Discount Certificates Tutorial

Introduction

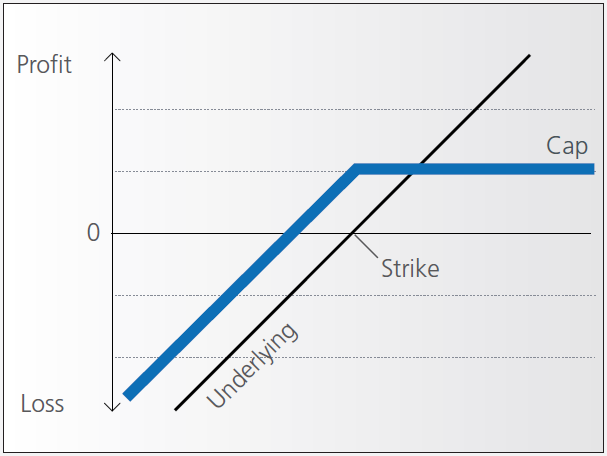

Discount certificates are designed to provide an enhanced return in sideways markets, compared to a direct investment in the underlying.

Discount certificates make it possible for you to buy an underlying instrument for less than its current market price. However, the maximum payback on a discount certificate is limited to a predetermined amount (cap).

Discount certificates normally have a term to maturity of one to three years. At maturity, a determination is made of where the price of the underlying instrument stands.

If it is at or above the cap, you’ll earn the maximum return and receive payment of the amount reflected by the cap.

If the price of the underlying instrument is below the cap on the maturity date, you’ll receive either the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

Pay-out Profile

Example

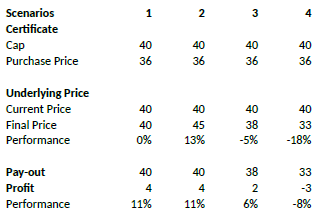

Assume a discount certificate on ABC share. The certificate has a cap of EUR 40.00, and a purchase price of EUR 36.00. The table below shows scenarios depending on the final price of the underlying.

Factor Certificates Tutorial

Introduction

Factor certificates employ a daily leverage factor that multiplies the daily performance of the underlying instrument. Unlike knock-out warrants and mini-futures, factor certificates do not have a knock-out barrier. To avoid a loss greater than the investment, the calculation resets intraday if the performance of the underlying threatens to render the certificate worthless.

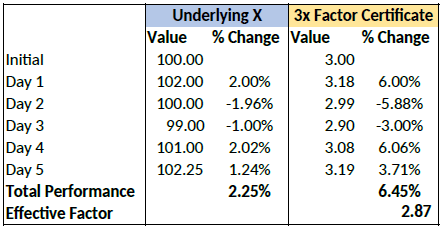

Daily Leverage

The performance of the certificate is calculated daily, without reference to previous days’ values. If the underlying returns 1% on the day, the value of 3x certificate increases by 3%, a 5x by 5%. The next day the process is repeated, referencing the prior day’s underlying close.

As such, factor certificates are particularly suitable for day-traders.

However, for a period of more than one day, the cumulative performance of the underlying cannot be simply multiplied by a factor of 3 as the previous day’s price always forms the new basis of calculating each day’s performance for the certificate. To illustrate with an example:

Cumulatively, the factor certificate has returned less than 3x the performance of the underlying.

Intraday Reset

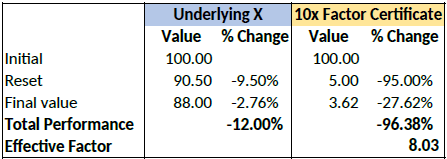

If an underlying for a factor certificate loses more than a certain percentage of its value intraday, the calculation is reset by simulating a new day. The reset threshold varies depending on the leverage factor.

Let’s assume a long factor certificate with a 10x leverage factor. According to the terms of the certificate, a reset will be triggered if the underlying loses more than 9.5% during the calculation day.

Let’s now assume that the underlying loses 12% of its value during a particular day. The reset

and final performance will be as follows:

Complex Position Size

For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e.g. a vertical spread where the short leg is assigned and the user re-writes the same leg the next day, or if the user creates a the position over multiple trades, or if the order is not filled as a native combination at the exchange.

Ajout et Retrait de liquidité

Cet article a pour but de vous permettre de comprendre les frais des Bourse ainsi que les frais d'ajout et de retrait de liquidité pour les tarifications ne comprenant pas les liasses de commissions.

Le concept d'ajout ou de retrait de liquidité s'applique à la fois aux actions et aux options sur actions/indices. Un ordre retire ou ajoute de la liquidité selon qu'il soit négociable ou non.

Les ordres négociables RETIRENT de la liquidité.

Les ordres négociables sont soit des ordres au marché, SOIT des ordres d'achat ou de vente à cours limité dont la limite est au-dessus ou en dessous du marché actuel.

1. Pour un ordre d'achat négociable à cours limité, le prix limite est au dessus ou au niveau du cours vendeur.

2. Pour un ordre de vente négociable à cours limité, le prix limite est au niveau ou en dessous du cours acheteur.

Exemple:

Les quantités/prix de l'action XYZ au cours vendeur (offre) en vigueur sont de 400 actions à 46.00. Vous entrez un ordre à cours limité de 100 actions XYZ à 46.01. Cet ordre sera considéré comme négociable car une exécution immédiate aura lieu. Si des frais de retrait de liquidité existent sur la Bourse, le client se verra appliquer ces frais.

Les ordres non négociables sont des ordres d'achat ou de vente à cours limité pour lesquels le prix limite est en-dessous ou au dessus du marché.

1. Pour un ordre d'achat à cours limité non négociable, le prix limite est en dessous du cours vendeur.

2. Pour un ordre de vente à cours limité non négociable, le prix limite est au dessus du cours acheteur.

Exemple:

Les quantités/prix de l'action XYZ au cours vendeur (offre) en vigueur sont de 400 actions à 46.00. Vous entrez un ordre d'achat à cours limité de 100 actions XYZ à 45.99. Cet ordre sera considéré comme non négociable car il sera communiqué sur le marché comme le meilleur cours acheteur au lieu d'être immédiatement exécuté.

Si quelqu'un passe un ordre de vente négociable qui entraîne l'exécution de votre ordre d'achat à cours limité, vous devriez recevoir une remise (un crédit) si celle-ci est proposée pour ajout de liquidité.

REMARQUE:

1. Toutes les comptes qui tradent des options seront soumis aux éventuelles débits et crédits pour retrait ou ajout de liquidité des Bourses d'options.

2. En ce qui concerne le site Internet IB, seuls les chiffres négatifs apparaissant dans la tarification de Retrait et Ajout de liquidité sont des remises (crédits).

Le lien ci-dessous vous dirige vers les frais/commissions pour les actions et options.

Pourquoi les frais de commissions aux États-Unis varient-ils?

La facturation des commissions sur les options est constituée de deux éléments:

1. Les frais d'exécution perçus par IB. Pour les ordres acheminés via Smart, ces frais sont fixés à 0.70$ par contrat, réduits à 0.15$ par contrat pour les ordres de plus de 100,000 contrats pour un mois donné (voir le site Internet pour les coûts des ordres routés, taux réduits sur les options à faible prime et frais d'ordre minimum); et

2. Frais de Bourse, frais réglementaires et/ou frais de transaction appliqués par des tiers.

Pour les frais de tierces parties, certaines Bourses d'options aux États-Unis ont une structure basée sur des frais/remise pour liquidité qui, une fois agrégés avec les frais d'exécution IB et autres frais réglementaires et/ou frais de transaction, peuvent entraîner des frais globaux par contrat, différents selon les ordres. Cela est imputable à la portion du calcul liés aux frais de Bourse qui peut aboutir à un paiement du client plutôt qu'à la facturation de frais, et qui dépend de certains facteurs qu'IB ne peut pas maîtriser, notamment les attributs de l'ordre du client et les cours acheteur et vendeur en vigueur.

Les Bourses qui appliquent des frais/remises pour liquidité débitent des frais pour les ordres qui retirent de la liquidité (ordres négociables) et en créditent pour les ordres qui ajoutent de la liquidité (ordres à cours limité non négociables). Les frais peuvent varier selon le type de Bourse, type de client (ex., public, négociateur-courtier, entreprise, teneur de marché, professionnel) et le sous-jacent de l'option avec remises aux clients publics (crédits) allant généralement de 0.10$ à 0.42$ et des frais aux clients publics allant de 0.15$ à 0.50$.

IB est tenu d'acheminer les ordres d'options négociables vers la Bourse fournissant le meilleur prix d'exécution. Le Smart Router tient compte des frais de retrait de liquidité lorsqu'il détermine la Bourse qui sera utilisée pour le routage de l'ordre lorsque le marché interne est partagé par plusieurs (acheminera l'ordre vers la Bourse dont les frais sont les moins élevés ou inexistants). De la même manière, le Smart Router n'acheminera que les ordres au marché vers une Bourse qui facture des frais plus élevés s'ils peut améliorer le prix d'au moins 0.01$ (multiplié par le facteur habituel de 100 pour les options, cela procurerait une amélioration de prix de 1.00$, ce qui est supérieur au frais de retrait de liquidité les plus élevés).

Pour plus d'informations concernant le concept d'ajout ou de retrait de liquidité et pour consulter des exemples, veuillez vous référer à l'article KB201.

Risks of Volatility Products

Trading and investing in volatility-related Exchange-Traded Products (ETPs) is not appropriate for all investors and presents different risks than other types of products. Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities (such as futures and swaps) and risks associated with the effects of leveraged investing in geared funds. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. We have summarized several risk factors (as identified in prospectuses for ETPs and in other sources) and included links so you can conduct further research. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. By providing this information, Interactive Brokers (IB) is not offering investment or trading advice regarding ETPs to any customer. Customers (and/or their independent financial advisors) must decide for themselves whether ETPs are an appropriate investment for their portfolios.

Priorité des ordres de clients professionnels

Fin 2009, certaines Bourses d'options américaines (CBOE, ISE) ont instauré des règles visant à distinguer les ordres provenant d'un groupe de clients publics considérés non pas comme des particuliers mais comme des "Professionnels" (des personnes ou entités qui ont accès aux informations et/ou à la technologie leur permettant de trader de la même manière qu'un courtier-négociateur). Conformément à ces règles, tout compte client qui n'est pas un courtier négociateur et qui passe en moyenne plus de 390 ordres d'options cotées par jour (qu'elles soient exécutées ou pas) sur l'ensemble des marchés d'options pour un mois donné, sera considéré comme un Professionnel. Depuis l'instauration de cette règle par la CBOE et l'ISE, la plupart des marchés d'options ont mis en place des procédures similaires afin de distinguer les ordres émanant de "Professionnels".

Les ordres soumis au nom de clients professionnels sur ces Bourses d'options seront traités, en termes de priorité d'exécution, comme s'ils émanaient de courtiers négociateurs. Ils seront par ailleurs soumis à des frais de transaction par contrat allant de remises de ($0.65) à des frais de $1.12 en fonction des classes d'options.

Les courtiers sont tenus de vérifier tous les trimestres si des clients ont excédé la limite de 390 ordres par mois pour un trimestre donné et doivent donc passer au statut de Professionnel le trimestre civil suivant. Veuillez noter qu'en vertu de ces règles, les ordres spread sont considérés comme un ordre unique; chaque jambe du spread ne représente donc pas un ordre. Les clients impactés par ces règles seront informés par IB. Par ailleurs, le Smart router IB prendra en considération ces nouveaux frais de Bourse lors du routage.

Pour plus d'informations, veuillez consulter les liens suivants:

Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.