TWSとMacOS 12(Monterey)間の相互作用

こちらのページでは、一部のお客様よりご報告いただいた、MacOS Monterey(バージョン12)によるトレーダー・ワークステーション(TWS)のパフォーマンスに関する問題点をご説明します。MacOS 12を使用した場合、TWSがフリーズすることや、突然シャットダウン(クラッシュ)することがあり、これはTWSの起動時または数分後や、場合によっては数時間後に発生することがあります。

修正プログラムの実装

TWSベータ版の修正プログラムがリリースされました。ダウンロードはこちらからできます。

現在の問題を対処しつつ他の問題も発生させないようにしながら、どのJavaプラットフォームがトレーダー・ワークステーションに一番適した代替となるかをテストして割り出すにあたってかなりの時間を要しました。

ご理解とご協力、誠に有難うございました。

遅延マーケットデータのタイミング

マーケットデータのベンダーは通常、リアルタイムと遅延タイプのふたつのカテゴリーに分けて、取引所データを提供しています。リアルタイムのマーケットデータは、情報が一般公開され次第に配信されます。遅延タイプのマーケットデータは、リアルタイムのクオートに通常、10分から20分遅れたものになります。

取引所の中には、マーケットデータ購読の費用は取らず、無料で遅延データを表示するところもあります。弊社にてリクエストを必要とせずに、遅延データを無料で提供(取引プラットフォームに商品のシンボルを入力すると遅延データが表示されます)している取引所は、以下の一覧のようになります。一覧には対応するリアルタイムの購読が含まれます。料金は弊社のウェブサイトよりご確認ください。

注意事項:

- 規制当局による要請に基づき、IBKRでは、米国株の遅延クオート情報をインタラクティブ・ブローカーズLLCのお客様にご提供することができなくなりました。

- 遅延データは取引のためではなく、参考としてご利用ください。記載される時間は予告なく変更されることがあります。

アメリカ大陸

| 外部での取引所名 | IBでの取引所名 | 遅延時間 | リアルタイム購読 |

| CBOT | CBOT | 10分 | CBOT Real-Time |

| CBOE Futures Exchange | CFE | 10分 | CFE Enhanced |

| Market Data Express (MDX) | CBOE | 10分 | CBOE Market Data Express Indices |

| CME | CME | 10分 | CME Real-Time |

| COMEX | COMEX | 10分 | COMEX Real-Time |

| ICE US | NYBOT | 10分 | ICE Futures U.S. (NYBOT) |

| Mexican Derivatives Exchange | MEXDER | 15分 | Mexican Derivatives Exchange |

| Mexican Stock Exchange | MEXI | 20分 | Mexican Stock Exchange |

| Montreal Exchange | CDE | 15分 | Montreal Exchange |

| NYMEX | NYMEX | 10分 | NYMEX Real-Time |

| NYSE GIF | NYSE | 15分 | NYSE Global Index Feed |

| One Chicago | ONE | 10分 | OneChicago |

| OPRA | OPRA | 15分 | OPRA Top of Book (L1) (US Option Exchanges) |

| OTC Markets | PINK | 15分 | OTC Markets |

| Toronto Stock Exchange | TSE | 15分 | Toronto Stock Exchange |

| Venture Exchange | VENTURE | 15分 | TSX Venture Exchange |

ヨーロッパ

| 外部での取引所名 | IBでの取引所名 | 遅延時間 | リアルタイム購読 |

| BATS Europe | BATE/CHIX | 15分 | European (BATS/Chi-X) Equities |

| Boerse Stuttgart | SWB | 15分 | Stuttgart Boerse incl. Euwax (SWB) |

| Bolsa de Madrid | BM | 15分 | Bolsa de Madrid |

| Borsa Italiana | BVME/IDEM | 15分 | Borsa Italiana (BVME stock / SEDEX / IDEM deriv) |

| Budapest Stock Exchange | BUX | 15分 | Budapest Stock Exchange |

| Eurex | EUREX | 15分 | Eurex Real-Time Information |

| Euronext | AEB/SBF/MATIF/BELFOX | 15分 | Euronext Cash |

| Euronext | AEB/SBF/MATIF/BELFOX | 15分 | Euronext Data Bundle |

| Frankfurt Stock Exchange and XETRA | FWB/IBIS/XETRA | 15分 | Spot Market Germany (Frankfurt/Xetra) |

| ICE Futures Europe (Commodities) | IPE | 10分 | ICE Futures E.U. - Commodities (IPE) |

| ICE Futures Europe (Financials) | ICEEU | 10分 | ICE Futures E.U. – Financials (LIFFE) |

| LSE | LSE | 15分 | LSE UK |

| LSEIOB | LSEIOB | 15分 | LSE International |

| MEFF | MEFF | 15分 | BME (MEFF) |

| NASDAQ OMX Nordic Derivatives | OMS | 15分 | Nordic Derivatives |

| Prague Stock Exchange | PRA | 15分 | Prague Stock Exchange Cash Market |

| SWISS Exchange | EBS/VIRTX | 15分 | SIX Swiss Exchange |

| Tel Aviv Stock Exchange | TASE | 15分 | Tel Aviv Stock Exchange |

| Turquoise ECN | TRQXCH/TRQXDE/TRQXEN | 15分 | Turquoise ECNs |

| Warsaw Stock Exchange | WSE | 15分 | Warsaw Stock Exchange |

アジア

| 外部での取引所名 | IBでの取引所名 | 遅延 時間 | リアルタイム購読 |

| Australian Stock Exchange | ASX | 20分 | ASX Total |

| Hang Seng Indices | HKFE-IND | 15分 | Hang Seng Indexes |

| Hong Kong Futures Exchange | HKFE | 15分 | Hong Kong Derivatives (Fut & Opt) |

| Hong Kong Stock Exchange | SEHK | 15分 | Hong Kong Securities Exchange (Stocks, Warrants & Bonds) |

