Discount Certificates Tutorial

Introduction

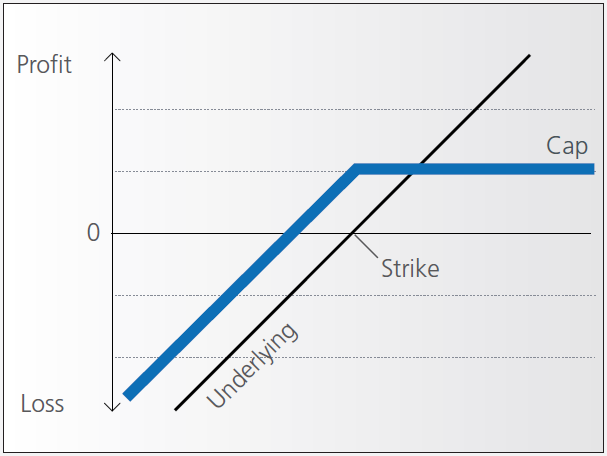

Discount certificates are designed to provide an enhanced return in sideways markets, compared to a direct investment in the underlying.

Discount certificates make it possible for you to buy an underlying instrument for less than its current market price. However, the maximum payback on a discount certificate is limited to a predetermined amount (cap).

Discount certificates normally have a term to maturity of one to three years. At maturity, a determination is made of where the price of the underlying instrument stands.

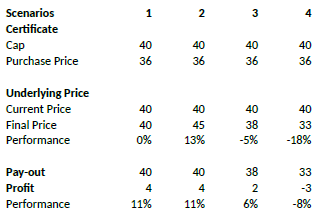

If it is at or above the cap, you’ll earn the maximum return and receive payment of the amount reflected by the cap.

If the price of the underlying instrument is below the cap on the maturity date, you’ll receive either the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

Pay-out Profile

Example

Assume a discount certificate on ABC share. The certificate has a cap of EUR 40.00, and a purchase price of EUR 36.00. The table below shows scenarios depending on the final price of the underlying.

Factor Certificates Tutorial

Introduction

Factor certificates employ a daily leverage factor that multiplies the daily performance of the underlying instrument. Unlike knock-out warrants and mini-futures, factor certificates do not have a knock-out barrier. To avoid a loss greater than the investment, the calculation resets intraday if the performance of the underlying threatens to render the certificate worthless.

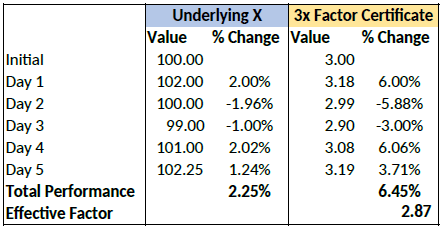

Daily Leverage

The performance of the certificate is calculated daily, without reference to previous days’ values. If the underlying returns 1% on the day, the value of 3x certificate increases by 3%, a 5x by 5%. The next day the process is repeated, referencing the prior day’s underlying close.

As such, factor certificates are particularly suitable for day-traders.

However, for a period of more than one day, the cumulative performance of the underlying cannot be simply multiplied by a factor of 3 as the previous day’s price always forms the new basis of calculating each day’s performance for the certificate. To illustrate with an example:

Cumulatively, the factor certificate has returned less than 3x the performance of the underlying.

Intraday Reset

If an underlying for a factor certificate loses more than a certain percentage of its value intraday, the calculation is reset by simulating a new day. The reset threshold varies depending on the leverage factor.

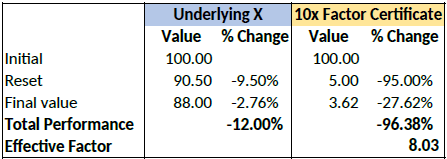

Let’s assume a long factor certificate with a 10x leverage factor. According to the terms of the certificate, a reset will be triggered if the underlying loses more than 9.5% during the calculation day.

Let’s now assume that the underlying loses 12% of its value during a particular day. The reset

and final performance will be as follows:

Complex Position Size

For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e.g. a vertical spread where the short leg is assigned and the user re-writes the same leg the next day, or if the user creates a the position over multiple trades, or if the order is not filled as a native combination at the exchange.

Risks of Volatility Products

Trading and investing in volatility-related Exchange-Traded Products (ETPs) is not appropriate for all investors and presents different risks than other types of products. Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities (such as futures and swaps) and risks associated with the effects of leveraged investing in geared funds. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. We have summarized several risk factors (as identified in prospectuses for ETPs and in other sources) and included links so you can conduct further research. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. By providing this information, Interactive Brokers (IB) is not offering investment or trading advice regarding ETPs to any customer. Customers (and/or their independent financial advisors) must decide for themselves whether ETPs are an appropriate investment for their portfolios.

Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

U.S. Securities Options Exercise Limits

INTRODUCTION

Option exercise limits, along with position limits (See KB1252), have been in place since the inception of standardized trading of U.S. securities options. Their purpose is to prevent manipulative actions in underlying securities (e.g., corners or squeezes) as well as disruptions in option markets where illiquidity in a given option class exists. These limits serve to prohibit an account, along with its related accounts, from cumulatively exercising within any five consecutive business day period, a number of options contracts in excess of the defined limit for a given equity options class (i.e., option contracts associated with a particular underlying security). This includes both early exercises and expiration exercises.

OVERVIEW

U.S. securities option exercise limits are established by FINRA and the U.S. options exchanges. The exercise limits are generally the same as position limits and they can vary by option class as they take into consideration factors such as the number of shares outstanding and trading volume of the underlying security. Limits are also subject to adjustment and therefore can vary over time. The Options Clearing Corporation (OCC), the central clearinghouse for U.S. exchange traded securities options, publishes a daily file with these limits on its public website. The link is as follows: http://www.optionsclearing.com/webapps/position-limits. FINRA Rule 2360(b)(4) addresses exercise limits and can be found via the following website link: http://finra.complinet.com/en/display/display.html?rbid=2403&record_id=16126&element_id=6306&highlight=2360#r16126).

Note that exercise limits are applied based upon the the side of the market represented by the option position. Accordingly, all exercises of call options over the past five business days are aggregated for purposes of determining the limit for the purposes of purchasing the underlying security. Similarly, a separate computation whereby all put exercises over the past five business days are aggregated is required for purposes of determining sales of the underlying.

IMPORTANT INFORMATION

It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. This is because exercise limits are cumulative and one could conceivably purchase options up to the position limit, exercise those options and purchase additional options which, if allowed to be exercised within the five business day window, would exceed the limit.

Account holders are responsible for monitoring their cumulative options exercises as well as the exercise limit quantities to ensure compliance. In addition, IB reserves the right to prohibit the exercise of any options, regardless of their intrinsic value or remaining maturity, if the effect of that exercise would be to violate the exercise limit rule.

"EMIR": Reporting to Trade Repository Obligations and Interactive Brokers Delegated Service to help meet your obligations

Determining Tick Value

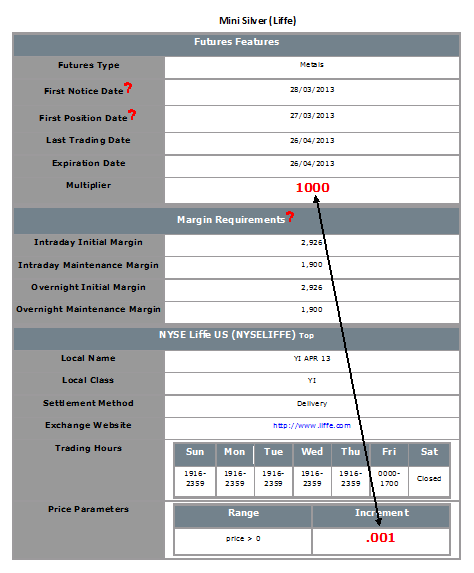

Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Tick values vary by instrument and are determined by the listing exchange. IB provides this information directly from the Contract Search tool on the website or via the Trader Workstation (TWS). To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. The contract specifications window for the instrument will then be displayed (Exhibit 1).

To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. As illustrated in the example below, the LIFFE Mini Silver futures contact has a tick value or minimum increment of .001 which, when multiplied by the contract multiplier of 1,000 ounces, results in a minimum tick value of $1.00 per contract. Accordingly, every tick change up or down results in a profit or loss of $1.00 per LIFFE Mini Silver futures contract.

Exhibit 1