Использование свободных денежных средств (cash sweep)

Согласно законодательству, все транзакции с ценными бумагами должны исполняться и обеспечиваться в сегменте ценных бумаг универсального счета, а транзакции с товарами – в сегменте товаров1. Хотя законом разрешено хранение позиций с полностью оплаченными ценными бумагами в сегменте товаров в качестве маржинального залога, IB хранит бумаги и товары в разных сегментах, тем самым ограничивая размер залога согласно более строгим правилам SEC. Поскольку решение о хранении позиций в том или ином сегменте определяется законодательством, единственным активом, который можно перемещать между сегментами с согласия клиента, являются наличные средства.

Ниже описаны варианты использования свободных денежных средств (применения cash sweep), как выбрать подходящий вариант и что при этом следует учесть.

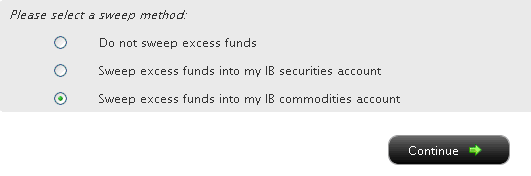

Выберите графу рядом с нужным вариантом и нажмите "Далее" (Continue). Настройки начнут действовать на следующий рабочий день и будут активны до тех пор, пока вы не выберите другой вариант. Обратите внимание, что если у вас есть необходимые торговые разрешения, описанные выше, менять настройки можно в любое время без ограничений.

A Comparison of U.S. Segregation Models (сравнение моделей разделения активов клиентов в США);

Key Information Documents (KID)

IBKR is required to provide EEA and UK retail customers with Key Information Documents (KID) for certain financial instruments.

Relevant products include ETFs, Futures, Options, Warrants, Structured Products, CFDs and other OTC products. Funds include both UCITS and non-UCITS funds available to retail investors.

Generally KIDs must be provided in an official language of the country in which a client is resident.

However, clients of IBKR have agreed to receive communications in English, and therefore if a KID is available in English all EEA and UK clients can trade the product regardless of their country of residence.

In cases where a KID is not available in English, IBKR additionally supports other languages as follows:

| Language | Can be traded by residents or citizens* of |

| German | Germany, Austria, Belgium, Luxembourg and Liechtenstein |

| French | France, Belgium and Luxembourg |

| Dutch | the Netherlands and Belgium |

| Italian | Italy |

| Spanish | Spain |

*regardless of country of residence

Are CDs purchased through IBKR FDIC insured?

Certificates of Deposit (CDs) offered by IBKR are not FDIC insured and are subject to the credit risk of the issuing bank.

ЧАВО: Миграция счетов в IBLUX в связи с Brexit

Данный документ содержит важную информацию относительно предлагаемого переноса Вашего счета из IBUK и IBLLC в IBLUX. Пожалуйста, прочтите его целиком, прежде чем принимать меры, описанные в присланном Вам по электронной почте сопроводительном письме.

Данная статья описывает ключевые изменения в регулировании, которые произойдут вследствие предложенного перевода (как указано ниже), и дает ответы на общие вопросы. Ее следует прочесть вместе с присланным Вам по электронной почте сопроводительным письмом. Если Вам потребуется дополнительная информация, воспользуйтесь контактными данными из сопроводительного письма, чтобы связаться с нами. Текущая статья служит заменой ранее опубликованным материалам под названием “ЧАВО: Миграция счетов в связи с Brexit” (т.н. исходные ЧАВО), поскольку она отражает самые новые сведения, с которыми мы просим Вас внимательно ознакомиться. В случае любых несоответствий с исходными ЧАВО, просим опираться на информацию, предоставленную в данной статье.

Объяснение:

Данная информационная брошюра разделена на три части.

- Часть А содержит ключевую информацию о предлагаемом переносе Вашего бизнеса.

- Часть B излагает основные нормативно-правовые вопросы, касающиеся процедур, изложенных в части A.

- В части C приведены ответы на другие возможные вопросы, а также практическая информация об изменениях, последующих за предлагаемым переносом.

ЧАСТЬ A – ПРЕДЛАГАЕМЫЙ ПЕРЕНОС

1. Что происходит и почему нужен перенос?

Как Вы знаете, в настоящее время Ваше сотрудничество с Interactive Brokers осуществляет Interactive Brokers (U.K.) Limited (“IBUK”), а оказываемые услуги предоставляет IBUK и, в зависимости от продуктов, наш филиал в США — Interactive Brokers LLC (“IBLLC”). Сейчас для предоставления своей части услуг в материковой Европе IBUK использует т.н. "паспорт финансового обслуживания". Мы предполагаем, что после завершения Брексита в этом году, IBUK не сможет его использовать, и с 1 января 2021 года Interactive Brokers необходимо будет сменить юридическое лицо, которое ведет с Вами бизнес.

2. В чем заключаются эти изменения?

Interactive Brokers создала новое юридическое лицо в Люксембурге, а именно Interactive Brokers Luxembourg SARL (“IBLUX”). Мы предлагаем перенести бизнес, который Вы в настоящее время ведете с IBUK и IBLLC, в IBLUX. Другими словами, все Ваши счета, инвестиции и услуги, оказываемые Вам IBUK и IBLLC, теперь будет хранить и оказывать IBLUX (далее “Предлагаемый перенос”).

3. Когда произойдет Предлагаемый перенос?

