Где найти Ваш номер счета для ACATS-перевода

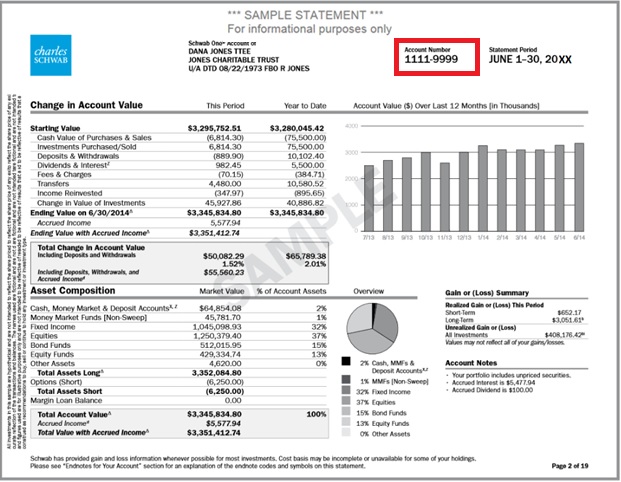

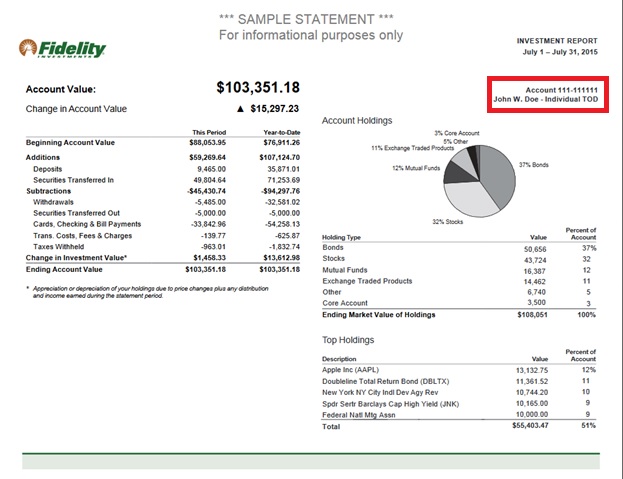

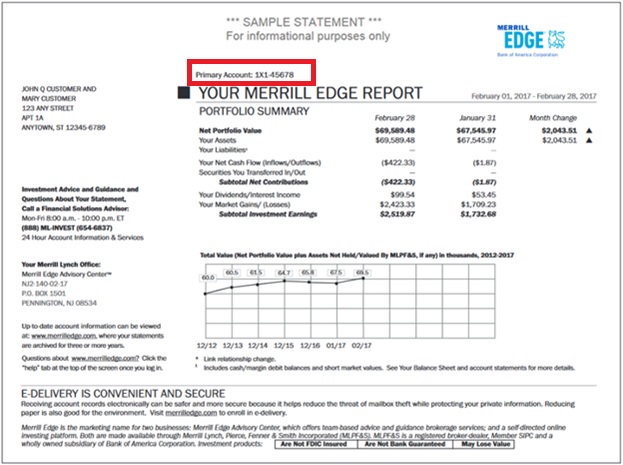

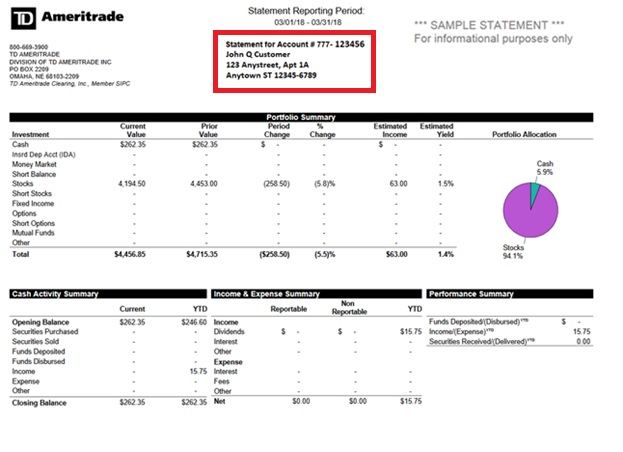

Для успешного перевода посредством ACAT или ATON Ваш брокер должен подтвердить номер счета, указанный в запросе. Если номер счета неправильный, то запрос будет отклонен. Клиентам рекомендуется ознакомиться с копией выписки от их брокера, чтобы убедиться в верности этих данных. Примеры выписок некоторых из популярных брокеров приведены ниже, местонахождение номера счета помечено красным.

