Linking Accounts

Account linkage allows for individual account holders maintaining multiple existing accounts or seeking to open a new account the ability to group those accounts together. In the case of a new account, linkage affords the opportunity to open the account without having to complete a full application, with the account holder providing solely that additional information which is specific to the new account. New account linkages are initiated either from the Client Portal of the existing account (via the User menu (head and shoulders icon in the top right corner) > Settings > Account Settings > Trading > Open an Additional Account) or automatically when initiating a new application from the website. The following article outlines the steps for linking one or more existing accounts.

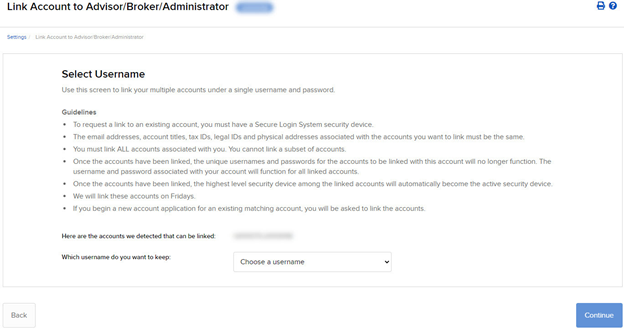

1. Log into Client Portal and click the User menu (head and shoulders icon in the top right corner) followed by Settings > Trading > Link Account to Advisor/Broker/Administrator.

.png)

2. Select the radio button next to Link All of My Existing Account Under a Single Username and Password, and then click CONTINUE.

The Select Username screen opens.

3. The screen shows all of your accounts that can be linked under a single username and password. Select which username you want to keep. Once your accounts are linked, you will use the selected username to log in to any of the linked accounts.

4. The screen updates to display the security device for the selected username. Click CONTINUE.

5. A series of pages appears to prompt you to enter the username and password for each account to be linked, followed by additional authentication using your Secure Login device.

6. Enter the username, password and authentication values for each account to be linked on the next screens, clicking CONTINUE to advance to the next screen.

7. We aggregate the financial information and trading experience info for all accounts to be linked. Verify your financial information and trading experience for the accounts to be linked, and then click CONTINUE.

8. Verify your account information and click CONTINUE.

9. If you need to update your financial information, trading experience or account information, wait for those updates to be approved and then restart this linking procedure.

10. Verify any saved bank information you may have and click CONTINUE.

11. Click CONTINUE.

12. Click Ok.

For information on how to cancel a linkage request, see Canceling a Pending Link Request.

IMPORTANT NOTES

* Once linked, account access to Client Portal and the trading platform is accomplished using a single user name and password each of which will contain a drop-down window for selecting the account that the owner wishes to act upon.

* As market data subscriptions are billed at a session level (i.e., user name) and only a single TWS session can be open for any one user at a given time, account holders previously maintaining subscriptions for multiple users have the opportunity to consolidate subscriptions to a single user. Account holders wishing to view multiple TWS sessions simultaneously may add additional users (subject to separate market data subscriptions). In addition, only those market data subscriptions already associated with the surviving user name will remain in effect following consolidation. Account holders maintaining different subscriptions across multiple users are advised to review those subscriptions subject to cancellation in order to determine which they wish to resubscribe to under the surviving user name. Also note that the market data subscriptions either terminated or initiated mid-month are subject to billing as if they were provided for the entire month (i.e., fees are not prorated).

Non-Objecting Beneficial Owner (NOBO)

A NOBO refers to an account holder who provides its carry broker (i.e., IB) permission to release their name and address to the companies or issuers of securities they hold. These companies or issuers request this information in the event they need to contact shareholders regarding important shareholder communications such as proxies, circulars for rights offerings and annual/quarterly reports. IB, by default, classifies clients as a NOBO but allows client to have their classification changed to that of an Objecting Beneficial Owner (OBO). To do so, clients are required to provide formal notice of their request to be classified as an OBO through a Message Center ticket available via Account Management.

Tax Treaty Benefits

Income payments (dividends and payment in lieu) from U.S. sources into your IB account may have U.S. tax withheld. Generally, a 30% rate is applied to non-U.S. accounts. Exemption from the withholding or a lower rate may apply if your home country has a tax treaty with the U.S. Complete the applicable Form W-8 to find out your status.

Tax Treaties*

U.S. tax treaties with some countries have different benefits. Legal tax residents of the following countries may be eligible for the treaty benefits. Below is a list of the tax treaty countries. Benefits vary by country.

| Australia | Czech Republic | India | Lithuania | Sweden |

| Austria | Denmark | Indonesia | Poland | Switzerland |

| Bangladesh | Egypt | Ireland | Portugal | Thailand |

| Barbados | Estonia | Israel | Romania | Trinidad & Tobago |

| Belgium | Finland | Italy | Russia | Tunisia |

| Bulgaria | France | Jamaica | Slovak Republic | Turkey |

| Canada | Germany | Japan | Slovenia | Ukraine |

| China, People's Rep. Of | Greece | Kazakhstan | South Africa | United Kingdom |

| Commonwealth of Ind. States | Hungary | Korea, Rep. of | Spain | Venezuela |

| Cyprus | Iceland | Latvia | Sri Lanka |

*Country list as of April 2009

Refer to IRS Publication 901 for details on withholding rates for your tax residence country and your eligible benefits.

Why am I required to provide a W-8 if I am not a US citizen or resident?

As IB LLC is a carrying broker domiciled in the U.S., it is required to report information and, in certain instances, make payment of withholding taxes to the U.S. tax authority, the Internal Revenue Service for all account holders. To certify oneself as a non-U.S. person, a Form W-8 is requested at the time of application and is required to be re-certified every three years thereafter. If IB does not receive the W-8 or the account holder fails to re-certify the W-8 in a timely manner, then the account holder is presumed to be a US person and, absent a W-9, may then be subject to back-up withholding taxes on interest, dividends and substitute payments in lieu, as well as gross proceeds.

By certifying yourself as a non-U.S. person through a properly completed W-8, your U.S. withholding is limited to dividends issued by US corporations. Note that virtually all countries apply withholding taxes when local companies seek to distribute dividends to externally based shareholders (whether those shareholders are corporate or not). The rate at which IB is obligated to withhold for a given payment depends largely upon whether there is a tax treaty in place between the country where the dividend paying country is based and the country of residence of the dividend recipient.

SIPP Overview

What is a SIPP?

A SIPP account is a pension account that allows customers to control their retirement savings and where they are invested. SIPPs provide customers with more flexibility and self control over their savings, and are available to all UK residents between the ages of 18 and 75. Customers who are employed or self-employed may contribute up to 100% of their earnings (up to £235,000) in any one tax year. Further they allow retired and unemployed customers to invest up to £3,600 per year. You can trade financial products, property and other items in a SIPP.

- Long Stock (no shorting)

- Long Call or a Long Put

- Covered Calls

- Short Naked Put: only if covered by cash

- Call Spread: Only European style cash settled

- Put Spread: Only European style cash settled

- Long Butterfly: Only European style cash settled

- Iron Condor: Only European style cash settled

- Long Call and Put (long straddle)

Can I trade my ISA through Interactive Brokers?

Cash Accounts: Does a cash account require completion of a W8 form?

If you are a non-US person or entity, Interactive Brokers is required to have a valid form W8 certifying your country of tax residence at the time of application. You may update your W8 form at any time in Account Management.

Can the base currency in a cash account be changed?

Yes, cash accounts may change the base currency on their account. However, please note that IBIS, EmployeeTrack, Flat Fee Referrer, Betting and IN/JPN domeestic accounts cannot change their base currency.

Adding (non-employee) users to an individual account

Individual account holders have the ability to add multiple users to their IBKR account. The account holder may wish to add a second user registered under their own name for the purpose of opening two TWS sessions simultaneously (one for normal access and the other for connecting via an API). The account holder may also provide access to up to 5 (non-employee) individuals, such as a family members, pursuant to a Limited Power of Attorney agreement. In addition, each of these individuals may also be provided with a second user access.

In each case, the additional user will be assigned a unique user name which is required for log in both to Client Portal and the trading platform of choice. Procedures for adding a (non-employee) individual user are outlined below (search KB1004 for procedures for adding a second user for an individual account holder).

Procedures for adding a non-employee user are as follows:

- Log into Client Portal.

- Click the User menu (head and shoulders icon in the top right corner) followed by Manage Account.

- The Users & Access Rights panel is displayed to the right in the Configuration column and shows all of the users that you have added to your account.

- Click the Configure (gear) icon to open the Users & Access Rights screen.

- Here there are two panels: the Users panel shows those individuals added to your account, as well as their relationship to the primary account holder; the User Roles panel shows all user roles that you have created.

- Add, edit, or delete Users using the set of icons to the right.

- The process of adding a user and assigning access rights is divided into several screens. When you complete each screen, click Continue to advance to the next screen. If you want to make changes to a previous screen, click Back.

- On the first screen, enter information about the user, including the username, password, name, relationship to the primary account holder and email address.

- On the next screen, select a user role, if you have saved any. User roles automatically apply a set of previously configured access rights to the new user. If you do this, you can skip any additional screens and continue to the review screen.

- Each screen that follows lets you give the new user rights to access a specific group of functions. On each screen, grant access to functions by clicking the box next to each one.

- The last screen in the process lets you review all of the information about the new user, including access rights. Rights that have been assigned to the new user are shown checked and in green; rights that have not been assigned to the new user are shown crossed out. Click Continue if everything is correct. Click Back to make changes.

- If you do not participate in the Secure Login System for two-factor authentication, you will receive an email with a confirmation number. Enter the confirmation number sent to you via email, then click Continue. If you have not received a confirmation number, click Request Confirmation Number to have a new confirmation number sent to your email address.

- Click OK to save the new user, which will appear in the Users & Access Rights panel.

IMPORTANT NOTES:

1. In accordance with market data vendor requirements, the primary user on the account will be assessed a separate market data subscription fee for each user account added.

2. Account holders may delete a user account by clicking on the delete link next to the user name located within the Users & Access Rights menu options.

How do I add a second user to my Friends and Family master account?

While technically, Friends and Family accounts can have more than one user, there cannot be more than one trader. The second user can access all other functions.

The second user on a Friends and Family master account is designed to accommodate an API connection.

Transfer on Death

Transfer on Death is a form of account registration which allows individuals to pass the assets in their IBKR account directly to another person or entity upon their death without having to go through probate. This registration option is solely available to individual accounts held by US residents (no joint or IRA accounts).

To elect this option, eligible account holders will need to do the following:

1. Log in to Client Portal and User menu (head and shoulders icon in the top right corner) followed by Settings. Next select Account Inheritance under the Account Configuration section.

2. You will need to specify your Primary Beneficiaries (from 1 to 6 whose percentage of ownership must total 100%)

3. You may elect to specify your Contingent Beneficiaries (from 1 to 6 whose percentage of ownership must total 100%). If you do not elect any Contingent Beneficiaries you will need to specify how you wish the interests of any Primary Beneficiaries that predecease you shall be treated (either pass back to the account holder's estate or pass to the remaining Primary Beneficiaries).

4) In the event any Primary or Contingent Beneficiary is a minor you will be required to designate an authorizer signer.

5) You will then be provided with a link to a pre-populated Transfer on Death Agreement which requires formal signature and notarization. Instructions are also provided for submitting the form. If the account holder is married and living in a community property state, spousal consent is required if the spouse is not named as the primary beneficiary (it is the responsibility of the account holder to make this determination).

6) Once the agreement has been returned and reviewed for approval, the registration will be complete and the account title amended (e.g. Jane Doe, TOD). Statements will also reflect this new account title.

7) Account holders may remove the TOD request prior to approval or revoke once approved (both via online option). A new agreement will need to be completed, signed and returned prior to the revocation becoming effective. In order for a revocation request to be effective, it must be received and approved by IBKR prior to the account holder's death.

8) In the event of the death of the account holder, surviving family, heirs, beneficiaries or executors should notify IBKR Client Services via email to:

- estateprocessing@interactivebrokers.com (for US accounts).

Upon receipt of a certified death certificate, IBKR will commence estate processing to determine appropriate distribution of assets. The process varies based upon account type, jurisdiction and other factors. Processing instructions will be provided to verified estate administrators, heirs or beneficiaries.