Fees for Trading Warrants and Structured Products on Euronext

Euronext's fee thresholds on structured products and how it impacts clients' trading, for both fixed and tiered commission models

Clients that place orders and trade for more than EUR 6'000 in Warrants and Structured Products will be charged a 2.5 basis points fee with a maximum of EUR 20.

The table below displays the exchange fees for warrants and structured products when trading on Euronext:

|

Product Group |

Fee |

Minimum per Trade |

Maximum per Trade |

|

Warrants & Structured Products – trade value up to EUR 6’000 |

0.00 |

N/A |

N/A |

|

Warrants & Structured Products – trade value more than EUR 6’000 |

2.50 bps |

N/A |

EUR 20 per Trade |

Calculations:

For Cost Plus (Tiered) Clients:

Example: Client wishes to trade structured products on Euronext for a total trade value of EUR 10’000.

Scenario A:

Trade value = EUR 10’000

Fee = 2.5 Bps

As the trade value is above EUR 6’000, the fee of 2.50 bps applies and therefore an additional EUR 2.50 will have to be paid for the trade.

Scenario B:

Order 1:

Trade Value = EUR 5’000

Fee = 0.00

Order 2:

Trade Value = EUR 5’000

Fee = 0.00

As the trade value of each trade is below EUR 6’000, no additional fees apply.

Note: This calculation does not impact clients on the Fixed commission schedule.

Más información acerca del uso de las órdenes stop

Los mercados de acciones estadounidenses ocasionalmente atraviesan periodos de extraordinaria volatilidad y desajuste de precios. A veces, estos sucesos son prolongados y en otras ocasiones son de muy corta duración. Las órdenes stop pueden contribuir a la presión a la baja en los precios y a la volatilidad del mercado. Asimismo, pueden tener como resultado ejecuciones a precios muy alejados del precio de activación.

Manejo de órdenes de mercado

Se les aconseja a los clientes considerar el uso de órdenes limitadas en lugar de órdenes de mercado, debido a que las órdenes de mercado son susceptibles a ejecutarse a precios mucho más bajos o altos que el bid/ask mostrado actualmente, en particular, en condiciones de mercado volátiles, en caso de cantidades de órdenes de gran volumen, o para órdenes que comprenden productos ilíquidos. Para proteger al cliente y también a IB contra pérdidas relacionadas con variaciones en el precio rápidas y significativas, IB podrá simular las órdenes de mercado de los clientes como órdenes de mercado con protección, y establecer puntos porcentuales de límite de ejecución más allá del bid/ask interno. Mientras que este límite se establece a un nivel cuyo propósito es equilibrar los objetivos de certeza de ejecución y minimización de riesgo en el precio, existe la posibilidad remota de que la ejecución se retrase o que no se realice.

Además, deberá observar que algunos mercados imponen, como medida de protección, sus propios límites de precio o bandas sobre órdenes de mercado a niveles que pueden ser más o menos restrictivas que aquellas impuestas por IB, y que podrán afectar de modo similar la velocidad y certeza de la ejecución de una orden.

Añadir eliminar liquidez

El objetivo de este artículo es proporcionar un mejor entendimiento de tarifas de mercado, tarifas por adición/eliminación de liquidez, para una estructura de comisiones no agrupada.

El concepto de añadir o eliminar liquidez es aplicable tanto a acciones como a opciones sobre índices/acciones. El que una orden añada o elimine liquidez dependerá de que esa orden sea negociable o no negociable.

Las órdenes negociables ELIMINAN liquidez.

Las órdenes negociables son órdenes de mercado U órdenes limitadas de compra/venta cuyo límite esté por encima/debajo del mercado actual.

1. Para una orden negociable limitada de compra, el precio límite es igual o superior al ask.

2. Para una orden negociable limitada de venta, el precio límite es igual o inferior al bid.

Ejemplo:

El tamaño/precio actual del ASK (oferta) de XYZ es de 400 participaciones a 46.00. Usted introduce una orden limitada de compra de 100 acciones de XYZ a 46.01. La orden se considerará negociable porque se producirá una ejecución inmediata. Si hay un cargo del mercado por eliminar liquidez, dicha tarifa se le cargará al cliente.

Las órdenes no negociables son órdenes limitadas de compra/Venta en las que el precio límite está por debajo/encima del mercado actual.

1. Para una orden limitada de compra no negociable, el precio límite está por debajo del ask.

2. Para una orden limitada de venta no negociable, el precio límite está por encima del bid.

Ejemplo:

El tamaño/precio actual del ASK (oferta) de XYZ es de 400 participaciones a 46.00. Usted introduce una orden limitada de compra para 100 acciones de XYZ a 45.99. Esta orden se considerará no negociable, porque se registrará en el mercado como el mejor bid, en lugar de ejecutarse inmediatamente.

En caso de que alguien más envíe una orden de venta negociable que haga que su orden limitada de compra se ejecute, usted debería recibir un reembolso(crédito) si hay crédito disponible por añadir liquidez.

POR FAVOR, TENGA EN CUENTA:

1. Todas las cuentas que operen en opciones estarán sujetas a las tarifas o créditos por eliminar/añadir liquidez de los mercados de opciones.

2. Según la página web de IB, solo los números negativos bajo las estructuras de eliminar añadir liquidez son reembolsos (créditos).

http://interactivebrokers.com/es/index.php?f=3706

IEX Discretionary Peg Order

IEX offers a Discretionary Peg™ (D-Peg™) order type which is a non-displayed order that is priced at either the National Best Bid (NBB for buys) or National Best Offer (NBO for sells). D-Peg™ orders passively rest on the book while seeking to access liquidity at a more aggressive price up to Midpoint of the NBBO, except when IEX determines that the quote is transitioning to less aggressive price

How to Place a D-Peg Order

Please note, the IEX D-Peg order type is only available via the TWS version 961 and above. Instructions for entering this order type are outlined below:

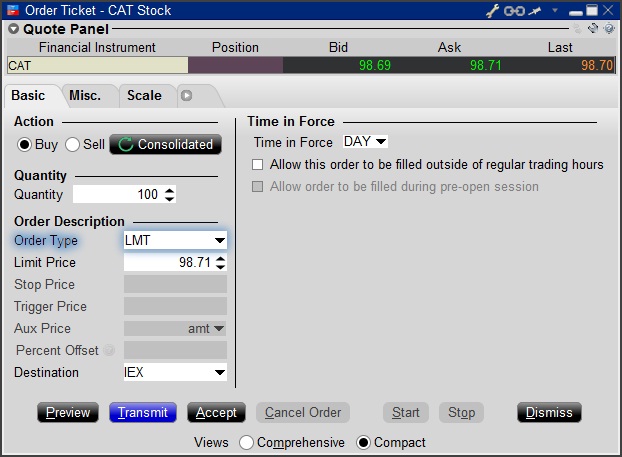

Step 1

Enter a symbol and choose a directed quote, selecting IEX as the destination. Right click on the data line and select Trade followed by Order Ticket to open the Order Ticket window.

Step 2

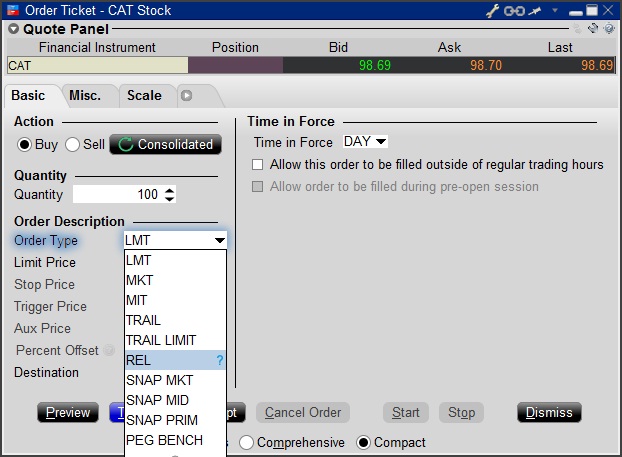

Select the REL order type from the Order Type drop down menu.

Step 3

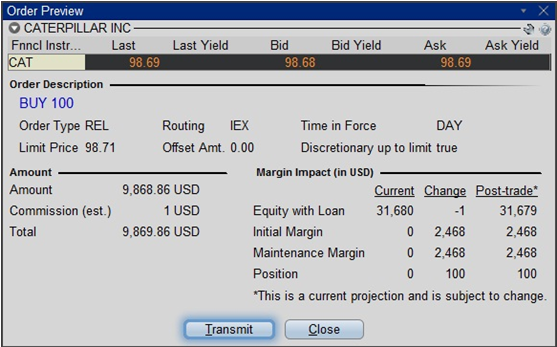

Click on the Miscellaneous tab (Misc.) and at the bottom there will be a checkbox for "Discretionary up to limit". Check this box. The price that you set in the Limit Price field will be used at the discretionary price on the order.

