Sending Funds to IBKR Post Migration

If your account has recently migrated to IBKR Ireland (IBIE) or IBKR Central Europe (IBCE), it is likely that you have outdated bank instructions saved in your Client Portal or with your bank. When transferring funds to IBKR after migration, you will want to enter a new deposit notification/bank instruction within Client Portal and update any saved IBKR bank information that you have with your bank.

Should you inadvertently use outdated bank instructions to send funds to IBKR and they arrive at the incorrect IBKR entity, as a courtesy we will attempt to forward the funds to the correct IBKR entity. Please note that this transfer will be done free of charge for the first instance. For subsequent transfers, IBKR will charge your account a processing fee of EUR 50 (or equivalent). You will also receive a message notifying you of the transfer and advising you to update your bank information.

Summary of Third Party Transaction Fees

United Kingdom

- 0.5% of trade value Stamp Tax

- Panel of Takeovers and Mergers Levy of GBP 1.00 on all orders over GBP 10,000 on shares of companies registered in the United Kingdom, Isle of Man or Channel Islands

Ireland

- 1% of trade value Stamp Tax

Switzerland

- The Swiss transaction tax is not charged automatically by Interactive Brokers on individual accounts. Clients who are subject to the tax should consult a local tax advisor for support with their tax obligations.

France

- French Financial Transaction Tax: 0.30% of trade value applied to shares of companies whose head office is located in France and whose market capitalisation exceeds EUR 1 billion

Italy

- Italian Financial Transaction Tax: 0.10% for shares transacted on regulated markets and MTFs and 0.20% for those transacted outside of these markets.

Spain

- Spanish Financial Transaction Tax: 0.20% or trade value applied to shares of Spanish companies whose market capitalisation exceeds EUR 1,000 million as of December 1 of the year preceding the date of acquisition.

Belgium

- The Belgian Tax on stock-exchange transactions (TST) is not charged automatically by Interactive Brokers on individual accounts. Clients who are subject to the tax should consult a local tax advisor for support with their tax obligations.

Hong Kong

- For stocks, warrants and structured products traded on the SEHK:

- Government stamp duty: 0.13%, rounded up to the nearest 1.00 for SEHK stocks, normally applies only to stocks

- SFC transaction levy: 0.0027%, normally applies to stocks, warrants and CBBCs

- FRC Transaction levy: 0.00015%, normally applies to stocks, warrants and CBBCs

- For products traded on the Shanghai-Hong Kong Stock Connect Northbound Trading Link and Shenzhen-Hong Kong Stock Connect:

- 0.1% Sale Proceeds Stamp Duty

Shares Subject To The Spanish Financial Transaction Tax

The following table lists the companies included in the scope of the Spanish Financial Transaction Tax as of December 2020. Based on the Spanish declaration, companies meeting the following qualifications would fall within the scope of the FTT:

- The shares must have been admitted to trading on a regulated market which may be the Spanish market, a market of another European Union Member state or an equivalent market in a third country

- The company's market capitalization must exceed EUR 1,000 million as of December 1 of the year preceding the year that the acquisition takes place (reviewed annually)

The list of companies provided below is being done on a best efforts basis and may be subject to ammendments at any time and without notification.

The list of ADRs which are subject to the Spanish Financial Transaction Tax are detailed at the bottom of this page.

