Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

U.S. Securities Options Exercise Limits

INTRODUCTION

Option exercise limits, along with position limits (See KB1252), have been in place since the inception of standardized trading of U.S. securities options. Their purpose is to prevent manipulative actions in underlying securities (e.g., corners or squeezes) as well as disruptions in option markets where illiquidity in a given option class exists. These limits serve to prohibit an account, along with its related accounts, from cumulatively exercising within any five consecutive business day period, a number of options contracts in excess of the defined limit for a given equity options class (i.e., option contracts associated with a particular underlying security). This includes both early exercises and expiration exercises.

OVERVIEW

U.S. securities option exercise limits are established by FINRA and the U.S. options exchanges. The exercise limits are generally the same as position limits and they can vary by option class as they take into consideration factors such as the number of shares outstanding and trading volume of the underlying security. Limits are also subject to adjustment and therefore can vary over time. The Options Clearing Corporation (OCC), the central clearinghouse for U.S. exchange traded securities options, publishes a daily file with these limits on its public website. The link is as follows: http://www.optionsclearing.com/webapps/position-limits. FINRA Rule 2360(b)(4) addresses exercise limits and can be found via the following website link: http://finra.complinet.com/en/display/display.html?rbid=2403&record_id=16126&element_id=6306&highlight=2360#r16126).

Note that exercise limits are applied based upon the the side of the market represented by the option position. Accordingly, all exercises of call options over the past five business days are aggregated for purposes of determining the limit for the purposes of purchasing the underlying security. Similarly, a separate computation whereby all put exercises over the past five business days are aggregated is required for purposes of determining sales of the underlying.

IMPORTANT INFORMATION

It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. This is because exercise limits are cumulative and one could conceivably purchase options up to the position limit, exercise those options and purchase additional options which, if allowed to be exercised within the five business day window, would exceed the limit.

Account holders are responsible for monitoring their cumulative options exercises as well as the exercise limit quantities to ensure compliance. In addition, IB reserves the right to prohibit the exercise of any options, regardless of their intrinsic value or remaining maturity, if the effect of that exercise would be to violate the exercise limit rule.

Prodotti strutturati: link degli emittenti

Nei siti web dei rispettivi emittenti sono disponibili importanti dettagli in merito ai termini e alle condizioni dei prodotti strutturati. Le borse valori indicate forniscono, inoltre, dettagli e analisi dei prodotti. Si prega di notare che, in ogni modo, è bene fare affidamento solamente ai siti web degli emittenti per poter consultare i dettagli aggiornati, i relativi contratti e altri documenti legali.

Di seguito sono elencati i link ai siti web dei relativi emittenti e delle borse valori.

Link ai siti web dei prodotti strutturati

Borse valori

| Euronext |

http://www.euronext.com/trader/priceslists/newpriceslistswarrants-1812-E...

|

| Scoach Germania |

http://www.scoach.de/EN/Showpage.aspx?pageID=8

|

| Scoach Svizzera |

http://scoach.ch/EN/Showpage.aspx?pageID=8

|

| Borsa di Stoccarda |

https://www.boerse-stuttgart.de/en/

|

Emittenti (siti globali)

| Barclays |

http://www.bmarkets.com/home.app

|

| BNP Paribas |

http://warrants.bnpparibas.com/

|

| CITI |

http://www.citiwarrants.com/EN/index.asp?pageid=31

|

| Commerzbank |

http://warrants.commerzbank.com/

|

| Credit Suisse |

https://derivative.credit-suisse.com/index.cfm?nav=jumper&CFID=10909284&...

|

| Deutsche Bank |

http://www.x-markets.db.com/EN/showpage.asp?pageid=33&blredirect=0

|

| Goldman Sachs |

http://www2.goldmansachs.com/services/investing/securitised-derivatives/...

|

| ING |

https://www.ingfm.com/spg/spg/shownews.do

|

| JP Morgan |

http://www.jpmorgansp.com/welcome/flash.html

|

| Macquarie Oppenheim |

http://www.macquarie-oppenheim.com/

|

| Merrill Lynch |

http://www.merrillinvest.ml.com/

|

| Morgan Stanley |

http://www.morganstanleyiq.com/showpage.asp

|

| Natixis |

http://www.natixis-direct.com/EN/showpage.asp?pageid=151

|

| Rabobank |

http://www.raboglobalmarkets.com/

|

| RBS |

http://markets.rbs.com/EN/Showpage.aspx?pageID=58

|

| Societe Generale |

|

| UBS |

|

| Zurcher Kantonalbank |

https://zkb.is-teledata.ch/html/search/simple/index.html

|

Emittenti (siti locali)

Liquidazioni legate a scadenza di opzioni e a operazioni sul capitale

Oltre a prevedere la liquidazione forzata delle posizioni dei clienti qualora i relativi margini scendano sotto i livelli obbligatori, IB liquiderà tali posizioni in corrispondenza di determinati eventi legati alla scadenza delle opzioni o alle operazioni sul capitale i quali, una volta avuti luogo, potrebbero date origine a rischi eccessivi e/o a problemi di natura operativa. Alcuni esempi di questi eventi sono illustrati in basso.

