How to request a Digital Security Card+ (DSC+) replacement

The below steps are required in order to:

- Replace a Digital Security Card+ which has been lost, stolen or has become inoperable

- Request a Digital Security Card+ alongside your current security device (if you are a new or existing Client with equity above $1,000,000, or equivalent)

1. Notify IBKR Client Services- Contact IBKR Client Services to obtain a temporary account access. This service can only be provided via telephone and requires the identity of the account holder to be verified, as detailed in the IBKR Knowledge Base.

2. Obtain an Online Security Code Card - Activate an Online Security Code Card, which offers enhanced protection and full Client Portal functionality for an extended period of 21 days. Please consult the IBKR Knowledge Base should you need guidance for this specific step.

3. Request the DSC+ replacement - Once you have completed the Online Security Code Card activation, please remain in the Secure Login System section of the Client Portal and order your replacement DSC.

Request a DSC+

1. Click on the button Request Physical Device.

.png)

.png)

3. Enter a four-digit Soft PIN1 for your DSC+. Please make sure to remember the PIN you are typing since it will be necessary to activate and to operate your device. When applicable and desired, you may change the account on which the 20 USD deposit will be kept on hold2. Complete this step by clicking on Continue..png)

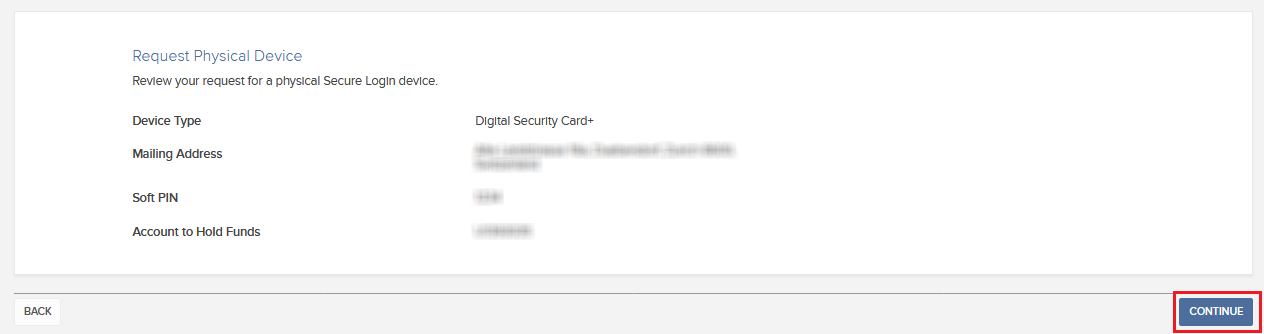

4. The system will show you a summary of your selection. Please make sure the information displayed is correct. Should you need to perform changes, click on the white Back button under the information field (not your browser back button), otherwise submit the request by clicking on Continue.

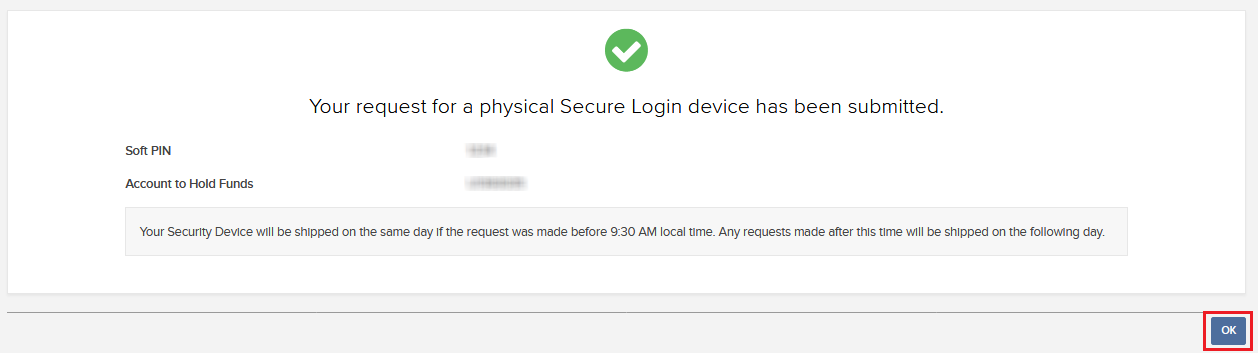

5. You will receive a final confirmation containing the estimated shipment date3. Click on Ok to finalize the procedure.

1. For PIN guidelines, please consult the IBKR Knowledge Base.

2. The Security token and the shipment are both free of charge. Nevertheless, when you order your device, we will freeze a small amount of your funds (20 USD). If your device is lost, intentionally damaged, stolen or if you close your account without returning it to IBKR, we will use that amount as a compensation for the loss of the hardware. In any other case, the hold will be released once your device has been returned to IBKR. More details on the IBKR Knowledge Base.

3. For security reasons, the replacement device is set to auto-activate within three weeks from the shipment date. IBKR will notify you when the auto-activation is approaching and when it is imminent.

IBKR Knowledge Base References

- See KB1131 for an overview of the Secure Login System

- See KB2636 for information and procedures related to Security Devices

- See KB2481 for instructions about sharing the Security Login Device between two or more users

- See KB2545 for instructions on how to opt back in to the Secure Login System

- See KB975 for instructions on how to return your security device to IBKR

- See KB2260 for instructions on activating the IB Key authentication via IBKR Mobile

- See KB2895 for information about Multiple 2Factor System (M2FS)

- See KB1861 for information about charges or expenses associated with the security devices

- See KB69 for information about Temporary passcode validity

Cash Sweeps

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

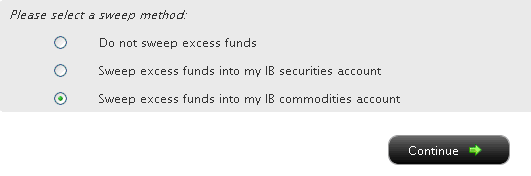

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models

Securities Account Protection for Interactive Brokers India Customers

Customer accounts domiciled under Interactive Brokers India Pvt. Limited,(IBI) are awarded different account protection services than our IB-LLC and IB-UK clients. There are two major exchanges, the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE), each one has established their own guidelines for investor grievances against exchange members and/or sub –brokers.

National Stock Exchange of India (NSE)

The NSE has established an Investor Protection Fund with the objective of compensating investors in the event of defaulters' assets not being sufficient to meet the admitted claims of investors, promoting investor education, awareness and research. The Investor Protection Fund is administered by way of registered Trust created for the purpose. The Investor Protection Fund Trust is managed by Trustees comprising of Public representative, investor association representative, Board Members and Senior officials of the Exchange.

The Investor Protection Fund Trust, based on the recommendations of the Defaulters' Committee, compensates the investors to the extent of funds found insufficient in Defaulters' account to meet the admitted value of claim, subject to a maximum limit of Rs. 11 lakhs (1.1 million USD) per investor per defaulter/expelled member.

Bombay Stock Exchange (BSE)

Currently trading is not offered on the BSE by Interactive Brokers.

Determining SIPC coverage where multiple accounts exist

Multiple accounts maintained in the same name and taxpayer ID number are grouped for purposes of applying the maximum per client protection limits of $500,000 by SIPC and $29.5 million under Lloyd’s supplementary protection. However, if you hold accounts with IBKR in separate capacities (for example, an account in your name, a trust account of which you are the trustee or a beneficiary, or a joint account), then each account would be protected by SIPC and the supplementary protection up to the stated limits.

Links: