How to download and install the IBKR Mobile app from alternative app stores

As a consequence of the US Government Huawei ban, the owners of Huawei smartphones will be no longer able to access the Google Play Store and download app from there. If you are affected by this constraint, you will still be able to download and install the IBKR Mobile app from an alternative app store.

Please proceed as follows:

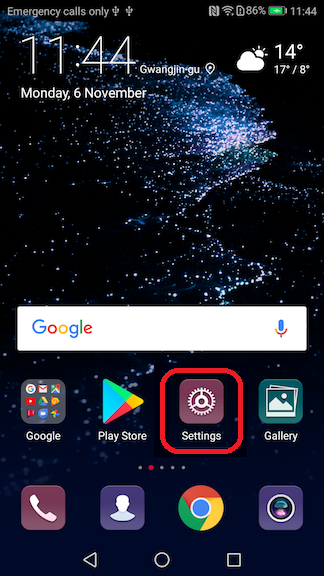

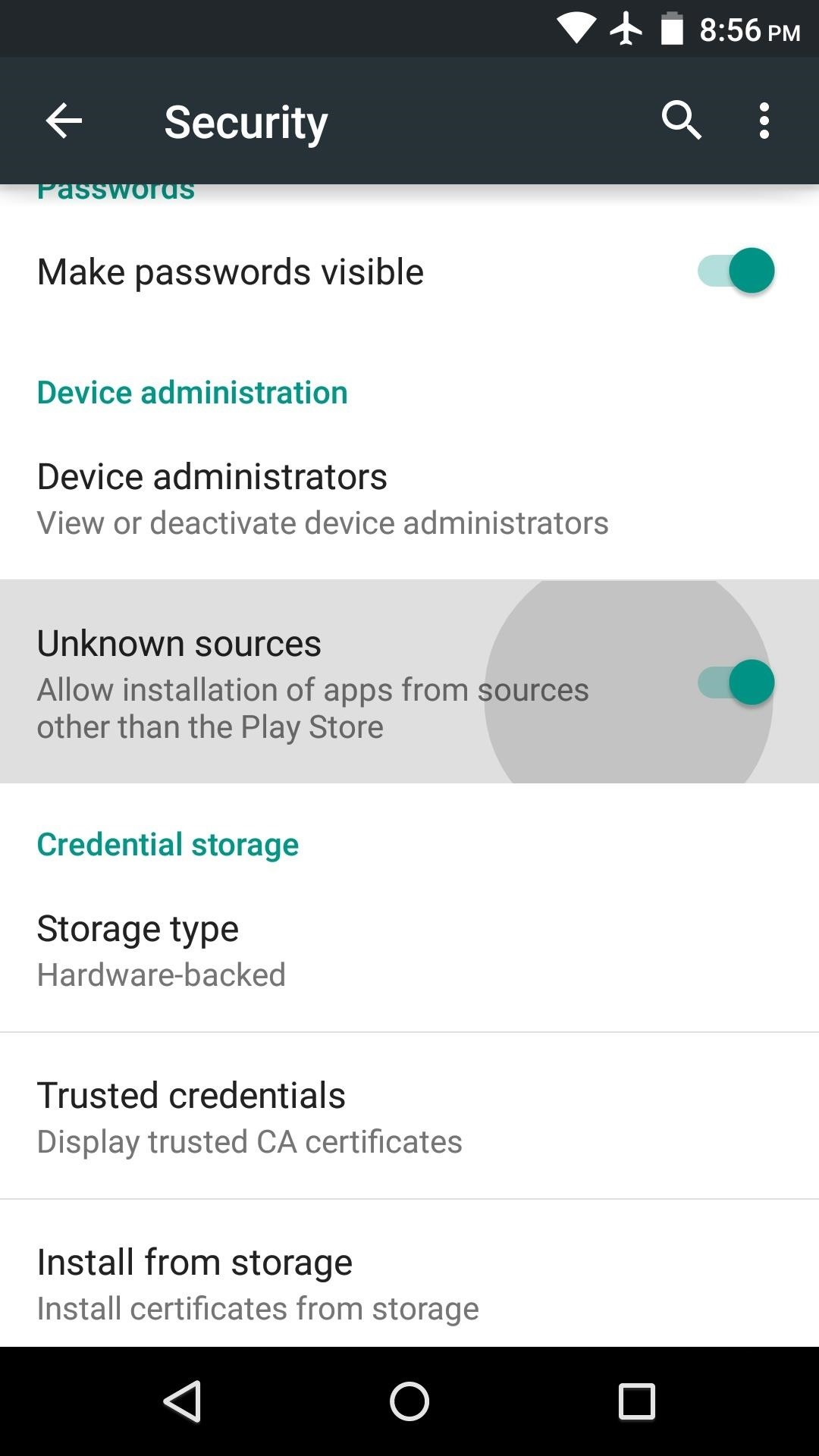

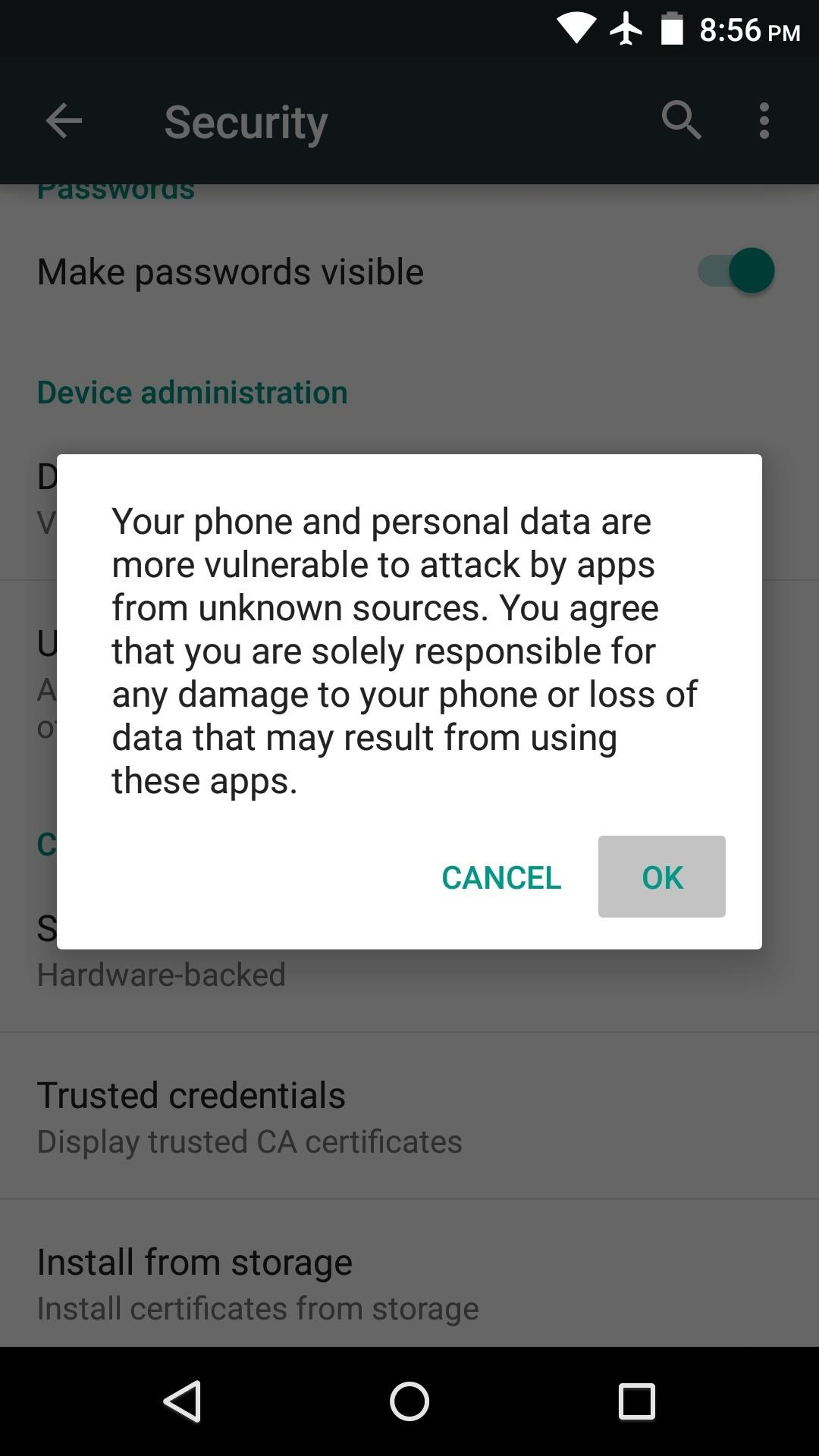