Esercizio di opzioni

IB si riserva il diritto di impedire l'esercizio di opzioni su azioni e/o di chiudere posizioni short in opzioni qualora l'esercizio di tali contratti determinerebbe un deficit relativo ai margini a carico del conto. Sebbene l’acquisto di opzioni non richieda in genere il ricorso alla marginazione (poiché i contratti vengono acquistati corrispondendo integralmente il relativo prezzo), a seguito del loro esercizio il titolare del conto è tenuto ad aprire una posizione long in azioni corrispondendone l’intero prezzo (nel caso delle opzioni call esercitate tramite conti di liquidità o di azioni non acquistabili in marginazione) o a finanziare una posizione long o short in azioni (nel caso di opzioni call o put esercitate tramite un conto a margine). Qualora il patrimonio netto associato al conto non risulti sufficiente, l’esercizio dell’opzione potrebbe determinare l’insorgere di un rischio eccessivo legato alla possibilità che all’approssimarsi della consegna il prezzo del sottostante subisca una variazione sfavorevole. Il potenziale deficit derivante da una tale situazione potrebbe risultare particolarmente elevato e rivelarsi significativamente più alto del valore intrinseco dell’opzione, specialmente considerando che le clearing house dispongono l’esercizio automatico delle opzioni alla loro scadenza perfino quando la loro “moneyness” ammonta a un solo centesimo di dollaro per azione.

Si consideri, per esempio, un conto il cui patrimonio netto al giorno 1 sia costituito esclusivamente da una posizione long in 20 opzioni call in scadenza su un ipotetico titolo azionario XYZ e con prezzo di esercizio pari a 50$. Supponiamo che al momento della scadenza il prezzo di mercato del sottostante sia pari a 51$ e dunque che ciascuna opzione abbia un valore intrinseco pari a 1$. Scenario 1: le opzioni vengono esercitate automaticamente e il prezzo di apertura di XYZ al giorno 2 è pari a 51$. Scenario 2: le opzioni vengono esercitate automaticamente e il prezzo di apertura di XYZ al giorno 2 è pari a 48$.

| Saldo del conto | Prima della scadenza | Scenario 1 - XYZ apre a 51$ | Scenario 2 - XYZ apre a 48$ |

|---|---|---|---|

| Liquidità | 0.00$ | ($100,000.00) | ($100,000.00) |

| Azioni long | 0.00$ | 102,000.00$ | 96,000.00$ |

|

Posizione long in opzioni* |

2,000.00$ | 0.00$ | 0.00$ |

| Patrimonio netto in caso di liquidazione/(deficit) | 2,000.00$ | 2,000.00$ | (4,000.00$) |

| Margini richiesti | 0.00$ | 25,500.00$ | 25,500.00$ |

| Margine in eccesso/(disavanzo) | 0.00$ | (23,500.00$) | (29,500.00$) |

*Le opzioni oggetto delle posizioni long non hanno alcun valore come garanzia (loan value).

Per impedire che all’avvicinarsi della scadenza si verifichino questi scenari, IB simulerà gli effetti di quest’ultima in base a una serie di ipotesi plausibili in merito alla variazione di prezzo del sottostante, stimando quindi l’esposizione a carico del cliente in caso di consegna dei titoli azionari. Qualora ritenga che tale esposizione risulti eccessiva, IB si riserva il diritto di: 1) liquidare le opzioni prima della scadenza; 2) disporre che scadano senza essere esercitate; e/o 3) consentire la consegna del sottostante disponendone in qualsiasi momento la liquidazione. IB potrebbe inoltre porre delle limitazioni alla capacità del cliente di aprire nuove posizioni o di incrementare la propria esposizione. Il numero di contratti soggetti a scadenza senza esercizio o a esercizio automatico sarà determinato nel giorno della scadenza poco dopo il termine delle contrattazioni. Al fine del summenzionato calcolo dell'esposizione gli effetti di eventuali attività di negoziazione svolte dopo la chiusura del mercato potrebbero non essere presi in considerazione.