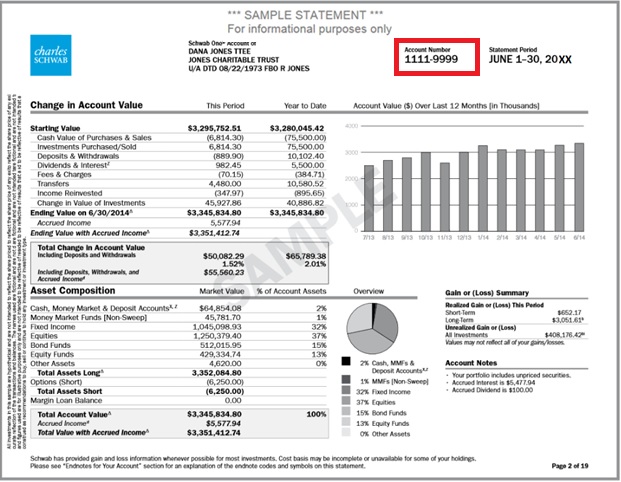

Charles Schwab - брокер №0164. Номер счета состоит из 8 знаков; только цифры.

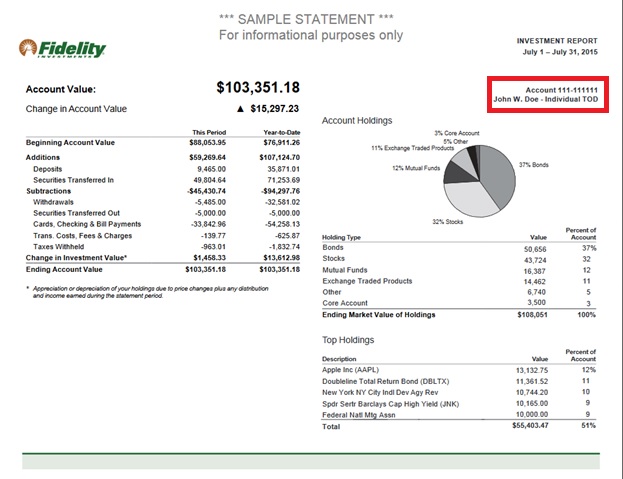

Fidelity Investments - брокер №0226, доставка через Национальную финансовую службу. Номер счета состоит из 9 знаков. Первые 3 знака могут быть буквами или цифрами, последние 6 знаков – цифры.

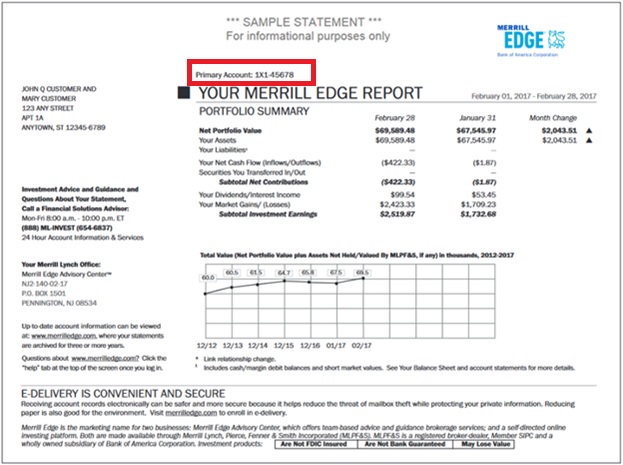

Merrill Edge - брокер №0671. Номер счета состоит из 8 буквенно-цифровых знаков.

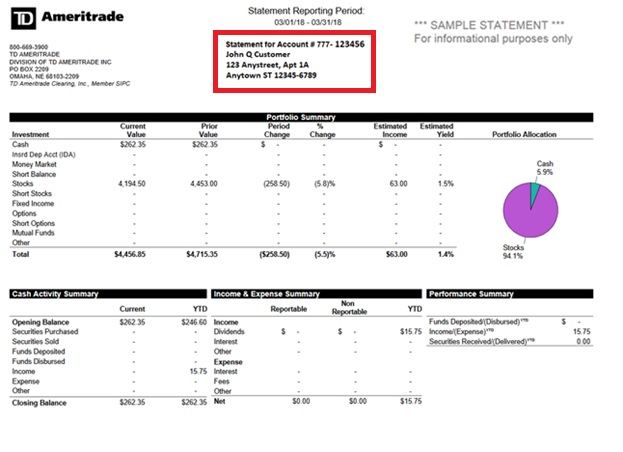

TD Ameritrade - брокер №0188. Номер счета состоит из 9 знаков; только цифры.

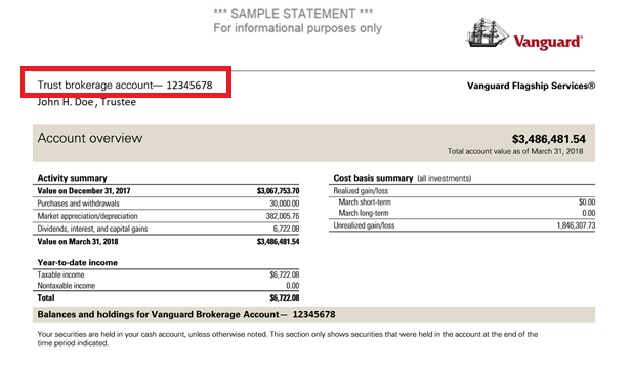

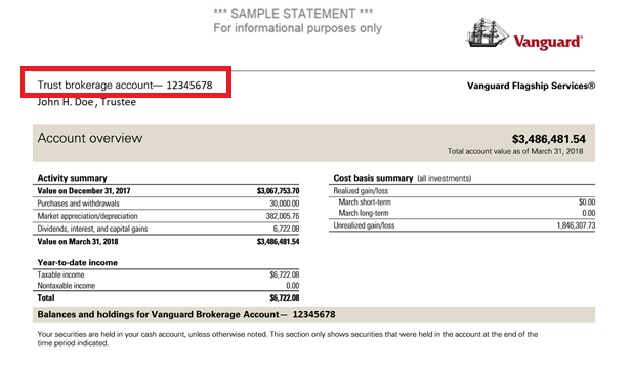

Vanguard- брокер №0062. Номер счета состоит из 8 знаков; только цифры.

ВНИМАНИЕ! Образцы различных брокерских выписок в данной статье используются в иллюстративных целях и могут содержать логотипы, принадлежащие соответствующему брокеру.

Ограничения для Microcap-акций США

Введение

В целях соблюдения правил продажи незарегистрированных ценных бумаг и минимизации ручной обработки при торговле акциями, которые не котируются публично, IBKR вводит определенные ограничения на акции микрокапитальных компаний США (Microcap). Список ограничений и другие часто задаваемые по этой теме вопросы приведены ниже.

Ограничения микрокапитальных акций

- IBKR принимает переводы пакетов Microcap-акций США только от определенных категорий клиентов. Категории включают счета: (1) с капиталом (до или после перевода) не менее $5 млн или принадлежащие клиентам финансовых консультантов с совокупной величиной активов в управлении не менее $20 млн; и (2) не менее половины капитала которых составляют Microcap-акции США.

- IBKR принимает переводы1 пакетов Microcap-акций США, только если соответствующий требованиям клиент может подтвердить, что акции приобретены на открытом рынке или зарегистрированы в SEC;

- IBKR не принимает от клиентов переводы1 Microcap-акций США или открытие ордеров на такие акции, если OTC присвоила им статусы "Caveat Emptor" (ответственность за покупку лежит на покупателе) или "Grey Market" ("серый" рынок). Клиенты могут закрыть все существующие позиции с такими акциями;

- IBKR не принимает переводы Microcap-акций США для покрытия коротких позиций, которые клиент имеет в IBKR;

- Только исполняющие клиенты (т.е., клиенты, которые исполняют сделки через IBKR, но осуществляют их клиринг на другой платформе) не могут торговать Microcap-акциями США со своего IBKR-счета (IBKR может сделать исключение для брокеров, зарегистрированных в США);

Часто задаваемые вопросы по Microcap

Что такое Microcap-акция США?

Термин “Microcap-акции” относится к акциям, которые (1) торгуются вне официальной биржи или (2) котируются на биржах Nasdaq и NYSE American, имеют рыночную капитализацию от $50 млн до $300 млн и торгуются по цене $5 или ниже. В рамках данной политики термин Microcap-акции также включает акции открытых компаний США, которые имеют рыночную капитализацию не больше $50 млн (также иногда называемые акциями с нанокапитализацией, или nanocap stocks) или торгуются на рынке, как правило, связанном с операциями по Microcap-акциям.

Во избежание постоянной переклассификации из-за краткосрочных колебаний цен, все акции США, отнесенные к категории Microcap, будут оставаться таковыми, пока рыночная капитализация и цена акций не станут непрерывно превышать $300 млн и $5 соответственно в течение 30 календарных дней.

Так как Microcap-акции часто имеют небольшую стоимость, их также называют "копеечными". IBKR может сделать исключения, в том числе для торгуемых по низким ценам акций, рыночная капитализация которых недавно была выше. Кроме того, IBKR не относит ADR иностранных (неамериканских) компаний к Microcap-акциям.

Где торгуются Microcap-акции?

Microcap-акции обычно торгуются на рынках OTC (т.е. внебиржевых, over-the-counter), а не на национальной бирже ценных бумаг. Акции часто котируются маркет-мейкерами электронно на платформах OTC, например, OTC Bulletin Board (OTCBB), и рынками в ведении OTC Markets Group (например, OTCQX, OTCQB и Pink). В эту категорию также входят акции, которые не торгуются публично и имеют статус "Caveat Emptor" (ответственность за покупку лежит на покупателе), "Grey Market" ("серый" рынок) или "Другие OTC".

Кроме того, регулирующие органы США также относят к категории Microcap акции, котируемые на биржах Nasdaq или NYSE American, которые торгуются по цене не больше $5 и имеют рыночную капитализацию не более $300 млн.

Что если перевод, который IBKR получает от подходящих клиентов, содержит одну или более позиций с Microcap-акциями?

Если IBKR получает перевод, содержащий пакет Microcap-акций, IBKR оставляет за собой право отграничить любую продажу Microcap-позиций из данного перевода, если соответствующий клиент не предоставит необходимое подтверждение того, что акции были приобретены на открытой бирже (т.е. на публичной бирже через другого брокера) или зарегистрированы SEC в соответствии с формой S-1 или аналогичным регистрационным заявлением.

Клиенты могут подтвердить, что акции были приобретены на открытой бирже, предоставив брокерскую выписку или подтверждение сделки от надежного брокера, в которых отражена покупка акций на публичной бирже. Подтвердить регистрацию акций можно предоставив номер документа в SEC (в системе Edgar), под которым компания зарегистрировала акции (и любые другие документы, необходимые для подтверждения, что торгуемые акции являются акциями, указанными в регистрационном заявлении).

ПРИМЕЧАНИЕ: Все клиенты могут в любое время вывести акции, на которые были наложены ограничения.

Какие ограничения IBKR накладывает на счета Prime?

Клиенты, пользующиеся услугами Prime, имеют необходимые права только в рамках тех сделок, которые IBKR согласилась принять от исполняющих брокеров. Однако, хотя счета Prime могут производить клиринг Microcap-акций США на IBKR, на такие акции будут распространяться ограничения до тех пор, пока IBKR не подтвердит, что они могут быть перепроданы в соответствии с описанным выше порядком.

Чтобы снять ограничения с акций, приобретенных на открытом рынке, попросите исполняющего брокера отправить нам письмо с подписью на официальном бланке компании или официальную выписку со счета, где указано, что акции были приобретены на открытом рынке. Письмо или выписка также должны соответствовать нижеприведенным критериям. Если же акции были куплены при их выпуске/предложении компанией, то письмо или выписка должны содержать ссылки на свидетельство о регистрации или другие документы, подтверждающие эмиссию конкретно этих бумаг.

Требования к письму:

1) Номер счета IBKR

2) Название счета IBKR

3) Дата сделки

4) Дата расчета

5) Символ

6) Сторона

7) Цена

8) Количество

9) Время исполнения

10) Биржа

11) Должна стоять подпись

12) Письмо должно быть напечатано на официальном бланке

Итак, длинные сделки на продажу будут приняты, если с длинной позиции сняты ограничения. Также разрешены короткие сделки на продажу. Длинные сделки на покупку разрешены, и позиция имеет ограничения до тех пор, пока в отдел по контролю не будет предоставлена достаточная для снятия ограничения информация. Сделки на продажу для покрытия (Buy Cover) и внутридневные сделки в обе стороны не принимаются.

Что если купленная акция получит статус "Grey Market" или "Caveat Emptor"?

Если вы приобрели акцию через свой счет IBKR, и ей позже был присвоен статус "Caveat Emptor" (ответственность за покупку лежит на покупателе) или "Grey Market" ("серый" рынок), вы сможете сохранить, закрыть или перевести позицию, но не сможете ее увеличить.

По каким причинам на моем счете может быть ограничена торговля Microcap-акциями?

Есть две основные причины, по которым Вам может быть недоступна торговля Microcap-акциями:

- Потенциальная связь с эмитентом: Правило 144 Комиссии по ценным бумагам и биржам США (SEC) ограничивает возможность торговли акциями (включая Microcap) "аффилированным лицом" эмитента. Если торговые операции или балансы клиента с Microcap-акциями будут близки к установленным в Правиле 144 предельным объемам, то IBKR может запретить ему торговать Microcap-акциями, пока не будет выполнена проверка на соответствие нормативным требованиям.

- Перевод Microcap-акций: если клиент недавно переводил Microcap-акции на свой счет IBKR, то IBKR может запретить ему торговать Microcap-акциями, пока не будет выполнена проверка на соответствие нормативным требованиям.

Если применима одна из вышеуказанных причин, торговля соответствующей ценной бумагой будет ограничена и клиенту будет отправлено уведомление через "Центр сообщений" в "Управлении счетом". В уведомлении будет указана причина ограничения и описаны шаги, которые клиент должен предпринять, прежде чем IBKR снимет ограничение.

Почему IBKR считает меня потенциальным "аффилированным лицом" эмитента Microcap-акций?

Аффилированное лицо – это такой индивид, как, например, административный сотрудник, директор или крупным акционер, имеющий некоторый уровень контроля над эмитентом.

Правило 144 распространяется на все ценные бумаги, включая Microcap-акции. Однако поскольку торговле Microcap-акциями характерен высокий риск, в случае приближения объема торгов и/или баланса клиента по Microcap-акциям к пределам, установленным в Правиле 144, IBKR его возможность совершать операции с Microcap-акциями. Данное ограничение будет действовать, пока отдел контроля не проверит потенциальную связь клиента с эмитентом.

Нужно ли мне запрашивать новую проверку на предмет связи с эмитентом каждые две недели?

Связь между клиентом и эмитентом акций может измениться вскоре после того, как IBKR завершит вышеупомянутую проверку. Поэтому IBKR считает целесообразным обновлять эти данные каждые две недели, если объемы торговых операций и/или капитала клиента остаются близки к пределам, установленным в Правиле 144.

Где можно найти список акций США, которые IBKR отнесла к типу Microcap?

Список IBKR с Microcap-акциями США доступен по ссылке:: www.ibkr.com/download/us_microcaps.csv

Обращаем ваше внимание, что список обновляется ежедневно.

Где можно найти больше информации о Microcap-акциях?

Дополнительная информация о Microcap-акциях, в том числе о рисках сделок с такого рода акциями, доступна на сайте SEC: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1Относится к любому способу перевода (например, ACATS, DWAC, FOP), конверсии канадских продуктов в американский аналог через южное направление, переводам для покрытия текущих коротких позиций, Prime-клиентам IB, которые исполняют сделку через другого брокера и производят клиринг в IBKR и т.д.

Locating your account number for ACATS transfers

In order for your ACAT or ATON transfer to be completed successfully, your broker must validate the account number provided on the request. If the account number is invalid, your broker will reject the request. IBKR recommends that clients review a copy of their brokerage statement to confirm their account number and has provided statement samples below from some of the more common brokers highlighting where this information can be found.

Charles Schwab - Broker #0164. Account Number convention is 8 characters, all numeric.

Fidelity Investments - Delivers through National Financial Services, Broker #0226. Account Number convention is 9 characters, first 3 alpha-numeric and last 6 numeric.

Merrill Edge - Broker #0671. Account Number convention is 8 characters, combination of alpha and numeric.

TD Ameritrade - Broker #0188. Account Number convention is 9 characters, all numeric.

Vanguard- Broker #0062. Account Number convention is 8 characters, all numeric.

Note: This article contains images of sample broker statements which are for illustrative purposes only and which may contain logos that remain the property of each of those brokers.

U.S. Microcap Stock Restrictions

Introduction

To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U.S. Microcap Stocks. A list of those restrictions, along with other FAQs relating to this topic are provided below.

Microcap Restrictions

- IBKR will only accept transfers of blocks of U.S. Microcap stocks from Eligible Clients. Eligible Clients include accounts that: (1) maintain equity (pre or post-transfer) of at least $5 million or, clients of financial advisors with aggregate assets under management of at least $20 million; and (2) have less than half of their equity in U.S. Microcap Stocks.

- IBKR will only accept transfers1 of blocks of U.S. Microcap Stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC;

- IBKR will not accept transfers1 of or opening orders for U.S. Microcap Stocks designated by OTC as Caveat Emptor or Grey Market from any client. Clients with existing positions in these stocks may close the positions;

- IBKR will not accept transfers of U.S. Microcap Stocks to cover a short position established at IBKR;

- Execution-only clients (i.e., execute trades through IBKR, but clear those trades elsewhere) may not trade U.S. Microcap Stocks within their IBKR account. (IBKR may make exceptions for U.S.-registered brokers);

Microcap FAQs

What is a U.S. Microcap Stock?

The term “Microcap Stock” refers to shares (1) traded over the counter or (2) that are listed on Nasdaq and NYSE American that have a market capitalization of between $50 million to $300 million and are trading at or below $5. For purposes of this policy, the term Microcap Stock will include the shares of U.S. public companies which have a market capitalization at or below $50 million, which are sometimes referred to as nanocap stocks or trade on a market generally associated with Microcap Stocks.

To avoid situations where minor, short-term fluctuations in a stock price cause repeated reclassification, any stock classified as U.S. Microcap will remain in that classification until both its market capitalization and share price exceed $300 million and $5, respectively, for a 30 consecutive calendar day period.

As Microcap Stocks are often low-priced, they are commonly referred to as penny stocks. IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. In addition, IBKR will not consider ADRs on non-US companies to be Micro-Cap stocks.

Where do Microcap Stocks trade?

Microcap Stocks typically trade in the OTC market, rather than on a national securities exchange. They are often electronically quoted by market makers on OTC systems such as the OTC Bulletin Board (OTCBB) and the markets administered by the OTC Markets Group (e.g., OTCQX, OTCQB & Pink). Also included in this category are stocks which may not be publicly quoted and which are designated as Caveat Emptor, Other OTC or Grey Market.

In addition, U.S. regulators also consider stocks listed on Nasdaq or NYSE American trading at or below $5 with a market capitalization at or less than $300 million to be Microcap Stocks.

What happens if IBKR receives a transfer from an Eligible Client where one or more of the positions transferred is a Microcap Stock?

If IBKR receives a transfer containing a block of a Microcap stock, IBKR reserves the right to restrict the sale of any Microcap position(s) included in the transfer unless the Eligible Client provides appropriate documentation establishing that the shares were either purchased on the open market (i.e., on a public exchange through another broker) or were registered with the SEC pursuant to an S-1 or similar registration statement.

Eligible Clients can prove that shares were purchased on the open market by providing a brokerage statement or trade confirm from a reputable broker reflecting the purchase of the shares on a public exchange. Eligible Clients can establish that the shares are registered by providing the SEC (Edgar system) File number under which their shares were registered by the company (and any documents necessary to confirm the shares are the ones listed in the registration statement).

NOTE: All customers are free to transfer out any shares we have restricted at any time.

What restrictions will IBKR apply to Prime accounts?

Clients whose activities include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. However, while Prime accounts may clear U.S. Microcap Stocks at IBKR, those shares will be restricted until such time IBKR confirms that the shares are eligible for re-sale under the procedures discussed above.

To remove the restriction for shares purchased on the open market, please have the executing broker provide a signed letter on company letterhead or an official Account Statement stating that the shares were purchased in the open market. The letter or statement must also include the below required criteria. Alternatively, if the shares were acquired through an offering the letter or statement must provide documents or links to the relevant registration statement and state that the shares were part of it.

Required Broker Letter Criteria:

1) IBKR Account Number

2) IBKR Account Title

3) Trade Date

4) Settlement Date

5) Symbol

6) Side

7) Price

8) Quantity

9) Time of Execution

10) Exchange

11) Must be signed

12) Must be on Firm's official letterhead

To summarize: Sell Long trades will be accepted if the long position is no longer restricted. Sell Short trades will be accepted. Buy Long trades will be accepted and the position will be restricted until Compliance is provided with sufficient information to remove the restriction. Buy Cover trades and intraday round trip trades will not be accepted.

What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor?

If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or transfer the position but will not be able to increase your position.

What are some of the reasons why Microcap Stock trading may be restricted in my account?

There are two primary reasons why you might be restricted from trading in a Microcap Stock:

- Potential Affiliation to Issuer: U.S. Securities and Exchange Commission (“SEC”) Rule 144 places certain limitations on trading of stocks (including Microcap Stocks) by an “affiliate” of the issuer. If IBKR observes trading activity or holdings in a Microcap Stock that are close to the trading volume thresholds under Rule 144 (“Rule 144 Thresholds”), IBKR may restrict the customer from trading the Microcap Stock until a compliance review is completed.

- Transfer of Microcap Stock: If the customer has recently transferred a Microcap Stock into their IBKR account, IBKR may restrict the customer from trading in that security until a compliance review is completed.

If one of the above reasons apply, trading will be restricted in the security and a notification will be sent to the customer’s message center in Account Management. This notification will describe the reason for the restriction and the steps the customer must take before IBKR will consider lifting the restriction.

Why does IBKR consider me to be a potential affiliate of a Microcap Stock issuer?

An “affiliate” is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

Rule 144 applies to all securities, including Microcap Stocks. However, given the heightened risks associated with trading Microcap Stocks, if a customer’s trading and/or holdings in a Microcap Stock are close to the Rule 144 Thresholds, IBKR will restrict the customer’s trading in the Microcap Stock. This restriction will remain in effect pending a compliance review into the customer’s potential affiliate status.

For the Potential Affiliate review, why do I need to ask for a new review every two weeks?

A customer’s affiliate status may change soon after IBKR completes the above-referenced Potential Affiliate review. As such, IBKR believes it is appropriate to refresh a Potential Affiliate review every two weeks if a customer’s trading activity and/or holdings in the Microcap Stock remain close to the Rule 144 Thresholds.

Where can I find a list of stocks that IBKR has designated as U.S. Microcaps?

A list of stocks designated as U.S. Microcaps by IBKR is available via the following link: www.ibkr.com/download/us_microcaps.csv

Note that this list is updated daily.

Where can I find additional information on Microcap Stocks?

Additional information on Microcap Stocks, including risks associated with such stocks may be found on the SEC website: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1This includes transfers by any method (e.g., ACATS, DWAC, FOP), conversion of Canadian listings to their U.S. equivalent via “Southbound” transfer, transfers to cover existing short positions, IB Prime customers executing with other brokers and clearing to IBKR, etc.

ACATS Transfer Guide (US brokerage account transfers)

ACATS Transfer Guide

Introduction

Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Through this article and other Knowledge Database resources, Interactive Brokers seeks to assist with your incoming and outgoing ACATS requests.

US brokerage firms utilize a standardized system to transfer customer accounts from one firm to another. Known as the Automated Customer Account Transfer Service or ACATS, the process allows assets to move seamlessly between brokerage firms in a unified time frame. ACATS transfers are facilitated by a third party, the National Securities Clearing Corporation (NSCC), to assist participating members with timely asset transfers.

ACATS Transfer Benefits

The majority of assets may be transferred between US brokerage firms and some banks through ACATS. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. Information on assets eligible for transfer is provided at "Assets Eligible..." Though impacted by multiple factors and time constraints, the accepted or rejected transfers finalize within 10 business days in most cases.

Navigating The Process

4 simple steps of the ACATS process will help you understand the flow and minimize delays. Familiarizing yourself with the transfer process helps to ensure a successful transition.

1. Incoming or Outgoing

Incoming ACATS Transfers

The financial institution that is receiving your assets and account transfer is known as the "receiving firm." Investors always work with and through the "receiving firm" to move full or partial account assets into a new broker.

Contact the "receiving firm" (Interactive Brokers) to review the firm's trading policies and requirements. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Not all ACATS transferable assets are acceptable for trading at every brokerage firm.

Outgoing ACATS Transfers

All outgoing ACATS transfers, full or partial, must be approved by the "delivering firm." Investors, however, should work with and through the "receiving firm" in order to begin the the transfer process or to status the progress of the request.

2. Initiating Your Transfer

Investors must always begin the ACATS transfer with the "receiving firm." An ACATS transfer form or Transfer Initiation Form (TIF) must be submitted. The "receiving firm" takes your reqeust and communicates with the "delivering firm" via ACATS. The process begins with this request for transfer of the account.

For your Interactive Brokers Account, the transfer is usually submitted online. Video instruction on submitting the transfer is provided at "How to deposit funds via a full ACATS/ATON Transfer." or through Step-by-step instructions.

Note: Outgoing account transfers from your IB account should be directed to the other broker. Your request will be submitted to IB from the other broker through the ACATS electronically.

3. What to Expect

Your Account

Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:

- Same Account Title

- Same Tax ID Number

- Same Account Type

Transfer Approval

Ultimately responsible for validating the transfer, the "delivering firm" may accept information from the "receiving firm" correcting data originally entered. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. Assets may not be accepted by the "receiving firm" for the following:

- Non-marginable or Margin (credit) violation

- Not Tradable

- DTC Chill

Note: The most common reasons for ACATS rejections are outlined by clicking here.

Processing Time-frame

The processing time for each transfer request is fixed. In general, approved transfers complete within 4 to 8 business days. Almost all transfers complete within 10 business days. Each firm is required to perform certain steps at specific intervals in the process. Feel free to review the Full ACATS transfer process flow.

Fees

While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge.

4. Who To Contact For Help

Interactive Brokers Customer Service stands poised to assist with your incoming ACATS transfer reqeust. Click here for Customer Service contact resources.

Note: Outgoing or ACATS transfers sending accounts to another broker should be directed to the "receiving firm." Their Account Transfer Group will work with Interactive Brokers directly to complete your outgoing request.

Free of Payment (FOP) Transfers

Free of Payment (FOP) is term used by IB to refer to a process of transferring long US securities between IB and another financial institution (e.g. bank, broker or transfer agent) through the Depository Trust Company (DTC).

The FOP transfer method is often used when:

1. The delivering form is not a DTC ACAT (Automated Customer Account Transfer) Participant.

2. The customer would like to expedite the delivery of their securities. The processing time frame for securities transferred via FOP may, in certain instances, be less than that associated with an ACATS transfer.

The following steps are to be followed in order to create a FOP notice:

1. Log into Account Management.

2. Select Funding or Funds Management and then Position Transfers.

3. From the drop-down list, select the Transfer Method: Free of Payment.

4. Select the applicable transaction Type: Deposit or Withdraw.

5. In the case of a FOP Withdrawal, the steps are as follows:

- Select the Destination to whom the securities are being transferred.

- Enter your account number of the Third Party Broker Acount Information.

- Specify the security (Stock, Warrants or US Bonds).

- Enter the Symbol, Shares and the Exchange (optional) and click Add.

- Provide your electronic signature authorizing the transfer request and clicking on the Continue button.

- Verify your identity by entering your password and clicking on the Confirm Request button;

- If your account is enrolled in the Secure Transaction Program (STP), the processing of your request will take place once you enter your confirmation code and click on the Confirm Request button. If not STP enrolled, your request will be subject to security verification, requiring that you contact our Customer Service Center to validate your identity and request.

6. In the case of a FOP Deposit, the steps are as follows:

- Select the Source to whom the securities are being transferred.

- Enter your account number of the Third Party Broker Acount Information.

- Specify the security (Stocks, Warrants or US Bonds).

- Enter the Symbol, Shares and the Exchange (optional) and click Add.

- Provide your electronic signature authorizing the transfer request and clicking on the Continue button.

- A printable version of the FOP request is made available should your transferring firm require an authorization form.

7. Transfer requests are typically completed within five business days.

IMPORTANT NOTE:

While IB does not assess a fee to process FOP transfers, other firms may and we therefore recommend that you confirm with the contra-firm their policies in this regard prior to submitting a request. In the event a contra-firm does charge a fee to IB, the fee will be passed to the IB account holder.

Assets eligible to be transferred through ACATS

Instruments handled by the ACATS system include the following asset classes: equities, options, corporate bonds, municipal bonds, mutual funds and cash. It should be noted; however, that ACATS eligibility does not guarantee that any given security will transfer as each receiving broker maintains its own requirements as to which asset classes as well as securities within a particular asset class it will accept.

Account holders are encouraged to use the Contract Search link on IB’s homepage to assess transfer eligibility prior to initiating a full account transfer request. In the case of mutual funds, please click here for a list of fund families and funds offered by IB.

How do I transfer my US securities positions from my current broker to IB?

Broker to broker transfers for US securities are conducted via a process known as the Automated Customer Account Transfer Service or ACATS. This process generally takes between 4 to 8 business days to complete in order to accommodate the verification of the transferring account and positions. The request is always initiated via the receiving broker (IB in this case) and can be prompted by following the steps below.

1. Log into Account Management and select the Transfer & Pay and then Transfer Positions menu options.

2. From the Transaction Type drop-down list select 'Inbound Position'

3. From the Method drop-down list select 'ACATS'.

4. Enter the sending Broker Information in the fields provided, and click CONTINUE

5. In the Transaction Information section, indicate whether or not you wish to transfer all assets and select Yes to the authorization option.

a. Note that a "transfer all assets" election does not require that you specify any assets as an attempt will be made to transfer your account in its entirety. Account holders should note, however, that certain positions may not be on the list of securities eligible to trade at IB and others, while transferable, may be subject to a house margin requirement higher than that of the delivering broker. In the event IB receives an asset list from the delivering broker which includes ineligible positions or the aggregate of the positions transferred are such that a margin deficit would exist were the transfer to occur, IB will attempt to contact you to remedy the situation within the allocated time frame after which an automatic reject of the full transfer would take effect. Account holders may wish to minimize potential delays or problems associated with a ‘Full’ transfer request by verifying security eligibility and margin requirements via the Contract Search link located at the upper right hand corner of the IB homepage prior to initiating the transfer.

b. If you elect to not "transfer all assets", the system will require that you specify the positions you wish to transfer. Click Add Asset to add the positions you wish to transfer. Fill out the Asset Search and Transaction Information sections and click Continue.

6. On the page that appears, type your signature in the Signature field, and then click CONTINUE.

Click BACK to modify the transfer request.

Please note that brokers generally freeze the account during the transfer period to ensure an accurate snapshot of assets to transfer and may restrict the transfer of option positions during the week prior to expiration. You may wish to check with the delivering broker to verify their policy in this regard. In addition, please note if your IB account is currently maintaining positions on margin, any cash withdrawals or adverse market moves could increase the likelihood that your account falls out of margin compliance during the transfer period which may delay or prevent completion of the transfer.

IMPORTANT NOTICE

Applicants may meet the initial account funding requirement through the transfer of securities positions and/or cash via the ACATS system.