Information Regarding Australian Regulatory Status Under IBKR Australia

Introduction

Australian resident customers maintaining an account with Interactive Brokers Australia Pty Ltd (IBKR

Australia), which holds an Australian Financial Services License, number 453554, are initially

classified as a retail investor, unless they satisfy one or more of the requirements to be classified as a

wholesale or professional investor according to the relevant provisions of the Corporations Act 2001.

This article outlines how this process is handled by IBKR Australia.

Australian Regulatory Status

All new customers of IBKR Australia default to being classified as a retail investor unless they produce to

IBKR Australia the required documentary evidence to allow IBKR Australia to treat them as a wholesale or

professional investor. Investors of IBKR Australia will only have their regulatory status change from

retail investor to either wholesale or professional investor subsequent to the required

documentation being received and approved by IBKR Australia.

What is a Wholesale Investor?

The most common way to be classified as a wholesale investor is to obtain a qualified accountant’s

certificate stating that you have net assets or net worth of at least $2.5 million AUD OR have a gross

annual income of at least $250,000 AUD in each of the last two financial years. The qualified

accountant’s certificate is only valid for two years before it needs to be renewed. We have prepared a

wholesale investor booklet, including a pro forma certificate for your accountant to complete, that

can be downloaded [here].

What is a Professional Investor?

In order to qualify as a professional investor, you must have an AFSL, be a body regulated by APRA, be a superannuation fund (but not a SMSF) and/or have net worth or liquid net worth of at least $10 million AUD. If you meet ONLY the financial criteria (i.e. net worth or liquid net worth of at least $10 million AUD), you will need to complete and submit to IBKR Australia the professional investor declaration contained within the professional investor booklet that we have prepared, which can be downloaded [here]. However, if you meet the criteria by virtue of having an AFSL, being a body regulated by APRA, or as a listed company (but not a SMSF), no booklet needs to be submitted.

What about Self-Managed Super Funds (SMSF’s)?

IBKR Australia have decided to treat all SMSF’s as retail investors, notwithstanding that they may meet the requirements to otherwise be classified as a wholesale or professional investor.

What about trusts?

For a trust to be considered as a wholesale investor, all trustees must be considered a wholesale

investor based on the tests described above.

Similarly, for a trust to be considered as a professional investor, all trustees must be considered a

professional investor based on the tests described above.

As a result, if at least one trustee is considered retail, the trust is considered a retail trust, regardless

of the status of any other trustees (if applicable).

Other

- For a full list of the disclosure documents and legal terms which govern the services IBKR Australia will make available please refer to the IBKR website.

- For further information on IBKR Australia, click on our Financial Services Guide.

- For more information or assistance, please contact IBKR Investor Services.

法律实体识别号码概况

背景

法律实体识别号码(LEI)是一个20位的参考代码,该代码能够标识参与全球各市场或司法辖域的金融交易的独立法律实体。LEI体系是G20集团根据ISO标准发展而来的,由LEI的签发机构——当地运营单位(LOU)提供注册和延期服务。为参与金融交易的每一家法律实体提供独特的识别号码(以及与实体相关的关键参考信息)的目的是提高市场透明度。

DTC和SWIFT充当美国的LEI签发方,且有专门的网站负责分配新的LEI和提供已有LEI的搜索服务。详情请见:http://www.gmeiutility.org/

需使用LEI的情况

在某些情况下,法律法规会要求经纪商报告有关客户的信息,这其中就包括客户识别信息。对于诸如信托和机构等实体,该识别信息即为LEI。需报告LEI的情况包括:

CFTC所有权及控制权报告

MIFIR交易报告

中国股票互联互通

EMIR交易信息库报告

获取LEI

法律实体可联系经授权的LEI签发机构(也称为当地运营单位/LOU)获取LEI。DTC和SWIFT充当美国的LEI签发方,且有专门的网站负责LEI注册和延期。请注意,LEI申请人可使用任何被认可的LOU的服务,不限于其所在国家的LEI签发机构。

此外,作为向客户提供的一项服务,IBKR会通过账户管理向需要LEI用于交易或满足其它监管报告职能的实体发送邀请。通过该邀请,客户可授权IBKR通过DTC的加速通道(需3个工作日)请求LEI,之后再从客户的账户中扣取申请费用和年度延期费用。

针对大麻类证券的清算所限制

斯图加特交易所(Boerse Stuttgart)和明讯银行(Clearstream Banking)宣布其将不再对主营业务与大麻及其它毒品直接或间接相关的证券提供服务。因此,该等证券将不会再于斯图加特(SWB)或法兰克福(FWB)证券交易所交易。自2018年9月19日收盘开始,IBKR将采取以下行动:

- 对于客户未采取行动平仓,但也不能转至美国挂牌市场的受影响头寸,进行强制平仓;

- 对于客户未采取行动平仓,但能够转至美国挂牌市场的受影响头寸,将股票转至其美国挂牌市场。

下方表格列出了斯图加特交易所和明讯银行截至2018年8月7日公布的受影响证券。该表格还标记了受影响证券是否能够转至美国挂牌市场。注意,清算所已声明该列表可能尚不完整,建议客户检查其各自网站了解最新信息。

| ISIN | 名称 | 交易所 | 是否可转至美国? | 美国代码 |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | 是 |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | 是 |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | 是 |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | 是 |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | 是 |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | 是 |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | 是 |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | 是 |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | 是 |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | 是 |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | 是 |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | 是 |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | 是 |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | 否 | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | 否 | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | 否 | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | 否 | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | 否 |

重要注意事项:

- 请注意,美国挂牌证券通常为场外交易(PINK),且以美元(而非欧元)计价,因此,除市场风险外,您还将面对汇率风险。

- 持有粉单(PINK Sheet)证券的账户持有人需要有美国(仙股)交易许可才能下达开仓定单。

- 拥有美国(仙股)交易许可之账户的所有使用者均须使用双因素验证登录账户。

Clearinghouse Restrictions on Cannabis Securities

Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Consequently, those securities will no longer trade on the Stuttgart (SWB) or Frankfurt (FWB) stock exchanges. Effective as of the 19 September 2018 close, IBKR will take the following actions:

- Force close any impacted positions which clients have not acted to close and that are not eligible for transfer to a U.S. listing; and

- Force transfer to a U.S. listing any impacted positions which clients have not acted to close and that are eligible for such transfer.

Outlined in the table below are impacted issues as announced by the Boerse Stuttgart and Clearstream Banking as of 7 August 2018. This table includes a notation as to whether the impacted issue is eligible for transfer to a U.S. listing. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information.

| ISIN | NAME | EXCHANGE | U.S. TRANSFER ELIGIBLE? | U.S. SYMBOL |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | YES |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | YES |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | YES |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | YES |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | YES |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | YES |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | YES |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | YES |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | YES |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | YES |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | YES |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | YES |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | YES |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

IMPORTANT NOTES:

- Note that the U.S. listings generally trade over-the-counter (PINK) and are denominated in USD not EUR thereby exposing you to exchange rate risk in addition to market risk.

- Account holders maintaining PINK Sheet securities require United States (Penny Stocks) trading permissions in order to enter opening orders.

- All users on accounts maintaining United States (Penny Stocks) trading permissions are required use 2 Factor login protection when logging into the account.

打包零售和保险类投资产品法规(PRIIP)

“打包零售投资和保险类投资产品法规” - 欧盟编号1286/2014(“PRIIP法规”或“PRIIP”)签署于2014年12月29日,其规定于2018年1月1日生效。法规要求产品生产者创建并维护关键信息文件(KID),销售或就打包零售投资和保险类投资产品提供咨询建议的人士向所有在欧洲经济区(EEA)的零售投资者提供关键信息文件,以帮助这些投资者更好地了解和比较产品。英国金融市场行为监管局(FCA)对英国居民也有同等的要求。

PRIIP法规的目的。

自2008年金融危机以来,欧盟委员会的主要目标之一即为加强投资者保护以及重建公众对金融市场的信心。

法规提出了新的标准化“关键信息文件(KID)”,以提升零售投资者对打包零售投资和保险类投资产品的了解,并能更好地比较这些产品。打包零售投资和保险类投资产品是指向投资者支付的金额随参照值变动而变动的任意投资产品。除保险产品外,PRIIPs还包括ETF、期权、期货、差价合约和结构化产品等。

该法规是一项投资者保护法规,其主要目标为:

- 确保投资者能理解并比较相似的产品,从而做出投资决策。

- 提高零售投资市场的透明度及公众的信心。

- 促进一体化欧盟保险市场的形成。

法规旨在通过规定关键信息文件的标准格式和内容来达成以上目标。

什么是关键信息文件?

关键信息文件是一份3页的文件,包括有关产品的重要信息,如产品的一般描述、成本、风险回报情况及可能的业绩情境。

该法规适用于哪些实体?

