FAQS: IBIE Account Transfer

This is an important document regarding the proposed transfer of your account from IBUK and IBLLC to IBIE that requires your attention. Please read the entirety of this document ahead of taking any action referred to in the Covering Letter sent to you via email.

Please take time to read these FAQs, which summarise some of the key changes to the regulatory framework which will be brought about by the Proposed Transfer (as described below) and provide answers to some of the more general questions that you may have. The FAQs should be read in conjunction with the Covering Letter. If you require any further information, please get in touch with us using the contact details provided in the Covering Letter.

Discussion:

The FAQs are split into three parts.

- Part A sets out key information in relation to the Proposed Transfer (as described below).

- Part B covers key legal and regulatory topics that arise as a result of the Proposed Transfer (as described below).

- Part C aims to answer any other questions that you may have and provides some further and more practical information in relation to what will and will not be changing following the Proposed Transfer (as described below).

PART A – THE PROPOSED TRANSFER

1. What is the situation currently?

As you will be aware, at present, your relationship with Interactive Brokers is led by our entity based in the United Kingdom, specifically Interactive Brokers (U.K.) Limited (“IBUK”) and the services provided to you are provided by IBUK and, depending on the products you do business in, our US affiliate Interactive Brokers LLC (“IBLLC”).

2. What is Interactive Brokers requesting?

We are inviting all clients domiciled in the European Economic Area (“EEA”) to transfer their accounts to one of our brokers based in Europe.

We propose to transfer the relationship that you currently have with IBUK and IBLLC to Interactive Brokers Ireland Limited (“IBIE”), an Interactive Brokers investment firm located in Ireland. It is our intention that all of your accounts, investments and services currently provided to you by IBUK and IBLLC will instead be singularly provided by IBIE (for convenience we will refer to this as the “Proposed Transfer”).

3. Who is IBIE? What sort of a firm is it?

IBIE is an investment firm regulated by the Central Bank of Ireland and authorised pursuant to the second Markets in Financial Instruments Directive (Directive 2014/65/EU). IBIE is an affiliate of IBUK and IBLLC.

4. What are IBIE’s legal details?

Interactive Brokers Ireland Limited is registered as a private company limited by shares (registration number 657406) and is listed in the Register of Companies maintained by the Irish Companies Registration Office. Its registered address is 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. IBIE can be contracted by telephone at 00800-42-276537 or electronically through the IBIE website at www.interactivebrokers.ie.

5. Who regulates IBIE and what are their contact details?

As set out above the Central Bank of Ireland is the competent regulator for IBIE (in the same way that the Financial Conduct Authority is the competent regulator for IBUK). IBIE is included in the Central Bank of Ireland’s register of authorised firms under number 423427. The Central Bank of Ireland’s contact details are set out below:

Location

The Central Bank of Ireland

New Wapping Street

North Wall Quay

Dublin 1

D01 F7X3

Contact Numbers

Phone: +353 (0)1 224 6000

Fax: +353 (0)1 224 5550

Postal Address

Central Bank of Ireland

P.O. Box 559

Dublin 1

Public Helpline

E-mail: enquiries@centralbank.ie

Lo-Call: 1890 777 777

Phone: +353 (0)1 224 5800

6. Where does IBIE fit with respect to the broader Interactive Brokers group?

IBIE is a wholly-owned subsidiary that sits within the broader Interactive Brokers Group.

7. What does the Proposed Transfer mean for me? Will there be any material impacts?

We do not anticipate any material impacts for you as a result of the Proposed Transfer. Nonetheless, it is very important that you read these FAQs carefully and in full and make sure that you understand what the changes are for you.

8. What do I have to do if I want to continue doing business with Interactive Brokers?

If you would like to continue to do business with Interactive Brokers, we require your cooperation and action.

Specifically, we need you to consent and agree to the Customer Agreement and other Documents available under the Important Information section of the Proposed Transfer process and to the regulatory matters outlined in the Covering Letter, the Important Information and Consent sections of the Proposed Transfer process. You can do this by following the instructions in the Covering Letter.

To be clear, you do not have to consent to the Proposed Transfer if you feel that you may be adversely affected by it. You have the option of transferring your positions to another broker or closing your positions and transferring any cash balance to another account.

If you do not take action by December 7, 2022, your account will be restricted from opening new transactions or transferring in new assets. You always have the ability to transfer your account to another broker. If you wish to decline, please follow the instructions in the Covering Letter.

In either case, we ask that you read the entirety of this FAQs and the Covering Letter before deciding to consent to or decline the Proposed Transfer.

9. What happens next?

If you consent to the transfer, please complete all actions detailed in the Covering Letter and we will prepare your account to be transferred to IBIE. Once your account is transferred, IBIE will write to you with further information about your new relationship with them.

PART B – LEGAL AND REGULATORY CHANGES THAT YOU SHOULD BE AWARE OF

1. What terms and conditions will govern my relationship with IBIE following the Proposed Transfer? Are these different to the ones that currently apply?

Trades that you conduct after the Proposed Transfer will be governed by the new Customer Agreement between you and IBIE. A copy of the IBIE Customer Agreement is available in the Important Information section of the Proposed Transfer process.

2. What conduct of business rules (including best execution) will apply to my relationship with IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

There are some changes to be aware of, which we explain below.

If you do business with IBUK on a “carried” basis (in other words, you trade index options, futures and futures options and IBUK carries your account and custodies your assets) then the Financial Conduct Authority’s conduct of business rules currently apply to you. These rules are based heavily on the recast Markets in Financial Instruments Directive, the Markets in Financial Regulation and various delegated directives and regulations (collectively, “MiFID”). In relation to best execution, where it applies, IBUK must take all sufficient steps to achieve the best possible result for you when we execute your order.

If you currently do business with IBUK on an “introduced” basis (in other words, you trade products outside of those mentioned in the previous paragraph and you have a relationship with both IBUK and its US affiliate, IBLLC) a mix of conduct of business rules will currently apply to you. For instance, with respect to the introduction of your business to IBLLC, the Financial Conduct Authority’s conduct of business rules will apply (see above in relation to these). Once introduced to IBLLC, the relevant U.S. Securities and Exchange Commission and U.S. Commodity Futures Trading Commission rules and regulations (among others) will apply to IBLLC’s role (including its obligations in relation to best execution and custody).

Please note that it is of course possible that your business is split across these two scenarios (in other words some of your business is conducted on a “carried” basis while some of it is conducted on an “introduced” basis).

Going forward, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish conduct of business rules will exclusively apply to your relationship with IBIE. Similar to the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID and IBIE’s obligations in relation to best execution will largely mirror those that currently apply to IBUK.

In our view, while the rules that apply to our relationship will change, we do not consider such changes to be material or to result in a lesser degree of protection being afforded to you.

3. How will my investments that I custody with IBIE be held from a legal/regulatory perspective? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

The rules that currently apply depends on the sort of business that you presently have with IBUK (please see the response to Question B2 above). Where you conduct “carried” business with IBUK, the Financial Conduct Authority’s client asset (or “CASS”) rules will apply. These rules are based heavily on MiFID. Where you conduct “introduced” business with IBUK and IBLLC, the US custody rules will apply to your custody assets.

