Negoziazione di future su criptovalute con IBKR

Qual è il simbolo di trading?

CME (Bitcoin Futures): inserisci il simbolo del sottostante BRR per poter richiamare i future

CME (Ether Futures): inserisci il simbolo del sottostante ETHUSDRR per poter richiamare i future

ICE (Bakkt® Bitcoin Futures): inserisci il simbolo del sottostante BAKKT per poter richiamare i future

Qual è l'orario di negoziazione?

CME: 17:00 – 16:00, ora di Chicago, domenica – venerdì

ICE: 19:00 – 17:00, ora di Chicago, domenica - venerdì

Ti ricordiamo che nel caso in cui tu voglia negoziare al di fuori dell'orario di trading regolare, o desideri che il tuo ordine venga innescato al di fuori dell'orario di trading regolare, dovrai configurare l'ordine di conseguenza. A tale proposito, è possibile seguire utilizzare uno dei seguenti tre metodi:

- Attraverso le Preimpostazioni per Ordini Future. TWS Classic: clicca sul pulsante Modifica e poi sulla voce Configurazione globale. Mosaic: clicca su File e poi sulla voce Configurazione globale. Espandi la sezione presente sul lato sinistro e seleziona “Future”. Nella prima sezione, Tempistica, seleziona il riquadro che dice "Consenti attivazione, invio, innesco o esecuzione dell'ordine al di fuori del normale orario di trading (se disponibile)". Clicca sulla voce Applica e, una volta terminato, su OK.

- Attraverso la linea dell'ordine. Clicca sul campo "Durata" in TWS Classic oppure in Mosaic e seleziona il riquadro in basso che dice "Innesca fuori da RTH". In WebTrader, selezionare il riquadro alla fine della linea dell'ordine che dice "Esegui fuori da RTH".

- Dal ticket d'ordine. Accedi alla sezione Durata e seleziona il riquadro che dice "Consenti esecuzione dell'ordine al di fuori dell'orario di trading regolare".

Per maggiori informazioni in merito alla negoziazione al di fuori dell'orario di trading regolare, ti invitiamo a consultare il seguente link:

https://www.interactivebrokers.com/en/index.php?f=719

Dove è possibile trovare informazioni in merito alle specifiche del contratto?

CME (Bitcoin Futures): http://www.cmegroup.com/trading/bitcoin-futures.html?itm_source=cmegroup&itm_medium=flyout&itm_campaign=bitcoin&itm_content=tech_flyout

CME (Ether Futures): https://www.cmegroup.com/trading/ether-futures.html

ICE (Bakkt® Bitcoin Futures): https://www.theice.com/products/72035464/Bakkt-Bitcoin-USD-Monthly-Futures-Contact

Vi saranno restrizioni al trading?

Il trading non sarà offerto ai conti pensionistici (ovvero, IRA, SIPP) o ai residenti in Giappone.

Qual è il requisito di margine?

Il requisito di margine delle posizioni lunghe definitive (outright) sarà fissato al 50% del prezzo di regolamento del mese più prossimo della giornata precedente. Per quanto concerne le posizioni corte definitive (outright), il tasso di margine sarà pari al 100% del prezzo di regolamento giornaliero.

Margine spread: la differenza netta tra i requisiti di margine di mantenimento definitivi del cliente su ciascun contratto long e short (usando il 50% sia per la componente long sia per quella short) più, per ciascuno spread, un onere sullo spread pari al 25% del prezzo di regolamento giornaliero, che è il maggiore tra tutti i contratti future XBT disponibili per il trading.

Si ricorda ai clienti che IBKR non effettua richieste di integrazione e potrebbe modificare i requisiti di margine in qualunque momento a sola discrezione di IBKR.

Per i dettagli dei requisiti di margine correnti di tutti i prodotti, si prega di fare riferimento alla seguente sezione del sito web IBKR: https://www.interactivebrokers.com/en/index.php?f=24176

Quali sono le commissioni?

Il tasso commissionale sulle criptovalute sarà di 10 USD per contratto per i prodotti di CME e ICE. IBKR trasmetterà le tariffe borsistiche, regolamentari e di compensazione. IBKR trasmetterà le tariffe borsistiche, regolamentari e di compensazione.

Per maggiori informazioni in merito alle commissioni e alle tariffe borsistiche, regolamentari e di compensazione, si prega di visitare la pagina del nostro sito web:

https://www.interactivebrokers.com/en/index.php?f=commission&p=futures1

Quali sono i permessi di trading richiesti?

Per fare trading con futures su criptovalute avrai bisogno dei permessi per fare trading con Crypto Futures statunitensi. Potrai richiedere il permesso per questo prodotto tramite il Portale Clienti: clicca sul menu Utente (la figura con testa e spalle che compare nell’angolo in alto a destra) e selezione Gestione Conto. Quindi clicca sull’icona dell’ingranaggio nella sezione “Esperienza di trading & Permessi”. Vai alla sezione “Futures” e seleziona la voce “Stati Uniti (Cripto)”.

Quali sono le opzioni disponibili per le sottoscrizioni ai dati di mercato?

Le quotazioni dal vivo per i future su criptovalute sono disponibili mediante abbonamento attraverso il Portale Clienti. L'offerta comprende le seguenti sottoscrizioni (le tariffe mensili delle sottoscrizioni sono pubblicate sul sito web IBKR):

CME (Borsa = CME. IB Exchange = CME)

Per utenti non professionisti

- Livello 1: CME in tempo reale – Livello 1 per non professionisti

- Livello 1: Pacchetto valore - comprende Istantanee Titoli USA e Future (NP, L1)

- Livello 2: CME in tempo reale – Livello 2 per non professionisti

- Livello 2: Pacchetto valore USA PLUS (NP, L2)

- È necessario avere l’abbonamento al Pacchetto Valore con Istantanee Titoli USA e Future

- Valido solo per la profondità del book

Per utenti professionisti

- Livello 2: CME in tempo reale per professionisti - Livello 2 (Il Livello 1 CME Pro non è disponibile per questo prodotto)

ICE (Borsa = ICE, Borsa presso IB = ICECRYPTO)

- Livello 2: ICE Futures US – Future su asset digitali, Livello 2 (Il Livello 1 non è disponibile sia per professionisti che per utenti non professionisti)

Ritorna alla Tavola dei Contenuti: Bitcoin e altri prodotti legati criptovalute disponibili presso IBKR

Trading Cryptocurrency Futures with IBKR

What is the trading symbol?

CME (Bitcoin Futures): Enter the underlying symbol BRR in order to bring up the futures

CME (Ether Futures): Enter the underlying symbol ETHUSDRR to bring up the futures

ICE (Bakkt® Bitcoin Futures): Enter the underlying symbol BAKKT to bring up the futures

What are the trading hours?

CME: 17:00 – 16:00 Chicago Time, Sunday – Friday

ICE: 19:00-17:00 Chicago Time, Sunday – Friday

Please note, if you wish to trade outside of regular trading hours or have your order triggered outside of regular trading hours you must configure your order accordingly. You can do so using the following steps:

- Through Futures Order Presets. In Classic TWS, click Edit followed by Global Configuration. In Mosaic, click File followed by Global Configuration. Expand the Presets section on the left side and select Futures. The first section will be Timing, and you will want to check the box that says "Allow order to be activated, triggered, or filled outside of regular trading hours (if available)". Click Apply and OK once finished.

- Through the order line. In both Classic TWS as well as Mosaic, click on the Time in Force field and check the box at the bottom that says "Trigger outside RTH". In WebTrader, check the box at the end of the order line that says "Fill Outside RTH".

- Through the Order Ticket. In the Time in Force section, check the box that says "Allow this order to be filled outside of regular trading hours".

Please see the following link for more information on trading futures outside of regular trading hours:

https://www.interactivebrokers.com/en/index.php?f=719

Where can I find information about the contract specifications?

