外国為替取引(FX)に関して

IBでは、外国為替取引を中心としたトレーダーだけでなく、複数の通貨建ての株式やデリバティブ取引から外国為替取引を行うトレーダーも対象として取引場所や取引プラットフォームを提供しています。以下の記事では、TWSプラットフォームでのFX注文入力の基本と、クオートの慣習やポジション(取引後)の報告に関する注意点について説明します。

FX(外国為替)取引では、ある通貨の購入と別の通貨の売却を同時に行いますが、その組み合わせは一般的にクロスペアと呼ばれています。 以下の例では、EUR.USDのクロスペアをもとに説明します。クロスペアの第1通貨(EUR)を売却する取引通貨とし、第2通貨を決済通貨としています。

こちらのページの記事の特定のトピックに移動するには、下記リンクをクリックしてください。

外国為替気配値について

通貨ペアとは外国為替市場において、ある通貨単位の価値を別の通貨単位で表示するためのものです。別の通貨単位で価格を表示される元の通貨を基準通貨=取引通貨、一方で価格表示をする通貨をクオート通貨=決済通貨と呼びます。TWSでは、各通貨ペアに対して1つのティッカーシンボルとなります。FXTraderを使用すると、通貨ペアを逆にして、その価格を表示することもできます。トレーダーは基準通貨を売り、クオート通貨を買うことで通貨ペアの取引を行います。例えば、EUR/USDの通貨ペアのティッカーシンボルは次のようになります:

EUR.USD

となります。

- EURは基準通貨

- USDはクオート通貨

上記の通貨ペアの価格は、現在1ユーロ(基準通貨=取引通貨)が何米ドル(クオート通貨=決済通貨)になるのかを表しています。つまり、1ユーロの価格を米ドルで表示しているのです。

EUR.USDの買い注文は、表示されている取引価格に基づいてユーロを買い、そのユーロに相当する米ドルを売ることになります。

気配値の表示方法について

TWS上に通貨ペアの気配値を表示するための手順は以下のとおりです。

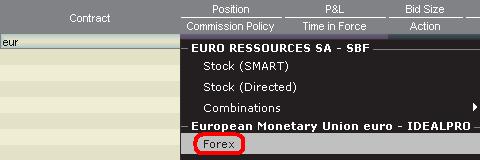

1. 取引通貨(例: EUR)を入力し、ENTERキーを押します。

2. 商品タイプのFX

を選択します。

3. 決済通貨(例: USD)を選択し、FXの取引所を選択します。

.jpg)

注意事項

IDEALFXにおける最低発注量(通常25,000米ドル)を超える注文は、IDEALFXにおいてインターバンクの外国為替市場に直接アクセスすることができます。IDEALFXに発注された注文のうち最低発注量を満たさないものは、主に外国為替取引用の少額注文取引所に自動的に振り分けられます。IDEALFXの最小・最大取引量に関する詳細は こちらをご覧ください。

外国為替取引において為替ディーラーが通貨ペアを表示する方法は決まっており、 例えば、通貨にCAD(カナダドル)を選択した場合、 決済通貨を選択する選択肢上にUSD(米ドル)が表示されないことがわかります。 これは、このペアが「USD.CAD」の順番で表示することが決まっており、基準通貨となる「USD」を入力してから「Forex」を選択しないとCADとUSDの通貨ペアにアクセスできないためです。

注文の作成方法について

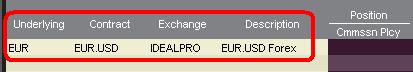

表示されているヘッダーに応じて、通貨ペアは次のように表示されます。

「コントラクト」と「詳細」のコラムには、取引通貨と決済通貨の形式で通貨ペアが表示されます(例: EUR.USD)。 「銘柄」のコラムには、取引通貨のみが表示されます。

