。

借出去的股票由于看涨期权被行权或看跌期权行权被交付会怎么样?

借贷将于平仓或减仓操作(交易、被行权、行权)的T+1日终止。

借出去的股票被暂停交易会怎么样?

暂停交易对股票借出没有直接影响,只要IBKR能继续借出该等股票,则无论股票是否被暂停交易,借贷都可以继续进行。

借贷股票的抵押可以划至商品账户段冲抵保证金和/或应付行情变化吗?

不能。股票借贷的抵押不会对保证金或融资造成任何影响。

计划参与者发起保证金贷款或提高现有贷款金额会怎么样?

如果客户有全额支付的证券通过股票收益提升计划借出,之后又发起保证金贷款,则不属于超额保证金证券的部分将被终止借贷。同样,如果客户有超额保证金证券通过此计划借出,之后又要增加现有保证金贷款,则不属于超额保证金证券的部分也将被终止借贷。

什么情况下股票借贷会被终止?

发生以下情况(但不限于以下情况),股票借贷将被自动终止:

- 客户选择退出计划

- 转账股票

- 以股票作抵押借款

- 卖出股票

- 看涨期权被行权/看跌期权行权

- 账户关闭

股票收益提升计划的参与者是否会收到被借出股票的股息?

通过股票收益提升计划借出的股票通常会在除息日前召回以获取股息、避免股息替代支付。但是仍然有可能获得股息替代支付。

股票收益提升计划的参与者是否对被借出的股票保有投票权?

不能。如果登记日或投票、给予同意或采取其它行动的截止日期在贷款期内,则证券的借用者有权就证券相关事项进行投票或决断。

股票收益提升计划的参与者是否能就被借出的股票获得权利、权证和分拆股份?

可以。被借出股票分配的任何权利、权证和分拆股份都将属于证券的借出方。

股票借贷在活动报表中如何呈现?

借贷抵押、借出在外的股数、活动和收益在以下6个报表区域中反映:

1. 现金详情 – 详细列出了期初抵押(美国国债或现金)余额、借贷活动导致的净变化(如果发起新的借贷则为正;如果股票归还则为负)和期末现金抵押余额。

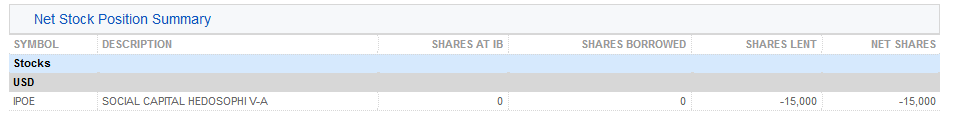

2. 净股票头寸总结 – 按股票详细列出了在IBKR持有的总股数、借入的股数、借出的股数和净股数(=在IBKR持有的总股数 + 借入的股数 - 借出的股数)。

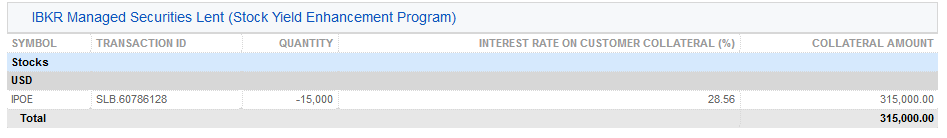

3. 借出的IBKR管理证券(股票收益提升计划) – 对通过股票收益提升计划借出的股票按股票列出了借出的股数以及利率(%)。

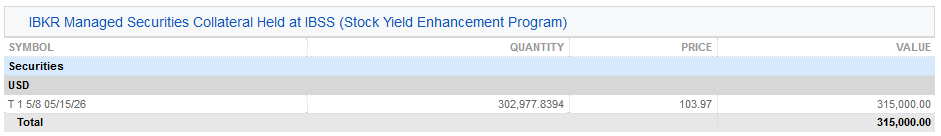

3a. 在IBSS保管的IBKR管理证券的抵押(股票收益提升计划)– IBLLC的客户会看到其报表中多出来一栏,显示作为抵押的美国国债以及抵押的数量、价格和总价值。

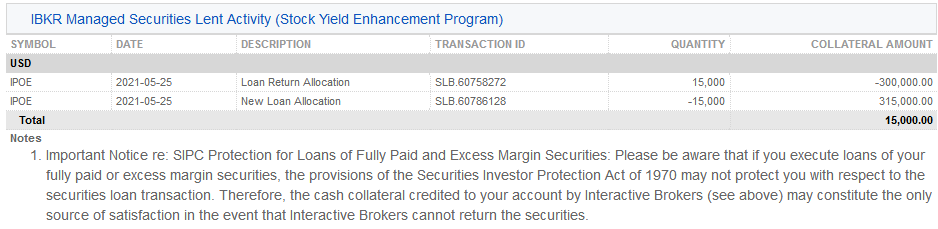

4. IBKR管理证券借出活动 (股票收益提升计划)– 详细列出了各证券的借贷活动,包括归还份额分配(即终止的借贷);新借出份额分配(即新发起的借贷);股数;净利率(%);客户抵押金额及其利率(%)。

5. IBKR管理的证券借出活动利息详情 (股票收益提升计划)– 按每笔借出活动详细列出了IBKR赚取的利率(%);IBKR赚取的收益(为IBKR从该笔借出活动赚取的总收益,等于{抵押金额 * 利率}/360);客户抵押的利率(为IBKR从该笔借出活动赚取的收益的一半)以及支付给客户的利息(为客户的现金抵押赚取的利息收入)

注:此部分只有在报表期内客户赚取的应计利息超过1美元的情况下才会显示。

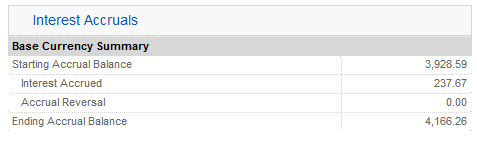

6. 应计利息 – 此处利息收入列为应计利息,与任何其它应计利息一样处理(累积计算,但只有超过$1美元才会显示并按月过账到现金)。年末申报时,该笔利息收入将上报表格1099(美国纳税人)。

Shorting US Treasuries

Interactive Brokers clients have the ability to gain direct exposure to US Treasuries on both the short and long side of the market.

Order Entry

Orders can be entered via TWS.

Cost to Borrow

The borrow fee to short US Treasuries is based on IBKR’s borrow cost and is subject to daily change. If the Treasury is borrowed by Interactive Brokers at the General Collateral rate, the customer does not incur a borrow fee.

Interest Income

Customers earn Short Credit Interest on their short US Treasury positions based on IBKR’s standard tiered rates.

.png)

Margin Requirements

Margin1 requirements on Short US Treasury positions are the same as Long US Treasury positions. The requirement is between 1% and 9%, depending on time to maturity. The proceeds of the short sale are not available for withdrawal. The amount available for withdrawal is generally Equity with Loan Value – Initial Margin.

Additional information on fixed income margin requirements can be found here.

Commissions

Selling short US Treasuries incurs the same commission cost as buying US Treasuries. IBKR’s commission schedule can be found here.

Trading Policy

Minimum short position size is $250,000 face value per CUSIP due to limitations of the US Treasury borrow market. Once the minimum position size is met, the minimum order increment is $250,000 for both short sales and buy to covers (as long as the resulting short position remains higher than the $250,000 face value minimum).

Short Sale Order Examples

| Existing US Treasury Short Position Face Value in Account (per CUSIP) | Face Value of Short Sale Order | Face Value of Resulting Position | Order Accepted? | Reason |

| Flat | $250,000 | $250,000 | Yes | Face Value of resulting position is => $250,000 |

| Flat | $100,000 | $100,000 | No | Face Value of resulting position is < $250,000 |

| $250,000 | $50,000 | $300,000 | No | Order increment < $250,000 |

| $250,000 | $250,000 | $500,000 | Yes | Order increment =>$250,000 |

Buy-to-cover orders that will result in a short US Treasury position of less than $250,000 face value will not be accepted.

Buy to Cover Order Examples

| Existing US Treasury Short Position Face Value in Account (per CUSIP) | Face Value of Buy to Cover Order | Face Value of Resulting Position | Order Accepted? | Reason |

| $500,000 | $250,000 | $250,000 | Yes | Face Value of resulting position is => $250,000 |

| $500,000 | $300,000 | $200,000 | No | Face Value of resulting position is < $250,000 |

| $500,000 | $500,000 | Flat | Yes | Order increment => $250,000 |

Payment in Lieu

When a short US Treasury position is held over the record date of an interest payment, the borrower’s account will be debited a payment-in-lieu of interest equal to the interest payment owed to the lender.

Eligible US Treasuries for Shorting

Only accounts carried under Interactive Brokers LLC and Interactive Brokers UK are eligible to short sell US Treasuries.

US Treasury Notes and Bonds with an outstanding value greater than $14 Billion can be sold short.

US Treasury Bills, TIPs, STRIPs, TF (Floating Rate Notes) and WITFs (When-Issued Floating Rate Notes) are not available for shorting.

Non-US sovereign debt is also not available for shorting.

1Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment.

For more information regarding margin loan rates, see ibkr.com/interest

Regulation SHO Rule 204, Closeouts, and Introducing Brokers

As a US registered broker-dealer, Interactive Brokers LLC (“IBKR”) is subject to Regulation SHO, a collection of US Securities & Exchange Commission rules relating to short-selling of equity securities. Rule 204 of Regulation SHO places certain requirements on clearing brokers in the event that they fail to deliver securities on settlement date in connection with a sale of those securities. This can happen for a variety of commonplace operational reasons, and does not indicate a problem at the clearing broker. In certain circumstances, Rule 204 may require a clearing broker to not permit shorting a security for a certain period of time (unless sufficient shares of that security are pre-borrowed to cover the order marked as a short sale).

Rule 204(a) requires that a clearing broker, if it fails to deliver on a sale trade on the settlement date, must closeout its fail by buying or borrowing the relevant security a specified number of trading days later (depending on whether the sale was long or short), prior to the opening of the regular trading session on that day.

Rule 204(b) provides that if the clearing broker does not closeout its fail in accordance with Rule 204(a), the broker may not accept short sale orders from its customers in the relevant stock (the stock in which the unclosed-out fail has occurred), or place such orders for its own account, unless it has first borrowed the shares of the relevant stock to cover the new short sale order. This is colloquially known in the securities industry as being in the “penalty box” for the relevant security. This restriction exists until the clearing broker has purchased shares in the amount of the unclosed-out fail, and that purchase has settled.

Any broker that executes trades through that clearing broker, and clears and settles those trades through that clearing broker, is subject to the same Rule 204(b) restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker.

Rule 204(c) requires clearing brokers to notify brokers from whom they receive trades for clearance and settlement of when they become subject to a short-sale restriction under Rule 204(b), and when that restriction ends. This is so that the notified brokers can avoid executing trades away from the clearing broker that are not permitted under the clearing broker’s short-sale restriction. If you have received a notice from IBKR regarding Rule 204(c), it generally means that IBKR's books and records show that you are an introducing broker or dealer that clears and settles trades through IBKR, and that also has the capability (or your client has such capability) of executing trades at away brokers or dealers for settlement through IBKR. You should not execute any short-sale order at an away broker-dealer in a security which we have notified you is shortsale restricted, unless you have first arranged to pre-borrow sufficient shares of that security through IBKR. For more information on pre-borrowing, please click here or contact us.

The above is a general description of Rule 204 of Regulation SHO, to aid our broker-dealer clients in understanding IBKR's obligations and why certain stocks may become unshortable at certain times irrespective of their availability to be borrowed. It is not legal advice and should not be used as such.

Operational Risks of Short Selling

Rate Risk

Holders of short call options can be assigned before option expiration. When the long holder of an option enters an early exercise request, the Options Clearing Corporation (OCC) allocates assignments to its members (including Interactive Brokers) at random. The OCC reports assignments to IBKR on the day of the long call exercise (T) but after US market hours. As such, option assignments are reflected in IBKR client accounts on the next business day (T+1), which is also the settlement date. The assignment causes a sale of the underlying stock on T, which can result in a short position if no underlying shares are held beforehand. Settled short position holders are subject to borrow fees, which can be high. Additionally, if IBKR cannot fulfil the short sale delivery obligation due to a lack of securities lending inventory on settlement date, the short position can be subject to a closeout buy-in.

