專業客戶委託單優先級

美國期權交易所已設定規則,把交易行為被視為“專業”(即交易方式更類似於做市商而非普通客戶的個人或實體)的一批公眾客戶(即並非經紀交易商)委託單,與交易行為並非“專業”的公眾客戶區分開來。 根據該等細則,任何不是經紀交易商的客戶,但在每季度的最少1個月內,每日平均下達超過390筆美國上市期權委託單(在其自有受益賬戶),將被分類為專業。

代專業客戶提交的委託單在執行優先級和費用方面與經紀交易商待遇相同。

經紀商需最少每個季度進行一次審查,以確定該季度內的任意月份,哪些客戶超過了390筆委託單的臨界值,以及哪些客戶將在下一個季度被指定為專業。

委託單計算

各地交易所對委託單的定義略有不同,尋求特定期權計算規則的客戶(特別是使用算法委託單類型時,在某些情況下,可能導致在市場兩邊下達委託單)應查看相關交易所的規則手冊和指南。然而,為達到計算期權委託單的目的,委託單通常被定義為:

- 單一委託單;

- 8條或以下期權邊的複雜委託單;

- 在一個9條或以上期權邊的複雜委託單中的每條期權邊;或

- 母委託單,即使該委託單被經紀商分割為多筆同邊/系列的子委託單,以達到執行或傳遞目的( 掛鉤全國最佳買賣報價(NBBO)的委託單除外,下方會加以說明)。

根據上方的邏輯,由客戶發起的取消和取代母委託單(通過任意方式,如分段委託單)會計算為新委託單(如取消/取代一筆單邊委託單會計算為一筆新委託單,而取消/取代一筆9條期權邊的委託單會計算為9筆新委託單)。

掛鉤全國最佳買賣報價(NBBO)/最佳買賣報價(BBO)的委託單

請注意,使用掛鉤NBBO或BBO期權委託單的客戶(如相對委託單或掛鉤波幅委託單,或其它母委託單類型,其設計是跟隨NBBO/BBO移動),每筆基於NBBO/BBO改變而取消/取代的子委託單,將構成一筆額外新委託單。 把掛鉤委託單存放在IBUSOPT以參與RFQ競價的客戶應留意,每次掛鉤委託單在IBKR系統參與RFQ競價時,將以取消並取代的方式處理(無論該委託單是否成為交易所競價的發起委託單)。

賬戶集合

在計算委託單總數時,經紀商必須把客戶全部實益擁有賬戶的期權委託單加起來。IBKR把個人或實體賬戶的期權委託單與其相關的聯名賬戶、信託賬戶和組織賬戶加起來。

如客戶身份由零售客戶轉變為專業客戶,IBKR將向其發出通知。此外,IBKR智能傳遞在做出傳遞決定時,會把交易費因素(包括專業和非專業客戶費用的差距)考慮在內。

更多額外信息,請查看以下鏈接:

Snapshot Market Data

BACKGROUND

IBKR offers eligible clients the option of receiving a real-time price quote for a single instrument on a request basis. This service, referred to as “Snapshot Quotes” differs from the traditional quote services which offer continuous streaming and updates of real-time prices. Snapshot Quotes are offered as a low-cost alternative to clients who do not trade regularly and require data from specific exchanges1 when submitting an order. Additional details regarding this quote service is provided below.

QUOTE COMPONENTS

The Snapshot quote includes the following data:

- Last price

- Last size

- Last exchange

- Current bid-ask

- Size for each of current bid-ask

- Exchange for each of current bid-ask

AVAILABLE SERVICES

| Service | Restrictions | Price per Quote Request (USD)2 |

|---|---|---|

| AMEX (Network B/CTA) | $0.01 | |

| ASX Total | No access to ASX24. Limited to Non-Professional subscribers |

$0.03 |

| Bolsa de Madrid | $0.03 | |

| Canadian Exchange Group (TSX/TSXV) | Limited to Non-Professional subscribers who are not clients of IB Canada | $0.03 |

| CBOT Real-Time | $0.03 | |

| CME Real-Time | $0.03 | |

| COMEX Real-Time | $0.03 | |

| Eurex Core | Limited to Non-Professional subscribers | $0.03 |

| Euronext Basic | Limited to Non-Professional subscribers Includes Euronext equities, indices, equity derivatives and index derivatives. |

