COMEX貴金屬期貨實物交割

關於COMEX貴金屬期貨實物交割

IBLLC的客戶將可以發起和接收COMEX貴金屬期貨交割,具體說來為黃金(GC)、白銀(SI)及對應的黃金微型合約(MGC)和白銀微型合約(SIL)。

對於每張標準規格或E-微型期貨合約,實物交割是以經登記的電子權證或累積交換憑證(ACE)的形式進行的。

關於黃金和白銀權證

- 每只黃金(GC)和白銀(SI)期貨將交割一張代表相應合約單位可交割黃金或白銀的權證。

- 黃金(GC):100金衡盎司重量偏差5%左右、最低純度995的黃金。更多信息請參見COMEX規則手冊第113章。

- 白銀(SI):5000金衡盎司重量偏差10%左右、最低純度999的白銀。更多信息請參見COMEX規則手冊第112章。

- 權證是COMEX批准的存托機構發行的電子憑證。

- 每張權證都在COMEX進行過登記並與具體的可交割貴金屬條關聯,唯一識別號碼也可追溯到COMEX的存托機構。

- 權證將登記在盈透證券(COMEX清算成員)名下。

- 將收取保管費。

- 客戶將在“U”賬戶內看到其權證:

- 代碼將包含已登記權證的唯一憑證號碼。

- 數量永遠是1。

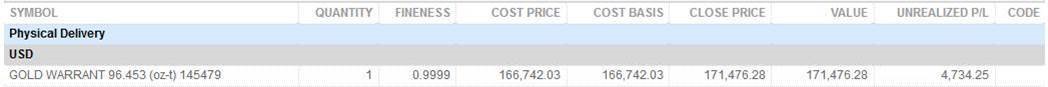

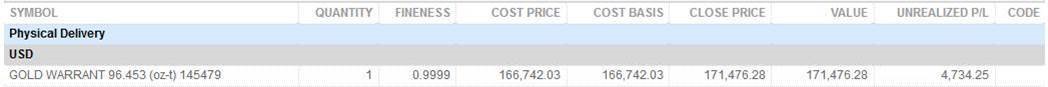

- 權證對應的貴金屬條淨重和純度可供客戶查看。下方為客戶報表範例。

有關累積交換憑證(ACE)

- 微型黃金和微型白銀合約將交割由清算所發行的累積交換憑證(ACE)。

- 微型黃金(MGC):一個ACE代表以權證形式持有的100金衡盎司金條10%的所有權。更多信息請參見COMEX規則手冊第120章。

- 微型白銀(SIL):一個ACE代表以權證形式持有的5000金衡盎司銀條20%的所有權。更多信息請參見COMEX規則手冊第121章。

- 權證可以轉換成ACES。

- 只要累積到適當倍數(黃金是10,白銀是5),ACES也可以兌換回權證。

- 將收取保管費。

關於交割意向

要接收或發起交割,您必須針對對應期貨輸入意向。如果沒有意向,期貨倉位將受相關交割週期限制,可能會被平倉清算。參見下方的交割週期清算安排。

- 多頭期貨 – 必須在相應交割月份第一頭寸日前至少提前兩個工作日針對對應數量的多頭期貨輸入接收意向。客戶也可以在交割過程中輸入接收意向,以針對當前交割月份期貨下達一個買入委託單。

- 只有在賬戶有足夠資金接收已聲明之數量的權證交割時,接收意向委託單才會被接受。如果資金不足,接收意向委託單會被拒絕。

- 空頭期貨 – 必須在相應交割月份最後交易日前至少提前兩個工作日針對對應數量的空頭期貨輸入交割意向。客戶也可以在最後交易日前一天和最後交易日當天輸入交割意向,以針對當前交割月份期貨下達一個賣出委託單。

- 只有在賬戶有足夠數量的權證/ACE憑證可滿足交割時,交割意向委託單才會被接受。如果憑證不足,則交割意向委託單會被拒絕。

下達交割意向

- 要從TWS中訪問實物交割工具:

- 右鍵點擊可實物交割的期貨合約 > 交割或

- 選擇交易 > 實物交割

- 要從客戶端中訪問實物交割工具:

- 點擊可實物交割的期貨合約 > 您的持倉 > 行操作按鈕(3個點) > 交割

- 從持倉頁面,點擊行操作(3個點) > 交割

- 移動IBKR應用程序:

- 打開主菜單 > 交易 > 交割

- 點擊可實物交割的期貨合約以打開合約詳情 > 持倉 > 交割工具

要針對該等貴金屬產品表明意向,您必須按以下流程操作:

接收意向

提交接收意向不僅僅可用於表示希望在交割窗口結束時接收產品(以登記權證或ACE的形式),在交割窗口期內開立新的期貨倉位也需要用到接收意向(即如果沒有先針對期貨產品提交接收意向,則無法在交割窗口期內開立可實物交割的期貨倉位)。

任何在交割窗口結束時沒有對應期貨倉位的接收意向都將被取消。

交割意向

提交交割意向表示希望交割產品(如權證或ACE)。這要求賬戶做空可實物交割期貨的同時持有相應的憑證可用於交割。

任何在交割窗口結束時沒有對應期貨倉位的交割意向都將被取消。

申請交割

只有在交割窗口期內才能提交交割申請,表示希望當天(而不是交割意向表示的在交割窗口結束時)交割產品。提交交割申請,賬戶必須有符合條件的產品(如權證或ACE)以及相應的空頭期貨倉位(如GC、MGC等)。

美國現貨黃金實物交割

美國現貨黃金實物交割

不記名登記的美國現貨黃金(代碼:USGOLD)可以轉換成下方任一產品:

- Gold Bullion Bar (.999) - 1 kg

- Gold Bullion Bar ISO Accredited (.9999) - 1 oz

- Gold Bullion Bar ISO Accredited (.9999) - 10 oz

- Gold American Eagle Coin - 1 oz

- Gold American Buffalo Coin - 1 oz

- Gold Canadian Maple Leaf Coin - 1 oz

申請交割

如果想將您的不記名登記美國現貨黃金倉位轉換成實物黃金:

- 登錄客戶端

- 打開消息中心

- 點擊“撰寫>新諮詢單”

- 選擇“實物黃金交割”作為話題

交割費用和運送

美國現貨黃金實物交割的成本費用為以下各項總和:

- 黃金現貨價格和實物產品成本之間的差額。

- 實物金屬產品由Fidelitrade Inc.提供。實物產品的預估成本可參見Fidelitrade Inc.的網站。

- 產品的成本是FideliTrade顯示的指示性賣價。1

- $25美元的交割費

- $500美元的IBKR手續費

FideliTrade的運送政策:

- 金條通過聯邦快遞、美國郵政服務或運鈔車運送。

- 通過聯邦快遞或美國郵政服務運送時,每個包裹保價10萬美元;通過運鈔車運送時,保價額度更高。

- 金條只能運送到您IBKR賬戶登記的地址,以確保最高級別的安全。

交易許可

要交易美國現貨黃金,您的賬戶需要有美國金屬交易許可。您可根據以下步驟申請許可:

- 登錄客戶端

- 從窗口底部選擇設置>賬戶設置菜單選項

- 點擊交易經驗與許可旁邊的“配置”(齒輪)圖標

- 點擊“更多產品”下拉菜單

- 選擇“金屬”

- 在彈框中,選擇“美國”然後點擊保存

- 點擊繼續

美國現貨黃金只適用于美國合法居民。美國現貨黃金不適用於Arizona、Montana、New Hampshire和Rhode Island的合法居民。

1. 顯示的賣價僅為指示性報價,可能會發生變化。

美國現貨黃金實物交割常見問題

IB Global Investments(IBGI)是誰?

IBGI是IBKR集團的全資子公司,其作為做市商代IBLLC為其客戶促成實物形式的不記名登記黃金交易。IBGI通過接收交易所掛牌期貨合約的黃金權證交割促成交易。IBLLC和IBGI都沒有自營交易,IBGI持有用來促成客戶交易的權證採用空頭期貨合約對沖。

“不記名登記”黃金是什麼意思?

購買不記名登記的黃金時,您擁有的是IBGI給到IBLLC的實物黃金中不可分割的一部分權益。換句話說,對應可明確按數量區分之金條的權證是以IBLLC的名義持有的,而IBLLC會將客戶的所有權益登記在自己的帳簿記錄中(類似股票的“行號代名”)。

黃金如何“記名登記”?

