Cash Sweeps

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

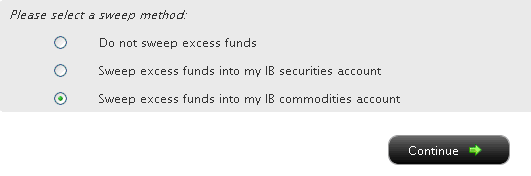

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models

銀行送金による出金方法

ご出金いただく場合は、アカウントマネジメントより出金指示をご入力ください。

<アカウントマネジメントのメニューが左側に表示されている場合>

アカウントマネジメントへログインし、Funds Management(資金管理)、Fund Transfers(入金・出金)を選択してください。

※画面上部に表示されております国旗を選択することでメニューの言語切替が可能です。

<アカウントマネジメントのメニューが上部に表示されている場合>

アカウントマネジメントへログインし、Funding(入金・出金)、Fund Transfers(入金・出金)を選択してください。

※画面右上に表示されております世界地図をクリックすることでメニューの言語切替が可能です。

1. 表示される画面上でTransaction(入金・出金)より「Withdraw Funds(出金)」、Method(方法)より「Zengin Wire(国内送金)」、Instruction(指示)より「Add New Instruction(出金先の新規登録)」を選択します。

※ IBSJ口座(国内商品取引口座)をお持ちのお客様は、上部にございます日本の国旗をクリックすることでメニューを日本語に変換できます。

※ IBLLC口座(海外商品取引口座)をお持ちのお客様は、Transactionより「Withdrawal Funds(出金)」、Methodより「Wire(電子送金)」、Instructionより「Add New Instruction(出金先の新規登録)」を選択してください。

2. 次にCurrency(通貨)、Bank Location(銀行所在地)、Bank Account Number(銀行口座番号)、Account Type(口座種別)、Bank/Branch code(銀行および支店コードをスペースなしで続けて入力)等の情報を入力する画面が表示されます。これらの情報をご入力後、「Continue(次に進む)」をクリックしてAmount(金額)をご入力ください。出金確認ページを完了しますと、お客様の出金リクエストは担当部署にてレビュー後、処理されます。

※ IBLLC口座(海外商品取引口座)をお持ちのお客様には、Currency(通貨)、Bank Location(銀行所在地)、Bank Account Number(銀行口座番号)、SWIFT code(SWIFTコード)等の情報を入力する画面が表示されます。

※ マネーロンダリング防止の取り組みとして、弊社からの出金は全てお客様のIB口座名義にて出金処理されますのでご了承ください。

この他ご不明な点がございましたら、カスタマーサービスまでお問い合わせください。

www.interactivebrokers.com/en/p.php?f=customerService&ib_entity=llc

How to withdraw funds via bank wire transfer

To make a wire withdrawal to your bank account you will first need to register a new withdrawal instruction through Account Management.

<If your Account Management has menus on left side>

Once logged into Account Management, select the Funds Management and then Funds Transfers menu options. ※ You may change languages by clicking a flag shown on the top.

<If your Account Management has menus on top>

Once logged into Account Management, select the Funding and then Funds Transfers menu options.

※ You may change languages by clicking a gray global map on the right top of the screen.

1. From there you will select the Transaction Type of "Withdrawal", the Method of " Zengin Wire ", the Instruction of "Add New Instruction".

※ If you are IBLLC customers, you will select the Transaction Type of "Withdraw Funds", the Method of "Wire", and Instruction of "Add New Instruction".

2. You will then be prompted to input Currency of denomination, Bank Location, Bank Account Number, Account Type, and Bank/Branch code (no space between bank and branch codes). Once that information has been input, click "Continue" button to enter withdrawal amount. After confirmation page, your withdrawal request will be reviewed and processed.

※ IBLLC customers will be prompted to input your receiving bank details including Currency of denomination, Bank Location, Bank Account Number and SWIFT code of your bank.

※ Please note that all withdrawals will be sent in the name of IB account holder in accordance with anti-money laundering regulations.

Should you have further questions, please contact one of our Customer Service Centers.

www.interactivebrokers.com/en/p.php?f=customerService&ib_entity=llc

IRA: Charitable Donations from IRAs

Charitable Distributions

What is a Qualified Charitable Distribution (QCD)?