A) Allow your phone to install software from alternative app stores in this way:

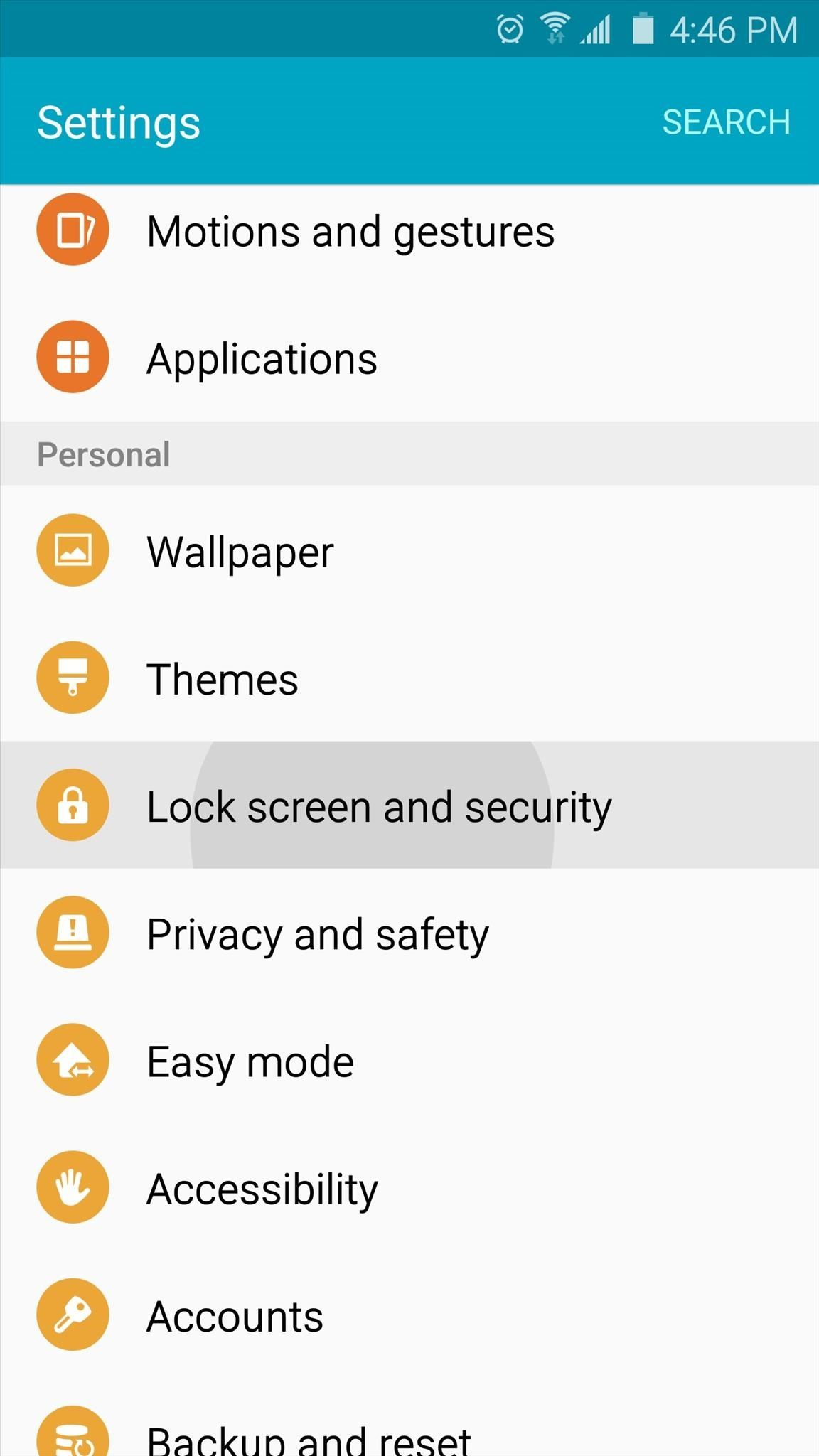

2) Under the section System you will find the item Security (it can be called Lock Screen and Security). Click on it

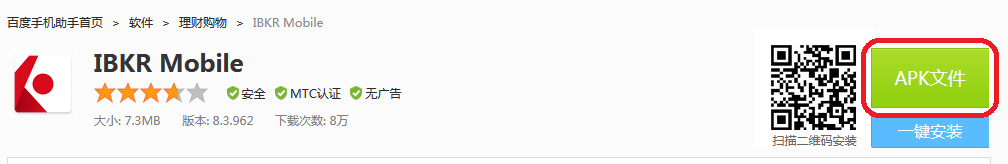

B) You can now download the IBKR Mobile by clicking on one of the links below, according to the alternative store you want to use:

360.cn

.png)

Baidu

快照市場數據

背景

符合一定要求的IBKR客戶可選擇提交單次請求,要求接收某個金融産品的實時報價。該服務被稱爲“快照報價”。傳統報價服務會持續更新實時報價,而快照報價不會,這是它與傳統報價服務的不同之處。對于不經常交易且不希望根據延時報價1下單的客戶,快照報價的價格更有競爭力。有關該報價服務的更多信息如下。

報價項目

快照報價包括以下數據:

