Informazioni aggiuntive circa l'utilizzo degli ordini stop

I mercati azionari degli Stati Uniti possono attraversare dei periodi di straordinaria volatilità e turbolenza dei prezzi. Talvolta questi eventi sembrano perdurare nel tempo, altre volte invece la loro durata è piuttosto breve. Gli ordini stop possono avere un ruolo determinante e contribuiscono alla pressione dei prezzi al ribasso e alla volatilità dei mercati. Questi fenomeni potrebbero dar luogo a delle esecuzioni a prezzi molto più alti di quelli di innesco.

Cosa accade se faccio trading con un prodotto denominato in una valuta che non detengo nel mio conto?

La valuta specifica, necessaria per l’acquisto e il regolamento di qualunque prodotto, viene stabilita dalla Borsa e non da IBKR. Se per esempio, decidi di effettuare una transazione per acquistare un titolo denominato in una valuta che non detieni e ipotizzando che tu abbia un conto con margine ed un eccesso di margine sufficiente, IBKR creerà un prestito per tali fondi. Ti ricordiamo che questa procedura è necessaria in quanto IBKR ha l’obbligo di regolare la transazione con la camera di compensazione esclusivamente nella valuta designata per la denominazione. Nel caso in cui tu preferisca non creare questo prestito ed evitare di incorrere nei costi degli interessi associati a questa operazione, avrai due opzioni: 1) versare i fondi nel tuo conto usando la valuta e l’importo richiesti; oppure 2) convertire i fondi esistenti nel tuo conto usando il nostro servizio IdealPro (per gli importi superiori a 25.000 USD o equivalenti) oppure ricorrendo alle sedi per spezzature (odd lot), entrambe le possibilità sono disponibili su TWS.

Ti ricordiamo inoltre che una volta liquidata la posizione sul titolo denominato in una determinata valuta, i proventi rimarranno in quella valuta indipendentemente se questa coincida o meno con la valuta di base che hai scelto per il tuo conto. I proventi saranno inoltre soggetti ad un tasso di cambio sul rischio relativo alla tua valuta base a meno che tu non decida di eseguire una conversione valutaria oppure di usare i proventi per un prodotto denominato nella stessa valuta.

Per quale motive la sezione del Resoconto Liquidità nel mio Rendiconto delle Attività riporta un trasferimento interno fra titoli e commodity?

Al fine di rispettare la normativa vigente, IBKR deve segregare gli asset relativi ai titoli presenti nel tuo conto dagli asset legati a commodity. Quest’ultimo tipo di asset potrebbe includere il valore di mercato delle opzioni su future e in più qualsiasi saldo di liquidità richiesto come margine per posizioni relative a futures su commodity e opzioni su futures. Verrà ricalcolato periodicamente il requisito di margine delle tue posizioni su commodity e nel caso in cui questo requisito dovesse scendere, la liquidità in eccesso usata come margine delle commodity verrà trasferita dal comparto commodity del tuo conto a quello dedicato ai titoli. Allo stesso modo, nel caso in cui il margine delle commodity dovesse aumentare, IBKR provvederà a trasferire la liquidità disponibile dal comparto titoli a quello delle commodity. Considerato che l’assicurazione della SIPC viene garantita per gli asset presenti nel comparto titoli del tuo conto (ma non per quello delle commodity), questo trasferimento periodico verrà effettuato per garantire che il tuo saldo di cassa possa mantenere la maggiore protezione possibile. Va ricordato che questi movimenti di liquidità rappresentato delle voci quotidiane nel tuo conto che hanno l’obiettivo di compensarsi l’un l’altra e dunque non avranno alcun impatto sul saldo di liquidità aggregato all’interno del conto (si veda la colonna del Totale nella sezione “Resoconto Liquidità” nel Rendiconto delle Attività).

Come vengono calcolati i requisiti di margine per i future e per i future su opzioni?

Le opzioni su future, così come i margini per contratti future, sono regolati attraverso un algoritmo di calcolo noto come “marginazione SPAN”. Per informazioni sullo SPAN e su come funziona ti invitiamo a consultare il sito web del CME Group www.cmegroup.com. Nel sito web ufficiale potrai fare una ricerca sullo SPAN e troverai molte informazioni utili su questo argomento e sul funzionamento di questo algoritmo la cui sigla sta per Standard Portfolio Analysis of Risk. Si tratta di una metodologia altamente sofisticata che calcola i requisiti relativi alla performance delle obbligazioni attraverso un’analisi dei vari scenari ipotetici in base alle diverse possibili condizioni di mercato.

In genere ecco come funziona il sistema SPAN:

Lo SPAN valuta il rischio complessivo del portafoglio calcolando la peggiore perdita possibile che un portafoglio con titoli derivati e strumenti fisici possa sostenere in un determinato periodo di tempo (una giornata di contrattazione). Per fare questo il sistema calcola i profitti e le perdite del portafoglio in diverse condizioni di mercato. Al centro della metodologia vi è la matrice di rischio, una serie di valori numerici che indicano in che modo un dato contratto potrà guadagnare o perdere valore in determinate condizioni. Ogni condizione viene detta “scenario di rischio”. Il valore numerico per ciascun scenario di rischio rappresenta il profitto o la perdita alla quale andrà incontro un determinato contratto per una determinata combinazione di variazione del prezzo (o del prezzo del sottostante, variazione della volatilità e diminuzione al momento della scadenza.

I file del margine ottenuti con il sistema SPAN vengono inviati dalla borsa valori a IBKR ad intervalli specifici durante tutta la giornata e vengono quindi inseriti in un calcolatore di margine SPAN. Tutte le opzioni su future continuano ad essere calcolate legate al rischio fino alla loro scadenza oppure alla loro chiusura. Il fatto che questo tipo di opzione possa essere “out-of-the-money” è ininfluente. Tutti gli scenari devono tener conto di cosa potrebbe accadere in condizioni di estrema volatilità del mercato e di conseguenza l’impatto sul margine di questo opzioni su future verrà considerato fino a quando sarà presente una posizione su questo tipo di prodotto. I requisiti di margine SPAN vengono quindi confrontati con gli scenari predefiniti relativi a movimenti estremi di mercato realizzati da IBKR.

Margin Considerations for Intramarket Futures Spreads

Background

Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin rate to reflect the risk of this price deviation.

Spread Margin Adjustment

This reduction is accomplished by effectively decoupling or breaking the spread in phases on each of the 3 business days preceding the close out date of the front contract month, as follows:

- On the 3rd business day prior to close out, the initial and maintenance margin requirements will be equal to 10% of their respective requirements on each contract month as if there was no spread, plus 90% of the spread requirement;

- On the 2nd business day prior to close out, the initial and maintenance margin requirements will be equal to 20% of their respective requirements on each contract month as if there was no spread, plus 80% of the spread requirement;

- On the business day prior to close out, the initial and maintenance margin requirements will be equal to 30% of their respective requirements on each contract month as if there was no spread, plus 70% of the spread requirement.

Working Example

Assume a hypothetical futures contract XYZ with the margin requirements as outlined in the table below:

| XYZ | Front Month - 1 Short Contract (Uncovered) | Back Month - 1 Long Contract (Uncovered) | Spread - 1 Short Front Month vs. 1 Long Back Month |

| Initial Margin | $1,250 | $1,500 | $500 |

| Maintenance Margin | $1,000 | $1,200 | $400 |

Further assume a position consisting of 1 short front month contract and 1 long back month contract with the front month contract close out date = T. using this hypothetical example, the initial margin requirement over the 3 business day period preceding close out date is outlined in the table below:

| Day | Initial Margin Requirement | Calculation Details |

| T-4 | $500 | Unadjusted |

| T-3 | $725 | .1($1,250 + $1,500) + .9($500) |

| T-2 | $950 | .2($1,250 + $1,500) + .8($500) |

| T-1 | $1,175 | .3($1,250 + $1,500) + .7($500) |

| T | $1,175 | Positions not in compliance with close out requirements are subject to liquidation. |

How to Complete CFTC Form 40

Clients maintaining a U.S. futures or futures option position at a quantity exceeding the CFTC's reportable thresholds may be contacted directly by the CFTC file with a request that they complete a Form 40. Contact will generally be made via email and clients are encouraged to respond to such requests in a timely manner to avoid trading restrictions and/or fines imposed by CFTC upon their account at the FCM.

