U.S. Securities Options Exercise Limits

INTRODUCTION

Option exercise limits, along with position limits (See KB1252), have been in place since the inception of standardized trading of U.S. securities options. Their purpose is to prevent manipulative actions in underlying securities (e.g., corners or squeezes) as well as disruptions in option markets where illiquidity in a given option class exists. These limits serve to prohibit an account, along with its related accounts, from cumulatively exercising within any five consecutive business day period, a number of options contracts in excess of the defined limit for a given equity options class (i.e., option contracts associated with a particular underlying security). This includes both early exercises and expiration exercises.

OVERVIEW

U.S. securities option exercise limits are established by FINRA and the U.S. options exchanges. The exercise limits are generally the same as position limits and they can vary by option class as they take into consideration factors such as the number of shares outstanding and trading volume of the underlying security. Limits are also subject to adjustment and therefore can vary over time. The Options Clearing Corporation (OCC), the central clearinghouse for U.S. exchange traded securities options, publishes a daily file with these limits on its public website. The link is as follows: http://www.optionsclearing.com/webapps/position-limits. FINRA Rule 2360(b)(4) addresses exercise limits and can be found via the following website link: http://finra.complinet.com/en/display/display.html?rbid=2403&record_id=16126&element_id=6306&highlight=2360#r16126).

Note that exercise limits are applied based upon the the side of the market represented by the option position. Accordingly, all exercises of call options over the past five business days are aggregated for purposes of determining the limit for the purposes of purchasing the underlying security. Similarly, a separate computation whereby all put exercises over the past five business days are aggregated is required for purposes of determining sales of the underlying.

IMPORTANT INFORMATION

It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. This is because exercise limits are cumulative and one could conceivably purchase options up to the position limit, exercise those options and purchase additional options which, if allowed to be exercised within the five business day window, would exceed the limit.

Account holders are responsible for monitoring their cumulative options exercises as well as the exercise limit quantities to ensure compliance. In addition, IB reserves the right to prohibit the exercise of any options, regardless of their intrinsic value or remaining maturity, if the effect of that exercise would be to violate the exercise limit rule.

Dans quels cas envisager d'exercer une option d'achat avant expiration ?

INTRODUCTION

Exercer une option d'achat avant expiration ne présente, en règle générale, pas d'intérêt d'un point de vue financier. En effet :

- cela conduit à une confiscation de la valeur temps de l'option pour la période restante ;

- requiert une mobilisation plus importante de capital pour le paiement ou le financement de la livraison de l'action ; et

- peut exposer le détenteur de l'option à un risque accru de perte sur l'action comparé à la prime de l'option.

Toutefois, pour les détenteurs de compte ayant la capacité de faire face à une exigence de capital ou d'emprunt plus importante ou à un risque accru de baisse du marché, il peut être intéressant de demander l'exercice anticipé d'une option d'achat américaine afin de bénéficier d'une distribution de dividende imminente.

RAPPEL

Le détenteur d'une option d'achat ne reçoit pas de dividende sur l'action sous-jacente car ce dividende revient au détenteur de l'action au moment de la date d'enregistrement (record Date). À la date ex-dividende, le cours de l'action diminue normalement d'un montant égal à celui du dividende. Bien que la théorie sur le prix des options suggère que le prix d'un call reflétera la valeur réduite des dividendes qui doivent être payés durant la période, ce prix peut également baisser à la date ex-dividende. Les conditions rendant ce scénario plausible et un exercice anticipé favorable sont les suivantes :

1. L'option est "deep-in-the-money" et a un Delta de 100 ;

2. L'option n'a pas ou peu de valeur temps ;

3. Le dividende est relativement élevé et la date ex-dividende précède la date d'expiration de l'option.

EXEMPLES

Pour illustrer l'impact de ces conditions sur une décision d'exercice anticipé, prenons l'exemple d'un compte avec une position longue en numéraire de 9,000 USD et une position longue d'options d'achat de l'action hypothétique “ABC” dont le prix d'exercice est 90.00 USD, avec une expiration dans 10 jours. Le dividende d'ABC, qui s'échange actuellement à 100.00 USD, est de 2.00 USD par action, avec une date ex-dividende le lendemain. Nous supposerons également que le prix de l'option et le cours de l'action se comportent de manière similaire et baissent du montant du dividende à la date ex-dividende.