Sebbene IB si riservi il diritto di prendere i provvedimenti di cui sopra, la responsabilità di gestire il rischio derivante dall'esercizio delle opzioni detenute nel proprio conto è esclusiva responsabilità dei clienti. IB non è soggetta ad alcun obbligo di gestire tale rischio per conto dei propri clienti.

IB si riserva inoltre il diritto di liquidare le posizioni dei propri clienti nel pomeriggio della data del regolamento qualora, in base a quanto calcolato dai propri sistemi, tale regolamento determinerebbe l'insorgere di un deficit relativo ai margini. Per impedire che all’avvicinarsi della scadenza si verifichino gli scenari di cui sopra, IB simulerà gli effetti di quest’ultima in base a una serie di ipotesi plausibili in merito alla variazione di prezzo del sottostante, stimando quindi l’esposizione a carico del cliente una volta avvenuto il regolamento. Qualora preveda che il regolamento determinerà la chiusura di posizioni (es. in caso di scadenza di opzioni out of the money oppure di opzioni in the money regolate in contanti), IB calcolerà le conseguenze di tale evento sui margini.

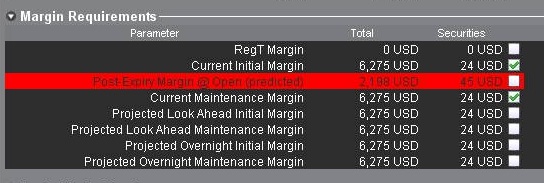

Qualora ritenga che l'esposizione derivante da tali eventi risulti eccessiva, IB potrebbe liquidare alcune posizioni per colmare l'eventuale deficit relativo ai margini. È possibile monitorare tale "esposizione" legata alla scadenza delle opzioni tramite la finestra "Conto" di TWS: qualora il valore associato al parametro "Margine post-scadenza" risulti negativo la relativa riga sarà evidenziata in rosso (v. figura in basso); ciò indica che il conto potrebbe essere soggetto a liquidazione forzata di posizioni. L'esposizione viene calcolata a partire da 3 giorni prima della successiva data di scadenza e il valore risultante viene aggiornato all'incirca ogni 15 minuti. Si noti inoltre che in determinati tipi di conti caratterizzati da una struttura gerarchica (es. i conti "Separate Trading Limit") questo dato sarà presentato solo a livello di conto master, tenendo tuttavia in considerazione le posizioni detenute da tutti i conti di secondo livello.

Eventuali liquidazioni legate ai meccanismi di cui sopra saranno poste in essere due ore prima della chiusura dei mercati; IB si riserva tuttavia il diritto di compiere tali operazioni con diverse tempistiche qualora le circostanze lo rendano opportuno. Le posizioni da liquidare verranno inoltre determinate in base a una serie di fattori specifici per ciascun conto, come il valore di liquidazione netto, il deficit post-scadenza previsto e la relazione tra il prezzo di esercizio dell'opzione e il prezzo del sottostante.

Strategie "call spread" in prossimità della data di stacco cedola del sottostante

Qualora un cliente attui una "call spread" (una strategia consistente nell'acquistare un'opzione call e nel venderne un'altra con lo stesso sottostante) in prossimità della data di stacco della cedola associata al sottostante senza chiudere le posizioni relative allo spread o esercitare le opzioni call acquistate, IB si riserva il diritto di esercitare in tutto o in parte le opzioni call acquistate e/o di chiudere in tutto o in parte le posizioni relative allo spread a propria esclusiva discrezione qualora ritenga che: a) le opzioni call vendute saranno verosimilmente esercitate e b) il patrimonio netto associato al conto non risulterebbe sufficiente a corrispondere l'importo dei dividendi o, in generale, a soddisfare i requisiti relativi ai margini. Qualora IB determini l’esercizio delle opzioni acquistate ma le opzioni vendute non vengano esercitate il cliente potrebbe subire delle perdite. L'eventuale liquidazione parziale delle posizioni connesse allo spread da parte di IB potrebbe altresì determinare l'insorgere di perdite oppure un risultato diverso da quello preventivato dal cliente.

Per impedire il verificarsi di questi scenari i clienti sono tenuti a monitorare attentamente le proprie posizioni in opzioni e il patrimonio netto associato al proprio conto in prossimità delle date di stacco cedola dei titoli sottostanti, gestendo il relativo rischio e le sue conseguenze sul proprio conto.