Completion of the Form requires the following steps:

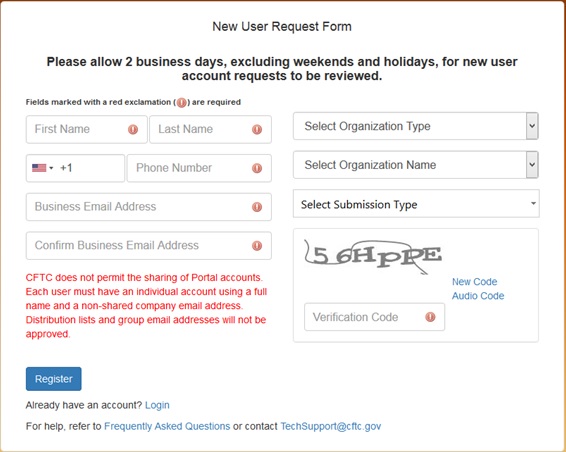

- Register for a CFTC Portal Account - performed online at: https://portal.cftc.gov/Account/Register.aspx Registration will require entry of the 9-digit code that the CFTC provided to you within the email requesting that you register. If you cannot locate your code or receive an invalid entry message, contact TechSupport@cftc.gov. When entering "Organization Type" from the drop-down selector, choose "LTR (Large Traders)".

2. Complete Form 40 - You will receive an email notification from the CFTC once your Portal Account has been approved. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. The email will contain a link to the Portal where you will be prompted to log in: https://portal.cftc.gov/

Instructions for completing the form are available at: https://www.ecfr.gov/cgi-bin/text-idx?node=ap17.1.18_106.a

Note that Portal provides the opportunity to save a copy of your submission in XML format, a recommended step, as this allows for uploading the file to the Portal should you need to make modifications at a later date. This will eliminate the need to renter the form in its entirety.

The CFTC will send a confirmation email upon successful completion of your Form 40.

3. Confirm with IBKR - forward your confirmation email, or other evidence that you have submitted the Form 40 to cftc_form40_filing@interactivebrokers.com. This will assist to ensure that your account is not subject to CFTC directed restrictions or fines.

Overview of CFTC Form 40

The CFTC, the primary regulator of U.S. commodity futures markets and Futures Commission Merchants (FCMs), operates a comprehensive system of collecting information on market participants as part of its market surveillance and large trader reporting program.

IBKR, as a registered FCM providing clients with access to those markets, is obligated to report to the CFTC information on clients who hold a position in a quantity that exceeds defined thresholds (i.e., a "reportable position"). In order to report this information, IBKR requires clients trading U.S. futures or futures options to complete an online CFTC Ownership and Control Reporting form at the point the client requests futures trading permissions.

Once a client holds a "reportable position", the CFTC may then contact that client directly and require them to file more detailed information via CFTC Form 40. The information required of this report includes the following:

- Trader's name and address

- Principal business

- Form of ownership (e.g., individual, joint, partnership, corporation, trust, etc.)

- Whether the reporting trader is registered under the Commodity Exchange Act

- Whether the reporting trader controls trading for others

- Whether any other person controls the trading of the reportable trader

- Name and location of all firms through which the reportable trader carries accounts

- Name and location of other persons providing a trading guarantee or having a financial interest in account of 10% or greater

- Name of accounts not in the reporting trader's name in which the trader provides a guarantee or has a financial interest of 10% or more.

Clients who fail to complete this Form in a timely manner may be subject to trading restrictions and/or fines imposed by CFTC upon their account at the FCM. It is therefore imperative that clients immediately respond to these CFTC requests.

To complete the CFTC Form 40, clients must first register for a CFTC Portal Account, an online process which is subject to a review period of 2 business days from the point of initial registration to acknowledgement of approval by the CFTC. For information regarding this registration process and completing the Form 40, see KB3149.

Future OTC di IBKR sui metalli del LME – Fatti, domande e risposte

Introduzione

I contratti future OTC sul LME di IBKR forniscono ai clienti accesso sintetico alla Borsa dei Metalli di Londra (London Metal Exchange - LME), un mercato peer-to-peer solitamente non disponibile per gli investitori che non ne siano membri.

I future OTC del LME sono contratti derivati OTC aventi IBUK come controparte. I future OTC del LME riflettono i corrispondenti future del LME in termini di prezzo, dimensioni del lotto, tipologia e specifiche, ma di per sé non sono contratti registrati. La consegna fisica non è permessa.

I contratti future OTC sul LME di IBKR sono negoziati tramite il proprio conto a margine, e, di conseguenza, è possibile inserire posizioni a leva lunghe e corte. I tassi di margine corrispondono a quelli stabiliti dal LME. Così come gli altri contratti future, si tratta di prodotti basati sul rischio (SPAN) e, quindi, variabili. I margini correnti sono compresi tra il 6% e il 9% a seconda del contratto.

Contratti

IBKR offre contratti future OTC alle scadenze del terzo mercoledì per i seguenti metalli:

| Metallo | Simbolo IB | Prezzo USD/ | Moltiplicatore |

| Alluminio primario d'alta qualità | AH | Tonnellata | 25 |

| Rame di grado A | CA | Tonnellata | 25 |

| Nickel primario | NI | Tonnellata | 6 |

| Piombo standard | PB | Tonnellata | 25 |

| Stagno | SNLME | Tonnellata | 5 |

| Zinco speciale d'alta qualità | ZSLME | Tonnellata | 25 |

Scadenze del 3° mercoledì

La Borsa dei metalli di Londra prevede una gamma di contratti adattati alle esigenze dei trader e degli operatori prudenti (hedger) che negozino prodotti fisici. I contratti principali sono quelli forward a tre mesi utilizzati dai trader di prodotti fisici per abbinare precisamente le coperture alle proprie esigenze.

I contratti del terzo mercoledì sono mensili, come i future, e, in quanto tali, più adeguati alle esigenze degli operatori finanziari. Così come suggerito dal nome, questi scadono il terzo mercoledì di ogni mese, e, nonostante fisicamente regolati sul LME, sono rigorosamente regolati in contanti presso IBKR. I contratti del terzo mercoledì sono divenuti estremamente popolari e rappresentano il 65% delle posizioni aperte sul LME .

Quotazioni e dati di mercato

IBKR fornisce le quotazioni in streaming del LME (dati di mercato di livello 2) senza aumentare la quotazione. Ciascuno degli ordini dei clienti è, innanzitutto, coperto sulla Borsa e l'ordine OTC del LME è negoziato al prezzo della copertura.

Flussi di cassa

La variazione giornaliera del margine e il P&L realizzato dei future OTC sul LME di IBKR sono regolati ogni giorno in contanti, come i contratti future standard. Al contrario, i flussi di cassa del contratto del LME sottostante sono regolati solamente dopo la scadenza dello stesso.

Margini

I requisiti di margine dei contratti future OTC sul LME di IBKR corrispondono al requisito del contratto sottostante sul LME. La Borsa dei metalli di Londra effettua il calcolo del margine iniziale utilizzando l'analisi del rischio di portafoglio standard (SPAN).

Così come per gli altri contratti future, i tassi di margine sono stabiliti come un valore assoluto per contratto e, in genere, aggiornati con cadenza mensile.

Permessi di trading

È necessario configurare i permessi per i metalli del Regno Unito in Gestione conto.