- 最後價

- 最後價交易數量

- 最後價交易所

- 當前買價-賣價

- 當前買價-賣價的交易數量

- 當前買價-賣價的交易所

可用服務

| 服務 | 限制 | 每條報價請求的價格(美元)2 |

|---|---|---|

| AMEX(B/CTA網絡) | $0.01 | |

| ASX Total | 不支持ASX24 僅限非專業訂閱用戶 |

$0.03 |

| Bolsa de Madrid | $0.03 | |

| 加拿大交易所集團(TSX/TSXV) | 僅限不是IB加拿大客戶的非專業訂閱用戶 | $0.03 |

| CBOT實時 | $0.03 | |

| CME實時 | $0.03 | |

| COMEX實時 | $0.03 | |

| Eurex Core | 僅限非專業訂閱用戶 | $0.03 |

| Euronext基礎版 | 僅限非專業訂閱用戶 包括Euronext股票、指數、股票衍生品及指數衍生品 |

$0.03 |

| 德國ETF和指數 | 僅限非專業訂閱用戶 | $0.03 |

| 香港(HKFE)衍生品 | $0.03 | |

| 香港證券交易所(股票、權證、債券) | $0.03 | |

| 約翰內斯堡證券交易所 | $0.03 | |

| 蒙特利爾衍生品 | 僅限非專業訂閱用戶 | $0.03 |

| NASDAQ(C/UTP網絡) | $0.01 | |

| Nordic衍生品 | $0.03 | |

| Nordic股票 | $0.03 | |

| NYMEX實時 | $0.03 | |

| NYSE(A/CTA網絡) | $0.01 | |

| OPRA(美國期權交易所) | $0.03 | |

| 上交所5秒快照(通過HKEx) | $0.03 | |

| 深交所5秒快照(通過HKEx) | $0.03 | |

| SIX瑞士交易所 | 僅限非專業訂閱用戶 | $0.03 |

| 即期市場德國(Frankfurt/Xetra) | 僅限非專業訂閱用戶 | $0.03 |

| STOXX指數實時數據 | 僅限非專業訂閱用戶 | $0.03 |

| 多倫多證券交易所 | 僅限IB加拿大客戶中的非專業訂閱用戶 | $0.03 |

| 多倫多證券交易所創業板 | 僅限IB加拿大客戶中的非專業訂閱用戶 | $0.03 |

| 英國倫敦證券交易所(IOB)股票 | $0.03 | |

| 英國倫敦證券交易所股票 | $0.03 |

1根據監管要求,IBKR不再向Interactive Brokers LLC的客戶提供美國股票的延時報價信息。

2費用按每筆快照報價請求計算,如果不是美元計費,則將按賬戶基礎貨幣收取。

資格要求

- 賬戶必須達到市場數據訂閱的最低和維持資産要求才能使用快照報價服務。

- 用戶必須運行TWS 976.0或以上版本才能使用快照報價功能。

定價詳情

- 每月客戶可免費接收$1.00美元的快照報價。免費快照可能會用于美國或非美國報價請求,而一旦免費額度用完,便會直接開始收費,不再另行通知。客戶可在客戶端中查看其每日的快照使用情况。

- 報價采用後付費模式,通常在提供快照服務次月的第一周收取。賬戶現金或含貸款價值的淨資産如不足以支付月費的,賬戶持倉將面臨清算。

- 快照數據的月費用不得超過相關實時數據的月費。如果當月快照報價合計費用達到了相關實時數據的價格,則該月剩餘時間用戶無需支付額外費用便可使用實時數據服務。系統將在用戶達到快照數據費用上限下一個工作日的美東時間18:30左右切換爲實時報價。月末,實時報價服務會自動終止,次月快照費用則重新開始累計。每項服務的費用均單獨累計,一項服務的報價請求不得與另一項服務合幷來應用上限。詳情請見以下表格。

| 服務 | 每條報價請求的價格(美元) | 非專業訂閱用戶上限(請求次數/總費用)2 | 專業訂閱用戶上限(請求次數/總費用)3 |

|---|---|---|---|

| AMEX(B/CTA網絡) | $0.01 | 150/$1.50 | 2,300/$23.00 |

| NASDAQ(C/UTP網絡) | $0.01 | 150/$1.50 | 2,500/$25.00 |

| NYSE(A/CTA網絡) | $0.01 | 150/$1.50 | 4,500/$45.00 |

請求快照報價

桌面版交易——標準模式TWS:

如您已能看到延時數據且啓用了快照報價,則您可在“代碼行動”欄下看到“快照”按鈕:

點擊“快照”按鈕後會出現報價詳情窗口。一旦系統收到了該産品的NBBO(全國最佳買賣價)報價,報價詳情窗口會即刻生成一個時間戳幷顯示NBBO信息:

在報價詳情窗口中點擊刷新鏈接會更新NBBO報價。

舉例:

在上例中,GOOG是一家在納斯達克(C/UTP 網絡)上市的公司。每請求一次報價(一次快照)的費用爲0.01美元。

- 非專業用戶最多可再請求149條GOOG或任意其它在納斯達克(C/UTP 網絡)挂牌的股票的快照數據,超過149條將切換爲實時報價。

- 專業用戶最多可再請求2449條GOOG或任意其它在納斯達克(C/UTP 網絡)上市的股票的快照數據,超過2449條將切換爲實時報價。

您請求快照數據産生的費用不會超過上限。一旦達到上限,該月剩餘時間將不會産生新的費用,且您將收到該産品的實時數據。

桌面版交易——TWS魔方:

如您已能看到延時數據且啓用了快照報價,選擇監控標簽下的某一行後,“定單輸入”窗口會顯示請求快照數據的選項。

點擊+快照鏈接後會出現報價詳情窗口。一旦系統收到了該産品的NBBO報價,報價詳情窗口會即刻生成一個時間戳幷顯示NBBO信息:

在報價詳情窗口中點擊刷新鏈接會更新NBBO報價。

客戶端:

如您已能看到延時數據且啓用了快照報價,在買價/賣價下的“定單委托單”窗口內,您將看到快照鏈接:

點擊快照鏈接後會出現報價詳情窗口。一旦系統收到了該産品的NBBO報價,報價詳情窗口會即刻生成一個時間戳:

在報價詳情窗口中點擊刷新鏈接會更新NBBO報價。

網絡交易——網絡交易者(WebTrader):

如您已能看到延時數據且啓用了快照報價,在“市場”標簽下的“其它數據”欄上您將看到“快照”數據:

點擊“快照”按鈕後會出現報價詳情窗口。一旦系統收到了該産品的NBBO報價,報價詳情窗口會即刻生成一個時間戳:

移動交易——移動IBKR應用:

在報價界面點擊任意産品代碼會擴展報價框。如您已能看到延時數據且啓用了快照報價,您將看到“快照”鏈接:

點擊“快照”鏈接後會出現報價詳情窗口。一旦系統收到了該産品的NBBO(全國最佳買賣價)報價,報價詳情窗口會即刻生成一個時間戳幷顯示NBBO信息:

Why do I receive a message stating market data is over the limit?

When you open an account with IBKR, you are initially set to receive a minimum of 100 concurrent lines of market data. This means that, either on IBKR Trading Platforms (TWS, IBKR Mobile, Client Portal trading facility) or on API/third party interface, you can simultaneously feed 100 tickers with market data. As explained here, after the first month of trading, your allowance might be increased either automatically (based on your account equity/commission) or manually (by the purchase of Quote Booster packs.)

Note: The same market data allowance is set for all the users of the same account, since it is based on account-wise parameters such as commissions and equities.

Table of contents

Why some financial instruments show question marks instead of data?

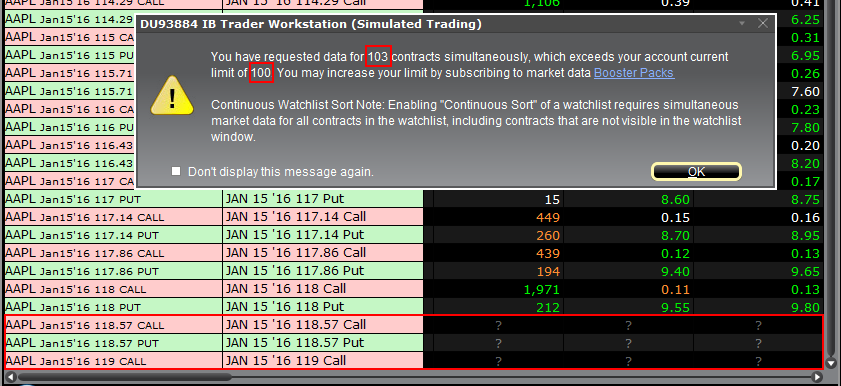

There are various functions and tools in TWS using market data: watchlists, charts, trading or analytical tools, alarms. In general, any foreground window which actively uses market data for display or for calculations, will increase the total number of market data channels currently opened. Once you have exceeded the maximum Market Data allowance for your account, you will be prevented from receiving additional market data. In this case, one or more tickers will show a "?" instead of actual quotes and your TWS will display the following warning message:

"You have requested data for XXX contracts simultaneously, which exceeds your account current limit of YYY. You may increase your limit by subscribing to market data Booster Packs."

