Clearinghouse Restrictions on Cannabis Securities

Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Consequently, those securities will no longer trade on the Stuttgart (SWB) or Frankfurt (FWB) stock exchanges. Effective as of the 19 September 2018 close, IBKR will take the following actions:

- Force close any impacted positions which clients have not acted to close and that are not eligible for transfer to a U.S. listing; and

- Force transfer to a U.S. listing any impacted positions which clients have not acted to close and that are eligible for such transfer.

Outlined in the table below are impacted issues as announced by the Boerse Stuttgart and Clearstream Banking as of 7 August 2018. This table includes a notation as to whether the impacted issue is eligible for transfer to a U.S. listing. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information.

| ISIN | NAME | EXCHANGE | U.S. TRANSFER ELIGIBLE? | U.S. SYMBOL |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | YES |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | YES |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | YES |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | YES |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | YES |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | YES |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | YES |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | YES |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | YES |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | YES |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | YES |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | YES |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | YES |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

IMPORTANT NOTES:

- Note that the U.S. listings generally trade over-the-counter (PINK) and are denominated in USD not EUR thereby exposing you to exchange rate risk in addition to market risk.

- Account holders maintaining PINK Sheet securities require United States (Penny Stocks) trading permissions in order to enter opening orders.

- All users on accounts maintaining United States (Penny Stocks) trading permissions are required use 2 Factor login protection when logging into the account.

Legal Entity Identifier Overview

BACKGROUND

The Legal Entity Identifier (LEI) is a 20-digit reference code that uniquely identifies legally distinct entities engaging in financial transactions globally, and across markets and jurisdictions. The LEI system was developed by the G-20 in accordance with ISO standards and the issuers of LEIs, referred to as Local Operating Units (LOU), supply registration and renewal services. Providing a unique identifier for each legal entity (along with key reference information associated with the entity) participating in financial transactions is intended to promote transparency.

DTC, in collaboration with SWIFT, operate as the local (U.S.) source provider of LEIs and maintains a website for the assignment of new and search of existing LEIs. See: http://www.gmeiutility.org/

SITUATIONS REQUIRING A LEI

In certain instances, brokers are required by regulation to report information regarding a client and include in that information a client identifier. For entities such as trusts and organizations, that identifier is referred to an a LEI. Examples of these reporting instances include the following:

CFTC Ownership and Control Reporting

MiFIR Transaction Reporting

China Stock Connect

EMIR reporting to trade repository

OBTAINING THE LEI

A LEI can be obtained by contacting an authorized LEI issuer, also referred to as a Local Operating Unit (LOU). The DTC, in collaboration with SWIFT, operates as a U.S. LOU and maintains a website for purposes of LEI registration and renewal. Note that LEI applicants can use the services of any accredited LOU and are not limited to using an LEI issuer in their own country.

In addition, as a service to its clients, IBKR will send an invite via Account Management to those who are required to obtain a LEI for trading or other regulatory reporting functions. Through this invite, the client can authorize IBKR to request an LEI through DTC on an accelerated basis (24 hours) and debit the client's account for the application fee and the annual renewal fee thereafter.

PRIIP Order Reject Translations

Clients entering opening orders for products covered by the PRIIPs Regulation where the issuer has not provided the required disclosure documents or Key Information Documents (KIDS) will have their order rejected and will receive the following reject message:

English

This product is currently unavailable to clients classified as 'retail clients'.

Note: Individual clients and entities that are not large institutions generally are classified as 'retail' clients.

There may be other products with similar economic characteristics that are available for you to trade.

French

Ce produit n’est pas actuellement disponible pour les clients considérés comme des clients “Particuliers/de détail”. Remarque : les clients particuliers et entreprises de détail qui ne sont pas de larges établissements sont classifiés comme des clients “de détail”.

D’autres produits aux caractéristiques similaires peuvent exister mais ne vous sont pas proposés au trading.

German

Dieses Produkt ist derzeit für Kunden, die als „Retail-Kunden” eingestuft werden, nicht verfügbar. Hinweis: Einzelkunden und Körperschaften, bei denen es sich nicht um große Institutionen handelt, werden grundsätzlich als „Retail”-Kunden bezeichnet.

Es ist möglich, dass Ihnen andere Produkte mit ähnlichen wirtschaftlichen Merkmalen zum Handel zur Verfügung stehen.

Italian

Questo prodotto al momento non è disponibile per i clienti “retail”. Nota: i clienti privati e le organizzazioni di non grandi dimensioni sono in genere classificati come clienti “retail”.

Potrebbero esserci altri prodotti con simili caratteristiche disponibili per le negoziazioni.

Spanish

Este producto no está actualmente disponible para clientes clasificados como “clientes minoristas”. Nota: los clientes individuales y las entidades que no sean grandes instituciones son clasificados, generalmente, como clientes “minoristas”.

Podría haber otros productos con características económicas similares que estén disponibles para que usted opere en ellos.

Russian

На данный момент этот продукт недоступен для розничных клиентов. Примечание: Частные лица и юридические структуры, не являющиеся крупными предприятиями, как правило, относятся к числу розничных клиентов.

Вам могут быть доступны другие продукты с похожими экономическими характеристиками.