表示されているヘッダーを変更する方法は、こちらをご覧ください。

1. 注文の発注にはBID=買気配(売り注文の作成のため)またはASK=売気配(買い注文の作成のため)を左クリックします。

2. 買い、または売りたい取引通貨(=基準通貨)の数量を指定します。注文の数量は、基準通貨=取引通貨で表されます。これはTWSで表示される通貨ペアの第1通貨です。

インタラクティブ・ブローカーズでは外国為替取引において、一定の決まった取引量を基準通貨(=取引通貨)で表す「コントラクト」という概念はなく、取引サイズは基準通貨(=取引通貨)における最小取引単位以上(例:ユーロの場合は1ユーロ)からとなります。

例えば、100,000 EUR.USDの買い注文は、表示されている為替レートに基づいて、100,000 EURを買い、同等の米ドルを売ることになります。

3. ご希望の注文タイプと為替レート(価格)を指定し、注文を発注します。

注意事項: 注文は全ての通貨の最小取引単位から行うことができ、上述のIDEALFX最低発注量の他に最小コントラクトや最小ロットサイズを考慮する必要はありません。

よくあるご質問: FXTraderではどのように注文を発注するのですか?

ピップ値について

ピップ値とは、通貨ペアの変化を表す尺度で、ほとんどの通貨ペアでは最小の変化を表します。通貨ペアの中には、少数ピップでの表示が可能なものもあります。

例えば、EUR.USDでは1ピップは0.0001、USD.JPYでは1ピップは0.01となります。

1ピップの値をクオート通貨単位で計算するには、以下の式を適用します。

(取引金額)x (1ピップ)

例:

- ティッカーシンボル = EUR.USD

- 取引金額 = 100,000ユーロ

- 1ピップ = 0.0001

1ピップの価値 = 100’000 x 0.0001= 10 USD

- ティッカーシンボル = USD.JPY

- 取引金額 = 100’000 USD

- 1ピップ = 0.01

1ピップの価値 = 100’000 x (0.01)= 1000円

基準通貨単位で1ピップの価値の計算するには、以下の式を適用します。

(取引金額)x (1ピップ/為替レート)

例:

- ティッカーシンボル = EUR.USD

- 取引金額 = 100’000ユーロ

- 1ピップ = 0.0001

- 為替レート = 1.3884

1ピップの価値 = 100’000 x (0.0001/1.3884)= 7.20ユーロ

- ティッカーシンボル = USD.JPY

- 取引金額 = 100’000 USD

- 1ピップ = 0.01

- 為替レート = 101.63

1ピップの価値 = 100’000 x (0.01/101.63)= 9.84 USD

取引後のポジション表示について

FXポジション情報はIBにおける取引の重要な側面であり、ライブ口座での取引を実行する前に理解しておく必要があります。 IBの取引ソフトウェアはFXポジションを2つの異なる場所に反映させ、その両方を口座ウィンドウから確認することができます。

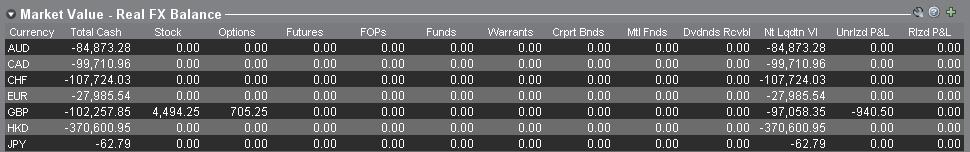

1. 市場価格

口座ウィンドウの「市場価格」のセクションには、通貨ペアではなく個々の通貨単位で、リアルタイムの通貨ポジションが反映されます。

口座ウィンドウの「市場価格」のセクションは、トレーダーがリアルタイムに反映されたFXポジション情報を見ることができる唯一の場所です。 複数の通貨をFXの通貨ポジションとして保有する場合、ポジションを建てた時と同じ通貨ペアで決済する必要はありません。 例えばEUR.USDの買い(EURの買い、USDの売り)とUSD.JPYの買い(USDの買い、JPYの売い)を行ったトレーダーは、EUR.JPYの取引(EURの売り、JPYの買い)でポジションを決済することができます。

注意事項

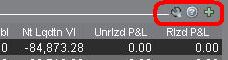

「市場価格」のセクションは拡張/縮小が可能です。 流動性資産価値のコラムのすぐ上に、緑色のマイナスの記号が表示されていることをご確認ください。 緑色のプラス記号が表示されている場合には、一部の保有ポジションが表示されていない可能性があります。

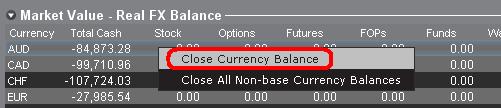

決済したい通貨を右クリックして「選択した通貨残高を口座通貨の残高へ両替」または「基準通貨以外の全ポジションのクローズ」を選択することで、「市場価格」のセクションから決済取引を行うことができます。

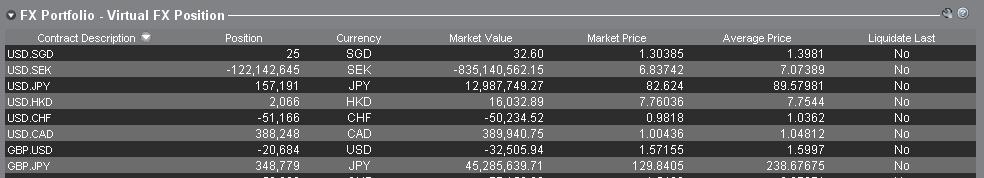

2. FXポートフォリオ

口座ウィンドウのFXポートフォリオのセクションでは、仮想ポジションを表示し、市場価格のセクションのよう個々の通貨ではなく、通貨ペアで表示されます。 この特別な表示方法は機関投資家のFXトレーダーに共通する習慣に合わせたもので、個人やFX取引を頻繁に行わないのトレーダーを対象とするものではありません。FXポートフォリオのポジション表示はすべてのFX取引を反映しているわけではありませんが、ここに表示されるポジション数と平均コストは変更することができます。 実際に取引を行うことなくポジション数と平均コストの情報を変更できるこの機能は、基準通貨に加えて非基軸通貨建ての商品の取引にも携わるトレーダーに向いています。 この機能を利用することにより、基準通貨建て以外の商品を取引する際に自動的に発生する通貨変換の係る取引を、明らかなFX取引と手動で分けて管理することができます。

FXポートフォリオのセクションには、他のすべての取引ウィンドウに表示されるFXポジションと損益情報が表示されます。 このため、実際のリアルタイムのポジション情報を判断するにあたって混乱が生じる傾向があります。 混乱を軽減また解消するため、下記の作業のいずれかを行っていただくことをお薦めします。

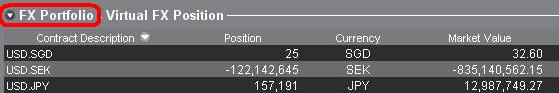

a. FXポートフォリオのセクションを非表示にする

「FXポートフォリオ」の左側にある矢印をクリックすると、FXポートフォリオのセクションを折りたたむことができます。 このセクションを折りたたむと、すべての取引ページにFXのバーチャルポジションの情報が表示されなくなります。(注意事項: FXポートフォリオの情報のみ表示されなくなり、市場価値の情報は表示されます。)