Note: If you have decided to hide the warning by ticking the checkbox "Don't display this message again", you will not see it again next times you exceed the market data limit. Nevertheless you will still see "?" for one or more tickers instead of the actual quotes.

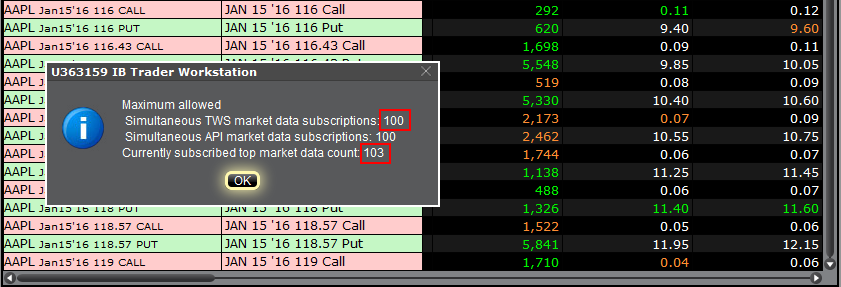

Where can I check the current market data allowance?

Within TWS, you can check how much of your total market data allowance you are currently consuming in the "Maximum Allowed" window. While in TWS, press the keys Ctrl + Alt + = (on a MAC click: Control + Option + =) and you will see the Maximum allowed pop-up indicating the market data allowance (the value close to "Simultaneous TWS market data subscriptions") and the market data lines currently used (the value close to "Currently subscribed top market data count".)

Which solutions are available to me?

-

Reduce the number of financial instruments displayed within your trading platform

To overcome an excessive market data usage, the easiest solution is to reduce the amount of financial instruments present within your trading platform. Here below are some ways to accomplish that:

a. Delete some tickers from your watchlist(s). There might be old tickers you are no longer interested in or there may be expired contracts. Deleting those will reduce the overall market data usage.

b. Minimize or hide one or more watchlist or other tools consuming market data. Only the TWS windows which are active and in the foreground contribute to market data count. If you have floating watchlists/charts and you minimize them or send them to the background, you will actually decrease the overall market data usage by the number of tickers present on those watchlists/charts

c. Use more restrictive filters within Option Trader / Option Chains / Strategy Builder. Those tools often become top market data consumers due to the high number of option contracts they display. All those tools provide filtering based on strike / expiry / trading class. By acting on those filters you can reduce the number of option contracts displayed

Note: Some derivatives contracts (Futures, Options, Future Options) will often consume two market data channel, one for the contract himself and one for the underlying, since the underlying contract is used for Greeks / Volatility calculations

-

Purchase Quote Booster pack(s)

Each Quote Booster pack will cost you 30 USD monthly and will entitle you to 100 additional market data lines (on the top of your current allotment). The maximum number of Quote Booster packs you can purchase for your account is 10.

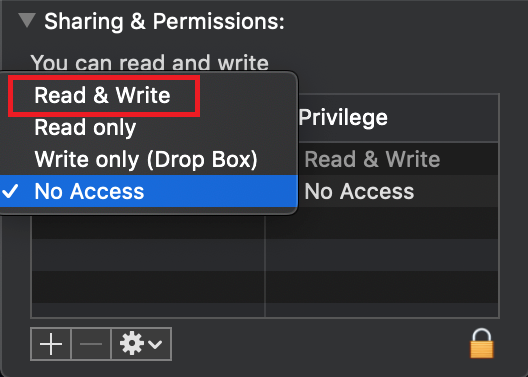

How to fix the "Cannot create ... file" error during TWS installation on MacOS

The filesystem permissions are controlled by your machines operating system. One of their functions is to secure your files, preventing unauthorized access or undesired modifications to the system and to your personal data.

Some software on your computer may modify or override the permissions assigned by the operating system. Under certain circumstances, this prevents the TWS installer from accessing the folder where the application core files have to be created (/users/youruser/home/Applications). In such cases, the TWS installation usually displays the error "Cannot create ... file. Shall I try again?"

Procedure:

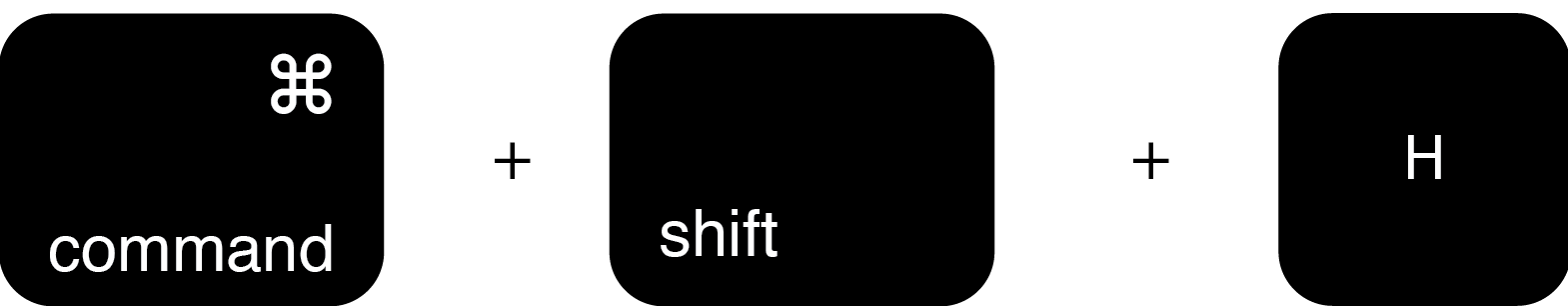

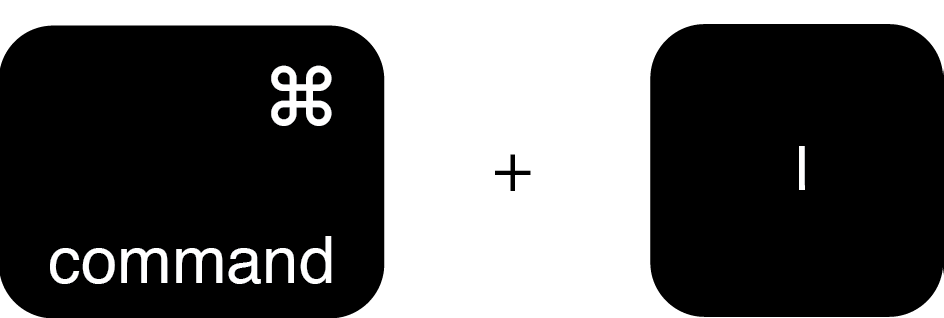

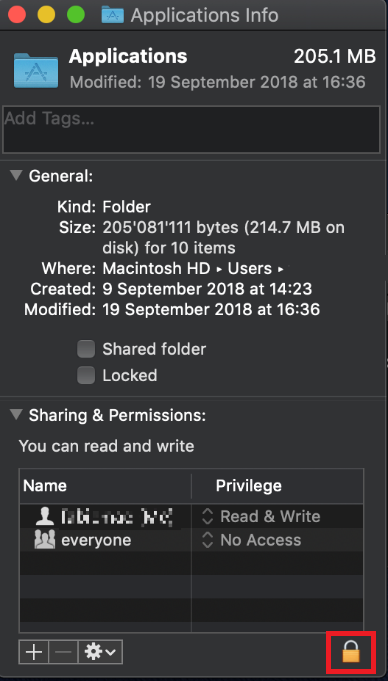

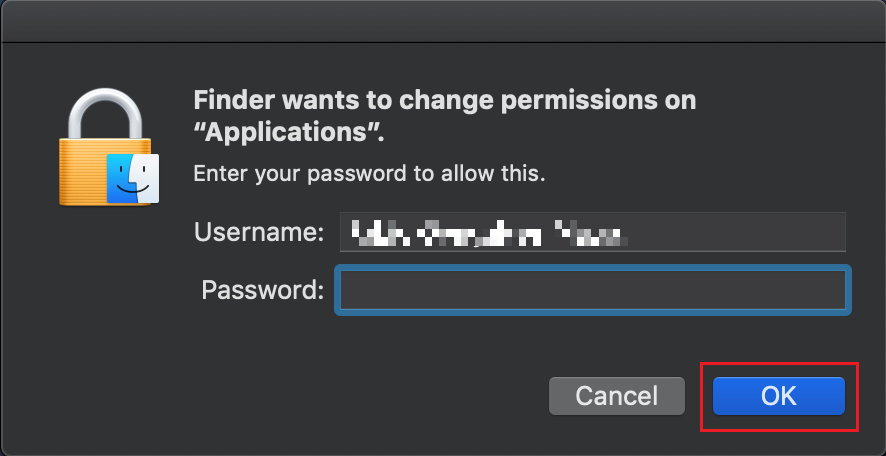

.png)

.png)

.png)

7. Once the installation has completed successfully, repeat the previous steps from 1. to 5. setting back the permissions of “everyone” to “Read Only” to revert your changes to the initial status

Complex Position Size

For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e.g. a vertical spread where the short leg is assigned and the user re-writes the same leg the next day, or if the user creates a the position over multiple trades, or if the order is not filled as a native combination at the exchange.

IB TWS和IB Key整合為移動IBKR

概況

如何遷移賬戶使用者取決於您當前使用何種應用程序:

1. 您的智能手機僅用於交易(安裝了IB TWS)- 點擊此處

2. 您的智能手機僅用於驗證(安裝了IB Key) - 點擊此處

3. 您的智能手機既用於交易,也用於驗證(安裝了IB TWS和IB Key) - 點擊此處

4. 您的智能手機用於進行借記卡交易(安裝了IB Key) - 點擊此處

您是IB TWS用戶

您使用手機上的IB TWS交易,但您未使用IB Key。

1. 在首次打開應用程序時,您將看到以下新的主頁面。

圖1是iOS設備上的移動IBKR主頁面。圖2是安卓設備的版本。

.png)

.png)

圖 1 圖 2

2. 點擊“交易”按鈕。

3. 應用程序的其它方面與您之前使用的一樣。

通過“交易”頁面訪問其它功能

如您希望使用移動IBKR的其它功能,比如驗證模塊或借記卡功能:

對於iOS設備(圖3)

1. 打開菜單上的“更多”(頁面右下角)。

2. 滾動到頁面底部。

對於安卓設備(圖4)

1. 打開“應用”菜單

2. 滾動到底部的App設置

.png)

.png)

圖3 圖 4

您是IB Key使用者

激活

1. 打開移動IBKR并點擊“驗證”。

2. 應用程序會檢測設備上是否安裝了IB Key并提示您下一步如何操作 - 要么自動遷移(圖5),要么先更新、然后再自動遷移。

您也可選擇之后再手動遷移。

.png)

.png)

.png)

圖5 圖6 圖7

遷移完成后,如您嘗試運行獨立的IB Key應用 - 即您之前驗證過的IB Key - 您將看到以下界面(圖8)。

.png)

圖8

日常操作

A. 如您有網絡連接,則日常登錄沒有任何變化 - 系統會使用無縫驗證:

1. 在(TWS、賬戶管理、網頁交易者或移動IBKR)的相應區域內輸入您的登錄信息。點擊“登錄”。

2. 系統會向您的手機發送一條通知 - 點擊該通知。

3. 取決於您的設備,(在iOS設備上)將面部置於攝像頭前或在指紋傳感器上按壓指紋,或(在安卓設備上)輸入您的PIN碼。系統會自動登錄。

B. 如您沒有互聯網連接,您可通過驗證-響應的模式使用移動IBKR:

1. 在(TWS、賬戶管理、網頁交易者或移動IBKR)的相應區域內輸入您的登錄信息。點擊“登錄”。

2. 點擊“我沒有收到通知”。

3. 打開移動IBKR并點擊“驗證”。

4. 在您手機的“驗證碼”區域輸入登錄界面上顯示的值。點擊“生成”按鈕。

5. 在登錄界面的“響應字符串”區域輸入您智能手機應用顯示的值。點擊“登錄”。

您既是IB TWS的使用者,也是IB Key的使用者

1. 請先激活移動IBKR程序的“驗證”模塊(點擊此處)。

2. 點擊您新的移動IBKR應用主頁面上的“交易”按鈕登錄交易界面(點擊此處)。

您使用IB借記卡

1. 請先激活移動IBKR程序的“驗證”模塊(點擊此處)。

2. 在移動IBKR應用的主頁面上點擊“借記卡”按鈕。其它功能的使用和過去一樣。

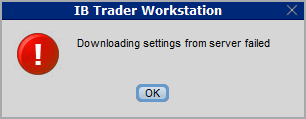

How to overcome the "Downloading settings from server failed" error

Store settings on server allows clients the ability to store their Trader Workstation (TWS) settings/configuration on the cloud and retrieve them at anytime from another computer. This feature allows you to use the layout of a specific user on two or more machines.

In some specific circumstances, the operation which stores/downloads the settings to/from the cloud may fail and the following error message may appear shortly after the TWS has loaded on the screen:

How to overcome this error message?

The underlying causes of this message are usually the following:

- ACCESS TO THE LOCAL MACHINE IS BLOCKED: A security setup, such as a firewall or antivirus, prevents the access of this computer to the cloud storage. This prevents TWS from accessing the remote server, thus disallowing the settings file upload or download. Recommended workaround: set up an exception on the firewall or antivirus in order to exclude the TWS executable file (c:\Jts\tws.exe) or the entire TWS folder (C:\Jts) from the real time security scan. The procedure to set an exclusion may vary, according to the software you are using, therefore we recommend consulting the user guide or the on-line documentation of your specific security program.

- ACCESS TO THE REMOTE SERVER IS BLOCKED: A firewall or proxy service blocks the communication with the cloud storage through the network on which this computer is. In this scenario, you (or your IT / Networking departments, in case you do not have the rights for such an operation) can modify the firewall or proxy settings to allow the computer to communicate with the cloud server s3.amazonaws.com on the TCP port 443. For additional details about the hosts/ports which needs to be allowed for the proper TWS operation, please see as well the section "DESKTOP TWS" of KB2816. Please refer to the documentation of your specific software in order to create specific rules for your firewall or proxy system.

Why is my chart delayed, showing question marks or only partially populated?

What are SMART Charts and how are they generated?

The SMART charting mechanism analyzes and compares the market data coming from all venues a given contract is traded on and graphically displays the most favorable quotes.

When all the data streams are live, the data points are available for all sources and for each time point, thus they can be fully compared. The resulting SMART chart will be up to date and fully populated, moreover it will constantly and automatically update1.