賬戶持有人通過交割實際擁有黃金之前,黃金都將保持“不記名登記”狀態。

不記名登記黃金的交易代碼是什麼?

代碼是USGOLD。

不記名登記黃金的最小委託單交易數量是多少?

最小委託單交易數量為1盎司。

不記名登記黃金的最小價格增量是多少?

$0.001

不記名登記黃金交易的結算時間是多久?

交易會在2個工作日內結算。

IBGI和IB LLC會對實物黃金交易進行加價嗎?

不會。無論是IBGI對IBLLC還是IBLLC對客戶都不會有加價或隱藏的價差。IBLLC作為不擔風險的交易主體按其與IBGI交易的價格與客戶交易,會向客戶收取交易傭金(詳情參見我們的網站)。

IBKR允許賣空不記名登記黃金嗎?

不允許。只允許買入。想從金價下跌中獲利的客戶可以通過期貨合約、期貨期權合約和/或各種黃金ETF賣空來實現這一風險敞口。

IBKR為不記名登記黃金倉位提供借貸嗎?

不提供。不記名登記黃金的保證金要求為100%。這意味著IBKR不會允許您用不記名登記黃金作為抵押借用資金。同樣,您的全額支付不記名登記黃金倉位也不能用來作為抵押買入或維持證券倉位。

不記名登記黃金受證券投資者保護公司(SIPC)保護嗎?

不受其保護。SIPC只針對證券賬戶中持有的證券和現金提供保護。

以什麼形式的黃金進行交割?

客戶可以轉換其不記名登記的黃金,選擇以下產品中的任意一種接收實物交割:

- Gold Bullion Bar (.999) 1 kg

- Gold Bullion Bar ISO Accredited (.9999) - 1 oz

- Gold Bullion Bar ISO Accredited (.9999) - 10 oz

- Gold American Eagle Coin - 1 oz

- Gold American Buffalo Coin - 1 oz

- Gold Canadian Maple Leaf Coin -1 oz

交割將通過FideliTrade Incorporated進行。FideliTrade Incorporated是一家專門提供交割和保管服務的全服務貴金屬投資公司。詳情請參見:https://www.fidelitrade.com/

可以部分交割嗎?

可以,您可以選擇只交割部分不記名登記的黃金倉位。

怎麼申請交割?

想要實物交割的客戶必須通過消息中心、使用“實物黃金交割”話題提交申請。申請必須注明多少盎司以及交割的形式。IBKR會確認成本和費用,待客戶確認後,再通知FideliTrade發起交割。請注意,只支持交付到賬戶持有人登記的地址。

接收交割的成本費用有哪些?是否有額外費用?

美國現貨黃金實物交割的成本費用為以下各項總和:

- 黃金現貨價格和實物產品成本之間的差額。

- 實物金屬產品由Fidelitrade Inc.提供。實物產品的預估成本可參見Fidelitrade Inc.的網站。

- 產品的成本是FideliTrade顯示的指示性賣價。

- $25美元的交割費

- $500美元的IBKR手續費

需要什麼交易許可?

對應的交易所和許可組合是美國金屬。

獲取IBMETAL交易許可有什麼資格要求嗎?

美國現貨黃金只適用于美國合法居民。美國現貨黃金不適用於Arizona、Montana、New Hampshire和Rhode Island的合法居民。

客戶同時還必須滿足以下要求:

- 投資目標:交易,或投機,或對沖,或增長(現金帳戶)

- 財務狀況:必須滿足期貨財務要求

- 沒有最低年限交易經驗

- 沒有最低交易筆數

- 適用所有賬戶類型(現金、保證金、投資組合保證金)

- 不適用UGMA/UTMA賬戶

- 不適用IRA賬戶

- 財務顧問/經紀商子賬戶:主賬戶(財務顧問或經紀商)必須獲准可以交易大宗商品

費用概覽

我們鼓勵客戶和潛在客戶訪問我們的網站瞭解詳細費用信息。

最常見的幾項費用有:

1. 傭金——取決於產品類型和掛牌交易所,以及您選擇的是打包式(一價全含)還是非打包式收費。例如,美國股票傭金為每股0.005美元,每筆交易最低傭金為1.00美元。

2. 利息——保證金貸款需繳納利息,IBKR採用國際公認的隔夜存款基準利率作為基礎來確定自己的利率。然後我們將分等級在基準利率基礎上應用一個浮動值(這樣餘額越大對應的利率就越有利)來確定實際利率。例如,對於美元計價的貸款,基準利率是聯邦基金利率,而10萬美元以內的餘額利率會在基準利率的基礎上加1.5%。此外,賣空股票的個人應注意,借用“難以借到”的股票還會有一筆特殊費用,以日息表示。

3. 交易所費用——取決於產品類型和交易所。例如,對於美國證券期權,某些交易所會對消耗流動性的委託單(市價委託單或適銷的限價委託單)收取費用、對添加流動性的委託單(限價委託單)給與補貼。此外,許多交易所還會對取消或修改的委託單收取費用。

4. 市場數據——您並非一定要訂閱市場數據,但是如果不訂閱市場數據,您可以會產生月費用,具體取決於供應交易所及其訂閱服務。我們提供市場數據助手工具,可根據您想交易的產品幫助您選擇適當的市場數據訂閱服務。要訪問該工具,請登錄客戶端,點擊支持然後打開市場數據助手鏈接。

5. 最低月活動費用——為迎合活躍客戶的需求,我們規定如果賬戶產生的月傭金能達到最低月傭金要求,則可免交月活動費用;而如果產生的月傭金未能達到最低月傭金要求,則需繳納差額作為活動費用。最低月傭金要求為10美元。

6. 雜費 - IBKR允許每月一次免費取款,後續取款將收取費用。此外,還會代收交易取消請求費用、期權和期貨行權&被行權費用以及ADR保管費用。

更多信息,請訪問我們的網站,從定價菜單中選擇查看。

Physical Delivery of US Spot Gold FAQs

Who is IB Global Investments (IBGI)?

IBGI is a wholly owned subsidiary of the IBKR Group that operates as a market maker, facilitating physical unallocated gold transactions on behalf of IBLLC for its clients. IBGI facilitates these transactions by taking delivery of gold warrants from exchange-listed futures contracts. Neither IBLLC nor IBGI engages in proprietary trading, and the inventory of warrants IBGI holds to facilitate client purchases are hedged with short futures contracts.

What does the term “unallocated” gold mean?

When you purchase unallocated gold, you own an undivided, fractional interest in the physical gold that IBGI has allocated to IBLLC. In other words, the warrants, which reference gold bars that are specifically identifiable by number, are held in the name of IBLLC who, in turn, records clients’ ownership interests on its books and records (similar to how stock is held in “street name”).

How does the gold get “allocated”?

The gold remains “unallocated” until the account holder takes physical possession of it via the delivery process.

What is the trading symbol for unallocated gold?

The symbol is USGOLD.

What is the minimum order size for unallocated gold?

The minimum order size is 1 ounce.

What is the minimum price increment for unallocated gold?

$0.001

What is the settlement time for an unallocated gold transaction?

Transactions settle in 2 business days.

Does IBGI or IB LLC add a mark up to physical gold transactions?

No. There is no markup or hidden price spreads added by IBGI to IBLLC or IBLLC to the client. IBLLC acts as a riskless principal, transacting with the client at the same price it transacts with IBGI, and charges the client a commission for the transaction, which is disclosed on our website.

Does IBKR allow short sales of unallocated gold?

No; only purchases are allowed. Clients seeking to profit from falling gold prices may obtain this exposure via futures contracts, options on futures contracts and/or short sales of various gold ETFs.

Does IBKR provide any loan value for unallocated gold positions?

No. Unallocated gold will be subject to a 100% margin requirement. This means that IBKR will not allow you to borrow money using unallocated gold as collateral. Similarly, your fully-paid unallocated gold positions cannot be used as collateral to purchase or maintain securities positions.

Is unallocated gold SIPC protected?

No. SIPC only offers protection for securities and cash held in a securities account.

In what forms of gold is delivery offered?

Clients may convert their unallocated gold and take physical delivery of one of the following products:

- Gold Bullion Bar (.999) 1 kg

- Gold Bullion Bar ISO Accredited (.9999) - 1 oz

- Gold Bullion Bar ISO Accredited (.9999) - 10 oz

- Gold American Eagle Coin - 1 oz

- Gold American Buffalo Coin - 1 oz

- Gold Canadian Maple Leaf Coin -1 oz

Delivery will be transacted through FideliTrade Incorporated, a full-service precious metals investment company that specializes in delivery and custody services. See https://www.fidelitrade.com/

Is partial delivery offered?

