Currency Margin Calculation (Withdrawals)

The following provides an example of how currency margins are calculated when determining the funds available for withdrawal.

Margin for Withdrawal Example

In the following example, assume the base currency for the account is USD and the net asset value positions (the sum of the values of all stock, cash, option, etc positions in each currency) are as follows:

- USD 50,000

- EUR 30,000

- CHF -39,000

- MXN -100,000

- Determine the net asset value (net liquidation value) for each currency. In this example, this is shown in columns 1 and 2 of the example table.

- Convert all non-base currency positions to base currency using prevailing market rates between the asset currency and base currency, here, USD. (column 3). This result is shown in column 4.

- Apply the margin rate for each currency (column 5).

- Calculate the margin in base currency as the net asset value from each original currency converted to USD multiplied by the margin for that currency (column 4 times column 5). The result is shown in column 6.

- The total margin requirement is the sum of each currency sourced margin requirement. In our example, the total margin requirement in base currency, USD, is $2,126. As the total net liquidating value expressed in USD is $46,476, the available funds is the difference, $44,350.

|

1

|

2

|

3

|

4

|

5

|

6

|

|

Currency

|

Net Asset Value (local currency)

|

Currency Rate

|

Net Asset Value

(converted to base currency, USD) |

Margin Rate

|

Margin Requirement

(in base currency, USD) |

| USD | 50,000 | 1.0000 USD/USD | 50,000 | 0% | 0.00 |

| EUR | 30,000 | 1.2000 USD/EUR | 36,000 | 2.5% | 900 |

| CHF | -39,000 | 1.3000 CHF/USD | -30,000 | 2.5% | 750 |

| MXN | -100,000 | 10.500 MXN/USD | -9,524 | 5% | 476 |

| TOTAL | US $ 46,476 | US $2,126 | |||

| Available Funds | US $ 44,350 |

Currency Margin Calculation

The following provides an example of how currency margins are calculated.

Margin for Trading Example

Assume base currency is USD for the below example

1. Determine the base-currency equivalent of net liq values in the account

NetLiq USD Equivalent

EUR: -14,362.69 -19,712.723

KRW: 6,692,613.37 5032.04

USD: 15,073.07 15,073.07

Using exchange rates as follows

EUR USD 0.72860

KRW USD 1330.00000

2. Determine the haircut rates for each currency pair

HairCut Rates

USD EUR .025

USD KRW .10

EUR KRW .10

3. Determine the largest negative currency balance

4. Sort the haircut rates from smallest to largest

EUR USD 0.025

EUR KRW 0.10

5. Starting with the positive net liq base-currency equivalent with the lowest haircut rate, calculate the margin requirement on that portion which may be used to off-set the negative net liq value

Consume 15,073.07 USD equivalent against the EUR

Margin1 = (15,073.07) x 0.025 = 376.82

6. Repeat step (5) until all negative net liq values have been covered

Remaining negative net liq

-19,712.723 + 15,073.07 = -4,639.65

Consume remaining negative net liq with 4,639.65 USD equivalent of KRW

Margin2 = (4,639.65) x 0.10 = 463.97

Remaining negative net liq

-4,639.65 + 4,639.65 = 0.00

Total margin requirement = Margin1 + Margin2 = 376.82 + 463.97 = 840.79

Availability of proceeds in a 'Cash' type account

Accounts which have been set up as a 'Cash' type do not have access to the proceeds from the sale of securities until such time the transaction has settled at the clearinghouse and proceeds have been issued to IBKR. Securities settlement generally takes place on the third business day following the sale transaction. Providing access to the funds prior to settlement would constitute a loan, a transaction which is precluded from taking place within this account type.

The one exception is under the Free-Riding rule. Clients with a cash account can use the proceeds from the sale of a security to purchase a different security under the condition that the second security is held until settlement of the initial sale. If the client sells the second security prior to settlement of the initial trade, they will be in violation of the Free-Riding rule and will be locked for 90 days from utilizing this exception.

Account holders who wish to have access to settled funds prior to the settlement day may do so by electing an account type of 'Margin'. Under this account type unsettled funds may be used for trading purposes but may not be withdrawn until settlement. Account holders maintaining a 'Cash' account may request an upgrade to a 'Margin' type account by logging in to Client Portal and selecting the Settings > Account Settings menu item and Account Type from the Configuration panel. Upgrade requests are subject to a compliance review to ensure that the account holder maintains the appropriate qualifications.

Can mutual funds be purchased on margin?