Future con consegna fisica

A eccezione di determinati contratti future su valute, in generale IB non consente di consegnare o ricevere in consegna le attività sottostanti dei future con consegna fisica o delle opzioni su future. Per evitare la consegna associata a un contratto in scadenza, i clienti sono tenuti a rinnovarlo ("rollover") o a chiudere la relativa posizione entro la "close-out deadline" specifica di quel contratto (una lista delle "close-out deadline" associate a ciascun contratto è disponibile sul nostro sito web).

Il rispetto della "close-out deadline" è responsabilità esclusiva dei clienti; i future a consegna fisica la cui posizione non venga chiusa entro la data specificata potrebbero essere liquidati da IB senza alcun preavviso.

Considerazioni sull'esercizio di opzioni di acquisto prima della scadenza

INTRODUZIONE

In genere, l'esercizio delle opzioni di acquisto su titoli azionari prima della relativa scadenza non apporta alcun vantaggio, in quanto:

- comporta la perdita del valore temporale residuo delle opzioni;

- richiede un ulteriore impegno di capitale per il pagamento e/o finanziamento della consegna del titolo; e

- può esporre il titolare dell'opzione a maggiori rischi di perdita sull'azione relativa al premio dell'opzione.

Tuttavia, i titolari di conti in grado di far fronte a un aumento di capitale e/o requisito di assunzione in prestito, e a un ulteriore rischio di mercato potenzialmente maggiore, possono trarre vantaggio dall'esercizio anticipato delle opzioni di acquisto di tipo americano nel tentativo di realizzare un dividendo futuro.

PREMESSA

Premettendo che i titolari di opzioni di acquisto non hanno diritto a percepire dividendi sulle azioni sottostanti, in quanto tali dividendi spettano solamente ai titolari delle azioni a partire dalla data di registrazione del dividendo, il prezzo dei titoli, a parità di altre condizioni, dovrebbe diminuire di un importo pari al valore del dividendo alla data di stacco cedola. Per quanto la teoria dei prezzi delle opzioni suggerisca che il prezzo di acquisto rifletterà il valore scontato dei dividendi attesi corrisposti nel corso della durata di suddetto prezzo, anch'esso potrebbe diminuire alla data di stacco cedola. Le condizioni che rendono tale ipotesi altamente possibile e favoriscono la scelta dell'esercizio anticipato sono le seguenti:

1. l'opzione è profondamente in the money e ha un delta pari a 100;

2. l'opzione ha un valore temporale scarso o nullo;

3. il dividendo è piuttosto alto e la data di stacco cedola precede quella della scadenza dell'opzione.

ESEMPI

Per illustrare l'impatto di queste condizioni sulla decisione di esercizio anticipato, si consideri un conto che detiene un saldo di liquidità positivo pari a 9,000 USD e una posizione di acquisto lunga su un'ipotetica azione "ABC" con un prezzo di esercizio di 90.00 USD e una durata residua di 10 giorni. ABC, che è attualmente scambiata a 100.00 USD, ha dichiarato un dividendo pari a 2.00 USD per azione con la data di stacco cedola prevista per il giorno successivo. Si presuma, inoltre, che il prezzo dell'opzione e quello del titolo azionario si comportino in modo analogo e subiscano un calo pari all'importo del dividendo alla data di stacco cedola.

A questo punto, riesamineremo la decisione di esercizio con l'intento di mantenere una posizione delta di 100 azioni e massimizzare il capitale complessivo in base a due ipotesi sui prezzi, una secondo la quale l'opzione è venduta in condizione di parità, ed un'altra, in cui questa è venduta oltre la parità.

I IPOTESI: prezzo dell'opzione scambiato alla pari: 10.00 USD

Nel caso in cui il prezzo dell'opzione sia scambiato alla pari, l'esercizio anticipato permette di mantenere il delta della posizione ed evitare la perdita di valore dell'opzione lunga quando l'azione è scambiata ex-cedola, al fine di proteggere il capitale. In questo caso, i proventi in contanti sono interamente impiegati per l'acquisto dell'azione al prezzo di esercizio, il premio dell'opzione viene perso e l'azione, al netto del dividendo, viene accreditata sul conto insieme al dividendo maturato. Se si intende ottenere lo stesso risultato vendendo l'opzione prima della data di stacco cedola e acquistando l'azione, è bene tenere in considerazione le commissioni e gli spread:

| I IPOTESI |

||||

|

Componenti del conto |

Saldo iniziale |

Esercizio anticipato |

Nessuna operazione

|

Vendita dell'opzione e acquisto dell'azione |

| Liquidità | 9,000 USD | 0 USD | 9,000 USD | 0 USD |

| Opzione | 1,000 USD | 0 USD | 800 USD | 0 USD |

| Azione | 0 USD | 9,800 USD | 0 USD | 9,800 USD |

| Dividendo maturato | 0 USD | 200 USD | 0 USD | 200 USD |

| Capitale complessivo | 10,000 USD | 10,000 USD | 9,800 USD | 10,000 USD meno commissioni/spread |