На данный момент перенос планируется осуществить после 30 октября 2020 года, в зависимости от готовности Вашего счета (т.е. выполнения необходимых действий, изложенных в сопроводительном письме).

4. Что собой представляет IBLUX? Чем занимается эта компания?

В ноябре 2018 года IBLUX получила разрешение от Комиссии Люксембурга по надзору за финансовым сектором (фр. Commission de Surveillance du Secteur Financier, CSSF) на осуществление деятельности инвестиционной фирмы. Правовой статус и положение IBLUX очень близки к IBUK. Это связано с тем, что и IBLUX, и IBUK уполномочены в рамках второй Директивы "О рынках финансовых инструментов" (англ. Markets in Financial Instruments Directive). Данная директива является общеевропейским законодательным актом, который призван унифицировать регулирование инвестиционных фирм.

Это не означает, что правила, которые применяются к Вашему счету сейчас и после переноса, не будут отличаться . Подробнее о данных отличиях рассказывается в части B ниже.

5. Каковы юридические сведения IBLUX?

Interactive Brokers Luxembourg SARL зарегистрирована в реестре компаний Люксембурга как частная компания с ответственностью, ограниченной акциями, (société à responsabilité limitée) (регистрационный номер B229091). Она зарегистрирована по адресу 4, rue Robert Stümper, L - 2557 Luxembourg (L - 2557, Люксембург, ул. Роберт Стампер, 4). Мы завершаем согласование сведений для повседневной связи с IBLUX и сообщим их позднее .

6. Кто регулирует IBLUX и как связаться с этим органом?

Уполномоченным надзорным органом IBLUX является Комиссия Люксембурга по надзору за финансовым сектором (CSSF) — в той же мере, в какой Управление финансового надзора Великобритании (англ. Financial Conduct Authority) регулирует IBUK. Контактные данные Комиссии Люксембурга по надзору за финансовым сектором (CSSF) приведены ниже:

Местонахождение

Commission de Surveillance du Secteur Financier

283, route d’ArlonL-1150

Luxembourg

Почтовый адрес и контактный телефон

Commission de Surveillance du Secteur Financier

L-2991 Luxembourg

Телефон: (+352) 26 25 11 факс: (+352) 26 25 12601

Справочная служба

E-mail: direction@cssf.lu

Телефон: (+352) 26 25 12 28 0

7. Какое место занимает IBLUX в группе компаний Interactive Brokers?

IBLUX является стопроцентной дочерней компанией Interactive Brokers Group.

8. Что данный переход означает для меня? Ожидаются ли существенные изменения?

Мы не ожидаем значительных изменений. Тем не менее, внимательно изучите данную статью, чтобы быть в курсе предстоящих изменений.

9. Что нужно сделать, чтобы и дальше быть клиентом Interactive Brokers?

Если Вы хотите продолжать вести дела с Interactive Brokers, Вам необходимо предпринять некоторые шаги.

В частности, необходимо подтвердить свое согласие с Клиентским соглашением и другими документами в приложении к сопроводительному письму, а также с вопросами регулирования, изложенными в сопроводительном письме. Чтобы подтвердить согласие, следуйте инструкциям в сопроводительном письме.

Обращаем Ваше внимание, что Вы можете не соглашаться с Предлагаемым переносом, если считаете, что он повлияет на Вас негативно. Однако в этом случае по окончании процедуры Брексита IBUK, скорее всего, не сможет обслуживать Ваш счет. Тогда счет подвергнется ликвидации, и Вам будет необходимо перевести свои активы к другому брокеру. Чтобы отказаться от переноса, следуйте инструкциям в сопроводительном письме.

В любом случае, перед тем как подтвердить свое согласие или отказ, внимательно и полностью изучите данную информационную брошюру и сопроводительное письмо.

10. Что дальше?

Если Вы согласны на перенос, выполните шаги, изложенные в сопроводительном письме, и мы подготовим Ваш счет к Предлагаемому переносу. После переноса Вы получите сообщение от IBLUX с дальнейшей информацией о сотрудничестве с компанией.

ЧАСТЬ B – НОРМАТИВНО-ПРАВОВЫЕ ИЗМЕНЕНИЯ

1. Какие положения и условия будут действовать после Предлагаемого переноса? Отличаются ли они от действующих сейчас?

Сделки, совершенные после Предлагаемого переноса, будут регулироваться Клиентским соглашением между Вами и IBLUX. Новое соглашение будет доступно Вам в электронной форме вместе с предложением подтвердить согласие. Информация о дате Предполагаемого переноса приведена в вопросе A3 выше.

2. Какие правила ведения бизнеса (включая лучшее исполнение) будут действовать для нового сотрудничества с IBLUX? Будут ли существенные изменения в соответствующем регламенте сотрудничества с IBLUX по сравнению с IBUK?

Перенос приведет к ряду изменений, описанных ниже.

Если Вы сотрудничаете с IBUK на основе “ведения” (другими словами, Вы торгуете индексными опционами, фьючерсами и фьючерсными опционами, и IBUK хранит Ваш счет и активы), тогда для Вас действуют правила ведения бизнеса, установленные Управлением финансового надзора Великобритании. Данные правила во многом основаны на дополненной Директиве "О рынках финансовых инструментов", Регламенте "О финансовых рынках" и различных делегированных директивах и регламентах (вместе “MiFID”). Касаемо лучшего исполнения, где оно применимо, IBUK обязана предпринять все необходимые меры, чтобы при исполнении ордера обеспечить для Вас лучший возможный результат.