Preview Order / Check Margin

The Preview Order/Check Margin feature offers the ability to review the projected cost, commission and margin impact of an order prior to its transmission. This feature is made available in both the TWS and WebTrader, with the TWS version providing greater detail.

Trader Workstation (TWS)

The TWS Check Margin feature provides the ability to isolate the margin impact of the proposed order from one's existing positions and also displays the new margin requirement on the assumption the order is executed. Key margin balances including the Initial and Maintenance Requirements are reported as is the Equity With Loan Value. To use this feature, place your cursor on the order line, right-click on the mouse button and select Check Margin from the drop-down menu.

Example: Buy 1 ES June 2012 Future @ 1387.25

The first section of the Order Preview displays the bid, ask, and last trade price for the security.

The second section displays the basic order details

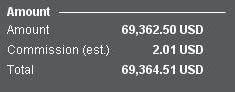

The Amount section shows the value of the order as well as the applicable commission estimate.

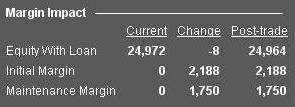

The Margin Impact section displays a breakdown of the following;

Current = The current account values, excluding the order being transmitted.

Change = The effect of the order being submitted ignoring any positions in the account.

Post-Trade = The anticipated account values when the order being transmitted has been executed and incorporated into the account portfolio.

WebTrader

The WebTrader order preview displays the equivalent of the TWS Post-Trade values only.

What is the margin on a Butterfly option strategy?

In order for the software utilized by IB to recognize a position as a Butterfly, it must match the definition of a Butterfly exactly. These are the 3 different types of Butterfly spreads recognized by IBKR, and the margin calculation on each:

Long Butterfly:

Two short options of the same series (class, multiplier, strike price, expiration) offset by one long option of the same type (put or call) with a higher strike price, and one long option of the same type with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

There is no margin requirement on this position. The long option cost is subtracted from cash and the short option proceeds are applied to cash.

Short Butterfly Put:

Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

The margin requirement for this position is (Aggregate put option highest exercise price - aggregate put option second highest exercise price). Long put cost is subtracted from cash and short put proceeds are applied to cash.

Short Butterfly Call:

Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

The margin requirement for this position is (Aggregate call option second lowest exercise price - aggregate call option lowest exercise price). Long option cost is subtracted from cash and short option proceeds are applied to cash.

*Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Other option positions in the account could cause the software to create a strategy you didn't originally intend, and therefore would be subject to a different margin equation.

What is the margin on an Iron Condor option strategy?

If an iron condor strategy exists in the account, the margin requirement will be the short put strike - the long put strike.

Example:

10 SPY Dec19 160P

-10 SPY Dec19 170P

-10 SPY Dec19 180C

10 SPY Dec19 190C

The margin requirement is determined by taking the strike of the short put (170) and subtracting the strike of the long put (160)

170-160 = 10

Take the difference and multiply by the number of contracts (10) and the multiplier (100)

10*10*100 = 10,000

In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the puts and the calls must be equal. If the distance between the puts and calls is different the position will be margined as two separate spreads with two separate margin requirements.

*Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as such.

Overview of the SPAN margining system

The Standard Portfolio Analysis of Risk (SPAN) is a methodology developed by the CME and used by many clearinghouses and exchanges around the world to calculate the Performance Bond (i.e., margin requirement) on futures and options on futures which the clearinghouse collects from the carrying FCM and the FCM, in turn, from the client.

SPAN establishes margin by determining what the potential worst-case loss a portfolio will sustain over a given time frame (typically set to one day), using a set of 16 hypothetical market scenarios which reflect changes to the underlying price of the future or option contract and, in the case of options, time decay and a change in implied volatility.

The first step in calculating the SPAN requirement is to organize all positions which share the same ultimate underlying into grouping referred to as a Combined Commodity group. Next, SPAN calculates and aggregates, by like scenario, the risk of each position within a Combined Commodity, with that scenario generating the maximum theoretical loss being the Scan Risk. The 16 scenarios are determined based upon that Combined Commodity’s Price Scan Range (the maximum underlying price movement likely to occur for the given timeframe) and Volatility Scan Range (the maximum implied volatility change likely to occur for options).

Assume a hypothetical portfolio having one long future and a one long put on stock index ABC having an underlying price of $1,000, a multiplier of 100 and a Price Scan Range of 6%. For this given portfolio, the Scan Risk would be $1,125 scenario 14.

|

# |

1 Long Future |

1 Long Put |

Sum |

Scenario Description |

|

1 |

$0 |

$20 |

$20 |

Price unchanged; Volatility up the Scan Range |

|

2 |

$0 |

($18) |

($18) |

Price unchanged; Volatility down the Scan Range |

|

3 |

$2,000 |

($1,290) |

$710 |

Price up 1/3 Price Scan Range; Volatility up the Scan Range |

|

4 |

$2,000 |

($1,155) |

$845 |

Price up 1/3 Price Scan Range; Volatility down the Scan Range |

|

5 |

($2,000) |

$1,600 |

($400) |

Price down 1/3 Price Scan Range; Volatility up the Scan Range |

|

6 |

($2,000) |

$1,375 |

($625) |

Price down 1/3 Price Scan Range; Volatility down the Scan Range |

|

7 |

$4,000 |

($2,100) |

$1,900 |

Price up 2/3 Price Scan Range; Volatility up the Scan Range |

|

8 |

$4,000 |

($2,330) |

$1,670 |

Price up 2/3 Price Scan Range; Volatility down the Scan Range |

|

9 |

($4,000) |

$3,350 |

($650) |

Price down 2/3 Price Scan Range; Volatility up the Scan Range |

|

10 |

($4,000) |

$3,100 |

($900) |

Price down 2/3 Price Scan Range; Volatility down the Scan Range |

|

11 |

$6,000 |

($3,100) |

$2,900 |

Price up 3/3 Price Scan Range; Volatility up the Scan Range |

|

12 |

$6,000 |

($3,375) |

$2,625 |

Price up 3/3 Price Scan Range; Volatility down the Scan Range |

|

13 |

($6,000) |

$5,150 |

($850) |

Price down 3/3 Price Scan Range; Volatility up the Scan Range |

|

14 |

($6,000) |

$4,875 |

($1,125) |

Price down 3/3 Price Scan Range; Volatility down the Scan Range |

|

15 |

$5,760 |

($3,680) |

$2,080 |

Price up extreme (3 times the Price Scan Range) * 32% |

|

16 |

($5,760) |

$5,400 |

($360) |

Price down extreme (3 times the Price Scan Range) * 32% |

The Scan Risk charge is then added to any Intra-Commodity Spread Charges (an amount that accounts for the basis risk of futures calendar spreads) and Spot Charges (A charge that covers the increased risk of positions in deliverable instruments near expiration) and is reduced by any offset from an Inter-Commodity Spread Credit (a margin credit for offsetting positions between correlated products). This sum is then compared to the Short Option Minimum Requirement (ensures that a minimum margin is collected for portfolios containing deep-out-of-the-money options) with the greater of the two being the risk of the Combined Commodity. These calculations are performed for all Combined Commodities with the Total Margin Requirement for a portfolio equal to the sum of the risk of all Combined Commodities less any credit for risk offsets provided between the different Combined Commodities.

The software for computing SPAN margin requirements, known as PC-SPAN is made available by the CME via its website.

Are the funds I deposited today considered for buying power calculations?

The answer is yes. To calculate buying power IB compares Current Equity with Loan Value to Previous Day Equity with Loan Value. Whichever figure is lesser is used. From the lesser of these two figures, the Initial Margin Requirement on the positions you currently hold in the account is subtracted. The difference is then multiplied by the current leverage amount (at present 4:1), which results in your intraday buying power. Funds deposited today are now considered as part of Previous Day ELV.

Please understand that funds deposited today will not be considered until they have cleared all appropriate funds and banking channels and are officially in the account.

Also note that this calculation of buying power applies to Regulation T margin type accounts and not to Portfolio Margin type accounts.

The Previous Day ELV check is done once an account is labeled as a "Pattern Day Trader" account. This occurs when the account has completed 4 day trades in a 5 day period. If the account is not labeled as a PDT, then the Previous Day ELV check doesn't apply.

The equation used is:

((Lesser of: Equity With Loan Value or Previous Day Equity With Loan Value) - Initial Margin)*4 for accounts labeled as PDT accounts.

(Equity With Loan Value - Initial Margin)*4 for accounts not labeled as PDT accounts.

Does IBKR provide for a dormant or inactive account status?

While there is no provision for dormant or inactive account status, there is no monthly minimum activity requirement or inactivity fee in your IBKR account.

While we have no minimum account balance, should the account balance fall below USD 2,000 IBKR is precluded, by regulation, from affording margin treatment to securities positions. In addition, account holders will also be billed for any market data subscriptions maintained and, as a matter of policy, will have subscriptions terminated automatically when the account balance falls below USD 500.

Individuals seeking to close an account are encouraged to refer to our User's Guide to familiarize themselves with the steps and prerequisites for taking this action.