| Company Name | Symbol | Exchange |

| ACS ACTIVIDADES CONS Y SERV | ACS | BM |

| ACERINOX SA | ACX | BM |

| ACERINOX SA | ACXN | MEXI |

| AENA SME SA | AENA | BM |

| AENA SME SA | AENAN | MEXI |

| CORPORACION FINANCIERA ALBA | ALB | BM |

| ALMIRALL SA | ALM | BM |

| AMADEUS IT GROUP SA | AMS2 | BM |

| ACCIONA SA | ANA | BM |

| APPLUS SERVICES SA | APPS | BM |

| BANCO BILBAO VIZCAYA ARGENTA | BBVA | BM |

| BANCO BILBAO VIZCAYA ARGENTA | BBVA | MEXI |

| BANKIA SA | BKIA | BM |

| BANKIA SA | BKIAN | MEXI |

| BANKINTER SA | BKT | BM |

| BANKINTER SA | BKTN | MEXI |

| BANCO SANTANDER SA | BNC | LSE |

| CAIXABANK S.A | CABK | BM |

| CONSTRUCC Y AUX DE FERROCARR | CAF | BM |

| CONSTRUCC Y AUX DE FERROCARR | CAFEN | MEXI |

| PROSEGUR CASH SA | CASH2 | BM |

| PROSEGUR CASH SA | CASHN | MEXI |

| CIE AUTOMOTIVE SA | CIE | BM |

| CIE AUTOMOTIVE SA | CIEAN | MEXI |

| CELLNEX TELECOM SA | CLNX | BM |

| CELLNEX TELECOM SA | CLNXN | MEXI |

| INMOBILIARIA COLONIAL SOCIMI | COL | BM |

| AMREST HOLDINGS SE | EAT | WSE |

| AMREST HOLDINGS SE | EAT | BM |

| AMREST HOLDINGS SE | EATN | MEXI |

| EBRO FOODS SA | EBRO | BM |

| EDP RENOVAVEIS SA | EDPR | BVL |

| EUSKALTEL SA | EKT1 | BM |

| EUSKALTEL SA | EKTN | MEXI |

| ENDESA SA | ELE | BM |

| ENDESA SA | ELE1N | MEXI |

| ENAGAS SA | ENG | BM |

| FAES FARMA SA - | FAE | BM |

| FOMENTO DE CONSTRUC Y CONTRA | FCC | BM |

| FLUIDRA SA | FDR | BM |

| FLUIDRA SA | FDRN | MEXI |

| FERROVIAL SA | FER | BM |

| SIEMENS GAMESA RENEWABLE ENE | GAM | BM |

| NATURGY ENERGY GROUP SA | GAS | BM |

| GRUPO CATALANA OCCIDENTE SA | GCO | BM |

| GRUPO CATALANA OCCIDENTE SA | GCON | MEXI |

| GESTAMP AUTOMOCION SA | GEST | BM |

| GESTAMP AUTOMOCION SA | GESTN | MEXI |

| GRIFOLS SA | GRF | BM |

| GRIFOLS SA - B | GRF.P | BM |

| INTL CONSOLIDATED AIRLINE-DI | IAG | LSE |

| INTL CONSOLIDATED AIRLINE-DI | IAG | BM |

| INTL CONSOLIDATED AIRLINE-DI | IAGN | MEXI |

| IBERDROLA SA | IBE | BM |

| IBERDROLA SA | IBEN | MEXI |

| INDRA SISTEMAS S.A. | IDR | BM |

| INDUSTRIA DE DISENO TEXTIL | ITX | BM |

| INDUSTRIA DE DISENO TEXTIL | ITXN | MEXI |

| CIA DE DISTRIBUCION INTEGRAL | LOG | BM |

| MAPFRE SA | MAP | BM |

| MELIA HOTELS INTERNATIONAL | MEL | BM |

| MELIA HOTELS INTERNATIONAL | MELN | MEXI |

| MERLIN PROPERTIES SOCIMI SA | MRL | BM |

| NH HOTEL GROUP SA | NHH | BM |

| PHARMA MAR SA | PHM | BM |

| PHARMA MAR SA | PHM1N | MEXI |

| PROSEGUR COMP SEGURIDAD | PSG | BM |

| RED ELECTRICA CORPORACION SA | REE | BM |

| RED ELECTRICA CORPORACION SA | REEN | MEXI |

| REPSOL SA | REP | BM |

| REPSOL SA | REPSN | MEXI |

| LABORATORIOS FARMACEUTICOS R | ROVI | BM |

| BANCO DE SABADELL SA | SAB2 | BM |

| BANCO SANTANDER SA | SAN | MEXI |

| BANCO SANTANDER SA | SAN | WSE |

| BANCO SANTANDER SA | SAN1 | BM |

| SACYR SA | SCYR | BM |

| SIEMENS GAMESA RENEWABLE ENE | SGREN | MEXI |

| SOLARIA ENERGIA Y MEDIO AMBI | SLR | BM |

| TELEFONICA SA | TEF | BM |

| TELEFONICA SA | TEF1N | MEXI |

| TELEFONICA SA | TEFOF | PINK |

| MEDIASET ESPANA COMUNICACION | TL5 | BM |

| MEDIASET ESPANA COMUNICACION | TL5N | MEXI |

| UNICAJA BANCO SA | UNI2 | BM |

| VIDRALA SA | VID | BM |

| VISCOFAN SA | VIS | BM |

| VISCOFAN SA | VISCN | MEXI |

| ZARDOYA OTIS SA | ZOT | BM |

| ZARDOYA OTIS SA | ZOTN | MEXI |

The following is a list of ADRs which are subject to the Spanish Financial Transaction Tax.

| Company Name | Symbol | Exchange |

| ACERINOX SA-UNSPON ADR | ANIOY | PINK |

| ACS ACTIVIDADES CONS-UNS ADR | ACSAY | PINK |

| AENA SME SA-ADR | ANYYY | PINK |

| AMADEUS IT GROUP-UNSP ADR | AMADY | PINK |

| BANCO BILBAO VIZCAYA-SP ADR | BBVA | NYSE |

| BANCO DE SABADELL-UNSPON ADR | BNDSY | PINK |

| BANCO SANTANDER SA-SPON ADR | SAN | NYSE |

| BANKIA SA-UNSP ADR | BNKXY | PINK |

| BANKINTER SA-SPONS ADR | BKNIY | PINK |

| CAIXABANK- UNSPON ADR | CAIXY | PINK |

| CELLNEX TELECOM SAU-UNSP ADR | CLLNY | PINK |

| EBRO FOODS SA -UNSP ADR | EBRPY | PINK |

| ENAGAS-UNSPONSORED ADR | ENGGY | PINK |

| ENDESA SA-UNSP ADR | ELEZY | PINK |

| FERROVIAL SA-UNSPONSORED ADR | FRRVY | PINK |

| FOMENTO DE CONST-UNSPON ADR | FMOCY | PINK |

| GRIFOLS SA-ADR | GRFS | NASDAQ |

| GRIFOLS SA-SPON ADR | GIKLY | PINK |

| IBERDROLA SA-SPONSORED ADR | IBDRY | PINK |

| INDITEX-UNSPON ADR | IDEXY | PINK |

| INDRA SISTEMAS SA-UNSP ADR | ISMAY | PINK |

| MAPFRE SA-UNSP ADR | MPFRY | PINK |

| NATURGY ENERGY GROUP SA-ADR | GASNY | PINK |

| PROSEGUR CASH SA - UNSP ADR | PGUCY | PINK |

| RED ELECTRICA COR-UNSPON ADR | RDEIY | PINK |

| REPSOL SA-SPONSORED ADR | REPYY | PINK |

| TELEFONICA SA-SPON ADR | TEF | NYSE |

| TELEFONICA SA-SPON ADR | TNE2 | IBIS |

| TELEFONICA SA-SPON ADR | TEFN | MEXI |

| ABENGOA SA-UNSPON ADR | ABGOY | PINK |

| ABERTIS INFRAESTR-UNSPON ADR | ABRTY | VALUE |

| ATRESMEDIA CORP DE -UNSP ADR | ATVDY | PINK |

| BOLSAS Y MERCADOS ESP-UN ADR | BOLYY | VALUE |

| DISTRIBUIDORA INT-UNSP ADR | DIDAY | PINK |

| GAMESA CORP TECN-UNSPON ADR | GCTAY | PINK |

| PROMOTORA DE INFORMA-ADR | PRISY | PINK |

Information Regarding the Spanish Financial Transaction Tax

Overview

This document provides an overview of how the Spanish Financial Transaction Tax (FTT) will be handled by Interactive Brokers.

Effective January 16, 2021, a new tax will be implemented on the purchase of certain Spanish securities.

Tax Rate

The announced tax is 0.20%.

Scope

The FTT will be applied to shares of Spanish companies whose market capitalisation exceeds EUR 1,000 million as of December 1 of the year preceding the year that the acquisition takes place. The shares must have been admitted to trading on a regulated market which may be the Spanish market, a market of another European Union Member state or an equivalent market in a third country. The Spanish Ministry of Finance will publish a list of Spanish companies with a market cap exceeding this threshold by December 31 each year. The Ministry of Finance will review and republish the list the first month the FTT is in place.

The following cases are subject to the Spanish FTT:

- Shares acquired on an exchange transaction

- Shares acquired on the execution or settlement of fixed-income securities which may be converted or exchanged for shares

- Shares acquired as a result of execution or settlement of financial derivatives (i.e. stock option exercise/assignment)

- Shares acquired from the execution of finance contracts defined in article 2.1 of Order EHA3537/2005 (contracts not traded on official secondary markets for which a credit institution receives money or securities from customers assuming a repayment obligation)

Accrual

Tax becomes payable on the settlement date of the transaction

Tax Base

There will be a special calculation for intra-day transactions. Therefore, only the net settlement will be taxed.

Exposure Fee Calculations Overview

Introduction

IBKR's global risk management routine includes a daily execution of computations through which each client’s portfolio is stress tested to determine its exposure to a series of prices changes beyond that protected by margin. These stress tests serve to identify accounts that, while margin compliant, project losses which exceed the account’s equity were these scenarios to be realized and which IBKR regards as excessive. In an effort to increase client awareness as to their potential exposure, IBKR has implemented a daily Exposure Fee, that is assessed to any account reporting end of day uncovered risk in excess of specified levels.

Current Exposure Fee Overview

The current Exposure Fee calculation is intended to reflect a more comprehensive set of market scenarios in addition to price dependencies among all products types. The calculation is based upon a Monte Carlo simulation which incorporates thousands of market scenarios and projects the exposure of your portfolio assuming sector-based price changes (e.g., individual stock and sectors such as oil, gas, meat, sugar, cocoa, metals, foreign exchange & crypto-currencies), and then applying this evaluation to all other products based upon their respective sector correlation.

Managing the Exposure Fee

At the initial point an account is detected as being subject to the Exposure Fee, a communication will be sent out explaining the fee and affording the account holder one week to adjust positions and equity before the Fee, if still applicable, will take effect. To assist with avoidance or mitigation of the Fee, IBKR provides a daily Exposure Fee Calculation report via Account Management which details the Fee and provides examples of hypothetical adjustments to existing positions which, if implemented, are projected to reduce the Fee given information then available.

Primary Risk Factors

Each portfolio will be re-valued based upon stressing each primary risk factor, which is represented by a future contract, index or ETF, and all other product(s) in the portfolio will adjusted based upon their correlation associated with that primary risk factor.

Below is a summary of each risk factor, the representing Future Contract, Index or ETF, and the upper and lower range in which we stress each risk factor.

| Risk Factors | Product | Lower Bound | Upper Bound |

| Equity | S&P 500 Index (SPX) | -30.00% | 20.00% |

| Australia Equity | S&P 500 / ASX 200 Index Australia Index (AP) | -30.00% | 20.00% |

| United Kingdom Equity | FTSE 100 Index (Z) | -30.00% | 20.00% |

| European Equity | Dow Jones Euro STOXX50 Index (ESTX50) | -30.00% | 20.00% |

| Hong Kong Equity | Hang Seng Index (HSI) | -30.00% | 20.00% |

| Japanese Equity | Nikkei 225 Index (N225) | -30.00% | 20.00% |

| Korean Equity | Korean Stock Exchange KOSPI 200 Index (K200) | -30.00% | 20.00% |

| Mainland China Equity | FTSE China A50 Index (XINA50) | -30.00% | 20.00% |

| Indian Equity | CNX NIFTY Index (NIFTY) | -30.00% | 20.00% |

| Individual Stocks | -50.00% | 50.00% | |

| Oil (Crude Oil) | Light Sweet Crude Oil Futures | -32.00% | 62.00% |

| Oil (Brent Oil) | Brent Crude Oil Futures | -30.00% | 60.00% |

| CO2 | ICE ECX EUA Futures (ECF) | -74.30% | 59.50% |

| Treasury | iShares 20+ Year Treasury Bond ETF (TLT) | -19.80% | 15.60% |

| Treasury1 | iShares 1-3 Year Treasury Bond ETF (SHY) | -1.80% | 1.20% |

| Treasury2 | iShares 1-3 Year International Treasury Bond ETF (ISHG) | -9.80% | 10.00% |

| Italian Govt Bond | Euro-BTP Italian Government Bond | -13.00% | 13.00% |

| BAX | 3 Month Canadian Bankers' Acceptance Futures | -0.40% | 0.40% |

| EuroBund | Euro Fund (10 Year Bond - GBL) | -7.60% | 8.60% |

| JGB | Japanese Government Bonds (JGB) | -2.20% | 2.20% |

| Live Cattle | Live Cattle (LE) | -30.00% | 30.00% |

| Feeder Cattle | Feeder Cattle (GF) | -30.00% | 30.00% |

| Hogs | Lean Hogs Index (HE) | -30.00% | 30.00% |

| Ind. Metals. | COMEX Copper Index (HG) | -25.30% | 22.10% |

| Prec. Metals | SPDR Gold Shars (GLD) | -20.70% | 34.50% |

| Silver | COMEX Silver Index (SI) | -26.20% | 28.80% |

| Wheat | ETFS Wheat (OD7S) | -40.90% | 64.70% |

| Corn | Teucrium Corn Fund (CORN) | -23.50% | 41.50% |

| Soybean | Teucrium Soybean Fund (SOYB) | -22.60% | 27.40% |

| Rice | Rough Rice Futures (ZR) | -22.60% | 27.40% |

| Cocoa | iPath Bloomberg Cocoa Subindex Total Return (NIB) | -28.60% | 37.40% |

| Gas | United States Natural Gas Fund (UNG) | -18.80% | 62.00% |

| Crypto | The NYSE bitcoin Index (NYXBT) | -100.00% | 93.90% |

| Sugar | iPath Bloomberg Sugar Subindex Total Return (SGGFF) | -34.50% | 52.30% |

| Cotton | ETFS Cotton (COTN) | -50.00% | 50.00% |

| Coffee | iPath Bloomberg Coffee Subindex Total Return (JJOFF) | -30.00% | 50.00% |

| Lumber | Random Length Lumber (LB) | -30.00% | 30.00% |

| Milk | Milk Class III Index (DA) | -15.00% | 15.00% |

| Orange Juice | FC Orange Juice "A" (OJ) | -35.00% | 35.00% |

| Forex Risk Factor | Lower Bound | Upper Bound |

| AUD | -18.10% | 18.10% |

| BGN | -6.80% | 6.80% |

| BRL | -17.00% | 17.00% |

| CAD | -13.70% | 13.70% |

| CHF | -13.90% | 13.90% |

| CNH | -8.20% | 8.20% |

| CNY | -6.70% | 6.70% |

| CYP | -7.20% | 7.20% |

| CZK | -9.50% | 9.50% |

| DKK | -7.90% | 7.90% |

| EEK | -5.50% | 5.50% |

| EUR | -9.90% | 9.90% |

| GBP | -13.00% | 13.00% |

| HKD | -8.00% | 8.00% |

| HRK | -7.00% | 7.00% |

| HUF | -20.50% | 20.50% |

| ILS | -8.80% | 8.80% |

| INR | -12.40% | 12.40% |

| ISK | -9.90% | 9.90% |

| JPY | -16.80% | 16.80% |

| KRW | -18.00% | 18.00% |

| LTL | -7.20% | 7.20% |

| LVL | -7.00% | 7.00% |

| MTL | -7.20% | 7.20% |

| MXN | -16.70% | 16.70% |

| NOK | -12.90% | 12.90% |

| NZD | -14.60% | 14.60% |

| PLN | -31.40% | 31.40% |

| RON | -6.90% | 6.90% |

| RUB | -40.00% | 40.00% |

| SEK | -13.20% | 13.20% |

| SGD | -6.30% | 6.30% |

| SIT | -7.20% | 7.20% |

| SKK | -7.20% | 7.20% |

| TRY | -40.10% | 40.10% |

| TWD | -14.20% | 14.20% |

| USD | -9.30% | 9.30% |

| ZAR | -19.00% | 19.00% |

For additional information concerning this Exposure Fee Calculation report, please see KB3113.

French Withholding Tax Reclaim

European withholding taxes on dividends are taxed at source. This means that the tax is withheld by the depository prior to remittance of the distribution to IBKR and the subsequent credit of the net distribution to the accounts of any IBKR's customer.

As outlined in the customer agreement, IBKR holds all shares in street name. For this reason the rate between the dividend paying country (France) and the receiving country (IB LLC US) is 28% for 2020 (reduced from 30% for 2019). While you may hold an account with Interactive Brokers UK, IBUK in turn acts as an introducing broker for Interactive Brokers LLC. As such, Interactive Brokers LLC is the street facing holder of shares. See the below link to the IBKR Customer Agreement for further clarification. In case the link does not work, find the Forms and Disclosures link at the bottom of the Interactive Brokers website and select Agreements followed by Customer Agreements and IB UK Limited Customer Agreement:

On French stock dividends, IBKR can facilitate the process of dividend tax reclaim. To reclaim taxes you are required to complete Forms 5000 and 5001. Please return the completed forms to IBKR initially as an attachment to an Inquiry Ticket. Upon receipt, IBKR will review the forms and confirm if they can be accepted. Once reviewed, the original forms should be sent to:

Snapshot Market Data

BACKGROUND

IBKR offers eligible clients the option of receiving a real-time price quote for a single instrument on a request basis. This service, referred to as “Snapshot Quotes” differs from the traditional quote services which offer continuous streaming and updates of real-time prices. Snapshot Quotes are offered as a low-cost alternative to clients who do not trade regularly and require data from specific exchanges1 when submitting an order. Additional details regarding this quote service is provided below.

QUOTE COMPONENTS

The Snapshot quote includes the following data:

- Last price

- Last size

- Last exchange

- Current bid-ask

- Size for each of current bid-ask

- Exchange for each of current bid-ask

AVAILABLE SERVICES

| Service | Restrictions | Price per Quote Request (USD)2 |

|---|---|---|

| AMEX (Network B/CTA) | $0.01 | |

| ASX Total | No access to ASX24. Limited to Non-Professional subscribers |

$0.03 |

| Bolsa de Madrid | $0.03 | |

| Canadian Exchange Group (TSX/TSXV) | Limited to Non-Professional subscribers who are not clients of IB Canada | $0.03 |

| CBOT Real-Time | $0.03 | |

| CME Real-Time | $0.03 | |

| COMEX Real-Time | $0.03 | |

| Eurex Core | Limited to Non-Professional subscribers | $0.03 |

| Euronext Basic | Limited to Non-Professional subscribers Includes Euronext equities, indices, equity derivatives and index derivatives. |

$0.03 |

| German ETF's and Indices | Limited to Non-Professional subscribers | $0.03 |

| Hong Kong (HKFE) Derivatives | $0.03 | |

| Hong Kong Securities Exchange (Stocks, Warrants, Bonds) | $0.03 | |

| Johannesburg Stock Exchange | $0.03 | |

| Montreal Derivatives | Limited to Non-Professional subscribers | $0.03 |

| NASDAQ (Network C/UTP) | $0.01 | |

| Nordic Derivatives | $0.03 | |

| Nordic Equity | $0.03 | |

| NYMEX Real-Time | $0.03 | |

| NYSE (Network A/CTA) | $0.01 | |

| OPRA (US Options Exchanges) | $0.03 | |

| Shanghai Stock Exchange 5 Second Snapshot (via HKEx) | $0.03 | |

| Shenzhen Stock Exchange 3 Second Snapshot (via HKEx) | $0.03 | |

| SIX Swiss Exchange | Limited to Non-Professional subscribers | $0.03 |

| Spot Market Germany (Frankfurt/Xetra) | Limited to Non-Professional subscribers | $0.03 |

| STOXX Index Real-Time Data | Limited to Non-Professional subscribers | $0.03 |

| Toronto Stk Exchange | Limited to Non-Professional subscribers who are clients of IB Canada | $0.03 |

| TSX Venture Exchange | Limited to Non-Professional subscribers who are clients of IB Canada | $0.03 |

| UK LSE (IOB) Equities | $0.03 | |

| UK LSE Equities | $0.03 |

1In accordance with regulatory requirements, IBKR no longer offers delayed quotation information on U.S. equities to Interactive Brokers LLC clients. All clients (IBKR Lite and Pro) have access to streaming real-time US equity quotes from Cboe One and IEX at no charge. Since this data does not include all markets, IB does not show this quote when entering parameters for an order in a US stock quote. IB customers are able to access a snapshot of real-time quote information for US stocks at the point of order entry.

2Cost is per snapshot quote request and will be assessed in the Base Currency equivalent, if not USD.

ELIGIBILITY

- Accounts must maintain the Market Data Subscription Minimum and Maintenance Equity Balance Requirements in order to qualify for Snapshot quotes.

- The Users must operate TWS Build 976.0 or higher to access Snapshot quote functionality.

PRICING DETAILS

- Clients will receive $1.00 of snapshot quotes free of charge each month. Free snaphots may be applied to either U.S. or non-U.S. quote requests and charges will be applied, without additional notice, once the free allocation has been exhausted. Clients may review their snapshot usage as of the close of each business day via the Client Portal.

- Quote fees are assessed on a lag basis, generally in the first week after the month in which Snapshot services were provided. Accounts which do not have sufficient cash or Equity With Loan Value to cover the monthly fee will be subject to position liquidations.

- The monthly fee for snapshots will be capped at the related streaming real-time monthly service price. At which time the streaming quotes will be provided at no additional cost for the remainder of the month. The switch to streaming quotes will take place at approximately 18:30 EST the following business day after reaching the snapshot threshold. At the close of the month, the streaming service will automatically terminate and the snapshot counter will reset. Each service is capped independently of the others and quote requests for one service cannot be counted towards the cap of another. See table below for sample details.

| Service | Price per Quote Request (USD) | Non-Pro Subscriber Cap (Requests/Total Cost)2 | Pro Subscriber Cap (Requests/Total Cost)3 |

|---|---|---|---|

| AMEX (Network B/CTA) | $0.01 | 150/$1.50 | 2,300/$23.00 |

| NASDAQ (Network C/UTP) | $0.01 | 150/$1.50 | 2,500/$25.00 |

| NYSE (Network A/CTA) | $0.01 | 150/$1.50 | 4,500/$45.00 |

Market Data Non-Professional Questionnaire

Insight into completing the new Non-Professional Questionnaire.

The NYSE and most US exchanges require vendors to positively confirm the market data status of each customer before allowing them to receive market data. Going forward, the Non-Professional Questionnaire will be used to identify and positively confirm the market data status of all customer subscribers. As per exchange requirements, without positively identifying customers as non-professional, the default market data status will be professional. The process will protect and maintain the correct market data status for all new subscribers. For a short guide on non-professional definitions, please see https://ibkr.info/article/2369.

Each question on the questionnaire must be answered in order to have a non-professional designation. As exchanges require positive confirmations of proof for non-professional designations, an incomplete or unclear Non-Professional Questionnaire will result in a Professional designation until the status can be confirmed.

If the status should change, please contact the helpdesk.

Explanation of questions:

1) Commercial & Business purposes

a) Do you receive financial information (including news or price data concerning securities, commodities and other financial instruments) for your business or any other commercial entity?

Explanation: Are you receiving and using the market data for use on behalf of a company or other organization aside from using the data on this account for personal use?

b) Are you conducting trading of any securities, commodities or forex for the benefit of a corporation, partnership, professional trust, professional investment club or other entity?

Explanation: Are you trading for yourself only or are you trading on behalf of an organization (Ltd, LLC, GmbH, Co., LLP, Corp.)?

c) Have you entered into any agreement to (a) share the profit of your trading activities or (b) receive compensation for your trading activities?

Explanation: Are you being compensated to trade or are you sharing profits from your trading activities with a third party entity or individual?

d) Are you receiving office space, and equipment or other benefits in exchange for your trading or work as a financial consultant to any person, firm or business entity?

Explanation: Are you being compensated in any way for your trading activity by a third party, not necessarily by being paid in currency.

2) Act in a capacity

a) Are you currently acting in any capacity as an investment adviser or broker dealer?

Explanation: Are you being compensated to manage third party assets or compensated to advise others on how to manage their assets?

b) Are you engaged as an asset manager for securities, commodities or forex?

Explanation: Are you being compensated to manage securities, commodities, or forex?

c) Are you currently using this financial information in a business capacity or for managing your employer’s or company’s assets?

Explanation: Are you using data at all for a commercial purposes specifically to manage your employer and/or company assets?

d) Are you using the capital of any other individual or entity in the conduct of your trading?

Explanation: Are there assets of any other entity in your account other than your own?

3) Distribute, republish or provide data to any other party

a) Are you distributing, redistributing, publishing, making available or otherwise providing any financial information from the service to any third party in any manner?

Explanation: Are you sending any data you receive from us to another party in any way, shape, or form?

4) Qualified professional securities / futures trader

a) Are you currently registered or qualified as a professional securities trader with any security agency, or with any commodities or futures contract market or investment adviser with any national or state exchange, regulatory authority, professional association or recognized professional body? i, ii

YES☐ NO☐

i) Examples of Regulatory bodies include, but are not limited to,

- US Securities and Exchange Commission (SEC)

- US Commodities Futures Trading Commission (CFTC)

- UK Financial Service Authority (FSA)

- Japanese Financial Service Agency (JFSA)

ii) Examples of Self-Regulatory Organization (SROs) include, but are not limited to:

- US NYSE

- US FINRA

- Swiss VQF

Exposure Fee Monitoring via Account Window

The Account Window provides the high-level information suitable for monitoring one's account on a real-time basis. This includes key balances such as total equity and cash, the portfolio composition and margin balances for determining compliance with requirements and available buying power. This window also includes information relating to the most recently assessed exposure fee and a projection of the next fee taking into consideration current positions.

To open the Account Window:

• From TWS classic workspace, click on the Account icon, or from the Account menu select Account Window (Exhibit 1)

Exhibit 1

.jpg)

• From TWS Mosaic workspace, click on Account from the menu, and then select Account Window (Exhibit 2)

Exhibit 2

.jpg)

After opening the window, scroll down to the Margin Requirements section and click on the + sign in the upper-right hand corner to expand the section. There, the "Last" and "Estimated Next" exposure fees will be detailed for each of the product classifications to which the fee applies (e.g., Equity, Oil). Note that the "Last" balance represents the fee as of the date last assessed (note that fees are computed based upon open positions held as of the close of business and assessed shortly thereafter). The "Estimated Next" balance represents the projected fee as of the current day's close taking into account position activity since the prior calculation (Exhibit 3).

Exhibit 3.jpg)

To set the default view when the section is collapsed, click on the checkbox alongside any line item and those line items will remain displayed at all times.

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2276 for verifying exposure fee through the Order Preview screen.

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. Exposure Fee Monitoring via the Account window is only available for accounts that have been charged an exposure fee in the last 30 days

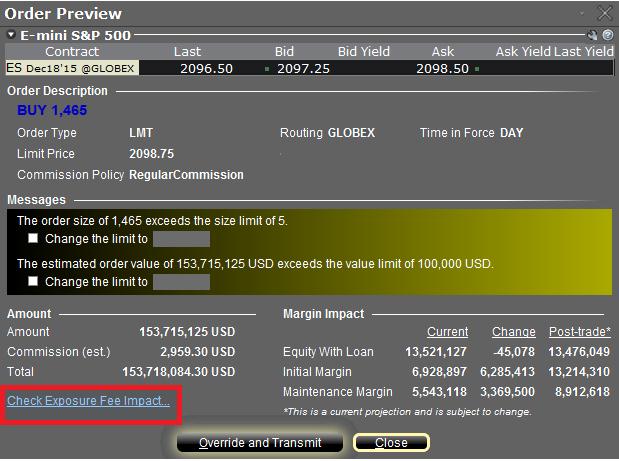

Order Preview - Check Exposure Fee Impact

IB provides a feature which allows account holders to check what impact, if any, an order will have upon the projected Exposure Fee. The feature is intended to be used prior to submitting the order to provide advance notice as to the fee and allow for changes to be made to the order prior to submission in order to minimize or eliminate the fee.

The feature is enabled by right-clicking on the order line at which point the Order Preview window will open. This window will contain a link titled "Check Exposure Fee Impact" (see red highlighted box in Exhibit I below).

Exhibit I

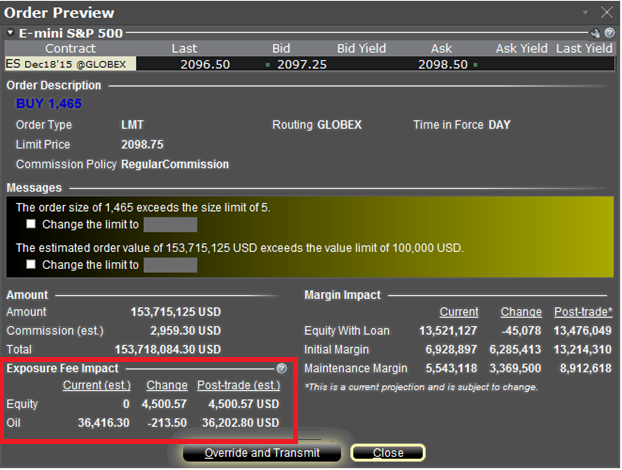

Clicking the link will expand the window and display the Exposure fee, if any, associated with the current positions, the change in the fee were the order to be executed, and the total resultant fee upon order execution (see red highlighted box in Exhibit II below). These balances are further broken down by the product classification to which the fee applies (e.g. Equity, Oil). Account holders may simply close the window without transmitting the order if the fee impact is determined to be excessive.

Exhibit II

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2344 for monitoring fees through the Account Window

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. The Check Exposure Fee Impact is only available for accounts that have been charged an exposure fee in the last 30 days