| Korea Stock Exchange | KSE | 20分 | Korea Stock Exchange |

| National Stock Exchange of India | NSE | 15分 | National Stock Exchange of India, Capital Market Segment |

| Osaka Securities Exchange | OSE.JPN | 20分 | Osaka Exchange |

| SGX Derivatives | SGX | 10分 | Singapore Exchange (SGX) - Derivatives |

| Shanghai Stock Exchange | SEHKNTL | 15分 | Shanghai Stock Exchange |

| Shanghai Stock Exchange STAR Market | SEHKSTAR | 15分 | Shanghai Stock Exchange |

| Shenzhen Stock Exchange | SEHKSZSE | 15分 | Shenzhen Stock Exchange |

| Singapore Stock Exchange | SGX | 10分 | Singapore Exchange (SGX) - Stocks |

| Sydney Futures Exchange | SNFE | 10分 | ASX24 Commodities and Futures |

| Tokyo Stock Exchange | TSEJ | 20分 | Tokyo Stock Exchange |

インタラクティブ・ブローカーズにおける価格上限の通知に関するディスクロージャー

規制当局では、取引に支障をきたす恐れのある注文(突然発生する短期間の価格変動など)を取引所に発注することを防止するための管理を証券会社が維持することを求めています。

こういった要求を満たすため、インタラクティブ・ブローカーズではお客様の注文に様々な価格フィルターを設定しています。価格フィルターは特定の状況下において、市場の混乱を避けるためにお客様の注文に価格制限を設けることがあり、こういった価格制限は通常、弊社が算出した参照価格帯から一定の割合の範囲内となります。(価格制限の範囲は、銘柄のタイプと現在の価格によって異なります。)

価格制限は、取引の確実性と価格リスクの最小化のバランスを取ることを目的としていますが、価格制限の結果として取引が遅延する、または取引が行われないこともあります。詳細は、インタラクティブ・ブローカーズの「注文のルーティングおよびペイメント・フォー・オーダー・フローに関するディスクロージャー」をご参照ください。

弊社のシステムが注文に価格上限を設定している場合、お客様に下記のいずれかが送信されます: (i) トレーダー・ワークステーション、API、またはFIX tag 58(FIXユーザーの場合)経由で、価格制限に関するリアルタイムの通知、および/または (ii) 前日に価格上限が設定された最初の10注文のダイジェスト、それらの注文の最初の価格上限、またそれらの注文の今後の価格上限の範囲を含める日時のFYIメッセージ。

メッセージをご希望されないお客様は、FYIメッセージ内のオプトアウトリンクをクリックして、今後のFYIメッセージの受信を停止することができます。今後のFYIメッセージの受信をオプトアウトすることにより、下記にご同意いただくことになります:

- お客様の注文に対する価格上限の適用に関するインタラクティブ・ブローカーズからの今後の通知を放棄することへの同意。および、

- ご自身の注文に、今後、価格上限が設定される可能性があることを理解しつつ、価格上限が適用されることに関して再度通知を受信することを希望しないことの承認。

Interaction between TWS and MacOS 12 (Monterey)

The present article addresses performance on the Trader Workstation (TWS) under MacOS Monterey (version: 12), as experienced by several clients. The TWS may experience freezes or may shut down unexpectedly (crash) when running on MacOS 12. This can happen immediately during the TWS start up phase or may occur at a later time point, after some minutes or even hours.

Fix Implementation

A fix has been released in the TWS Beta, available for download here

This process included an extensive amount of testing, in order to see which of the alternative Java platforms was the best fit for the Trader Workstation and as well to avoid introducing new issues while solving the current one.

We sincerely thank you for your patience.

TWS Account Window for Retail Clients of IBKR Ireland and Central Europe

This article describes the information provided in the TWS account window for IBKRs EU based entities.

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with IBKR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Retail clients who are residents of the EEA and therefore maintain an account with one of IBKR’s European brokers, IBIE or IBCE, are subject to EU regulations which introduce leverage and other restrictions applicable to CFD transactions.

Notably the regulations require the use of free cash to satisfy CFD margin requirements and prohibit retail clients from using securities in the account as collateral to borrow funds to initiate or maintain a CFD position. Please see Overview of ESMA CFD Rules Implementation for Retail Clients at IBIE and IBCE for full details.

The accounts of IBKRs EU entities are universal accounts in which clients can trade all asset classes available on IBKRs platform, but unlike IBKRs US and UK entities, there are no separately funded segments.

Working examples of how this restriction is applied, along with details as to how clients can monitor free cash available for CFD transactions, are outlined below.

Account Window

IBKR enforces the restriction relating to free cash by calculating the funds available for CFD trading on a real-time basis, rejecting new orders and liquidating existing positions when the available free cash is insufficient to cover CFD initial and maintenance margin requirements.

IBKR offers clients the ability to monitor free cash available for CFD transactions via an enhancement to the TWS Account Window which displays the level of free cash in the account. Importantly, the funds shown as available for CFD trading do not imply that cash is held in a separate segment. It simply indicates what proportion of total account balances is available for CFD trading.

