FATCA FAQs - Issues Involving U.S. Green Card Holders

FATCA related FAQs involving U.S. Green Card Holders. See KB2601 for other FATCA related FAQ topics.

Q1: I have a U.S. Green Card but am not a U.S. taxpayer. What additional information or documentation do I need to provide to ensure you can accept my Form W-8BEN?

A1: In general, all U.S. Green Card holders are U.S. taxpayers, even if they do not live in the United States (and even if their Green Card has expired or is otherwise invalid). In general, a U.S. Green Card holder cannot provide Form W-8BEN, and must provide Form W-9 instead. If you are a former U.S. Green Card holder who gave up your U.S. Green Card, you will need to provide a copy of your Form I-407 (Record of Abandonment of Lawful Permanent Resident Status.

Q2: I used to have a U.S. Green Card but gave it up. What additional information or documentation do I need to provide to ensure you can accept my Form W-8BEN?

A2: You will need to provide a copy of your Form I-407 (Record of Abandonment of Lawful Permanent Resident Status).

Q3: I have a U.S. Green Card but it expired. I received notification asking me provide a reasonable written explanation as to why I am a non-U.S. taxpayer despite having a Green Card. I responded that my Green Card is expired but received an email saying my response was insufficient to resolve the issue. Why?

A3: Even if your Green Card has expired for immigration purposes (that is, you cannot use it to enter the United States), tax rules, generally, provide you remain a U.S. taxpayer until you formally renounce your U.S. Green Card. Generally, a U.S. Green Card holder cannot provide Form W-8BEN, and must provide Form W-9 instead. If you did formally renounce your US Green Card, please provide a copy of your Form I-407 (Record of Abandonment of Lawful Permanent Resident Status).

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

FATCA FAQs - Issues Involving U.S. Place of Birth

FATCA related FAQs involving U.S. Place of Birth. See KB2601 for other FATCA related FAQ topics.

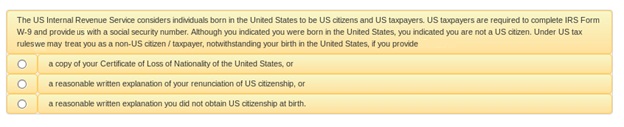

Q1: I was born in the United States but I do not have a U.S. passport and am not a U.S. taxpayer. Why am I being asked for additional documentation?

A1: In most cases, you automatically acquired U.S. citizenship when you were born in the United States even if you have never applied for a passport. U.S. tax rules designate all U.S. citizens as U.S. taxpayers, even those that did not live in the U.S. or receive a U.S. passport. U.S. citizens are required to provide us with IRS Form W-9 and a valid taxpayer ID (e.g. Social Security Number). Nevertheless, we may accept IRS Form W-8 from you to establish your status as a non-U.S. taxpayer if you provide us with a copy of your Certificate of Loss of Nationality of the United States (Form DS-4083) and a copy of your passport evidencing citizenship in another country.

Alternatively, you may provide us with a written explanation of why you are not a U.S. citizen (for instance, you were born in the United States to parents who were fully-accredited foreign diplomats). We may request further information from you depending on the explanation provided.

Q2: I was born in the United States but I am not a U.S. taxpayer. I do not have a Certificate of Loss of Nationality of the United States (Form DS-4083). What should I do?

A2: In general, you are a U.S. citizen and U.S. taxpayer if you were born in the United States. Unlike many jurisdictions, the U.S. taxes its citizens regardless of where they live (or even if they have never lived in the United States). We cannot accept IRS Form W-8 from a U.S. citizen, and must receive a Form W-9 instead. If you are a former U.S. citizen who gave up your citizenship, please refer to the FAQ above for the additional information and documentation you may need to provide to establish your status as a former U.S. citizen.

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

FATCA FAQs - General

General FAQs involving FATCA . See KB2601 for other FATCA related FAQ topics.

Index of FATCA Related FAQs

Outlined below are links to a series of FATCA related FAQs organized by topic. For a general overview of FATCA, please see KB1986.

1. General (See KB2602)

2. Issues Involving U.S. Place of Birth (See KB2603)

3. Issues Involving U.S. Green Card Holders (See KB2604)

4. Issues Involving U.S. Passport or Other Evidence of U.S. Citizenship (See KB2605)

5. Issues Involving U.S. Address or Telephone Number (See KB2606)

6. Issues Involving Mismatch Between Tax Treaty Country and Address (See KB2607)

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

IB Tax Form Users Guide

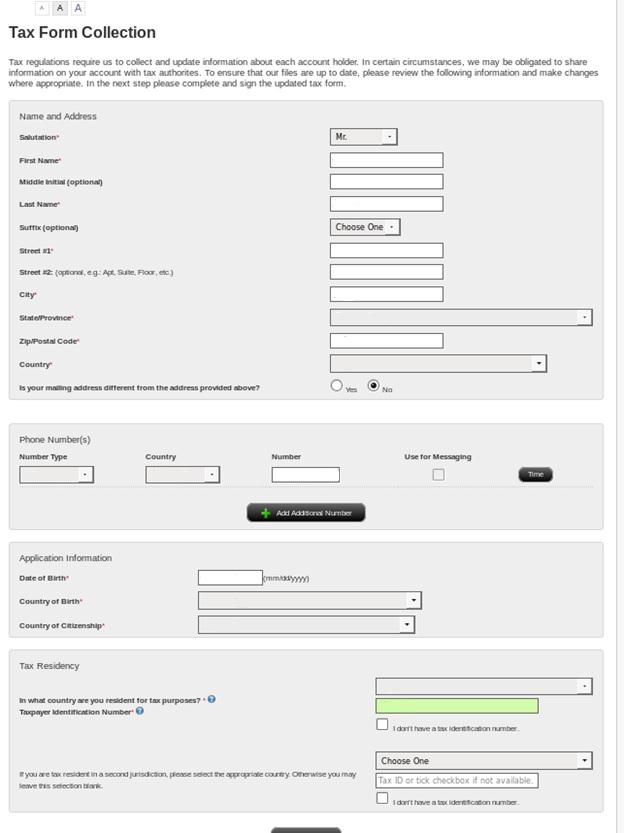

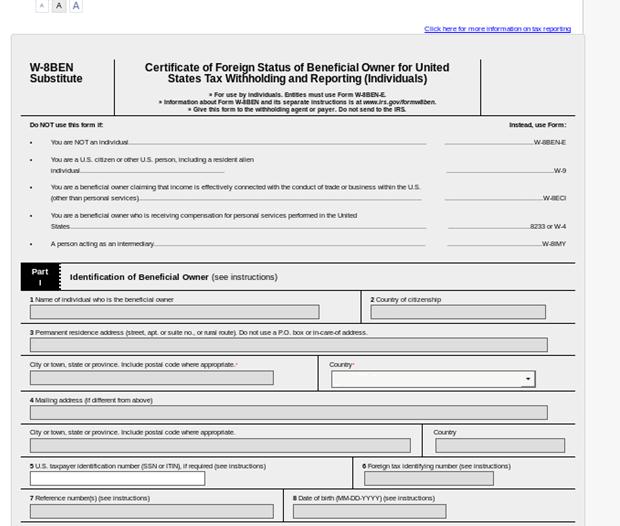

Introduction

Client should hit “Submit” button after all personal information is completed. Assuming no entry errors have been made, the client will be directed to Page 2 (tax form).

Screen 1

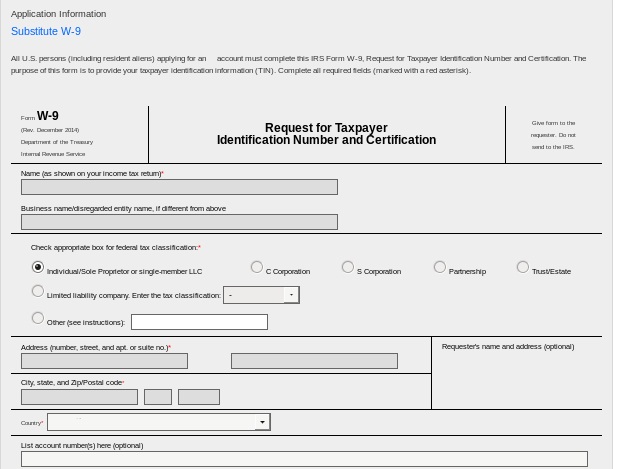

Important: To change the pre-populated information on the W-9, the client MUST hit the back button and change the relevant information on the prior page for the tax form to be updated.

