Fees for Trading Warrants and Structured Products on Euronext

Euronext's fee thresholds on structured products and how it impacts clients' trading, for both fixed and tiered commission models

Clients that place orders and trade for more than EUR 6'000 in Warrants and Structured Products will be charged a 2.5 basis points fee with a maximum of EUR 20.

The table below displays the exchange fees for warrants and structured products when trading on Euronext:

|

Product Group |

Fee |

Minimum per Trade |

Maximum per Trade |

|

Warrants & Structured Products – trade value up to EUR 6’000 |

0.00 |

N/A |

N/A |

|

Warrants & Structured Products – trade value more than EUR 6’000 |

2.50 bps |

N/A |

EUR 20 per Trade |

Calculations:

For Cost Plus (Tiered) Clients:

Example: Client wishes to trade structured products on Euronext for a total trade value of EUR 10’000.

Scenario A:

Trade value = EUR 10’000

Fee = 2.5 Bps

As the trade value is above EUR 6’000, the fee of 2.50 bps applies and therefore an additional EUR 2.50 will have to be paid for the trade.

Scenario B:

Order 1:

Trade Value = EUR 5’000

Fee = 0.00

Order 2:

Trade Value = EUR 5’000

Fee = 0.00

As the trade value of each trade is below EUR 6’000, no additional fees apply.

Note: This calculation does not impact clients on the Fixed commission schedule.

外国為替取引(FX)に関して

IBでは、外国為替取引を中心としたトレーダーだけでなく、複数の通貨建ての株式やデリバティブ取引から外国為替取引を行うトレーダーも対象として取引場所や取引プラットフォームを提供しています。以下の記事では、TWSプラットフォームでのFX注文入力の基本と、クオートの慣習やポジション(取引後)の報告に関する注意点について説明します。

FX(外国為替)取引では、ある通貨の購入と別の通貨の売却を同時に行いますが、その組み合わせは一般的にクロスペアと呼ばれています。 以下の例では、EUR.USDのクロスペアをもとに説明します。クロスペアの第1通貨(EUR)を売却する取引通貨とし、第2通貨を決済通貨としています。

こちらのページの記事の特定のトピックに移動するには、下記リンクをクリックしてください。

外国為替気配値について

通貨ペアとは外国為替市場において、ある通貨単位の価値を別の通貨単位で表示するためのものです。別の通貨単位で価格を表示される元の通貨を基準通貨=取引通貨、一方で価格表示をする通貨をクオート通貨=決済通貨と呼びます。TWSでは、各通貨ペアに対して1つのティッカーシンボルとなります。FXTraderを使用すると、通貨ペアを逆にして、その価格を表示することもできます。トレーダーは基準通貨を売り、クオート通貨を買うことで通貨ペアの取引を行います。例えば、EUR/USDの通貨ペアのティッカーシンボルは次のようになります:

EUR.USD

となります。

- EURは基準通貨

- USDはクオート通貨

上記の通貨ペアの価格は、現在1ユーロ(基準通貨=取引通貨)が何米ドル(クオート通貨=決済通貨)になるのかを表しています。つまり、1ユーロの価格を米ドルで表示しているのです。

EUR.USDの買い注文は、表示されている取引価格に基づいてユーロを買い、そのユーロに相当する米ドルを売ることになります。

気配値の表示方法について

TWS上に通貨ペアの気配値を表示するための手順は以下のとおりです。

1. 取引通貨(例: EUR)を入力し、ENTERキーを押します。

2. 商品タイプのFX

を選択します。

3. 決済通貨(例: USD)を選択し、FXの取引所を選択します。

.jpg)

注意事項

IDEALFXにおける最低発注量(通常25,000米ドル)を超える注文は、IDEALFXにおいてインターバンクの外国為替市場に直接アクセスすることができます。IDEALFXに発注された注文のうち最低発注量を満たさないものは、主に外国為替取引用の少額注文取引所に自動的に振り分けられます。IDEALFXの最小・最大取引量に関する詳細は こちらをご覧ください。

外国為替取引において為替ディーラーが通貨ペアを表示する方法は決まっており、 例えば、通貨にCAD(カナダドル)を選択した場合、 決済通貨を選択する選択肢上にUSD(米ドル)が表示されないことがわかります。 これは、このペアが「USD.CAD」の順番で表示することが決まっており、基準通貨となる「USD」を入力してから「Forex」を選択しないとCADとUSDの通貨ペアにアクセスできないためです。

注文の作成方法について

表示されているヘッダーに応じて、通貨ペアは次のように表示されます。

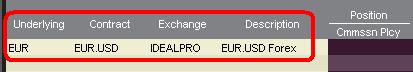

「コントラクト」と「詳細」のコラムには、取引通貨と決済通貨の形式で通貨ペアが表示されます(例: EUR.USD)。 「銘柄」のコラムには、取引通貨のみが表示されます。

表示されているヘッダーを変更する方法は、こちらをご覧ください。

1. 注文の発注にはBID=買気配(売り注文の作成のため)またはASK=売気配(買い注文の作成のため)を左クリックします。

2. 買い、または売りたい取引通貨(=基準通貨)の数量を指定します。注文の数量は、基準通貨=取引通貨で表されます。これはTWSで表示される通貨ペアの第1通貨です。

インタラクティブ・ブローカーズでは外国為替取引において、一定の決まった取引量を基準通貨(=取引通貨)で表す「コントラクト」という概念はなく、取引サイズは基準通貨(=取引通貨)における最小取引単位以上(例:ユーロの場合は1ユーロ)からとなります。

例えば、100,000 EUR.USDの買い注文は、表示されている為替レートに基づいて、100,000 EURを買い、同等の米ドルを売ることになります。

3. ご希望の注文タイプと為替レート(価格)を指定し、注文を発注します。

注意事項: 注文は全ての通貨の最小取引単位から行うことができ、上述のIDEALFX最低発注量の他に最小コントラクトや最小ロットサイズを考慮する必要はありません。

よくあるご質問: FXTraderではどのように注文を発注するのですか?

ピップ値について

ピップ値とは、通貨ペアの変化を表す尺度で、ほとんどの通貨ペアでは最小の変化を表します。通貨ペアの中には、少数ピップでの表示が可能なものもあります。

例えば、EUR.USDでは1ピップは0.0001、USD.JPYでは1ピップは0.01となります。

1ピップの値をクオート通貨単位で計算するには、以下の式を適用します。

(取引金額)x (1ピップ)

例:

- ティッカーシンボル = EUR.USD

- 取引金額 = 100,000ユーロ

- 1ピップ = 0.0001

1ピップの価値 = 100’000 x 0.0001= 10 USD

- ティッカーシンボル = USD.JPY

- 取引金額 = 100’000 USD

- 1ピップ = 0.01

1ピップの価値 = 100’000 x (0.01)= 1000円

基準通貨単位で1ピップの価値の計算するには、以下の式を適用します。

(取引金額)x (1ピップ/為替レート)

例:

- ティッカーシンボル = EUR.USD

- 取引金額 = 100’000ユーロ

- 1ピップ = 0.0001

- 為替レート = 1.3884

1ピップの価値 = 100’000 x (0.0001/1.3884)= 7.20ユーロ

- ティッカーシンボル = USD.JPY

- 取引金額 = 100’000 USD

- 1ピップ = 0.01

- 為替レート = 101.63

1ピップの価値 = 100’000 x (0.01/101.63)= 9.84 USD

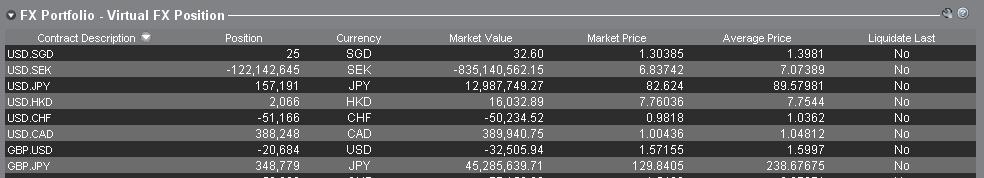

取引後のポジション表示について

FXポジション情報はIBにおける取引の重要な側面であり、ライブ口座での取引を実行する前に理解しておく必要があります。 IBの取引ソフトウェアはFXポジションを2つの異なる場所に反映させ、その両方を口座ウィンドウから確認することができます。