CME (Bitcoin Futures): http://www.cmegroup.com/trading/bitcoin-futures.html?itm_source=cmegroup&itm_medium=flyout&itm_campaign=bitcoin&itm_content=tech_flyout

CME (Ether Futures): https://www.cmegroup.com/trading/ether-futures.html

ICE (Bakkt® Bitcoin Futures): https://www.theice.com/products/72035464/Bakkt-Bitcoin-USD-Monthly-Futures-Contact

Will there be any restrictions on trading?

Trading will not be offered in retirement accounts (e.g., IRA, SIPP) or for residents of Japan.

What is the Margin Requirement?

The margin requirement for outright long positions will be set at 50% of the prior day's lead month settlement price. In the case of outright short positions, the margin rate will be 100% of the daily settlement price.

Spread Margin: The net difference between the outright customer maintenance margin requirements on each long and short contracts (using 50% for both the long and the short leg) plus, for each spread, a spread charge equal to 25% of the daily settlement price that is the greatest among all XBT futures contracts available for trading.

Clients are reminded that IBKR does not issue margin calls and may modify margin requirements at any time, at IBKR's sole discretion.

Please refer to the following section of the IBKR website for current margin requirements for all products: https://www.interactivebrokers.com/en/index.php?f=24176

What are the commissions?

The commission rate for Crypocurrency futures will be USD 10 per contract for the CME and ICE products. IBKR will pass through exchange, regulatory and clearing fees.

For more information on commission as well as exchange, regulatory and clearing fees, please visit the Commission page of our website:

https://www.interactivebrokers.com/en/index.php?f=commission&p=futures1

What trading permissions are required?

To trade Crypocurrency futures, you must have trading permissions for US Crypto Futures. You can request US Crypto Futures trading permission in Client Portal by clicking the User menu (head and shoulders icon in the top right corner) followed by Manage Account. Click the gear icon in the top right corner of the Trading Experience & Permissions section. Go to the "Futures" section and check off "United States (Crypto)".

What are the market data subscription options?

Live quotes for Crypocurrency futures are available on a paid subscription basis through Client Portal. The following subscriptions are offered (monthly subscription fees are posted to the IBKR website):

CME (Exchange = CME. IB Exchange = CME)

Non-Professional

- Level 1: CME Real-Time Non-Professional Level 1

- Level 1: US Securities Snapshot and Futures Value Bundle (NP,L1)

- Level 2: CME Real-Time Non-Professional Level 2

- Level 2: US Value Bundle PLUS (NP,L2)

- Requires US Securities Snapshot and Futures Value Bundle

- This is only for depth of book

Professional

- Level 2: CME Real-Time Professional Level 2 (There is no CME Pro level 1 product)

ICE (Exchange = ICE, IB Exchange = ICECRYPTO)

- Level 2: ICE Futures US - Digital Asset Futures Level 2 (There is no level 1 available for either professional or professional)

Back to Table of Contents: Bitcoin and Other Cryptocurrency Products @ IBKR

Risks of Volatility Products

Trading and investing in volatility-related Exchange-Traded Products (ETPs) is not appropriate for all investors and presents different risks than other types of products. Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities (such as futures and swaps) and risks associated with the effects of leveraged investing in geared funds. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. We have summarized several risk factors (as identified in prospectuses for ETPs and in other sources) and included links so you can conduct further research. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. By providing this information, Interactive Brokers (IB) is not offering investment or trading advice regarding ETPs to any customer. Customers (and/or their independent financial advisors) must decide for themselves whether ETPs are an appropriate investment for their portfolios.

Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

"EMIR": Reporting to Trade Repository Obligations and Interactive Brokers Delegated Service to help meet your obligations

Determining Tick Value

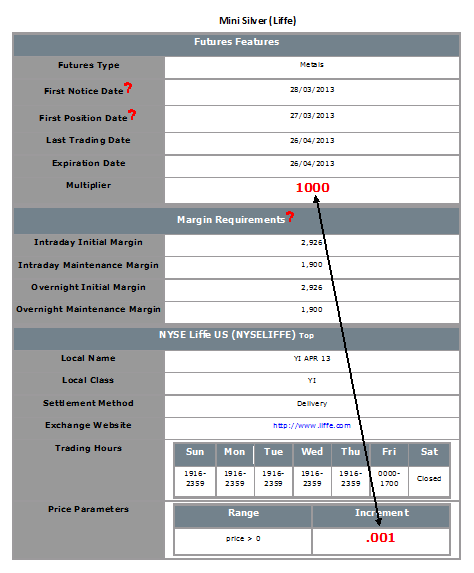

Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Tick values vary by instrument and are determined by the listing exchange. IB provides this information directly from the Contract Search tool on the website or via the Trader Workstation (TWS). To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. The contract specifications window for the instrument will then be displayed (Exhibit 1).

To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. As illustrated in the example below, the LIFFE Mini Silver futures contact has a tick value or minimum increment of .001 which, when multiplied by the contract multiplier of 1,000 ounces, results in a minimum tick value of $1.00 per contract. Accordingly, every tick change up or down results in a profit or loss of $1.00 per LIFFE Mini Silver futures contract.

Exhibit 1

Compatibility between MetaTrader and Interactive Brokers

Interactive Brokers (IBKR) provides to its account holders a variety of proprietary trading platforms at no cost and therefore does not actively promote or offer the platforms or add-on software of other vendors. Nonetheless, as IBKR's principal trading platform, the TraderWorkstation (TWS), operates with an open API, there are numerous third-party vendors who create order entry, charting and various other analytical programs which operate in conjunction with the TWS for purposes of executing orders through IBKR. As these API specifications are made public, we are not necessarily aware of all vendors who create applications to integrate with the TWS but do offer a program referred to as the Investors Marketplace which operates as a self-service community bringing together third party vendors who have products and services to offer with IBKR customers seeking to fill a specific need.

While MetaQuotes Software is not a participant of IBKR's Investors Marketplace, they offer to Introducing Brokers the oneZero Hub Gateway so that MetaTrader 5 can be used to trade IBKR Accounts[1]. Clients interested would need to contact oneZero directly for additional assistance. Please refer to the Contact section from the following URL.

Note: Besides oneZero Hub Gateway, different vendors such as Trade-Commander, jTWSdata and PrimeXM also offer a software which they represent, acts as a bridge between MetaTrader 4/5 and the TWS. As is the case with other third-party software applications, IBKR is not in a position to provide information or recommendations as to the compatibility or operation of such software.

1: oneZero is not available for Individual Accounts, please click here for more information on Introducing Brokers.

Commodity Futures & Futures Options Position Limits

Regulators and exchanges typically impose limits on the number of commodity positions any customer may maintain with the intent of controlling excessive speculation, deterring market manipulation, ensuring sufficient market liquidity for bona fide hedgers and to prevent disruptions to the price discovery function of the underlying market. These limits are intended as strict caps, with no one account or group of related accounts allowed to aggregate or maintain a position in excess of the stated limit. Outlined below is an overview of the various limit types, calculation considerations, enforcement and links for finding additional information.

I. POSITION LIMIT TYPES

Position limits generally fall into one of the following 4 categories:

1. All Months Limit - apply to the account holder's positions summed across all delivery months for a given contract (e.g. positions in CBOT Oat futures contract for the Mar, May, Jul, Sep and Dec delivery months combined).

2. Single Month Limit - apply to the account holder's positions in any given futures delivery month (e.g. positions in CBOT Oat futures contract for any of the Mar, May, Jul, Sep and Dec delivery months). Note that in certain instances, the limit may vary by delivery month.

3. Spot Month Limit - apply to the account holder's positions in the contract month currently in delivery. For example, the March contract month for a product having delivery months of March, June, September and December, while considered a nearby month at the start of the year, does not become a spot month contract for position limit purposes until the date it actually enters delivery. Most spot month limits become effective at the close of trading on the day prior to the First Notice Date (e.g., if the First Notice Date for a Dec contract is the last trading date of the prior month, then the spot month limit would apply as of the close of business on Nov 29th). In other instances, the limit goes into effect or tightens during the last 3-10 days of trading.