Important: The first 3 boxes on the W-9 under certification must be checked to avoid having the client subject to back up withholding.

.jpg)

Next, the client will need to provide an electronic signature by typing their name (i.e., account title) exactly as it appears on the screen and select the “Save and Continue” button. The client will then be taken to the confirmation screen which will list any documents that they need to send to the broker.

.jpg)

On Part II of the W-8BEN the client will be prompted to specify whether they are a resident of a country which maintains a tax treaty with the U.S. Only those countries with which the U.S. maintains a treaty will be shown on the drop-down list and if the client does not see his or her treaty country, the client should select “N/A” or “I am not resident in a treaty country.”

.jpg)

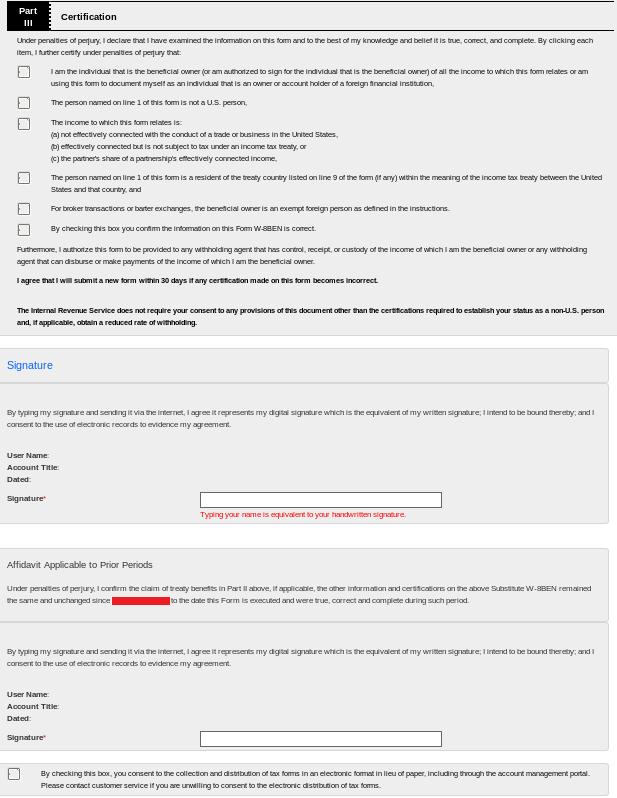

On Part III of the W-8BEN the client will be prompted to certify that the information provided on the form is accurate by checking the boxes and providing an electronic signature by typing their name (i.e., account title) exactly as it appears on the screen.

The client will then be prompted to check the box through which they consent to electronic collection and delivery of tax forms and then select the “Save and Continue” button. The client will then be taken to the confirmation screen which will list any documents that they need to send to the broker.

Final Review & Document Request

Once the form has been completed, it is subject to review by IB for purposes of verifying the client’s stated tax residency. This review may generate discrepancies in one of the following three areas: U.S. Connection, Treaty Claim or U.K. Crown Connection. If a client account is flagged for any discrepancy, you will need to contact them and request documents to resolve. The steps for resolving each of these is as follows:

IB will send a periodic report listing clients who have tasks which need to be completed so that you may contact them to act. This will include those accounts who have not logged into Account Management to complete the Tax Form or who have completed the form but need to send in documentation.

EXHIBIT 1 – Tax Form Prompt – U.S.

Confirming your information is essential to ensure that you will not become subject to backup withholding, including withholding on trade proceeds.

We appreciate your prompt attention to this matter.

Confirming your information is essential to ensure that (a) we can give you the most favorable rate on normal dividend and interest withholding as defined by standard international tax treaties; and (b) you will not become subject to any exceptional U.S. tax withholding.

We appreciate your prompt attention to this matter.