II IPOTESI: prezzo delle opzioni al di sopra della parità: 11.00 USD

Nel caso in cui l'opzione sia scambiata al di sopra della parità, un esercizio anticipato finalizzato all'ottenimento del dividendo potrebbe non risultare economicamente vantaggioso. Secondo questa ipotesi, l'esercizio anticipato comporterebbe una perdita di 100 USD in termini di valore temporale dell'opzione, mentre la vendita dell'opzione e il successivo acquisto dell'azione, al netto delle commissioni, potrebbe rivelarsi un'operazione meno vantaggiosa del non effettuare alcuna operazione. In questa circostanza la misura da preferire è quella di non adottare alcuna misura.

| II IPOTESI |

||||

|

Componenti del conto |

Saldo iniziale |

Esercizio anticipato |

Nessuna operazione

|

Vendita dell'opzione e acquisto dell'azione |

| Liquidità | 9,000 USD | 0 USD | 9,000 USD | 100 USD |

| Opzione | 1,100 USD | 0 USD | 1,100 USD | 0 USD |

| Azione | 0 USD | 9,800 USD | 0 USD | 9,800 USD |

| Dividendo maturato | 0 USD | 200 USD | 0 USD | 200 USD |

| Capitale complessivo | 10,100 USD | 10,000 USD | 10,100 USD | 10,100 USD meno commissioni/spread |

![]() N.B.: i titolari di conti che detengono una posizione di acquisto lunga quale parte dello spread dovrebbero prestare particolare attenzione ai rischi derivanti dal mancato esercizio del segmento lungo, data la possibilità che venga assegnato al segmento corto. Si prega di notare che l'assegnazione di un'opzione di acquisto corta determina una posizione azionaria corta e, alla data di registrazione del dividendo, i titolari di posizioni azionarie corte sono tenuti al pagamento del dividendo al prestatore delle azioni. Inoltre, la procedura di elaborazione della stanza di compensazione relativa alle notifiche di esercizio non accetta l'invio delle notifiche di esercizio in risposta all'assegnazione.

N.B.: i titolari di conti che detengono una posizione di acquisto lunga quale parte dello spread dovrebbero prestare particolare attenzione ai rischi derivanti dal mancato esercizio del segmento lungo, data la possibilità che venga assegnato al segmento corto. Si prega di notare che l'assegnazione di un'opzione di acquisto corta determina una posizione azionaria corta e, alla data di registrazione del dividendo, i titolari di posizioni azionarie corte sono tenuti al pagamento del dividendo al prestatore delle azioni. Inoltre, la procedura di elaborazione della stanza di compensazione relativa alle notifiche di esercizio non accetta l'invio delle notifiche di esercizio in risposta all'assegnazione.

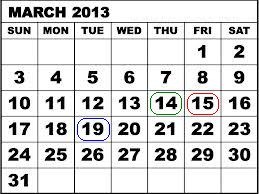

Si consideri, per esempio, un call spread (al ribasso) creditizio su SPDR S&P 500 ETF Trust (SPY) costituito da 100 contratti short al prezzo di esercizio di 146 USD a marzo 2013 e 100 contratti long al prezzo di esercizio di 147 USD a marzo 2013. Il 14 marzo 2013 lo SPY Trust dichiara un dividendo di 0.69372 USD per azione, pagabile il 30 aprile 2013 agli azionisti registrati alla data del 19 marzo 2013. Considerando il termine del regolamento di tre giorni lavorativi per le azioni statunitensi, l'investitore avrebbe dovuto acquistare l'azione o esercitare l'opzione di acquisto non più tardi del 14 marzo 2013 per poter realizzare un dividendo, in quanto il giorno successivo l'azione ha iniziato a essere scambiata ex-cedola.