The comparison between non synchronized market data streams (some live and some delayed) is just partially possible, since the delayed feeds are lacking data points for the last 15 or 20 minutes. Therefore, within that time frame, the SMART chart will usually display a series of yellow question marks to indicate unavailability of source data. In this case the SMART Chart will not update automatically.

When the lack of data points is more extensive or when the Exchange does not distribute delayed data for a given contract, the correspondent SMART Chart may be completely blank.

What should I do to obtain a fully populated, up-to-date chart?

If your trading method is based on SMART charts, you would need to activate the live market data subscriptions for all the marketplaces your financial instruments are traded on2. For additional details, please see KB1201

If your trading method does not require SMART charts, you can decide to use Direct chart routing as a workaround.

A Directed Chart will allow you to graphically represent the market data coming from a single, specific Exchange. When possible, we suggest to select the primary marketplace for the product for this purpose, since this is usually the one offering the highest liquidity and trade volume, hence normally providing the most favorable quotes. If you have subscribed the market data for that venue, the resulting Directed Chart will be fully populated, up to date and it will update automatically1.

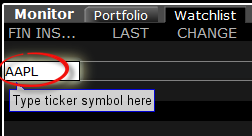

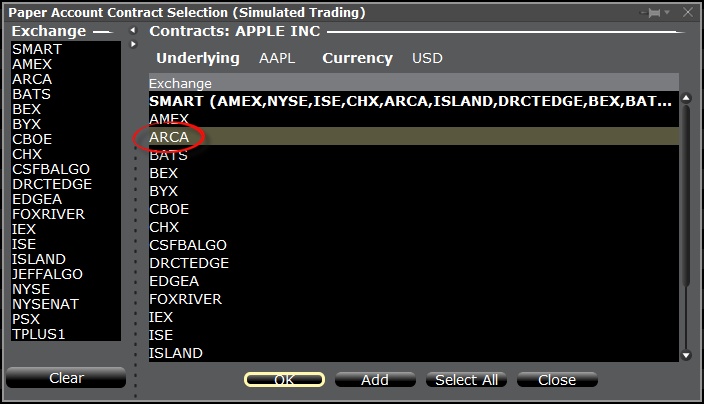

How do I set up a Directed Chart?

1. Within a watchlist, type the contract symbol and press Enter on your keyboard.

2. When then contract selection menu appears, select the item Stock (Directed). If you do not see this item, click on the small down arrow at the bottom of the menu to reveal the hidden menu items.

.png)

3. The Exchange selection screen will appear. You can now select the main Exchange for the product or the Exchange for which you have an active live market data subscription. Once done, click OK.

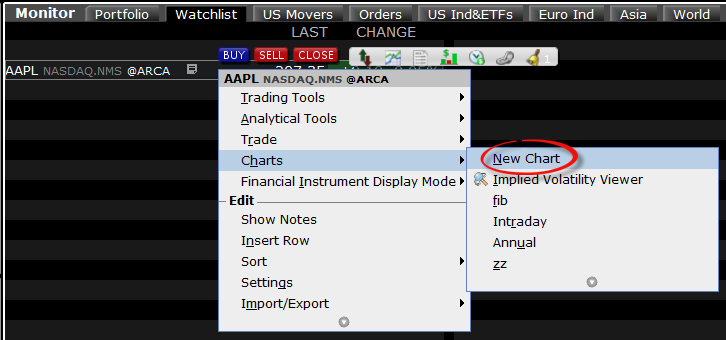

4. Within your watchlist you will see a newly created Directed Ticker line. It will contain the contract symbol and, preceded by the @ sign, the Exchange you selected at the previous step. Right click on that directed ticker line and select Chart > New Chart

Delayed Market Data Timing

Market data vendors typically offer exchange data in two categories, real-time and delayed. Real-time market data is disseminated as soon as the information is publicly available. Delayed market data is on a time lag that is usually 10-20 minutes behind real-time quotes.

Some exchanges allow delayed data to be displayed without any market data subscription, free of charge. A list of the exchanges we provide delayed data for at no cost and without formal request (i.e., the delayed data will be displayed upon entry of the product symbol on the trading platform) are outlined in the table below. The table also includes the corresponding real-time subscription, the fees for which are posted on IBKR's public website.

Please Note:

- In accordance with regulatory requirements, IBKR no longer offers delayed quotation information on U.S. equities to Interactive Brokers LLC clients.

- Delayed quotes should be used for indicative purposes and not necessarily for trading. The times mentioned may be subject to further delays without notice.

The Americas

| External Exchange Name | IB Exchange Name | Delay Period | Real Time Subscription |

| CBOT | CBOT | 10 minutes | CBOT Real-Time |

| CBOE Futures Exchange | CFE | 10 minutes | CFE Enhanced |

| Market Data Express (MDX) | CBOE | 10 minutes | CBOE Market Data Express Indices |

| CME | CME | 10 minutes | CME Real-Time |

| COMEX | COMEX | 10 minutes | COMEX Real-Time |

| ICE US | NYBOT | 10 minutes | ICE Futures U.S. (NYBOT) |

| Mexican Derivatives Exchange | MEXDER | 15 minutes | Mexican Derivatives Exchange |

| Mexican Stock Exchange | MEXI | 20 minutes | Mexican Stock Exchange |

| Montreal Exchange | CDE | 15 minutes | Montreal Exchange |

| NYMEX | NYMEX | 10 minutes | NYMEX Real-Time |

| NYSE GIF | NYSE | 15 minutes | NYSE Global Index Feed |

| One Chicago | ONE | 10 minutes | OneChicago |

| OPRA | OPRA | 15 minutes | OPRA Top of Book (L1) (US Option Exchanges) |

| OTC Markets | PINK | 15 minutes | OTC Markets |

| Toronto Stock Exchange | TSE | 15 minutes | Toronto Stock Exchange |

| Venture Exchange | VENTURE | 15 minutes | TSX Venture Exchange |

Europe

| External Exchange Name | IB Exchange Name | Delay Period | Real Time Subscription |

| BATS Europe | BATE/CHIX | 15 minutes | European (BATS/Chi-X) Equities |

| Boerse Stuttgart | SWB | 15 minutes | Stuttgart Boerse incl. Euwax (SWB) |

| Bolsa de Madrid | BM | 15 minutes | Bolsa de Madrid |

| Borsa Italiana | BVME/IDEM | 15 minutes | Borsa Italiana (BVME stock / SEDEX / IDEM deriv) |

| Budapest Stock Exchange | BUX | 15 minutes | Budapest Stock Exchange |

| Eurex | EUREX | 15 minutes | Eurex Real-Time Information |

| Euronext | AEB/SBF/MATIF/BELFOX | 15 minutes | Euronext Cash |

| Euronext | AEB/SBF/MATIF/BELFOX | 15 minutes | Euronext Data Bundle |

| Frankfurt Stock Exchange and XETRA | FWB/IBIS/XETRA | 15 minutes | Spot Market Germany (Frankfurt/Xetra) |

| ICE Futures Europe (Commodities) | IPE | 10 minutes | ICE Futures E.U. - Commodities (IPE) |

| ICE Futures Europe (Financials) | ICEEU | 10 minutes | ICE Futures E.U. – Financials (LIFFE) |