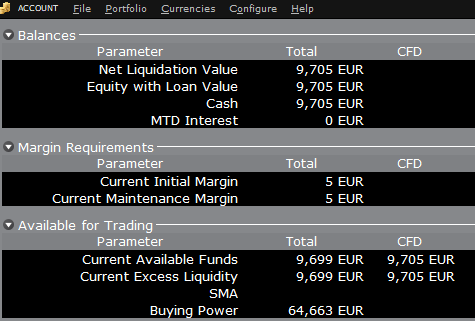

For example, assume that an account has EUR 9,705 in cash and no positions. All the cash is available to open CFD positions, or positions in any other asset class:

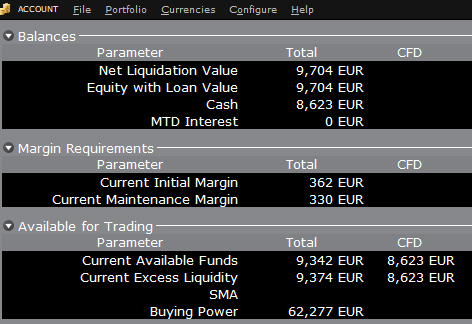

If the account now purchases 10 shares of AAPL stock for an aggregate value of USD 1,383 the cash in the account is reduced by a corresponding amount in EUR, and the funds available for CFD trading are reduced by the

same amount:

Note that Total available funds are reduced by a smaller amount, corresponding to the stock margin requirement.

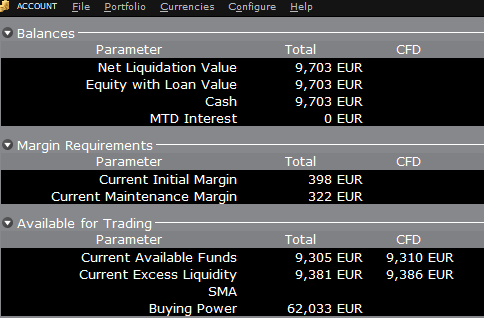

If, instead of buying AAPL stock, the account buys 10 AAPL CFDs the impact will be different. As the transaction involves a derivative contract rather than the purchase of the underlying asset itself, there’s no reduction in cash but the funds available for CFDs are reduced by the CFD margin requirement to secure performance on the contract:

In this case Total available funds and CFD available funds are reduced by an equal amount; the CFD margin requirement.

Funding

As noted above, EU-based accounts do not have segments and therefore there is no need for internal transfers. Funds are available for trades in all asset classes in the amounts indicated in the account window, without the need for sweeps or transfers.

Note also that should an account have a margin loan, i.e. negative cash, it will not be possible to open CFD positions since the CFD margin requirement must be satisfied by free, positive cash. Should you have a margin loan and wish to trade CFDs you must first either close margin positions to eliminate the loan, or add cash to the account in an amount that covers the margin loan and creates a cash buffer sufficient for the necessary CFD margin.

Portfolio Restrictions

Residents of Luxembourg (LU): IB Luxembourg (“IB-LUX”) cannot support Commodity-Metals (London Gold Certificates).

Residents of Central-Eastern Europe (HU, CZ, PO, BG, RO, HR, SK, EE, LV, LT, CY, MT): IB Central Europe (“IB-CE”) cannot support commodity metals. Furthermore, IBCE currently only supports for the following currencies: EUR, USD, CZK, HUF, PLN. GBP and CHF are expected in the near future.

If you hold any of these currencies in your portfolio, you must close the positions as soon as possible in order to facilitate transfer of your account. Short cash positions (borrowing) do not have to be close immediately, just long positions.

リスク・ナビゲーター: 代替となる証拠金計算機能

弊社では証拠金レベルを定期的に見直し、市況の許す法定最小限以上に上げるための変更を行います。 こういった変更がポートフォリオに与える影響をご理解いただくサポートとして、弊社では「代替となる証拠金計算機能」をリスクナビゲーター内でご提供しています。下記は証拠金へのインパクトを左右する「What-if(仮想)」ポートフォリオ作成のステップとなります。

ステップ 1: 新しい「What-if(仮想)」ポートフォリオを開く

クラシックTWS取引プラットフォームからは、 分析ツール、リスク・ナビゲーターと進み、新しいWhat-Ifを開くメニューを選択してください(表示1)。

表示 1

.png)

モザイクTWS取引プラットフォームからは、新規ウィンドウ、リスク・ナビゲーターと進み、新しいWhat-Ifを開くメニューを選択してください。

ステップ 2: 開始時のポートフォリオを設定する

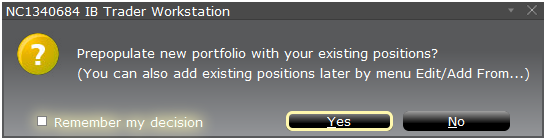

ポップアップ・ウィンドウが表示され(表示 2)、お客様の現在のポートフォリオから仮想ポートフォリオを作成するか、または新しいポートフォリオを作成するか質問されます。「はい」をクリックすると既存のポジションが新しい「What-If」ポートフォリオにダウンロードされます。