Il 14 marzo 2013, a un giorno di trading dalla scadenza, i due contratti di opzioni sono stati scambiati alla pari, indicando un rischio massimo di 100 USD per contratto o di 10,000 USD sulla posizione di 100 contratti. Tuttavia, il mancato esercizio del contratto lungo, al fine di ottenere il dividendo e tutelarsi dalla possibile assegnazione su contratti corti da parte della concorrenza, ha causato un ulteriore rischio pari a 67.372 USD per contratto o 6,737.20 USD sulla posizione che riflette il pagamento obbligatorio del dividendo in caso di assegnazione di tutte le opzioni di acquisto corte. Come illustrato nella tabella sottostante, nel caso in cui il segmento dell'opzione azionaria corta non venisse assegnato, il massimo rischio possibile, al momento della definizione del finale prezzo di regolamento del contratto in data 15 marzo 2013, sarebbe rimasto pari a 100 USD per contratto.

| Data | Chiusura SPY | Op. call 146 USD mar '13 | Op. call 147 USD mar '13 |

| 14 marzo 2013 | 156.73 USD | 10.73 USD | 9.83 USD |

| 15 marzo 2013 | 155.83 USD | 9.73 USD | 8.83 USD |

Si prega di notare che, se il proprio conto è soggetto ai requisiti in materia di ritenute d'imposta ai sensi della normativa 871(m) del Ministero del Tesoro statunitense, potrebbe rivelarsi vantaggioso chiudere una posizione lunga su opzioni prima della data di stacco cedola e riaprire la posizione dopo tale data.

Per informazioni relative alle modalità di inoltro delle notifiche di esercizio anticipato, si prega di cliccare qui.

Il presente articolo è fornito esclusivamente a scopo informativo e non è da intendersi come una raccomandazione o un suggerimento di investimento, né intende suggerire che l'esercizio anticipato sia vantaggioso e/o appropriato per tutti i clienti e/o tutte le transazioni. I titolari di conto sono pregati di rivolgersi a un consulente fiscale per verificare le eventuali conseguenze fiscali derivanti dall'esercizio anticipato, prestando, inoltre, particolare attenzione ai potenziali rischi derivanti dalla sostituzione di posizioni lunghe su opzioni con posizioni lunghe su azioni.

"EMIR": Reporting to Trade Repository Obligations and Interactive Brokers Delegated Service to help meet your obligations

Determining Tick Value

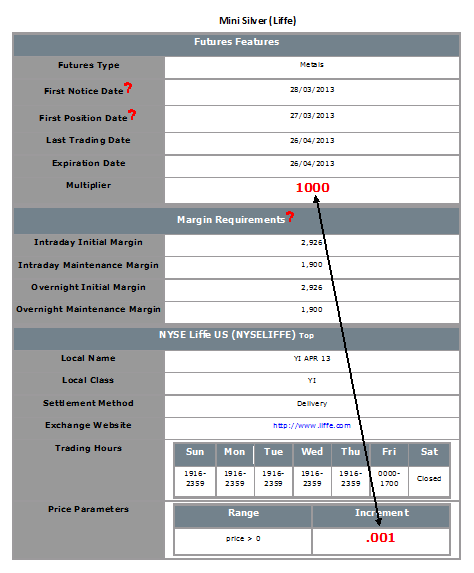

Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Tick values vary by instrument and are determined by the listing exchange. IB provides this information directly from the Contract Search tool on the website or via the Trader Workstation (TWS). To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. The contract specifications window for the instrument will then be displayed (Exhibit 1).

To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. As illustrated in the example below, the LIFFE Mini Silver futures contact has a tick value or minimum increment of .001 which, when multiplied by the contract multiplier of 1,000 ounces, results in a minimum tick value of $1.00 per contract. Accordingly, every tick change up or down results in a profit or loss of $1.00 per LIFFE Mini Silver futures contract.

Exhibit 1

Considerations for Exercising Call Options Prior to Expiration

INTRODUCTION

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:

- It results in a forfeiture of any remaining option time value;

- Requires a greater commitment of capital for the payment or financing of the stock delivery; and

- May expose the option holder to greater risk of loss on the stock relative to the option premium.

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

BACKGROUND

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:

1. The option is deep-in-the-money and has a delta of 100;

2. The option has little or no time value;

3. The dividend is relatively high and its Ex-Date precedes the option expiration date.

EXAMPLES

To illustrate the impact of these conditions upon the early exercise decision, consider an account maintaining a long cash balance of $9,000 and a long call position in hypothetical stock “ABC” having a strike price of $90.00 and time to expiration of 10 days. ABC, currently trading at $100.00, has declared a dividend of $2.00 per share with tomorrow being the Ex-Dividend date. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date.