| LSE | LSE | 15 minutes | LSE UK |

| LSEIOB | LSEIOB | 15 minutes | LSE International |

| MEFF | MEFF | 15 minutes | BME (MEFF) |

| NASDAQ OMX Nordic Derivatives | OMS | 15 minutes | Nordic Derivatives |

| Prague Stock Exchange | PRA | 15 minutes | Prague Stock Exchange Cash Market |

| SWISS Exchange | EBS/VIRTX | 15 minutes | SIX Swiss Exchange |

| Tel Aviv Stock Exchange | TASE | 15 minutes | Tel Aviv Stock Exchange |

| Turquoise ECN | TRQXCH/TRQXDE/TRQXEN | 15 minutes | Turquoise ECNs |

| Warsaw Stock Exchange | WSE | 15 minutes | Warsaw Stock Exchange |

Asia

| External Exchange Name | IB Exchange Name | Delay Period | Real Time Subscription |

| Australian Stock Exchange | ASX | 20 minutes | ASX Total |

| Hang Seng Indices | HKFE-IND | 15 minutes | Hang Seng Indexes |

| Hong Kong Futures Exchange | HKFE | 15 minutes | Hong Kong Derivatives (Fut & Opt) |

| Hong Kong Stock Exchange | SEHK | 15 minutes | Hong Kong Securities Exchange (Stocks, Warrants & Bonds) |

| Korea Stock Exchange | KSE | 20 minutes | Korea Stock Exchange |

| National Stock Exchange of India | NSE | 15 minutes | National Stock Exchange of India, Capital Market Segment |

| Osaka Securities Exchange | OSE.JPN | 20 minutes | Osaka Exchange |

| SGX Derivatives | SGX | 10 minutes | Singapore Exchange (SGX) - Derivatives |

| Shanghai Stock Exchange | SEHKNTL | 15 minutes | Shanghai Stock Exchange |

| Shanghai Stock Exchange STAR Market | SEHKSTAR | 15 minutes | Shanghai Stock Exchange |

| Shenzhen Stock Exchange | SEHKSZSE | 15 minutes | Shenzhen Stock Exchange |

| Singapore Stock Exchange | SGX | 10 minutes | Singapore Exchange (SGX) - Stocks |

| Australia Securities Exchange | ASX24 | 10 minutes | ASX24 Commodities and Futures |

| Taiwan Stock Exchange | TWSE | 20 minutes | Taiwan Stock Exchange |

| Tokyo Stock Exchange | TSEJ | 20 minutes | Tokyo Stock Exchange |

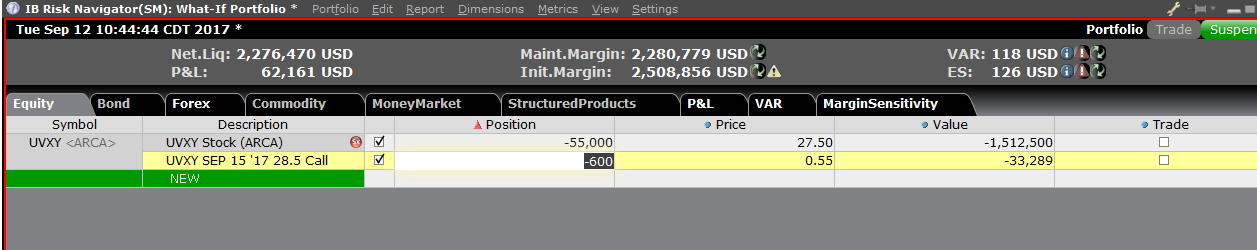

Risk Navigator: Alternative Margin Calculator

IB routinely reviews margin levels and will implement changes which serve to increase requirements above statutory minimums as market conditions warrant. To assist clients with understanding the effects of such changes on their portfolio, a feature referred to as the "Alternative Margin Calculator" is provided within the Risk Navigator application. Outlined below are the steps for creating a “what-if” portfolio for the purpose of determining the impact of such margin changes.

Step 1: Open a new “What-if” portfolio

From the Classic TWS trading platform, select the Analytical Tools, Risk Navigator, and then Open New What-If menu options (Exhibit1).

Exhibit 1

.png)

From the Mosaic TWS trading platform, select New Window, Risk Navigator, and then Open New What-If menu options.

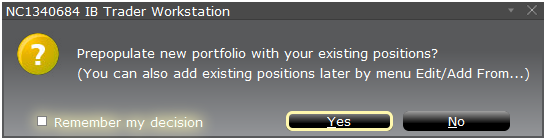

Step 2: Define starting portfolio

A pop-up window will appear (Exhibit 2) from which you will be prompted to define whether you would like to create a hypothetical portfolio starting from your current portfolio or a newly created portfolio. Clicking on the "yes" button will serve to download existing positions to the new “What-If” portfolio.

Exhibit 2

Clicking on the "No" button will open up the “What – If” Portfolio with no positions.