4. Expiration Month Limit - expiration month limits apply to the account holder's positions in the contract currently in its last month of trading. Most expiration month limits become effective at the open of trading on the first business day of the last trading month. If the contract ceases trading before delivery begins, then the expiration month may precede the delivery month. (e.g., if the last trade date for a Dec contract is Nov 30th, then the expiration month limit would apply as Nov 1st). In other instances, the limit goes into effect or tightens during the last 3-10 days of trading.

II. CALCULATION CONSIDERATIONS

- Position limits are determined by aggregating option and futures contracts. In the case of option contracts, the position is converted to an equivalent futures position based upon the delta calculations provided by the exchange.

- Positions in contracts with non-standard notional values (e.g. mini-sized contracts) are normalized prior to aggregation.

- Most limits are applied on a net position basis (long - short) although certain are applied on a gross position basis (long + short). For purposes of determining the net or gross position, long calls and short puts are considered equivalent to long futures positions (subject to the delta adjustment) and short calls and long puts equivalent to short futures positions.

- Limits are imposed on both an intra-day and end of day basis.

III. ENFORCING LIMITS

IB acts to prevent account holders from entering into transactions which would result in a position limit violation. This process includes monitoring account activity, sending a series of notifications intended to allow the account holder to self-manage exposure and placing trading restrictions upon accounts approaching a limit. Examples of notifications which are sent via email, TWS bulletin and Message Center are as follows:

1. Information Level - sent when the position exceeds 50% of the limit. Intended to inform as to the existence of the position limit and its level.

2. Warning Level - sent when the position exceeds 70% of the limit. Intended to provide advance warning that account will be subject to trading restrictions should exposure increase to 90%.

3. Restriction Level - sent when the position exceeds 90% of the limit. Provides notice that account is restricted to closing transactions until exposure has been reduced to 85%.

IV. ADDITIONAL INFORMATION

For additional information, including various exchange rules position limit thresholds by contract and limit type, please refer to the following website links:

CFE ( Rule 412) - http://cfe.cboe.com/publish/CFERuleBook/CFERuleBook.pdf

CME (Rule 559) - http://www.cmegroup.com/rulebook/CME/index.html

CME (CBOT Rule 559) - http://www.cmegroup.com/rulebook/CBOT/index.html

CME (NYMEX Rule 559) - http://www.cmegroup.com/rulebook/NYMEX/index.html

ELX Futures (Rule IV-11) - http://www.elxfutures.com/PDFs/Rulebooks/ELX-FUTURES-RULEBOOK.aspx

ICE US / NYBOT (Rules 6.26 to 6.28) - https://www.theice.com/publicdocs/rulebooks/futures_us/6_Regulatory.pdf

NYSE LIFFE (Rule 420) - http://www.nyseliffeus.com/rulebook

OneChicago (Rule 414) - http://www.onechicago.com/wp-content/uploads/rules/OneChicago_Current_Rulebook.pdf

Overview of the OneChicago NoDiv Contract

The OneChicago NoDiv single stock futures contract (OCX.NoDivRisk) differs from the Exchange's traditional single stock futures contract by virtue of its handling of ordinary distributions (e.g., dividends, capital gains, etc.). Whereas the traditional contract is not adjusted for such ordinary distributions (the discounted expectations are reflected in the price), the NoDiv contract is intended to remove the risk of dividend expectations through a price adjustment made by the clearinghouse. The adjustment is made on the morning of the ex-date to ensure that the effect of the distribution is removed from the daily mark-to-market or cash variation pay/collect.

For example, assume a NoDiv contract which closes at $50.00 on the business day prior the ex-date at which stockholders of a $1.00 dividend are to be determined. On the ex-date OCC will adjust that prior day's final settlement price from $50.00 downward by the amount of the dividend to $49.00. The effect of this adjustment will be to ensure that the dividend has no impact upon the cash variation pay/collect as of ex-date close (i.e., short position holder does not receive the $1.00 variation collect and the long holder incur the $1.00 payment).