Due to T+1 settlement mechanics described previously, traditional purchases to cover a short position on T+1 will leave the account with a settled short stock position for at least 1 night (or longer in case of a weekend or holiday).

Long in-the-money Puts are automatically exercised on expiration date. A short position as a result of the exercise carries the same risks as assigned short calls.

| Day | Short Sale | Buy to Cover | Settled Short Position | Borrow Fee Charged? | |

| Monday | OCC reports short call assignment to IBKR after market hours. | -100 XYZ stock Trade Date (T) |

Flat | No | |

| Tuesday | Call assignment and stock sale are reflected in the account | T+1 Settlement Date | +100 XYZ stock Trade Date (T) |

Yes | Yes |

| Wednesday | T+1 Settlement Date | Flat | No |

Special Risks Associated with ETN & Leveraged ETF Short Sales

Introduction

While account holders are always at risk of having a short security position closed out if IB is unable to borrow shares at settlement of the initial trade or bought in if the trade settles and the shares are recalled by the lender thereafter, certain securities have characteristics which may increase the likelihood of these events occurring. Two examples are leveraged Exchange Traded Funds (ETF) and Exchange Traded Notes (ETN), where the supply of shares available to borrow can be influenced by a number of factors not found with shares of common stock. An overview of these securities and these factors is provided below.

Overview

As background, an ETF is a security organized as a pooled investment vehicle that can offer diversified exposure or track a particular index by investing in stocks, bonds, commodities, currencies, options or a blend of assets. An ETF is similar to a mutual fund in that each share of an ETF represents an undivided interest in the underlying assets of the fund. However, unlike a mutual fund in which orders are only processed at a price determined at the end of the day, ETF shares are repriced and trade throughout the day on an exchange. To balance the supply and demand of shares and ensure that secondary market prices approximate the market value of the underlying assets, ETF issuers allow Authorized Participants (typically large broker-dealers) to create and redeem ETF shares in large blocks, typically 50,000 to 100,000 shares. While many ETFs invest solely in securities, others use debt or derivatives to track and/or magnify exposure to an index. The ProShares Ultra VIX Short-Term Futures ETF ( symbol: UVXY) is one example of a widely traded leveraged ETF.

ETNs are also securities that are repriced and trade throughout the day on an exchange and are designed to provide investors with a return that corresponds to an index. Unlike ETFs, however, ETNs are unsecured debt instruments and do not represent an interest in an underlying pool of assets. They do not pay interest like traditional debit instruments, but rather a promise to pay a specific return that typically corresponds to an index or benchmark. The Barclays iPath® S&P 500 VIX Short-Term Futures™ ETN (symbol: VXX) is one example of a widely traded ETN.

The supply of shares available to borrow in order to initiate or maintain a short sale position may be less stable for certain leveraged ETFs and ETNs, including UVXY and VXX, due to the following factors:

- Limited Authorized Participants: The number of Authorized Participants willing to issue ETFs, particularly those that invest in derivatives (e.g., futures contracts, swap agreements and forward contracts) rather than securities and seek performance equal to a multiple (i.e., 2x) or an inverse multiple (i.e., -2x) of a benchmark may be limited. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to minimize their exposure as a dealer.

- No Authorized Participants: As ETN shares represent credit instruments, the supply of such shares is determined solely by the issuing financial institution and Authorized Participants are not involved with the creation or redemption of shares. The ETN issuer typically reserves the right to limit, restrict or stop selling additional shares at any time.

- Limited Holding Period: Certain leveraged ETFs and ETNs seek to match the performance of a benchmark index for a single day rather than an extended period. They are principally used by institutional investors and other traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market. These factors can result in a higher rate of turnover and less stability of share inventory available to lend for short sales.

- Margin Considerations: Shares made available for lending to short sellers often originate from brokers who maintain a lien on the shares as they’ve financed the purchase of the shares on behalf of clients via margin loans. Clients purchasing shares using borrowed funds are subject to regulatory margin requirements, compliance to which depends in part upon the value of the shares supporting the loan. As certain leveraged ETFs/ETNs are designed to provide returns in multiples of their benchmark, the inherent volatility of these products may diminish clients’ ability to maintain the position and, in turn, the broker’s ability to lend the shares.