Yes, you may take delivery of only a portion of your unallocated gold position.

How do I request delivery?

Clients requesting physical delivery must submit their request via the Message Center using the topic "Physical Gold Delivery". The request should include the number of ounces and the form of delivery. IBKR will then confirm the cost and fees and, once approved by the client, instruct FideliTrade to deliver. Please note that delivery is only supported to the account holder’s address of record.

What is the cost of taking delivery (and do I pay a premium)?

The cost of physical delivery of US Spot Gold is the sum of:

- The differential between the spot price of gold and the cost of the physical product.

- Physical metals products are provided by Fidelitrade Inc. Estimated cost of the physical product can be found on their website.

- The cost of the product is the indicative ASK price displayed by FideliTrade.

- A $25 delivery fee

- A $500 IBKR processing fee

What trading permissions are required?

The exchange and permission bundle is United States Metals.

What are the eligibility requirements for obtaining IBMETAL trading permissions?

US Spot Gold is only available to legal residents of the United States. US Spot Gold is not available to legal residents of Arizona, Montana, New Hampshire, and Rhode Island.

Clients must also meet the following requirements

- Investment Objective: Trading, or Speculation, or Hedging, or Growth (Cash account)

- Financials: Must meet Futures financial requirements

- No minimum years trading experience

- No minimum trades

- Available in all account types (CASH, MRGN, PMRGN)

- Not available for UGMA/UTMA accounts

- Not available for IRA accounts

- FA/Broker Sub accounts: master account (FA or Broker) must be approved for Commodities trading

Physical Delivery of COMEX Precious Metals Futures

About Physical Delivery of COMEX Precious Metals Futures

Clients of IBLLC will be able to make and take delivery of COMEX Precious Metals Futures, specifically Gold (GC), Silver (SI) and the corresponding micro contracts for Gold (MGC) and Silver (SIL).

Physical delivery, in this context, is represented by the delivery-versus-payment of a registered electronic warrant or an Accumulated Certificate of Exchange (“ACE”) for each full size or E-micro futures contract.

About Gold and Silver Warrants

- Each Gold (GC) and Silver (SI) future will deliver one warrant representing deliverable grade gold or silver associated with the contract unit.

- Gold (GC): one hundred (100) troy ounces of gold with a weight tolerance of 5% either higher or lower with a minimum of 995 fineness. Additional information is available via COMEX Rulebook Chapter 113.

- Silver (SI): five thousand (5,000) troy ounces of silver with a weight tolerance of 10% either higher or lower with a minimum of 999 fineness. Additional information is available via COMEX Rulebook Chapter 112.

- Warrants are electronic documents that are issued by COMEX approved depositories.

- Each warrant is registered at COMEX and linked to specific deliverable grade bars with identifiable and unique warrant numbers traceable to each COMEX depository.

- Warrants will be registered to Interactive Brokers as the COMEX Clearing Member.

- Storage fees apply.

- Clients will see warrants in their "U" accounts:

- The symbol will contain the unique certificate number for the registered warrant.

- The quantity will always be 1.

- The net weight and fineness of the bars associated to the warrant will be visible. Below is an example of a client statement.

About Accumulated Certificate of Exchange (“ACE”)

- Micro Gold and Silver contracts deliver an Accumulated Certificate of Exchange (“ACE”), issued by the Clearing House.

- Micro Gold (MGC): An ACE represents a 10% ownership in a 100-troy ounce gold bar held in the form of a Warrant. Additional information is available via COMEX Rulebook Chapter 120.

- Micro Silver (SIL): An ACE represents a 20% ownership in a 5000-troy ounce silver bar held in the form of a Warrant. Additional information is available via COMEX Rulebook Chapter 121.

- Warrants can be converted to ACES.

- ACES can be redeemed for warrants once the correct multiples are accumulated (10 for gold and 5 for silver).

- Storage fees apply.

About Delivery Intents

In order to take or make delivery, an intent must be entered for the corresponding future. In the absence of an intent, futures positions will be subject to the relevant delivery period restrictions and positions may be liquidated. Refer to the delivery period liquidation schedule.

- Long Futures – Intent to Receive must be entered, for the corresponding number of long futures, a minimum of 2 business days prior to First Position Date of the corresponding delivery month. Clients can also enter Intents to Receive during the delivery period in order to place a buy order on a future in the current delivery month.

- Intent to Receive orders will be accepted only if the account has sufficient funds to take delivery of the declared amount of warrants. If there are insufficient funds, Intent to Receive orders will be rejected.

- Short Futures – Intent to Deliver must be entered for the corresponding number of short futures, a minimum 2 business days prior to the Last Trade Date of the corresponding delivery month. Clients can also enter Intents to Receive on the day preceding Last Trade Date, and Last Trade Date, in order to place a sell order on a future in the current delivery month.

- Intent to Deliver orders will be accepted only if the account has a sufficient number of warrant/ACE certificates to satisfy the delivery. If there are insufficient certificates, Intent to Deliver orders will be rejected.

Placing Delivery Intents

- To access the Physical Delivery tool from Trader Workstation (TWS):

- Right click on the eligible futures contract > Delivery OR

- Select Trade > Physical Delivery

- To access the Physical Delivery tool from Client Portal:

- Tap an eligible futures contract > Your Position > Row Action button (3 dots at end) > Delivery

- From the Positions page, tap the Row Action (3 dots at end) > Delivery

- IBKR Mobile App:

- Navigate to Main Menu > Trade > Delivery

- Tap an eligible futures contract to open the Contract Details > Positions > Delivery tool

To declare your intent for these precious metals you must follow one of the workflows below:

Intent to Receive

Submitting intent to receive not only indicates the desire to take delivery of the product at the end of the delivery window (in the form of a certified Warrant or ACE), it is also REQUIRED to open new Futures positions during the delivery window (i.e. it is not possible to open a physically deliverable futures position, during the delivery window, without first submitting the Intent to Receive for that Future).

Any Intents to Receive that do not have a corresponding Futures position at the end of the delivery window will be cancelled.

Intent to Deliver

Submitting intent to deliver indicates the desire to make delivery of a product (e.g. Warrant or ACE). It is also REQUIRED that the account is both short an eligible Future position and has the corresponding certificate to provide.

Any Intents to Deliver that do not have corresponding Future positions at the end of the delivery window will be canceled.

Request to Deliver

Submitting a request to deliver is ONLY available during the delivery window and indicates a desire to deliver the product that day (instead of at the end of the delivery window, as with the intent to deliver). It is REQUIRED that to submit this request an account must have an existing, eligible product (e.g. Warrant or ACE) and corresponding short Future position (e.g. GC, MGC etc.).

Physical Delivery of US Spot Gold

Physical Delivery of US Spot Gold

Unallocated US Spot Gold (symbol: USGOLD) can be converted into any of the following products:

- Gold Bullion Bar (.999) - 1 kg

- Gold Bullion Bar ISO Accredited (.9999) - 1 oz

- Gold Bullion Bar ISO Accredited (.9999) - 10 oz

- Gold American Eagle Coin - 1 oz

- Gold American Buffalo Coin - 1 oz

- Gold Canadian Maple Leaf Coin - 1 oz

Requesting a Delivery

If you would like to convert your unallocated US Spot Gold position into a physical metal:

- Log in to Client Portal

- Navigate to the Message Center

- Click “Compose > New Ticket”

- Select “Physical Gold Delivery” as the Topic

Delivery Costs and Shipping

The cost of physical delivery of US Spot Gold is the sum of:

- The differential between the spot price of gold and the cost of the physical product.

- Physical metals products are provided by Fidelitrade Inc. Estimated cost of the physical product can be found on their website.

- The cost of the product is the indicative ASK price displayed by FideliTrade.1

- A $20 delivery fee plus an additional $2.50 per ounce delivered 2

- A $500 IBKR processing fee

FideliTrade Shipping Policy:

- Bullion is shipped via Federal Express, the US Postal Service or armored carrier.

- Bullion is insured to $100,000 per package when shipped via Federal Express or USPS and to higher levels when shipped via armored carrier.

- Bullion is shipped only to address on record for your IBKR Account to ensure the highest level of security.