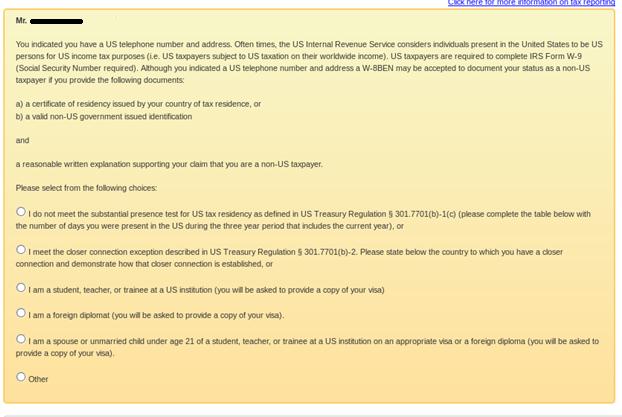

Documenting Taxpayer Status - Non U.S. Persons with U.S. Addresses

The U.S. Internal Revenue Service generally considers individuals with certain U.S. connections to be U.S. resident taxpayers who are required to complete IRS Form W-9 and provide IB with a U.S. taxpayer ID (e.g., social security number).

One common indicator of a U.S. connection for individuals is the presence of a U.S. residential or mailing address. In these cases, the individual is assumed to be a U.S. taxpayer and required to submit Form W-9 unless they can demonstrate that the address falls under one of the permissible explanations for a U.S. connection. These include:

(A) You do not meet the “substantial presence test” for U.S. tax residency as found in U.S. Treasury Regulation 301.7701(b)-1(c) and the address in the U.S. is

(B) You meet the closer connection exception described in US Treasury Regulation § 301.7701(b)-2 and the address in the United States is

(C) You are present in the United States as a student, teacher or trainee at a US institution. Here you will need to provide a copy of your F, J, M or Q visa from U.S. Immigration and Customs Enforcement.

(D) You are present in the United States as a foreign diplomat. Here you will need to provide a copy of your A or G visa (other than A-3 or G-3 visa) from U.S. Immigration and Customs Enforcement.

(E) You are present in the United States and are a spouse or unmarried child under the age of 21 of a person described in (C) or (D) above. Here you will need to provide a copy of your visa.

Note: the examples above are not the only permissible explanations for US connections. If none of the examples apply to your situation but you still believe you are a non-US taxpayer, you will need to provide a written explanation supporting your claim of non-US status

1099-B Proceeds From Broker and Barter Exchange Transaction

Proceeds from broker and barter exchange provides the sales proceeds from multiple transactions, including sales, exchanges, covered options, and tender offers on page 2 of the Consolidate Forms 1099.

1099-B Proceeds from broker and barter exchange reporting is made up of four separate sub-sections on the 1099-B Summary Page. The first three sections are separated based upon cost basis reporting regulations, while the fourth section includes Regulated Futures, Section 1256 contracts.

- Covered Securities with Short-Term gains or losses.

- Covered Securities with Long-Term gains or losses.

- Noncovered Securities.

- Regulated Future Contracts and Options.

IRS regulations classify covered and noncovered securities as outlined in the table below:

| Covered Securities | Uncovered Securities | |

| Broker/dealer vs. Tax Payer Responsibility | Brokers/dealers report cost basis to IRS and taxpayer on Form 1099-B. Taxpayer will use From 1099-B data to prepare their tax returns. | Taxpayer to maintain and report cost basis to IRS. Includes assets designated as noncovered due to asset type or incomplete cost basis information. |

| Equities | Acquired on or after January 1, 2011 | Acquired prior to January 1, 2011 |

| Mutual Funds | Acquired on or after January 1, 2012 | Acquired prior to January 1, 2012 |

| Fixed Income and options | Acquired on or after January 1, 2014 | Acquired prior to January 1, 2014 |

1099-B Summary Page

Transaction details appear following the Consolidated Forms 1099- Summary page. Boxes 1d to 1g of the 1099-B report the combined total for securities classified within sections one through three. Interactive Brokers includes cost basis reporting to the IRS for covered securities. Noncovered securities are exempt from broker cost basis reporting due to either designation or unknown information.

1099-B Sub Sections

1. Covered Securities with Short-Term gains or losses

Section one reports proceeds and cost basis information for covered securities with a short-term gain or loss. Grouped by their unique security identification number (CUSIP or ISIN), these covered securities correspond with the Worksheet for Form 8949 Part I Short-Term Capital Gains and Losses - Assets Held One Year or Less, Box A.

Box 1e reflects the original or adjusted cost basis. If applicable, a cost basis adjustment code may appears under Box 1f within the section's transaction details that follow the Summary.

2. Covered Securities with Long-Term gains or losses

Section two reports information for transactions of covered securities with a long-term gain or loss. Also grouped by security identification number, these assets correspond with the Worksheet for Form 8949 Part II Long-Term Capital Gains and Losses - Assets Held More Than One Year, Box D.

3. Noncovered Securities

Section three reports transaction of non-covered securities including index options without determination of holding period. Securities under this section include transactions for which the cost basis is not known or not reportable by Interactive Brokers to the IRS. Based on personal records, the taxpayer must report the cost basis and determine the short or long term.

These assets correspond with the Worksheet for Form 8949 Part I Short-Term Capital Gains and Losses, Box B, as well as Part II Long-Term Capital Gains and Losses, Box E.

4. Regulated Future Contracts and Options

We are required to report the aggregate profit/loss in four components under Boxes 8 to 11, even though taxpayers only report the aggregate profit/loss from regulated futures.

All settled or closed contracts during the tax year are displayed in Box 8. Any unrealized profit or loss at the beginning of the year (Box 9) and at the end of the year (Box 10) is adjusted from Box 8 to report an aggregate profit or loss on all contracts, open or closed, in Box 11.

For a contract level profit and loss summary, we include a Gain/Loss Worksheet for 1256 Contracts as part of our Year End Reports. There is one section for Futures and one section for Options.

Important Points

- Wash Sales: Brokers take into wash sales with calculating cost basis and holding period for covered securities within an account. The amount of the disallowed loss and the subsequent cost basis adjustment will be reported. For an understanding of wash sale basics, click here.

- Bond/Option: Bond and option purchases became covered securities as of January 1, 2014.

- Form 8949 Worksheet: Transactions not reported to the IRS on Form 1099-B may be included on your 8949 Worksheet, along with details for each 1099-B transaction.

- Multiple Trading Account: Each of these reports is specific to the account associated with the report, however the tax code requires you to report on your tax return across all of your trading accounts. If you hold the same security in multiple accounts and sell it, the gain or loss calculated and reported to the IRS may be different than presented on an account level and must be adjusted.

- Tax ID Numbers: An IRS identity protection ruling allows truncated reporting of tax ID numbers on 1099s. Account tax ID numbers display the last four digits (XXX-XX-0123) on Interactive Brokers tax forms.

Note:

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

1099-MISC Miscellaneous Income

Miscellaneous Income represents those amounts not reportable on any of the other 1099 forms. In addition to royalty trust and payments in lieu, amounts may include reimbursements.

Royalties

Box 2 reports income credited to your account from royalty trusts. Payments of royalties are generally from investments in natural resource companies.Supplemental tax information is furnished for this income on the WHFIT Tax Information Statement by March 15.

Other income

Box 3 reports income credits classified as "other income" for tax purposes. This includes stock loan fees earned.

Non-Employee Compensation

Box 7 reports reports asset management fees earned.

Substitute Payments in Lieu of Dividends or Interest (PIL)

Box 8 reports PIL payments credited to your account during the previous calendar year. The amounts were credited in lieu of the normal interest or dividend payment when your security is lent. As disclosed within your margin disclosure, your broker is authorized to loan your shares from an account with an outstanding margin debit balance. (Note: PIL payments are not eligible to be treated as qualified dividends, except under specific circumstances.)

Important Points on PIL Income:

- The PIL income (credited to your IB account) cannot be “netted” with PIL paid (debited from your IB account) on stocks you have borrowed.