Going forward, as set out above, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish custody rules will exclusively apply to your relationship with IBIE. Like the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID. Please consult the Client Assets Key Information Document provided in the Important Information section in relation to the Irish custody regime.

4. How am I protected against loss? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

Currently, your eligible assets are protected from loss either under the US Securities Investor Protection Corporation at an amount of up to USD 500,000 (subject to a cash sublimit of USD 250,000) or the UK Financial Services Compensation Scheme at an amount up to GBP 50,000 (which regime applies depends on the relevant segment of your IBUK account, as explained in the response to Question B2 above). After the Proposed Transfer, the Irish Investor Compensation Scheme, which is administered by The Investor Compensation Company DAC, may protect your assets from loss should IBIE default and be unable to meet its obligations to you.

Ireland’s compensation scheme is similar to the compensation scheme you have access to in the UK, albeit with a lower limit. The purpose of the Irish Investor Compensation Scheme is to pay compensation to you (subject to certain limits) if you have invested money or investment instruments in either of the following cases:

- A firm goes out of business and cannot return your investments or money; and

- A Central Bank of Ireland determination or a court ruling has been made under the Investor Compensation Act 1998.

The Investor Compensation Company DAC (ICCL) administers the scheme. IBIE will be a member of the scheme.

The scheme covers investment products including:

- Public and private company shares

- Units in collective investment schemes

- Life insurance policies (including unit-linked funds)

- Non-life insurance policies

- Tracker bonds

- Futures and options

Usually, you can only make a claim after a firm goes out of business and its assets have been liquidated and distributed to those who are owed money. Please check the details of the schemes for any limits that apply – not all losses will be covered as there are maximum levels of compensation. The ICCL will pay you compensation for 90% of the amount you have lost, up to a maximum of €20,000.

5. How do I make a complaint to IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK? What if my complaint relates to something that happened while I was a customer of IBUK?

The new Customer Agreement sets out how to lodge a complaint with IBIE. The complaints handling procedures are materially similar to those that apply to your existing relationship with IBUK. If the substance of your complaint relates to something that happened prior to the Proposed Transfer, then you should address your complaint to IBUK. Its current contact information will stay the same and can be found at interactivebrokers.co.uk should you need to contact IBUK.

6. After the Proposed Transfer, will I still have access to the Financial Ombudsman Service?

In case of complaint, investors should follow the complaints procedure as referred to in the Customer Agreement. Once your account is transferred to IBIE, the UK Financial Ombudsman Service will cease to have jurisdiction over any complaints that you may have in respect of IBUK. However, please be aware that Ireland has a dispute resolution scheme in the form of the Financial Services and Pensions Ombudsman (“FSPO”). The FSPO is a free and independent statutory dispute resolution scheme for financial services. You may be eligible to make a complaint to the FSPO if you are an “eligible complainant”. Details of who are “eligible complainants” can be found on www.fspo.ie. The FSPO can be contacted at:

Postal Address

Financial Services and Pensions Ombudsman

Lincoln House,

Lincoln Place

Dublin 2

D02 VH29

Telephone

+353 (0)1 567 7000

Email

Info@fspo.ie

7. How will my personal data be processed and protected? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK in this context?

Your data will be processed and protected in accordance with the Interactive Brokers Group Privacy Policy which can be found at: https://www.interactivebrokers.com/en/index.php?f=305. There will be no material change.

PART C – OTHER PRACTICAL QUESTIONS AND NEXT STEPS

1. Who should I contact before the Proposed Transfer takes place and after the Proposed Transfer if I have any questions in the ordinary course?

Generally speaking, you should contact IBUK with any questions that you may have prior to the Proposed Transfer, and you should contact IBIE with any questions that you may have following the Proposed Transfer taking place. Regardless of who you contact at Interactive Brokers, we will ensure your query is promptly dealt with and we will help you to connect with the right person or department.

2. Will the range of products offered be the same?

Our current expectation is that the same range of products will be offered by IBIE as are offered by IBUK.

There might be a restriction on Foreign Exchange transactions that would create a negative balance or would increase a preexisting negative balance in either component currency. However, the same currency pairs can be traded as Forex CFD. Contracts For Difference are complex instruments, and we invite you to carefully review the CFD risk warnings before trading these instruments following the transfer of your account.

Please note that IBIE offers financing for securities and commodities trades but cannot support withdrawals of borrowed funds. You will be free to withdraw any free cash not needed to support your open positions. If you would like to withdraw additional funds, you can sell positions and withdraw the proceeds.

In limited instances where clients hold restricted products, clients may transfer and maintain or close such positions but won’t be allowed to increase the position.

3. I currently trade OTC derivatives with IBUK – what will happen to my open positions?

Your open positions will be transferred to IBIE and you will face IBIE rather than IBUK. You will no longer have any legal relationship with IBUK in relation to those positions. We will separately provide you with an updated Key Investor Information Document (please follow the link to the PRIIPs KID landing page in the Covering Letter).

4. What happens to any security I have granted to IBUK/IBLLC as part of a margin loan?

If you have granted security or collateral to IBUK/IBLLC this will transfer to IBIE upon the Proposed Transfer taking place.

We do not anticipate you needing to take any steps to reflect the change in beneficiary, although we may need to take some administrative steps of our own to update security registers with the change in details. This should, however, not affect our priority or otherwise affect the date from which the security is valid.

5. Will I have access to the same trading platform or be subject to any software changes following the transfer of my account?

The transfer of your account will have no impact upon the software you use to trade or administer your account. The technology will remain the same as it is today.

6. Will all account balances be transferred at the same time?

All balances, with the exception of accruals (e.g., interest, dividends) will be transferred at the same time. Once accruals have been posted to cash, they will automatically be swept to the transferred account.

7. What will happen to my current account following the transfer of my account?

Once all accruals have been swept, your current account will be closed and inaccessible for trading purposes. You will still be able to access this closed account via the Client Portal for purposes of viewing and printing archived activity and tax statements.

8. Will IBKR’s commissions and fees change when my account is transferred?

No. IBKR commissions and fees do not vary by the broker your account is maintained with.

9. Will my trading permissions change when my account is transferred?

No. Your trading permissions will not change when your account is transferred.

10. Will open orders (e.g., Good-til-Canceled) be carried over when my account is transferred?

Open orders will not be carried over to the new account, and we recommend that clients review their orders immediately following the transfer of their account to ensure that the open orders are consistent with their trading intentions.

11. Will I be subject to the U.S. Pattern Day Trading Rule if my account is transferred?

Accounts maintained with IBUK are subject to the U.S. Pattern Day Trading (PDT) rule as the accounts are introduced to and carried by IBLLC, a U.S. broker. The PDT rules restricts accounts with equity below USD 25,000 to no more than 3 Day Trades within any 5-business day period.

As accounts transferred to IBIE will not be introduced to IBLLC, they will not be subject to the PDT rule.

12. Will I receive a single, combined annual activity statement at year end?

No. You will receive an annual statement of your existing account which will cover the period starting 1 January 2022 through the date your account was transferred and a second annual statement for your new account which will cover the period starting from the transfer date through the end of the year.

13. Will the current cost basis of positions be carried over when my account is transferred?

Yes, the transfer of your account will have no impact upon the cost basis of your positions.

14. Will the transferred account retain the same configuration as the current account?

The configuration of the account following transfer will match that of the current account to the extent permissible by regulation. This includes attributes such as margin capability, market data, additional users, and alerts.

15. Will my login credentials change?

No. Your username, password, and any 2-factor authentication process in place for your existing account will remain active following transfer. You will, however, be assigned a new account ID for your transferred account.

常见问题解答:英国脱欧相关账户迁移

简介

盈透证券集团(以下简称“IB”)及其英国子公司盈透证券(英国)有限公司(以下简称“IBUK”)一直在为英国脱欧过渡期结束(目前定于2020年12月31日)做筹划,致力于为我们的欧洲客户准备替代方案。我们的重点是把相关变化和影响降到最小,确保为客户提供的经纪服务能够无缝衔接过渡。此事件涉及的客户将会收到通知,通知中会说明相关的变化和时间线。下方为从IBUK到我们其它欧洲经纪公司的账户迁移相关常见问题及解答。

常见问题解答

问:2021年1月1日英国脱欧开始后IBKR将采取什么措施确保经纪服务持续运行?

答:早在2018年,IBKR便设立了盈透证券卢森堡有限公司(以下简称“IBLUX”),并于2019年11月获得监管授权。此外,我们目前还在着手创建两家位于欧盟的经纪公司:盈透证券爱尔兰有限公司(以下简称“IBIE”)和盈透证券中欧有限公司(以下简称“IBCE”)。

我们计划在2020年12月31日之前将所有受英国脱欧影响的客户迁移到这三家位于欧盟的经纪公司(以下简称“欧盟经纪公司”)。迁移到IBIE和IBCE还需要获得相关国家主管机关的监管授权。

问:我们的账户要迁移到哪家IBKR经纪公司?

答:哪些账户要迁移到IBLUX、IBIE和IBCE这三家经纪公司中的哪一家尚未最终确定。我们预计大多数西欧客户会迁移到IBIE,中欧和东欧客户则迁移到IBCE,还有部分客户会迁移到IBLUX。这其中客户的账户类型和头寸也会纳入考虑。

在最终发送迁移请求前,我们会向所有客户发送通知,详细说明其将被迁入的经纪公司。

问:此次迁移计划涉及哪些客户?

答:涉及的客户包括居住在欧盟的个人客户和在欧盟国家成立的实体客户。这些账户大部分都开立在盈透证券(英国)有限公司。

问:通过什么方式征求客户同意?

答:我们准备好迁移账户后,您会收到一封邮件让您登录客户端。登录后,您会看到相关披露文件和客户协议,您可以以电子方式在线表示同意。未对最开始的邮件作出回应的客户将会收到一系列后续提醒邮件。

问:如果我不做任何操作会怎么样?

答:如果未能作出回应表示同意,您的账户最终会受到交易和转账限制,就如同您不同意迁移一样。另外请注意,您的账户将继续适用当前协议的条款和条件(包括费用和保证金政策),直至完成迁移到指定欧盟经纪公司、迁移到IBKR以外的其它经纪公司或关闭。

问:如果我不同意迁移会怎么样?

答:如果您不同意将账户迁移到指定欧盟经纪公司,您的账户将受到限制、无法开展新的交易或转入更多资金和/或头寸。该等限制不会阻止您将账户迁出IBKR。

问:我的登录信息会变更吗?

答:不会。您当前账户的用户名、密码和双因素验证程序在迁移后仍然有效。但是,迁移的账户会有新的账户号码。

问:迁移后我还可以访问现在的交易平台吗?会有什么软件方面的变化吗?

答:迁移不会对您用于交易和管理账户的软件造成任何影响。所有的技术都不会发生改变。

问:所有账户余额也会迁移吗?

答:除应计项目(如利息和股息)之外的所有余额也会一并迁移。应计项目会在实现现金后迁移。如果是利息,应计项目通常是逆向的,现金会在应计款项下一个月的第一周记入账户。如果是股息,应计项目是逆向的,抵消现金会在发行发支付股息的当天记入账户。

问:迁移后我当前的账户会怎么样?

答:所有应计项目都记入为现金并转入迁移账户后,您当前的账户便会关闭。关闭后,账户将无法用于交易。但是,您仍可以通过客户端的账户选择器访问此账户,查看或打印历史报表。

问:账户迁移后,IBKR的佣金费用会发生变化吗?

答:不会。IBKR的佣金和费用不会因您账户所在的经纪公司发生变化。

问:账户迁移后,我的交易许可会发生变化吗?

答:您的交易许可将保持不变,但迁移到IBLUX的账户由于监管限制将无法进行杠杆外汇交易。尽管目前看来IBIE和IBCE的账户没有类似限制,但如果政策调整,我们会在迁移前通知您。

问:账户迁移后,未完成的定单(如取消前有效定单)会被保留下来吗?

答:未完成的定单将被转到新账户,但是,我们建议客户在迁移后立即对定单进行检查,确保定单符合其交易目的。

问:账户迁移后,我还受美国典型日内交易规则限制吗?

答:在IBUK开立的账户由于最终是被引入美国经纪公司IBL并由IBL提供底层清算,因此适用美国典型日内交易(PDT)规则。根据PDT规则,资产低于25,000美元的账户任意5个工作日内日内交易不得超过3笔。

而迁移到IBLUX、IBIE和IBCE的账户不再是引入IBL,因此不再适用PDT规则。

问:年末我会收到一份合并的年度报表吗?

答:不会。您会收到一份当前账户的年度报表(时间范围为2020年1月1日至迁移日)和一份迁移后新账户的年度报表(时间范围为迁移日至2020年12月31日)。

问:账户迁移后,当前账户内头寸的成本基础是否会保留到新账户?

答:是的。迁移不会影响您头寸的成本基础。

问:迁移后的新账户是否会保留当前账户的配置?

答:在法规允许的范围内,迁移后的账户配置会与当前账户的配置保持一致。这包括保证金、市场数据、多个使用者和警报等属性。在有限的情况下,账户会被迁移到无法支持全部产品的行政辖区。持有受限产品的客户可以进行迁移并维持或平仓该等产品的头寸,但无法增加新的头寸。

问:如果IBKR在2020年12月31日前未能取得迁移所必需的监管许可会怎么样?

答:IBLUX已经获批,但在业务规模方面受到一定限制;因此要在2020年12月31日前完成迁移就必需要获得IBIE或IBCE的许可。如果确定这两家经纪公司都无法及时拿到许可,我们会联系客户解释英国脱欧过渡期结束后其账户的处理方案。

问:迁移后我还能继续向英国申诉服务机构(FOS)提交投诉吗?