Если Вы сотрудничаете с IBUK на основе “представления” (другими словами, Вы торгуете продуктами, не перечисленными в предыдущем параграфе, и явялетесь клиентом и IBUK, и филиала в США — IBLLC), то для Вас действует группа правил ведения бизнеса. Например, в отношении перевода своего бизнеса в IBLLC будут действовать правила ведения бизнеса, установленные Управлением финансового надзора Великобритании (подробнее об этом можно узнать выше). После перевода бизнеса в IBLLC для нашей компании (в т.ч. к ее обязанностям по обеспечению лучшего исполнения и хранения) будут применяться, в том числе, правила и регуляции Комиссии по ценным бумагам и биржам США (Securities and Exchange Commission) и Комиссии по торговле товарными фьючерсами США (Commodity Futures Trading Commission).

В целом, обращаем Ваше внимание, что Ваш бизнес может быть поделен между способами сотрудничества (другими словами, одна часть Вашего бизнеса ведется на основе "ведения", и другая — на основе "представления").

В дальнейшем мы не будем разграничивать два вида сотрудничества, и в каждом случае, описанном выше, для сотрудничества с IBLUX будут действовать правила ведения бизнеса Люксембурга. Как и правила Управления финансового надзора Великобритании, правила Люксембурга во многом основаны на MiFID, и обязательства IBLUX по обеспечению лучшего исполнения аналогичны действующим для IBUK.

По нашему мнению, хотя правила сотрудничества изменятся, такие изменения не являются существенными и не ухудшат степень защищенности Ваших средств.

3. Как будет осуществляться хранение моих инвестиций в IBLUX с нормативной/правовой точки зрения? Будут ли существенные изменения в соответствующем регламенте сотрудничества с IBLUX по сравнению с IBUK?

Применяемые в настоящий момент правила зависят от рода Вашего сотрудничества с IBUK (см. вопрос B2 выше). Если Вы сотрудничаете с IBUK на основе "ведения", для Вас будут действовать правила о клиентских активах Управления финансового надзора Великобритании (или правила “CASS”). Эти правила во многом основаны на MiFID. Если Вы сотрудничаете с IBUK и IBLLC на основе "представления", к Вашим активам будет применяться регламент хранения США.

Как описано выше, в дальнейшем мы не будем разграничивать два вида сотрудничества, и в каждом случае, описанном выше, для сотрудничества с IBLUX будет действовать регламент хранения Люксембурга. Как и правила Управления финансового надзора Великобритании, этот регламент во многом основан на MiFID.

4. Каковы условия защиты от убытков? Будут ли существенные изменения в соответствующем регламенте сотрудничества с IBLUX по сравнению с IBUK?

На данный момент Ваши активы застрахованы либо в Корпорации защиты фондовых инвесторов (“SIPC”), либо Программой Великобритании по компенсации в сфере финансовых услуг ("FSCS"). Применяемый режим зависит от сегмента Вашего счета IBUK, как описано в вопросе B2 выше. После перевода для Вас начнет действовать Система Люксембурга по компенсации инвесторам (Système d’indemnisation des investisseurs, SIIL), которая обеспечит сохранность Ваших активов в случае банкротства IBLUX.

Люксембургская система компенсаций схожа с доступной Вам в Великобритании, но у нее более низкий лимит. Она предназначена для возмещения потерянных Вами вложений (до определенной максимальной суммы) в одной из следующих ситуаций:

- Комиссия Люксембурга по надзору за финансовым сектором (CSSF) решила, что фирма не в состоянии рассчитаться с инвесторами/выполнить свои обязательства или

- Постановление суда препятствует возврату Ваших инвестиций фирмой.

Данная система реализуется Комиссией Люксембурга по надзору за финансовым сектором (фр. Commission de Surveillance du Secteur Financier, CSSF) и регулируется Советом по защите вкладчиков и инвесторов (фр. Conseil de protection des déposants et des investisseurs, CPDI). Если фирма, участвующая в системе, прекращает свою деятельность и оказывается неплатежеспособна, то у Вас может быть право на компенсацию согласно правилам системы.

IBLUX также относится к числу участников.

Охватываемые продукты включают:

- Акции частных и публичных компаний

- Бумаги коллективных инвестиционных схем

- Облигации слежения

- Фьючерсы и опционы

Как правило, Вы можете претендовать на компенсацию только после того, как фирма прекратит коммерческую деятельность, а ее активы будут ликвидированы и распределены между понесшими убытки лицами. Ознакомьтесь с ограничениями соответствующих систем – не все потери будут возмещены, поскольку действуют определенные лимиты. Система Люксембурга по компенсации инвесторам покрывает убытки максимум до 20 000 €.

5. Какова процедура подачи жалоб в IBLUX? Будут ли существенные изменения в соответствующем регламенте сотрудничества с IBLUX по сравнению с IBUK? Что делать, если моя жалоба относится ко времени, когда я еще являлся(-лась) клиентом IBUK?

Процедура подачи жалобы в IBLUX устанавливается новым Клиентским соглашением. Он в существенной степени совпадает с действующим в IBUK. Если жалоба касается чего-то, что произошло до Предлагаемого переноса, то ее следует адресовать IBUK. IBUK останется уполномоченной инвестиционной фирмой и после Брексита. Ее контактные данные не изменятся.

6. Останется ли у меня доступ к Службе финансового омбудсмена (FOS) Великобритании?