- PIL is not eligible to be treated as qualified dividends, except under specific circumstances

- PIL income is not an interest or dividend payment, but miscellaneous income and should be treated as such on your tax return.

Note:

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

1099-DIV Dividend Income

Dividend and Distribution Income received by you from securities are reported on the 1099-DIV, The corresponding transaction details in the annual Dividend Report breakout dividends earned by tax category, which is available in Account Management from the Reports > Tax > Tax Forms page.

Total Ordinary Dividends

Box 1a includes all dividend distributions from stocks, mutual funds, REITS, and UITS by U.S. and non-U.S. issuers. This includes money market and bond dividend income.

Short-term capital gains distributions paid by mutual funds are included under Box 1a, but not under Box 2a.

Qualified Dividends

Box 1b reports the portion of total ordinary dividend income from Box 1a which may be eligible for qualified dividend treatment. Qualified dividends are taxed at the Long-term Capital Gain (LTCG) tax rate (0%, 15%, & 20%). Consult a qualified tax adviser to verify your eligibility.

Total Capital Gains Distributions

Box 2a reports any long-term capital gain distributions paid by mutual funds and REITS. Short-term capital gains distributions are reported under Box 1a.

Unrecaptured Section 1250 Gain

Box 2b includes real property depreciation recapture from the capital gains distributions under Box 2a, if any.

Non-dividend Distributions

The total amount of payments classified as a return of capital paid to you is reported in Box 3. A reduction to the cost basis of security is occurs. This may include mutual funds, REITS, WHFITS, and corporations.

Federal Income Tax withheld

Any U.S. income tax withheld from a dividend distribution is reported under Box 4.

Investment Expenses

Your portion of investment expenses from UIT, WHFIT, and WHMT investments is reported under Box 5. These expenses may be deductible, subject to the 2% limitation.

Foreign Tax Paid

Box 6 reports foreign tax paid, including foreign tax withheld from foreign source dividends. This is usually attributed to a mutual fund's investment in foreign securities. As a supplement to assist with your tax preparation, a summary of foreign dividends and tax paid on them is displayed on the annual Dividend Report.

Liquidation Distributions

Reducing your cost basis, Boxes 8 and 9 report payments as a result of mergers or acquisitions. Any amount of a cash payment not classified as a dividend or exceeding your basis is considered a capital gain. Non-cash payments are a return of your investment and reduce your basis.

Exempt Interest Dividends

Generally, dividends paid by tax-exempt bond funds are listed on Box 10. Any portion of Box 11 payments classified as Specific Private Activity Bond Interest reported to calculate AMT.

Note:

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

Circular 230 Notice:

Important: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

1099-INT Interest Income

Interest Income received from taxable and tax-exempt earnings are reported on this form. This includes domestic and foreign bonds, municipal bonds, mutual funds, as well as other interest payment sources.

Interest income

Box 1 reports interest income, exclusive of U.S. savings bond and U.S. Treasury obligations interest. The transaction level details are provided on other year-end activity statements and reports.

U.S. savings bonds and treasury obligations

Box 3 reports interest from U.S. savings bonds and US Treasury obligations. US savings bond and treasury obligation interest is separated for state tax reporting. Interest on these obligations is generally not subject to state tax.

Federal income tax withheld

If the IRS has notified us that income tax must be withheld (backup withholding) on interest income in your account, the tax withheld amount will be reported in Box 4.

Note: Interest payments details are part of the supplemental information on the Consolidated 1099.

Investment Expenses

Box 5 reports investment expenses from real estate mortgage investment conduits (REMIC) income.

Foreign Taxes

Boxes 6 and 7 pertain to both any foreign tax withheld from interest income and the associated foreign country code.

Tax-exempt interest

Interest payments not subject to federal taxation, such as municipal bonds, are reported under Box 8. Accrued interest paid: Provided in supplemental information on consolidated 1099 – reduce the amount of reported interest by interest paid.

Any amounts reported in Box 8 subject to the Alternative Minimum Tax (AMT) is reported in Box 9.

Market Discount & Bond Premium

The market discount and bond premium for taxable and tax-exempt bonds are reported as separate sub-totals in Boxes 10, 11, and 13.

Note:

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.