表示 2

「いいえ」をクリックするとポジションは入力せずに「What-If」ポートフォリオが開きます。

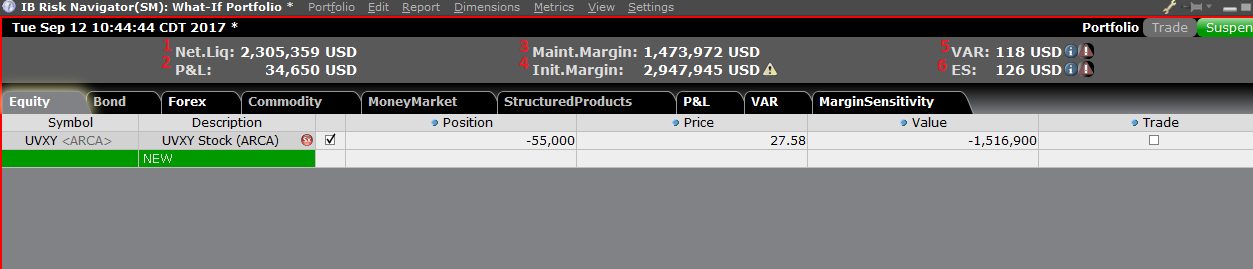

リスク・ダッシュボード

リスク・ダッシュボードは商品タブに並んでピンされ、「what-if」および実際のポートフォリオの両方に利用できます。「What-if」ポートフォリオの場合には値がオンデマンドで計算されます。ダッシュボードには以下を含める口座情報が一目で分かるように表示されます:

1) 流動性資産価値: 口座の流動性資産価値

2) 損益: ポートフォリオ全体の日次の損益合計

3) 維持証拠金: 現在の維持証拠金の合計

4) 委託証拠金: 委託証拠金の合計

5) VAR: ポートフォリオ全体のバリューアットリスク(VAR)

6) 予想される不足額(ES): 最悪のシナリオにおけるポートフォリオのリターンである予想される不足額(平均リューアットリスク)

代替となる証拠金計算機能

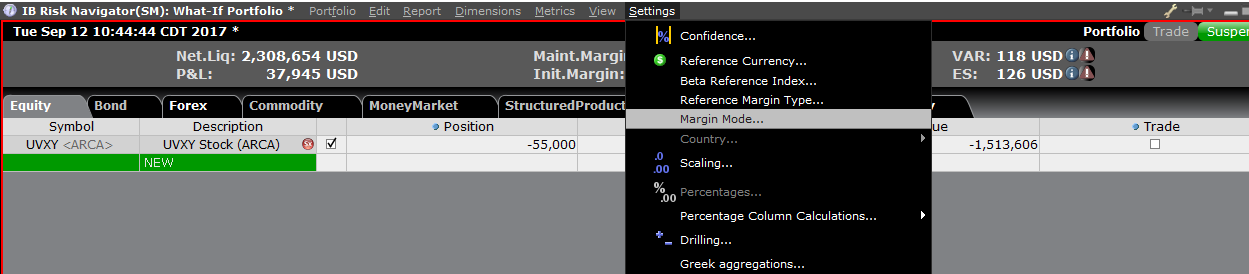

設定メニューより証拠金モード(表示 3)をクリックしてアクセスできる「代替となる証拠金計算機能」は、証拠金が変更された場合の必要証拠全体金への影響を割り出します。

表示 3

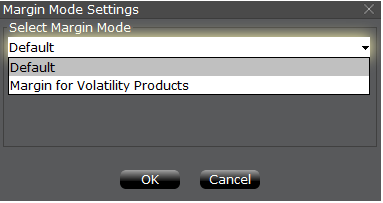

ステップ 3: 証拠金モード設定の選択

証拠金モード設定とタイトルのついたポップアップ・ウィンドウが表示されます(表示 4)。ウィンドウ内のドロップダウンメニューを利用して、証拠金計算をデフォルト(現在のポリシー)から、新しい証拠金設定(新しい証拠金ポリシーとして)の新しいタイトル に変更します。選択したらウィンドウ内の「OK」ボタンをクリックしてください。