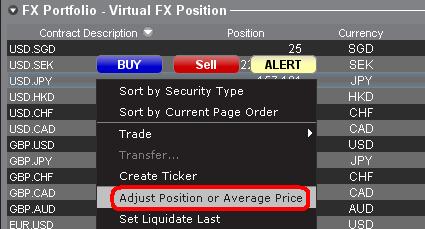

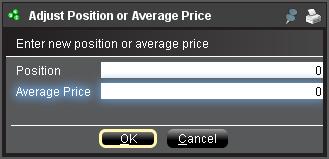

b. ポジションまたは平均価格の調整

口座ウィンドウのFXポートフォリオのセクションを右クリックすると、ポジションまたは平均価格を調整するオプションがあります。 非基準通貨によるポジションをすべて決済し、市場価格のセクションでも決済が確認できたら、ポジションおよび平均価格の欄を0にリセットすることができます。 この調整を行うことにより、FXポートフォリオのセクションに反映されるポジション数がリセットされ、画面上でより正確なポジションと損益情報を見ることができるようになります。注意事項: この作業は手動になるため、通貨ポジションが決済されるたびに行う必要があります。 ポジションに関する情報は常に市場価格のセクションからご確認の上、発注された注文のポジションがご希望通りに建ち、また決済されていることをご確認ください。

上記の内容をご参考にしていただき、ライブ口座でお取引を始める前にペーパー取引口座、またはデモ口座でFX取に慣れていただくことをお薦め致します。 上記の内容についてご不明な点などございましたら、お気軽にIBまでお問い合わせください。

その他のよくあるご質問:

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

An Introduction to Forex (FX)

IB offers market venues and trading platforms which are directed towards both forex-centric traders as well as traders whose occasional forex activity originates from multi-currency stock and/or derivative transactions. The following article outlines the basics of forex order entry on the TWS platform and considerations relating to quoting conventions and position (post-trade) reporting.

A forex (FX) trade involves a simultaneous purchase of one currency and the sale of another, the combination of which is commonly referred to as a cross pair. In the examples below the EUR.USD cross pair will be considered whereby the the first currency in the pair (EUR) is known as the transaction currency that one wishes to buy or sell and the second currency (USD) the settlement currency.

Jump to a specific topic in this article;

- Forex Price Quotes

- Creating a quote line

- Creating an order

- Pip Value

- Position (Post-Trade) Reporting

Forex Price Quotes

A currency pair is the quotation of the relative value of a currency unit against the unit of another currency in the foreign exchange market. The currency that is used as reference is called quote currency, while the currency that is quoted in relation is called base currency. In TWS we offer one ticker symbol per each currency pair. You could use FXTrader to reverse the quoting. Traders buy or sell the base currency and sell or buy the quote currency. For ex. the EUR/USD currency pair’s ticker symbol is:

EUR.USD

where:

- EUR is the base currency

- USD is the quote currency

The price of the currency pair above represents how many units of USD (quote currency) are required to trade one unit of EUR (base currency). Said in other words, the price of 1 EUR quoted in USD.

A buy order on EUR.USD will buy EUR and sell an equivalent amount of USD, based on the trade price.

Creating a quote line

The steps for adding a currency quote line on the TWS are as follows:

1. Enter the transaction currency (example: EUR) and press enter.

2. Choose the product type forex

3. Select the settlement currency (example: USD) and choose the forex trading venue.

.jpg)

Notes:

The IDEALFX venue provides direct access to interbank forex quotes for orders that exceed the IDEALFX minimum quantity requirement (generally 25,000 USD). Orders directed to IDEALFX that do not meet the minimum size requirement will be automatically rerouted to a small order venue principally for forex conversions. Click HERE for information regarding IDEALFX minimum and maximum quantities.

Currency dealers quote the FX pairs in a specific direction. As a result, traders may have to adjust the currency symbol being entered in order to find the desired currency pair. For example, if the currency symbol CAD is used, traders will see that the settlement currency USD cannot be found in the contract selection window. This is because this pair is quoted as USD.CAD and can only be accessed by entering the underlying symbol as USD and then choosing Forex.

Creating an order

Depending on the headers that are shown, the currency pair will be displayed as follows;

The Contract and Description columns will display the pair in the format Transaction Currency.Settlement Currency (example: EUR.USD). The Underlying column will display only the Transaction Currency.

Click HERE for information regarding how to change the shown column headers.

1. To enter an order, left click on the bid (to sell) or the ask (to buy).

2. Specify the quantity of the trading currency you wish to buy or sell. The quantity of the order is expressed in base currency, that is the first currency of the pair in TWS.

Interactive Brokers does not know the concept of contracts that represent a fixed amount of base currency in Foreign exchange, rather your trade size is the required amount in base currency.

For example, an order to buy 100,000 EUR.USD will serve to buy 100,000 EUR and sell the equivalent number of USD based on the displayed exchange rate.

3. Specify the desired order type, exchange rate (price) and transmit the order.

Note: Orders may be placed in terms of any whole currency unit and there are no minimum contract or lot sizes to consider aside from the market venue minimums as specified above.

Common Question: How is an order entered using the FX Trader?

Pip Value

A pip is measure of change in a currency pair, which for most pairs represents the smallest change, although for others changes in fractional pips are allowed.

For ex. in EUR.USD 1 pip is 0.0001, while in USD.JPY 1 pip is 0.01.

To calculate 1 pip value in units of quote currency the following formula can be applied:

(notional amount) x (1 pip)

Examples:

- Ticker symbol = EUR.USD

- Amount = 100,000 EUR

- 1 pip = 0.0001

1 pip value = 100’000 x 0.0001= 10 USD

- Ticker symbol = USD.JPY

- Amount = 100’000 USD

- 1 pip = 0.01

1 pip value = 100’000 x (0.01)= JPY 1000

To calculate 1 pip value in units of base currency the following formula can be applied:

(notional amount) x (1 pip/exchange rate)

Examples:

- Ticker symbol = EUR.USD

- Amount = 100’000 EUR

- 1 pip = 0.0001

- Exchange rate = 1.3884

1 pip value = 100’000 x (0.0001/1.3884)= 7.20 EUR

- Ticker symbol = USD.JPY

- Amount = 100’000 USD

- 1 pip = 0.01

- Exchange rate = 101.63

1 pip value = 100’000 x (0.01/101.63)= 9.84 USD

Position (Post-Trade) Reporting

FX position information is an important aspect of trading with IB that should be understood prior to executing transactions in a live account. IB's trading software reflects FX positions in two different places both of which can be seen in the account window.

1. Market Value

The Market Value section of the Account Window reflects currency positions in real time stated in terms of each individual currency (not as a currency pair).

The Market Value section of the Account view is the only place that traders can see FX position information reflected in real time. Traders holding multiple currency positions are not required to close them using the same pair used to open the position. For example, a trader that bought EUR.USD (buying EUR and selling USD) and also bought USD.JPY (buying USD and selling JPY) may close the resulting position by trading EUR.JPY (selling EUR and buying JPY).

Notes:

The Market Value section is expandable/collapsible. Traders should check the symbol that appears just above the Net Liquidation Value Column to ensure that a green minus sign is shown. If there is a green plus symbol, some active positions may be concealed.

Traders can initiate closing transactions from the Market Value section by right clicking on the currency that they wish to close and choosing "close currency balance" or "close all non-base currency balances".

2. FX Portfolio

The FX Portfolio section of the account window provides an indication of Virtual Positions and displays position information in terms of currency pairs instead of individual currencies as the Market Value section does. This particular display format is intended to accommodate a convention which is common to institutional forex traders and can generally be disregarded by the retail or occasional forex trader. FX Portfolio position quantities do not reflect all FX activity, however, traders have the ability to modify the position quantities and average costs that appear in this section. The ability to manipulate position and average cost information without executing a transaction may be useful for traders involved in currency trading in addition to trading non-base currency products. This will allow traders to manually segregate automated conversions (which occur automatically when trading non base currency products) from outright FX trading activity.