Dati di mercato

È necessaria una sottoscrizione di livello II alla Borsa dei metalli di Londra, attualmente corrispondente a 1.00 GBP

Risorse sugli OTC del LME

Elenco dei prodotti e collegamenti ai dettagli dei contratti

Commissioni

Requisiti di margine

Domande frequenti

Come bisogna procedere per negoziare i future OTC del LME?

È necessario configurare i permessi di trading per i metalli del Regno Unito in Gestione conto. Se si dispone di un conto IB LLC o di un conto IB UK mantenuto da IB LLC, provvederemo alla configurazione di un nuovo segmento del conto (identificato con il numero del proprio conto più il suffisso "F"). Una volta confermata la configurazione, sarà possibile iniziare a negoziare. Il nuovo conto F non richiederà una procedura di finanziamento separata; al contrario, i fondi saranno automaticamente trasferiti dal proprio conto principale per soddisfare i requisiti di margine.

In che modo sono rappresentate le transazioni e le posizioni su future OTC del LME all'interno dei propri rendiconti?

Le proprie posizioni sono depositate in un segmento del conto separato, identificato con il numero del proprio conto principale e il suffisso "F". È possibile scegliere di visualizzare i rendiconti di attività del segmento "F" separatamente o insieme al proprio conto principale. È possibile effettuare la scelta nella finestra del rendiconto di Gestione conto.

Quali sono le tipologie di protezione del conto previste per la negoziazione di future OTC del LME?

I future OTC del LME sono contratti aventi IB UK come controparte, e non sono negoziati su una Borsa valori regolamentata, né compensati presso una stanza di compensazione centrale. Dato che IB UK è la propria controparte nelle transazioni, si è esposti ai relativi rischi finanziari e commerciali, compreso il rischio di credito associato alle negoziazioni con IB UK. Si prega di notare, tuttavia, che tutti i fondi dei clienti sono sempre interamente segregati, compresi quelli dei clienti istituzionali. IB UK è un partecipante del Financial Services Compensation Scheme ("FSCS") del Regno Unito. IB UK non fa parte della Securities Investor Protection Corporation ("SIPC") degli Stati Uniti.

È possibile negoziare future OTC del LME in via telefonica?

No. In casi eccezionali potremmo acconsentire all'elaborazione telefonica degli ordini di chiusura di posizioni, ma non di quelli di apertura.

IBKR OTC Futures on LME Metals – Facts and Q&A

Introduction

IBKR LME OTC Futures provide clients synthetic access to the London Metal Exchange, a peer to peer exchange not generally available to non-member investors.

The LME OTC Futures are OTC derivative contracts with IBUK as the counterparty. The LME OTC Futures reference the corresponding LME future in terms of price, lot size, type and specification but are themselves not registered contracts. Physical delivery is not permitted.

IBKR LME OTC Futures are traded through your margin account, and you can therefore enter long as well as short leveraged positions. Margin rates equal those established by the LME. Like other futures they are risk-based (SPAN), and therefore variable. Current margins range between 6 and 9% depending on the contract.

Contracts

IBKR offers OTC Futures on the 3rd Wednesday expirations for the following metals:

| Metal | IBKR Symbol | Price USD/ | Multiplier |

| High Grade Primary Aluminium | AH | Metric Ton | 25 |

| Copper Grade A | CA | Metric Ton | 25 |

| Primary Nickel | NI | Metric Ton | 6 |

| Standard Lead | PB | Metric Ton | 25 |

| Tin | SNLME | Metric Ton | 5 |

| Special High Grade Zinc | ZSLME | Metric Ton | 25 |

3rd Wednesday Expirations

The LME features a range of contracts adapted to the needs of physical traders and hedgers. The principal among them are daily 3-month forwards used by physical traders to precisely match their hedges to their needs.

The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the needs of financial traders. As the name suggests, they expire on the 3rd Wednesday of each month and, although physically settled on the LME, are strictly cash-settled at IBKR. The 3rd Wednesday contracts have become increasingly popular and account for 65% of open interest on the LME.

Quotes and Market Data

IBKR streams quotes from the LME (L2 market data) and does not widen the quote. Every client order is first hedged on exchange and the LME OTC order filled at the price of the hedge.

Cash Flows

Daily variation margin and realized P&L for the IBKR LME OTC Futures are cash-settled daily, like a standard future. By contrast, cash flows for the underlying LME contract are only settled after the contract has expired.

Margins

The margin requirements for the IBKR LME OTC Futures equal the requirement for the underlying contract on the LME. LME uses Standard Portfolio Analysis of Risk (SPAN) to calculate Initial Margin.

Like for other futures, the margin rates are established as an absolute value per contract and usually updated monthly.

Trading Permissions

You will need to set up permissions for United Kingdom Metals in Client Portal.

Market Data

You will need a subscription for Level II London Metal Exchange, currently GBP 1.00.

LME OTC Resources

Product Listings & Links to Contract Details

Commissions

Margin Requirements

Frequently asked Questions

What do I need to do to start trading LME OTC Futures?

You need to set up trading permission for United Kingdom Metals in Client Portal. If you have an IB LLC or an IB UK account carried by IB LLC we will set up a new account segment (identified with your existing account number plus the suffix “F”). Once the set-up is confirmed you can begin to trade. You do not need to fund the F segment separately; funds will be automatically transferred from your main account to meet margin requirements.

How are my LME OTC Futures trades and positions reflected in my statements?

Your positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Client Portal.

What account protections apply when trading LME OTC Futures?

LME OTC Futures are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Since IB UK is the counterparty to your trades, you are exposed to the financial and business risks, including credit risk, associated with dealing with IB UK. Please note however that all client funds are always fully segregated, including for institutional clients. IB UK is a participant in the UK Financial Services Compensation Scheme ("FSCS"). IB UK is not a member of the U.S. Securities Investor Protection Corporation (“SIPC”).

Can I trade LME OTC Futures over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

MIFID II Commodity Position Limits

Background

On 3 January 2018, a new Directive 2014/65/EC (“MiFID II”) and Regulation (EU) No 600/2014 (“MiFIR”) will become effective, introducing new requirements on position limits and position reporting for commodity derivatives and emission allowances.

National Competent Authorities (“NCAs”) (i.e. regulators) of each European Economic Area (“EEA”) Country will calculate the limits on the size of the net position that a person can hold in commodity derivatives traded on an EU venue or its “economically equivalent contracts” (“EEOTC”).

The European Securities and Markets Authority (“ESMA”) intends to publish approved position limits on its website.

Limits will be set for the spot month and all other months, for both physically settled and cash settled commodities.

Investment firms trading in commodity derivatives and emissions allowances are obliged, on a daily basis, to report

their own positions in commodity derivatives traded on a trading venue and EEOTC contracts, as well as those of

their clients and the clients of those clients until the end client is reached, to the NCA.

Clients holding positions have to be identified using specified National Identifiers for individuals and LEIs for

organisations under MiFID II.

Interactive Brokers’ Implementation of the Requirements

In order to comply with its reporting obligations, IB will not allow its clients to trade if they have not provided the

specific National Identifier or LEI that is necessary for reporting positions of in scope financial products.

Whenever possible, IB will act to prevent account holders from entering transactions that may result in a position

limit violation. This process will include monitoring account activity, sending a series of notifications intended to

allow the account holder to self-manage exposure and placing trading restrictions on accounts approaching a limit.

Examples of notifications which are sent via email, TWS bulletin and Message Center are as follows:

- Information Level: sent when the position exceeds 50% of the limit. Intended to inform as to the existence of the position limit and its level.

- Warning Level: sent when the position exceeds 70% of the limit. Intended to provide advance warning that account will be subject to trading restrictions should exposure increase to 90%.

- Restriction Level: sent when the position exceeds 90% of the limit. Provides notice that account is restricted to closing transactions until exposure has been reduced to 85%.