表示 4

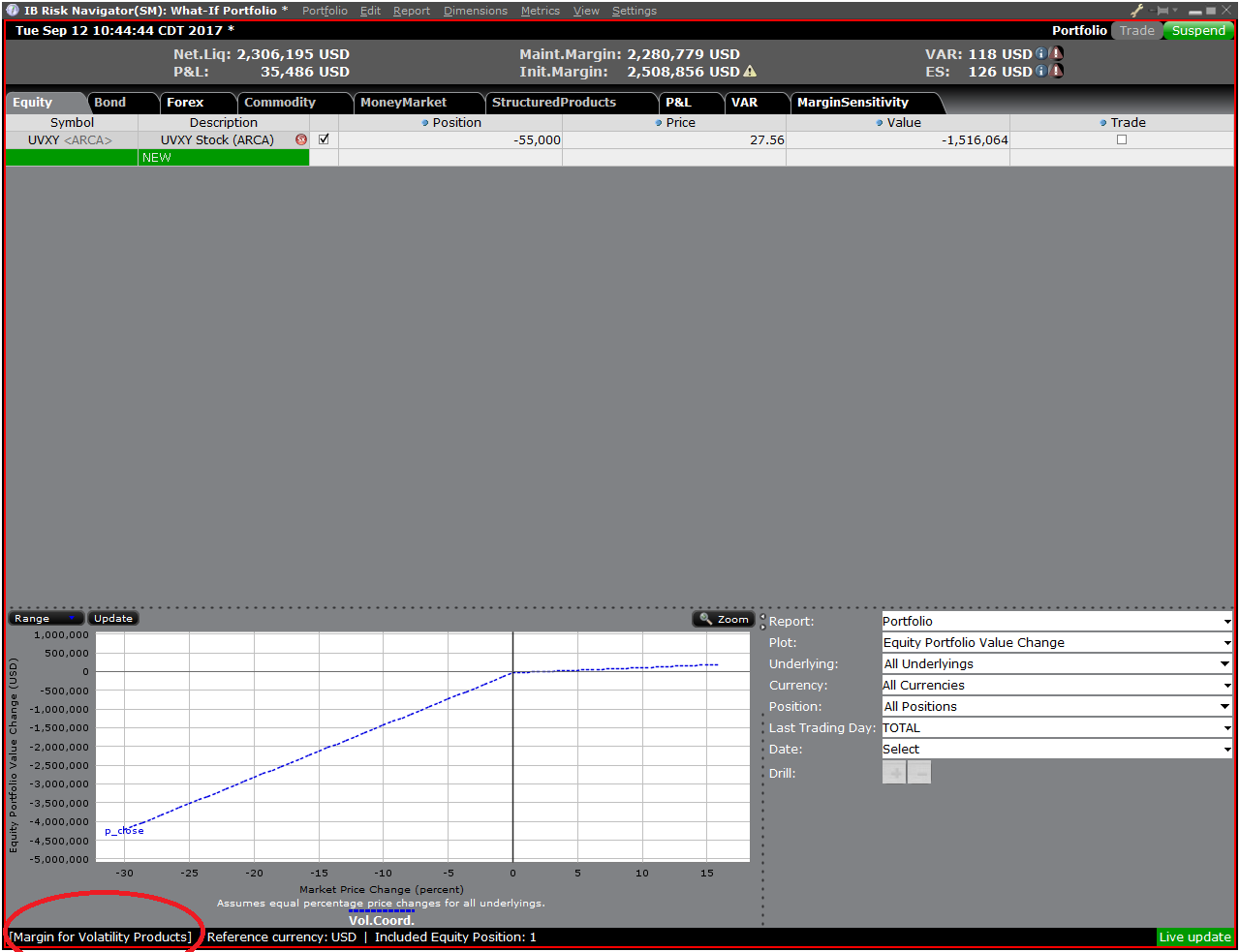

新しい証拠金モード設定が指定され次第、リスク・ナビゲーターのダッシュボードがこれを反映して自動的に更新されます。証拠金モード設定はどちらにでも簡単に切り替えることができます。現在の証拠金モードはリスク・ナビゲーターのウィンドウ(表示 5)の左下端に表示されます。

表示 5

ステップ 4: ポジションの追加

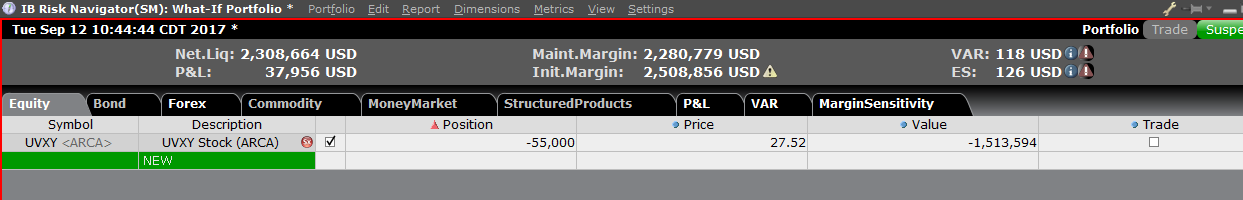

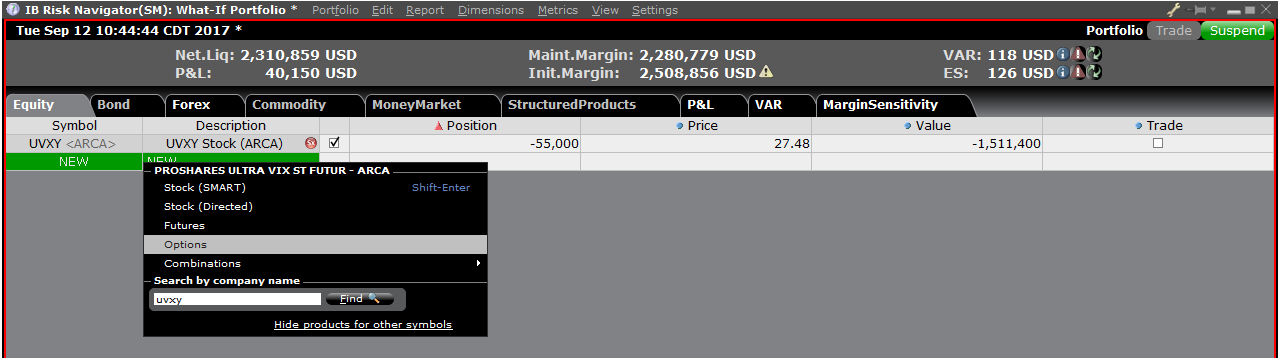

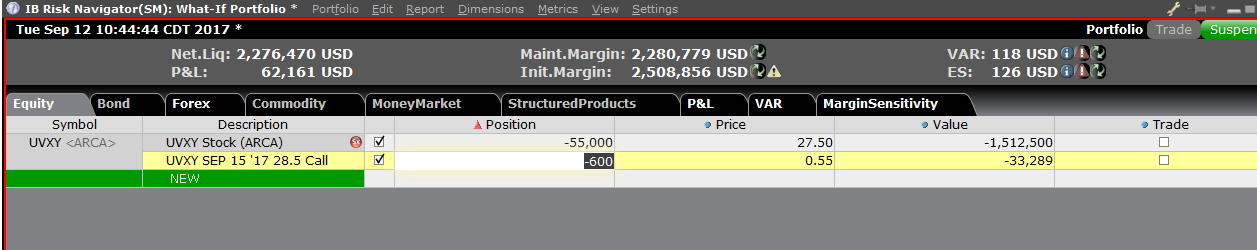

「What-If」ポートフォリオにポジションを追加するには、先ず「新規」とタイトルのついた緑色の列をクリックしてから原資産シンボルを入力してください(表示 6)。この後、商品タイプを指定してから(表示 7)ポジションの数量を入力してください(表示 8)。