.jpg)

Step 4

Hit Preview to view the Order Preview window.

For additional information concerning this order type, please review the following exchange website link: https://www.iextrading.com/trading/dpeg/

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

Hong Kong - China Stock Connect

Hong Kong – China Stock Connect (“China Connect”) is a mutual market access program through which Hong Kong and international investors can trade shares listed on the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) via the Stock Exchange of Hong Kong (SEHK) and their existing clearinghouse. As a member of SEHK, IBKR provides you with direct access to trade with eligible listed products on the Shanghai and Shenzhen Stock Exchange. IBKR clients with China Connect trading permissions will be eligible to trade SSE/SZSE securities through Shanghai and Shenzhen - Stock Connect.

Among the different types of SSE/SZSE-listed securities, only A shares (shares in mainland China-based companies that trade on Chinese stock exchange) are included in the Shanghai and Shenzhen Stock Connect.

Shanghai Connect includes all the constituent stocks of the SSE 180 Index, SSE 380 Index and all the SSE-listed A shares that have corresponding H shares listed on the SEHK.

Product List and Stock Codes for SSE

Shenzhen Connect includes all the constituent stocks of the SZSE Component Index, the SZSE Small/Mid Cap Innovation Index that have a market capitalization of not less than RMB 6 billion and all the SZSE-listed A shares that have corresponding H shares listed on SEHK.

Product List and Stock Codes for SZSE

IBKR Commission for Trading SSE/SZSE Securities

Same as trading Hong Kong stocks, IBKR charges only 0.08% of trade value as a commission with a minimum CNH 15 per order. Detailed fee rates can be found in the Hong Kong – China Stock Connect Northbound fee table.

Daily Quota

Trading under Shanghai Connect and Shenzhen Connect is subject to a Daily Quota. The Daily Quota is applied on a “net buy” basis. The Daily Quota limits the maximum net buy value of cross-boundary trades under Shanghai Connect and Shenzhen Connect each day.

If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected. Or if it happens during a continuous auction session or closing call auction session, no further buy orders will be accepted for the remainder of the day. SEHK will resume the Northbound buying service on the following trading day.

SEHK will also publish the remaining balance of the Aggregate Quota and Daily Quota.

For details, please refer to HKEX Stock Connect FAQ or HKEX Stock Connect Rule 1407

Trading Information of Shanghai and Shenzhen Connect

|

Trading currency |

RMB |

|

Order Type |

IBKR offers various order types but will stimulate the order into limit order for execution. More information can be referred to our website.

|

|

Tick Size / Spread |

Uniform at RMB 0.01 |

|

Board Lot |

100 shares (applicable for buyers only) |

|

Odd Lot |

Sell orders only (odd lot should be made in one single order) |

|

Max Order Size |

1 million shares |

|

Price Limit |

±10% on previous closing price (±5% for stocks under special treatment under risk alert, i.e. ST and *ST stocks) |

|

Day (Turnaround) Trading |

Not allowed |

|

Block Trade |

Not available |

|

Manual Trade |

Not available |

|

Order Modification |

IBKR will cancel and replace the order for any order modification |

|

Settlement cycle |

Securities: Settlement on T day Cash from China Connect trades: Settlement on T+1 day Forex*: Settlement on T+2 day |

*Due to the unsynchronized settlement cycle, clients who exchange CNH themselves should execute the Forex trade one day prior to the stock trade (T-1) to avoid the extra day’s interest payment (considering normal settlement without involving holidays).

Trading Hours

|

SSE/SZSE Trading Sessions |

SSE/SZSE Trading Hours |

|

Opening Call Auction |

09:15 - 09:25 |

|

Continuous Auction (Morning) |

09:30 – 11:30 |

|

Continuous Auction (Afternoon) |

13:00 – 14:57 |

|

Closing Call Auction |

14:57 – 15:00 |

Half-day Trading

If a Northbound trading day is a half-trading day in the Hong Kong market, it will continue until respective Connect Market is closed. Refer to the exchange website for holiday trading arrangements and additional information.

Disclosure Obligation

If client holds or controls up to 5% of the issued shares of China Connect, the client is required to report in writing to the China Securities Regulatory Commission (“CSRC”) and the relevant exchange, and inform the Mainland listed company within three working days of reaching 5%.

The client is not allowed to continue purchasing or selling shares in that Mainland listed company during the three days notification period. Visit the IBKR Knowledge Base for more information.

Shareholding Restriction

A single foreign investor’s shareholding in a Mainland listed company is not allowed to exceed 10% of the company’s total issued shares, while all foreign investors’ shareholding in the A shares of the listed company is not allowed to exceed 30% of its total issued shares. Visit the IBKR Knowledge Base for more information.

Forced-sale Arrangement

Each IBKR client is not allowed to hold more than a specific percentage of the China Connect listing company's total issued shares. HKEX requires the client to follow the forced-sell requirements if the shares exceed the limit:

|

Situation |

Shareholding (in a listed company) |

|

A single foreign investor |

> = 10% of the company’s total issued shares |

|

All foreign investors |

> = 30% of the company’s total issued shares |

Margin Financing

Margin trading in China Connect securities will subject to restrictions and only certain A shares will be eligible for margin trading. Eligible Securities, as determined by SSE and SZSE from time to time, are listed on the HKEX website.

According to the relevant rules of SSE and SZSE, either market may suspend margin trading activities in specific A shares when the volume of margin trading activities for a specific A share exceeds the prescribed threshold. The market will resume margin trading activities in the affected A share when its volume drops below a prescribed threshold.

Stock Borrowing and Lending (SBL)

SBL in China Stock Connect Securities is subject to restrictions set by the SSE or SZSE and stated in the Rules of the Exchange.

IBHK does not offer this service at the moment.

Eligible Short Selling Securities

SBL for the purpose of short selling will be limited to those China Stock Connect Securities that are eligible for both buy orders and sell orders through Shanghai and Shenzhen Connect (i.e., excluding Connect Securities that are only eligible for sell orders).

IBHK does not offer this service at the moment.

Trading Shenzhen ChiNext and Shanghai Star shares

Trading Shenzhen ChiNext and Shanghai Star shares are limited to institutional professional investors.

Holidays

Clients will only be allowed to trade China Connect on days where Hong Kong and Mainland markets are both open for trading and banking services are available in both Hong Kong and Mainland markets on the corresponding settlement days. This arrangement is essential in ensuring that investors and brokers will have the necessary banking support on the relevant settlement days when they will be required to make payments.

The following table illustrates the holiday arrangement of Northbound trading of SSE/SZSE Securities:

|

|

Mainland |

Hong Kong |

Open for Northbound Trading |

|

Day 1 |

Business Day |

Business Day |

Yes |

|

Day 2 |

Business Day |

Business Day |

No, HK market closes on money settlement day |

|

Day 3 |

Business Day |

Public Holiday |

No, HK market closes on trading day |

|

Day 4 |

Public Holiday |

Business Day |

No, Mainland market closes |

Severe Weather Conditions

Information on the trading arrangement available under severe weather conditions can found on the HKEx website.

Where to Learn More?

Please refer to the following exchange website links for additional information regarding Hong Kong China Stock Connect:

If you have any questions regarding Hong Kong-China Stock Connect, please contact IBKR Client Services for further information.

IPO Considerations

An Initial Public Offering, or IPO, is defined as the first sale of stock by a company to the public. As IB generally does not operate as an underwriter or selling agent of IPO shares, the first opportunity customers have to transact in such shares does not take place until the issue begins trading in the secondary market. Outlined below are key issues which customers should consider when transacting in shares on their first day of listing:

1. Margin

As IPOs are inherently subject to a high degree of uncertainty as to price and liquidity once secondary market trading begins, each new issue is subject to a review to determine whether initial and maintenance margin requirements above the minimum which is required by regulation is warranted. Current margin information is made available through the "Check Margin" feature on the trading platform. Customers should also note that IB reserves the right to change margin on an intraday basis and without advance notice when warranted.

2. Order Entry

IB monitors for upcoming IPOs and makes every effort to provide customers the ability to enter orders in advance of the day at which trading begins in the secondary market. In certain circumstances, either IB and/or the exchange may impose restrictions on the type of orders which may be accepted as well as the time in force conditions associated with such orders. It should also be noted that orders not direct-routed to the primary exchange may be subject to special auction handling and therefore may receive a different opening print from that of the primary exchange. In addition, as the price at which the issue trades once available in the secondary market may differ significantly from the IPO price, customers are strongly encouraged to use limit orders when.

3. Short Availability

Customers should assume that IPO issues will not be available for shorting immediately upon trading in the secondary market. This limitation is a function of regulations which require the broker to locate and make a good faith determination that shares are available to borrow at settlement coupled with the likelihood that such shares will not be available (due to underwriter lending restrictions and the fact that secondary market transactions have not yet settled).

How to Place a CFD Trade on the Trader Workstation

How to place trades in U.K. CFDs on the Trader Workstation