Here, we will review the exercise decision with the intent of maintaining the 100 share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

SCENARIO 1: Option Price At Parity - $10.00

In the case of an option trading at parity, early exercise will serve to maintain the position delta and avoid the loss of value in long option when the stock trades ex-dividend, to preserve equity. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock (net of dividend) and dividend receivable are credited to the account. If you aim for the same end result by selling the option prior to the Ex-Dividend date and purchasing the stock, remember to factor in commissions/spreads:

| SCENARIO 1 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $0 |

| Option | $1,000 | $0 | $800 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,000 | $10,000 | $9,800 | $10,000 less commissions/spreads |

SCENARIO 2: Option Price Above Parity - $11.00

In the case of an option trading above parity, early exercise to capture the dividend may not be economically beneficial. In this scenario, early exercise would result in a loss of $100 in option time value, while selling the option and buying the stock, after commissions, may be less beneficial than taking no action. In this scenario, the preferable action would be No Action.

| SCENARIO 2 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $100 |

| Option | $1,100 | $0 | $1,100 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,100 | $10,000 | $10,100 | $10,100 less commissions/spreads |

![]() NOTE:

NOTE:

Options have two components that make up their total premium value - intrinsic value and time value. The intrinsic value is the amount by which the option is in-the-money, while the time value represents the possibility that the option could become even more profitable before expiration as the underlying asset price fluctuates while providing protection against adverse moves.

Many options are American-style, which means they can be exercised early, ahead of their expiration date. Early exercise of an option eliminates the remaining time value component from the option's premium, since the option holder loses protection against unfavorable movements in the underlying asset’s price.

This makes early exercise suboptimal in most situations, as the option holder is willingly forfeiting a portion of the option's value.

There are a few specific circumstances where early exercise could make sense, such as:

- For call options on a stock that will pay dividends soon, where the dividend amount exceeds the remaining time value (and only if the exercise will settle on or prior to the record date for the dividend).

- For deep in-the-money options where the time value is negligible compared to the intrinsic value, and the option is expected to drop in value due to interest rate effects (PUTS), or expected stock loan benefits (CALLS).

The first case, exercising an in the money call immediately ahead of a dividend payment, is the most common economically-sensible early exercise. In most cases, it is advisable to hold or sell the option instead of exercising it early, in order to capture the remaining time value. An option should only be exercised early after carefully considering all factors and determining that the benefits of early exercise outweigh the time value being surrendered.

Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

As example, consider a credit call (bear) spread on the SPDR S&P 500 ETF Trust (SPY) consisting of 100 short contracts in the March '13 $146 strike and 100 long contracts in the March '13 $147 strike. On 3/14/13, with the SPY Trust declared a dividend of $0.69372 per share, payable 4/30/13 to shareholders of record as of 3/19/13. Given the 3 business day settlement time frame for U.S. stocks, one would have had to buy the stock or exercise the call no later than 3/14/13 in order receive the dividend, as the next day the stock began trading Ex-Dividend.

On 3/14/13, with one trading day left prior to expiration, the two option contracts traded at parity, suggesting maximum risk of $100 per contract or $10,000 on the 100 contract position. However, the failure to exercise the long contract in order to capture the dividend and protect against the likely assignment on the short contracts by others seeking the dividend created an additional risk of $67.372 per contract or $6,737.20 on the position representing the dividend obligation were all short calls assigned. As reflected on the table below, had the short option leg not been assigned, the maximum risk when the final contract settlement prices were determined on 3/15/13 would have remained at $100 per contract.

| Date | SPY Close | March '13 $146 Call | March '13 $147 Call |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

Please note that if your account is subject to tax withholding requirements of the US Treasure rule 871(m), it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.

Why Do Commission Charges on U.S. Options Vary?

IBKR's option commission charge consists of two parts:

1. The execution fee which accrues to IBKR. For Smart Routed orders this fee is set at $0.65 per contract, reduced to as low as $0.15 per contract for orders in excess of 100,000 contracts in a given month (see website for costs on Direct Routed orders, reduced rates on low premium options and minimum order charges); and

2. Third party exchange, regulatory and/or transaction fees.

In the case of third party fees, certain U.S. option exchanges maintain a liquidity fee/rebate structure which, when aggregated with the IBKR execution fee and any other regulatory and/or transaction fees, may result in an overall per contract commission charge that varies from one order to another. This is attributable to the exchange portion of the calculation, the result of which may be a payment to the customer rather than a fee, and which depends upon a number of factors outside of IBKR's control including the customer's order attributes and the prevailing bid-ask quotes.

Exchanges which operate under this liquidity fee/rebate model charge a fee for orders which serve to remove liquidity (i.e., marketable orders) and provide a credit for orders which add liquidity (i.e., limit orders which are not marketable). Fees can vary by exchange, customer type (e.g., public, broker-dealer, firm, market maker, professional), and option underlying with public customer rebates (credits) generally ranging from $0.10 - $0.90 and public customer fees from $0.01 - $0.95.

IBKR is obligated to route marketable option orders to the exchange providing the best execution price and the Smart Router takes into consideration liquidity removal fees when determining which exchange to route the order to when the inside market is shared by multiple (i.e., will route the order to the exchange with the lowest or no fee). Accordingly, the Smart Router will only route a market order to an exchange which charges a higher fee if they can better the market by at least $0.01 (which, given the standard option multiplier of 100 would result in price improvement of $1.00 which is greater than the largest liquidity removal fee).

For additional information on the concept of adding/removing liquidity, including examples, please refer to KB201.

Expiration & Corporate Action Related Liquidations

In addition to the policy of force liquidating client positions in the event of a real-time margin deficiency, IBKR will also liquidate positions based upon certain expiration or corporate action related events which, after giving effect to, would create undue risk and/or operational concerns. Examples of such events are outlined below.

Option Exercise

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full (in the case of a call exercised in a cash account or stock subject to 100% margin) or finance the long/short stock position (in the case of a call/put exercised in a margin account). Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. This uncollateralized risk can be especially pronounced and may far exceed any in-the-money value the long option may have held, particularly at expiration when clearinghouses automatically exercise options at in-the-money levels as low as $0.01 per share.

Take, for example, an account whose equity on Day 1 consists solely of 20 long $50 strike call options in hypothetical stock XYZ which have closed at expiration at $1 per contract with the underlying at $51. Assume under Scenario 1 that the options are all auto-exercised and XYZ opens at $51 on Day 2. Assume under Scenario 2 that the options are all auto-exercised and XYZ opens at $48 on Day 2.

| Account Balance | Pre-Expiration | Scenario 1 - XYZ Opens @ $51 | Scenario 2 - XYZ Opens @ $48 |

|---|---|---|---|

| Cash | $0.00 | ($100,000.00) | ($100,000.00) |

| Long Stock | $0.00 | $102,000.00 | $96,000.00 |

|

Long Option* |

$2,000.00 | $0.00 | $0.00 |

| Net Liquidating Equity/(Deficit) | $2,000.00 | $2,000.00 | ($4,000.00) |

| Margin Requirement | $0.00 | $25,500.00 | $25,500.00 |

| Margin Excess/(Deficiency) | $0.00 | ($23,500.00) | ($29,500.00) |

*Long option has no loan value.

To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either: 1) liquidate options prior to expiration; 2) allow the options to lapse; and/or 3) allow delivery and liquidate the underlying at any time. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

IBKR also reserves the right to liquidate positions on the afternoon before settlement if IBKR’s systems project that the effect of settlement would result in a margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. For instance, if IBKR projects that positions will be removed from the account as a result of settlement (e.g., if options will expire out of the money or cash-settled options will expire in the money), IBKR’s systems will evaluate the margin effect of those settlement events.

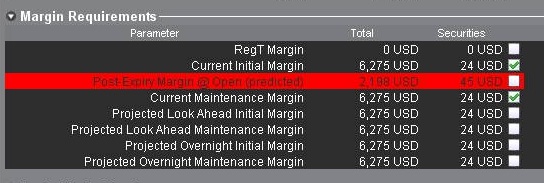

If IBKR determines the exposure is excessive, IBKR may liquidate positions in the account to resolve the projected margin deficiency. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. The projected margin excess will be displayed on the line titled “Post-Expiry Margin” (see below) which, if negative and highlighted in red indicates that your account may be subject to forced position liquidations. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Note that certain account types which employ a hierarchy structure (e.g., Separate Trading Limit account) will have this information presented only at the master account level where the computation is aggregated.

Note that IBKR generally initiates expiration related liquidations 2 hours prior to the close, but reserves the right to begin this process sooner or later should conditions warrant. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying.

Call Spreads in Advance of Ex-Dividend Date

In the event that you are holding a call spread (long and short calls having the same underlying) prior to an ex-dividend date in the underlying, and if you have not liquidated the spread or exercised the long call(s), IBKR reserves the right to: i) exercise some or all of the long call(s); and/or ii) liquidate (i.e., close out) some or all of the spreads - if IBKR, in its sole discretion, anticipates that: a) the short call(s) is (are) likely to be assigned; and b) your account would not ave sufficient equity to satisfy the liability to pay the dividend or to satisfy margin requirements generally. In the event that IBKR exercises the long call(s) in this scenario and you are not assigned on the short call(s), you could suffer losses. Likewise, if IBKR liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective.

In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly.

Physically Delivered Futures

With the exception of certain futures contracts having currencies or metals as their underlying, IBKR generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract (a list of which is provided on the website).

Note that it is the client’s responsibility to be aware of the Close-Out Deadline and physically delivered contracts which are not closed out within the specified time frame may be liquidated by IBKR without prior notification.