В случае жалоб инвесторы должны следовать процедурам, описанным в Клиентском соглашении. Служба финансового омбудсмена Великобритании утратит юридическую силу в отношении жалоб, как только произойдет перенос.

7. Как будет происходить обработка и защита моих личных данных? Будут ли мои отношения с IBLUX существенно отличаться от моих текущих отношений с IBUK в данном контексте?

Существенных изменений не произойдет.

ЧАСТЬ С – ДРУГИЕ ПРАКТИЧЕСКИЕ ВОПРОСЫ И ДАЛЬНЕЙШИЕ ШАГИ

1. С кем я могу связаться до и после Предлагаемого переноса, если у меня возникнут вопросы?

В целом, с любыми вопросами, возникшими до перевода Вашего счета, следует обращаться в IBUK, а после перевода — в IBLUX. Независимо от того, с кем Вы связались в Interactive Brokers, мы постараемся максимально быстро дать Вам ответ и соединим Вас с подходящим сотрудником или отделом.

2. Изменится ли предлагаемый выбор продуктов?

Мы полагаем, что большинство продуктов, доступных для торговли со счетов IBUK, также будут предлагаться в IBLUX. Однако действуют некоторые ограничения. Если Вы согласитесь на Предлагаемый перенос, то Ваш счет в IBLUX не будет поддерживать транзакции со следующими продуктами: (i) облигации; (ii) внебиржевые драгоценные металлы, и (iii) внебиржевые фьючерсы на металлы. Вдобавок в IBLUX недоступны валютные операции с кредитным плечом и "Программа повышения доходности акций", в которой Вы на данный момент можете участвовать.

Мы отдельно сообщим Вам, в какой мере Вас затрагивают эти изменения.

3. Я торгую внебиржевыми деривативами через IBUK — что случится с моими открытыми позициями?

Ваши открытые позиции будут переведены в IBLUX. Вы больше не будете связаны с IBUK правовыми отношениями по данным позициям. Мы вышлем Вам обновленный информационный документ (англ. Key Information Document, KID; воспользуйтесь ссылкой на соответствующую страницу в сопроводительном письме).

4. Что случится с залогом, предоставленным мной IBUK при маржинальном кредите?

Если Вы внесли залог или обеспечительный вклад, будучи клиентом IBUK/IBLLC, то он будет перемещен в IBLUX. Вам вряд ли придется принимать меры по смене бенефициара, но с нашей стороны могут потребоваться административные шаги, чтобы обновить регистры ценных бумаг. Это не должно повлиять на приоритет или дату вступления залога в силу.

5. Смогу ли я и дальше пользоваться текущей торговой платформой, или мне придется перейти на другое программное обеспечение после миграции?

Миграция не повлияет на ПО, которое Вы используете для торговли и контроля счета. Все системы останутся прежними.

6. Будут ли все средства переведены одновременно? Что произойдет с моим текущим счетом после миграции?

Ваш текущий счет будет закрыт после получения всех денежных начислений и их отправки на новый счет. После закрытия торговля с него станет невозможна, но у Вас останется доступ к его показателям и выпискам через меню выбора счета в "Портале клиентов".

7. Изменятся ли комиссии и сборы IBKR после миграции моего счета?

Нет. Комиссии и сборы IBKR не зависят от филиала, в котором находится Ваш счет.

8. Изменятся ли мои торговые разрешения после миграции счета?

После миграции Вы утратите возможность валютной торговли с кредитным плечом.

9. Будут ли активные ордера (например, ордер "Годен до отмены") перенесены вместе со счетом?

Активные ордера не будут перенесены на новый счет, и мы настоятельно рекомендуем Вам проверить их сразу после миграции, чтобы убедиться, что они соответствуют Вашим целям торговли.

10. Будет ли на меня распространяться правило США о системном дневном трейдинге после миграции счета?

Для счетов, находящихся в IBUK, действует правило США о системном дневном трейдинге (PDT), так как их операции перекладываются на IBLLC — брокера США. Правило PDT ограничивает счета, чей капитал составляет меньше 25 000 USD, до трех дневных сделок в течение пятидневного рабочего периода.

Поскольку операции счетов, переведенных в IBLUX, не будут происходить через IBLLC, правило PDT их не затронет

11. Получу ли я один общий годовой отчет по операциям в конце года?

Нет. Вы получите один отчет для Вашего текущего счета (от 1 января 2020 года до даты миграции) и второй отчет для нового счета (от даты миграции до 31 декабря 2020 года).

12. Сохранится ли базовая стоимость моих позиций после миграции счета?

Да, процесс миграции никак не повлияет на базовую стоимость позиций.

13. Останется ли конфигурация моего счета прежней?

Конфигурация счета после миграции будет сохранена в допустимой законом мере. Это касается таких характеристик, как рыночные данные, дополнительные пользователи, сигналы и право на маржу. В исключительных случаях счет будет переведен в юрисдикцию, где не разрешена торговля некоторыми продуктами. Владельцы счетов с такими продуктами смогут сохранить или закрыть эти позиции, но не увеличить их.

14. Изменятся ли мои реквизиты для входа?

Нет. Ваши имя пользователя, пароль и процесс двухфакторной аутентификации останутся прежними и после миграции. Однако Вашему счету будет присвоен новый ID-номер.

Как запросить замену Цифровой карты безопасности+ (ЦКБ+)

Приведенные ниже шаги необходимы, чтобы:

- Заменить утерянную, украденную или ставшую непригодной цифровую карту безопасности+;

- Запросить ЦКБ+ вместе с текущим устройством безопасности (если Вы являетесь новым или существующим клиентом с капиталом больше $ 1 000 000 или эквивалетной суммы в другой валюте).

