Ordervorschau/Marginauswirkung prüfen

Die Funktion „Ordervorschau/Marginauswirkung prüfen“ bietet die Möglichkeit, die voraussichtlichen Kosten und Provisionen und die Marginauswirkung einer Order zu überprüfen, ehe Sie diese übermitteln. Diese Funktion steht sowohl in der TWS als auch im WebTrader bereit, wobei die TWS-Variante mehr Details bereitstellt.

Trader Workstation (TWS)

Die TWS-Funktion „Margin überprüfen“ ermöglicht es Ihnen, die Marginauswirkung einer bestimmten geplanten Order von den bestehenden Positionen zu isolieren und zudem die neue Margin-Anforderung anzuzeigen, die bei Ausführung der betreffenden Order gelten würde. Die wichtigsten Marginwerte, wie zum Beispiel die Anforderungen für den Ersteinschuss und Mindesteinschuss, sowie das Eigenkapital mit Beleihungswert, werden hier ausgewiesen. Wenn Sie diese Funktion verwenden möchten, richten Sie den Mauszeiger auf eine Orderzeile, führen Sie einen Rechtsklick aus und wählen Sie die Option „Margin überprüfen“ aus dem Drop-Down-Menü aus.

Beispiel: Kauf von 1 ES Juni 2012 Future @ 1387.25

Im ersten Abschnitt der Ordervorschau werden der Geldkurs, der Briefkurs und der letzte Handelskurs des Wertpapiers angezeigt.

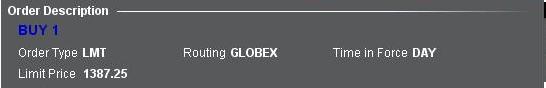

Im zweiten Abschnitt sehen Sie die wichtigsten Orderdetails.

Im Kontoabschnitt sehen Sie den Wert der Order sowie einen Schätzwert für die anfallenden Provisionen.

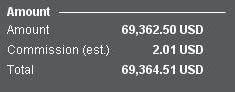

Der Abschnitt Marginauswirkung zeigt eine Aufstellung der folgenden Werte an:

Aktuell = Die aktuellen Marginwerte, ohne Berücksichtigung der Order, die platziert werden soll.

Veränderung = Die Auswirkung der Order, wenn diese übermittelt wird, ohne Einbeziehung jeglicher im Konto bestehender Positionen.

Nach Ausführung = Die Kontowerte, die sich voraussichtlich nach Übermittlung und Ausführung der Order und Aufnahme der Position ins Portfolio ergeben.

WebTrader

In der WebTrader-Ordervorschau sehen Sie lediglich äquivalente Werte zum Abschnitt „Nach Ausführung“ aus der TWS.

So können Sie feststellen, ob Sie ein Darlehen von IBKR nutzen

Wenn der Gesamtbarsaldo eines Kontos ein Sollsaldo - d. h. negativ - ist, wird der entsprechende Guthabenbetrag geliehen und es fallen Zinsen auf dieses Darlehen an. Es ist jedoch auch möglich, dass ein Darlehen vorliegt, wenn der Gesamtbarsaldo ein Habensaldo - d. h. positiv - ist. Dies kann durch die Verrechnung von Salden („Balance Netting“) oder zeitliche Differenzen begründet sein. Nachstehend finden Sie Beispiele für typische Szenarien, in denen dies der Fall ist:

Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

Overview of Dividend Payments in Lieu ("PIL")

Payment In Lieu of a Dividend (“payment in lieu” or “PIL”) is a term commonly used to describe a cash payment to an account in an amount equivalent to the ordinary dividend. Generally, the amount paid is per share owned. In addition, the dividend in most cases is paid quarterly (i.e., four times per year). The dividend payment is classified as follows: (1) ordinary dividend; and/or (2) payment in lieu of dividend. The former designation is for a payment received directly from the issuer or its paying agent. The latter designation is used when a cash payment is received from other than the issuer or the issuer’s agent.

Payment in lieu of an ordinary dividend may be received when the shares have been bought on margin, or when the account has a subsequent margin loan due to borrowing money to facilitate the payment for additional purchases of shares or as the result of a withdrawal from the margin account. Payment in lieu of a dividend may also be received when shares are owed to the brokerage firm and have not been received by the dividend record date.

To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations. Each business day, the Firm analyzes the positions in each customer account, every borrow, every loan, every pledge of shares for each security held by its customers to determine how many shares are held on margin and the associated margin loan balances. For each security that is fully paid, we are required to segregate those shares in a good control location (for example, a depository or a US bank. See KB1964). For shares that are held as collateral for a margin loan we are allowed to hypothecate and re-hypothecate shares valued up to 140 percent of the total debit balance in the customer account (See KB1967).

While the guidelines noted above for segregation of securities are clear, there are exceptions that are outside of the Firm's control. For instance, through no fault of its own, IB may have a deficit in segregated shares due to customer activity that changes the Firm’s overall segregation requirement for a security. This may be for a variety of reasons including a delay in receiving shares that have been loaned out to a counterparty after segregation requirements are recalculated and the Firm has issued a stock loan recall, sales of securities by one or more customers that reduce or eliminate margin loans, the deposit of cash by customers that similarly reduce or eliminate margin loans, or a failure of a counterparty to deliver shares for a trade settlement.

Upon issuing a recall of shares loaned, rules permit the borrower of the shares up to 3 business days to return them. The borrower of the shares is required to return them to us when we issue a recall, but if by business day 3 the shares have not been returned, IB may then issue a buy-in notice to begin the process of regaining possession of the shares. An additional 3 business days is generally needed for the purchased shares to settle and be delivered to the firm. Similarly if a counterparty fails to deliver by settlement date, shares to IB to settle a customer purchase, IB can issue a buy-in notice but the purchase of such shares are also subject to trade settlement in 3 days.

To summarize, if by the record date of a dividend certain shares have not been delivered to IB, the Firm will be paid an amount of cash that is equivalent to the dividend amount, but IB will not receive a qualified dividend payment directly from the issuer. In such cases, the Firm will receive PIL and will have no choice but to allocate such payment in lieu to customer accounts. The firm first allocates PIL to those accounts who hold the shares as collateral for a margin loan. If, after PIL is allocated to all shareholders whose accounts are not fully paid, any portion of PIL remains to be paid, it is allocated on a pro-rata basis to each remaining client account.

Account holders should be aware that a PIL may have different tax consequences than an ordinary dividend and should consult a tax advisor to understand such differences and whether they apply to their particular situation.

Kontrolle der Risikogebühren über das Kontoübersichtsfenster

Das Kontoübersichtsfenster zeigt Ihnen die übergeordneten, allgemeinen Informationen an, die Sie benötigen, um Ihr Konto auf Echtzeit-Basis zu kontrollieren. Dies umfasst die wichtigsten Salden, wie z. B. die Gesamtsummen Ihres Bar- und Aktienkapitals, die Portfolio-Zusammensetzung und Margin-Salden zur Feststellung der Einhaltung der Mindestanforderungen und der verfügbaren Kaufkraft. Das Fenster enthält außerdem Informationen zu den zuletzt berechneten Risikogebühren und eine Prognose für die nächste Gebührenzahlung unter Berücksichtigung der aktuellen Positionen.

So öffnen Sie die Kontoübersicht:

• Klicken Sie in der klassischen Version der TWS auf das „Konto“-Symbol, oder wählen Sie im Menü „Konto“ den Menüpunkt „Kontoübersicht“ aus (Abbildung 1)

Abbildung 1

.jpg)

• In der Mosaic-Version der TWS klicken Sie hierzu in der oberen Menüleiste auf „Konto“ und anschließend auf „Kontoübersicht“ (Abbildung 2)

Abbildung 2

.jpg)

Wenn Sie das Fenster geöffnet haben, scrollen Sie nach unten bis zum Abschnitt Margin-Anforderungen und klicken auf das „+“ Zeichen oben rechts, um den Abschnitt zu erweitern. Darin werden die Beträge der letzten und erwarteten nächsten Risikogebühr für jede Produktklasse, für die solche Gebühren erhoben werden (z. B. Aktien, Öl), im Detail angezeigt. Bitte beachten Sie, dass der „letzte“ Betrag die Gebühr mit dem Stand vom letzten Berechnungsdatum angibt (Gebühren werden auf Basis der bei Handelsschluss gehaltenen offenen Positionen berechnet und kurz danach in Rechnung gestellt). Der „geschätzte nächste“ Gebührenbetrag stellt die voraussichtliche Gebühr auf Basis des Stands bei Handelsschluss am aktuellen Tag dar, unter Berücksichtigung von Positionsveränderungen seit der vorangegangenen Berechnung (Abbildung 3).

Abbildung 3.jpg)

Um anzupassen, welche Informationen in der Ausgangsansicht angezeigt werden, wenn der Abschnitt minimiert ist, müssen Sie lediglich die Kontrollkästchen neben den entsprechenden Posten markieren. Die markierten Informationen bleiben anschließend jederzeit sichtbar.

In Artikel KB2275 erhalten Sie Informationen zur Nutzung des RiskNavigator von IB für die Verwaltung und Vorabberechnung von Risikogebühren. Informationen zur Verifizierung der Risikogebühren über das Ordervorschaufenster erhalten Sie in Artikel KB2276.

Ordervorschau - Auswirkungen auf Risikogebühren überprüfen

IB stellt Ihnen eine Funktion zur Verfügung, mit der Kontoinhaber überprüfen können, ob und in welchem Maße sich eine Order auf die voraussichtlichen Risikogebühren auswirken würde. Diese Funktion sollte vor der Übermittlung einer Order verwendet werden, damit Sie bereits vorab über die resultierenden Gebühren informiert sind. So haben Sie die Möglichkeit, Änderungen an der Order vorzunehmen, noch bevor Sie diese übermitteln, um ggf. die anfallenden Gebühren zu verringern oder zu aufzuheben.

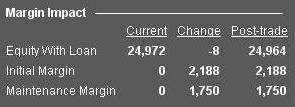

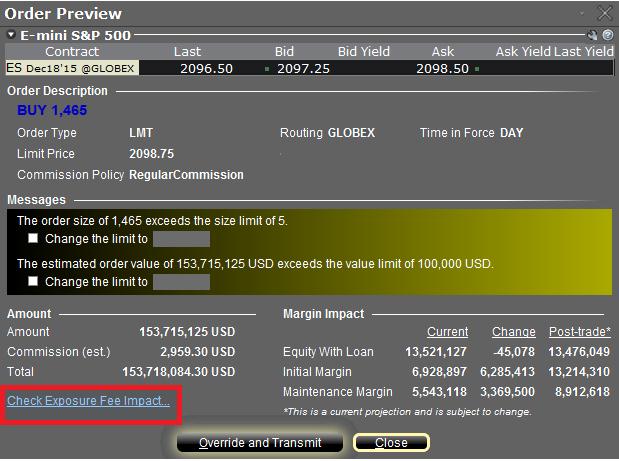

Sie können diese Funktion aktivieren, indem Sie mit der rechten Maustaste die Orderzeile anklicken. Daraufhin öffnet sich die Ordervorschau. Dieses Fenster enthält einen Link mit der Bezeichnung „Auswirkungen auf Risikogebühren prüfen“ (s. rote Markierung in Abbildung I).