答:IBUK的客户可以将在IBUK未得到满意解决的投诉提交给英国金融申诉服务机构处理。但迁移到IBLUX、IBIE或IBCE之后,英国金融申诉服务机构将不再适用,我们会为您提供新的替代服务相关信息。请注意,迁移不会影响我司内部的投诉处理流程。

问:迁移对数据保护有什么影响?

答:账户从IBUK迁移到IBLUX、IBIE或IBCE并不会对我们根据数据保护规则对您个人信息实施保护的方式造成任何影响。IBLUX、IBIE和IBCE均会承担数据保护责任,继续按照我们一贯的高标准保护您的个人信息。

问:我的账户保障会有什么影响?

答:在欧盟,发生经纪商违约的情况下客户的保险保障通常会不如在英国或美国。

目前,如果满足资格要求,IBUK的客户在投资服务方面可享受英国金融服务补偿计划(以下简称“UK FSCS”)最高达50,000英镑的保障。由于IBUK的客户由我们的美国经纪公司IBL进行底层清算,其账户的证券账户段可以参加证券投资者保护公司(以下简称“SIPC”)的保险,保额最高达500,000美元(其中现金不超过250,000美元)。

而在欧盟经纪公司,IBLUX、IBIE和IBCE的合资格索赔人最多可以申请20,000欧元的赔偿。有关具体方案、保险范围和索赔资格的更多信息会同迁移请求一并发送给您。

鉴于盈透证券集团82.5亿美元的总资本以及在集团所有经纪公司推行的审慎保证金政策(包括接受定单前的预先信用检查以及对不满足保证金要求的账户进行自动平仓清算),我们相信此次迁移并不会对客户资产的总体安全稳健造成影响。

Normal 0 false false false EN-US X-NONE X-NONE -->

EDD Requests for Information (RFI)

These FAQs are meant to serve as guidelines for answering customer questions with regard to recent communications that have been sent to a large number of IBKR account holders, requesting specific information. If there are further questions not addressed in this guide, please contact the EDD department.

Shareholders Rights Directive II

On 3 September 2020, a new European Directive, the Shareholders Rights Directive II ("SRD II"), will enter into force introducing important regulatory changes for intermediaries. SRD II aims to encourage long-term shareholder engagement in European shares by introducing new requirements, including:

- Obligations for all intermediaries in the chain of custody to provide shareholders information to issuers on demand and no later than the business day immediately following the date of receipt of the request;

- Requirements for intermediaries to make available meeting announcements or any other information which an issuer is required to provide to shareholders to enable a shareholder to exercise its rights

- Requirements for intermediaries to facilitate the ability of shareholders to participate in meetings by passing on a shareholder's participation instructions (for example a vote or request to attend the meeting), without delay.

Note that the Directive applies to any intermediary, whether based in the EEA or not. Accordingly, IBKR may in the future forward any request to provide shareholders information that IBKR may receive from issuers (or other appointed entities) whose share is owned through the IBKR accounts of an intermediary or their clients.

Upon receipt of these requests, intermediaries will be required to provide shareholders information directly to the issuers no later than the business day immediately following the date of receipt of the request.

Information to Disclose

- Full name;

- Contact details (address, email address);

- Unique identifiers;

- Number of shares held;

- Category/classes of shares held (Only if explicitly requested);

- Dates from which the shares are held (Only if explicitly requested);

- Depository location;

- Vote-eligible shares.

Requests Thresholds

Member states can establish that the right of the issuer to obtain the shareholders information is only effective with regard to holding of a minimum percentage of voting rights, which where set cannot exceed 0.5%.

Requests Handling

IBKR will send these requests in a standardised electronic format. Shareholders information shall be provided directly to the issuer (or other third party entity appointed) in the format prescribed by SRD II. We recommend that intermediaries review the Commission Implementing Regulation (EU) 2018 1212, which details the regulatory formats.

IBKR has appointed a third party provider, Mediant, to facilitate the requests handling. To use their services, they can be contacted directly at SRDTabulations@mediantonline.com.

Alternatively, intermediaries should ensure that they have alternative ways to reply to these requests for information after 3 September 2020.

SFTR: Reporting to Trade Repository Obligations and Interactive Brokers Delegated Service to help meet your obligations

Background: Securities Financing Transactions Regulation (“SFTR”) is a European regulation aimed at mitigating the risk of shadow banking. SFT's have been identified as being one of the central causes of the financial crisis and during and post crisis, regulators have struggled with anticipating the risks associated with securities financing. This led to the introduction of a reporting requirement for these SFTs.

Transactions that are reportable under SFTR: Repurchase agreements (repos), stock loans, margin loans, sell/buy-back transactions and collateral management transactions.

Whom do SFTR reporting obligations apply to: Reporting obligations normally apply to all clients established in the EU with the exception of natural persons. They apply to:

- Financial counterparties ("FC"): include investment firms, credit institutions, insurance and reinsurance undertakings, UCITS and UCITS management companies, Alternative Investment Fund managed by an AIFM authorised under the Alternative Investment Fund Managers Directive ("AIFMD"), institutions for occupational retirement provision, central counterparties and central securities depositories.

- Non-Financial Counterparty ("NFC"): Undertakings established in the Union or in a third country that do not fall under the definition of financial counterparty.

- Small Non- Financial Counterparty ("NFC-"): A small non-financial counterparty is one which does not exceed the limits of at least two of three criteria: a balance sheet total of EUR 20m, net turnover of EUR 40m, and average number of 250 employees during the financial year. Under SFTR, small NFC's reporting obligations are automatically delegated to the financial counterparty with which they execute an SFT.

What must be reported?

The types of SFTs in scope of the requirements include:

Transaction level reporting:

- Securities and commodities lending / borrowing transactions

- Buy-sell backs / sell-buy backs

- Repo transactions

Position Level reporting:

- Margin lending

In-scope entities will be required to report details of an SFT which is in scope if that SFT:

- is concluded after the date on which the Regulatory Technical Standards apply to the entity

- has a remaining maturity of over 180 days on the date on which the RTS apply to the entity

- is an open / rolling transaction that has been outstanding for more than 180 days on the date on which the RTS apply to the entity

When must it be reported?

SFTR is a two-sided reporting requirement, with both collateral provider (borrower) and collateral receiver (lender) required to report their side of the SFT to an approved Trade Repository on trade date +1 (T+1).

All new SFTs, modifications of open SFT’s and terminations of existing SFTs must be reported daily. Collateral is reported on T+1 or value date +1 (S+1) dependent on the method of collateralisation used.

What do reports include?

Reporting will be done using a combination of 153 fields, depending on product and report type.

- 18 counterparty data fields - which includes information about the counterparty such as LEI and country of legal residence.

- 99 Transaction fields – which includes the loan and collateral data information on the type of SFT which has been involved in the transaction

- 20 Margin fields – which includes information on margin such as the portfolio code and currency.

- 18 Reuse fields – which includes cash reinvestment and funding source data

What must match between reports?