1. Сообщите в службу поддержки IBKR: обратитесь в службу поддержки IBKR для получения временного доступа к счету. Обратиться в поддержку можно только по телефону; во время звонка Вам будет необходимо подтвердить свою личность (подробнее см. в "Базе знаний" IBKR).

2. Получите онлайн-карту кодов безопасности: активируйте онлайн-карту кодов безопасности, которая обеспечивает усиленную защиту и полный доступ к "Порталу клиентов" на 21 день. Подробнее о том, как получить карту, можно узнать в "Базе знаний" IBKR .

3. Запросите новое устройство защиты: активировав онлайн-карту кодов безопасности, запросите новую "Цифровую карту безопасности+" (ЦКБ+) в том же разделе "Система безопасного входа" на "Портале клиентов".

Запрос ЦКБ+

1. Нажмите на кнопку Запрос физического устройства (Request Physical Device).

.png)

.png)

3. Введите четырехзначный Мягкий PIN1 (Soft PIN) для Вашей ЦКБ+. Запомните PIN-код, который Вы ввели, т.к. он понадобится для активации и использования устройства. При желании Вы можете сменить счет, на котором будет заморожен депозит в размере 20 USD2. Нажмите Далее..png)

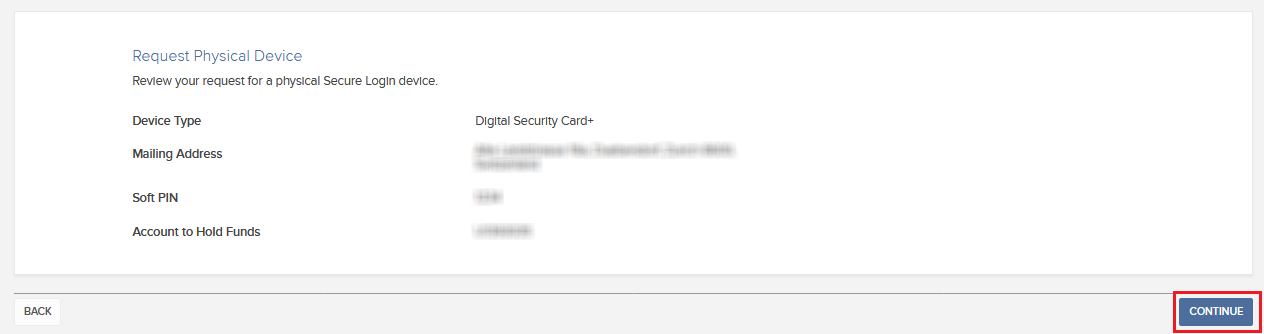

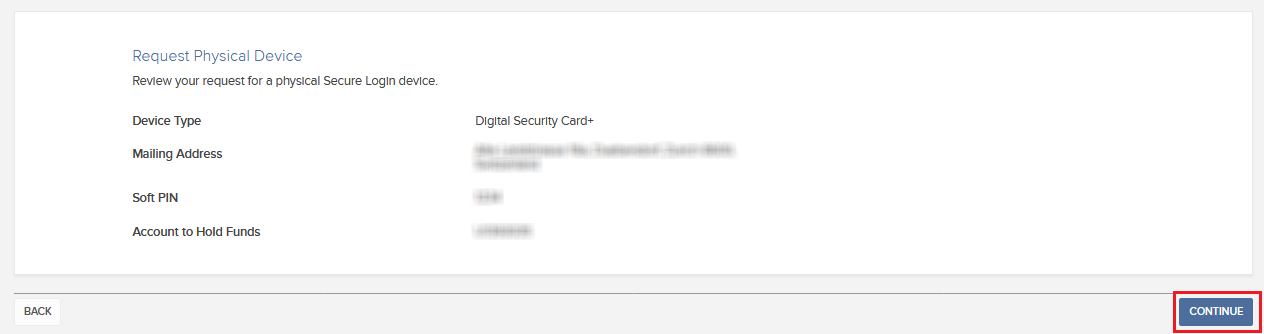

4. Вы увидите данные своего заказа. Убедитесь, что они верны. Если Вы захотите внести изменения, нажмите на белую кнопку Назад под полем с данными (не в браузере). Если данные верны, отправьте запрос, нажав Далее.