法规适用于打包零售投资和保险类投资产品的生产者和经销商。创建并维护文件的责任由产品生产者承担。然而,任何销售、就打包零售投资和保险类投资产品向零售投资者提供咨询建议、或接受零售投资者的买入该类产品的定单的经销商或金融中介机构都必须向投资者提供关键信息文件。这也适用于仅执行的线上环境。

谁应收到关键信息文件?

居住在欧洲经济区的零售投资者应在投资打包零售投资和保险类投资产品前收到关键信息文件。如生产者不提供关键信息文件,欧洲经济区的零售客户将无法交易该产品。

通常,关键信息文件必须以客户常住国家的官方语言提供。

但是,IBKR的客户已同意接收英语通讯,因此,关键信息文件的语言为英语,所有欧洲经济区客户和英国客户,无论其法定居住国家,均可交易该等产品。

如果关键信息文件的语言不是英语,而是其它语言,比如德语,则只有常住在以该语言为官方语言之国家(在该例子中为德国、奥地利、比利时、卢森堡或列支敦士登)的零售客户可以交易PRIIP。

对盈透证券的影响:

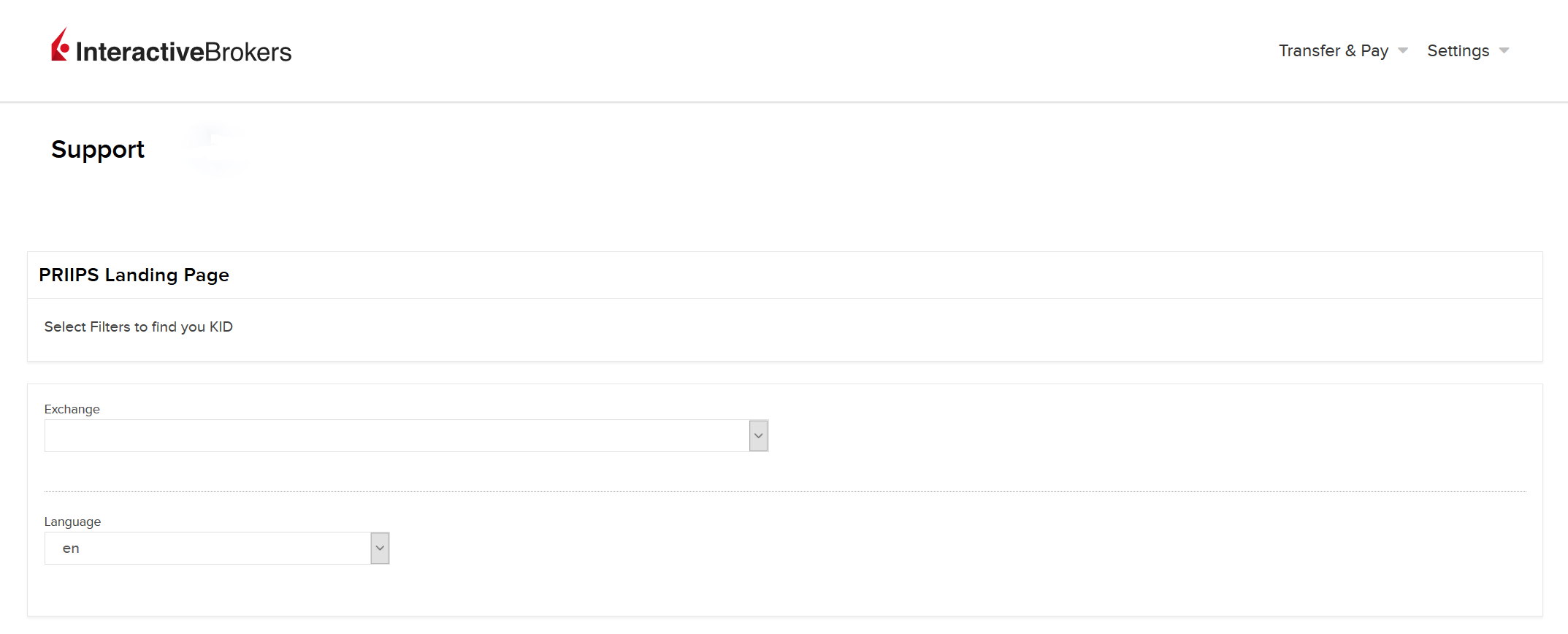

为遵守PRIIP法规,IB英国将通过网站以电子化的形式提供关键信息文件(“PRIIP关键信息文件登陆页”)。

我在哪里可以找到PRIIP关键信息文件登陆页?