1. 市場価格

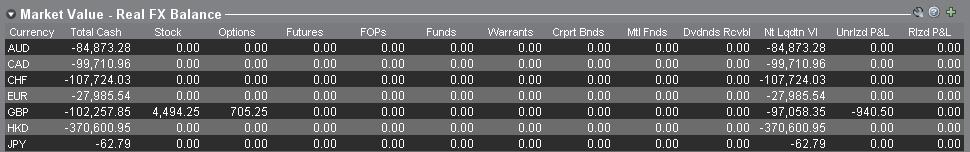

口座ウィンドウの「市場価格」のセクションには、通貨ペアではなく個々の通貨単位で、リアルタイムの通貨ポジションが反映されます。

口座ウィンドウの「市場価格」のセクションは、トレーダーがリアルタイムに反映されたFXポジション情報を見ることができる唯一の場所です。 複数の通貨をFXの通貨ポジションとして保有する場合、ポジションを建てた時と同じ通貨ペアで決済する必要はありません。 例えばEUR.USDの買い(EURの買い、USDの売り)とUSD.JPYの買い(USDの買い、JPYの売い)を行ったトレーダーは、EUR.JPYの取引(EURの売り、JPYの買い)でポジションを決済することができます。

注意事項

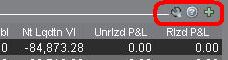

「市場価格」のセクションは拡張/縮小が可能です。 流動性資産価値のコラムのすぐ上に、緑色のマイナスの記号が表示されていることをご確認ください。 緑色のプラス記号が表示されている場合には、一部の保有ポジションが表示されていない可能性があります。

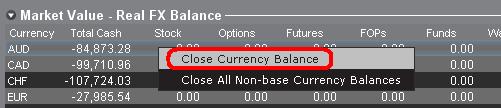

決済したい通貨を右クリックして「選択した通貨残高を口座通貨の残高へ両替」または「基準通貨以外の全ポジションのクローズ」を選択することで、「市場価格」のセクションから決済取引を行うことができます。

2. FXポートフォリオ

口座ウィンドウのFXポートフォリオのセクションでは、仮想ポジションを表示し、市場価格のセクションのよう個々の通貨ではなく、通貨ペアで表示されます。 この特別な表示方法は機関投資家のFXトレーダーに共通する習慣に合わせたもので、個人やFX取引を頻繁に行わないのトレーダーを対象とするものではありません。FXポートフォリオのポジション表示はすべてのFX取引を反映しているわけではありませんが、ここに表示されるポジション数と平均コストは変更することができます。 実際に取引を行うことなくポジション数と平均コストの情報を変更できるこの機能は、基準通貨に加えて非基軸通貨建ての商品の取引にも携わるトレーダーに向いています。 この機能を利用することにより、基準通貨建て以外の商品を取引する際に自動的に発生する通貨変換の係る取引を、明らかなFX取引と手動で分けて管理することができます。

FXポートフォリオのセクションには、他のすべての取引ウィンドウに表示されるFXポジションと損益情報が表示されます。 このため、実際のリアルタイムのポジション情報を判断するにあたって混乱が生じる傾向があります。 混乱を軽減また解消するため、下記の作業のいずれかを行っていただくことをお薦めします。

a. FXポートフォリオのセクションを非表示にする

「FXポートフォリオ」の左側にある矢印をクリックすると、FXポートフォリオのセクションを折りたたむことができます。 このセクションを折りたたむと、すべての取引ページにFXのバーチャルポジションの情報が表示されなくなります。(注意事項: FXポートフォリオの情報のみ表示されなくなり、市場価値の情報は表示されます。)

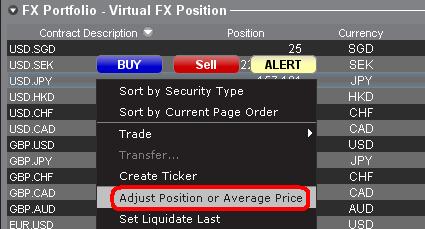

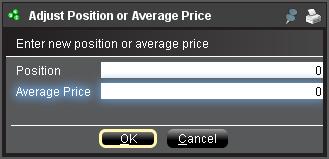

b. ポジションまたは平均価格の調整

口座ウィンドウのFXポートフォリオのセクションを右クリックすると、ポジションまたは平均価格を調整するオプションがあります。 非基準通貨によるポジションをすべて決済し、市場価格のセクションでも決済が確認できたら、ポジションおよび平均価格の欄を0にリセットすることができます。 この調整を行うことにより、FXポートフォリオのセクションに反映されるポジション数がリセットされ、画面上でより正確なポジションと損益情報を見ることができるようになります。注意事項: この作業は手動になるため、通貨ポジションが決済されるたびに行う必要があります。 ポジションに関する情報は常に市場価格のセクションからご確認の上、発注された注文のポジションがご希望通りに建ち、また決済されていることをご確認ください。

上記の内容をご参考にしていただき、ライブ口座でお取引を始める前にペーパー取引口座、またはデモ口座でFX取に慣れていただくことをお薦め致します。 上記の内容についてご不明な点などございましたら、お気軽にIBまでお問い合わせください。

その他のよくあるご質問:

Order Rejection on the Tel Aviv Stock Exchange (TASE)

According to the TASE regulations each stock has a minimum order size for regular trading. The size is a stock specific calculation of a minimal monetary value at the beginning of each month. Where the value for a stock in the TA-35 index is 5000 NIS and anything outside of this is 2’000.

- Example

- Minimum Size Calculation Example:

- Bank Leumi share's closing price is 1000 NIS on the 1st of the Month

- Min Size is 5000/1000 = 5

- Order Placement

- Successful order: 5 LEUMI Shares

- Unsuccessful order: 4 LEUMI Shares

- Minimum Size Calculation Example:

|

|

Sunday

|

Mon - Thu

|

|

Pre-Opening start

|

9:00

|

|

|

Theoretical Price start

|

9:10

|

|

|

Opening Auction start

|

9:45-9:46

|

|

|

Continuous Trade Phase Start

|

9:45-9:46

|

|

|

Pre-closing & theoretical prices start

|

16:14 -16:15

|

17:14-17:15

|

|

Closing Auction & end of trade

|

16:24 -16:25

|

17:24-17:25

|

Intermarket Sweep

An intermarket sweep order is generally a large quantity limit order that is sent to multiple exchanges simultaneously. The trader submitting this type of order is required to fulfill Regulation NMS order protection obligations and exchange rules by simultaneously sending orders to market centers with better prices than the defined order limit.

Traders may see, on occasion, execution prices reported to time and sales that are at price levels through an order that they may have had working at the time. Some time and sales service providers reflect these prints with a special designation (intermarket sweep). The TWS software does not display these designations, therefore, it may appear as if a order was due an execution when it may not have been.

This article is being written in attempt to assist traders in understanding intermarket sweep transactions.

When an intermarket sweep order is being executed, only the inside quote (NBBO) at each available exchange is "protected". This means that orders resting on an exchange at prices that are inferior to the best bid or ask prices at the time of the intermarket sweep print are not considered to be "protected" and may be traded through.

Example:

- An order is submitted in the pre market to sell at a price of 40.80 and is sent to exchange A.

- The best offer price on exchagne A is 40.63.

- Exchange B receives an intermarket sweep order to buy 800 shares of the stock at a limit price of 40.88.

- The best offer price on exchange B is 40.88

The trader that enters the intermarket sweep order would be required to fulfill their Regulation NMS requirement by executing the maximum available quantity on exchange A at 40.63 and then may execute the balance of the order on exchange B at 40.88 even though it is at a price that is inferior to the 40.80 order resting in the book on exchagne A. The 40.80 price is not the inside quote and is therefore not "protected" in terms of the balance of the sweep order executing at exchange B at a price of 40.88.

A wealth of information is available on the web regarding intermarket sweep orders and SEC regulation NMS. The following are some links that may be useful in terms of providing additional information on these topics;

Each exchange has rules that define how intermarket sweep orders are handled. The following are reference links to the rulebooks of the primary exchanges where traders can find more informaiton on intermarket sweep order handling;

An Introduction to Forex (FX)

IB offers market venues and trading platforms which are directed towards both forex-centric traders as well as traders whose occasional forex activity originates from multi-currency stock and/or derivative transactions. The following article outlines the basics of forex order entry on the TWS platform and considerations relating to quoting conventions and position (post-trade) reporting.

A forex (FX) trade involves a simultaneous purchase of one currency and the sale of another, the combination of which is commonly referred to as a cross pair. In the examples below the EUR.USD cross pair will be considered whereby the the first currency in the pair (EUR) is known as the transaction currency that one wishes to buy or sell and the second currency (USD) the settlement currency.

Jump to a specific topic in this article;

- Forex Price Quotes

- Creating a quote line

- Creating an order

- Pip Value

- Position (Post-Trade) Reporting

Forex Price Quotes

A currency pair is the quotation of the relative value of a currency unit against the unit of another currency in the foreign exchange market. The currency that is used as reference is called quote currency, while the currency that is quoted in relation is called base currency. In TWS we offer one ticker symbol per each currency pair. You could use FXTrader to reverse the quoting. Traders buy or sell the base currency and sell or buy the quote currency. For ex. the EUR/USD currency pair’s ticker symbol is:

EUR.USD

where:

- EUR is the base currency

- USD is the quote currency

The price of the currency pair above represents how many units of USD (quote currency) are required to trade one unit of EUR (base currency). Said in other words, the price of 1 EUR quoted in USD.

A buy order on EUR.USD will buy EUR and sell an equivalent amount of USD, based on the trade price.

Creating a quote line

The steps for adding a currency quote line on the TWS are as follows:

1. Enter the transaction currency (example: EUR) and press enter.

2. Choose the product type forex

3. Select the settlement currency (example: USD) and choose the forex trading venue.

.jpg)

Notes:

The IDEALFX venue provides direct access to interbank forex quotes for orders that exceed the IDEALFX minimum quantity requirement (generally 25,000 USD). Orders directed to IDEALFX that do not meet the minimum size requirement will be automatically rerouted to a small order venue principally for forex conversions. Click HERE for information regarding IDEALFX minimum and maximum quantities.

Currency dealers quote the FX pairs in a specific direction. As a result, traders may have to adjust the currency symbol being entered in order to find the desired currency pair. For example, if the currency symbol CAD is used, traders will see that the settlement currency USD cannot be found in the contract selection window. This is because this pair is quoted as USD.CAD and can only be accessed by entering the underlying symbol as USD and then choosing Forex.

Creating an order

Depending on the headers that are shown, the currency pair will be displayed as follows;

The Contract and Description columns will display the pair in the format Transaction Currency.Settlement Currency (example: EUR.USD). The Underlying column will display only the Transaction Currency.

Click HERE for information regarding how to change the shown column headers.

1. To enter an order, left click on the bid (to sell) or the ask (to buy).

2. Specify the quantity of the trading currency you wish to buy or sell. The quantity of the order is expressed in base currency, that is the first currency of the pair in TWS.

Interactive Brokers does not know the concept of contracts that represent a fixed amount of base currency in Foreign exchange, rather your trade size is the required amount in base currency.

For example, an order to buy 100,000 EUR.USD will serve to buy 100,000 EUR and sell the equivalent number of USD based on the displayed exchange rate.

3. Specify the desired order type, exchange rate (price) and transmit the order.

Note: Orders may be placed in terms of any whole currency unit and there are no minimum contract or lot sizes to consider aside from the market venue minimums as specified above.

Common Question: How is an order entered using the FX Trader?

Pip Value

A pip is measure of change in a currency pair, which for most pairs represents the smallest change, although for others changes in fractional pips are allowed.

For ex. in EUR.USD 1 pip is 0.0001, while in USD.JPY 1 pip is 0.01.

To calculate 1 pip value in units of quote currency the following formula can be applied:

(notional amount) x (1 pip)

Examples:

- Ticker symbol = EUR.USD

- Amount = 100,000 EUR

- 1 pip = 0.0001

1 pip value = 100’000 x 0.0001= 10 USD

- Ticker symbol = USD.JPY

- Amount = 100’000 USD

- 1 pip = 0.01

1 pip value = 100’000 x (0.01)= JPY 1000

To calculate 1 pip value in units of base currency the following formula can be applied:

(notional amount) x (1 pip/exchange rate)

Examples:

- Ticker symbol = EUR.USD

- Amount = 100’000 EUR

- 1 pip = 0.0001

- Exchange rate = 1.3884

1 pip value = 100’000 x (0.0001/1.3884)= 7.20 EUR

- Ticker symbol = USD.JPY

- Amount = 100’000 USD

- 1 pip = 0.01

- Exchange rate = 101.63

1 pip value = 100’000 x (0.01/101.63)= 9.84 USD

Position (Post-Trade) Reporting

FX position information is an important aspect of trading with IB that should be understood prior to executing transactions in a live account. IB's trading software reflects FX positions in two different places both of which can be seen in the account window.

1. Market Value

The Market Value section of the Account Window reflects currency positions in real time stated in terms of each individual currency (not as a currency pair).

The Market Value section of the Account view is the only place that traders can see FX position information reflected in real time. Traders holding multiple currency positions are not required to close them using the same pair used to open the position. For example, a trader that bought EUR.USD (buying EUR and selling USD) and also bought USD.JPY (buying USD and selling JPY) may close the resulting position by trading EUR.JPY (selling EUR and buying JPY).

Notes:

The Market Value section is expandable/collapsible. Traders should check the symbol that appears just above the Net Liquidation Value Column to ensure that a green minus sign is shown. If there is a green plus symbol, some active positions may be concealed.

Traders can initiate closing transactions from the Market Value section by right clicking on the currency that they wish to close and choosing "close currency balance" or "close all non-base currency balances".

2. FX Portfolio

The FX Portfolio section of the account window provides an indication of Virtual Positions and displays position information in terms of currency pairs instead of individual currencies as the Market Value section does. This particular display format is intended to accommodate a convention which is common to institutional forex traders and can generally be disregarded by the retail or occasional forex trader. FX Portfolio position quantities do not reflect all FX activity, however, traders have the ability to modify the position quantities and average costs that appear in this section. The ability to manipulate position and average cost information without executing a transaction may be useful for traders involved in currency trading in addition to trading non-base currency products. This will allow traders to manually segregate automated conversions (which occur automatically when trading non base currency products) from outright FX trading activity.

The FX portfolio section drives the FX position & profit and loss information displayed on all other trading windows. This has a tendency to cause some confusion with respect to determining actual, real time position information. In order to reduce or eliminate this confusion, traders may do one of the following;

a. Collapse the FX Portfolio section

By clicking the arrow to the left of the word FX Portfolio, traders can collapse the FX Portfolio section. Collapsing this section will eliminate the Virtual Position information from being displayed on all of the trading pages. (Note: this will not cause the Market Value information to be displayed it will only prevent FX Portfolio information from being shown.)

b. Adjust Position or Average Price

By right clicking in the FX portfolio section of the account window, traders have the option to Adjust Position or Average Price. Once traders have closed all non base currency positions and confirmed that the market value section reflects all non base currency positions as closed, traders can reset the Position and Average Price fields to 0. This will reset the position quantity reflected in the FX portfolio section and should allow traders to see a more accurate position and profit and loss information on the trading screens. (Note: this is a manual process and would have to be done each time currency positions are closed out. Traders should always confirm position information in the Market Value section to ensure that transmitted orders are achieving the desired result of opening or closing a position.

We encourage traders to become familiar with FX trading in a paper trade or DEMO account prior to executing transactions in their live account. Please feel free to Contact IB for additional clarification on the above information.

Other common questions:

Equity & Index Option Position Limits

Equity option exchanges define position limits for designated equity options classes. These limits define position quantity limitations in terms of the equivalent number of underlying shares (described below) which cannot be exceeded at any time on either the bullish or bearish side of the market. Account positions in excess of defined position limits may be subject to trade restriction or liquidation at any time without prior notification.

Position limits are defined on regulatory websites and may change periodically. Some contracts also have near-term limit requirements (near-term position limits are applied to the side of the market for those contracts that are in the closest expiring month issued). Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. The following information defines how position limits are calculated;

Option position limits are determined as follows:

- Bullish market direction -- long call & short put positions are aggregated and quantified in terms of equivalent shares of stock.

- Bearish market direction -- long put & short call positions are aggregated and quantified in terms of equivalent shares of stock.

The following examples, using the 25,000 option contract limit, illustrate the operation of position limits:

- Customer A, who is long 25,000 XYZ calls, may at the same time be short 25,000 XYZ calls, since long and short positions in the same class of options (i.e., in calls only or in puts only) are on opposite sides of the market and are not aggregated

- Customer B, who is long 25,000 XYZ calls, may at the same time be long 25,000 XYZ puts. Rule 4.11 does not require the aggregation of long call and long put (or short call and short put) positions, since they are on opposite sides of the market.

- Customer C, who is long 20,000 XYZ calls, may not at the same time be short more than 5,000 XYZ puts, since the 25,000 contract limit applies to the aggregate position of long calls and short puts in options covering the same underlying security. Similarly, if Customer C is also short 20,000 XYZ calls, he may not at the same time have a long position of more than 5,000 XYZ puts, since the 25,000 contract limit applies separately to the aggregation of short call and long put positions in options covering the same underlying security.

Notifications and restrictions:

IB will send notifications to customers regarding the option position limits at the following times:

- When a client exceeds 85% of the allowed limit IB will send a notification indicating this threshold has been exceeded

- When a client exceeds 95% of the allowed limit IB will place the account in closing only. This state will be maintained until the account falls below 85% of the allowed limit. New orders placed that would increase the position will be rejected.

Notes:

Position limits are set on the long and short side of the market separately (and not netted out).

Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side (index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge).

Position information is aggregated across related accounts and accounts under common control.

Definition of related accounts:

IB considers related accounts to be any account in which an individual may be viewed as having influence over trading decisions. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account (and accounts under common control), joint accounts with individual accounts for the joint parties and organization accounts (where an individual is listed as an officer or trader) with other accounts for that individual.

Position limit exceptions:

Regulations permit clients to exceed a position limit if the positions under common control are hedged positions as specified by the relevant exchange. In general the hedges permitted by the US regulators that are recognized in the IB system include outright stock position hedges, conversions, reverse conversions and box spreads. Currently collar and reverse collar strategies are not supported hedges in the IB system. For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product.

OCC posts position limits defined by the option exchanges. They can be found here.

http://www.optionsclearing.com/webapps/position-limits

Rule 611 of SEC Regulation NMS

Executions in equities will sometimes be listed as R6, which is short for Rule 611 of SEC Regulation NMS. This condition code indicates that the execution(s) in question is not subject to trade-through rules. R6 trades are given an SEC exemption.

Rule 611, which is the Trade Through Exemption of SEC Regulation NMS, is very lengthy to cover in detail. Parties interested in reading the rule in its entirely should type "SEC Rule 611" into an internet search engine. This is the portion of the document that is pertinent to IB traders, in a nutshell:

Typically the trades involved are a multi-component trade involving orders for a security and a related derivative, or, in the alternative, orders for related securities, that are executed at or near the same time. The SIA (Securities Industry Association) notes that the economics of a contingent trade are based on the relationship between the prices of the security and the related derivative or security, and that the execution of one order is contingent upon the execution of the other order.

The bottom line is that when a trade is ruled R6 the SEC has granted a trade-through exemption. This means that these execution reports do not affect the resting orders in-between the market at the time, and the R6 execution. For example, the real market is quoting 10.50 at 10.51, and an execution is reported at 10.90. This execution was given an R6 exemption. A sell limit order at 10.75, an an example, would not be executed because the 10.90 execution was given an R6 status.

What is an "Odd Lot" in stocks?

Simply stated, an "Odd Lot" is a stock order comprised of less than 100 shares of stock. So any stock order from 1 share to 99 shares is considered to be an odd lot.

This is the pertinent information traders should know about odd lot orders:

- An odd lot is a number of shares less than 100 (1-99)

- A "Round Lot" is 100 shares of stock

- Any number of shares that is a multiple of 100 is a round lot (i.e. 100, 600, 1,600, etc)

- An order for a number of shares greater than 100, but not a multiple of 100 (i.e. 142, 373, 1,948, etc) is a "Mixed Lot" (AKA PRL, or partial round lot, order)

- Odd-Lot orders are not posted to the bid/ask data on exchanges

- Odd-Lot orders are taken into the order book at the exchange they are routed to. When the exchange is able to match an order from the other side of the book with the odd-lot, it will be filled. This could lead to delay on execution of an odd-lot.

- There are numerous guidelines for the routing of odd-lot orders: Odd-Lot orders to initiate positions will not be routed to primary exchanges; Odd-Lot orders can be routed to primary exchanges, but only if the order in question is to close out a preexisting position; IB will not direct-route odd-lot orders which initiate positions to primary exchanges, therefore these type of orders should be Smart Routed so that IB's routing system can send the order to an ECN for execution. The exception is that odd lots can be routed to NYSE/ARCA/AMEX, but only as part of a basket order or as a market-on-close (MOC) order.

- A mixed lot or PRL (i.e. 257 shares) direct-routed to NYSE/AMEX will be submitted in whole to the exchange (applies to both market and limit orders). If the order is direct-routed to NYSE/ARCA, only the round lot portion of the order will be submitted and, if it is executed, the IB system will cancel the remaining odd-lot portion of the order. If the order is routed via IB Smart Routing, all market centers are eligible to receive the order according to the Smart Routing logic (including NYSE/ARCA, but only for the round lot portion of the order).

- IB will not route odd-lot orders for HOLDRS. The odd-lot portion of a PRL order for HOLDRS will be rejected by the IB system after the round lot portion of the order is executed.

- Individual exchanges may impose certain restrictions on odd lot orders, in addition to any of the restrictions mentioned above

Combo orders with stock and option legs.

Combo orders which involve a stock and an option leg are accepted natively only at ISE. So if you would like to create a covered call position, and wish to buy the stock and sell the option simultaneously, ISE is the exchange to which these orders will be sent if, in fact, the specific options trade at the ISE.

In the event that the option in question does not trade at ISE, the order can't be sent to that exchange. These orders will stay on IB's system until the point at which the possibility exists that both legs may be executed simultaneously.

For example, if you are long XYZ stock and short an XYZ call against it, you might choose to close this position using a combo order. This order will be sent to ISE since it has a stock and option component. However, if XYZ options don't trade at ISE, they can't accept the order. In this case the order will stay on IB's server until the system reads that the XYZ stock can be sold and the XYZ option bought, at which point the system will send the orders simultaneously to the respective exchanges. Please note that although it is possible that both orders will be executed simultaneously at the combo price, there is no guarantee of fill simply because the displayed quotes from each exchange indicate the combo price is available.

How can I remove a canceled order that is stuck on my screen in pink status?

The pink status indicates that you have sent a request to cancel the order, but have not yet received cancel confirmation from the order destination. At this point your order is not confirmed canceled. You may still receive an execution while your cancellation request is pending.

The most frequent cause of this issue is sending a cancel request to an exchange that is not currently open. For example, you have an open limit order that is at the NYSE. You send a cancel on that order at 16:05 EST, when the NYSE is closed. Their computers do not electronically respond, therefore IB can't confirm the cancel or clear the order. This example holds true for nearly all exchanges.

Another cause is an order being "stuck" electronically on your TWS system. In these cases traders will have to wait for the system to go through its "daily reset" for the order to disappear from the trading application.

*If you have an order in this status on your screen, you should contact IB immediately. If we are able to see the order in our system (and for orders that have been requested canceled by the account holder, but not acknowledged by the exchange, IB can usually see the orders in our system) we can attempt to call the exchange and request a confirmation of cancellation. Unfortunately in many cases, most notably with the NYSE, the exchanges will not answer their phones after they are officially closed for trading. If the exchange can't be contacted, the order will remain in this status until their computers send the cancel confirmation. As stated above: At this point your order is not confirmed canceled. You may still receive an execution while your cancellation request is pending.