Nous observerons les effets de la décision d'exercice visant à maintenir une position Delta de 100 actions et à maximiser la position. Deux prix d'options seront retenus, dans le premier cas, l'option est vendue à parité, dans le second, au dessus de la parité.

SCÉNARIO 1: Prix d'option à parité - 10.00 USD

Dans le cas d'une option s'échangeant à parité, l'exercice anticipé servira à maintenir la position Delta et à éviter une perte de valeur sur une action longue lorsque l'action trade ex-dividende pour préserver la valeur. Dans ce cas, les liquidités sont entièrement dédiées à l'achat de l'action au prix d'exercice, la prime de l'option est confisquée et l'action (nette de dividende) et le dividende à recevoir sont crédités sur le compte. Si vous souhaitez arriver au même résultat en vendant l'option avant la date ex-dividende et en achetant l'action, n'oubliez pas d'inclure les commissions/spreads dans vos calculs :

| SCÉNARIO 1 | ||||

| Éléments du compte | Solde de départ | Exercice anticipé | Aucune action | Vente option & achat action |

| Liquidités | 9,000$ | 0$ | 9,000$ | 0$ |

| Option | 1,000$ | 0$ | 800$ | 0$ |

| Action | 0$ | 9,800$ | 0$ | 9,800$ |

| Dividende à percevoir | 0$ | 200$ | 0$ | 200$ |

| Total | 10,000$ | 10,000$ | 9,800$ | 10,000$ moins commissions/spread |

SCÉNARIO 2: Prix d'option au-dessus de la parité - 11.00 USD

Dans le cas d'une option s'échangeant au dessus de la parité, un exercice anticipé afin de percevoir le dividende peut être avantageux. Dans un tel cas de figure, un exercice anticipé engendrerait une perte de 100 USD en valeur temps sur l'option, tandis qu'une vente de l'option et un achat de l'action, peut être, après commissions, moins avantageux que de ne rien faire. Dans ce cas, la meilleure solution est de ne rien faire.

| SCÉNARIO 2 | ||||

| Éléments du compte | Solde de départ | Exercice anticipé | Aucune action |

Vente option & achat action |

| Liquidités | 9,000$ | 0$ | 9,000$ | 100$ |

| Option | 1,100$ | 0$ | 1,100$ | 0$ |

| Action | 0$ | 9,800$ | 0$ | 9,800$ |

| Dividende à percevoir | 0$ | 200$ | 0$ | 200$ |

| Total | 10,100$ | 10,000$ | 10,100$ | 10,100$ moins commissions/spread |

![]() REMARQUE : Les titulaires de compte détenant une position longue d'options d'achat dans le cadre d'un spread doivent se montrer particulièrement vigilants quant au risque lié au non-exercice de la jambe longue compte tenu de la probabilité d'un exercice de la jambe short. Veuillez noter que l'assignation d'une option d'achat short entraîne une position short d'actions et les détenteurs de positions short d'actions à la date d'enregistrement du dividende ont l'obligation de payer un dividende au prêteur des actions. Par ailleurs, le cycle de traitement de la chambre de compensation ne permet pas la soumission de notifications d'exercice en réponse à une assignation.

REMARQUE : Les titulaires de compte détenant une position longue d'options d'achat dans le cadre d'un spread doivent se montrer particulièrement vigilants quant au risque lié au non-exercice de la jambe longue compte tenu de la probabilité d'un exercice de la jambe short. Veuillez noter que l'assignation d'une option d'achat short entraîne une position short d'actions et les détenteurs de positions short d'actions à la date d'enregistrement du dividende ont l'obligation de payer un dividende au prêteur des actions. Par ailleurs, le cycle de traitement de la chambre de compensation ne permet pas la soumission de notifications d'exercice en réponse à une assignation.

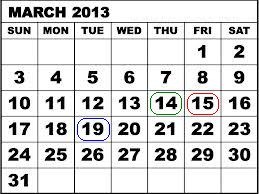

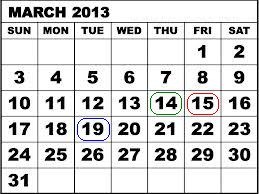

Prenons l'exemple d'un spread créditeur d'options d'achat (bear) sur le SPDR S&P 500 ETF Trust (SPY) comprenant 100 contrats short avec un prix d'exercice de 146 USD à mars 2013, et 100 contrats long au prix d'exercice de 147 USD à mars 2013. Le 14 mars 2013, SPY Trust annonce une distribution de dividende de 0.69372 USD par action, payable le 30 avril 2013 aux actionnaires à une date d'enregistrement au 19 mars 2013. Compte tenu des 3 jours ouvrables de règlement pour les actions U.S., il aurait fallu acheter l'action ou exercer l'option d'achat au 14 mars 2013 au plus tard, afin de recevoir un dividende, étant donné que l'action commençait à trader ex-dividende le lendemain.

Le 14 mars 2013, alors qu'il restait un jour de trading avant expiration, les deux options s'échangeaient à parité, ce qui implique un risque maximum de 100 USD par contrat, soit 10,000 USD sur la position de 100 contrats. Cependant, ne pas exercer le contrat long afin de percevoir un dividende et de se protéger contre l'assignation vraisemblable des contrats short par d'autres intervenants en quête d'un dividende, a engendré un risque supplémentaire de 67.372 USD par contrat, soit 6,737.20 USD sur la position restante lorsque toutes les positions d'achat seront assignées. Comme indiqué dans le tableau ci-dessous, si la jambe de l'option short n'avait pas été assignée, le risque maximum au prix de règlement final au 15 mars 2013, serait resté à 100 USD par contrat.

| Date | Clôture SPY | Option d'achat 146$ mars 2013 | Option d'achat 147$ mars 2013 |

| 14 mars 2013 | 156.73$ | 10.73$ | 9.83$ |

| 15 mars 2013 | 155.83$ | 9.73$ | 8.83$ |

Veuillez noter que si votre compte est soumis à une retenue fiscale dans le cadre de la règle du trésor américain 871(m), il peut être avantageux pour vous de fermer une position d'options longue avant la date ex-dividende et de la rouvrir après.

Pour plus d'informations sur la manière de procéder à un exercice anticipé, veuillez consulter le site Interactive Brokers.

L'article ci-dessus vous est fourni uniquement à titre d'information et ne constitue en rien une recommandation, un conseil de trading ni ne garantit que l'exercice anticipé d'option sera adéquat ou une opération réussie pour tous les clients ou toutes les transactions. Les détenteurs de compte doivent consulter un conseiller fiscal afin de s'informer de l'incidence fiscale, le cas échéant, d'un exercice anticipé et doivent être avertis des risques potentiels que présente la substitution d'une position longue d'option à une position longue d'actions.

Produits structurés : Liens vers les émetteurs

Des détails importants concernant les termes et conditions des produits structurés sont disponibles sur les sites Internet des différents émetteurs. Les bourses sur lesquelles ils sont cotées proposent également des informations et des analyses. Veuillez noter cependant que seuls les sites Internet des émetteurs sont des sources d'information fiables, ainsi que les descriptifs des termes et conditions correspondants, et autres document légaux.

Sites Internet des produits structurés

Bourses

| Euronext |

http://www.euronext.com/trader/priceslists/newpriceslistswarrants-1812-E...

|

| Scoach Germany |

http://www.scoach.de/EN/Showpage.aspx?pageID=8

|

| Scoach Switzerland |

http://scoach.ch/EN/Showpage.aspx?pageID=8

|

| Stuttgart Exchange |

https://www.boerse-stuttgart.de/en/

|

Émetteurs (sites internationaux)

| Barclays |

http://www.bmarkets.com/home.app

|

| BNP Paribas |

http://warrants.bnpparibas.com/

|

| CITI |

http://www.citiwarrants.com/EN/index.asp?pageid=31

|

| Commerzbank |

http://warrants.commerzbank.com/

|

| Credit Suisse |

https://derivative.credit-suisse.com/index.cfm?nav=jumper&CFID=10909284&...

|

| Deutsche Bank |

http://www.x-markets.db.com/EN/showpage.asp?pageid=33&blredirect=0

|

| Goldman Sachs |

http://www2.goldmansachs.com/services/investing/securitised-derivatives/...

|

| ING |

https://www.ingfm.com/spg/spg/shownews.do

|

| JP Morgan |

http://www.jpmorgansp.com/welcome/flash.html

|

| Macquarie Oppenheim |

http://www.macquarie-oppenheim.com/

|

| Merrill Lynch |

http://www.merrillinvest.ml.com/

|

| Morgan Stanley |

http://www.morganstanleyiq.com/showpage.asp

|

| Natixis |

http://www.natixis-direct.com/EN/showpage.asp?pageid=151

|

| Rabobank |

http://www.raboglobalmarkets.com/

|

| RBS |

http://markets.rbs.com/EN/Showpage.aspx?pageID=58

|

| Societe Generale |

|

| UBS |

|

| Zurcher Kantonalbank |

https://zkb.is-teledata.ch/html/search/simple/index.html

|

Émetteurs (sites locaux)

"EMIR": Reporting to Trade Repository Obligations and Interactive Brokers Delegated Service to help meet your obligations

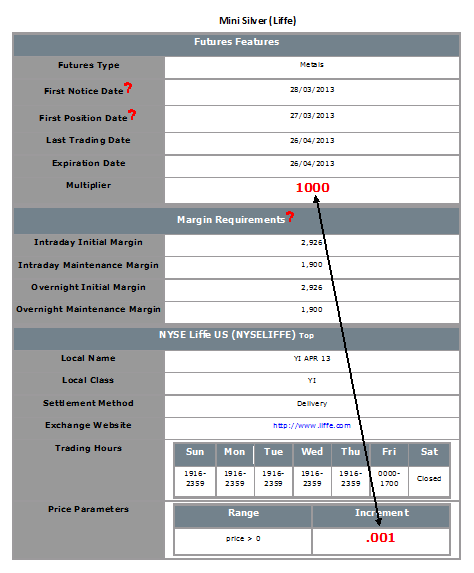

Determining Tick Value

Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Tick values vary by instrument and are determined by the listing exchange. IB provides this information directly from the Contract Search tool on the website or via the Trader Workstation (TWS). To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. The contract specifications window for the instrument will then be displayed (Exhibit 1).

To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. As illustrated in the example below, the LIFFE Mini Silver futures contact has a tick value or minimum increment of .001 which, when multiplied by the contract multiplier of 1,000 ounces, results in a minimum tick value of $1.00 per contract. Accordingly, every tick change up or down results in a profit or loss of $1.00 per LIFFE Mini Silver futures contract.

Exhibit 1

Considerations for Exercising Call Options Prior to Expiration

INTRODUCTION

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:

- It results in a forfeiture of any remaining option time value;

- Requires a greater commitment of capital for the payment or financing of the stock delivery; and

- May expose the option holder to greater risk of loss on the stock relative to the option premium.

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

BACKGROUND

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:

1. The option is deep-in-the-money and has a delta of 100;

2. The option has little or no time value;

3. The dividend is relatively high and its Ex-Date precedes the option expiration date.

EXAMPLES

To illustrate the impact of these conditions upon the early exercise decision, consider an account maintaining a long cash balance of $9,000 and a long call position in hypothetical stock “ABC” having a strike price of $90.00 and time to expiration of 10 days. ABC, currently trading at $100.00, has declared a dividend of $2.00 per share with tomorrow being the Ex-Dividend date. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date.