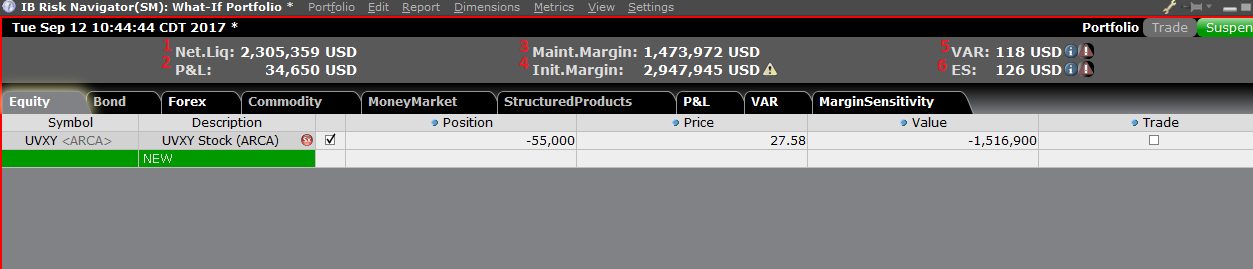

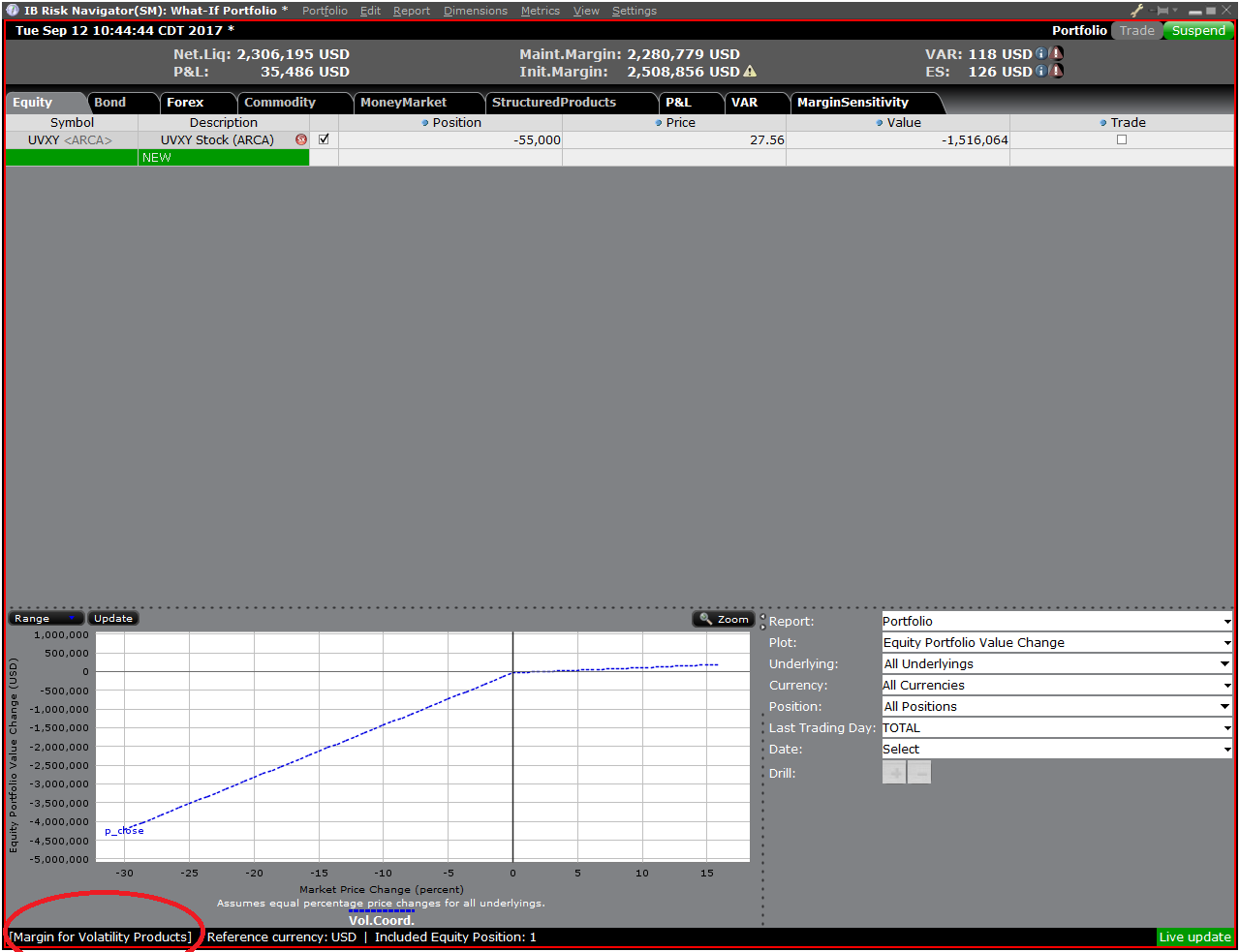

Risk Dashboard

The Risk Dashboard is pinned along the top of the product tab-sets, and is and is available for what-if as well as active portfolios. The values are calculated on demand for what-if portfolios. The dashboard provides at-a-glance account information including:

1) Net Liquidation Value: The total Net Liquidation Value for the account

2) P&L: The total daily P&L for the entire portfolio

3) Maintenance Margin: Total current maintenance margin

4) Initial Margin: Total initial margin requirements

5) VAR: Shows the Value at risk for the entire portfolio

6) Expected Shortfall (ES): Expected Shortfall (average value at risk) is expected return of the portfolio in the worst case

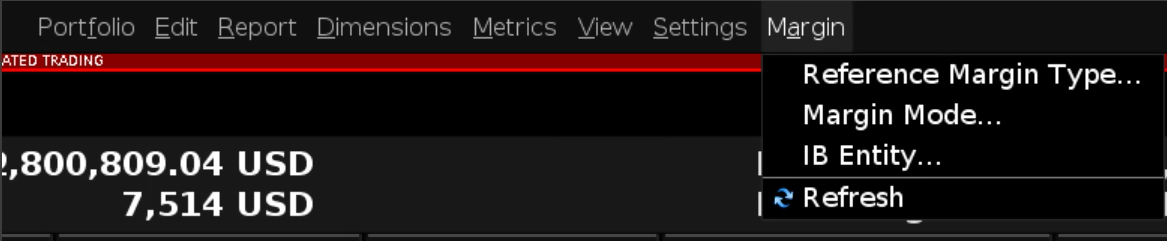

Alternative Margin Calculator

The Alternative Margin Calculator, accessed from the Margin menu and clicking on the Margin Mode (Exhibit 3), shows how the margin change will affect the overall margin requirement, once fully implemented.

Exhibit 3

Step 3: Selecting Margin Mode Settings

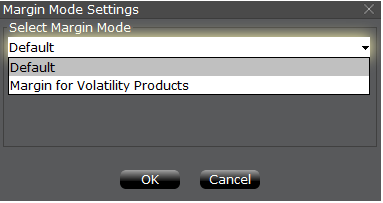

A pop-up window will appear (Exhibit 4) entitled Margin Mode Setting. You can use the drop-down menu in that window to change the margin calculations from Default (being the current policy) to the new title of the new Margin Setting (being the new margin policy). Once you have made a selection click on the OK button in that window.

Exhibit 4

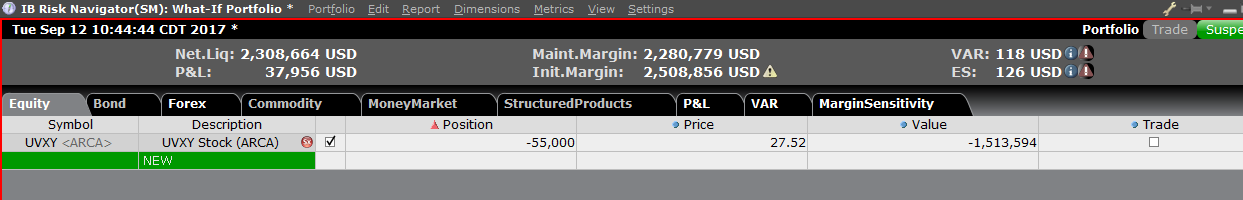

Once the new margin mode setting is specified, the Risk Navigator Dashboard will automatically update to reflect your choice. You can toggle back and forth between the Margin Mode settings. Note that the current Margin Mode will be shown in the lower left hand corner of the Risk Navigator window (Exhibit 5).

Exhibit 5

Step 4: Add Positions

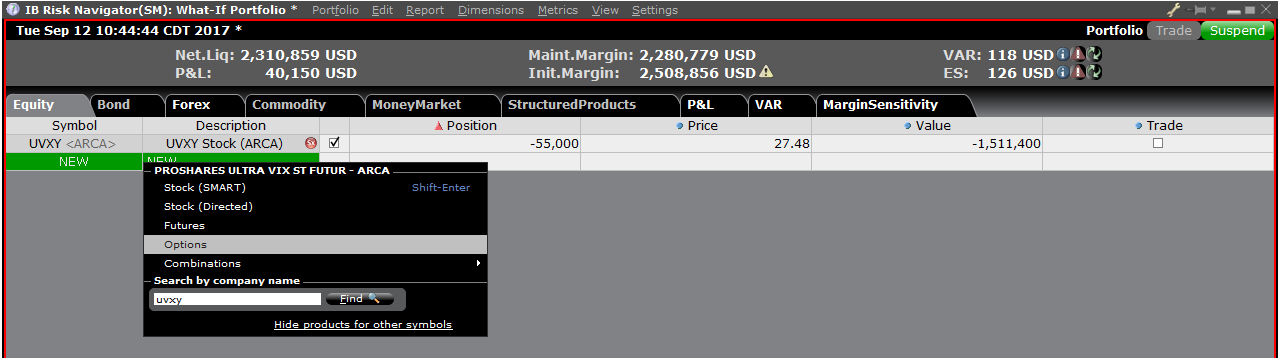

To add a position to the "What - If" portfolio, click on the green row titled "New" and then enter the underlying symbol (Exhibit 6), define the product type (Exhibit 7) and enter position quantity (Exhibit 8)

Exhibit 6

Exhibit 7

Exhibit 8

You can modify the positions to see how that changes the margin. After you altered your positions you will need to click on the recalculate icon (![]() ) to the right of the margin numbers in order to have them update. Whenever that icon is present the margin numbers are not up-to-date with the content of the What-If Portfolio.

) to the right of the margin numbers in order to have them update. Whenever that icon is present the margin numbers are not up-to-date with the content of the What-If Portfolio.