Introduction au Forex (FX)

IB propose des marchés et plateformes de trading qui sont pensés pour des traders centrés sur le Forex mais aussi pour ceux ayant une activité de trading de forex occasionnelle qui provient de transactions multi-devises et/ou de dérivés. L'article qui suit présente les bases d'entrée d'ordres forex sur TWS et les considérations concernant les conventions de cotations et de déclarations de positions (post-trade).

Une transaction forex (FX) implique l'achat d'une devise en même temps que la vente d'une autre, souvent appelé une paire. Dans les exemples ci-dessous, la paire EUR.USD sera utilisée, avec EUR appelé devise de transaction, que le client cherche à acheter ou vendre, et la seconde (USD), la devise de règlement.

Les sujets de l'article

- Cotes Forex

- Créer une ligne de cote

- Créer un ordre

- Valeur du pip

- Déclaration de position (Post-trade)

Cotes Forex

Une paire de devises est la cote de la valeur relative de l'unité d'une devise par rapport à l'unité d'une autre sur le marché des changes. La devise utilisée comme référence est appelée devise de cotation, et la devise cotée en comparaison est appelée devise de base. Dans TWS, nous proposons un code mnémonique pour chaque paire de devises. Vous pouvez utiliser FXTrader pour inverser la cote. Les traders achètent ou vendent la devise de base et vendent ou achètent la devise de cotation. Par ex. le code mnémonique de la paire EUR/USD :

EUR.USD

où :

- EUR est la devise de base

- USD est la devise de cotation

Le prix de la paire de devise ci-dessus représente le nombre d'unités d'USD (devise de cotation) requises pour trader une unité d'EUR (devise de base). Autrement dit, me prix d'1üEUR coté en USD.

Un ordre d'achat sur EUR.USD aura pour résultat l'achat d'EUR et la vente d'un montant équivalent d'USD, par rapport au cours de négociation.

Créer une ligne de cote

Les étapes pour ajouter une ligne de cotation sont les suivantes :

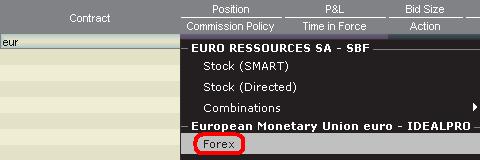

1. Saisir la devise de transaction (exemple : EUR) et appuyer sur Entrée.

2. Choisir forex

comme type de produit

3. Sélectionner la devise de règlement (exemple : USD) et choisir la Bourse souhaitée.

.jpg)

Remarques :

La Bourse IDEALFX propose un accès direct aux cotations forex interbancaires qui dépasse la quantité minimum requise d'IDEALFX (généralement 25,000 USD). Les ordres dirigés vers IDEALFX qui n'atteignent pas la quantité minimum requise seront immédiatement redirigés vers une Bourse plus petite pour les transactions forex. Cliquez ICI pour plus d'informations concernant les quantités maximum et minimum d'IDEALFX.

Les agents de change cotent les paires FX dans un sens précis. En conséquence, les traders peuvent avoir a ajuster le symbole saisi dans l'ordre pour trouver la paire de devises voulue. Par exemple, si le symbole CAD est utilisé, les traders verront que la devise de règlement USD ne peut pas être trouvée dans la fenêtre de sélection de contrat car cette paire est cotée USD.CAD et ne peut être trouvée en saisissant le symbole sous-jacent USD, puis en choisissant Forex.

Créer un ordre

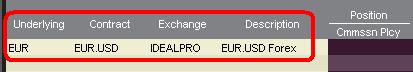

Selon les en-têtes affichées, la paire de devise sera présentée comme suit :

Les colonnes Contrat et Description afficheront la paire sous le format Devise de transaction.Devise de règlement (exemple : EUR.USD). La colonne Sous-jacent n'affiche que la devise de transaction.

Cliquez ICI pour savoir comment changer les en-têtes affichées.

1. Pour entrer un ordre, cliquez sur le cours acheteur (pour vendre) ou le cours vendeur (pour acheter).

2. Précisez la quantité de devise que vous souhaitez acheter ou vendre. La quantité de l'ordre est exprimée en devise de base , qui est la première devise de la paire dans TWS.

Interactive Brokers ne connaît pas le concept des contrats qui représentent un montant fixe de devise de base sur le marché des changes. Ici, la quantité que vous tradez est le montant requis en devise de base.