Here, we will review the exercise decision with the intent of maintaining the 100 share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

SCENARIO 1: Option Price At Parity - $10.00

In the case of an option trading at parity, early exercise will serve to maintain the position delta and avoid the loss of value in long option when the stock trades ex-dividend, to preserve equity. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock (net of dividend) and dividend receivable are credited to the account. If you aim for the same end result by selling the option prior to the Ex-Dividend date and purchasing the stock, remember to factor in commissions/spreads:

| SCENARIO 1 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $0 |

| Option | $1,000 | $0 | $800 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,000 | $10,000 | $9,800 | $10,000 less commissions/spreads |

SCENARIO 2: Option Price Above Parity - $11.00

In the case of an option trading above parity, early exercise to capture the dividend may not be economically beneficial. In this scenario, early exercise would result in a loss of $100 in option time value, while selling the option and buying the stock, after commissions, may be less beneficial than taking no action. In this scenario, the preferable action would be No Action.

| SCENARIO 2 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $100 |

| Option | $1,100 | $0 | $1,100 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,100 | $10,000 | $10,100 | $10,100 less commissions/spreads |

![]() NOTE:

NOTE:

Options have two components that make up their total premium value - intrinsic value and time value. The intrinsic value is the amount by which the option is in-the-money, while the time value represents the possibility that the option could become even more profitable before expiration as the underlying asset price fluctuates while providing protection against adverse moves.

Many options are American-style, which means they can be exercised early, ahead of their expiration date. Early exercise of an option eliminates the remaining time value component from the option's premium, since the option holder loses protection against unfavorable movements in the underlying asset’s price.

This makes early exercise suboptimal in most situations, as the option holder is willingly forfeiting a portion of the option's value.

There are a few specific circumstances where early exercise could make sense, such as:

- For call options on a stock that will pay dividends soon, where the dividend amount exceeds the remaining time value (and only if the exercise will settle on or prior to the record date for the dividend).

- For deep in-the-money options where the time value is negligible compared to the intrinsic value, and the option is expected to drop in value due to interest rate effects (PUTS), or expected stock loan benefits (CALLS).

The first case, exercising an in the money call immediately ahead of a dividend payment, is the most common economically-sensible early exercise. In most cases, it is advisable to hold or sell the option instead of exercising it early, in order to capture the remaining time value. An option should only be exercised early after carefully considering all factors and determining that the benefits of early exercise outweigh the time value being surrendered.

Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

As example, consider a credit call (bear) spread on the SPDR S&P 500 ETF Trust (SPY) consisting of 100 short contracts in the March '13 $146 strike and 100 long contracts in the March '13 $147 strike. On 3/14/13, with the SPY Trust declared a dividend of $0.69372 per share, payable 4/30/13 to shareholders of record as of 3/19/13. Given the 3 business day settlement time frame for U.S. stocks, one would have had to buy the stock or exercise the call no later than 3/14/13 in order receive the dividend, as the next day the stock began trading Ex-Dividend.

On 3/14/13, with one trading day left prior to expiration, the two option contracts traded at parity, suggesting maximum risk of $100 per contract or $10,000 on the 100 contract position. However, the failure to exercise the long contract in order to capture the dividend and protect against the likely assignment on the short contracts by others seeking the dividend created an additional risk of $67.372 per contract or $6,737.20 on the position representing the dividend obligation were all short calls assigned. As reflected on the table below, had the short option leg not been assigned, the maximum risk when the final contract settlement prices were determined on 3/15/13 would have remained at $100 per contract.

| Date | SPY Close | March '13 $146 Call | March '13 $147 Call |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

Please note that if your account is subject to tax withholding requirements of the US Treasure rule 871(m), it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.

Why Do Commission Charges on U.S. Options Vary?

IBKR's option commission charge consists of two parts:

1. The execution fee which accrues to IBKR. For Smart Routed orders this fee is set at $0.65 per contract, reduced to as low as $0.15 per contract for orders in excess of 100,000 contracts in a given month (see website for costs on Direct Routed orders, reduced rates on low premium options and minimum order charges); and

2. Third party exchange, regulatory and/or transaction fees.

In the case of third party fees, certain U.S. option exchanges maintain a liquidity fee/rebate structure which, when aggregated with the IBKR execution fee and any other regulatory and/or transaction fees, may result in an overall per contract commission charge that varies from one order to another. This is attributable to the exchange portion of the calculation, the result of which may be a payment to the customer rather than a fee, and which depends upon a number of factors outside of IBKR's control including the customer's order attributes and the prevailing bid-ask quotes.