表示 6

表示 7

表示 8

ポジションを変更して、これによる証拠金への影響を見ることができます。ポジションの変更後は証拠金額の右にある再計算アイコン(![]() )をクリックして、アップデートしてください。アイコンが表示されている場合には、証拠金額がWhat-If ポートフォリオの内容と一致していないことを意味します。

)をクリックして、アップデートしてください。アイコンが表示されている場合には、証拠金額がWhat-If ポートフォリオの内容と一致していないことを意味します。

Disclosure Regarding Interactive Brokers Price Cap Notices

Regulators expect brokerage firms to maintain controls designed to prevent the firm from submitting orders to market centers that create a risk of disruptive trading (e.g., the risk of sudden, transient price moves).

To comply with these expectations, Interactive Brokers implements various price filters on customer orders. Those price filters may, in certain circumstances, price cap customer orders in order to avoid market disruption, and those Price Caps will generally be in a % range from a reference price range calculated by IB. (The range of the Price Cap varies depending on the type of instrument and the current price.)

Although the price caps are intended to balance the objectives of trade certainty and minimized price risk, a trade may be delayed or may not take place as a result of price capping. More information is available in Interactive Broker’s Order Routing and Payment for Order Flow Disclosure.

If a customer’s order(s) are price capped by IB’s systems, that customer will either receive (i) real-time notification of those price cap(s) in Trader Workstation or via the API or FIX tag 58 (for FIX users); and/or (ii) a daily FYI message containing a digest of the first 10 order(s) that were price capped the prior day, the initial price cap(s) for those order(s) (if applicable), and the Price Cap Range(s) for further Price Cap(s) of those order(s).

Customers may opt out from receiving future FYI Messages by clicking the relevant opt-out link within an FYI Message. By opting out from receiving these future FYI Messages, a customer:

- Agrees to waive any further notifications from Interactive Brokers about the application of the firm’s Price Caps to that customer’s order(s); and

- Acknowledges that he or she understands that his or her orders may be price-capped in the future, but that the customer does not wish to be notified again about the application of any Price Caps to any of his or her orders.

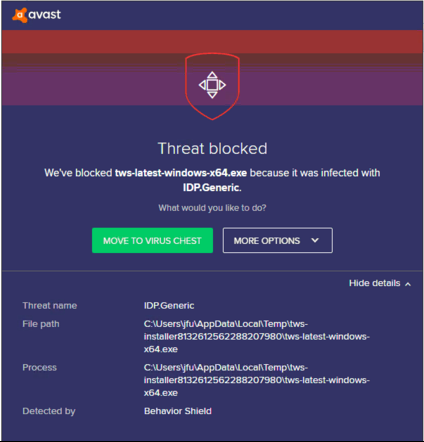

Possible Alerts during the TWS installation or update

IBKR's Trader Workstation (TWS) is a global trading system enabling clients to use a suite of online trading tools. The TWS can be installed on Windows, Mac OS X and Linux, and it requires the presence of a Java Runtime Environment (JRE). Therefore, when you install the TWS, it also downloads the necessary Java files in order to run using a Java Virtual Machine (JVM).

Sometimes, during the installation or update process of the TWS, software such as Antivirus applications will show an alert and prevent the process to complete. The warning and other messages in this case can safely be ignored, and you can complete the installation of the trading platform.

Table of content

Downloading the TWS installer and update patches

The TWS installers available in the download areas of ibkr.com or IBKR regional web sites are sealed and digitally signed using all the safety procedures required by the industry standards and do not contain any malicious code or process. The same industry standard practices have been used for the TWS update patches, which are automatically downloaded and installed when launching the TWS (if and only if there is an update available). Nevertheless, if you have received an alert, we recommend you to be cautious. Should you intend to keep the TWS installation file on your machine for future use, you should make sure that the same precautions for the protection of data from viruses and malware are applied to it.

Why do I receive a warning when I install the TWS or when the TWS automatic update runs?

You might see an alert (similar to Figure 1 but not limited to) and your security system would wait for your input on how to process the suspicious file. You usually have the option to quarantine the file, delete it, ignore it once or create a permanent exception for it.

Please note that your antivirus might autonomously quarantine or delete the TWS installer file or some of his components without asking for your confirmation and without showing you any warning. Nevertheless, this should only happen if you have preset your antivirus to specifically react in this way.

Figure 1.

What should I do when I receive a warning?