关键信息文件可通过我们专门的PRIIP关键信息文件登陆页找到。您可通过三种不同的方式找到关键信息文件。即通过IBKR交易者工作站(“TWS”)、IBKR网站和客户端均可找到。

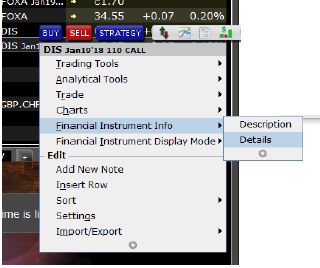

1. 通过TWS找到关键信息文件:

- 登录TWS

- 右击您想要获取关键信息文件的产品代码。

- 在金融产品信息下选择“详情”。

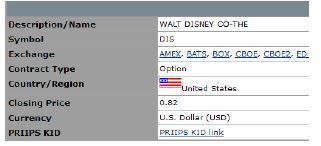

- 在合约详情页面,您可选择PRIIP关键信息文件链接。这将带您前往客户端中的PRIIP关键信息文件登陆页。

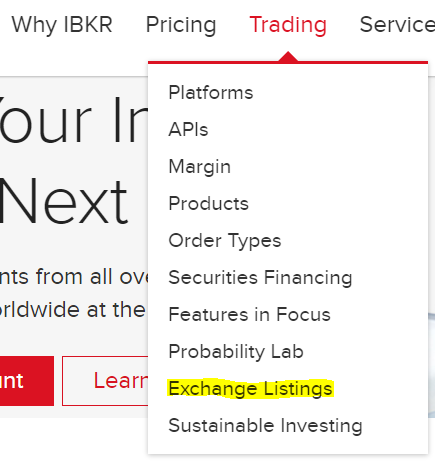

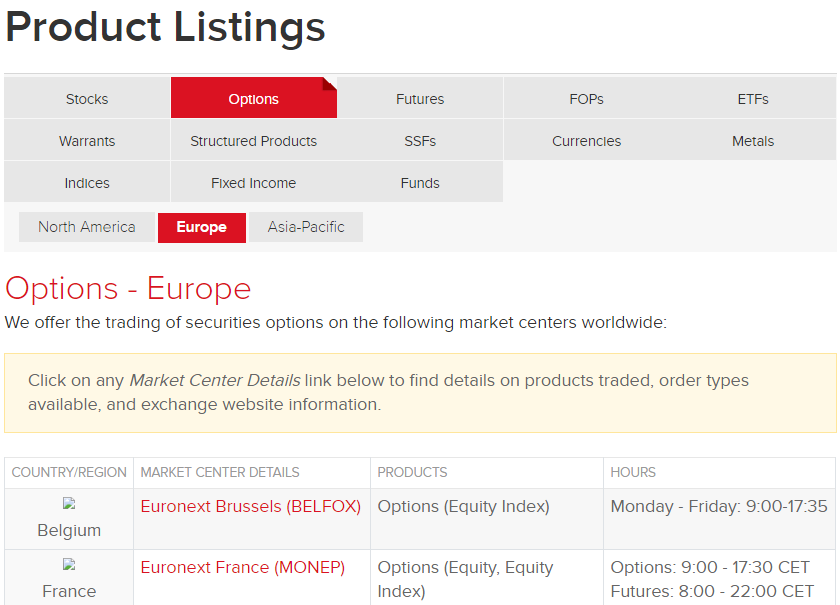

2. 通过IBKR网站找到关键信息文件:

- 打开“交易”标签并选择“交易所列表”。

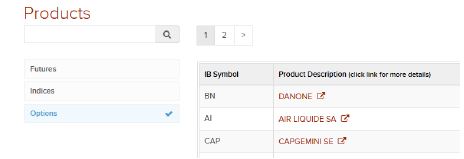

- 从这里选择“产品列表”。选择您想要获得合约信息的产品的衍生品类型、区域和交易所。

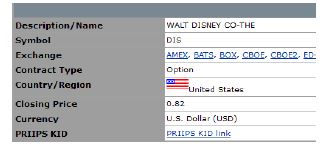

- 选择您想要查看关键信息文件的产品,转至合约详情页面。

- 在如下所示的合约详情页面上,您可点击PRIIPs关键信息文件链接,即可转至客户端中的PRIIP关键信息文件登陆页。

3. 通过客户端找到关键信息文件:

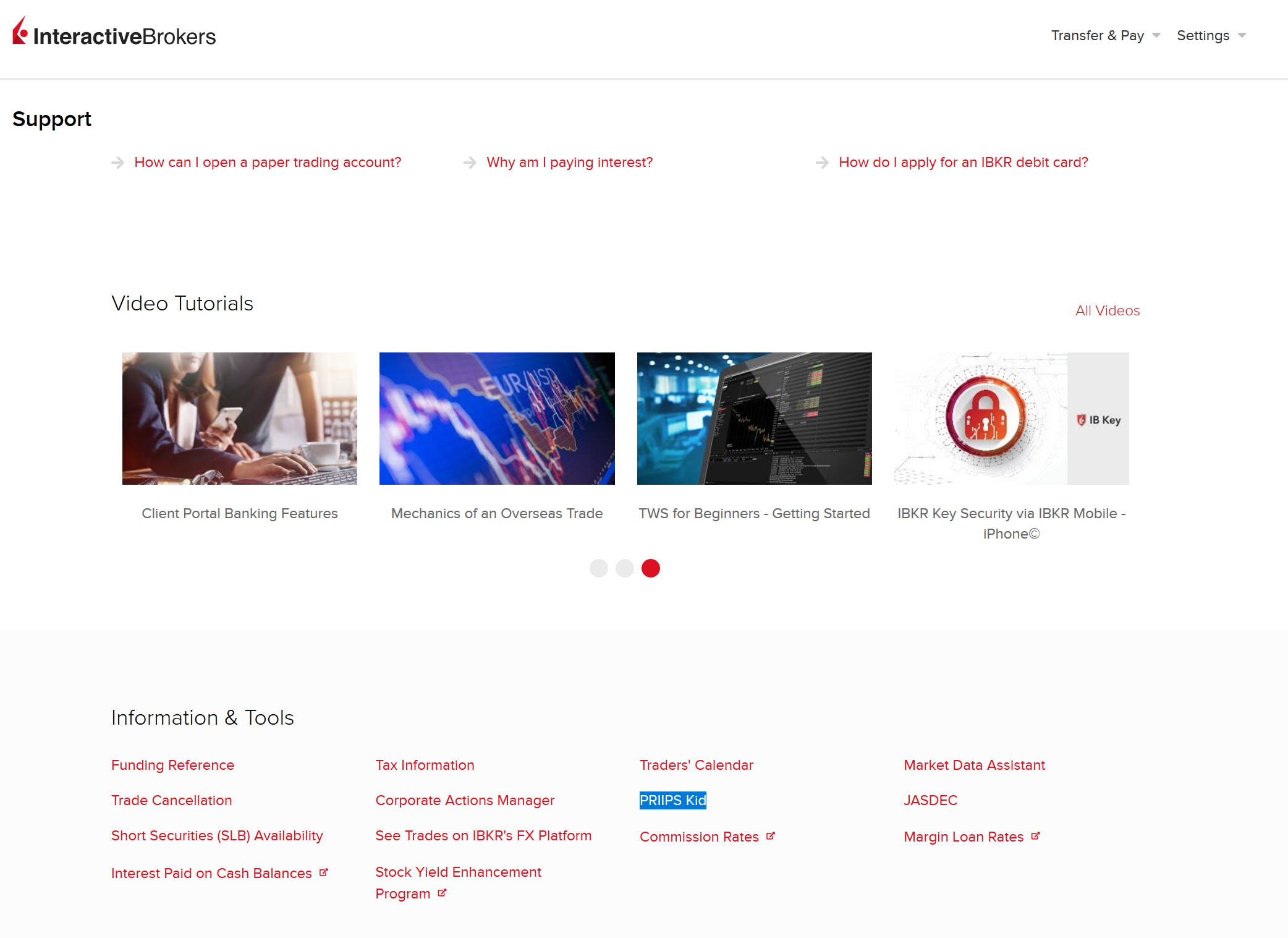

- 登录客户端。

- 点击“帮助”(?)图标进入“支持中心”。

- 在“信息与工具”部分,选择“PRIIP关键信息文件”,即可前往PRIIP关键信息文件登陆页。

我有可能通过差价合约投资美国ETF/其它PRIIP限制产品吗?

投资者在交易差价合约时有可能可以获得美国ETF/其它PRIIP限制产品的风险敞口,因为有些差价合约就是设计成跟踪底层资产(包括ETF和其它PRIIP产品)的表现的。

如果投资者交易的差价合约就是追踪美国ETF或其它PRIIP产品的表现的,则投资者也可能是在间接投资其底层资产。这是因为差价合约的价值是基于底层资产的价值确定的,底层资产价值的任何盈亏都会反映在差价合约的价值当中。

Legal Entity Identifier Overview

BACKGROUND

The Legal Entity Identifier (LEI) is a 20-digit reference code that uniquely identifies legally distinct entities engaging in financial transactions globally, and across markets and jurisdictions. The LEI system was developed by the G-20 in accordance with ISO standards and the issuers of LEIs, referred to as Local Operating Units (LOU), supply registration and renewal services. Providing a unique identifier for each legal entity (along with key reference information associated with the entity) participating in financial transactions is intended to promote transparency.

DTC, in collaboration with SWIFT, operate as the local (U.S.) source provider of LEIs and maintains a website for the assignment of new and search of existing LEIs. See: http://www.gmeiutility.org/

SITUATIONS REQUIRING A LEI

In certain instances, brokers are required by regulation to report information regarding a client and include in that information a client identifier. For entities such as trusts and organizations, that identifier is referred to an a LEI. Examples of these reporting instances include the following:

CFTC Ownership and Control Reporting

MiFIR Transaction Reporting

China Stock Connect

EMIR reporting to trade repository

OBTAINING THE LEI

A LEI can be obtained by contacting an authorized LEI issuer, also referred to as a Local Operating Unit (LOU). The DTC, in collaboration with SWIFT, operates as a U.S. LOU and maintains a website for purposes of LEI registration and renewal. Note that LEI applicants can use the services of any accredited LOU and are not limited to using an LEI issuer in their own country.

In addition, as a service to its clients, IBKR will send an invite via Account Management to those who are required to obtain a LEI for trading or other regulatory reporting functions. Through this invite, the client can authorize IBKR to request an LEI through DTC on an accelerated basis (24 hours) and debit the client's account for the application fee and the annual renewal fee thereafter.

中国股票交易“北向通”投资者ID模型

2017年11月,香港证监会(SFC)和中国证监会(CSRC)宣布就大陆-香港股票互联互通机制下的“北向通”交易推出投资者识别体系。该体系旨在增强对香港投资者交易大陆股票的合规监管,要求经纪商向上海证交所或深圳交易所报告客户的身份。 该法规自2018年9月26日起生效。 更多信息请见以下常见问题。

股票互联互通机制是香港、上海和深圳证券交易所间的合作项目,该机制使国际投资者和中国大陆投资者得以通过其所属交易所的交易和清算设施交易其它证券交易所的证券。

“北向通”交易是指通过香港证券交易所交易在中国大陆上市的股票(即在上交所或深交所上市的股票)。

要收集和报告的信息取决于客户分类。对于个人,要收集和报告的信息如下:

- 中英文姓名

- 身份证件的签发国家/司法辖域

- 身份证件类型(香港身份证、相关国家/地区政府机关签发的身份证、护照、或其它任意官方的身份证明文件,如驾照)

- 身份证号码(身份证明文件号码)

- 实体名称

- 其它正式的成立文件(IBKR会尽可能使用客户开户时提供的文件)。

- 法律实体识别号码(如您没有LEI,您可在请求“互联互通”交易许可时通过IBKR申请一个。请注意,申请LEI最长可能需要三天,需向LEI签发机构缴纳申请费,之后每年还需续费)。

想通过股票互联互通机制交易的客户必须同意IBKR向香港交易及结算所有限公司和中国的监管机构提供其信息,其中中国的监管机构包括:

- 上海和深圳证券交易所

- 中国证券登记结算(香港)有限公司

- 中国大陆的监管机构和执法机关

已有“北向通”交易许可的客户在登录账户管理时即会看到一份在线表格。该表格将授权IBKR收集必要的信息并就提交定单时分享该信息征求客户同意。

“北向通”投资者ID模型将于2018年10月22日实施。

SFC和CSRC也同意在“北向通”投资者ID模型成功实施后尽快为“南向通”建立类似的投资者识别体系。

“北向通”投资者ID模型实施后,客户若不提供必要的信息或不同意我们报告必要的信息,则其将无法提交“北向通”开仓定单,但可平仓已有头寸。

要交易中国股票互联互通机制下的股票,客户需登录账户管理请求相应的交易许可:设置 -> 账户设置 -> 交易许可 -> 香港/中国股票互联互通。

PRIIP Order Reject Translations

Clients entering opening orders for products covered by the PRIIPs Regulation where the issuer has not provided the required disclosure documents or Key Information Documents (KIDS) will have their order rejected and will receive the following reject message:

English

This product is currently unavailable to clients classified as 'retail clients'.

Note: Individual clients and entities that are not large institutions generally are classified as 'retail' clients.

There may be other products with similar economic characteristics that are available for you to trade.

French

Ce produit n’est pas actuellement disponible pour les clients considérés comme des clients “Particuliers/de détail”. Remarque : les clients particuliers et entreprises de détail qui ne sont pas de larges établissements sont classifiés comme des clients “de détail”.

D’autres produits aux caractéristiques similaires peuvent exister mais ne vous sont pas proposés au trading.

German

Dieses Produkt ist derzeit für Kunden, die als „Retail-Kunden” eingestuft werden, nicht verfügbar. Hinweis: Einzelkunden und Körperschaften, bei denen es sich nicht um große Institutionen handelt, werden grundsätzlich als „Retail”-Kunden bezeichnet.

Es ist möglich, dass Ihnen andere Produkte mit ähnlichen wirtschaftlichen Merkmalen zum Handel zur Verfügung stehen.

Italian

Questo prodotto al momento non è disponibile per i clienti “retail”. Nota: i clienti privati e le organizzazioni di non grandi dimensioni sono in genere classificati come clienti “retail”.

Potrebbero esserci altri prodotti con simili caratteristiche disponibili per le negoziazioni.

Spanish

Este producto no está actualmente disponible para clientes clasificados como “clientes minoristas”. Nota: los clientes individuales y las entidades que no sean grandes instituciones son clasificados, generalmente, como clientes “minoristas”.

Podría haber otros productos con características económicas similares que estén disponibles para que usted opere en ellos.

Russian

На данный момент этот продукт недоступен для розничных клиентов. Примечание: Частные лица и юридические структуры, не являющиеся крупными предприятиями, как правило, относятся к числу розничных клиентов.

Вам могут быть доступны другие продукты с похожими экономическими характеристиками.

Japanese

こちらの商品は現在「リテール・クライアント」として分類されるお客様にはご利用いただけません。注意:大きな機関ではない個人のお客様および事業体のお客様は、通常「リテール」クライアントとして分類されます。

似た経済特性を持つその他の商品で、お客様にお取引いただくことのできる商品がある可能性があります。

Chinese Simplified

该产品目前不适用于"零售客户"。 请注意:个人用户和非大型机构实体通常均被划分为"零售"客户。

可能有其他具有类似经济特征的产品适用于您的交易。

Chinese Traditional

該產品目前不適用於"零售客戶"。請注意: 個人用戶和非大型機構實體通常均被劃分為"零售"客戶。

可能有其他具有類似經濟特徵的產品適用於您的交易。

Please note, it is possible to be reclassified from Retail to Professional once certain qualitative, quantitative and procedural requirements are met. For more information on requirements, please see: How can I update my MiFID client category?

China Connect Northbound Investor ID Model

In November 2017, the Securities and Futures Commission (SFC) and China Securities Regulatory Commission (CSRC) announced an agreement to introduce an investor identification regime for Northbound trading under Mainland-Hong Kong Stock Connect. This regime is intended to enhance regulatory surveillance of mainland-listed stock trading from Hong Kong and requires brokers to report the identity of clients submitting orders to either the Shanghai or Shenzhen Stock Exchange. This regulation will be effective as of September 26, 2018. Additional information is provided in the series of FAQs below.

The Stock Connect is a collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges which allows international and Mainland Chinese investors to trade securities in each other's markets through the trading and clearing facilities of their home exchange.

Northbound trading refers to the trading of mainland-listed stocks (e.g., Shanghai and Shenzhen Stock Exchanges) from the Hong Kong Stock Exchange.

The information collected and reported depends upon the client classification. In the case of individuals, the information is as follows:

- Name in English and Chinese

- ID issuing country/jurisdiction

- ID type (Hong Kong ID card, ID card issued by the government authority of relevant country/region, passport, or any other official identity document e.g. driver's license)

- ID number (number of ID document)

- Entity name

- Other official incorporation documents (IBKR will attempt to us the documents clients provided at the point of account opening, whenever possible).

- Legal Entity Identifier (if you do not already have an LEI, you can order one through IBKR when requesting trading permissions for China Connect. Note that obtaining a LEI can take up to three days, is associated with an application fee imposed by the LEI issuing organization, and an annual renewal fee thereafter).

Clients who wish to access the Stock Connect must provide IBKR with consent to provide their information to the Hong Kong Exchanges and Clearing Ltd and the Chinese regulatory bodies such as:

- Shanghai and Shenzhen Stock Exchanges

- China Securities Depository and Clearing (Hong Kong) Company Limited

- Mainland regulatory authorities and law enforcement agencies

Clients with existing Northbound trading permissions will be presented with the online form upon log in to Client Portal. This form will allow IBKR to collect the required information and consent to submit this information upon order submission.

The Northbound Investor ID model will be effective as of October 22, 2018.

The SFC and the CSRC also agreed to introduce a similar investor identification regime for Southbound trading as soon as possible after the regime for Northbound trading is implemented.

Once the Northbound Investor ID model is in effect, clients who either fail to provide the required information or elect not to provide consent to report the required information will not be allowed to submit opening Northbound orders but will be allowed to close existing positions.

In order to trade China Connect stocks clients are required to login to Client Portal and request the necessary trading permissions. To do so:

- Log into Client Portal

- Click the User menu (head and shoulders icon in the top right corner) followed by Manage Account

- If you manage multiple accounts, select an account by clicking on the account number to popup the Account Selector

- Click the Configure (gear) icon next to Trading Experience & Permissions

- Click on "Stocks" and check the box next to "Hong Kong/China Stock Connect"

- Click CONTINUE and follow the prompts on screen.

China Connect - Disclosure Obligation and Foreign Shareholding Restriction

The following is a high-level summary of the disclosure obligations and foreign investors’ shareholding restriction applicable to the trading of Shanghai Stock Exchange (SSE) Securities or Shenzhen Stock Exchange (SZSE) Securities under Stock Connect.

Both Interactive Brokers, in its role as a China Connect Exchange Participant, and investors trading SSE/SZSE Securities through Interactive Brokers are required to comply with these requirements.

I. Disclosure Obligation

- When an investor holds or controls up to 5% of the issued shares of a Mainland listed company, the investor is required to report in writing to the China Securities Regulatory Commission (“CSRC”) and the relevant exchange, and inform the Mainland listed company within three working days of reaching 5%.

- The investor is not allowed to continue purchasing or selling shares in that Mainland listed company during the three day notification period.

- For such investor, whenever there is an increase or decrease in his shareholding that equals or exceeds 5% of the existing holdings, he is required to make disclosure within three working days of the change. From the day the disclosure obligation arises to two working days after the disclosure is made, the investor may not buy or sell the shares in the relevant Mainland listed company.

- If a change in shareholding of the investor is less than 5% but results in the shares held or controlled by him/her falling below 5% of the relevant Mainland listed company, the investor is required to disclose the information within three working days of the event.

II. Shareholding Restriction

- A single foreign investor’s shareholding in a Mainland listed company is not allowed to exceed 10% of the company’s total issued shares, while all foreign investors’ shareholding in the A shares of the listed company is not allowed to exceed 30% of its total issued shares.

- When the aggregate foreign shareholding of an individual A share reaches 26%, SSE or SZSE will publish a notice on its website.

- Once SSE or SZSE informs the Stock Exchange of Hong Kong Limited (SEHK) that the aggregate foreign shareholding of an SSE or SZSE Security reaches 28%, further Northbound buy orders in that SSE or SZSE Security will not be allowed, until the aggregate foreign shareholding of that SSE or SZSE Security is sold down to 26%.

- If the 30% threshold is exceeded due to Shanghai Connect or Shenzhen Connect, HKEX will identify the relevant China Connect Exchange Participant and require it to follow the forced-sale requirements, whereupon the foreign investors concerned will be requested to sell the shares on a last-in-first-out basis within five trading days of notifying the relevant China Connect Exchange Participant.

III. Additional Information

For additional information, including details of position disclosure and restriction, please refer to the following website links:

Stock Connect FAQ (10 April 2017): http://www.hkex.com.hk/-/media/hkexmarket/mutual-market/stock-connect/getting-started/information-bookletand-faq/faq/faq_en

Chapter 14A China Connect Service - Shanghai:

http://www.hkex.com.hk/-/media/hkex-market/services/rules-and-forms-andfees/rules/sehk/securities/rules/chap-14a_eng

Chapter 14B China Connect Service - Shenzhen:

http://www.hkex.com.hk/-/media/hkex-market/services/rules-and-forms-andfees/rules/sehk/securities/rules/chap-14b_eng