The FX portfolio section drives the FX position & profit and loss information displayed on all other trading windows. This has a tendency to cause some confusion with respect to determining actual, real time position information. In order to reduce or eliminate this confusion, traders may do one of the following;

a. Collapse the FX Portfolio section

By clicking the arrow to the left of the word FX Portfolio, traders can collapse the FX Portfolio section. Collapsing this section will eliminate the Virtual Position information from being displayed on all of the trading pages. (Note: this will not cause the Market Value information to be displayed it will only prevent FX Portfolio information from being shown.)

b. Adjust Position or Average Price

By right clicking in the FX portfolio section of the account window, traders have the option to Adjust Position or Average Price. Once traders have closed all non base currency positions and confirmed that the market value section reflects all non base currency positions as closed, traders can reset the Position and Average Price fields to 0. This will reset the position quantity reflected in the FX portfolio section and should allow traders to see a more accurate position and profit and loss information on the trading screens. (Note: this is a manual process and would have to be done each time currency positions are closed out. Traders should always confirm position information in the Market Value section to ensure that transmitted orders are achieving the desired result of opening or closing a position.

We encourage traders to become familiar with FX trading in a paper trade or DEMO account prior to executing transactions in their live account. Please feel free to Contact IB for additional clarification on the above information.

Other common questions:

Currency Conversion for Trading Products in a Non-Base Currency

How to convert a currency if you wish to trade products in a currency other than the currency your account was initially funded in

For additional information on currency conversions please refer to the Knowledge base articles:

Why Are There Two Currencies Shown When Trading Forex and How Do They Work?

What Happens if I Trade a Product Denominated in a Currency Which I Do Not Hold in My Account?

Can the base currency in a cash account be changed?

Yes, cash accounts may change the base currency on their account. However, please note that IBIS, EmployeeTrack, Flat Fee Referrer, Betting and IN/JPN domeestic accounts cannot change their base currency.

Will cash balances be converted once the designated Base Currency for the account has been changed?

It is important to note that changing your Base Currency does not serve to convert existing cash balances or change the denomination of a security into any other currency. Cash balances will remain in their currency of denomination unless converted via IB's IdealPro (for balances of at least USD 25,000 or equivalent) or odd lot (for balances below USD 25,000 or equivalent) Forex venues. Similarly, the denomination of securities and commodities positions cannot be changed as this is determined by the listing exchange.

Can I convert a long cash balance to a non-base currency or trade a position denominated in a non-base currency in my cash account?

Yes, albeit, with certain limitations. IBKR provides cash accounts the ability to trade products denominated in a currency other than the designated base currency of the account as long as the account is classified as a multi-currency cash account (i.e., maintains Forex trading permissions). To trade a security denominated in a non-base currency, the account holder must either first deposit the appropriate currency into their account or perform a currency conversion via the IdealPro venue. Regardless of the method selected, one needs to ensure that a sufficient balance of the appropriate currency exists in order to cover the purchase price of the applicable security including commissions prior to submitting the order or it will be rejected. This implies that IdealPro currency conversions must settle prior to the converted funds being available for a subsequent transaction (e.g., if you are converting USD into EUR for the purpose of purchasing a EUR denominated stock, you would not be able to enter the stock order until the conversion trade had settled two business days later).

Individuals trading futures in a cash account should note that futures variation is settled in cash and any variation which serves to generate a cash deficit in any given currency type (i.e. variation exceeds available cash margin) will result in a forced position liquidation in an amount sufficient to eliminate the cash deficit.

Finally, note that cash accounts are restricted from holding a short balance in any non-base currency as this would constitute a margin loan. In addition, clients of IB India are not allowed to maintain a multi-currency cash account and may only maintain assets which are denominated in INR.

Why does the Cash Report section of my statement reflect a reduction in cash despite no trade activity or withdrawals?

The Cash Report section details how each period's cash balance changes from beginning to end. If your account holds a long or short balance in a non-base currency, such balances will be translated (but not converted) into your base currency for statement reporting and account equity aggregation purposes. The rates at which these non-base balances have been converted are detailed in the Exchange Rates section located towards the bottom of your Daily Activity Statement. All other things being equal, any change in an exchange rate from one statement period to another will result in either an increase or decrease in your ending cash balance with the net change across all non-Base currencies being reflected in the Cash FX Translation Gain/Loss line. This does not reflect a realized gain or loss on these open currency positions but rather a mark-to-market calculation across statement periods.