In case you receive a warning during the TWS installation or update, we recommend the following steps:

1. Delete the TWS installer and download it again from the IBKR main or regional web site

a) Delete the TWS installer file already present on your computer and then delete it as well from your Trash (empty your Trash)

b) From the table below, click on the TWS download area correspondent to your location

| Location | TWS download area |

| US | https://www.ibkr.com |

| Asia / Oceania | https://www.interactivebrokers.com.hk |

| India | https://www.interactivebrokers.co.in |

| Europe | https://www.interactivebrokers.co.uk https://www.interactivebrokers.eu |

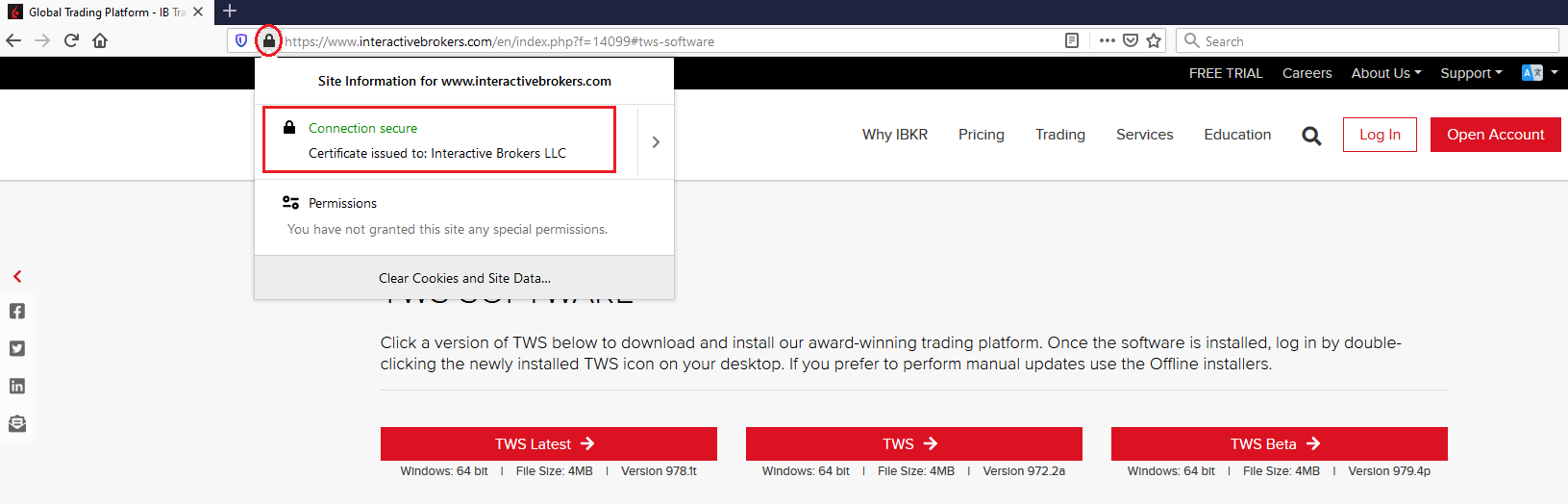

c) Check the website certificate. Most Internet browsers will immediately alert you in case the site certificate is invalid, compromised or expired. Nevertheless, if you want to check manually the validity of the site certificate, click on the padlock close to the address (URL) and make sure the Connection is reported as secure and no security warning are present (see Figure 2 below).

Figure 2.

d) Click on the button labeled with the TWS version you wish to use and download again the TWS installer

2. Check the digital signature of the TWS installer file you have downloaded

Normally you will immediately receive a security warning in case the digital signature of a file is compromised. Nevertheless, if you wish to perform a manual check, proceed as follows, according to your Operating System:

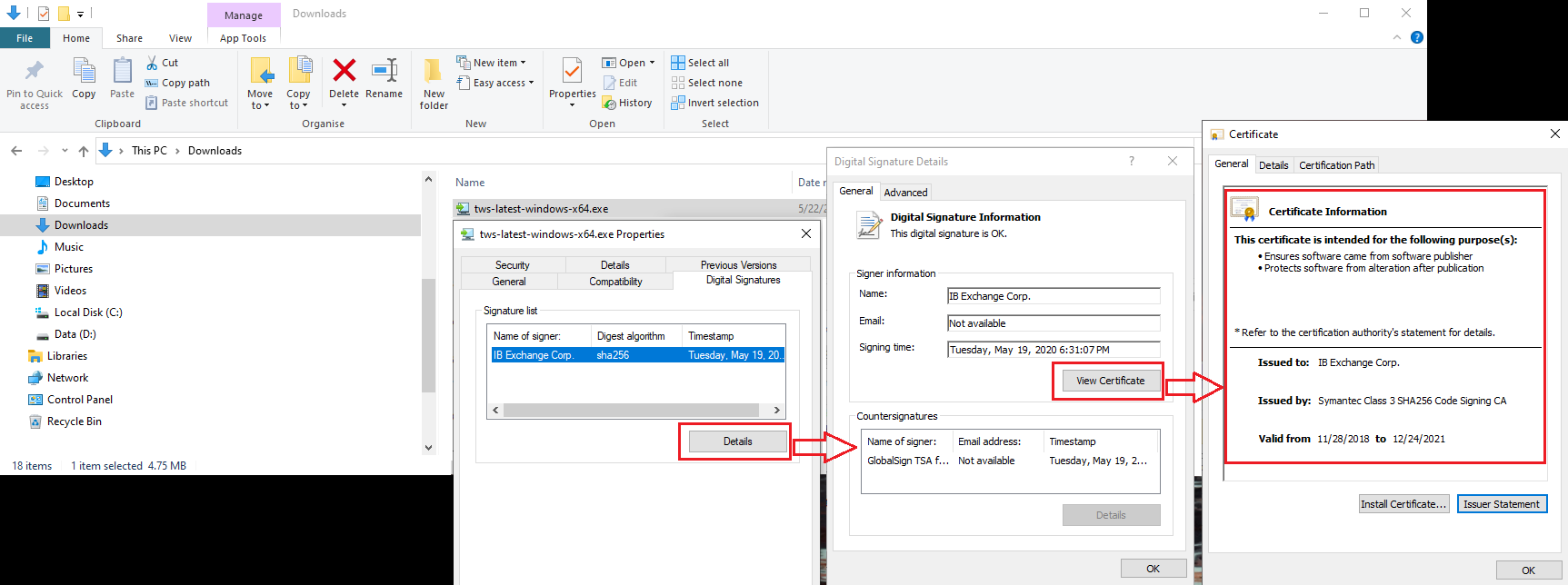

For Windows

a) From the Windows file explorer, access your Downloads folder or the folder where you placed the TWS installer