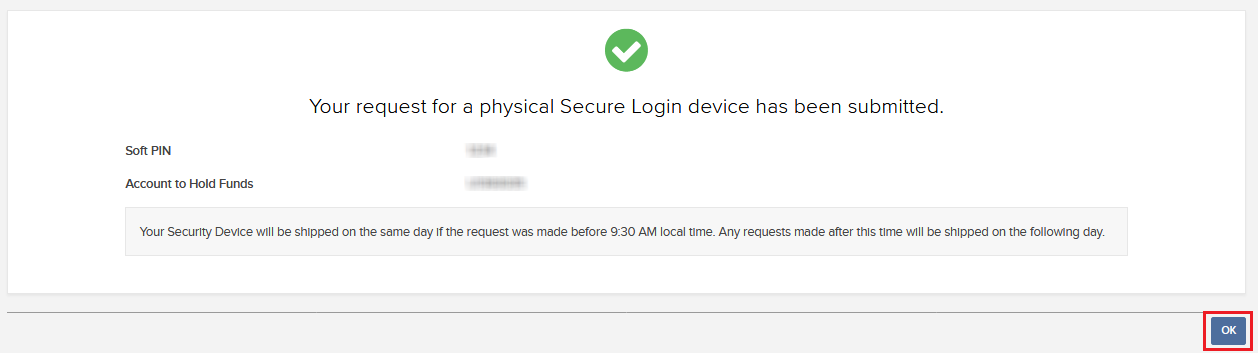

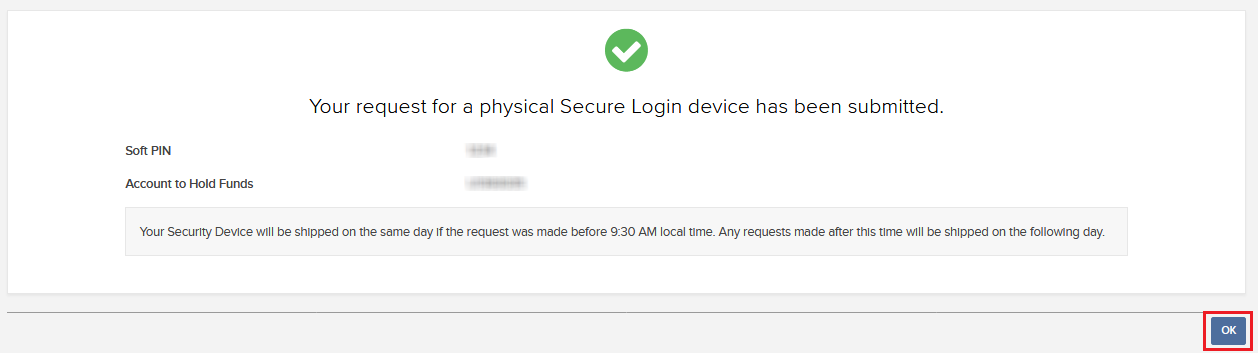

5. Вы увидите подтверждение с примерной датой доставки3. Для завершения нажмите OK.

1. Руководство по выбору PIN-кода доступно в "Базе знаний" IBKR.

2. Ключ безопасности и доставка бесплатны. Однако при заказе нового устройства на Вашем счете будет заморожена небольшая сумма (20 USD). В случае потери, повреждения или кражи устройства, а также если оно не возвращено IBKR при закрытии счета, эта сумма будет использована в качестве компенсации его стоимости. В остальных случаях сумма станет доступна после того, как Вы вернете устройство IBKR. Подробнее можно узнать в "Базе знаний" IBKR.

3. В целях безопасности замещающее устройство активируется автоматически по истечении 3-х недель с даты отправки. IBKR сообщит Вам о приближении срока и выполнении активации.

Ссылки

- Статья KB1131: общая информация о "Системе безопасного входа"

- Статья KB2636: информация и инструкции по устройствам безопасности

- Статья KB2481: инструкции о совместном использовании устройства безопасного входа двумя и более пользователями

- Статья KB2545: как снова подключить "Систему безопасного входа"

- Статья KB975: как вернуть устройство безопасности в IBKR

- Статья KB2260: как активировать аутентификацию по IB Key в IBKR Mobile

- Статья KB2895: двухфакторная система на нескольких устройствах (M2FS)

- Статья KB1861: информация о сборах и издержках, связанных с устройствами безопасности

- Статья KB69: информация о сроке действия временного кода доступа

Information Regarding SIPC Coverage

1. Interactive Brokers LLC is a member of SIPC.

2. SIPC protects cash and securities held with Interactive Brokers.

3. SIPC does not generally cover commodity futures or options on futures.

4. SIPC protects cash, including US dollars and foreign currency, to the extent that the cash was "deposited with Interactive Brokers for the purpose of purchasing securities."

5. SIPC does not generally cover cash or foreign currency that is not "deposited with Interactive Brokers for the purpose of purchasing securities." For example, SIPC does not generally cover cash in commodity futures trading accounts.

6. Interactive Brokers is not able to make any statements or representations about how cash deposited into a securities account in connection with forex trading or swept from a commodities account would be treated by SIPC. SIPC protection would depend in part on whether the cash was considered to be "deposited with Interactive Brokers for the purpose of purchasing securities." Interactive Brokers expects that at least one factor in deciding this would be whether and the extent to which the customer engages in securities trading in addition to or in conjunction with forex or commodities trading.

Account holders seeking further information should refer such inquiries to their own legal counsel or SIPC.

Excess Margin Securities

The term "excess margin securities" refers to margin securities carried for the account of a customer having a market value in excess of 140 percent of the total debit balance in the customer's account. These securities are in excess of the securities held in a customer's margin account that are pledged by the customer as collateral for the margin loan and can be used to support the purchase of additional securities on margin

Example:

A customer whose account equity consists solely of a cash balance of USD 10,000 on Day 1 purchases 400 shares of stock ABC at USD 50 per share on Day 2.

| Account Balance | Day 1 | Day 2 |

| Cash | $10,000 | ($10,000) |

| Stock | $0 | $20,000 |

| Total | $10,000 | $10,000 |

On Day 2, the customer's excess margin securities total USD 6,000. This is calculated by subtracting 140% of the margin debit or loan balance from the market value of the stock position ($6,000 = $20,000 - {1.4 * $10,000}).

The term is relevant from a regulatory perspective as the SEC requires that U.S. broker dealers segregate and maintain in a good control location (e.g., DTC or bank) all customer securities which are deemed excess margin securities. Such securities cannot be pledged or loaned to finance the activities of the firm or other customers without specific written permission from the customer. The portion of the securities classified as margin securities ($20,000 - $6,000 or $14,000 in this example) are subject to a lien and may be pledged or loaned by the broker to others to assist in financing the loan made to the customer.

Note that securities which were excess margin at the date of acquisition may later be reclassified as margin securities based upon the customer's subsequent trade and/or margin borrowing activity. For example, if the loan value of excess margin securities is subsequently used to acquire additional securities on margin, a portion of securities will then be reclassified as margin securities and subject to a lien. If the customer subsequently deposits cash or sells securities to reduce or eliminate the margin loan, the securities will be reclassified as excess margin or fully paid and are required to be segregated.

See also "fully paid securities".

Fully Paid Securities

The term "fully paid securities" refers to securities held in a customer's margin or cash account that have been completely paid for and are not being pledged as collateral to support the purchase of other securities on margin. The term is relevant from a regulatory perspective as the SEC requires that U.S. broker dealers segregate and maintain in a good control location (e.g., DTC or bank) all customer securities which are fully paid. Such securities cannot be pledged or loaned to finance the activities of the firm or other customers.

Note that securities which were fully paid at the date of acquisition may later be reclassified as margin or excess margin securities based upon the customer's subsequent trade and/or borrowing activity. For example, if the loan value of fully paid securities is subsequently used to acquire additional securities on credit, a portion of securities will then be classified as margin securities and subject to a lien and potential pledge or hypothecation by the broker.

See also "excess margin securities".

Comparison of U.S. Segregation Models

INTRODUCTION

The regulation of securities and commodities products and brokers1 in the U.S. is administered by two distinct federal agencies, the Securities and Exchange Commission (SEC) for securities including stocks, ETFs, bonds, options and mutual funds and the Commodities Futures Trading Commission (CFTC) for commodities including futures and options on futures.2 While both agencies seek to safeguard customer assets by restricting their use and “segregating” them from assets of the broker, the regulations and manner in which they accomplish this differs. The following article provides a basic overview of two segregation models and additional considerations relating to IB accounts.

OVERVIEW

Differences between the CFTC and SEC segregation models originate largely from the products themselves, whose characteristics are fundamentally unique. Commodity products, by nature, do not involve an extension of credit by the broker to the customer as a futures contract is not an asset but rather a contingent liability which is marked-to-market and a long futures option, while an asset, must be paid for in-full. Consequently, non-option assets in a commodities account are generally comprised of funds deposited as margin to secure performance on the contracts therein. Since the broker may not use the funds of one customer to margin or guarantee the transactions of another, the commodities segregation requirement (CFTC Rules 1.20 – 1.30) is equal to the gross assets of all customers and the broker needs to add its own funds to segregation to cover customers whose net equity is in deficit.

A securities margin account, in contrast, can facilitate the extension of credit for the purpose of long securities (e.g., stocks, bonds) purchases or short securities sales on a secured basis. The segregation or reserve requirement rules recognize this through special provisions for the protection of each of the cash and securities components, further distinguishing fully-paid securities from those whose purchase the broker has financed and maintains a lien upon. Here, the broker must deposit into a separate bank account the net amount of customer cash balances3, in accordance with a formula set forth in SEC Rule 15c3-3. In addition, the broker must identify and segregate in a good control location (e.g., depository, bank) customer securities which meet the definition of “fully paid” or “excess margin”.

The table below provides a comparison of the main principals of each model.

| COMPARISON OF CFTC & SEC SEGREGATION MODELS | ||

| PRINCIPAL | CFTC | SEC |

|

Separation of Customer Balances

|

Commodity customer balances must be maintained separate from firm assets and cannot be used to finance proprietary business activities or to satisfy firm debts.

Funds used for trading on non-US commodity exchanges must be kept separate from those used for trading on U.S. exchanges (even for the same customer). Commodity customer balances must also be maintained separate from securities customer balances (even for the same customer). |

Securities customer balances must be maintained separate from firm assets and cannot be used to finance proprietary business activities or to satisfy firm debts. Securities customer balances must also be maintained separate from commodity customer balances (even for the same customer).

|

|

Priority in the Event of Broker Default

|

Commodity customers maintain priority and equal claim over assets in each of their respective U.S. segregated and non-U.S. secured pools.

No claim on assets in a commodity pool in which one is not a participant and no claim on securities customer assets. If commodity segregated assets are insufficient to meet claims and broker is insolvent, customers share equally in shortfall and become general creditors for residual claims. |

Securities customers maintain priority and equal claim over assets.4

No claim on commodity segregated assets. If securities segregated assets are insufficient to meet claims, broker is insolvent and claims exceed SPIC coverage, customers share equally in shortfall and become general creditors for residual claims.

|

| Segregation Style |

Gross – the broker may not use the funds of one customer to margin or guarantee the transactions of another and must segregate assets in an amount at least equal to the sum of all customer credit balances. |

Net – broker may use customer cash credit balances to finance, on a secured basis, margin loans to other customers and may lend or pledge a portion of customer securities purchased on margin to other customers selling short.

|

| Investment of Cash Balances |

Broker is allowed to reinvest commodity customer’s cash balances and retain an interest in the income generated. Permissible investments include: U.S. government securities, municipal securities, government sponsored enterprise securities, bank CDs, corporate obligations (commercial paper, notes and bonds) fully guaranteed as to principal and interest by the U.S. under the Temporary Liquidity Guarantee Program and money market mutual funds. Securities which are the subject of reinvestment must be maintained in a segregated account. |