- Individual shipments of bullion via Federal Express or USPS have a maximum value of $100,000. Deliveries for bullion values larger than $100,000 will be broken up into multiple deliveries. 2

Trading Permissions

To trade US Spot Gold you need US Metals trading permission on your account. You can request permission by:

- logging in to Portal

- selecting the Settings > Account Settings menu item from the bottom of the window

- clicking the “Configure” (gear) icon for Trading Experience & Permissions.

- Click the drop down menu for "Additional Products"

- Select "Metals"

- In the pop-up, select "United States" and click Save

- clicking Continue

US Spot Gold is only available to legal residents of the United States. US Spot Gold is not available to legal residents of Arizona, Montana, New Hampshire and Rhode Island.

如果底層證券面臨全現金並購,美國證券期權會怎麼樣?

如果股票期權的底層發生並購,且底層證券2007年12月31日後已轉換為100%現金,則期權清算公司(OCC)會加速期權到期。該等期權新的到期日將提前至最近的標準到期日,除非現金轉換發生在到期周的週二之後,這種情況下所有當周未到期的合約其到期日將被推遲到下一個月的到期日。

注意,這種加速並不會影響到自動行權門檻(至少以$0.01的價內程度處理價內的期權將被OCC自動行權),也不會影響到現金結算(T+2日行權剩餘部分)的日期。

此外,請注意,這種加速也不會影響到在2007年12月31日或之前轉換成現金的期權,這類期權將保持有效,直至達到最初的到期日。

如果期權價差的空頭邊被行權,多頭期權邊會不會自動行權以抵消被行權導致的股票頭寸?

答案取決於被行權是發生在到期日還是到期日之前(美式期權)。到期時,許多清算所會採用非常規行權(exercise by exception)程序,以降低由清算會員公司提供行權指令帶來的運營開銷。對於美國證券期權,期權清算所(OCC)會自動行使至少以$0.01的價內程度處理價內的股票和指數期權,除非客戶向清算會員公司提供了不要行權的指令。因此,如果多頭期權到期日與空頭期權相同,並且到期時處於價內且價內程度不低於清算所非常規行權的門檻值,則其會被自動行權,抵消被行權帶來的股票義務。這可能會導致淨現金入帳或支出,具體取決於期權的行權價格。

如果被行權發生在到期日之前,由於無法推測多頭期權持有者的意圖,並且在到期前行使多頭期權將導致放棄期權的時間價值(時間價值通過賣出期權實現),IBKR和清算所都不會行使賬戶內持有的多頭期權。

為什麼第二天才通知我我的美國證券期權頭寸被行權?

美式期權到期日以外的行權通知不會實時處理,而是由期權清算公司(OCC)在夜間統一處理。此處理程序會導致通知到被行權客戶時出現至少一天的滯後,詳情如下:

- OCC通常會允許其清算會員公司全天代其以電子方式持有多頭期權頭寸的客戶提交行權通知,但一般不晚於其開始夜間處理的時間(Day E)。

- 作為其夜間頭寸處理程序的一部分,OCC會隨機將收到的行權通知分配到其清算會員公司的未平倉權益中。該等信息會在第二天(Day E+1)一早由OCC通知到其清算會員公司。

- 收到通知時,清算公司(如IBKR)為及時向客戶提供報表、保證金和結算信息,已經完成了當天交易活動的處理。此外,由於OCC以綜合方式持有清算會員公司的客戶頭寸(即不知道客戶的身份,只知道其所屬清算公司),請算會員公司必須執行隨機程序將行權通知分配給持有對應期權空頭頭寸的客戶。

- IBKR從OCC收到被行權通知並完成隨機分配後,分配結果便會在當天收盤前(E+1)發佈到受影響賬戶的TWS並在每日活動報表中反映出來。

此外,由於存在此處理程序並且考慮到多頭期權可能還剩餘時間價值,IBKR無法自動針對被行權的空頭頭寸為多頭期權價差向OCC提交行權通知,以抵消後續的交付義務。

賬戶持有人應參閱“標準期權的特徵與風險”披露文件,IBKR在賬戶申請時便向所有有期權交易資格的客戶提供了此文件,其中明確說明了被行權風險。此文件還可在期權清算公司網站上查看。