Abbildung I

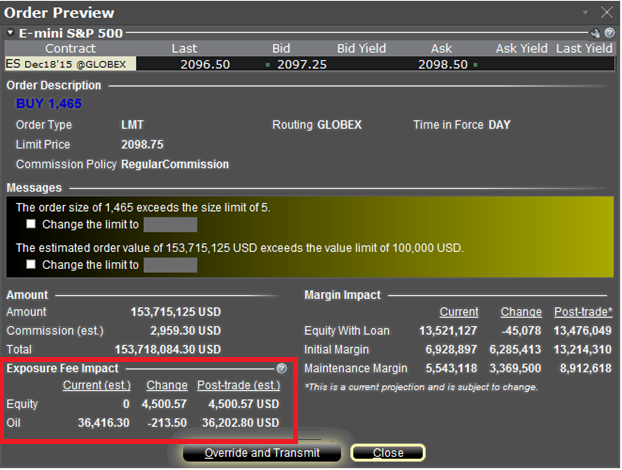

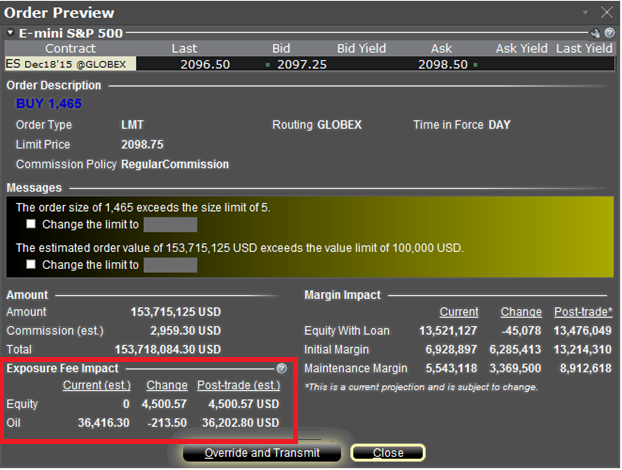

Wenn Sie diesen Link anklicken, wird das Fenster erweitert. Sie sehen nun eine Übersicht über ggf. anfallende Risikogebühren für die aktuellen Positionen, sowie die Veränderung der Gebühr bei Ausführung der angezeigten Order und die Gesamtgebührensumme nach Ausführung der Order (s. rote Markierung in Abbildung II unten). Diese Beträge werden weiter in die jeweiligen Produktklassen aufgeschlüsselt, für die die Gebühren anfallen (z. B. Aktien, Öl). Kontoinhaber können dieses Fenster einfach schließen, ohne die Order zu übermitteln, falls die Auswirkungen auf die Risikogebühren sich als zu groß erweisen.

Abbildung II

In Artikel KB2275 erhalten Sie Informationen zur Verwendung des RiskNavigator von IB für die Verwaltung und Vorabberechnung von Risikogebühren. Informationen zur Kontrolle der Gebühren über das Kontoübersichtsfenster erhalten Sie in Artikel KB2344.

Exposure Fee Monitoring via Account Window

The Account Window provides the high-level information suitable for monitoring one's account on a real-time basis. This includes key balances such as total equity and cash, the portfolio composition and margin balances for determining compliance with requirements and available buying power. This window also includes information relating to the most recently assessed exposure fee and a projection of the next fee taking into consideration current positions.

To open the Account Window:

• From TWS classic workspace, click on the Account icon, or from the Account menu select Account Window (Exhibit 1)

Exhibit 1

.jpg)

• From TWS Mosaic workspace, click on Account from the menu, and then select Account Window (Exhibit 2)

Exhibit 2

.jpg)

After opening the window, scroll down to the Margin Requirements section and click on the + sign in the upper-right hand corner to expand the section. There, the "Last" and "Estimated Next" exposure fees will be detailed for each of the product classifications to which the fee applies (e.g., Equity, Oil). Note that the "Last" balance represents the fee as of the date last assessed (note that fees are computed based upon open positions held as of the close of business and assessed shortly thereafter). The "Estimated Next" balance represents the projected fee as of the current day's close taking into account position activity since the prior calculation (Exhibit 3).

Exhibit 3.jpg)

To set the default view when the section is collapsed, click on the checkbox alongside any line item and those line items will remain displayed at all times.

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2276 for verifying exposure fee through the Order Preview screen.

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. Exposure Fee Monitoring via the Account window is only available for accounts that have been charged an exposure fee in the last 30 days

Order Preview - Check Exposure Fee Impact

IB provides a feature which allows account holders to check what impact, if any, an order will have upon the projected Exposure Fee. The feature is intended to be used prior to submitting the order to provide advance notice as to the fee and allow for changes to be made to the order prior to submission in order to minimize or eliminate the fee.

The feature is enabled by right-clicking on the order line at which point the Order Preview window will open. This window will contain a link titled "Check Exposure Fee Impact" (see red highlighted box in Exhibit I below).

Exhibit I

Clicking the link will expand the window and display the Exposure fee, if any, associated with the current positions, the change in the fee were the order to be executed, and the total resultant fee upon order execution (see red highlighted box in Exhibit II below). These balances are further broken down by the product classification to which the fee applies (e.g. Equity, Oil). Account holders may simply close the window without transmitting the order if the fee impact is determined to be excessive.

Exhibit II

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2344 for monitoring fees through the Account Window

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. The Check Exposure Fee Impact is only available for accounts that have been charged an exposure fee in the last 30 days

Tools Provided to Monitor and Manage Margin

IB provides a variety of tools and information intended to provide account holders with real-time details as to their state of margin compliance so as to avoid forced liquidations. These include the following:

Trading on margin in an IRA account

IRA accounts, by definition, may not use borrowed funds to purchase securities and must pay for all long stock purchases in full, may not carry short stock positions and may not hold a debit cash balance (in any currency). IRA accounts are eligible to carry futures and option contracts. In addition, IB offers a specific form of IRA account referred to as a “Margin IRA” that allows the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations.

For additional information regarding trading permissions in an IRA account, refer to KB188.