Broker is allowed to reinvest securities customer’s cash balances and retain an interest in the income generated. Permissible investments limited to “qualified securities” defined as securities which are guaranteed as to both interest and principal by the U.S. government. Securities which are the subject of reinvestment must be held in Special Reserve Bank Account (i.e., segregated). |

| Computation Frequency | Daily | Weekly |

| Insurance | None | Securities Investor Protection Corporation (SIPC) provides insurance of up to USD 500,000 with a cash sublimit of USD 250,000. |

ADDITIONAL CONSIDERATIONS

In addition to the safeguards afforded through segregation, IB employs a number of policies and practices which serve to enhance the safety and security of accounts beyond that outlined above. These include the following:

- IB computes its securities segregation or reserve requirement on a daily rather than weekly basis as allowed by regulation, thereby ensuring timely determination as to the amount required to be reserved and the deposit of funds necessary to satisfy the requirement.

- IB’s does not avail itself of the generally more permissive rules with respect to the investment of commodity customer cash balances. These balances are instead invested in a manner similar to that of securities cash balances (i.e., U.S. government securities) with the exception of an occasional investment in money market funds.

- All customer securities positions are held in the securities segment of the Universal Account as opposed to the commodities (commodities margin met with cash and/or futures options), thereby limiting their hypothecation to the more restrictive rules of the SEC.

- In addition to SIPC coverage, IB maintains an excess SIPC policy with Lloyd's of London which, in aggregate with SIPC, offers insurance totaling $30 million (with a cash sublimit of $900,000), subject to an aggregate firm limit of $150 million.

- IB offers account holders the ability to sweep cash balances in excess of that required for margin purposes in either the securities or commodities segment to the other segment. Details as to this feature may be found in KB1851.

- For additional information regarding IB strength and security, please review the following website page.

Other Relevant Knowledge Base Articles:

Information Regarding SIPC Coverage

Footnotes:

1The term broker as used in this article is intended to refer to an organization registered with both the SEC as a Broker-Dealer and the CFTC as a Futures Commission Merchant for the purpose of conducting customer transactions

2Single stock futures are a hybrid product jointly regulated by the SEC and CFTC and allowed to be carried in either account type.

3Including cash obtained through the use of customer securities such bank pledges or stock loans less cash required to finance customer transactions (e.g., stock borrows, customer fails to deliver of securities, or margin deposited for short option positions with OCC).

4Assets, or customer property, which securities customers share in proportion to their net equity claim, include cash, margin securities and fully-paid securities held in “street name”. IB does not hold securities in the customer’s name which are not considered bulk customer property.

How to request a Digital Security Card+ (DSC+) replacement

The below steps are required in order to:

- Replace a Digital Security Card+ which has been lost, stolen or has become inoperable

- Request a Digital Security Card+ alongside your current security device (if you are a new or existing Client with equity above $1,000,000, or equivalent)

1. Notify IBKR Client Services- Contact IBKR Client Services to obtain a temporary account access. This service can only be provided via telephone and requires the identity of the account holder to be verified, as detailed in the IBKR Knowledge Base.

2. Obtain an Online Security Code Card - Activate an Online Security Code Card, which offers enhanced protection and full Client Portal functionality for an extended period of 21 days. Please consult the IBKR Knowledge Base should you need guidance for this specific step.

3. Request the DSC+ replacement - Once you have completed the Online Security Code Card activation, please remain in the Secure Login System section of the Client Portal and order your replacement DSC.

Request a DSC+

1. Click on the button Request Physical Device.

.png)

.png)

3. Enter a four-digit Soft PIN1 for your DSC+. Please make sure to remember the PIN you are typing since it will be necessary to activate and to operate your device. When applicable and desired, you may change the account on which the 20 USD deposit will be kept on hold2. Complete this step by clicking on Continue..png)

4. The system will show you a summary of your selection. Please make sure the information displayed is correct. Should you need to perform changes, click on the white Back button under the information field (not your browser back button), otherwise submit the request by clicking on Continue.

5. You will receive a final confirmation containing the estimated shipment date3. Click on Ok to finalize the procedure.

1. For PIN guidelines, please consult the IBKR Knowledge Base.

2. The Security token and the shipment are both free of charge. Nevertheless, when you order your device, we will freeze a small amount of your funds (20 USD). If your device is lost, intentionally damaged, stolen or if you close your account without returning it to IBKR, we will use that amount as a compensation for the loss of the hardware. In any other case, the hold will be released once your device has been returned to IBKR. More details on the IBKR Knowledge Base.

3. For security reasons, the replacement device is set to auto-activate within three weeks from the shipment date. IBKR will notify you when the auto-activation is approaching and when it is imminent.

IBKR Knowledge Base References

- See KB1131 for an overview of the Secure Login System

- See KB2636 for information and procedures related to Security Devices

- See KB2481 for instructions about sharing the Security Login Device between two or more users

- See KB2545 for instructions on how to opt back in to the Secure Login System

- See KB975 for instructions on how to return your security device to IBKR

- See KB2260 for instructions on activating the IB Key authentication via IBKR Mobile

- See KB2895 for information about Multiple 2Factor System (M2FS)

- See KB1861 for information about charges or expenses associated with the security devices

- See KB69 for information about Temporary passcode validity