Par exemple, un ordre d'achat de 100,000 EUR.USD servira à acheter 100,000 EUR et vendre le nombre équivalent d'USD par rapport au taux de change affiché.

3. Précisez le type d'ordre et taux de change (prix) souhaités et passez l'ordre.

Remarque : Les ordres peuvent être passés en termes d'unités de devise entières et il n'y a pas de contrat minimum ou taille de lots à prendre en compte à part les minimums des bourses comme précisé ci-dessus.

Question fréquente : Comment entrer un ordre avec FX Trader ?

Valeur du pip

Un pip est la mesure de la variation dans une paire de devises, qui représente la plus petite variation pour la plupart des paires, même si d'autres variations en fractions de pips sont autorisées.

Par ex. Dans EUR.USD, 1 pip est 0.0001, et dans USD.JPY, 1 pip est 0.01.

Pour calculer la valeur d'1 pip en unités de devise de cotation, la formule suivante peut être appliquée :

(montant notionnel) x (1 pip)

Exemples :

- Code mnémonique = EUR.USD

- Montant = 100,000 EUR

- 1 pip = 0.0001

Valeur d'1 pip = 100’000 x 0.0001 = 10 USD

- Code mnémonique = USD.JPY

- Montant = 100’000 USD

- 1 pip = 0.01

Valeur d'1 pip = 100’000 x (0.01) = JPY 1000

Pour calculer la valeur d'1 en unités de devise de base la formule suivante peut être appliquée :

(montant notionnel) x (1 pip/taux de change)

Exemples :

- Code mnémonique = EUR.USD

- Montant = 100’000 EUR

- 1 pip = 0.0001

- Taux de change = 1.3884

Valeur d'1 pip = 100’000 x (0.0001/1.3884)= 7.20 EUR

- Code mnémonique = USD.JPY

- Montant = 100’000 USD

- 1 pip = 0.01

- Taux de change = 101.63

Valeur d'1 pip = 100’000 x (0.01/101.63)= 9.84 USD

Déclaration de position (Post-trade)

Les informations concernant les positions FX sont un aspect important du trading avec IB qui doit être compris avant d'exécuter toute transaction dans un compte en direct. Le logiciel de trading d'IB affiche les positions FX à deux endroits différents qui se trouvent sur la fenêtre Compte.

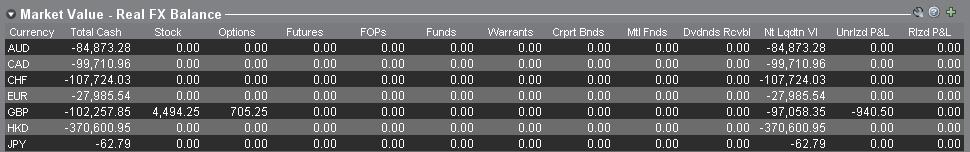

1. Valeur de marché

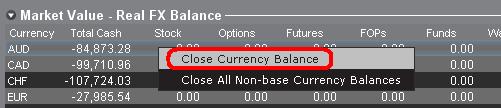

La section Valeur de marché de la fenêtre Compte affiche les positions de devises en temps réel exprimées par rapport à chaque devise individuellement (pas à la paire de devise).

La section Valeur de marché de la fenêtre Compte est le seul endroit où les traders peuvent voir les informations des positions FX en temps réel. Les traders détenant plus positions de devises ne sont pas tenus de les clôturer en utilisant la même paire utilisée pour ouvrir la position. Par exemple, un trader ayant acheté EUR.USD (acheter EUR et vendre USD) et également USD.JPY (acheter USD et vendre JPY) peut clôturer la position restante en tradant EUR.JPY (vendre EUR et acheter JPY).

Remarques :

La section Valeur de marché peut être agrandie/rétrécie. Il est recommandé aux traders de regarder le symbole au-dessus de la colonne Valeur liquidative popur s'assurer qu'n signe moins vert apparaît. S'il y a un signe moins vert, certaines positions actives peuvent être masquées.

Les traders peuvent initier des transactions de clôture depuis la section Valeur de marché en faisant un clic droit sur la devise qu'ils souhaitent clôturer et en choisissant « clôturer le solde de la devise » ou « clôturer les soldes de toutes les devises hors devise de base ».