$0.03 |

| German ETF's and Indices | Limited to Non-Professional subscribers | $0.03 |

| Hong Kong (HKFE) Derivatives | $0.03 | |

| Hong Kong Securities Exchange (Stocks, Warrants, Bonds) | $0.03 | |

| Johannesburg Stock Exchange | $0.03 | |

| Montreal Derivatives | Limited to Non-Professional subscribers | $0.03 |

| NASDAQ (Network C/UTP) | $0.01 | |

| Nordic Derivatives | $0.03 | |

| Nordic Equity | $0.03 | |

| NYMEX Real-Time | $0.03 | |

| NYSE (Network A/CTA) | $0.01 | |

| OPRA (US Options Exchanges) | $0.03 | |

| Shanghai Stock Exchange 5 Second Snapshot (via HKEx) | $0.03 | |

| Shenzhen Stock Exchange 3 Second Snapshot (via HKEx) | $0.03 | |

| SIX Swiss Exchange | Limited to Non-Professional subscribers | $0.03 |

| Spot Market Germany (Frankfurt/Xetra) | Limited to Non-Professional subscribers | $0.03 |

| STOXX Index Real-Time Data | Limited to Non-Professional subscribers | $0.03 |

| Toronto Stk Exchange | Limited to Non-Professional subscribers who are clients of IB Canada | $0.03 |

| TSX Venture Exchange | Limited to Non-Professional subscribers who are clients of IB Canada | $0.03 |

| UK LSE (IOB) Equities | $0.03 | |

| UK LSE Equities | $0.03 |

1In accordance with regulatory requirements, IBKR no longer offers delayed quotation information on U.S. equities to Interactive Brokers LLC clients. All clients (IBKR Lite and Pro) have access to streaming real-time US equity quotes from Cboe One and IEX at no charge. Since this data does not include all markets, IB does not show this quote when entering parameters for an order in a US stock quote. IB customers are able to access a snapshot of real-time quote information for US stocks at the point of order entry.

2Cost is per snapshot quote request and will be assessed in the Base Currency equivalent, if not USD.

ELIGIBILITY

- Accounts must maintain the Market Data Subscription Minimum and Maintenance Equity Balance Requirements in order to qualify for Snapshot quotes.

- The Users must operate TWS Build 976.0 or higher to access Snapshot quote functionality.

PRICING DETAILS

- Clients will receive $1.00 of snapshot quotes free of charge each month. Free snaphots may be applied to either U.S. or non-U.S. quote requests and charges will be applied, without additional notice, once the free allocation has been exhausted. Clients may review their snapshot usage as of the close of each business day via the Client Portal.

- Quote fees are assessed on a lag basis, generally in the first week after the month in which Snapshot services were provided. Accounts which do not have sufficient cash or Equity With Loan Value to cover the monthly fee will be subject to position liquidations.

- The monthly fee for snapshots will be capped at the related streaming real-time monthly service price. At which time the streaming quotes will be provided at no additional cost for the remainder of the month. The switch to streaming quotes will take place at approximately 18:30 EST the following business day after reaching the snapshot threshold. At the close of the month, the streaming service will automatically terminate and the snapshot counter will reset. Each service is capped independently of the others and quote requests for one service cannot be counted towards the cap of another. See table below for sample details.

| Service | Price per Quote Request (USD) | Non-Pro Subscriber Cap (Requests/Total Cost)2 | Pro Subscriber Cap (Requests/Total Cost)3 |

|---|---|---|---|

| AMEX (Network B/CTA) | $0.01 | 150/$1.50 | 2,300/$23.00 |

| NASDAQ (Network C/UTP) | $0.01 | 150/$1.50 | 2,500/$25.00 |

| NYSE (Network A/CTA) | $0.01 | 150/$1.50 | 4,500/$45.00 |

市場數據非專業客戶問卷

如何完成最新的非專業客戶問卷。

紐約證券交易所(NYSE)及大多數美國的交易所均要求供應商在允許客戶接收市場數據前確認每個客戶接收市場數據的身份。未來,我們將使用非專業客戶問卷來識別及確認所有訂閱用戶的市場數據身份。根據交易所的要求,在未明確客戶為非專業人士之前,將默認客戶的市場數據接收身份為專業人士。該流程能夠保證所有新訂閱用戶的數據訂閱身份是準確的。若要獲取有關非專業人士定義的簡要指南,請見ibkb.interactivebrokers.com/article/2369。

您必須回答問卷上的所有問題,方可被定義為非專業人士。鑑於交易所要求供應商明確獲得客戶為非專業人士的證明,若問卷回答不完整或不清晰,客戶將被界定為專業投資者,直至其身份得到確認。

如您的身份有所變更,請聯繫幫助台。

問題解釋:

1) 商業及業務用途

a) 您是否出於業務需要、或代表其他商業實體接收財經信息(包括關於證券、商品及其他金融產品的新聞或價格數據)?

解釋:除個人用途外,您是否代表公司或其他組織接收及使用本賬戶中的市場數據?

b) 您是否代表公司、合夥企業、專業信託機構、專業投資俱樂部或其他實體開展證券、商品或外匯交易?

解釋:您只代表個人交易,還是也代表機構(如,有限責任公司、有限責任企業、股份有限公司、公司、有限責任合夥企業等)交易?

c) 您是否就以下事項與其他實體或個人達成過協議:(a) 分享交易活動的盈利,或(b)獲取交易酬勞?

解釋:您是否通過交易獲得酬勞,或與第三方實體或個人分享交易活動的盈利?

d) 您是否通過交易換取辦公場所、設備或其他福利?或者,您是否擔任任意個人、企業或商業實體的財務顧問?

解釋:您是否以任意形式從第三方獲得交易的酬勞,該酬勞不一定以貨幣的形式支付。

2) 擔任職務

a) 目前您是否擔任任何投資顧問或經紀交易商的職務?

解釋:您是否通過管理第三方的資產或指導他人如何管理資產獲得酬勞?

b) 您是否擔任證券、商品或外匯方面的資產管理人?

解釋:您是否通過管理證券、商品或外匯資產獲得酬勞?

c) 目前您是否在工作中使用此類財經信息,或將其用於管理您的雇主或公司的資產?

解釋:您使用數據是否單純出於商業目的,即,用於管理您的雇主及/或公司的資產?

d) 您交易時是否使用了其他個人或實體的資金?

解釋:您的賬戶中除了您個人的資產,是否有其他實體的資產?

3) 向其他任意實體傳播、再發布或提供數據

a) 您是否以任意方式向任意第三方傳播、再傳播、發布或提供任何從服務中獲得的財經信息?

解釋:您是否以任意形式向其他實體發送您從我方獲得的任何數據?

4) 合資格的專業證券/期貨交易商

a) 目前,您是否為任意證券機構、商品或期貨市場的註冊或合資格的專業證券交易員,或為任意國家交易所、監管機構、專業協會或公認專業機構的投資顧問?i, ii

是☐ 否☐

i) 監管機構的例子包括但不限於:

- 美國證券交易委員會(SEC)

- 美國商品期貨交易委員會(CFTC)

- 英國金融服務局(FSA)

- 日本金融服務局(JFSA)

ii) 自律組織(SROs)的例子包括但不限於:

- 美國紐約證券交易所(NYSE)

- 美國金融業監管局(FINRA)

- 瑞士聯邦金融局(VQF)

安全設備更換費用

通過IBKR安全登錄系統登錄其賬戶的賬戶持有人會獲得一個安全設備,其在用戶名密碼保護外提供了一層額外的保護,用以防止網絡黑客和其他未經授權人士訪問您的賬戶。儘管IBKR對此設備的使用不收取任何費用,但某些版本的設備需賬戶持有人在賬戶關閉時歸還,否則會產生更換費用。如果設備遺失、被盜或者損壞,現有的賬戶持有人也需支付此更換費用(請注意,由於電池故障退回更換的設備不收取更換費用)。

此外,儘管IBKR只有在設備被確認為遺失、被盜、損壞或者未歸還的情況下才會收取更換費用,但在設備發放時賬戶便需留有一筆金額等於更換費用的預備金來確保設備能正常歸還。此預備金不會影響賬戶可用於交易的資產,但在設備歸還前,賬戶會被限制全額取款或轉帳(即不能提取預備金餘額)。

下表為各個設備的更換費用。

| 安全設備 | 更換費用 |

| 安全代碼卡1 | $0.001 |

| 數碼安全卡+ | $20.00 |

要瞭解如何歸還安全設備的說明,請參見KB975

1安全代碼卡在賬戶關閉時無需歸還,可在剩餘資金全部取出且賬戶完全關閉後銷毀或丟棄。賬戶關閉後,若想訪問客戶端查看、獲取活動報表和稅收文件,只需通過現有用戶名和密碼登錄即可。此類安全設備已不再發行。

Market Data Non-Professional Questionnaire

Insight into completing the new Non-Professional Questionnaire.

The NYSE and most US exchanges require vendors to positively confirm the market data status of each customer before allowing them to receive market data. Going forward, the Non-Professional Questionnaire will be used to identify and positively confirm the market data status of all customer subscribers. As per exchange requirements, without positively identifying customers as non-professional, the default market data status will be professional. The process will protect and maintain the correct market data status for all new subscribers. For a short guide on non-professional definitions, please see https://ibkr.info/article/2369.

Each question on the questionnaire must be answered in order to have a non-professional designation. As exchanges require positive confirmations of proof for non-professional designations, an incomplete or unclear Non-Professional Questionnaire will result in a Professional designation until the status can be confirmed.

If the status should change, please contact the helpdesk.

Explanation of questions:

1) Commercial & Business purposes

a) Do you receive financial information (including news or price data concerning securities, commodities and other financial instruments) for your business or any other commercial entity?

Explanation: Are you receiving and using the market data for use on behalf of a company or other organization aside from using the data on this account for personal use?

b) Are you conducting trading of any securities, commodities or forex for the benefit of a corporation, partnership, professional trust, professional investment club or other entity?

Explanation: Are you trading for yourself only or are you trading on behalf of an organization (Ltd, LLC, GmbH, Co., LLP, Corp.)?

c) Have you entered into any agreement to (a) share the profit of your trading activities or (b) receive compensation for your trading activities?

Explanation: Are you being compensated to trade or are you sharing profits from your trading activities with a third party entity or individual?

d) Are you receiving office space, and equipment or other benefits in exchange for your trading or work as a financial consultant to any person, firm or business entity?

Explanation: Are you being compensated in any way for your trading activity by a third party, not necessarily by being paid in currency.

2) Act in a capacity

a) Are you currently acting in any capacity as an investment adviser or broker dealer?

Explanation: Are you being compensated to manage third party assets or compensated to advise others on how to manage their assets?

b) Are you engaged as an asset manager for securities, commodities or forex?

Explanation: Are you being compensated to manage securities, commodities, or forex?

c) Are you currently using this financial information in a business capacity or for managing your employer’s or company’s assets?

Explanation: Are you using data at all for a commercial purposes specifically to manage your employer and/or company assets?

d) Are you using the capital of any other individual or entity in the conduct of your trading?

Explanation: Are there assets of any other entity in your account other than your own?

3) Distribute, republish or provide data to any other party

a) Are you distributing, redistributing, publishing, making available or otherwise providing any financial information from the service to any third party in any manner?

Explanation: Are you sending any data you receive from us to another party in any way, shape, or form?

4) Qualified professional securities / futures trader

a) Are you currently registered or qualified as a professional securities trader with any security agency, or with any commodities or futures contract market or investment adviser with any national or state exchange, regulatory authority, professional association or recognized professional body? i, ii

YES☐ NO☐

i) Examples of Regulatory bodies include, but are not limited to,

- US Securities and Exchange Commission (SEC)

- US Commodities Futures Trading Commission (CFTC)

- UK Financial Service Authority (FSA)

- Japanese Financial Service Agency (JFSA)

ii) Examples of Self-Regulatory Organization (SROs) include, but are not limited to:

- US NYSE

- US FINRA

- Swiss VQF

ADR代收費用

在美國存托憑證(ADR)中持有頭寸的帳戶持有人應注意此類證券需定期繳納費用以補償代表ADR提供託管服務的代理銀行。這些服務通常包括盤存外國股票ADR以及管理所有註冊、合規與記錄服務。

以前,代理銀行只能通過扣除ADR股息收集代理費用,但是因越來越多的ADR不再定期支付股息,這些銀行便無法收集費用。因此,在2009年,美國存管信託公司(DTC)獲得美國證監會(SEC)批准,代表銀行向那些不定期支付股息的ADR收取託管費用。DTC從代客戶持有ADR的經紀商(如IB)處收取這些費用。這些費用被稱為代收費用,因為它們是由指定經紀商從客戶處收取。

如果您在支付股息的ADR中持有頭寸,這些費用將像過去一樣從股息中扣除。如果您是在不支付股息的ADR中持有頭寸,這筆代收費用將反映在登記日的月度報表中。與現金股息的處理方法相同,IB將嘗試在帳戶報表的應計部份顯示即將進行的ADR費用分配。一旦被收取,該費用將在報表的存款&取款部份顯示,費用描述為“調整—其他”,且會顯示相關聯的ADR圖標。

該費用的金額範圍通常為每股$0.01至$0.03美元,但可能因ADR的不同而不同。我們推薦您參考您的ADR招股說明獲取具體信息。可通過美國證監會的EDGAR公司搜索工具進行在綫搜索。

通過帳戶窗口監控風險費用

賬戶窗口可供客戶實時監控賬戶。監控信息包括主要餘額,如總資產和現金、投資組合信息以及保證金餘額,獲悉這些信息可供客戶確定賬戶是否符合要求以及當前的購買力。該窗口還包括最新評估的風險費用信息以及綜合當前頭寸所預測的下一筆風險費用。

打開帳戶窗口:

• 從標準模式的TWS工作空間點擊賬戶圖標,或從賬戶菜單選擇賬戶窗口(圖例1)

圖例1

.jpg)

• 從TWS魔方工作空間的菜單依次選擇賬戶、賬戶窗口(圖例2)

圖例2

.jpg)

打開窗口後,滾動鼠標至保證金要求部分並點擊右上角的+號擴展該部分。 “最後”以及“預測的下一筆”風險費用部分將按照產品類別(如股票,石油)詳細顯示費用情況。請注意,“最後”餘額代表截至上次評估日期的費用(注意,該費用根據截至收盤時持有的未平倉頭寸計算且隨後收取)。 “預測的下一筆”餘額代表今天收盤起預測的費用,該費用考慮了自上次計算以來的賬戶頭寸活動(圖例3)。

圖例3.jpg)

想要在該部分收縮時設置默認視圖,請點擊數據行項目旁邊的複選框,如此,這些項目便會一直顯示。

有關通過IB風險漫遊管理並預測風險費用的更多信息請參見KB2275;有關通過定單預覽屏幕確認風險費用的更多信息請參見KB2276。

定單預覽—檢查風險費用影響

IB提供讓帳戶持有人檢查定單對預測風險費用影響的功能。這一功能在提交定單前使用,可提供有關費用的預先通知,並且允許客戶在提交定單前對定單進行修改以最小化或消除費用。

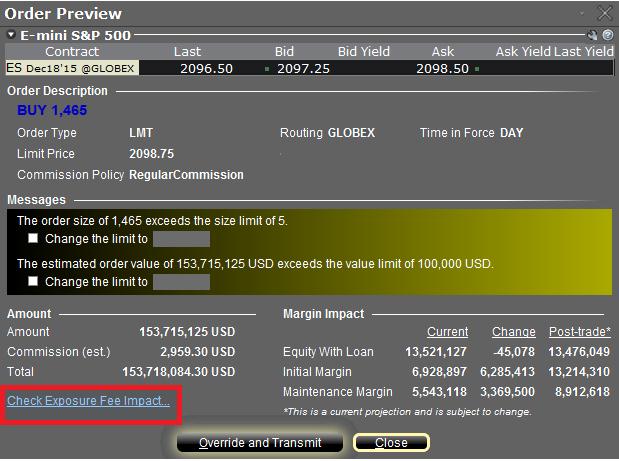

可通過右鍵點擊定單行打開定單預覽窗口啟用該功能。該窗口包含一個標題為“檢查風險費用影響”的鏈接(見圖例1中的紅色加亮框)。

圖例1

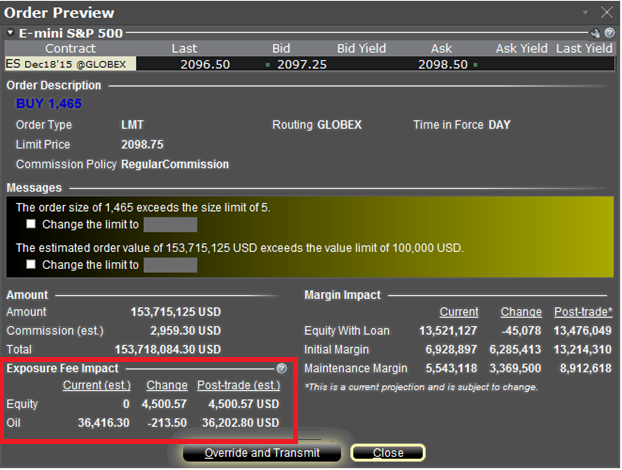

點擊鏈接將展開窗口并顯示當前頭寸對應的風險費用,定單執行后的費用變化以及定單執行后的總費用(見圖例2中的紅色加亮框)。這些余額進一步根據費用對應的產品分類進行了細分(如股票、原油)。如果費用影響確定為超出,帳戶持有人可以不傳遞定單,直接關閉窗口。

圖例2

使用風險漫遊預測風險費用

IB風險漫遊提供的自定義情境功能可供客戶確定投資組合變化對風險費用的影響。下方列出了在改變現有投資組合或設立全新投資組合的基礎上創建“如果怎樣”投資組合以及確定相應費用的步驟。請注意,僅TWS 951及以上版本可使用該功能。

.jpg)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Exposure Fee Monitoring via Account Window

The Account Window provides the high-level information suitable for monitoring one's account on a real-time basis. This includes key balances such as total equity and cash, the portfolio composition and margin balances for determining compliance with requirements and available buying power. This window also includes information relating to the most recently assessed exposure fee and a projection of the next fee taking into consideration current positions.

To open the Account Window:

• From TWS classic workspace, click on the Account icon, or from the Account menu select Account Window (Exhibit 1)

Exhibit 1

.jpg)

• From TWS Mosaic workspace, click on Account from the menu, and then select Account Window (Exhibit 2)

Exhibit 2

.jpg)

After opening the window, scroll down to the Margin Requirements section and click on the + sign in the upper-right hand corner to expand the section. There, the "Last" and "Estimated Next" exposure fees will be detailed for each of the product classifications to which the fee applies (e.g., Equity, Oil). Note that the "Last" balance represents the fee as of the date last assessed (note that fees are computed based upon open positions held as of the close of business and assessed shortly thereafter). The "Estimated Next" balance represents the projected fee as of the current day's close taking into account position activity since the prior calculation (Exhibit 3).

Exhibit 3.jpg)

To set the default view when the section is collapsed, click on the checkbox alongside any line item and those line items will remain displayed at all times.

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2276 for verifying exposure fee through the Order Preview screen.

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. Exposure Fee Monitoring via the Account window is only available for accounts that have been charged an exposure fee in the last 30 days