The SFTR reporting format includes 153 reportable fields, some of which must match between reports of the two counterparties. There will be two phases of the trade repositories’ reconciliation process, with the first phase consisting of 62 matching fields which are required for the initial SFTR implementation. A second phase, starting 2 years after the start of the reporting obligation, will contain another 34 fields which are required to match, bringing the total number of matching fields to 96.

In this context, it is particularly important that the globally unique transaction identifier - a UTI, be used and shared between the parties to the trade. The parties should agree who is to generate the UTI. If no such agreement is in place, the regulation describes a waterfall model for who would be the generating party. The generating party is obligated to share the UTI with the counterpart in an electronic format in a timely manner for both parties to be able to fulfil their T+1 reporting obligation.

INTERACTIVE BROKERS DELEGATED REPORTING SERVICE TO HELP MEET YOUR REPORTING OBLIGATIONS

FCs, NFCs and NFC-s must report details of their transactions to authorised Trade Repositories. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party (who submits reports on their behalf).

As mentioned above, when executing an SFT with an FC, an NFC- does not have to submit relevant reports, as these are submitted by the FC on the NFC-‘s behalf.

However, NFC-s who do not execute SFTs with an FC are required to submit reports.

Depending on the different setups available, Interactive Brokers clients’ may not be executing an SFT with an FC, and therefore Interactive Brokers offers a delegated reporting service, to ensure its clients can report all SFTs they execute.

As mentioned above, SFTR reports submitted by the two counterparties of an SFT must contain the same UTI. To ensure this requirement is satisfied, Interactive Brokers suggests that all of its clients in scope delegate reporting to Interactive Brokers.

Interactive Brokers will take care of generating matching UTIs when submitting its own reports and those of its clients on whose behalf it submits reports.

Validating Explicit Permissions - The European Securities and Markets Authority (ESMA) have introduced a mandate whereby trade repositories need to confirm a delegated reporting agreement is in place between the two parties before accepting and sending on any reports to the regulator. Due to this, the Trade Repository that Interactive Brokers works with - Depository Trust and Clearing Corporation ("DTCC"), has introduced a process to collect this information. As a client of Interactive Brokers, if you opt for delegated reporting, this mandate will apply.

DTCC will collect this information by sending clients an email asking for confirmation from the client that they have delegated their SFTR reporting to Interactive Brokers. – This will be a one-time process for each client. Once confirmed, DTCC will accept the reports and send them onto the regulator.

Securities Financing Transactions: Currently, Interactive Brokers clients can execute two types of SFTs: margin lending and stock loans. SFTR also requires reporting information on funding sources and collateral reuse.

Trade repository Interactive Brokers use: Interactive Brokers (U.K.) Limited will use the services of Depository Trust and Clearing Corporation ("DTCC") Trade Repository.

Timetable to report to Trade repositories: The reporting start date is 13 July 2020:

July 2020: Report Phase 1 – July 13 2020 reporting go-live for banks, investment firms & Credit Institutions and CCPs & CSDs

Oct 2020: Report Phase 2 - Insurance, UCITS, AIF & Pensions

Jan 2021: Report phase 3 - Reporting go-live for Non-Financial Companies

THIS INFORMATION IS GUIDANCE FOR INTERACTIVE BROKERS CLEARED CUSTOMERS ONLY.

NOTE: THE INFORMATION ABOVE IS NOT INTENDED TO BE A COMPREHENSIVE OR EXHAUSTIVE NOR A DEFINITIVE INTERPRETATION OF THE REGULATION, BUT A SUMMARY OF ESMA'S SFTR REGULATION AND RESULTING TRADE REPOSITORY REPORTING OBLIGATIONS

IBKR Australia Short Position Reporting

Introduction

You can request IBKR Australia perform your Australian short position reporting obligations on your behalf.

What is a short position?

A short position arises where the quantity of an eligible product that you hold is less than the quantity of the eligible product that you have an obligation to deliver, such as when you engaged in short selling an ASX-listed security and borrowed securities from IBKR to cover your delivery obligation.

When do I have a reporting obligation?

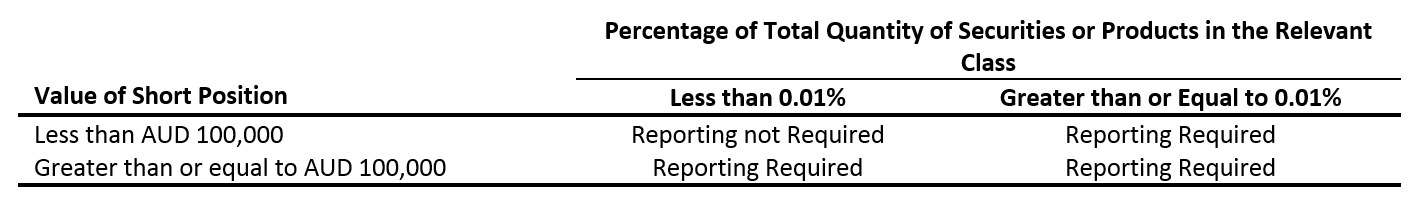

Short sellers have an obligation to report certain short positions to the Australian Securities & Investments Commission (ASIC). Reporting on short positions that are below the thresholds set by ASIC is optional. A short position does not need to be reported to ASIC when:

- The value of the position is AUD 100,000 or less; and

- The position is 0.01% or less of the total quantity of securities or products on issue for that security or product.

Otherwise, the short position must be reported.

The following table provides a convenient summary of when a short position must be reported (“Reportable Short Position”):

What you need to know about short position reporting:

It is important that any clients trading or wishing to trade eligible products understand that they may have an obligation to report their Reportable Short Positions to ASIC daily.

This obligation applies to any short sellers with a Reportable Short Position under the rules whether inside or outside of Australia. By default, IBKR Australia does not report Reportable Short Positions on your behalf, so you must arrange for the reporting of your short positions (if required).

IBKR Australia, along with many third-party firms, can provide this service to you subject to applicable terms and conditions.

If you would like IBKR Australia to perform your short position reporting for eligible products held in your IBKR account, please enrol in the service via Client Portal. Currently, this service is offered at no additional cost to IBKR Australia clients.

Please note:

- If your account does not allow shorting of securities, there is no need to sign up for this service.

- IBKR Australia will only offer the option to report all short positions and not only your Reportable Short Positions.

If you enroll in the IBKR short position reporting service:

- You must not hold any other eligible products with any other bank, broker or custodian because our systems use the positions in your IBKR account to determine whether you have a reportable short position. We cannot accurately calculate your short position if you hold eligible positions elsewhere.

- You must ensure that the information you provide us is complete and accurate in all respects, as we are required to provide ASIC with certain personal information about you.

- The obligation to report your short positions is always yours and is not transferred to IBKR under any circumstance (i.e. IBKR does not become responsible for your short position reporting obligations);

- If, for any reason, we are unable to report your short positions to ASIC before the deadline or at all, we will endeavour to inform you as early as possible so that you can make alternative arrangements. However, we make no warranties that you will receive the notification prior to the reporting deadline.

How do I apply?

To apply, all you need to do is log in to your account via the Client Portal, navigate to the Settings > Account Settings menu, click on the “ASIC Short Position Reporting” icon and follow the prompts.

As part of this process, you will need a unique identifier. For Australian applicants, this can be your ACN or ARBN. For overseas clients this can be your SWIFT BIC. Alternatively, you may register with ASIC to obtain a unique identity code.

Upon electing IBKR Australia to perform this short position reporting obligation on your behalf, you must warrant that the reportable short positions held with IBKR Australia represent your entire portfolio in applicable Reportable Short Positions and acknowledge that IBKR Australia will rely on this representation and warranty in good faith on each occasion that it makes a short position report to ASIC on your behalf.

Where can I get more information?

Clients seeking more information on their short position reporting obligations should refer to the following resources:

- ASIC Regulatory Guide 196, which contains an overview of the applicable short selling rules and disclosure requirements.

- ASIC Info Sheet 98, which provides an overview of how to submit short position reports to ASIC via FIX and a list of vendors who may be able to assist you with your short position reporting obligations if you don’t elect to enrol in the IBKR short position reporting service.

PRIIP概述

背景

2018年,一项欧盟新规生效,该新规旨在对“零售”客户进行保护,确保其在买入某种产品时能够获得充分的披露信息。该法规被称为零售及保险投资产品组合法规(MiFID II指令2014/65/EU)或PRIIP,其覆盖了所有应付给客户的金额会受参考值或一种或多种并非由该等零售投资者直接买入之资产的业绩表现影响而波动的投资。常见列子包括期权、期货、差价合约、ETF、ETN和其它结构性产品。

值得注意的是,经纪商不得允许零售客户购买PRIIP覆盖的产品,除非该产品的发行机构已经备好了要求的披露文件让经纪商提供给客户。这种披露文件被称为关键信息文件(“KID”),包括产品描述、成本、风险回报情况及可能的业绩情境等信息。美国客户不受PRIIP影响,因此,某些美国挂牌ETF的发行机构通常不会创建关键信息文件。这就意味着,欧洲经济区(“EEA”)的零售客户可能无法购买此类产品。

客户分类

IBKR默认将所有个人客户分类为“零售”客户,因为这样可以给与客户MiFID提供的最广泛的保护。被分类为“专业”客户的客户无法享受“零售”客户级别的保护,但同时也不需要受KID文件要求的限制。根据MiFID II的定义,“专业”客户包括受监管的实体、大型客户和要求被重新分类为“选择性专业客户”并且在知识、经验和财务实力方面满足MiFID II要求的个人。

IB提供了线上程序可供“零售”客户申请将其分类更改为“专业”。重新分类的资格要求以及申请重新分类的步骤,请参见KB3298,如果要直接申请更改分类,可通过客户端/账户管理中的相关问卷进行。

盈透证券(英国)有限公司 – MiFID分类

简介

欧盟《金融工具市场法规(MiFID)》及其后修订版MiFID II要求盈透证券英国有限公司【Interactive Brokers (U.K.) Limited (IBUK)】根据客户的知识水平、经验和专长将客户分为“零售客户”、“专业客户”或“合格对手方”这几类。

专业客户与零售客户在监管保障方面的主要区别有:

1. 组合投资的性质与风险说明:以其它服务或产品作为协议条件向零售客户提供投资服务的公司必须:(i) 告知零售投资者组合协议的风险是否与各组成部分单独对应的风险有所不同;并(ii) 向零售客户提供协议不同组成部分的充分说明以及各部分相互作用改变风险的方式。上述要求不适用于专业客户。但是,除了下方第3点的情况外,IBUK的处理方法并不会有太多不同。

2. 差价合约(”CFD“)的投资者保护措施:欧洲证券与市场管理局(”ESMA“)针对向零售客户提供差价合约推出了干预措施。措施包括:(i) 对开仓头寸实施新的杠杆限制,根据底层证券的波动率而定;(ii) 以单个账户为单位的保证金平仓规则,标准化了供应商必须平仓一个或多个未结差价合约的保证金百分比水平;(iii) 以单个账户为单位的负余额保护规则;

(iv) 限制交易差价合约的奖励;以及(v) 标准化风险警示,包括披露差价合约供应商出现亏损的零售投资者账户的百分比。上述要求不适用于专业客户。

3. 与客户的沟通:公司必须确保其与所有客户的沟通均清楚、公证、不具误导性。但是,公司与专业客户沟通(有关其自身、其服务与产品以及其报酬)的方式则可能会和与零售客户沟通的方式不同。公司在信息提供的详细程度、使用的工具以及时间选择方面的责任都会根据客户是零售客户还是专业客户而会有所不同。发送某些产品特定文件(如零售及保险投资产品组合(“PRIIP”)关键信息文件(“KID”)的要求不适用于专业客户。

4. 价值减损报告: 若零售客户账户持有杠杆金融产品头寸或涉及或有负债交易,则如果各产品的初始价值下降10%且之后以10%的倍数下跌,则公司必须通知零售客户。上述要求不适用于专业客户。

5. 合适性:在评估非咨询(non-advised)服务的合适性时,公司须确定客户是否具备必要的经验和知识,能够了解所提供或需求之产品或服务相关的风险。该等合适性评估要求应用到客户时,公司会认为专业客户具备必要的经验和知识了解其被分类为专业客户的该等特定投资服务或交易、或该等类型交易或产品相关的风险。但公司不会对零售客户作此假设,而是必须确定零售客户确实具备必要的经验和知识水平。

IBUK提供非咨询服务,在评估既定服务或产品的合适性时,不需要像对零售客户那样对专业客户索取信息或遵守评估程序,如果不能确定某一既定服务或产品的合适性,IBUK也不需要向专业客户发出警告。

6. 责任免除:在FCA法规下,公司针对零售客户免除或限制其自身责任或义务的能力比针对专业客户时要弱。

7. 金融服务申诉机构:英国金融申诉服务机构对专业客户不可用,除非其是,例如,在其自身行业、业务、技能或专业之外行动的消费者、小型企业或个人。

8. 补偿: IBUK是英国金融服务补偿计划的参与成员。如果IBUK不能履行对您的义务,您有权从该计划索取赔偿。这取决于业务的类型以及索赔的情况;补偿仅对某些类型的索赔人和某些类型的业务可用。从补偿计划获取补偿的资格将根据计划适用的规则确定。

重新分类为专业客户

IBUK允许其零售客户申请重新分类为专业客户。我们会告知客户其客户分类,并且客户可随时在账户管理(设置>账户设置>MiFID客户类别)中进行查看。客户也可从本页面请求更改其MiFID分类。

在下方两种情况下,IBUK会考虑将零售客户重新分类为专业客户:

(i) 被授权或受监管在金融市场运作;或

(ii) 公司层面满足下方规模要求中任意两项的大型事业:

(a) 资产负债表总额达20,000,000欧元;

(b) 净营业额达40,000,000欧元;

(c) 自有资金达2,000,000欧元;

(iii) 主要活动为投资金融产品的机构投资者。这包括致力于资产证券化或其它融资交易的实体。

2. 如果基于对客户技能、经验和知识的评估,IBUK有理由相信,考虑所设想之交易或服务的性质,客户能够自行做出投资决定并了解其中风险,则IBUK会将客户作为选择性专业客户。不满足固有专业客户要求的客户仍然可以申请被分类为选择性专业客户。

要获得重新分类,零售客户必须提供证据证明其至少满足以下标准中的两项:

1. 在过去4个季度,客户进行大额金融产品交易的平均频率达每季度10次。

IBUK会考虑以下条件来确定大额交易:

a. 过去4个季度内,进行了至少40笔交易;

b. 过去4个季度内每个季度至少进行了1笔交易;

c. 过去4个季度内进行的最大的40笔交易总名义价值大于200,000欧元;

d. 账户净资产价值大于50,000欧元。

现货外汇和未分配OTC金属交易不纳入计算。

2. 客户持有的金融产品(包括现金)投资组合超过500,000欧元(或等值);

3. 客户是个人账户持有人或机构账户交易者,且其至少有一年在金融行业要求具备产品知识的专业岗位工作的经验。

申请重新分类为专业客户的零售客户在提交相关申请前,必须阅读并了解IBUK的警告信息。

重新分类为零售客户 专业客户可以在上述同一账户管理页面(设置>账户设置>MiFID客户类别)向IBUK提出申请将其重新分类为零售客户。

除了受监管实体或由受监管基金经理管理的基金应分类为固有专业客户外,IBUK可接受所有此类请求。

本信息仅用于指导盈透证券全披露清算服务客户。

注:以上信息不作为全面穷尽式指南,也不是对法规的权威性解释,而是对IBUK对待客户分类和重新分类政策之方法的总结。

PRIIPs Overview

BACKGROUND

In 2018, an EU regulation, intended to protect “Retail” clients by ensuring that they are provided with adequate disclosure when purchasing certain products took effect. This disclosure document is referred to as a Key Information Document, or KID, and it contains information such as product description, cost, risk-reward profile and possible performance scenarios.

This regulation is known as the Packaged Retail and Insurance-based Investment Product Regulation (MiFID II, Directive 2014/65/EU), or PRIIPs, and it covers any investment where the amount payable to the client fluctuates because of exposure to reference values or to the performance of one or more assets not directly purchased by such retail investor. Common examples of such products include options, futures, CFDs, ETFs, ETNs and other structured products.

The UK Financial Conduct Authority (FCA) has equivalent requirements for UK residents.

It’s important to note that a broker cannot allow a Retail client to purchase a product covered by PRIIPs unless the issuer of that product has prepared the required disclosure document for the broker to provide to the client. U.S. clients are not impacted by PRIIPs, so the issuers of U.S. listed ETFs do not as a rule create KIDs. This means that EEA and UK Retail clients may not purchase the product. Clients nevertheless have several options:

- Many US ETF issuers have equivalent ETFs issued by their European entities. European-issued ETFs have KIDs and are therefore freely tradable.

- Clients can trade most large US ETFs as CFDs. The CFDs are issued by IBKRs European entities and as such meet all KID requirements.

- Clients may be eligible for re-classification as a professional client, for whom KIDs are not required.

CLIENT CATEGORISATION

We categorize all individual clients as “Retail” by default as this affords clients the broadest level of protection afforded by MiFID. Client who are categorised as “Professional” do not receive the same level of protection as “Retail” but are not subject to the KIDs requirement. As defined under MiFID II rules, “Professional” clients include regulated entities, large clients and individuals who have asked to be re-categorised as “elective professional clients” and meet the MiFID II requirements based on their knowledge, experience and financial capability.

We provide an online step-by-step process that allows “Retail” to request that their categorisation be changed to “Professional". The qualifications for re-categorisation along with the steps for requesting that one’s categorisation be considered are outlined in KB3298 or, to directly apply for a change in categorisation, the questionnaire is available in the Client Portal/Account Management.

Interactive Brokers (U.K.) Limited – MiFID Categorisation

Introduction

The European Union legislative act known as the Markets in Financial Instruments Directive, or MiFID, as amended by MiFID II, requires Interactive Brokers (U.K.) Limited (IBUK) to classify each Client according to their knowledge, experience and expertise: "Retail", "Professional" or "Eligible Counterparty".

In accordance with the Financial Conduct Authority rules, IBUK categorises most clients as Retail clients, providing them with a higher degree of protection.

Only those clients that are either regulated entities or funds managed by regulated fund managers, are categorised as Per Se Professional Clients.

Professional Clients are entitled to a lower degree of protection under the UK regulatory regimes than Retail Clients. This notice contains, for information purposes only, a summary of the protections that a Retail Client might lose if they are to be treated as a Professional Client.

1. Description of the nature and risks of packaged investments: A firm that offers an investment service with another service or product or as a condition of the same agreement with a Retail Client must: (i) inform Retail Clients if the risks resulting from the agreement are likely to be different from the risks associated with the components when taken separately; and (ii) provide Retail Clients with an adequate description of the different components of the agreement and the way in which its interaction modifies the risks. The above requirements do not apply in respect of Professional Clients. However, IBUK will not make such differentiation apart from the case specified under point 3 below.

2. Retail investor protection measures on the provision of Contracts for Differences (“CFDs”): The regulatory measures include: (i) Leverage limits on the opening of a position, which vary according to the volatility of the underlying; (ii) A margin close out rule on a per account basis that standardises the percentage of margin (at 50%of the minimum required margin) at which providers are required to close out one or more open CFDs; (iii) Negative balance protection on a per account basis;(iv) A restriction on the incentives offered to trade CFDs; and (v) A standardised risk warning, including the percentage of losses on a CFD provider’s Retail investor accounts. These measures do not apply in respect of Professional Clients.

3. Communication with clients, including financial promotions: A firm must ensure that its communications with all clients are, and remain, fair, clear and not misleading. However, the simplicity and frequency in which a firm may communicate with Professional Clients (about itself, its services and products, and its remuneration) may be different to the way in which the firm communicates with Retail Clients. Regulations relating to restrictions on, and the required contents of, direct offer financial promotions do not apply to promotions to Professional Clients and such promotions need not contain sufficient information for Professional Clients to make an informed assessment of the investment to which they relate. A firm’s obligations in respect of the level of details, medium and timing of the provision of information are different depending on whether the client is a Retailor Professional Client. The requirements to deliver certain product-specific documents, such as Key Information Documents (“KIDs”) for Packaged Retail and Insurance-based Investment Products (“PRIIPs”), are not applied to Professional Clients.

4. Depreciation in value reporting to clients: A firm that holds a Retail Client account that includes positions in leveraged financial instruments or contingent liability transactions must inform the Retail Client, where the initial value of each instrument depreciates by 10 per cent and thereafter at multiples of 10 per cent. The above reporting requirements do not apply in respect of Professional Clients (i.e., these reports do not have to be produced for Professional Clients).

5. Appropriateness: For transactions where a firm does not provide the client with investment advice or discretionary management services (such as an execution-only trade), it may be required to assess whether the transaction is appropriate. When assessing appropriateness for non-advised services, a firm may be required to determine whether the client has the necessary experience and knowledge in order to understand the risks involved in relation to the product or service offered or demanded. Where such an appropriateness assessment requirement applies in respect of a Retail Client, there is a specified test for ascertaining whether the client has the requisite investment knowledge and experience to understand the risks associated with the relevant transaction. However, in respect of a Professional Client the firm is entitled to assume that a Professional Client has the necessary level of experience, knowledge and expertise in order to understand the risks involved in relation to those particular investment services or transactions, or types of transaction or product, for which the client is classified as a Professional Client. IBUK provides non-advised services and is not required to request information or adhere to the assessment procedures for a Professional Client when assessing the appropriateness of a given service or product as with a Retail Client, and IBUK may not be required to give warnings to the Professional Client if it cannot determine appropriateness with respect to a given service or product.

6. Information about costs and associated charges: A firm must provide clients with information on costs and associated charges for its services and/or products. The information provided may not be as comprehensive for Professional Clients as it must be for Retail Clients.

7. Dealing: When undertaking transactions for Retail Clients, the total consideration, representing the price of the financial instrument and the costs relating to execution, should be the overriding factor in any execution. For Professional Clients a range of factors may be considered in order to achieve best execution –price is an important factor, but the relative importance of other different factors, such as speed, costs and fees may vary. However, IBUK will not make such differentiation.

8. Difficulty in carrying out orders: In relation to order execution, firms must inform Retail Clients about any material difficulty relevant to the proper carrying out of orders promptly on becoming aware of the difficulty. This is not required in respect of Professional Clients. The timeframe for providing confirmation that an order has been carried out is more rigorous for Retail Clients’ orders than Professional Clients’ orders.

9. Share trading obligation: In respect of shares admitted to trading on a regulated market or traded on a trading venue, the firm may, in relation to the investments of Retail Clients, only arrange for such trades to be carried out on a regulated market, a multilateral trading facility, a systematic internaliser or a third-country trading venue. This is a restriction which may not apply in respect of trading carried out for Professional Clients (i.e., this restriction can be disapplied where trades in such shares are carried out for Professional Clients in certain circumstances).

10. Exclusion of liability: Firms’ ability to exclude or restrict any duty or liability owed to clients is narrower under the FCA rules in the case of Retail Clients than in respect of Professional Clients.

11. The Financial Services Ombudsman: The services of the Financial Ombudsman Service in the UK may not be avail-able to Professional Clients, unless they are, for example, consumers, small businesses or individuals acting outside of their trade, business, craft or profession.

12. Compensation: IBUK is a member of the UK Financial Services Compensation Scheme. You may be entitled to claim compensation from that scheme if IBUK cannot meet its obligations to you. This will depend on the type of business and the circumstances of the claim; compensation is only available for certain types of claimants and claims in respect of certain types of business. Eligibility for compensation from the Financial Services Compensation Scheme is not contingent on your categorisation but on how the firm is constituted. Eligibility for compensation from the scheme is determined under the rules applicable to the scheme (more information is available at https://www.fscs.org.uk/).

13. Transfer of financial collateral arrangements: As a Professional Client, the firm may conclude title transfer financial collateral arrangements with you for the purpose of securing or covering your present or future, actual or contingent or prospective obligations, which would not be possible for Retail Clients.

14. Client money: The requirements under the client money rules in the FCA Handbook (CASS) are more prescriptive and provide more protection in respect of Retail Clients than in respect of Professional Clients.

Re-categorisation as Professional Client

IBUK allows its Retail Clients to request to be re-categorised as Professional Clients. Clients are notified of their Client Category and can check it at any time from Account Management, under Settings> Account Settings> MiFID Client Category. From this same screen, Clients can also request to change their MiFID Category.

IBUK will consider re-categorising Retail Clients to Professional Clients in two instances:

1. Per Se Professional Clients can notify IBUK that they consider that they should have been categorised as Per Se Professionals under the FCA rules, because at least one of the following conditions applies:

(i) authorised or regulated to operate in the financial markets; or

(ii) a large undertaking meeting two of the following size requirements on a company basis:

(a) balance sheet total of EUR 20,000,000;

(b) net turnover of EUR 40,000,000;

(c) own funds of EUR 2,000,000;

(iii) an institutional investor whose main activity is to invest in financial instruments. This includes entities dedicated to the securitisation of assets or other financing transactions.

2. IBUK may treat Clients as Elective Professional Clients if, based on an assessment of the Client’s expertise, experience, and knowledge, IBUK is reasonably assured that, in light of the nature of the transactions or services envisaged, the Client is capable of making its own investment decisions and understand the risks involved. Clients who do not meet the requirements to be categorised as Per Se Professional Clients can still request to be categorised as Elective Professional Clients.

To obtain such re-categorisation, Retail Clients must provide evidence that they satisfy at least two (2) of the following criteria:

1. Over the last four (4) quarters, the Client conducted trades in financial instruments in significant size at an average frequency of ten (10) per quarter.

To determine the significant size IBUK considers the following:

a. During the last four quarters, there were at least forty (40) trades; and

b. During each of the last four (4) quarters, there was at least one (1) trade; and

c. The total notional value of the top forty (40) trades of the last four (4) quarters is greater than EUR 200,000; and

d. The account has a net asset value greater than EUR 50,000.

Trades in Spot FX and Unallocated OTC Metals are not considered for the purpose of this calculation.

2. The Client holds a portfolio of financial instruments (including cash) that exceeds EUR 500,000 (or equivalent);

3. The Client is an individual account holder or a trader of an organisation account who works or has worked in the financial sector for at least one year in a professional position which requires knowledge of products it trades in.

Upon review and verification of the information and supporting evidence provided, IBUK will re-categorise clients if all relevant conditions are met to satisfaction.

Retail Clients requesting to be re-categorised as Professional Accounts must read and understand the warning provided by IBUK before the relevant request is submitted.

Re-categorisation as Retail Client

Professional Clients can request IBUK to be re-categorised as Retail Clients, from the same Account Management page described above (under Settings> Account Settings> MiFID Client Category).

With the sole exception of regulated entities or funds managed by regulated fund managers, which are categorised as Per Se Professional Clients, IBUK accepts all such requests.

THIS INFORMATION IS GUIDANCE FOR INTERACTIVE BROKERS FULLY DISCLOSED CLEARED CUSTOMERS ONLY.

NOTE: THE INFORMATION ABOVE IS NOT INTENDED TO BE A COMPREHENSIVE, EXHAUSTIVE NOR A DEFINITIVE INTERPRETATION OF THE REGULATION, BUT A SUMMARY OF IBUK’S APPROACH TO CLIENT CATEGORISATION AND RE-CATEGORISATION POLICY.