Option Levels 1-4

What are the levels of Option Trading Permissions?

IBKR introduced two new, lower levels of option trading permissions, Level 1 and 2, in order to be able to offer option trading to those who currently would not qualify for Limited or Full option trading permissions. Limited permissions are now referred to as Level 3, and Full permissions are considered Level 4.

Please note that clients of IB Canada and IB India are not eligible for option level permissions and remain with Limited or Full option trading permissions.

The type of option strategies available to trade will depend on the level of option permissions approved on the account. The various levels are as follows:

|

Level |

Option Strategies Allowed |

|

Level 1 |

Covered calls, i.e. short call vs long equal quantity of underlying, are allowed. |

|

Level 2 |

Covered Options Positions as defined by FINRA Rule 2360 are allowed with the additional restriction that the expiration date of the long option must be on or after the expiration date of the short option in a spread. |

|

Level 3 |

Option strategies that have limited maximum potential loss are allowed. |

|

Level 4 |

All option strategies are allowed. |

For examples of the types of option combinations allowed in each level, please see the following chart:

|

Strategy |

Level Requirement |

|

Covered Call/Covered Basket Call |

Level 1 |

|

Buy Write |

Level 1 |

|

Long option positions |

Level 2 |

|

Long Call |

Level 2 |

|

Long Put |

Level 2 |

|

Covered Put |

Level 2 |

|

Protective Call |

Level 2 |

|

Protective Put |

Level 2 |

|

Long Straddle |

Level 2 |

|

Long Strangle |

Level 2 |

|

Conversion |

Level 2 |

|

Long call spread |

Level 2 |

|

Long put spread |

Level 2 |

|

Long Iron Condor |

Level 2 |

|

Long Box Spread |

Level 2 |

|

Collar |

Level 2 |

|

Short Collar |

Level 2 |

|

Short Put |

Level 3 |

|

Synthetic |

Level 3 |

|

Reversal |

Level 3 |

|

Short Call Spread |

Level 3 |

|

Short Put Spread |

Level 3 |

|

Short Iron Condor |

Level 3 |

|

Long Butterfly |

Level 3 |

|

Unbalanced Butterfly |

Level 3 |

|

Short Butterfly |

Level 3 |

|

Calendar Spread - Debit |

Level 3 |

|

Diagnol Spread - Short leg expires first |

Level 3 |

|

Short Naked Call |

Level 4 |

|

Short Straddle |

Level 4 |

|

Short Strangle |

Level 4 |

|

Short Synthetic |

Level 4 |

|

Calendar Spread - Credit |

Level 4 |

|

Diagnol Spread - Long leg expires first |

Level 4 |

What account type is needed to trade options?

Option trading permissions are available for Margin, Cash and IRA/Retirement accounts.

A Margin account may request any level of option trading permissions (1-4). A Cash or IRA account may only request levels 1-3, and full payment is required for all call and put purchases.

Please Note

- Clients who maintain either a cash or margin type account must maintain net liquidating equity of at least USD 2,000 (or equivalent in other currencies) in order to establish or increase an existing uncovered options position.

How do I request or update my option trading permissions?

To update your trading permissions for options:

1. Log in to Client Portal

2. Select the User menu (head and shoulders icon in the top right corner) followed by Settings

3. Under Account Settings find the Trading section

4. Click on Trading Permissions

5. Locate Options section, select Add/Edit or Request under Options, select the level of permissions you want to request and click on CONTINUE.

6. Review and sign the disclosures and agreements.

7. Click CONTINUE and follow the prompts on screen.

Trading permission requests may take 24-48 hours to be reviewed. Find more information on trading permissions in the Client Portal Users' Guide.

Please Note

- When only Options permissions are available for a country the permissions will include both Stock and Index Options.

- US legal residents are generally excluded from trading securities options outside of the United States due to SEC restrictions. Securities options are defined as any option on an individual stock, US legal stock, or any cash settled broad based index future.

- Certain option contracts require an additional permission for "Complex or Leveraged Exchange Traded Products".

Is it possible for someone under the age of 21 to trade options?

All clients are eligible for Level 1 options trading permissions. However, IBKR requires that clients be at least 21 years of age to be eligible for level 2-4 option trading.

What are the requirements to qualify for option trading permissions?

IBKR offers various levels of trading permissions to applicants meeting minimum age, liquid net worth, investment objectives, product knowledge and prior experience qualifications. This information is gathered in the account application phase or in Client Portal if a trading permissions upgrade is requested following initial account approval.

If you need to update or review your financial information, investment objectives or experience use the button above or follow this procedure:

1. Log into Client Portal

2. Go to the User menu (head and shoulders icon in the top right corner) followed by Settings

3. Under Account Settings find the Account Profile section

4. Click on Financial Profile, rectify your information and confirm.

Quelles formules utiliser pour calculer la marge sur des options ?

Il existe de nombreuses formules pour calculer l'exigence de marge des options. La formule utilisée dépend du type d'option ou de la stratégie déterminée par le système. Il existe un nombre important de formules détaillées qui sont appliquées à diverses stratégies. Pour trouver ces informations, rendez-vous sur la page d'accueil IBKR sur www.interactivebrokers.com. Choisissez le menu Trading et cliquez sur Marge. Depuis la page Exigences de marge, cliquez sur l'onglet Options. Sur cette page, vous trouverez un tableau qui liste toutes les stratégies possibles, et les différentes formules utilisées pour calculer la marge de chaque.

Les informations ci-dessus s'appliquent pour les options sur actions et les options sur indices. Les options sur contrats à terme emploient une méthodologie complètement différente appelée la marge SPAN. Pour plus d'informations sur la marge SPAN, faites une recherche sur cette page pour « SPAN » ou « marge d'option sur contrats à terme ».

VR(T) time decay and term adjusted Vega columns in Risk Navigator (SM)

Background

Risk Navigator (SM) has two Adjusted Vega columns that you can add to your report pages via menu Metrics → Position Risk...: "Adjusted Vega" and "Vega x T-1/2". A common question is what is our in-house time function that is used in the Adjusted Vega column and what is the aim of these columns. VR(T) is also generally used in our Stress Test or in the Risk Navigator custom scenario calculation of volatility index options (i.e VIX).

Abstract

Implied volatilities of two different options on the same underlying can change independently of each other. Most of the time the changes will have the same sign but not necessarily the same magnitude. In order to realistically aggregate volatility risk across multiple options into a single number, we need an assumption about relationship between implied volatility changes. In Risk Navigator, we always assume that within a single maturity, all implied volatility changes have the same sign and magnitude (i.e. a parallel shift of volatility curve). Across expiration dates, however, it is empirically known that short term volatility exhibits a higher variability than long term volatility, so the parallel shift is a poor assumption. This document outlines our approach based on volatility returns function (VR(T)). We also describe an alternative method developed to accommodate different requests.

VR(T) time decay

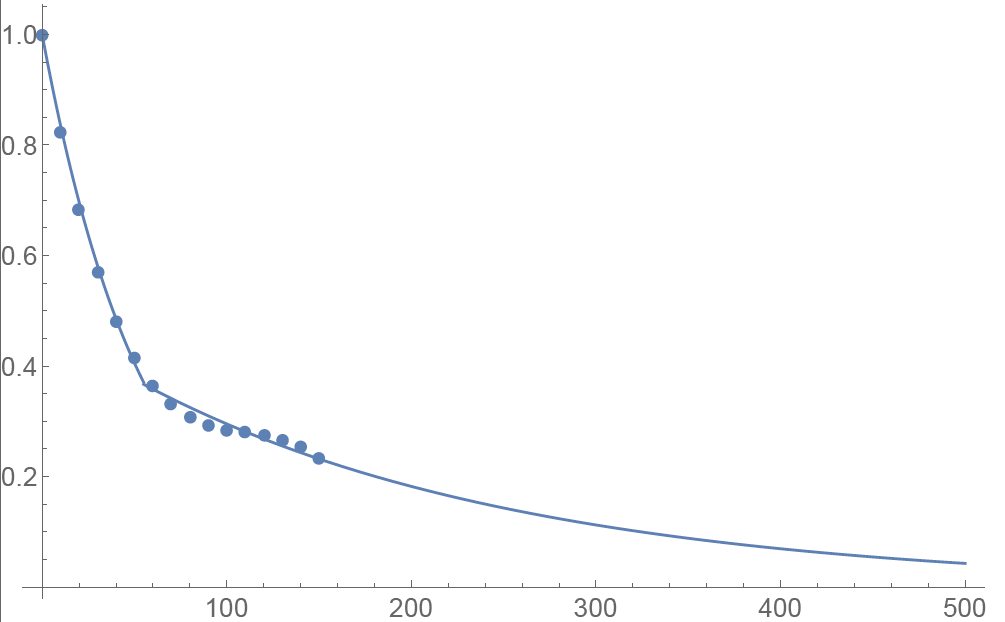

We applied the principal component analysis to study daily percentage changes of volatility as a function of time to maturity. In that study we found that the primary eigen-mode explains approximately 90% of the variance of the system (with second and third components explaining most of the remaining variance being the slope change and twist). The largest amplitude of change for the primary eigenvector occurs at very short maturities, and the amplitude monotonically decreases as time to expiration increase. The following graph shows the main eigenvector as a function of time (measured in calendar days). To smooth the numerically obtained curve, we parameterize it as a piecewise exponential function.

Functional Form: Amplitude vs. Calendar Days

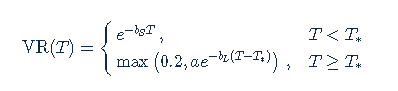

To prevent the parametric function from becoming vanishingly small at long maturities, we apply a floor to the longer term exponential so the final implementation of this function is:

where bS=0.0180611, a=0.365678, bL=0.00482976, and T*=55.7 are obtained by fitting the main eigenvector to the parametric formula.

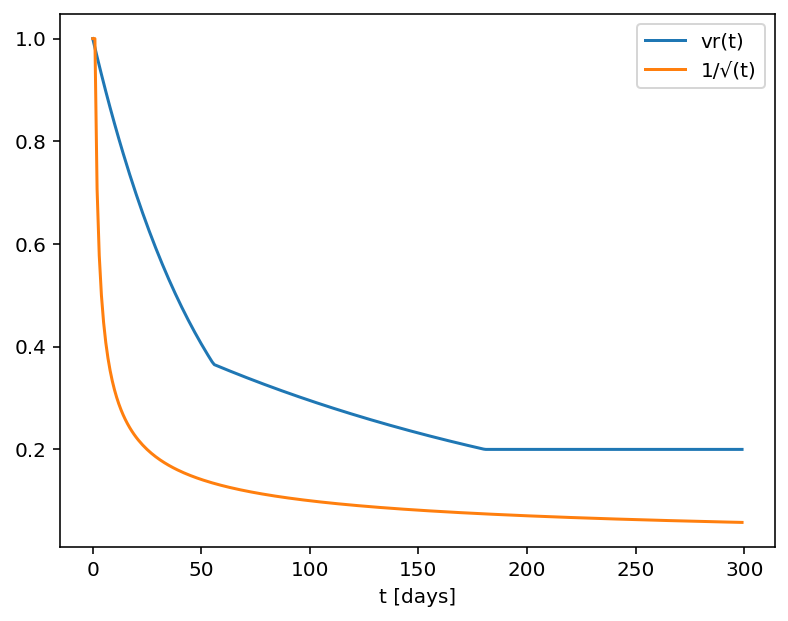

Inverse square root time decay

Another common approach to standardize volatility moves across maturities uses the factor 1/√T. As shown in the graph below, our house VR(T) function has a bigger volatility changes than this simplified model.

Time function comparison: Amplitude vs. Calendar Days

Adjusted Vega columns

Risk Navigator (SM) reports a computed Vega for each position; by convention, this is the p/l change per 1% increase in the volatility used for pricing. Aggregating these Vega values thus provides the portfolio p/l change for a 1% across-the-board increase in all volatilities – a parallel shift of volatility.

However, as described above a change in market volatilities might not take the form of a parallel shift. Empirically, we observe that the implied volatility of short-dated options tends to fluctuate more than that of longer-dated options. This differing sensitivity is similar to the "beta" parameter of the Capital Asset Pricing Model. We refer to this effect as term structure of volatility response.

By multiplying the Vega of an option position with an expiry-dependent quantity, we can compute a term-adjusted Vega intended to allow more accurate comparison of volatility exposures across expiries. Naturally the hoped-for increase in accuracy can only come about if the adjustment we choose turns out to accurately model the change in market implied volatility.

We offer two parametrized functions of expiry which can be used to compute this Vega adjustment to better represent the volatility sensitivity characteristics of the options as a function of time to maturity. Note that these are also referred as 'time weighted' or 'normalized' Vega.

Adjusted Vega

A column titled "Vega Adjusted" multiplies the Vega by our in-house VR(T) term structure function. This is available any option that is not a derivative of a Volatility Product ETP. Examples are SPX, IBM, VIX but not VXX.

Vega x T-1/2

A column for the same set of products as above titled "Vega x T-1/2" multiplies the Vega by the inverse square root of T (i.e. 1/√T) where T is the number of calendar days to expiry.

Aggregations

Cross over underlying aggregations are calculated in the usual fashion given the new values. Based on the selected Vega aggregation method we support None, Straight Add (SA) and Same Percentage Move (SPM). In SPM mode we summarize individual Vega values multiplied by implied volatility. All aggregation methods convert the values into the base currency of the portfolio.

Custom scenario calculation of volatility index options

Implied Volatility Indices are indexes that are computed real-time basis throughout each trading day just as a regular equity index, but they are measuring volatility and not price. Among the most important ones is CBOE's Marker Volatility Index (VIX). It measures the market's expectation of 30-day volatility implied by S&P 500 Index (SPX) option prices. The calculation estimates expected volatility by averaging the weighted prices of SPX puts and calls over a wide range of strike prices.

The pricing for volatility index options have some differences from the pricing for equity and stock index options. The underlying for such options is the expected, or forward, value of the index at expiration, rather than the current, or "spot" index value. Volatility index option prices should reflect the forward value of the volatility index (which is typically not as volatile as the spot index). Forward prices of option volatility exhibit a "term structure", meaning that the prices of options expiring on different dates may imply different, albeit related, volatility estimates.

For volatility index options like VIX the custom scenario editor of Risk Navigator offers custom adjustment of the VIX spot price and it estimates the scenario forward prices based on the current forward and VR(T) adjusted shock of the scenario adjusted index on the following way.

- Let S0 be the current spot index price, and

- S1 be the adjusted scenario index price.

- If F0 is the current real time forward price for the given option expiry, then

- F1 scenario forward price is F1 = F0 + (S1 - S0) x VR(T), where T is the number of calendar days to expiry.

Où puis-je trouver des informations supplémentaires concernant les options ?

L'Options Clearing Corporation (OCC), la chambre de compensation principale pour toutes les options sur actions négociées en Bourses aux États-Unis, maintient un centre d'appels pour répondre aux besoins en informations des investisseurs particuliers et courtiers en titres de détail. Ce centre peut répondre aux besoins et problèmes suivants, liés aux produits d'options compensés par l'OCC :

- Informations de l'Options Industry Council concernant des séminaires, vidéos et documents pédagogiques ;

- Questions de base concernant les options comme des définitions et des informations sur les produits ;

- Réponses aux questions stratégiques et opérationnelles, notamment les positions de transactions et stratégies.

Vous pouvez joindre les centre d'appels en composant 1-800-OPTIONS. Les heures de service sont du lundi au jeudi de 8 h 00 à 17 h 00 (CST) et le vendredi de 8 h 00 à 17 h 00 (CST). Les heures pour le vendredi d'échéance du mois seront prolongées jusqu'à 17 h 00 (CST).

Complex Position Size

For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e.g. a vertical spread where the short leg is assigned and the user re-writes the same leg the next day, or if the user creates a the position over multiple trades, or if the order is not filled as a native combination at the exchange.

Dans quels cas envisager d'exercer une option d'achat avant expiration ?

INTRODUCTION

Exercer une option d'achat avant expiration ne présente, en règle générale, pas d'intérêt d'un point de vue financier. En effet :

- cela conduit à une confiscation de la valeur temps de l'option pour la période restante ;

- requiert une mobilisation plus importante de capital pour le paiement ou le financement de la livraison de l'action ; et

- peut exposer le détenteur de l'option à un risque accru de perte sur l'action comparé à la prime de l'option.

Toutefois, pour les détenteurs de compte ayant la capacité de faire face à une exigence de capital ou d'emprunt plus importante ou à un risque accru de baisse du marché, il peut être intéressant de demander l'exercice anticipé d'une option d'achat américaine afin de bénéficier d'une distribution de dividende imminente.

RAPPEL

Le détenteur d'une option d'achat ne reçoit pas de dividende sur l'action sous-jacente car ce dividende revient au détenteur de l'action au moment de la date d'enregistrement (record Date). À la date ex-dividende, le cours de l'action diminue normalement d'un montant égal à celui du dividende. Bien que la théorie sur le prix des options suggère que le prix d'un call reflétera la valeur réduite des dividendes qui doivent être payés durant la période, ce prix peut également baisser à la date ex-dividende. Les conditions rendant ce scénario plausible et un exercice anticipé favorable sont les suivantes :

1. L'option est "deep-in-the-money" et a un Delta de 100 ;

2. L'option n'a pas ou peu de valeur temps ;

3. Le dividende est relativement élevé et la date ex-dividende précède la date d'expiration de l'option.

EXEMPLES

Pour illustrer l'impact de ces conditions sur une décision d'exercice anticipé, prenons l'exemple d'un compte avec une position longue en numéraire de 9,000 USD et une position longue d'options d'achat de l'action hypothétique “ABC” dont le prix d'exercice est 90.00 USD, avec une expiration dans 10 jours. Le dividende d'ABC, qui s'échange actuellement à 100.00 USD, est de 2.00 USD par action, avec une date ex-dividende le lendemain. Nous supposerons également que le prix de l'option et le cours de l'action se comportent de manière similaire et baissent du montant du dividende à la date ex-dividende.

Nous observerons les effets de la décision d'exercice visant à maintenir une position Delta de 100 actions et à maximiser la position. Deux prix d'options seront retenus, dans le premier cas, l'option est vendue à parité, dans le second, au dessus de la parité.

SCÉNARIO 1: Prix d'option à parité - 10.00 USD

Dans le cas d'une option s'échangeant à parité, l'exercice anticipé servira à maintenir la position Delta et à éviter une perte de valeur sur une action longue lorsque l'action trade ex-dividende pour préserver la valeur. Dans ce cas, les liquidités sont entièrement dédiées à l'achat de l'action au prix d'exercice, la prime de l'option est confisquée et l'action (nette de dividende) et le dividende à recevoir sont crédités sur le compte. Si vous souhaitez arriver au même résultat en vendant l'option avant la date ex-dividende et en achetant l'action, n'oubliez pas d'inclure les commissions/spreads dans vos calculs :

| SCÉNARIO 1 | ||||

| Éléments du compte | Solde de départ | Exercice anticipé | Aucune action | Vente option & achat action |

| Liquidités | 9,000$ | 0$ | 9,000$ | 0$ |

| Option | 1,000$ | 0$ | 800$ | 0$ |

| Action | 0$ | 9,800$ | 0$ | 9,800$ |

| Dividende à percevoir | 0$ | 200$ | 0$ | 200$ |

| Total | 10,000$ | 10,000$ | 9,800$ | 10,000$ moins commissions/spread |

SCÉNARIO 2: Prix d'option au-dessus de la parité - 11.00 USD

Dans le cas d'une option s'échangeant au dessus de la parité, un exercice anticipé afin de percevoir le dividende peut être avantageux. Dans un tel cas de figure, un exercice anticipé engendrerait une perte de 100 USD en valeur temps sur l'option, tandis qu'une vente de l'option et un achat de l'action, peut être, après commissions, moins avantageux que de ne rien faire. Dans ce cas, la meilleure solution est de ne rien faire.

| SCÉNARIO 2 | ||||

| Éléments du compte | Solde de départ | Exercice anticipé | Aucune action |

Vente option & achat action |

| Liquidités | 9,000$ | 0$ | 9,000$ | 100$ |

| Option | 1,100$ | 0$ | 1,100$ | 0$ |

| Action | 0$ | 9,800$ | 0$ | 9,800$ |

| Dividende à percevoir | 0$ | 200$ | 0$ | 200$ |

| Total | 10,100$ | 10,000$ | 10,100$ | 10,100$ moins commissions/spread |

![]() REMARQUE : Les titulaires de compte détenant une position longue d'options d'achat dans le cadre d'un spread doivent se montrer particulièrement vigilants quant au risque lié au non-exercice de la jambe longue compte tenu de la probabilité d'un exercice de la jambe short. Veuillez noter que l'assignation d'une option d'achat short entraîne une position short d'actions et les détenteurs de positions short d'actions à la date d'enregistrement du dividende ont l'obligation de payer un dividende au prêteur des actions. Par ailleurs, le cycle de traitement de la chambre de compensation ne permet pas la soumission de notifications d'exercice en réponse à une assignation.

REMARQUE : Les titulaires de compte détenant une position longue d'options d'achat dans le cadre d'un spread doivent se montrer particulièrement vigilants quant au risque lié au non-exercice de la jambe longue compte tenu de la probabilité d'un exercice de la jambe short. Veuillez noter que l'assignation d'une option d'achat short entraîne une position short d'actions et les détenteurs de positions short d'actions à la date d'enregistrement du dividende ont l'obligation de payer un dividende au prêteur des actions. Par ailleurs, le cycle de traitement de la chambre de compensation ne permet pas la soumission de notifications d'exercice en réponse à une assignation.

Prenons l'exemple d'un spread créditeur d'options d'achat (bear) sur le SPDR S&P 500 ETF Trust (SPY) comprenant 100 contrats short avec un prix d'exercice de 146 USD à mars 2013, et 100 contrats long au prix d'exercice de 147 USD à mars 2013. Le 14 mars 2013, SPY Trust annonce une distribution de dividende de 0.69372 USD par action, payable le 30 avril 2013 aux actionnaires à une date d'enregistrement au 19 mars 2013. Compte tenu des 3 jours ouvrables de règlement pour les actions U.S., il aurait fallu acheter l'action ou exercer l'option d'achat au 14 mars 2013 au plus tard, afin de recevoir un dividende, étant donné que l'action commençait à trader ex-dividende le lendemain.

Le 14 mars 2013, alors qu'il restait un jour de trading avant expiration, les deux options s'échangeaient à parité, ce qui implique un risque maximum de 100 USD par contrat, soit 10,000 USD sur la position de 100 contrats. Cependant, ne pas exercer le contrat long afin de percevoir un dividende et de se protéger contre l'assignation vraisemblable des contrats short par d'autres intervenants en quête d'un dividende, a engendré un risque supplémentaire de 67.372 USD par contrat, soit 6,737.20 USD sur la position restante lorsque toutes les positions d'achat seront assignées. Comme indiqué dans le tableau ci-dessous, si la jambe de l'option short n'avait pas été assignée, le risque maximum au prix de règlement final au 15 mars 2013, serait resté à 100 USD par contrat.

| Date | Clôture SPY | Option d'achat 146$ mars 2013 | Option d'achat 147$ mars 2013 |

| 14 mars 2013 | 156.73$ | 10.73$ | 9.83$ |

| 15 mars 2013 | 155.83$ | 9.73$ | 8.83$ |

Veuillez noter que si votre compte est soumis à une retenue fiscale dans le cadre de la règle du trésor américain 871(m), il peut être avantageux pour vous de fermer une position d'options longue avant la date ex-dividende et de la rouvrir après.

Pour plus d'informations sur la manière de procéder à un exercice anticipé, veuillez consulter le site Interactive Brokers.

L'article ci-dessus vous est fourni uniquement à titre d'information et ne constitue en rien une recommandation, un conseil de trading ni ne garantit que l'exercice anticipé d'option sera adéquat ou une opération réussie pour tous les clients ou toutes les transactions. Les détenteurs de compte doivent consulter un conseiller fiscal afin de s'informer de l'incidence fiscale, le cas échéant, d'un exercice anticipé et doivent être avertis des risques potentiels que présente la substitution d'une position longue d'option à une position longue d'actions.

Annonce de résultats

Aux États-Unis, les sociétés cotées en bourse ont généralement l'obligation de publier leurs résultats tous les trimestres. Ces résultats contiennent de nombreuses informations telles que des statistiques, leur chiffre d'affaires, des données sur leurs marges et bien souvent, des projections concernant la rentabilité future de l'entreprise. Ces données peuvent avoir un impact significatif sur le prix des actions de ces entreprises. En ce qui concerne le trading d'options, tout ce qui est susceptible d'entraîner la volatilité d'une action affecte le prix des options. Les publications de résultats ne font pas exception à la règle.

Les traders d'options tentent souvent d'anticiper les réactions du marché aux annonces de résultats. Ils savent que la volatilité, facteur déterminant du prix des options, va régulièrement augmenter et que la polarisation (la différence de volatilité entre les options dans la monnaie et hors de la monnaie) va régulièrement s'accentuer à l'approche de la date d'annonce des résultats. Le degré d'ajustement de ces facteurs est souvent lié aux performances historiques. Les actions qui, dans le passé, ont enregistré des mouvements importants après l'annonce de résultats, ont souvent des prix d'options plus élevés.

Les risques liés à l'annonce de résultats sont idiosyncratiques, c'est-à-dire qu'ils sont généralement liés à l'action en elle-même et il n'est pas facile de s'en protéger par le biais d'un index ou d'une entreprise similaire. Des actions généralement fortement corrélées peuvent réagir différemment, ce qui aboutit à des prix d'actions divergents ou des indices présentant des mouvements moins importants. Pour cette raison, il n'existe pas de stratégie unique qui puisse s'appliquer au trading d'options dans ces circonstances. Les traders doivent avoir des attentes claires vis-à-vis des mouvements potentiels d'une action avant de décider quelle combinaison d'options est la plus à même de générer des gains si le trader a vu juste.

Si le marché semble trop positif vis-à-vis des perspectives de résultats d'une entreprise, il est relativement simple (bien que souvent coûteux) d'acheter un straddle ou un put hors de la monnaie et d'espérer qu'un mouvement important se produira. Tirer profit des perspectives inverses, lorsque les volatilités au mois le plus proche semblent trop importantes, peut également se révéler avantageux mais être en position courte sur une option est également susceptible d'engendrer des pertes importantes en cas de fort mouvement à la hausse de l'action. Les traders peuvent tirer profit d'une forte volatilité au mois le plus proche en achetant un calendar spread - ils vendent un put avec échéance au mois le plus proche et achètent le même prix d'exercice le mois d'après. Le potentiel de profit maximum est atteint si l'action s'échange au prix d'exercice, tandis que l'option à échéance au mois le plus proche décline bien plus rapidement que l'option à long terme, plus chère. Les pertes sont limitées au prix de trading initial.

Parfois une polarisation extrême traduit des craintes excessives lorsque les options put hors de la monnaie affichent des volatilités de plus en plus élevées et supérieures aux options dans la monnaie. Les traders utilisant des spreads verticaux peuvent tirer profit de ce phénomène. Les traders baissiers peuvent acheter un put dans la monnaie et vendre un put hors de la monnaie. Cela permet à l'acheteur de payer une partie des coûts d'une option plus chère, bien que cela plafonne les profits générés par la transaction si l'action baisse en dessous du prix d'exercice le plus bas. D'un autre côté, ceux qui estiment que le marché est excessivement baissier peuvent vendre un put hors de la monnaie tout en achetant un put au prix d'exercice encore plus bas. Bien que le trader achète l'option présentant la plus forte volatilité, cela lui permet de gagner de l'argent tant que l'action reste au-dessus du prix d'exercice le plus haut, tout en limitant ses pertes à la différence entre les deux prix d'exercice.

Cet article vous est fourni uniquement à titre d'information et ne constitue aucunement une recommandation ou une sollicitation d'achat ou de vente de valeurs. Le trading d'options comporte des risques importants. Avant de trader des options, veuillez consulter la page "Characteristics and Risks of Standardized Options." Les clients sont tenus entièrement responsables de leurs propres décisions de trading.

Earnings

Publicly traded companies in North America generally are required to release earnings on a quarterly basis. These announcements, which contain a host of relevant statistics, including revenue and margin data, and often projections about the company's future profitability, have the potential to cause a significant move in the market price of the company's shares. From an options trading viewpoint, anything with the potential to cause volatility in a stock affects the pricing of its options. Earnings releases are no exceptions.

Options traders often try to anticipate the market's reaction to earnings news. They know implied volatilities, the key to options prices, will steadily rise while skew - the difference in implied volatility between at-money and out-of-the-money options - will steadily steepen as the earnings date approaches. The degree by which those adjustments occur is often based on history. Stocks that have historically made significant post-earnings moves often have more expensive options.

Earnings risk is idiosyncratic, meaning that it is usually stock specific and not easily hedged against an index or a similar company. Stocks that are normally quite well correlated may react quite differently, leading to share prices that diverge or indices with dampened moves. For those reasons, there is no single strategy that works for trading options in these situations. Traders must have very clear expectations for a stock's potential move, and then decide which combination of options will likely lead to the most profitable results if the trader is correct.

If the market seems too sanguine about a company's earnings prospects, it is fairly simple (though often costly) to buy a straddle or an out-of the-money put and hope for a big move. Taking advantage of the opposite prospect, when front month implied volatilities seem too high, can also be profitable but it can also cause serious losses to be short naked options in the face of a big upward stock move. Traders can take advantage of high front month volatility by buying a calendar spread - selling a front month put and buying the same strike in the following month. The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more expensive longer-term option. Losses are limited to the initial trade price.

Sometimes excessive fear is expressed by extremely steep skew, when out-of-the-money puts display increasingly higher implied volatilities than at-money options. Traders who use vertical spreads can capitalize on this phenomenon. Those who are bearish can buy an at-money put while selling an out-of-the-money put. This allows the purchaser to defray some of the cost of a high priced option, though it caps the trade's profits if the stock declines below the lower strike. On the other hand, those who believe the market is excessively bearish can sell an out-of-the-money put while buying an even lower strike put. Although the trader is buying the higher volatility option, it allows him to make money as long as the stock stays above the higher strike price, while capping his loss at the difference between the two strikes.

This article is provided for information only and is not intended as a recommendation or a solicitation to buy or sell securities. Option trading can involve significant risk. Before trading options read the "Characteristics and Risks of Standardized Options." Customers are solely responsible for their own trading decisions.

Considerations for Exercising Call Options Prior to Expiration

INTRODUCTION

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:

- It results in a forfeiture of any remaining option time value;

- Requires a greater commitment of capital for the payment or financing of the stock delivery; and

- May expose the option holder to greater risk of loss on the stock relative to the option premium.

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

BACKGROUND

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:

1. The option is deep-in-the-money and has a delta of 100;

2. The option has little or no time value;

3. The dividend is relatively high and its Ex-Date precedes the option expiration date.

EXAMPLES

To illustrate the impact of these conditions upon the early exercise decision, consider an account maintaining a long cash balance of $9,000 and a long call position in hypothetical stock “ABC” having a strike price of $90.00 and time to expiration of 10 days. ABC, currently trading at $100.00, has declared a dividend of $2.00 per share with tomorrow being the Ex-Dividend date. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date.

Here, we will review the exercise decision with the intent of maintaining the 100 share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

SCENARIO 1: Option Price At Parity - $10.00

In the case of an option trading at parity, early exercise will serve to maintain the position delta and avoid the loss of value in long option when the stock trades ex-dividend, to preserve equity. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock (net of dividend) and dividend receivable are credited to the account. If you aim for the same end result by selling the option prior to the Ex-Dividend date and purchasing the stock, remember to factor in commissions/spreads:

| SCENARIO 1 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $0 |

| Option | $1,000 | $0 | $800 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,000 | $10,000 | $9,800 | $10,000 less commissions/spreads |

SCENARIO 2: Option Price Above Parity - $11.00

In the case of an option trading above parity, early exercise to capture the dividend may not be economically beneficial. In this scenario, early exercise would result in a loss of $100 in option time value, while selling the option and buying the stock, after commissions, may be less beneficial than taking no action. In this scenario, the preferable action would be No Action.

| SCENARIO 2 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $100 |

| Option | $1,100 | $0 | $1,100 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,100 | $10,000 | $10,100 | $10,100 less commissions/spreads |

![]() NOTE:

NOTE:

Options have two components that make up their total premium value - intrinsic value and time value. The intrinsic value is the amount by which the option is in-the-money, while the time value represents the possibility that the option could become even more profitable before expiration as the underlying asset price fluctuates while providing protection against adverse moves.

Many options are American-style, which means they can be exercised early, ahead of their expiration date. Early exercise of an option eliminates the remaining time value component from the option's premium, since the option holder loses protection against unfavorable movements in the underlying asset’s price.

This makes early exercise suboptimal in most situations, as the option holder is willingly forfeiting a portion of the option's value.

There are a few specific circumstances where early exercise could make sense, such as:

- For call options on a stock that will pay dividends soon, where the dividend amount exceeds the remaining time value (and only if the exercise will settle on or prior to the record date for the dividend).

- For deep in-the-money options where the time value is negligible compared to the intrinsic value, and the option is expected to drop in value due to interest rate effects (PUTS), or expected stock loan benefits (CALLS).

The first case, exercising an in the money call immediately ahead of a dividend payment, is the most common economically-sensible early exercise. In most cases, it is advisable to hold or sell the option instead of exercising it early, in order to capture the remaining time value. An option should only be exercised early after carefully considering all factors and determining that the benefits of early exercise outweigh the time value being surrendered.

Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

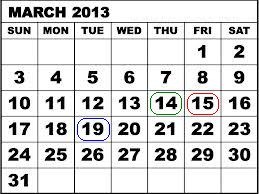

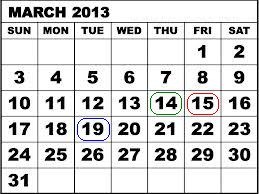

As example, consider a credit call (bear) spread on the SPDR S&P 500 ETF Trust (SPY) consisting of 100 short contracts in the March '13 $146 strike and 100 long contracts in the March '13 $147 strike. On 3/14/13, with the SPY Trust declared a dividend of $0.69372 per share, payable 4/30/13 to shareholders of record as of 3/19/13. Given the 3 business day settlement time frame for U.S. stocks, one would have had to buy the stock or exercise the call no later than 3/14/13 in order receive the dividend, as the next day the stock began trading Ex-Dividend.

On 3/14/13, with one trading day left prior to expiration, the two option contracts traded at parity, suggesting maximum risk of $100 per contract or $10,000 on the 100 contract position. However, the failure to exercise the long contract in order to capture the dividend and protect against the likely assignment on the short contracts by others seeking the dividend created an additional risk of $67.372 per contract or $6,737.20 on the position representing the dividend obligation were all short calls assigned. As reflected on the table below, had the short option leg not been assigned, the maximum risk when the final contract settlement prices were determined on 3/15/13 would have remained at $100 per contract.

| Date | SPY Close | March '13 $146 Call | March '13 $147 Call |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

Please note that if your account is subject to tax withholding requirements of the US Treasure rule 871(m), it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.