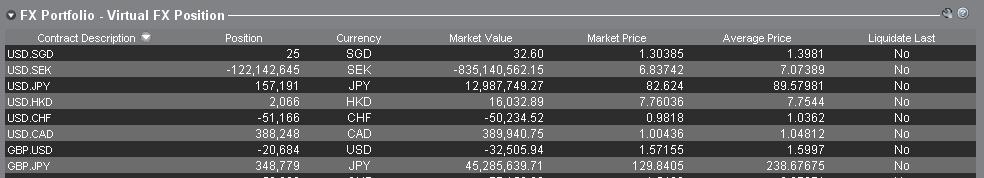

2. Portefeuille FX

La section Portefeuille FX de la fenêtre Compte fournit une indication des Positions virtuelles et affiche des informations concernant la position par rapport à la paire de devises et non les devises individuelles, comme le fait la section Valeur de marché. Ce format d'affichage tend à se rendre conforme à une convention courante pour les traders forex institutionnels et peut généralement être ignorée par les traders forex occasionnels ou de détail. Les quantités de position du portefeuille FX ne reflètent pas toute l'activité FX, cependant les traders ont la possibilité de modifier la quantité de la position et des coûts moyens qui apparaissent dans cette section. La possibilité de modifier les informations de position et coût moyen sans exécuter une transaction peut être utile pour les traders impliqués dans des le trading de devises en plus de trader des produits dans une devise autre qu'une devise de base. Cela permettra aux traders de séparer manuellement les conversions automatiques (qui intervient automatiquement lors du trading de produits en devise autre que la devise de base) de l'activité de trading FX directe.

La section portefeuille FX dirige les informations de position FX et P&L affichées dans toutes les autres fenêtres de trading. Cella a tendance à causer une certaine confusion pour déterminer les informations de position en temps réel. Pour réduire ou éliminer cette confusion, les traders peuvent :

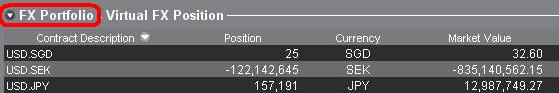

a. Réduire la section Portefeuille FX

En cliquant sur la flèche à gauche de portefeuille FX, les traders peuvent réduire la section. Réduire cette section empêchera les informations de positions virtuelles d'être affichées sur toutes les pages de trading. (Remarque : cela n'affichera pas les informations de Valeur de marché, et empêchera d'afficher les information de Portefeuille FX.)

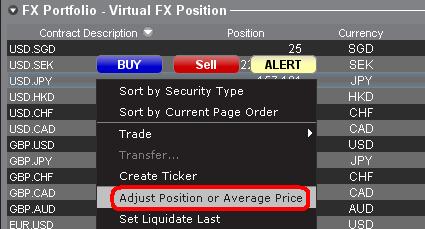

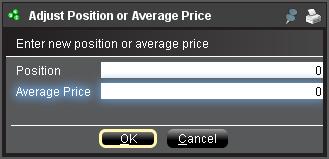

b. Ajuster la position ou le prix moyen

En faisant un clic droit sur la section Portefeuille FX de la fenpetre compte, les traders ont la possibilité d'ajuster la position ou le prix moyen. Une fois que les traders ont clôturé toutes les position en devises autres que la devise de base et confirmé que la section valeur de marché indique que toutes les positions en devises autres que la devise de base sont clôturées, les traders peuvent réinitialiser les champs Position et Prix moyen à 0. La quantité de position indiquée dans le Portefeuille FX sera réinitialisée et cela permettra aux traders de voir une position plus précise ainsi que les informations de P&L sur les fenêtres de trading. (Remarque : il s'agit d'un processus manuel qui doit être exécuté à chaque que des positions de devise sont clôturées. Les traders doivent toujours confirmer les informations de position dans la section Valeur de marché pour s'assurer les les ordres transmis atteingnent les résultats souhaités d'ouverture ou de clôture de position.

Nous invitons les traders à se familiariser avec le trading FX avec un compte de trading simulé ou de DÉMO avant d'exécuter des transactions en direct. Pour toute clarification des informations ci-dessus, n'hésitez pas à contacter IB.

Autres questions fréquentes :

How to update the US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on your account

If you have been informed or believe that your account profile contains an incorrect US SSN/ITIN, you may simply log into your Account Management to update this information. Depending on your taxpayer status, you can update your US SSN/ITIN by modifying one of the following documents:

1) IRS Form W9 (if you are a US tax resident and/or US citizen holding a US SSN/ITIN)

2) IRS Form W-8BEN (if you are a Non-US tax resident holding a US SSN/ITIN)

Please note, if your SSN/ITIN has already been verified with the IRS you will be unable to update the information. If however the IRS has not yet verified the ID, you will have the ability to update through Account Management.

How to Modify Your W9/W8

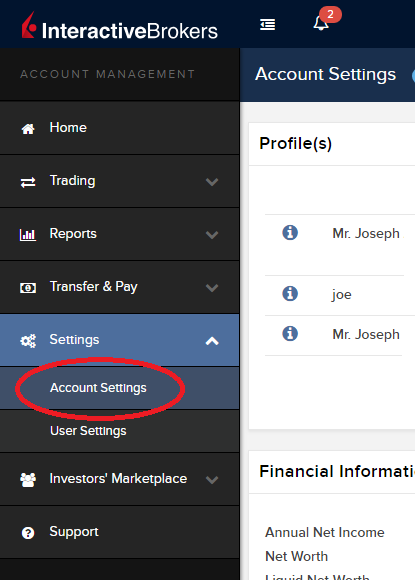

1) To submit this information change request, first login to Account Management

2) Click on the Settings section followed by Account Settings

3) Find the Profile(s) section. Locate the User you wish to update and click on the Info button (the "i" icon) to the left of the User's name

.png)

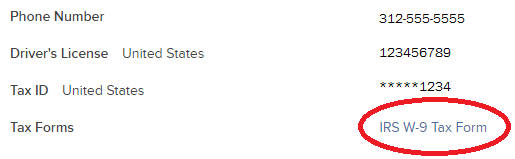

4) Scroll down to the bottom where you will see the words Tax Forms. Next to it will be a link with the current tax form we have for the account. Click on this tax form to open it

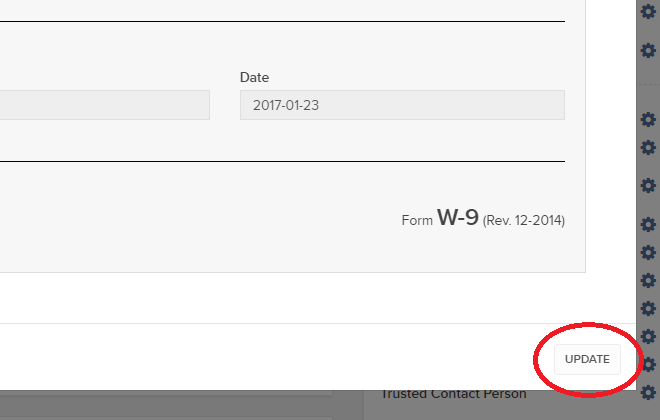

5) Review the form. If your US SSN/ITIN is incorrect, click on the UPDATE button at the bottom of the page

6) Make the requisite changes and click the CONTINUE button to submit your request.

7) If supporting documentation is required to approve your information change request, you will receive a message. Otherwise, your information change request should be approved within 24-48 hours.

IRA: Required Minimum Distributions

IRA owners may be required to to withdraw funds beginning at age 73, and every year thereafter. Determining your Required Minimum Distribution (RMD) is significant while retaining an IRA, considering both your life expectancy and the IRA's fair market value.

The required amount for each eligible person is based on the December 31 IRA account value of the previous year and the IRA owners date of birth. Your spouse's date of birth may also be a factor if your spouse is at least 10 years younger than you. Interactive Brokers LLC provides several information resources to understand and calculate your RMD, including access to the online FINRA RMD Calculator.

Requesting Your RMD Withdrawal

The Internal Revenue Service (IRS) requires the IRA plan custodian to notify IRA owners about the RMD requirements by January 31 each year. If you turn 73 this year, you are required to begin taking RMDs before April 1 of the following year.

Eligible IRA owners must begin receiving withdrawals by December 31 of the year they reach age 73. The first RMD withdrawal, however, may be delayed until April 1 of the following year.

If you elect to delay the withdrawal, then please observe the following considerations:

(1) Two RMD withdrawals will be required the following year, the undistributed initial RMD and the new RMD.

(2) The new RMD will be slightly larger due to the December 31 market value's inclusion of the undistributed initial RMD.

Subsequent RMD withdrawals from your IRA must be distributed by December 31 to avoid a penalty tax.

Note: Roth IRAs are exempt from the RMD rules during the IRA owner's lifetime.

Requesting Your RMD Withdrawal

You may request a withdrawal of funds through the Transfer & Pay and then Transfer Funds menu options within Client Portal. The IRS deadline for taking RMDs is December 31 each year. Keep in mind that the year end withdrawal cut off for processing withdrawals from your Interactive Brokers account may occur before December 31.

Please note that you can elect to transfer your funds to your bank account or to an Interactive Brokers non-IRA account. To transfer funds to an Interactive Brokers non-IRA account, log into Client Portal, select Transfer & Pay, Transfer Funds then select Transfer Funds Between Accounts.

Your RMD is determined by dividing the account balance on December 31 of last year by your life expectancy factor. Your life expectancy factor is taken from the Life Expectancy Tables contained in IRS Publication 590. Your IRA beneficiary election may play an important role in determining your RMD, as well.

You must calculate your RMD separately for each qualifying IRA custodied at Interactive Brokers and any other financial institution. The RMD, however, may be satisfied from any single one or combination of your IRAs. The IRA Required Minimum Distribution Worksheets may provide additional assistance with the calculation of your RMD.

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

IRA: Retirement Account Resource Center

IMPORTANT NOTE: This article has been customized for use by self-directed Individual Retirement Account (IRA) owners for information purposes only. Persons are encouraged to consult a qualified tax professional with the investments and elections within the IRA. IB does not provide tax advice. For detailed information regarding IRAs, you may consult the IRS Publication 590-A about IRA contributions and the IRS Publication 590-B about IRA distributions.

This resource center provides a central reference point for information concerning the various IRA account types offered by IB.

Important Notice - Select IRA Tax Reporting for key information with transaction and tax reporting in your IRA.

Account Management IRA Reference

Beneficiary Options

Recharacterizations from a Roth IRA

Required Minimum Distributions

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

IRA: Rollover Rules & Conditions

This information is for general educational purposes only. Individuals should consult with their financial adviser or legal counsel to determine how rollover regulations affect their unique situations.

Generally, an IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. The contribution to the second retirement plan is called a rollover contribution.

This article outlines the types of IRA rollover transactions, rules and conditions, IB's Rollover Certification form, and rollover transaction details. Select from list below for details:

Eligible Rollover Transactions

Rules & Conditions

Prior to completing an IRA Rollover transaction, we recommend that you review the rules and conditions surrounding eligibility. Interactive Brokers can accept as a tax-free transaction an eligible rollover distribution as defined under the Internal Revenue Code. Included in this article is information about eligible transactions, as well as the Interactive Brokers IRA Rollover Certification form.

IRA Rollover Certification

Before accepting an IRA rollover transaction into an Interactive Brokers LLC IRA, we require that you review your eligibility for the rollover and certify your understanding of the rollover rules and conditions. The IRA Rollover Form includes the IRA Rollover Certification.

The Transfer Funds page within the Client Portal lets you notify IB of an IRA Rollover deposit of funds into your account. From the Transfer & Pay menu select Transfer Funds and then Make a Deposit. Select one of the saved deposit instructions and follow the prompts on the screen or create a new deposit instruction by selecting the Currency of the deposit from the drop-down menu. Click Connect or Get Instructions for the method you will use to transfer funds. And finally follow the remaining instructions provided to initiate the transfer with your bank.

Rollover Transactions

Two types of IRA rollover transactions exist with different guidelines and delivery methods:

- Direct Rollover - a transfer of assets from an employer-sponsored retirement plan directly to an eligible IRA. If you choose to receive the distribution first, then you may roll over the funds to the IRA within 60 days.

- Indirect Rollover - a distribution from an IRA paid to you, followed by a rollover into another IRA within 60 days. The IRS allows an indirect rollover of each IRA's funds once during a twelve-month period.

(Note: A distributions directly from one IRA trustee to another IRA trustee is a Trustee-to-Trustee transfer. It is not affected by the twelve-month waiting period.)

For additional information about rollovers, visit Understanding Rollovers. See also IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) for more specific guidelines on moving retirement plan assets.

Eligible Rollover Transactions

Almost any distribution from a qualified plan can be rolled over to an IRA. Your retirement account may be eligible for one of the following eligible rollover transactions.

Traditional IRA or SIMPLE IRA to Traditional IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- During the preceding 12 months, no other distributions from the distributing IRA were rolled over

- The assets involved in the transaction have not been rolled over in the past 12 months

- Required Minimum Distribution satisfied (if over 73)

- For SIMPLE IRAs, after two years from the first contribution

Roth IRA to Roth IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- During the preceding 12 months, no other distributions from the distributing IRA were rolled over

- The assets involved in the transaction have not been rolled over in the past 12 months

Rollover or Direct Rollover from Qualified Plan into a Traditional IRA

- Eligible participant (participant, spouse beneficiary, or former spouse due to divorce)

- Funds or property deposited less than 60 days of receipt by the participant from the previous plan

- Funds received from an eligible qualified retirement plan

- Required Minimum Distribution satisfied (if over 73)

- Consists of funds, property, or proceeds from the sale of property distributed from the qualified plan

- All of the funds are eligible to be rolled over

Roth IRA to Roth IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- Required Minimum Distribution satisfied (if over 73)

Ineligible Rollover Transactions

Some funds distributed from a retirement plan are not eligible for rollover into an IRA. The following transactions are not eligible rollover transactions.

- Any portion of a distribution from a retirement plan not rolled over

- Required Minimum Distributions

- Distribution of excess contributions and related earnings

- Retirement plan loan treated as a distribution

- Hardship distributions

- Distributions part of substantially equal payments (73-t)

- Dividends on employer securities

- Non-spousal death benefit distributions

- The cost of life insurance coverage

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

IRA: Charitable Donations from IRAs

Charitable Distributions

What is a Qualified Charitable Distribution (QCD)?

How to determine if a charity can receive the QCD

Where can an IRA owner find additional information on QCDs?

Withdrawal Processing

When can I submit my withdrawal?

Can IBKR customers submit a QCD withdrawal online?

What amount may be withdrawn? Why?

Where are the funds disbursed?

Does the distribution count towards the Required Minimum Distribution (RMD) amount?

Eligible IRA Accounts

Is the Charitable Distribution allowed from all IRAs held at IBKR?

Are the QCDs allowed from other IRA and retirement plans not held at IBKR?

QCD Tax Reporting

How is the QCD reported to the IRS?

Can any taxes be withheld from the distribution?

Do federal taxes have to be paid on the distribution?

Does a state or municipal tax have to be paid on the distribution?

Charitable Distributions

What is a Qualified Charitable Distribution (QCD)?

An otherwise taxable distribution from an eligible IRA owned by an individual 72 or older paid to an IRS qualified charity.

How to determine if a charity can receive the QCD?

The IRS Exempt Organizations Select Check allows users to "Search for Charities" among a list of organizations eligible to receive tax-deductible charitable contributions.

Where can an IRA owner find additional information on QCDs?

Visit Charitable Donations for IRAs for additional information on qualified charitable distributions. See also IRS Publication 590-b.

Withdrawal Processing

Can IBKR customers submit a QCD withdrawal online?

What amount may be withdrawn? Why?

IBKR will process the withdrawal for any amount, as long as the account has sufficient available funds. Why? Although the QCD donations to the charity must not exceed $100,000 per year to retain QCD status, charitable gifts may exceed this limit.

Where are the funds disbursed?

Funds are made payable to the IRS qualified charity and mailed direct to the charity. Only funds disbursed to the charity can be designated from your IRA as a QCD.

Does the distribution count towards the Required Minimum Distribution (RMD) amount?

Yes

Eligible IRA Accounts

Is the Charitable Distribution allowed from all IRAs held at IBKR?

No, see the list below. IRA owners should contact a qualified tax advisor about how to preserve QCD tax benefits. Not all distributions are created equal. A tax advisor will be able to assess an IRA owner’s best choice.

Traditional IRA > YES

Rollover IRA > YES

Roth IRA > YES

Inherited IRA > YES, if the beneficiary is at least age 70 1/2

SEP IRA > NO

Education IRA > NO

Are the Charitable Distributions allowed from other IRA and retirement plans not held at IBKR?

No, not directly. Retirement plans, employer sponsored SEP IRAs, and Simple IRAs (account classifications not held at IBKR) are not eligible for a QCD election. IRA owners may be eligible to rollover assets from these plans into a traditional, rollover, or Roth IRA to request a charitable distribution. IRA owners should contact a qualified tax advisor or their retirement plan administrator.

QCD Tax Reporting

How is the QCD reported to the IRS?

IBKR will report the charitable distributions on Form 1099-R when issued. See Reports and Dates for 1099 availability dates.

Can any taxes be withheld from the distribution?

No.

Do federal taxes have to be paid on the distribution?

Generally, federal taxes are not paid with QCDs. But distributions in excess of the IRS limit may be subject to income tax. IBKR recommends that customers contact a qualified tax advisor.

Does a state or municipal tax have to be paid on the distribution?

Contact your tax advisor or local tax authority on state and municipal requirements for the distributed amount.

Disclaimer: IBKR does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax advisor or refer to the U.S. Internal Revenue Service.

ACATS Transfer Guide (US brokerage account transfers)

ACATS Transfer Guide

Introduction

Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Through this article and other Knowledge Database resources, Interactive Brokers seeks to assist with your incoming and outgoing ACATS requests.

US brokerage firms utilize a standardized system to transfer customer accounts from one firm to another. Known as the Automated Customer Account Transfer Service or ACATS, the process allows assets to move seamlessly between brokerage firms in a unified time frame. ACATS transfers are facilitated by a third party, the National Securities Clearing Corporation (NSCC), to assist participating members with timely asset transfers.

ACATS Transfer Benefits

The majority of assets may be transferred between US brokerage firms and some banks through ACATS. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. Information on assets eligible for transfer is provided at "Assets Eligible..." Though impacted by multiple factors and time constraints, the accepted or rejected transfers finalize within 10 business days in most cases.

Navigating The Process

4 simple steps of the ACATS process will help you understand the flow and minimize delays. Familiarizing yourself with the transfer process helps to ensure a successful transition.

1. Incoming or Outgoing

Incoming ACATS Transfers

The financial institution that is receiving your assets and account transfer is known as the "receiving firm." Investors always work with and through the "receiving firm" to move full or partial account assets into a new broker.

Contact the "receiving firm" (Interactive Brokers) to review the firm's trading policies and requirements. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Not all ACATS transferable assets are acceptable for trading at every brokerage firm.

Outgoing ACATS Transfers

All outgoing ACATS transfers, full or partial, must be approved by the "delivering firm." Investors, however, should work with and through the "receiving firm" in order to begin the the transfer process or to status the progress of the request.

2. Initiating Your Transfer

Investors must always begin the ACATS transfer with the "receiving firm." An ACATS transfer form or Transfer Initiation Form (TIF) must be submitted. The "receiving firm" takes your reqeust and communicates with the "delivering firm" via ACATS. The process begins with this request for transfer of the account.

For your Interactive Brokers Account, the transfer is usually submitted online. Video instruction on submitting the transfer is provided at "How to deposit funds via a full ACATS/ATON Transfer." or through Step-by-step instructions.

Note: Outgoing account transfers from your IB account should be directed to the other broker. Your request will be submitted to IB from the other broker through the ACATS electronically.

3. What to Expect

Your Account

Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:

- Same Account Title

- Same Tax ID Number

- Same Account Type

Transfer Approval

Ultimately responsible for validating the transfer, the "delivering firm" may accept information from the "receiving firm" correcting data originally entered. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. Assets may not be accepted by the "receiving firm" for the following:

- Non-marginable or Margin (credit) violation

- Not Tradable

- DTC Chill

Note: The most common reasons for ACATS rejections are outlined by clicking here.

Processing Time-frame

The processing time for each transfer request is fixed. In general, approved transfers complete within 4 to 8 business days. Almost all transfers complete within 10 business days. Each firm is required to perform certain steps at specific intervals in the process. Feel free to review the Full ACATS transfer process flow.

Fees

While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge.

4. Who To Contact For Help

Interactive Brokers Customer Service stands poised to assist with your incoming ACATS transfer reqeust. Click here for Customer Service contact resources.

Note: Outgoing or ACATS transfers sending accounts to another broker should be directed to the "receiving firm." Their Account Transfer Group will work with Interactive Brokers directly to complete your outgoing request.

Year End Statement & Report Comparison

The Interactive Brokers Year End Reports provide an activity review for US persons and US entities. The various account statements provide the transaction details as the basis for each report. Each of the standard reports spans the time period from January 1 through December 31.

Some reports, such as the Gain/Loss Summary Worksheet, may consolidate transactions and calculations. For the sake of conserving volume, trade activity may be combined. The account statements include all activity. For your convenience and to assist with your reconcilation, customized statements permit activity displays suitable for your personal needs (see the tab "Customized Templates" for details).

All US tax reports include the total figures as required under the US tax laws.

Non-US Persons and Entities

Income paid from US sources to non-US persons and entities may find this comparison helpful. IB is required to withhold US taxes at a rate of 30% on payments of US source stock dividends and substitute payments in lieu. Both the withholding and the income is reported on the US tax Form 1042-S.

For additional information about how IB handles non-US persons and entities, select this Tax Information and Reporting link and choose the tab Non-US Persons and Entities.

Year End Reports (For Trading) Comparison shown below identifies the most common transaction types which appear on the year end reports. Not all activity is included on each report.

| Year End Reports | Stock | Bond | Equity & Index Option | Single Stock Futures | Futures | Forex |

| Form 1099 | Sell | Sell | - | - | Gain/Loss | - |

| Form 1042-S | - | - | - | - | - | - |

| Annual Statement | Buy/Sell Gain/Loss | Buy/Sell Gain/Loss | Buy/Sell Gain/Loss |

Buy/Sell Gain/Loss |

Buy/Sell Gain/Loss |

Buy/Sell Gain/Loss |

| Gain/Loss Worksheet |

Cost/Sell Gain/Loss | Cost/Sell Gain/Loss | Cost/Sell1 Gain/Loss1 | Cost/Sell Gain/Loss | - | - |

| 1256 Worksheet |

- | - | Gain/Loss5 | - | Gain/Loss | - |

NOTES: (1) Only cash settled; (2) Gain/Loss Worksheet was first published by IB with tax year 2007. Worksheets for prior years are not available. IB did provide gain and loss data on the Annual Statements; (3) The 1256 Worksheet was first published by IB with tax year 2008; (4) Option transactions are not 1099 or 1042-S reportable transactions. In accordance with the IRS guidelines, IB excludes the activity from the tax reports; (5) Only broad-sed index options appear on the 1256 Worksheet

Year End Reports (For Income) Comparison shown below identifies the most common types of income which appear on the year end reports. Not all income is reportable on a 1099 or Dividend Summary.

| Year End Reports | Dividends | Credit Interest | Debit Interest | Accruals | Pay In Lieu Credit | Pay In Lieu Debits | Fees |

| Form 1099 | Yes | Yes | No | No | Yes | No | No |

| Form 1042-S | Yes | Yes | No | No | Yes | No | No |

| Annual Statement | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Dividend Summary | Yes | No | No | No | Yes | Yes | No |

| Gain/Loss Worksheet | No | No | No | No | No | No | No |

| 1256 Worksheet | No | No | No | No | No | No | No |

NOTES: (1) US Tax Form 1042-S is provided to non-US persons/entities, along with the Dividend Summary. The Tax Form reports interest, dividends, substitute payments in lieu, and US tax withholding from US securities; (2) For US persons/entities, the Dividend Summary may list dividends as potentially eligible for treatment as “Qualified” based on the holding period. IB does not report this on the 1099-DIV or to the Internal Revenue Service; (3) Debit transactions are not 1099 or 1042-S reportable transactions. In accordance with the IRS guidelines, IB excludes the activity from the tax reports; (4) Exchange, market data, and activity fees

Tax Reporting: When to expect Forms 1099-R and 5498

Forms 1099-R and 5498 are available by January 31 and May 31, respectively.

IRS Circular 230 Notice: The information contained in this FAQ is provided for information purposes only, is not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations and does not resolve any tax issues in your favor. Refer to IRS Publication 590, Individual Retirement Accounts for additional information on IRAs in general and consult your tax advisor about your individual tax situation.

Can I contribute to an IRA if I already have a retirement plan through my employer?

Yes. You can contribute to a Roth IRA or Traditional IRA regardless of whether or not you have an employer-sponsored plan. While participation in a retirement plan does not change how much you can contribute to an IRA, it can affect whether or not you are eligible to deduct your Traditional IRA contributions on your tax return.

IRS Circular 230 Notice: The information contained in this FAQ is provided for information purposes only, is not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations and does not resolve any tax issues in your favor. Refer to IRS Publication 590, Individual Retirement Accounts for additional information on IRAs in general and consult your tax advisor about your individual tax situation.