b) Right click on the TWS installer file, select Properties and then click on the tab "Digital Signatures"

c) Click on "Details" and on "View Certificate" to check the certificate status and signer. The legitimate signer is "IB Exchange Corp." (See Figure 3 below)

Figure 3.

For Mac OS X

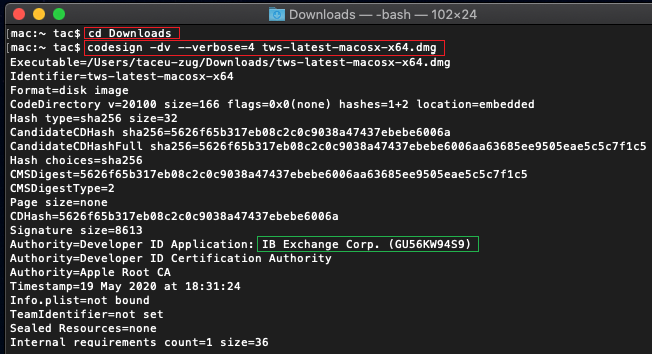

a) Click on the magnifier glass (Spotlight Search) on the top right of your screen and type Terminal. From the search results, launch the Terminal app

b) Type cd Downloads and press Enter

c) Type codesign -dv --verbose=4 tws-latest-macosx-x64.dmg and press Enter. Please notice that the name of the file (tws-latest-macosx-x64.dmg) may differ according to the TWS version you decided to download. If needed, replace the file name in the command with the appropriate one

d) Check the command output and make sure the "Developer ID Application" is "IB Exchange Corp." (see Figure 4 below)

Figure 4.

3. Run the TWS installer file you have downloaded

Once you have downloaded again the TWS installer and after you made sure the file is original (points 1. and 2. above), you can proceed with the installation. Should you still receive a warning from your antivirus, you can reasonably consider it as a false positive and ignore it. Should you need guidance on this step, please proceed directly to the next section.

How can I signal an Alert as false positive?

All modern security systems allow the creation of exceptions, precisely in order to address false positive cases. An exception is a rule forcing the antivirus engine not to scan a specific file or process. That specific file or process will hence be deemed safe and no further alerts will be raised for it.

The procedure for creating an exception may vary, according to the security software you are using. You may be able to create a temporary or permanent exception directly from the alert pop-up or you may have to create one manually from a specific section in the main configuration panel.

If you are unsure of the procedure, we recommend you to consult your antivirus documentation.

Once you have set an exception for the TWS installer file or for the TWS updater process, those will be no longer blocked and will be able to complete their respective tasks successfully.

What else can I do if I have doubts or if my system behaves abnormally?

If you have reasons to believe your machine may be compromised or infected, we recommend performing a full system scan. Usually you can right click on the antivirus icon present on the bottom taskbar (for Windows) or on the upper menu bar (for MacOS) and you will find the option to launch a full system scan. Alternatively, you may start that task from the main antivirus window. If you are unsure of the procedure, we recommend you to consult your antivirus documentation.

Technical Background

How does my security system scan the files I download from the Internet?

Modern antivirus and anti-malware engines base their threats recognition on:

Signature-based scanning: the antivirus scanner searches for a specific pattern of bytes that was previously catalogued as malicious or at least suspicious. The antivirus may check as well file signatures (called hash) against a database of known threats (called virus definitions).

Analysis of behavior: the antivirus engine detects specific actions which individually may not represent a threat but, when correlated together, resemble the usual activity of a malicious software (e.g. the ability of a code to replicate or hide itself, download additional files from the Internet, contact external hosts over the Internet, modify the Operating System registry) This type of scan is designed to detect previously unknown computer threats.

Heuristic detection: the scanner de-compiles the code or runs it within a virtual, restricted environment. It then classifies and weights the actions performed by the code against a predefined, behavior based, rule set.

Cloud-based protection and machine learning: those are relatively new techniques. The file that needs to be analyzed is sent to the antivirus / security system vendor cloud where sophisticated algorithms perform a deep analysis of the code authenticity and behavior.

Are those scan methods infallible?

Modern threats are very sophisticated and, like biological viruses, can mutate their code and their signatures. Moreover, new malwares and exploits are created every day and spread rapidly over the Internet. The threat recognition methods mentioned above are therefore not infallible but can guarantee a high percentage of malware recognition when combined together.

While signature based techniques are very successful in recognizing known threats and less prone to false positives, they are not so efficient in recognizing unknown malware or mutations of existing ones. In this area, the behavioral and heuristic methods perform much better although they are more prone to false positives since their detection is not based on bare code matching but on a certain degree of interpretation and hence uncertainty.

The term "false positive" is used when a security system classifies an innocuous file or process as malware.

Reference: