Delayed Market Data Timing

Market data vendors typically offer exchange data in two categories, real-time and delayed. Real-time market data is disseminated as soon as the information is publicly available. Delayed market data is on a time lag that is usually 10-20 minutes behind real-time quotes.

Some exchanges allow delayed data to be displayed without any market data subscription, free of charge. A list of the exchanges we provide delayed data for at no cost and without formal request (i.e., the delayed data will be displayed upon entry of the product symbol on the trading platform) are outlined in the table below. The table also includes the corresponding real-time subscription, the fees for which are posted on IBKR's public website.

Please Note:

- In accordance with regulatory requirements, IBKR no longer offers delayed quotation information on U.S. equities to Interactive Brokers LLC clients.

- Delayed quotes should be used for indicative purposes and not necessarily for trading. The times mentioned may be subject to further delays without notice.

The Americas

| External Exchange Name | IB Exchange Name | Delay Period | Real Time Subscription |

| CBOT | CBOT | 10 minutes | CBOT Real-Time |

| CBOE Futures Exchange | CFE | 10 minutes | CFE Enhanced |

| Market Data Express (MDX) | CBOE | 10 minutes | CBOE Market Data Express Indices |

| CME | CME | 10 minutes | CME Real-Time |

| COMEX | COMEX | 10 minutes | COMEX Real-Time |

| ICE US | NYBOT | 10 minutes | ICE Futures U.S. (NYBOT) |

| Mexican Derivatives Exchange | MEXDER | 15 minutes | Mexican Derivatives Exchange |

| Mexican Stock Exchange | MEXI | 20 minutes | Mexican Stock Exchange |

| Montreal Exchange | CDE | 15 minutes | Montreal Exchange |

| NYMEX | NYMEX | 10 minutes | NYMEX Real-Time |

| NYSE GIF | NYSE | 15 minutes | NYSE Global Index Feed |

| One Chicago | ONE | 10 minutes | OneChicago |

| OPRA | OPRA | 15 minutes | OPRA Top of Book (L1) (US Option Exchanges) |

| OTC Markets | PINK | 15 minutes | OTC Markets |

| Toronto Stock Exchange | TSE | 15 minutes | Toronto Stock Exchange |

| Venture Exchange | VENTURE | 15 minutes | TSX Venture Exchange |

Europe

| External Exchange Name | IB Exchange Name | Delay Period | Real Time Subscription |

| BATS Europe | BATE/CHIX | 15 minutes | European (BATS/Chi-X) Equities |

| Boerse Stuttgart | SWB | 15 minutes | Stuttgart Boerse incl. Euwax (SWB) |

| Bolsa de Madrid | BM | 15 minutes | Bolsa de Madrid |

| Borsa Italiana | BVME/IDEM | 15 minutes | Borsa Italiana (BVME stock / SEDEX / IDEM deriv) |

| Budapest Stock Exchange | BUX | 15 minutes | Budapest Stock Exchange |

| Eurex | EUREX | 15 minutes | Eurex Real-Time Information |

| Euronext | AEB/SBF/MATIF/BELFOX | 15 minutes | Euronext Cash |

| Euronext | AEB/SBF/MATIF/BELFOX | 15 minutes | Euronext Data Bundle |

| Frankfurt Stock Exchange and XETRA | FWB/IBIS/XETRA | 15 minutes | Spot Market Germany (Frankfurt/Xetra) |

| ICE Futures Europe (Commodities) | IPE | 10 minutes | ICE Futures E.U. - Commodities (IPE) |

| ICE Futures Europe (Financials) | ICEEU | 10 minutes | ICE Futures E.U. – Financials (LIFFE) |

| LSE | LSE | 15 minutes | LSE UK |

| LSEIOB | LSEIOB | 15 minutes | LSE International |

| MEFF | MEFF | 15 minutes | BME (MEFF) |

| NASDAQ OMX Nordic Derivatives | OMS | 15 minutes | Nordic Derivatives |

| Prague Stock Exchange | PRA | 15 minutes | Prague Stock Exchange Cash Market |

| SWISS Exchange | EBS/VIRTX | 15 minutes | SIX Swiss Exchange |

| Tel Aviv Stock Exchange | TASE | 15 minutes | Tel Aviv Stock Exchange |

| Turquoise ECN | TRQXCH/TRQXDE/TRQXEN | 15 minutes | Turquoise ECNs |

| Warsaw Stock Exchange | WSE | 15 minutes | Warsaw Stock Exchange |

Asia

| External Exchange Name | IB Exchange Name | Delay Period | Real Time Subscription |

| Australian Stock Exchange | ASX | 20 minutes | ASX Total |

| Hang Seng Indices | HKFE-IND | 15 minutes | Hang Seng Indexes |

| Hong Kong Futures Exchange | HKFE | 15 minutes | Hong Kong Derivatives (Fut & Opt) |

| Hong Kong Stock Exchange | SEHK | 15 minutes | Hong Kong Securities Exchange (Stocks, Warrants & Bonds) |

| Korea Stock Exchange | KSE | 20 minutes | Korea Stock Exchange |

| National Stock Exchange of India | NSE | 15 minutes | National Stock Exchange of India, Capital Market Segment |

| Osaka Securities Exchange | OSE.JPN | 20 minutes | Osaka Exchange |

| SGX Derivatives | SGX | 10 minutes | Singapore Exchange (SGX) - Derivatives |

| Shanghai Stock Exchange | SEHKNTL | 15 minutes | Shanghai Stock Exchange |

| Shanghai Stock Exchange STAR Market | SEHKSTAR | 15 minutes | Shanghai Stock Exchange |

| Shenzhen Stock Exchange | SEHKSZSE | 15 minutes | Shenzhen Stock Exchange |

| Singapore Stock Exchange | SGX | 10 minutes | Singapore Exchange (SGX) - Stocks |

| Australia Securities Exchange | ASX24 | 10 minutes | ASX24 Commodities and Futures |

| Taiwan Stock Exchange | TWSE | 20 minutes | Taiwan Stock Exchange |

| Tokyo Stock Exchange | TSEJ | 20 minutes | Tokyo Stock Exchange |

Risk Navigator: Alternative Margin Calculator

IB routinely reviews margin levels and will implement changes which serve to increase requirements above statutory minimums as market conditions warrant. To assist clients with understanding the effects of such changes on their portfolio, a feature referred to as the "Alternative Margin Calculator" is provided within the Risk Navigator application. Outlined below are the steps for creating a “what-if” portfolio for the purpose of determining the impact of such margin changes.

Step 1: Open a new “What-if” portfolio

From the Classic TWS trading platform, select the Analytical Tools, Risk Navigator, and then Open New What-If menu options (Exhibit1).

Exhibit 1

.png)

From the Mosaic TWS trading platform, select New Window, Risk Navigator, and then Open New What-If menu options.

Step 2: Define starting portfolio

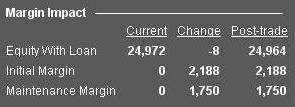

A pop-up window will appear (Exhibit 2) from which you will be prompted to define whether you would like to create a hypothetical portfolio starting from your current portfolio or a newly created portfolio. Clicking on the "yes" button will serve to download existing positions to the new “What-If” portfolio.

Exhibit 2

Clicking on the "No" button will open up the “What – If” Portfolio with no positions.

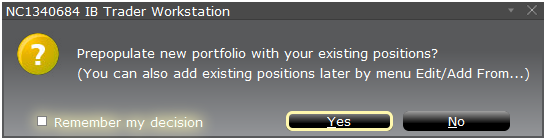

Risk Dashboard

The Risk Dashboard is pinned along the top of the product tab-sets, and is and is available for what-if as well as active portfolios. The values are calculated on demand for what-if portfolios. The dashboard provides at-a-glance account information including:

1) Net Liquidation Value: The total Net Liquidation Value for the account

2) P&L: The total daily P&L for the entire portfolio

3) Maintenance Margin: Total current maintenance margin

4) Initial Margin: Total initial margin requirements

5) VAR: Shows the Value at risk for the entire portfolio

6) Expected Shortfall (ES): Expected Shortfall (average value at risk) is expected return of the portfolio in the worst case

Alternative Margin Calculator

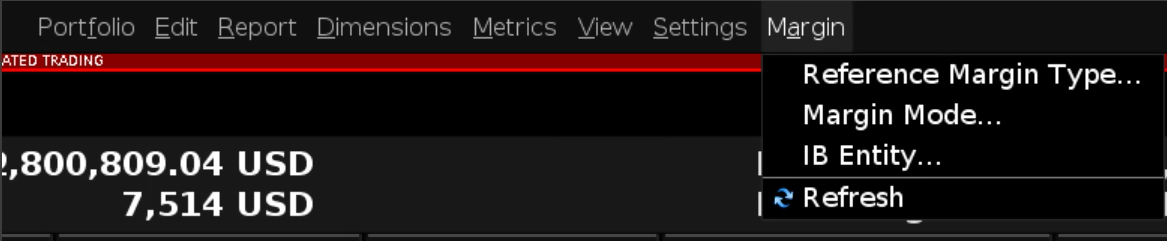

The Alternative Margin Calculator, accessed from the Margin menu and clicking on the Margin Mode (Exhibit 3), shows how the margin change will affect the overall margin requirement, once fully implemented.

Exhibit 3

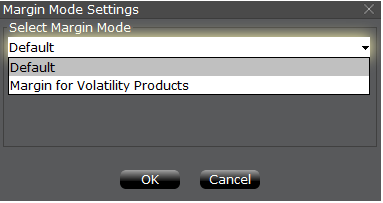

Step 3: Selecting Margin Mode Settings

A pop-up window will appear (Exhibit 4) entitled Margin Mode Setting. You can use the drop-down menu in that window to change the margin calculations from Default (being the current policy) to the new title of the new Margin Setting (being the new margin policy). Once you have made a selection click on the OK button in that window.

Exhibit 4

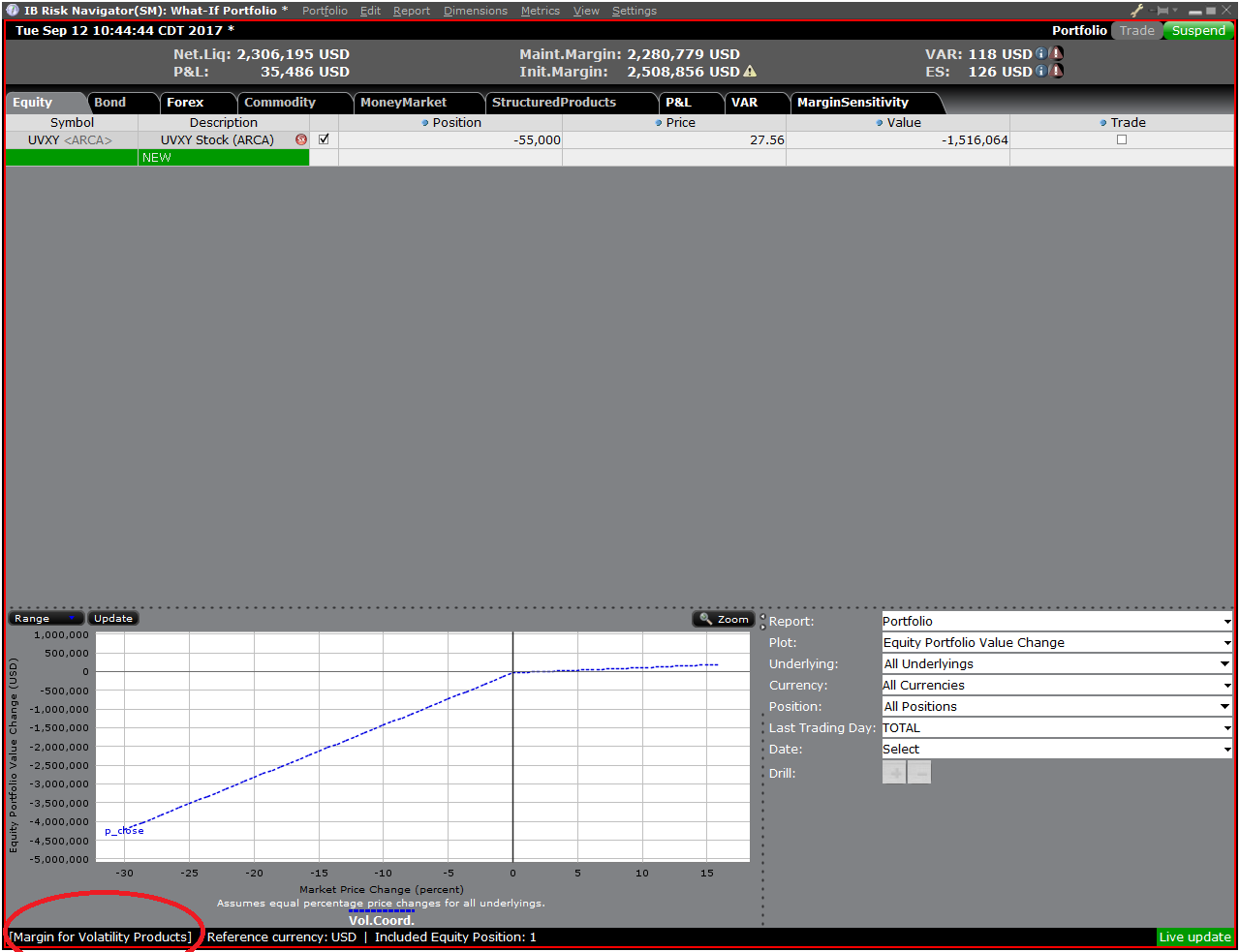

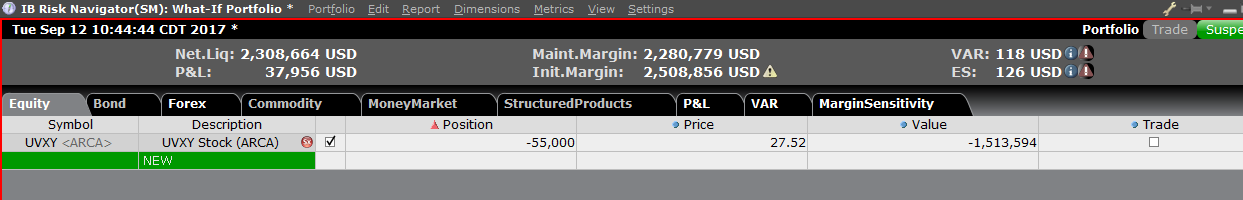

Once the new margin mode setting is specified, the Risk Navigator Dashboard will automatically update to reflect your choice. You can toggle back and forth between the Margin Mode settings. Note that the current Margin Mode will be shown in the lower left hand corner of the Risk Navigator window (Exhibit 5).

Exhibit 5

Step 4: Add Positions

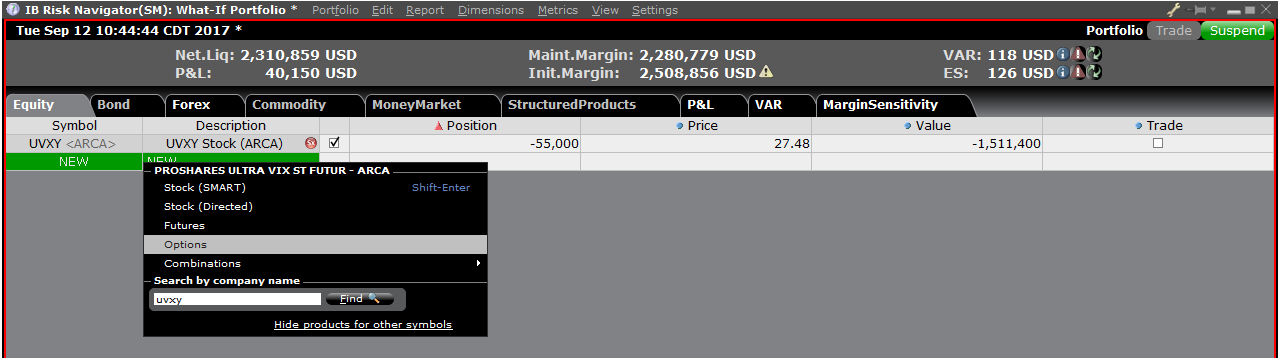

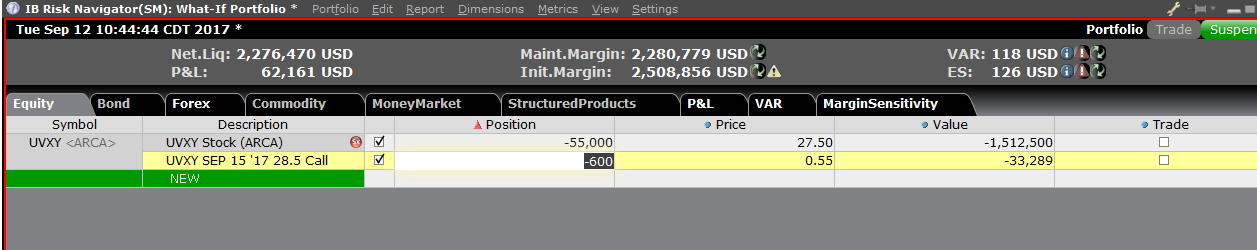

To add a position to the "What - If" portfolio, click on the green row titled "New" and then enter the underlying symbol (Exhibit 6), define the product type (Exhibit 7) and enter position quantity (Exhibit 8)

Exhibit 6

Exhibit 7

Exhibit 8

You can modify the positions to see how that changes the margin. After you altered your positions you will need to click on the recalculate icon (![]() ) to the right of the margin numbers in order to have them update. Whenever that icon is present the margin numbers are not up-to-date with the content of the What-If Portfolio.

) to the right of the margin numbers in order to have them update. Whenever that icon is present the margin numbers are not up-to-date with the content of the What-If Portfolio.

20-Minute Reconnect Grace Period, Unless Fingerprint/PIN Device Lock is Enabled

We recently introduced 30-hour Extended Trading access for mobile users (see the Android or iOS release notes).

IB TWS for Mobile - Extended Trading Access

Get extended trading access in IB TWS for Mobile when you enabled fingerprint security on your device.

Once logged in to TWS for Mobile, all users have a 20-minute grace period during which they can take a call or use another app and still retain full access to their trading session without having to perform a full login (username/password + second factor authentication). After this grace period, users who have fingerprint security enabled on their device will enjoy secure trading for up to 30 hours without having to complete the full login.

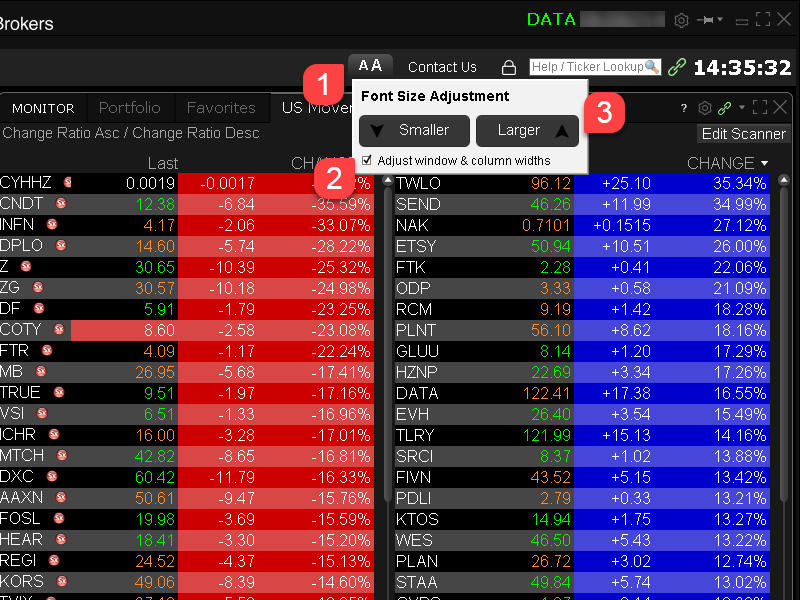

How to adjust font size in TWS

By default, Trader Workstation (TWS) is designed to display in a font size and style which can be read comfortably for the average user across various screen sizes and resolutions. With the advent of new technologies, there has been an exponential push to make monitors with higher display sizes and your layout may need to be further adjusted manually. This document serves to explain how to manually adjust the font size for TWS.

Procedure

To adjust font size throughout TWS:

- From the Anchor window, click the Font Size Adjustment icon.

- Check the button Adjust window & column widths to ensure all windows will resize automatically to keep the same font:window ratio. (If unchecked, only font size will change but window size will remain the same).

- Click the button Smaller or Larger until the font size is correct.

Notice that the font size will change immediately as you click the button. - Click the Font Size Adjustment icon

when done.

when done.

Note: It is possible that currently not all windows will be adjusted in the same way.

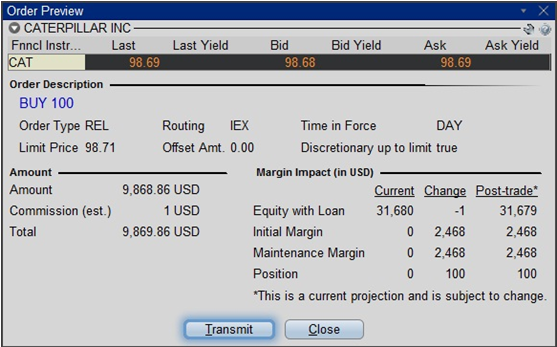

Aperçu de l'ordre / Impact sur la marge

La fonctionnalité Aperçu de l'ordre/impact sur la marge offre la possibilité de voir le coût projeté, la commission et l'impact sur la marge d'un ordre avant sa transmission. Cette fonctionnalité est disponible à la fois dans TWS et WebTrader. La version de TWS est plus détaillée.

Trader Workstation (TWS)

La fonctionnalité de vérification de marge dans TWS offre la possibilité d'isoler l'impact sur la marge de l'ordre proposé par rapport à une position et d'afficher la nouvelle exigence de marge dans l'hypothèse où l'ordre est exécuté. Les soldes clés de marge, notamment les exigences de marge initiales et de maintien, sont reportés de la même manière que les actifs avec valeur d'emprunt. Pour utiliser cette fonctionnalité, veuillez placer votre curseur sur la ligne d'ordre, cliquez avec le bouton droit de votre souris et sélectionnez Vérifier la marge dans le menu déroulant.

Exemple: Acheter 1 ES June 2012 Future @ 1387.25

La première section de l'Aperçu de l'ordre affiche le cours acheteur, le cours vendeur et le dernier cours pour ce titre.

La seconde section affiche les informations de base de l'ordre

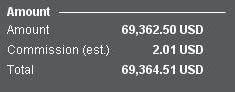

La section Montant affiche la valeur de l'ordre ainsi qu'une estimation de la commission applicable.

La section Impact sur la marge affiche les informations suivantes de manière détaillée ;

Actuel = les valeurs de compte actuelles, à l'exclusion de l'ordre actuellement transmis.

Modification = l'impact de l'ordre actuellement transmis en ne tenant pas compte des positions dans le compte.

Post-Trade = les valeurs de compte anticipées une fois que l'ordre actuellement transmis aura été exécuté et incorporé dans le portefeuille du compte.

WebTrader

L'affichage WebTrader affiche l'équivalent des valeurs Post-Trade TWS uniquement.

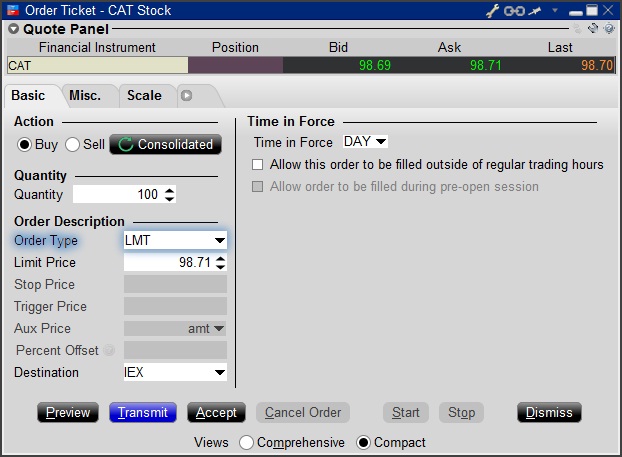

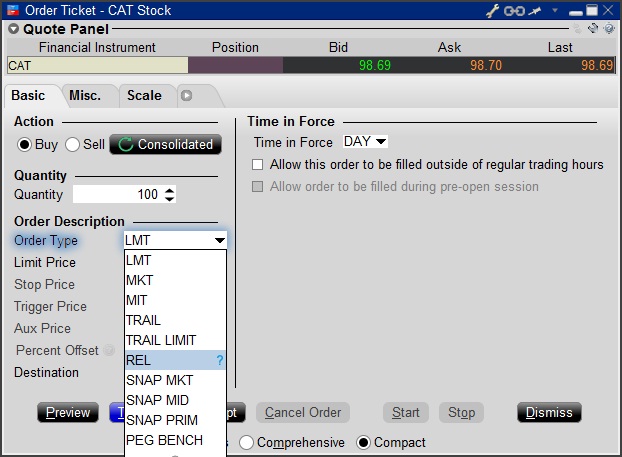

IEX Discretionary Peg Order

IEX offers a Discretionary Peg™ (D-Peg™) order type which is a non-displayed order that is priced at either the National Best Bid (NBB for buys) or National Best Offer (NBO for sells). D-Peg™ orders passively rest on the book while seeking to access liquidity at a more aggressive price up to Midpoint of the NBBO, except when IEX determines that the quote is transitioning to less aggressive price

How to Place a D-Peg Order

Please note, the IEX D-Peg order type is only available via the TWS version 961 and above. Instructions for entering this order type are outlined below:

Step 1

Enter a symbol and choose a directed quote, selecting IEX as the destination. Right click on the data line and select Trade followed by Order Ticket to open the Order Ticket window.

Step 2

Select the REL order type from the Order Type drop down menu.

Step 3

Click on the Miscellaneous tab (Misc.) and at the bottom there will be a checkbox for "Discretionary up to limit". Check this box. The price that you set in the Limit Price field will be used at the discretionary price on the order.

.jpg)

Step 4

Hit Preview to view the Order Preview window.

For additional information concerning this order type, please review the following exchange website link: https://www.iextrading.com/trading/dpeg/

IBot Quick Guide

Availability

- Quotes: “quote Interactive Brokers”, “show the price of Interactive Brokers”

- IBot can also display fundamental information

- Options: In cases where there is more than one option contract on the same exchange with the same expiry, strike and right, IBot will choose a contract as follows:

- Choose smart over non-smart

- Choose non-weekly contracts

- Choose the contract with a standard multiplier

- Partial Instrument Match: In cases where you leave out a parameter, IBot will try to identify the option contract with an educated guess based on the following logic:

- If the underlying is missing, assume the last used underlying if one is available

- If the type is missing, use a CALL.

- If the expiration is missing, use the nearest month.

- If the strike is missing, use the at-the-money strike.

- Charts: “10 day 1 hour bar chart for Interactive Brokers”, “chart Interactive Brokers”

- If you omit bar sizes or time ranges, IBot will display the most reasonable chart based on what you entered

- Orders: “buy 100 shares of Interactive Brokers at market”, “sell 100 shares of IBKR at 40”, “close my Interactive Brokers position”, “close 10% of my long positions”

- You MUST click the Submit button located within IBot to place the order

- Trades: “show trades in Interactive Brokers”

- Market Scanners: “top gaining US stocks", "biggest US market winners"

- Market Depth Level II Data: “market depth for Interactive Brokers”, “level 2 for IBKR”

- Option Chains: “option chains for Interactive Brokers”, “jan options for IBKR”

- Calendar: "show portfolio events", "upcoming events for portfolio companies"

- Your Account: “show my P&L”, “show my buying power”, “what is my net liquidation value”

- Modify a Command: after creating an order, “change this order to market”

- Help: get help with IBot by typing help before a type of command, “help with orders”, “help with chart”

- Company Fundamentals: “show summary for Interactive Brokers”, “Return on Equity for IBKR”

- Customer Service Information: “customer support”, “support”

- Will include a link to the Contact Client Services page of our website

- IBKR web site information: Use the terms Search: or Search for to return reference information from the IBKR web site. IBot will return the top matches with links to the relevant web page.

Snapshot Market Data

BACKGROUND

IBKR offers eligible clients the option of receiving a real-time price quote for a single instrument on a request basis. This service, referred to as “Snapshot Quotes” differs from the traditional quote services which offer continuous streaming and updates of real-time prices. Snapshot Quotes are offered as a low-cost alternative to clients who do not trade regularly and require data from specific exchanges1 when submitting an order. Additional details regarding this quote service is provided below.

QUOTE COMPONENTS

The Snapshot quote includes the following data:

- Last price

- Last size

- Last exchange

- Current bid-ask

- Size for each of current bid-ask

- Exchange for each of current bid-ask

AVAILABLE SERVICES

| Service | Restrictions | Price per Quote Request (USD)2 |

|---|---|---|

| AMEX (Network B/CTA) | $0.01 | |

| ASX Total | No access to ASX24. Limited to Non-Professional subscribers |

$0.03 |

| Bolsa de Madrid | $0.03 | |

| Canadian Exchange Group (TSX/TSXV) | Limited to Non-Professional subscribers who are not clients of IB Canada | $0.03 |

| CBOT Real-Time | $0.03 | |

| CME Real-Time | $0.03 | |

| COMEX Real-Time | $0.03 | |

| Eurex Core | Limited to Non-Professional subscribers | $0.03 |

| Euronext Basic | Limited to Non-Professional subscribers Includes Euronext equities, indices, equity derivatives and index derivatives. |

$0.03 |

| German ETF's and Indices | Limited to Non-Professional subscribers | $0.03 |

| Hong Kong (HKFE) Derivatives | $0.03 | |

| Hong Kong Securities Exchange (Stocks, Warrants, Bonds) | $0.03 | |

| Johannesburg Stock Exchange | $0.03 | |

| Montreal Derivatives | Limited to Non-Professional subscribers | $0.03 |

| NASDAQ (Network C/UTP) | $0.01 | |

| Nordic Derivatives | $0.03 | |

| Nordic Equity | $0.03 | |

| NYMEX Real-Time | $0.03 | |

| NYSE (Network A/CTA) | $0.01 | |

| OPRA (US Options Exchanges) | $0.03 | |

| Shanghai Stock Exchange 5 Second Snapshot (via HKEx) | $0.03 | |

| Shenzhen Stock Exchange 3 Second Snapshot (via HKEx) | $0.03 | |

| SIX Swiss Exchange | Limited to Non-Professional subscribers | $0.03 |

| Spot Market Germany (Frankfurt/Xetra) | Limited to Non-Professional subscribers | $0.03 |

| STOXX Index Real-Time Data | Limited to Non-Professional subscribers | $0.03 |

| Toronto Stk Exchange | Limited to Non-Professional subscribers who are clients of IB Canada | $0.03 |

| TSX Venture Exchange | Limited to Non-Professional subscribers who are clients of IB Canada | $0.03 |

| UK LSE (IOB) Equities | $0.03 | |

| UK LSE Equities | $0.03 |

1In accordance with regulatory requirements, IBKR no longer offers delayed quotation information on U.S. equities to Interactive Brokers LLC clients. All clients (IBKR Lite and Pro) have access to streaming real-time US equity quotes from Cboe One and IEX at no charge. Since this data does not include all markets, IB does not show this quote when entering parameters for an order in a US stock quote. IB customers are able to access a snapshot of real-time quote information for US stocks at the point of order entry.

2Cost is per snapshot quote request and will be assessed in the Base Currency equivalent, if not USD.

ELIGIBILITY

- Accounts must maintain the Market Data Subscription Minimum and Maintenance Equity Balance Requirements in order to qualify for Snapshot quotes.

- The Users must operate TWS Build 976.0 or higher to access Snapshot quote functionality.

PRICING DETAILS

- Clients will receive $1.00 of snapshot quotes free of charge each month. Free snaphots may be applied to either U.S. or non-U.S. quote requests and charges will be applied, without additional notice, once the free allocation has been exhausted. Clients may review their snapshot usage as of the close of each business day via the Client Portal.

- Quote fees are assessed on a lag basis, generally in the first week after the month in which Snapshot services were provided. Accounts which do not have sufficient cash or Equity With Loan Value to cover the monthly fee will be subject to position liquidations.

- The monthly fee for snapshots will be capped at the related streaming real-time monthly service price. At which time the streaming quotes will be provided at no additional cost for the remainder of the month. The switch to streaming quotes will take place at approximately 18:30 EST the following business day after reaching the snapshot threshold. At the close of the month, the streaming service will automatically terminate and the snapshot counter will reset. Each service is capped independently of the others and quote requests for one service cannot be counted towards the cap of another. See table below for sample details.

| Service | Price per Quote Request (USD) | Non-Pro Subscriber Cap (Requests/Total Cost)2 | Pro Subscriber Cap (Requests/Total Cost)3 |

|---|---|---|---|

| AMEX (Network B/CTA) | $0.01 | 150/$1.50 | 2,300/$23.00 |

| NASDAQ (Network C/UTP) | $0.01 | 150/$1.50 | 2,500/$25.00 |

| NYSE (Network A/CTA) | $0.01 | 150/$1.50 | 4,500/$45.00 |

Documentation : Hôtes et ports IBKR

TWS se connecte aux serveurs via les ports 4000 et 4001 si SSL est utilisé et ne fonctionnera sur aucun autre port. Si vous utilisez un serveur proxy, il devra être transparent avec des ports entrants et sortants ouverts afin que TWS fonctionne correctement.

Vous trouverez ci-dessous une liste de toutes les passerelles ainsi que les destinations correspondantes qui peuvent être utilisées par TWS lorsque vous faites usage de nos services. Vous devez permettre l'accès à ces hôtes.

La façon la plus simple de tester si votre connexion requiert une configuration particulière ou si elle a bien été configurée, est d'utiliser la Page IBKR dédiée aux tests, qui fournira un test dynamique de votre connexion réseau à nos serveurs de trading et données de marché principaux. Si vous avez confirmation que l'opération est réussie : « Success », aucune autre action ne sera requise. En revanche, si l'opération échoue : « Failure », nous recommandons l'ajout d'une exception à votre configuration réseau pour les nouveaux hôtes ou nous vous conseillons de revoir vos modifications.

Remarque : si votre réseau utilise un navigateur proxy, la page de test peut produire des faux positifs. Dans ce cas, ou dans le cas où vous n'êtes pas certain de la configuration du réseau, consultez votre administrateur de réseau qui peut effectuer des tests ping et telnet des hôtes mentionnés ci-dessous pour confirmer la conformité aux conditions de connectivité.

Spécifications :

|

PORTAIL CLIENT ET SITE |

||||

|

RÉGION/PRODUIT |

SERVEUR (HÔTE) |

PORTS1 |

||

|

SITE IBKR – AMÉRIQUE |

443 |

|||

|

SITE IBKR – Canada |

443 |

|||

|

SITE IBKR – UK |

443 |

|||

|

SITE IBKR – INDE2 |

443 |

|||

|

SITE IBKR – JAPON2 |

443 |

|||

|

SITE IBKR – HONG KONG2 |

www.interactivebrokers.com.hk | 443 | ||

|

SITE IBKR – CHINE2 |

www.ibkr.com.cn | 443 | ||

|

SITE IBKR - AUSTRALIE |

www.interactivebrokers.com.au | 443 | ||

|

PORTAIL CLIENT – EST |

443 |

|||

|

PORTAIL CLIENT – CENTRE |

443 |

|||

1 : Communication Standard: TCP Port 80 | Communication SSL : TCP Port 443.

2 : Ce serveur IB ne prend pas en charge les demandes ping.

Remarque importante : si vous accédez au réseau client depuis un réseau d'entreprise où l'accès Internet est fourni via un équipement d’équilibrage de charge, vous pourrez recevoir des messages d'erreur concernant une session ayant expiré ou invalide et/ou du contenu web manquant durant ou après la phase de connexion. L'équilibreur de charge crée des cycles de connexion externe sur deux (ou plus) interfaces de réseau pour équilibrer la charge du réseau. En raison de ce mécanisme, vos demandes HTTP atteignent nos systèmes depuis différentes adresses IP, ce qui rend invalide votre session sur le Portail Client. Si cela se produit, veuillez demander à votre administrateur de réseau ou groupe informatique de configurer votre appareil de sorte qu'il contourne l'équilibreur de charge. Cela permettra à votre session de rester valide et active.

|

TWS SUR BUREAU |

|||

|

RÉGION/OUTIL |

PRINCIPAL/DE SAUVEGARDE |

SERVEUR (HÔTE) |

PORTS |

|

|

PRINCIPAL |

|

|

|

SAUVEGARDE |

|||

|

|

PRINCIPAL |

|

|

|

SAUVEGARDE |

|||

|

|

PRINCIPAL |

|

|

|

SAUVEGARDE |

|||

|

TWS ASIE |

PRINCIPAL |

4000 / 4001 |

|

|

SAUVEGARDE |

|||

|

TWS ASIE- CHINE3 |

PRINCIPAL |

4000 / 4001 |

|

|

SAUVEGARDE |

mcgw1_hb1.ibllc.com.cn | ||

| TWS - MISE À JOUR AUTOMATIQUE | PRINCIPAL | 443 | |

|

RISK NAVIGATOR |

PRINCIPAL |

443 |

|

|

PARAMÈTRES TWS CLOUD |

PRINCIPAL |

443 |

|

|

IB CAM |

PRINCIPAL |

4000 / 4001 |

|

|

RAPPORTS DIAGNOSTIQUES |

PRINCIPAL |

443 |

|

3 : Portail dédié aux clients dont les comptes sont assignés au serveur de Hong Kong mais qui sont physiquement connectés depuis la Chine continentale.