How to determine if a charity can receive the QCD

Where can an IRA owner find additional information on QCDs?

Withdrawal Processing

When can I submit my withdrawal?

Can IBKR customers submit a QCD withdrawal online?

What amount may be withdrawn? Why?

Where are the funds disbursed?

Does the distribution count towards the Required Minimum Distribution (RMD) amount?

Eligible IRA Accounts

Is the Charitable Distribution allowed from all IRAs held at IBKR?

Are the QCDs allowed from other IRA and retirement plans not held at IBKR?

QCD Tax Reporting

How is the QCD reported to the IRS?

Can any taxes be withheld from the distribution?

Do federal taxes have to be paid on the distribution?

Does a state or municipal tax have to be paid on the distribution?

Charitable Distributions

What is a Qualified Charitable Distribution (QCD)?

An otherwise taxable distribution from an eligible IRA owned by an individual 72 or older paid to an IRS qualified charity.

How to determine if a charity can receive the QCD?

The IRS Exempt Organizations Select Check allows users to "Search for Charities" among a list of organizations eligible to receive tax-deductible charitable contributions.

Where can an IRA owner find additional information on QCDs?

Visit Charitable Donations for IRAs for additional information on qualified charitable distributions. See also IRS Publication 590-b.

Withdrawal Processing

Can IBKR customers submit a QCD withdrawal online?

What amount may be withdrawn? Why?

IBKR will process the withdrawal for any amount, as long as the account has sufficient available funds. Why? Although the QCD donations to the charity must not exceed $100,000 per year to retain QCD status, charitable gifts may exceed this limit.

Where are the funds disbursed?

Funds are made payable to the IRS qualified charity and mailed direct to the charity. Only funds disbursed to the charity can be designated from your IRA as a QCD.

Does the distribution count towards the Required Minimum Distribution (RMD) amount?

Yes

Eligible IRA Accounts

Is the Charitable Distribution allowed from all IRAs held at IBKR?

No, see the list below. IRA owners should contact a qualified tax advisor about how to preserve QCD tax benefits. Not all distributions are created equal. A tax advisor will be able to assess an IRA owner’s best choice.

Traditional IRA > YES

Rollover IRA > YES

Roth IRA > YES

Inherited IRA > YES, if the beneficiary is at least age 70 1/2

SEP IRA > NO

Education IRA > NO

Are the Charitable Distributions allowed from other IRA and retirement plans not held at IBKR?

No, not directly. Retirement plans, employer sponsored SEP IRAs, and Simple IRAs (account classifications not held at IBKR) are not eligible for a QCD election. IRA owners may be eligible to rollover assets from these plans into a traditional, rollover, or Roth IRA to request a charitable distribution. IRA owners should contact a qualified tax advisor or their retirement plan administrator.

QCD Tax Reporting

How is the QCD reported to the IRS?

IBKR will report the charitable distributions on Form 1099-R when issued. See Reports and Dates for 1099 availability dates.

Can any taxes be withheld from the distribution?

No.

Do federal taxes have to be paid on the distribution?

Generally, federal taxes are not paid with QCDs. But distributions in excess of the IRS limit may be subject to income tax. IBKR recommends that customers contact a qualified tax advisor.

Does a state or municipal tax have to be paid on the distribution?

Contact your tax advisor or local tax authority on state and municipal requirements for the distributed amount.

Disclaimer: IBKR does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax advisor or refer to the U.S. Internal Revenue Service.

Overview of Fees

Clients and as well as prospective clients are encouraged to review our website where fees are outlined in detail.

An overview of the most common fees is provided below:

1. Commissions - vary by product type and listing exchange and whether you elect a bundled (all in) or unbundled plan. In the case of US stocks, for example, we charge $0.005 per share with a minimum per trade of $1.00.

2. Interest - interest is charged on margin debit balances and IBKR uses internationally recognized benchmarks on overnight deposits as a basis for determining interest rates. We then apply a spread around the benchmark interest rate (“BM”) in tiers, such that larger cash balances receive increasingly better rates, to determine an effective rate. For example, in the case of USD denominated loans, the benchmark rate is the Fed Funds effective rate and a spread of 1.5% is added to the benchmark for balances up to $100,000. In addition, individuals who short stock should be aware of special fees expressed in terms of daily interest where the stock borrowed to cover the short stock sale is considered 'hard-to-borrow'.

3. Exchange Fees - again vary by product type and exchange. For example, in the case of US securities options, certain exchanges charge a fee for removing liquidity (market order or marketable limit order) and provide payments for orders which add liquidity (limit order). In addition, many exchanges charge fees for orders which are canceled or modified.

4. Market Data - you are not required to subscribe to market data, but if you do you may incur a monthly fee which is dependent upon the vendor exchange and their subscription offering. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. To access, log in to Portal click on the Support section and then the Market Data Assistant link.

5. Minimum Monthly Activity Fee - there is no monthly minimum activity requirement or inactivity fee in your IBKR account.

6. Miscellaneous - IBKR allows for one free withdrawal per month and charges a fee for each subsequent withdrawal. In addition, there are certain pass-through fees for trade bust requests, options and futures exercise & assignments and ADR custodian fees.

For additional information, we recommend visiting our website and selecting any of the options from the Pricing menu option.

Withdrawal restrictions applicable to assets transferred via ACATS

Assets transferred to IBKR via ACATS are subject to a withdrawal hold period of up to 30 days, the count of which begins the day after the transfer has settled and ends at midnight of the 30th day thereafter. Note that assets are often credited to an account holder’s equity and made available for trade prior to transfer settlement. The date at which a given ACATS deposit is eligible for withdrawal may be determined through the Transaction History function within Client Portal.

How can I check the status of funding transactions?

IBKR provides account holders with a tool that provides real-time updates and current status of all deposit and withdrawal transactions relating to both cash and positions which have taken place over the prior 45 calendar day period. This tool is made available through the secure Account Management application and may be accessed via the Transfer & Pay and then Transaction History menu options.

Display

By default, the Transaction History page shows all of your funding transactions for the past ten days. You can adjust that up to the past 90 days by adjusting the time slider. Click and drag the slider right or left to change the time. The page updates to display all of your funding transactions for the selected period.

By default, transactions are displayed by date in descending order. Change the sort order by clicking any column heading. To change the sort order from descending to ascending, click the column heading again. For example, if you want to view all deposits listed together, click the Type column heading.

Click the Configure (gear) icon to configure the transaction history to display additional information, including Account ID, Account Title and Method.

To view transaction details, click anywhere on a transaction row. Details for the transaction appear in a popup window. From the transaction detail popup window, you can perform any of the following operations:

- Cancel any transaction that has a status of Pending by clicking Cancel. Click Yes to confirm the cancellation.

- Print the transaction details by clicking Print.

- Stop payment on a check withdrawal.

- Close the popup window by clicking the X icon in the upper corner.

- Note: DO NOT CLICK THE CANCEL BUTTON UNLESS YOU WANT TO CANCEL THE TRANSACTION.

Search and Filter

Search for a specific transaction by Account ID, Account Title, Transaction Type (deposit, withdrawal, etc.), Transaction Method (check, wire, etc.), or Status by typing the search criteria in the Search field, and then clicking the Search (magnifying glass) icon. Search words are not case-sensitive.

Filter the transaction history by Transaction Type, Method or Status.

Print and Export

To print the transaction history as currently displayed, click the Print icon located in the upper right corner of the screen.

To export your transaction history to an XLS file (Microsoft Excel-compatible), click the Export icon located in the upper right corner of the page. You are prompted to save or download the .XLS page to your computer (depending on your web browser). Once saved, you can open that file in Microsoft Excel.

Availability of proceeds in a 'Cash' type account

Accounts which have been set up as a 'Cash' type do not have access to the proceeds from the sale of securities until such time the transaction has settled at the clearinghouse and proceeds have been issued to IBKR. Securities settlement generally takes place on the third business day following the sale transaction. Providing access to the funds prior to settlement would constitute a loan, a transaction which is precluded from taking place within this account type.

The one exception is under the Free-Riding rule. Clients with a cash account can use the proceeds from the sale of a security to purchase a different security under the condition that the second security is held until settlement of the initial sale. If the client sells the second security prior to settlement of the initial trade, they will be in violation of the Free-Riding rule and will be locked for 90 days from utilizing this exception.

Account holders who wish to have access to settled funds prior to the settlement day may do so by electing an account type of 'Margin'. Under this account type unsettled funds may be used for trading purposes but may not be withdrawn until settlement. Account holders maintaining a 'Cash' account may request an upgrade to a 'Margin' type account by logging in to Client Portal and selecting the Settings > Account Settings menu item and Account Type from the Configuration panel. Upgrade requests are subject to a compliance review to ensure that the account holder maintains the appropriate qualifications.

Are the proceeds from a closing stock sale made available immediately to my account?

IBKR allows account holders to designate and maintain their account as either a 'Margin' or 'Cash' type of account at the point of application. If one maintains a 'Margin' type account, the proceeds from closing stock sales are made available for trading effective with the sale transaction. However, the account holder may not withdraw those funds from the account until such time as settlement has taken place and IBKR has been credited with the proceeds from the clearinghouse (generally 3 business days).

If one maintains a 'Cash' type account, proceeds from closing stock sales are not available for trading or withdrawal until settlement has been completed. To provide otherwise would constitute an extension of credit which is prohibited from being offered to 'Cash' accounts.

Click here for information on upgrading from a 'Cash' type account to a 'Margin' type account.

What does the 'Pending Advisor' status mean next to my withdrawal request?

In the Transaction History section of Client Portal, client accounts who are logged in and have requested a withdrawal, may see the status as 'Pending Advisor'.

Information:

In the advisor structure, client accounts can request withdrawals by logging in to Client Portal just as any individual account would. Once a withdrawal request is made by a client account, the advisor must consent to the request. If the Advisor does not consent to the request, the withdrawal will still be processed, but there will up to be a three business day delay.

Advisor Steps to Confirm:

Once a withdrawal request has been submitted by a client account, the advisor will receive an email notification, stating that a client has requested a withdrawal. In order to consent, the advisor must log in to Advisor Portal and navigate to Manage Clients then Dashboard and the Pending Items tab. The advisor would then click the 'Consent' button in order to expedite the processing of the pending withdrawal.

Note about hold periods:

In order to ensure the timely processing of client initiated withdrawal requests, the hold period for withdrawals where the amount of the request is greater than 80% of the amount available for withdrawal, will be held until consented to by the advisor or 3 calendar days, whichever comes first. For amounts representing less than 80% will be held until consented to by the advisor or the next business day.

These holds are in place to ensure that your advisor is aware of your withdrawal request and is afforded time to make funds available if necessary.

How do I transfer US Securities to IB from another broker?

Broker to broker transfers for US securities are conducted via a process known as the Automated Customer Account Transfer Service (ACATS). This process generally takes between 4 to 8 business days to complete in order to accommodate the verification of the transferring account and positions. The request is always initiated by the receiving broker. Please note that brokers generally freeze the account during this period to ensure an accurate snapshot of assets to transfer and may restrict the transfer of option positions during the week prior to expiration.

FAQS

The NSCC's ACATS system enables your broker to enter, review, and settle account transfers in a fully automated system.

Under normal circumstances, an ACATS should take between four to eight business days. With some circumstances, such as an attempt to transfer unsettled funds, positions that are not paid in full, or restricted stock shares, this process could take longer.

No. In order for your application to be considered for approval, you must specify a funding election. Note, however, that IB will not initiate your ACATS reqquest until such time as your account has been approved.

The ACATS feature is available under Account Management. Choose the Funds Management and then Position Transfers menu options. After selecting the ACATS - US Broker Transfer method, you will be prompted to specify whether the transfer is full or partial, the delvering broker and, if partial, the positions to be transferred.

The dropdown menu is a listing of Clearing Firms that are participants in the ACATS program. Not all firms are self-clearing. If you do not find your firm on the list, please contact one of their representatives to identify their clearing firm.

Interactive Brokers accepts only products that are available for trading. Certain Fixed Income issues, Mutual Funds and Limited Partnership units are not eligible to be held in your Interactive Brokers account.

Can I transfer a Traditional IRA to a Roth IRA?

No. IRAs may only be transferred to the same type of IRA (i.e. Traditional to Traditional, Roth to Roth, etc.). Also note that IRAs cannot contain any margin loans, short positions, or equity option positions.