Japanese

こちらの商品は現在「リテール・クライアント」として分類されるお客様にはご利用いただけません。注意:大きな機関ではない個人のお客様および事業体のお客様は、通常「リテール」クライアントとして分類されます。

似た経済特性を持つその他の商品で、お客様にお取引いただくことのできる商品がある可能性があります。

Chinese Simplified

该产品目前不适用于"零售客户"。 请注意:个人用户和非大型机构实体通常均被划分为"零售"客户。

可能有其他具有类似经济特征的产品适用于您的交易。

Chinese Traditional

該產品目前不適用於"零售客戶"。請注意: 個人用戶和非大型機構實體通常均被劃分為"零售"客戶。

可能有其他具有類似經濟特徵的產品適用於您的交易。

Please note, it is possible to be reclassified from Retail to Professional once certain qualitative, quantitative and procedural requirements are met. For more information on requirements, please see: How can I update my MiFID client category?

China Connect Northbound Investor ID Model

In November 2017, the Securities and Futures Commission (SFC) and China Securities Regulatory Commission (CSRC) announced an agreement to introduce an investor identification regime for Northbound trading under Mainland-Hong Kong Stock Connect. This regime is intended to enhance regulatory surveillance of mainland-listed stock trading from Hong Kong and requires brokers to report the identity of clients submitting orders to either the Shanghai or Shenzhen Stock Exchange. This regulation will be effective as of September 26, 2018. Additional information is provided in the series of FAQs below.

The Stock Connect is a collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges which allows international and Mainland Chinese investors to trade securities in each other's markets through the trading and clearing facilities of their home exchange.

Northbound trading refers to the trading of mainland-listed stocks (e.g., Shanghai and Shenzhen Stock Exchanges) from the Hong Kong Stock Exchange.

The information collected and reported depends upon the client classification. In the case of individuals, the information is as follows:

- Name in English and Chinese

- ID issuing country/jurisdiction

- ID type (Hong Kong ID card, ID card issued by the government authority of relevant country/region, passport, or any other official identity document e.g. driver's license)

- ID number (number of ID document)

- Entity name

- Other official incorporation documents (IBKR will attempt to us the documents clients provided at the point of account opening, whenever possible).

- Legal Entity Identifier (if you do not already have an LEI, you can order one through IBKR when requesting trading permissions for China Connect. Note that obtaining a LEI can take up to three days, is associated with an application fee imposed by the LEI issuing organization, and an annual renewal fee thereafter).

Clients who wish to access the Stock Connect must provide IBKR with consent to provide their information to the Hong Kong Exchanges and Clearing Ltd and the Chinese regulatory bodies such as:

- Shanghai and Shenzhen Stock Exchanges

- China Securities Depository and Clearing (Hong Kong) Company Limited

- Mainland regulatory authorities and law enforcement agencies

Clients with existing Northbound trading permissions will be presented with the online form upon log in to Client Portal. This form will allow IBKR to collect the required information and consent to submit this information upon order submission.

The Northbound Investor ID model will be effective as of October 22, 2018.

The SFC and the CSRC also agreed to introduce a similar investor identification regime for Southbound trading as soon as possible after the regime for Northbound trading is implemented.

Once the Northbound Investor ID model is in effect, clients who either fail to provide the required information or elect not to provide consent to report the required information will not be allowed to submit opening Northbound orders but will be allowed to close existing positions.

In order to trade China Connect stocks clients are required to login to Client Portal and request the necessary trading permissions. To do so:

- Log into Client Portal

- Click the User menu (head and shoulders icon in the top right corner) followed by Manage Account

- If you manage multiple accounts, select an account by clicking on the account number to popup the Account Selector

- Click the Configure (gear) icon next to Trading Experience & Permissions

- Click on "Stocks" and check the box next to "Hong Kong/China Stock Connect"

- Click CONTINUE and follow the prompts on screen.

China Connect - Disclosure Obligation and Foreign Shareholding Restriction

The following is a high-level summary of the disclosure obligations and foreign investors’ shareholding restriction applicable to the trading of Shanghai Stock Exchange (SSE) Securities or Shenzhen Stock Exchange (SZSE) Securities under Stock Connect.

Both Interactive Brokers, in its role as a China Connect Exchange Participant, and investors trading SSE/SZSE Securities through Interactive Brokers are required to comply with these requirements.

I. Disclosure Obligation

- When an investor holds or controls up to 5% of the issued shares of a Mainland listed company, the investor is required to report in writing to the China Securities Regulatory Commission (“CSRC”) and the relevant exchange, and inform the Mainland listed company within three working days of reaching 5%.

- The investor is not allowed to continue purchasing or selling shares in that Mainland listed company during the three day notification period.

- For such investor, whenever there is an increase or decrease in his shareholding that equals or exceeds 5% of the existing holdings, he is required to make disclosure within three working days of the change. From the day the disclosure obligation arises to two working days after the disclosure is made, the investor may not buy or sell the shares in the relevant Mainland listed company.

- If a change in shareholding of the investor is less than 5% but results in the shares held or controlled by him/her falling below 5% of the relevant Mainland listed company, the investor is required to disclose the information within three working days of the event.

II. Shareholding Restriction

- A single foreign investor’s shareholding in a Mainland listed company is not allowed to exceed 10% of the company’s total issued shares, while all foreign investors’ shareholding in the A shares of the listed company is not allowed to exceed 30% of its total issued shares.

- When the aggregate foreign shareholding of an individual A share reaches 26%, SSE or SZSE will publish a notice on its website.

- Once SSE or SZSE informs the Stock Exchange of Hong Kong Limited (SEHK) that the aggregate foreign shareholding of an SSE or SZSE Security reaches 28%, further Northbound buy orders in that SSE or SZSE Security will not be allowed, until the aggregate foreign shareholding of that SSE or SZSE Security is sold down to 26%.

- If the 30% threshold is exceeded due to Shanghai Connect or Shenzhen Connect, HKEX will identify the relevant China Connect Exchange Participant and require it to follow the forced-sale requirements, whereupon the foreign investors concerned will be requested to sell the shares on a last-in-first-out basis within five trading days of notifying the relevant China Connect Exchange Participant.

III. Additional Information

For additional information, including details of position disclosure and restriction, please refer to the following website links:

Stock Connect FAQ (10 April 2017): http://www.hkex.com.hk/-/media/hkexmarket/mutual-market/stock-connect/getting-started/information-bookletand-faq/faq/faq_en

Chapter 14A China Connect Service - Shanghai:

http://www.hkex.com.hk/-/media/hkex-market/services/rules-and-forms-andfees/rules/sehk/securities/rules/chap-14a_eng

Chapter 14B China Connect Service - Shenzhen:

http://www.hkex.com.hk/-/media/hkex-market/services/rules-and-forms-andfees/rules/sehk/securities/rules/chap-14b_eng

How to Complete CFTC Form 40

Clients maintaining a U.S. futures or futures option position at a quantity exceeding the CFTC's reportable thresholds may be contacted directly by the CFTC file with a request that they complete a Form 40. Contact will generally be made via email and clients are encouraged to respond to such requests in a timely manner to avoid trading restrictions and/or fines imposed by CFTC upon their account at the FCM.

Completion of the Form requires the following steps:

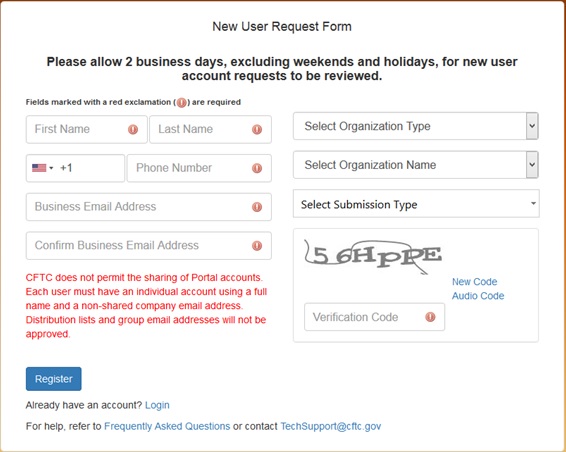

- Register for a CFTC Portal Account - performed online at: https://portal.cftc.gov/Account/Register.aspx Registration will require entry of the 9-digit code that the CFTC provided to you within the email requesting that you register. If you cannot locate your code or receive an invalid entry message, contact TechSupport@cftc.gov. When entering "Organization Type" from the drop-down selector, choose "LTR (Large Traders)".

2. Complete Form 40 - You will receive an email notification from the CFTC once your Portal Account has been approved. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. The email will contain a link to the Portal where you will be prompted to log in: https://portal.cftc.gov/

Instructions for completing the form are available at: https://www.ecfr.gov/cgi-bin/text-idx?node=ap17.1.18_106.a

Note that Portal provides the opportunity to save a copy of your submission in XML format, a recommended step, as this allows for uploading the file to the Portal should you need to make modifications at a later date. This will eliminate the need to renter the form in its entirety.

The CFTC will send a confirmation email upon successful completion of your Form 40.

3. Confirm with IBKR - forward your confirmation email, or other evidence that you have submitted the Form 40 to cftc_form40_filing@interactivebrokers.com. This will assist to ensure that your account is not subject to CFTC directed restrictions or fines.

Overview of CFTC Form 40

The CFTC, the primary regulator of U.S. commodity futures markets and Futures Commission Merchants (FCMs), operates a comprehensive system of collecting information on market participants as part of its market surveillance and large trader reporting program.

IBKR, as a registered FCM providing clients with access to those markets, is obligated to report to the CFTC information on clients who hold a position in a quantity that exceeds defined thresholds (i.e., a "reportable position"). In order to report this information, IBKR requires clients trading U.S. futures or futures options to complete an online CFTC Ownership and Control Reporting form at the point the client requests futures trading permissions.

Once a client holds a "reportable position", the CFTC may then contact that client directly and require them to file more detailed information via CFTC Form 40. The information required of this report includes the following:

- Trader's name and address

- Principal business

- Form of ownership (e.g., individual, joint, partnership, corporation, trust, etc.)

- Whether the reporting trader is registered under the Commodity Exchange Act

- Whether the reporting trader controls trading for others

- Whether any other person controls the trading of the reportable trader

- Name and location of all firms through which the reportable trader carries accounts

- Name and location of other persons providing a trading guarantee or having a financial interest in account of 10% or greater

- Name of accounts not in the reporting trader's name in which the trader provides a guarantee or has a financial interest of 10% or more.

Clients who fail to complete this Form in a timely manner may be subject to trading restrictions and/or fines imposed by CFTC upon their account at the FCM. It is therefore imperative that clients immediately respond to these CFTC requests.

To complete the CFTC Form 40, clients must first register for a CFTC Portal Account, an online process which is subject to a review period of 2 business days from the point of initial registration to acknowledgement of approval by the CFTC. For information regarding this registration process and completing the Form 40, see KB3149.

PRIIPs Regulation

The Packaged Retail and Insurance-based Investment Products Regulation - EU No 1286/2014 (“PRIIPs Regulation” or “PRIIPs”) became applicable on 1 January 2018.

A PRIIP is defined as any investment where the amount repayable to the investor is subject to fluctuations because of exposure to reference values. PRIIPs include ETFs, options, futures, CFDs, structured products, etc.

The Regulation requires product manufacturers to create Key Information Documents (KIDs) and persons advising or selling PRIIPs to provide retail investors based in the European Economic Area (EEA) with KIDs to enable those investors to better understand and compare products. The UK Financial Conduct Authority (FCA) has equivalent requirements for UK residents.

As a broker, IBKR is required to block trading in a PRIIP if a KID is not available.

The objectives of the PRIIPs Regulation.

Since the financial crisis of 2008, one of the main objectives of the European Commission has been to increase consumer protection and rebuild confidence in financial markets.

The Regulation specifies that the Key Information Document (KID) must be prepared in a standardised format.

By defining a standard format and content for the KID, the Regulation aims to:

- Ensure that the information provided is complete and comparable between similar products in order to help investors make informed investment decisions.

- Improve transparency and increase confidence in the retail investment market.

What is a KID?

The KID is a 3-page document that contains important details of the product including general description, cost, risk reward profile and possible performance scenarios.

Who is the regulation applicable to?

The Regulation applies to both PRIIPs manufacturers and distributors. The responsibility to create and maintain the document falls to the product manufacturer. However, any distributor or financial intermediary that sells or provides advice about PRIIPs to a retail investor, or receives a buy order for a PRIIP from a retail investor, must provide the investor with a KID. This also applies to execution-only, online environments.

Who should receive a KID?

Retail investors domiciled in the EEA and the UK should receive a KID prior to investing in a PRIIP. If no KID is available from the manufacturer, the PRIIP will be restricted from trading for EEA and UK retail clients.

Generally KIDs must be provided in an official language of the country in which a client is resident.

However, clients of IBKR have agreed to receive communications in English, and therefore if a KID is available in English all EEA and UK clients can trade the product regardless of their country of residence.

If a KID is not available in English, but one is available in another language, German for example, the PRIIP can only be traded by retail clients who are citizens of, or resident in countries where that language is an official language, in this example Germany, Austria, Belgium, Luxembourg or Liechtenstein.

Special Case – US ETFs

U.S. clients are not impacted by PRIIPs, so the issuers of U.S. listed ETFs do not as a rule create KIDs. This means that EEA and UK Retail clients may not purchase the product. Clients nevertheless have several options:

- Many US ETF issuers have equivalent ETFs issued by their European entities. European-issued ETFs have KIDs and are therefore freely tradable.

- Clients can trade most large US ETFs as CFDs. The CFDs are issued by IBKRs European entities and as such meet all KID requirements.

- Clients may be eligible for re-classification as a professional client, for whom KIDs are not required.

CLIENT CATEGORISATION

We categorize all individual clients as “Retail” by default as this affords clients the broadest level of protection afforded by MiFID. Client who are categorised as “Professional” do not receive the same level of protection as “Retail” but are not subject to the KIDs requirement. As defined under MiFID II rules, “Professional” clients include regulated entities, large clients and individuals who have asked to be re-categorised as “elective professional clients” and meet the MiFID II requirements based on their knowledge, experience and financial capability.

We provide an online step-by-step process that allows “Retail” to request that their categorisation be changed to “Professional". The qualifications for re-categorisation along with the steps for requesting that one’s categorisation be considered are outlined here or, to directly apply for a change in categorisation, the questionnaire is available in the Client Portal/Account Management.

Implications for Interactive Brokers:

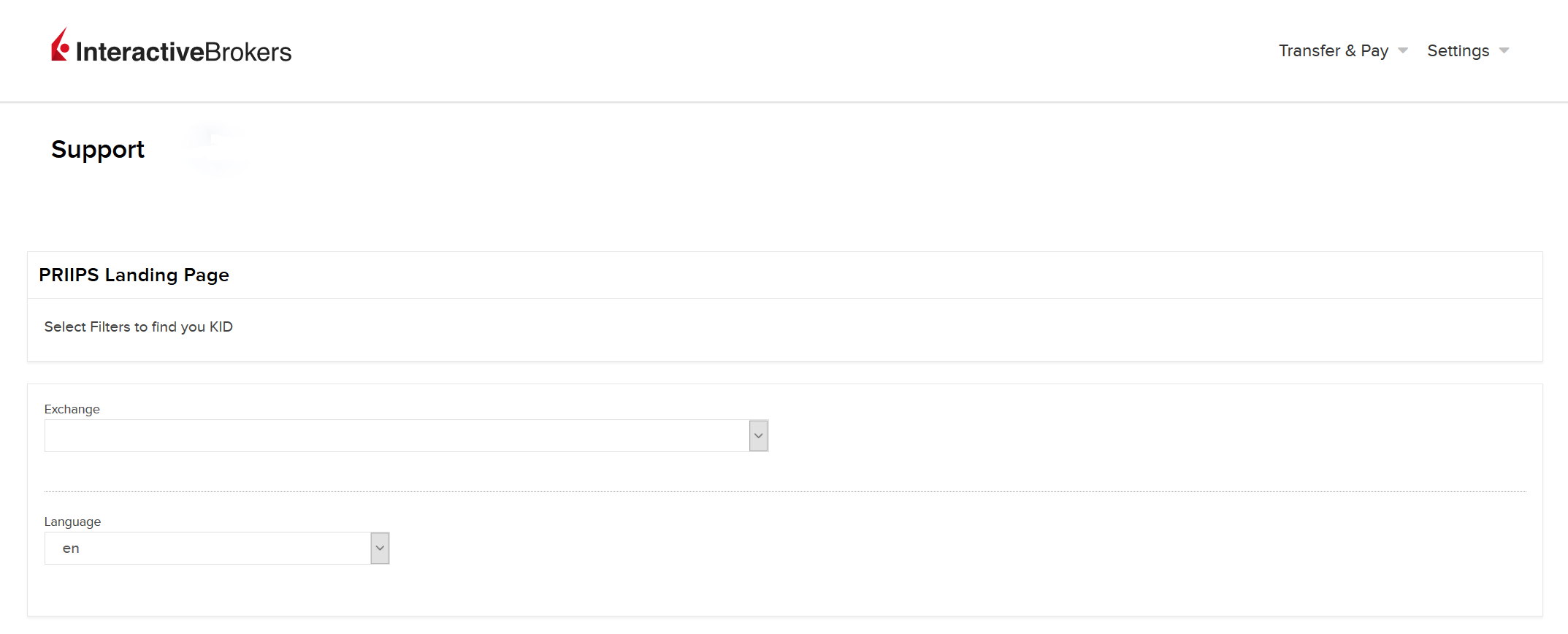

In order to meet the PRIIPs Regulation, where required, IB UK will provide KIDs electronically by means of a website (“PRIIPs KID Landing Page”).

Where can I find the PRIIPs KID Landing Page?

The KIDs can be accessed from our designated PRIIPs KID Landing Page. There are three different ways you can find the KIDs. They are available through the IBKR Trader Workstation (“TWS”), the IBKR website and Client Portal.

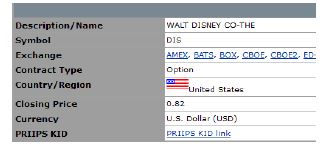

1. Find KIDs through TWS:

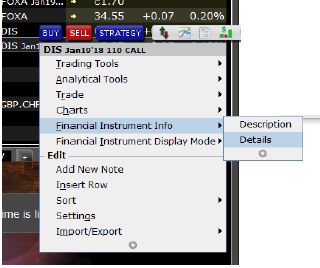

- Log into TWS

- Right click on the symbol of the product for which you want the KID.

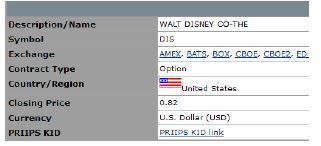

- Under Financial Instrument Info select Details.

- From the Contract Details page, you can select the PRIIPs KID link. This will take you to our PRIIPs KID Landing Page in Client Portal.

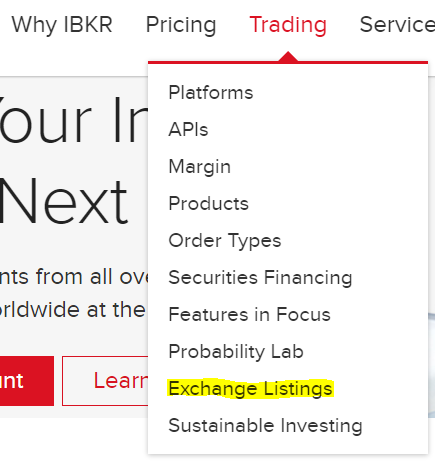

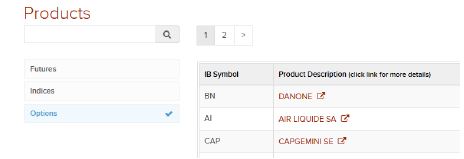

2. Find KIDs through the IBKR website:

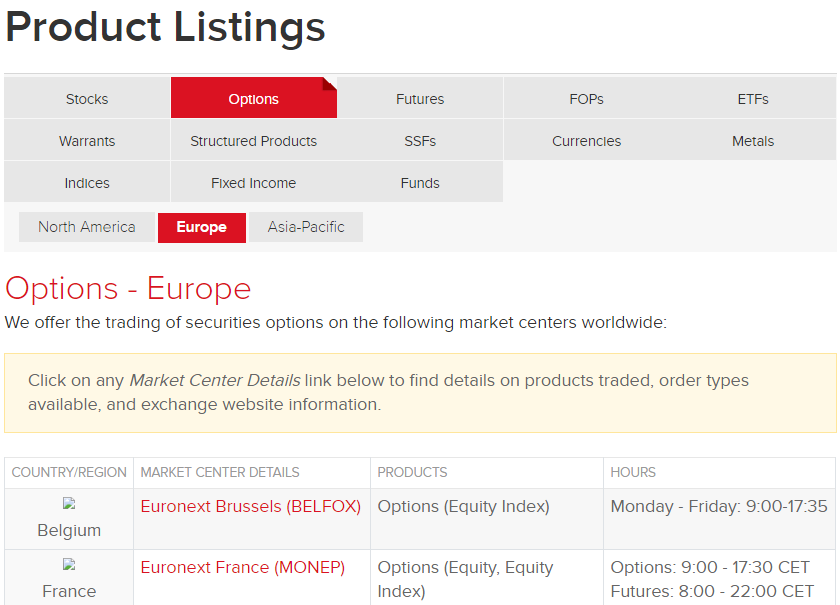

- Open the Trading tab and select Exchange Listings.

- From there, select Product Listings. Select the derivative type, region and exchange of the product for which you would like to find the contract information.

- Select the product you would like to see the KID of, which will take you to the Contract Details page.

- From the Contract Details page, as above, you can select the PRIIPs KID link, which will take you to our PRIIPs KID Landing Page in Client Portal.

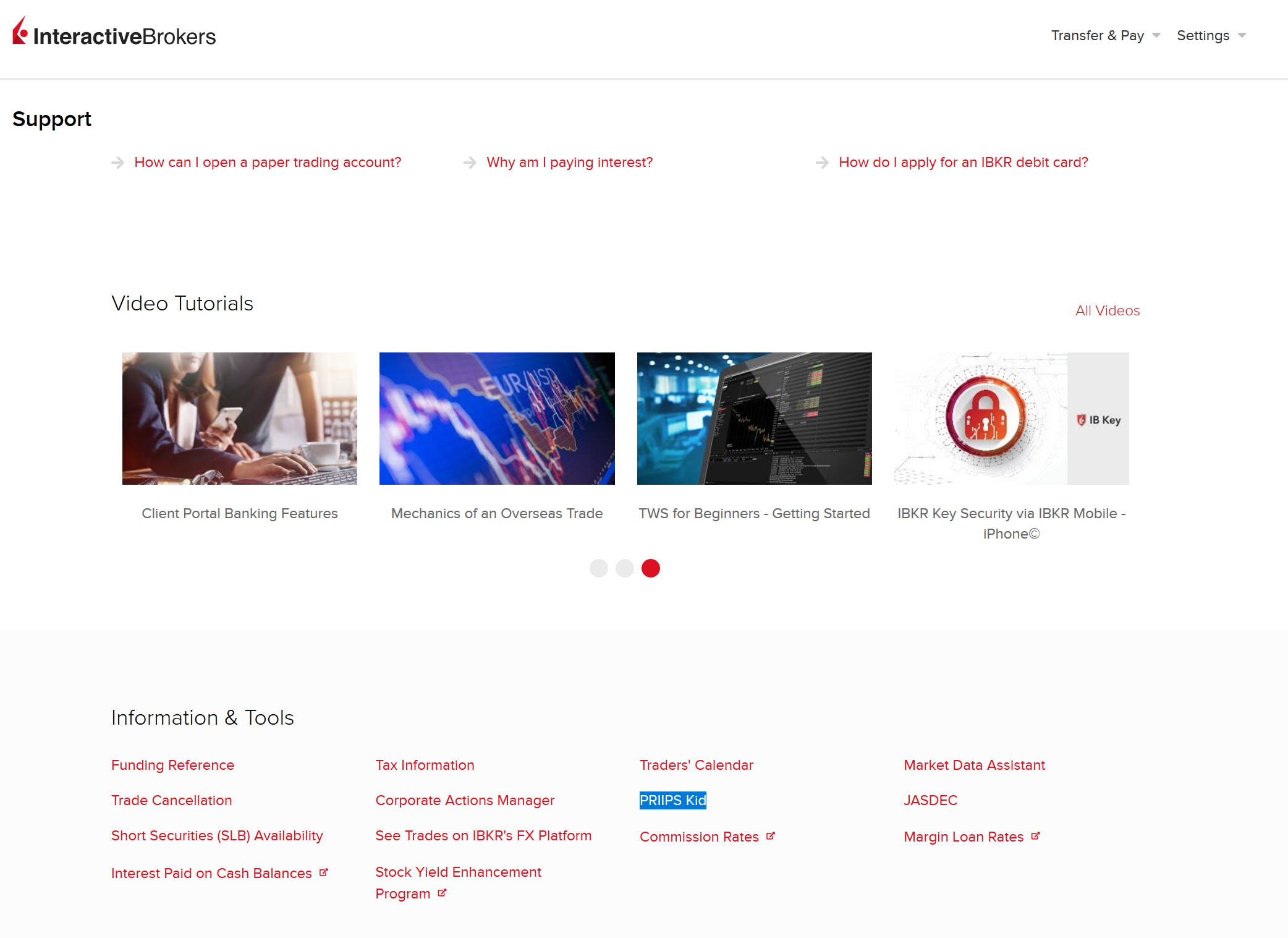

3. Find KIDs through Client Portal:

- Log into Client Portal.

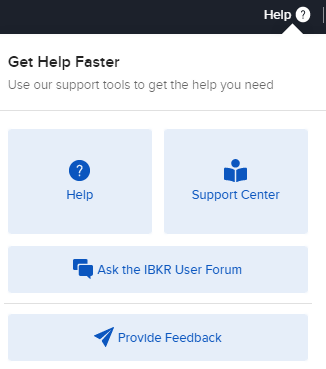

- Click the Help (?) icon followed by Support Center.

- In the Information & Tools section, select PRIIPs Kid, which will take you to our PRIIPs KID Landing Page.

Can I potentially get exposure to a US ETF/other PRIIPs restricted product through a CFD?

An investor could potentially get exposure to a U.S. ETF or other PRIIPs restricted product when trading a CFD (Contract for Difference) as some CFDs are designed to track the performance of underlying assets, including ETFs and other PRIIPs products.

If an investor trades a CFD that is designed to track the performance of a U.S. ETF or other PRIIPs product, the investor may be indirectly investing in that underlying asset. This is because the CFD's value is based on the value of the underlying asset, and any gains or losses in the value of the underlying asset will be reflected in the value of the CFD.

MiFIR Definitions & Terms

European Economic Area (EEA) - As of October 2017, the EEA consists of the following countries: Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the United Kingdom.

Investment Firms - Article 4 (1) (1) of MiFID II defines investment firm as any legal person whose regular occupation or business is the provision of one or more investment services to third parties and/or the performance of one or more investment activities on a professional basis. The investment services and activities covered by the framework are listed in Section A of Annex I of MiFID II.

Transactions Executed - For the purposes of MiFIR Transaction Reporting, a transaction is the conclusion of an acquisition or disposal of one of the financial instruments covered by MiFIR. A transaction is considered to be executed when it resulted from one of the following activities performed by an Investment Firm:

- Reception or transmission of orders in relation to one or more financial instruments (exceptions apply under Article 4 of Commission Delegated Regulation (EU) 2017/590);

- Execution of orders on behalf of clients;

- Dealing on own account;

- Making an investment decision in accordance with a discretionary mandate given by a client;

- Transfer of financial instruments to or from accounts.

[Ref: Articles 2 and 3 of Commission Delegated Regulation (EU) 2017/590]

IB Broker - Accounts that trade financial instruments which are received and/or transmitted by one of the following Interactive Brokers Group entities ("IB Brokers"):

- Interactive Brokers (U.K.) Limited

- Interactive Brokers Central Europe Zrt.

- Interactive Brokers Ireland Limited

Financial Instruments Covered by MiFIR - Article 26 (2) of Regulation (EU) No 600/2014 (MiFIR) lays out the transaction reporting obligation with regard to transactions in financial instruments listed below, irrespective of whether or not such transactions are carried out on the trading venue:

- Financial instruments which are admitted to trading or traded on a trading venue or for which a request for admission to trading has been made;

- Financial instruments where the underlying is a financial instrument traded on a trading venue; and

- Financial instruments where the underlying is an index or a basket composed of financial instruments traded on a trading venue.

The financial instruments covered by this requirement are legally enumerated in Section C of MiFID II:

(1) Transferable securities;

(2) Money-market instruments;

(3) Units in collective investment undertakings;

(4) Options, futures, swaps, forward rate agreements and any other derivative contracts relating to securities, currencies, interest rates or yields, emission allowances or other derivatives instruments, financial indices or financial measures which may be settled physically or in cash;

(5) Options, futures, swaps, forwards and any other derivative contracts relating to commodities that must be settled in cash or may be settled in cash at the option of one of the parties other than by reason of default or other termination event;

(6) Options, futures, swaps, and any other derivative contract relating to commodities that can be physically settled provided that they are traded on a regulated market, a MTF, or an OTF, except for wholesale energy products traded on an OTF that must be physically settled;

(7) Options, futures, swaps, forwards and any other derivative contracts relating to commodities, that can be physically settled not otherwise mentioned in point 6 of this Section and not being for commercial purposes, which have the characteristics of other derivative financial instruments;

(8) Derivative instruments for the transfer of credit risk;

(9) Financial contracts for differences;

(10) Options, futures, swaps, forward rate agreements and any other derivative contracts relating to climatic variables, freight rates or inflation rates or other official economic statistics that must be settled in cash or may be settled in cash at the option of one of the parties other than by reason of default or other termination event, as well as any other derivative contracts relating to assets, rights, obligations, indices and measures not otherwise mentioned in this Section, which have the characteristics of other derivative financial instruments, having regard to whether, inter alia, they are traded on a regulated market, OTF, or an MTF;

(11) Emission allowances consisting of any units recognised for compliance with the requirements of Directive 2003/87/EC (Emissions Trading Scheme).

National Identifiers - Under MiFIR, natural persons must be reported by using specific national identifiers required under a priority order that depends and varies on the Country of citizenship that is identified as relevant under MiFIR. The identifier can be a passport, a national ID card, a tax or personal code or a concatenation of full name and date of birth (“CONCAT”). The IB Broker will only request clients to provide national identifiers that are not already available.

Legal Entity Identifiers (“LEI”) = 20-character unique identifier based on the ISO 17442 for the global identification of legal entities that engage in financial transactions.

Commodity Derivatives Transactions that reduce risk in an objectively measurable way - When reporting transactions in commodity derivatives, the IB Broker will have to specify whether the transaction reduces risk in an objectively measurable way in accordance with Article 57 of Directive 2014/65/EU (“Art 57”). The IB Broker will allow such transactions only from accounts held by entities that are non-financial entities using the account for trades in commodity derivatives that are intended to objectively reduce risk directly relating to their commercial activity in accordance with Art 57. (e.g. company that produces wheat that trades in such derivatives to hedge its commercial activity).

Account holders that make such a declaration in the Trading Permission section of their Account Management, agree that all the transactions executed in commodity derivatives for that account will be executed for reducing the risk under Art 57, and the IB Broker will report the relevant transactions accordingly.

Individual or algorithm responsible at the reporting firm for making the investment decision - Under MiFIR, Investment Firms are required to include in their transaction reports the identification of the individual or algorithm that was primarily responsible for making the investment decision within the firm to acquire or dispose of a financial instrument. Only one individual or algorithm can be identified as responsible with regard to a transaction, and Investment Firms must identify such individual or algorithm as specified in Article 8 of commission delegated regulation (EU) 2017/590.

In accordance with these requirements, your IB Broker has implemented a new section in Account Management and new features in the IB Trader Workstation to allow Investment Firms that report their transactions through an IB Broker to identify individuals and algorithms in compliance with the new obligations.

Individual responsible at the reporting firm for the execution of a transaction - Art 9 of Commission Delegated Regulation (EU) 2017/590 requires Investment Firms to identify individuals or algorithms responsible for determining which trading venue to access […], which firms to transmit orders to or any other condition related to the execution of an order. While this requirement applies only to IB Brokers for the majority of the transactions reports (because the IB Broker is usually the entity that executes the transaction), when an order is submitted by an Investment Firm that transaction reports through an IB Broker via the Delegated Transaction Reporting, the specific user that has submitted the order will be reported as responsible for executing the transaction.

Article 4 of commission delegated regulation (EU) 2017/590 - Transmission of an order

1. An investment firm transmitting an order pursuant to Article 26(4) of Regulation (EU) No 600/2014 (transmitting firm) shall be deemed to have transmitted that order only if the following conditions are met:

(a) the order was received from its client or results from its decision to acquire or dispose of a specific financial instrument in accordance with a discretionary mandate provided to it by one or more clients;

(b) the transmitting firm has transmitted the order details referred to in paragraph 2 to another investment firm (receiving firm);

(c) the receiving firm is subject to Article 26(1) of Regulation (EU) No 600/2014 and agrees either to report the transaction resulting from the order concerned or to transmit the order details in accordance with this Article to another investment firm.

For the purposes of point (c) of the first subparagraph the agreement shall specify the time limit for the provision of the order details by the transmitting firm to the receiving firm and provide that the receiving firm shall verify whether the order details received contain obvious errors or omissions before submitting a transaction report or transmitting the order in accordance with this Article.

2. The following order details shall be transmitted in accordance with paragraph 1, insofar as pertinent to a given order:

(a) the identification code of the financial instrument;

(b) whether the order is for the acquisition or disposal of the financial instrument;

(c) the price and quantity indicated in the order;

(d) the designation and details of the client of the transmitting firm for the purposes of the order;

(e) the designation and details of the decision maker for the client where the investment decision is made under a power of representation;

(f) a designation to identify a short sale;

(g) a designation to identify a person or algorithm responsible for the investment decision within the transmitting firm;

(h) country of the branch of the investment firm supervising the person responsible for the investment decision and country of the investment firm's branch that received the order from the client or made an investment decision for a client in accordance with a discretionary mandate given to it by the client;

(i) for an order in commodity derivatives, an indication whether the transaction is to reduce risk in an objectively measurable way in accordance with Article 57 of Directive 2014/65/EU;

(j) the code identifying the transmitting firm.

For the purposes of point (d) of the first subparagraph, where the client is a natural person, the client shall be designated in accordance with Article 6. For the purposes of point (j) of the first subparagraph, where the order transmitted was received from a prior firm that did not transmit the order in accordance with the conditions set out in this Article, the code shall be the code identifying the transmitting firm. Where the order transmitted was received from a prior transmitting firm in accordance with the conditions set out in this Article, the code provided pursuant to point (j) referred to in the first subparagraph shall be the code identifying the prior transmitting firm.

3. Where there is more than one transmitting firm in relation to a given order, the order details referred to in points (d) to (i) of the first subparagraph of paragraph 2 shall be transmitted in respect of the client of the first transmitting firm.

4. Where the order is aggregated for several clients, information referred to in paragraph 2 shall be transmitted for each client.

Also see:

Overview of MIFIR Transaction Reporting

MiFIR Enriched and Delegated Transaction Reporting for EEA Investment Firms

MiFIR Information Required from Account Holders that do not have Reporting Obligations

MiFIR Information Required from Account Holders that do not have Reporting Obligations

The MiFIR Transaction Reporting regime requires Investment Firms, like your IB Broker, to include specific client identifiers in their transaction reports.

Accounts that trade in financial instruments which are received and/or transmitted by one of the following Interactive Brokers Group entities (“IB Brokers”) will need to be identified in the IB Broker’s reports by using specific identifiers that may or may not be already available to it.

- Interactive Brokers (U.K.) Limited

- Interactive Brokers Central Europe Zrt.

- Interactive Brokers Ireland Limited

Similarly, Investment Firms that use the IB platform for their clients’ orders and have elected to transaction report through their IB Broker will have to use the same identifiers for their client orders. If you are the client of such a firm, your IB Broker may need additional information from you to complete the transaction reports.

Information Required

When additional information is necessary for this purpose, clients will be asked to provide it via the completion of an electronic form available in the Account Management.

The information requested for these accounts is:

- All countries of citizenship for natural persons that are account holders and authorised traders;

- A specific National Identifier for natural persons that are account holders and authorised traders;

- The Legal Entity Identifier for legal entities. Clients that do not have an LEI will be able to apply for one through their IB Broker.

- For organisation accounts, an indication as to whether the Legal Entity is a non-financial entity using the account for trades in Commodity Derivatives Transactions to reduce risk in an objectively measurable way in accordance with Article 57 of MiFID II.

Note: For a listing of common MiFIR definitions and terms, see KB2980

THIS INFORMATION IS GUIDANCE FOR INTERACTIVE BROKERS CLEARED CLIENTS ONLY. THIS GUIDANCE DOES NOT APPLY TO EXECUTION ONLY ACCOUNTS.

NOTE: THE INFORMATION ABOVE IS NOT INTENDED TO BE A COMPREHENSIVE OR EXHAUSTIVE GUIDANCE AND IT IS NOT A DEFINITIVE INTERPRETATION OF THE REGULATION, BUT A SUMMARY OF MiFIR TRANSACTION REPORTING OBLIGATIONS.