Exchanges which operate under this liquidity fee/rebate model charge a fee for orders which serve to remove liquidity (i.e., marketable orders) and provide a credit for orders which add liquidity (i.e., limit orders which are not marketable). Fees can vary by exchange, customer type (e.g., public, broker-dealer, firm, market maker, professional), and option underlying with public customer rebates (credits) generally ranging from $0.10 - $0.90 and public customer fees from $0.01 - $0.95.

IBKR is obligated to route marketable option orders to the exchange providing the best execution price and the Smart Router takes into consideration liquidity removal fees when determining which exchange to route the order to when the inside market is shared by multiple (i.e., will route the order to the exchange with the lowest or no fee). Accordingly, the Smart Router will only route a market order to an exchange which charges a higher fee if they can better the market by at least $0.01 (which, given the standard option multiplier of 100 would result in price improvement of $1.00 which is greater than the largest liquidity removal fee).

For additional information on the concept of adding/removing liquidity, including examples, please refer to KB201.

Expiration & Corporate Action Related Liquidations

In addition to the policy of force liquidating client positions in the event of a real-time margin deficiency, IBKR will also liquidate positions based upon certain expiration or corporate action related events which, after giving effect to, would create undue risk and/or operational concerns. Examples of such events are outlined below.

Option Exercise

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full (in the case of a call exercised in a cash account or stock subject to 100% margin) or finance the long/short stock position (in the case of a call/put exercised in a margin account). Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. This uncollateralized risk can be especially pronounced and may far exceed any in-the-money value the long option may have held, particularly at expiration when clearinghouses automatically exercise options at in-the-money levels as low as $0.01 per share.

Take, for example, an account whose equity on Day 1 consists solely of 20 long $50 strike call options in hypothetical stock XYZ which have closed at expiration at $1 per contract with the underlying at $51. Assume under Scenario 1 that the options are all auto-exercised and XYZ opens at $51 on Day 2. Assume under Scenario 2 that the options are all auto-exercised and XYZ opens at $48 on Day 2.

| Account Balance | Pre-Expiration | Scenario 1 - XYZ Opens @ $51 | Scenario 2 - XYZ Opens @ $48 |

|---|---|---|---|

| Cash | $0.00 | ($100,000.00) | ($100,000.00) |

| Long Stock | $0.00 | $102,000.00 | $96,000.00 |

|

Long Option* |

$2,000.00 | $0.00 | $0.00 |

| Net Liquidating Equity/(Deficit) | $2,000.00 | $2,000.00 | ($4,000.00) |

| Margin Requirement | $0.00 | $25,500.00 | $25,500.00 |

| Margin Excess/(Deficiency) | $0.00 | ($23,500.00) | ($29,500.00) |

*Long option has no loan value.

To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either: 1) liquidate options prior to expiration; 2) allow the options to lapse; and/or 3) allow delivery and liquidate the underlying at any time. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

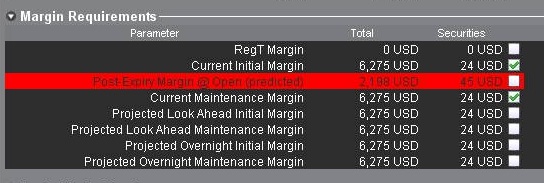

IBKR also reserves the right to liquidate positions on the afternoon before settlement if IBKR’s systems project that the effect of settlement would result in a margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. For instance, if IBKR projects that positions will be removed from the account as a result of settlement (e.g., if options will expire out of the money or cash-settled options will expire in the money), IBKR’s systems will evaluate the margin effect of those settlement events.

If IBKR determines the exposure is excessive, IBKR may liquidate positions in the account to resolve the projected margin deficiency. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. The projected margin excess will be displayed on the line titled “Post-Expiry Margin” (see below) which, if negative and highlighted in red indicates that your account may be subject to forced position liquidations. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Note that certain account types which employ a hierarchy structure (e.g., Separate Trading Limit account) will have this information presented only at the master account level where the computation is aggregated.

Note that IBKR generally initiates expiration related liquidations 2 hours prior to the close, but reserves the right to begin this process sooner or later should conditions warrant. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying.

Call Spreads in Advance of Ex-Dividend Date

In the event that you are holding a call spread (long and short calls having the same underlying) prior to an ex-dividend date in the underlying, and if you have not liquidated the spread or exercised the long call(s), IBKR reserves the right to: i) exercise some or all of the long call(s); and/or ii) liquidate (i.e., close out) some or all of the spreads - if IBKR, in its sole discretion, anticipates that: a) the short call(s) is (are) likely to be assigned; and b) your account would not ave sufficient equity to satisfy the liability to pay the dividend or to satisfy margin requirements generally. In the event that IBKR exercises the long call(s) in this scenario and you are not assigned on the short call(s), you could suffer losses. Likewise, if IBKR liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective.

In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly.

Physically Delivered Futures

With the exception of certain futures contracts having currencies or metals as their underlying, IBKR generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract (a list of which is provided on the website).

Note that it is the client’s responsibility to be aware of the Close-Out Deadline and physically delivered contracts which are not closed out within the specified time frame may be liquidated by IBKR without prior notification.

Considerations for Optimizing Order Efficiency

Account holders are encouraged to routinely monitor their order submissions with the objective of optimizing efficiency and minimizing 'wasted' or non-executed orders. As inefficient orders have the potential to consume a disproportionate amount of system resources. IB measures the effectiveness of client orders through the Order Efficiency Ratio (OER). This ratio compares aggregate daily order activity relative to that portion of activity which results in an execution and is determined as follows:

OER = (Order Submissions + Order Revisions + Order Cancellations) / (Executed Orders + 1)

Outlined below is a list of considerations which can assist with optimizing (reducing) one's OER:

1. Cancellation of Day Orders - strategies which use 'Day' as the Time in Force setting and are restricted to Regular Trading Hours should not initiate order cancellations after 16:00 ET, but rather rely upon IB processes which automatically act to cancel such orders. While the client initiated cancellation request which serve to increase the OER, IB's cancellation will not.

2. Modification vs. Cancellation - logic which acts to cancel and subsequently replace orders should be substituted with logic which simply modifies the existing orders. This will serve to reduce the process from two order actions to a single order action, thereby improving the OER.

3. Conditional Orders - when utilizing strategies which involve the pricing of one product relative to another, consideration should be given to minimizing unnecessary price and quantity order modifications. As an example, an order modification based upon a price change should only be triggered if the prior price is no longer competitive and the new suggested price is competitive.

4. Meaningful Revisions – logic which serves to modify existing orders without substantially increasing the likelihood of the modified order interacting with the NBBO should be avoided. An example of this would be the modification of a buy order from $30.50 to $30.55 on a stock having a bid-ask of $31.25 - $31.26.

5. RTH Orders – logic which modifies orders set to execute solely during Regular Trading Hours based upon price changes taking place outside those hours should be optimized to only make such modifications during or just prior to the time at which the orders are activated.

6. Order Stacking - Any strategy that incorporates and transmits the stacking of orders on the same side of a particular underlying should minimize transmitting those that are not immediately marketable until the orders which have a greater likelihood of interacting with the NBBO have executed.

7. Use of IB Order Types - as the revision logic embedded within IB-supported order types is not considered an order action for the purposes of the OER, consideration should be given to using IB order types, whenever practical, as opposed to replicating such logic within the client order management logic. Logic which is commonly initiated by clients and whose behavior can be readily replicated by IB order types include: the dynamic management of orders expressed in terms of an options implied volatility (Volatility Orders), orders to set a stop price at a fixed amount relative to the market price (Trailing Stop Orders), and orders designed to automatically maintain a limit price relative to the NBBO (Pegged-to-Market Orders).

The above is not intended to be an exhaustive list of steps for optimizing one's orders but rather those which address the most frequently observed inefficiencies in client order management logic, are relatively simple to implement and which provide the opportunity for substantive and enduring improvements. For further information or questions, please contact the Customer Service Technical Assistance Center.

Structured Products: Issuer Links

Structured Products Web Links

Below are links to the relevant exchanges' product pages and issuer listings. The listings include links to the issuers' web sites.

The exchange web sites provide search tools, product overviews and analytics. Only the issuers' web sites can be relied upon for fully up to date details, including term sheets and other legal documentation.

| Germany | |

|

The Netherlands France |