How do I convert my individual or joint account to a grantor trust?

The process of converting an individual or joint account to grantor trust account is outlined below:

- As the trust account structure differs from that of the joint account in terms of account holder information required, legal agreements and, in certain cases, taxpayer reporting, direct conversion is not supported and a new trust account application must be completed online and the account balances transferred therafter. The application is available on our website at: https://www.interactivebrokers.com/inv/en/main.php#open-account. Be sure to request trading permissions and, if necessary, margin status, sufficient to maintain the positions currently carried in your individual account. Note that if your account is managed by a financial advisor or you are a client of an introducing broker, please contact your advisor or broker to initiate the new application (you may need to make arrangements with your advisor or broker for fees that have accrued but not yet paid if the individual account closes). The trust account application requires Compliance review and approval and documentation including Trustee Certification Form, proof of identity and address for trustees and grantors. A list of required documents and document submission instructions will be provided at the conclusion of the online application.

- Once you have received an email confirming approval of the joint account application, send a request from your Message Center authorizing IB to manually transfer positions from your individual or joint account to the trust account. Prior to submitting the request you should make sure to close all open orders in the individual account to ensure that no executions take place following the transfer.

Due to the manual steps and scheduling required, you should allow a minimum of one week after trust account approval and submitting your request for the transfer to take effect.

IMPORTANT NOTES

- Note that exchange regulations preclude ownership transfer of derivative contracts such as futures and options. If your trust results in a change in ultimate beneficial ownership and your individual or joint account is holding such positions, you would either need to close them prior to the transfer taking place or request that they remain in your individual or joint account.

- Prior to processing the transfer, you should make sure to close all open orders in the individual or joint account to ensure that no executions take place following the transfer.

- The SMA (Special Memorandum Account) balance in your individual or joint account will not transfer to the trust account. In certain cases this may impact your ability to open new positions in the trust account on the first day after the transfer is completed.

- Elective options such as market data subscriptions and participation in IB's Yield Enhancement Program will not be carried over to the trust account and must be reinitiated to continue.

- The cost basis of transferred positions as reported in the activity statements will remain unchanged for tax purposes. The cost basis as reported in your trading platform (which is not used for tax reporting purposes) will not transfer over to the trust account but may be manually adjusted.

- Once the transfer has been completed and assuming all positions have been transferred, your individual or joint account will be designated for automatic closure. Note that certain balances such as dividend accruals can’t be transferred until paid, after which they will then be transferred and your individual or joint account closed.

- You'll receive any applicable tax forms for the reportable activity transacted in each of your individual or joint and trust accounts at year end. Access to Account Management for you individual or joint account will remain after it has been closed for the purpose of reviewing and printing activity statements and tax forms.

- IBKR does not provide tax advice or investment guidance and recommends that account holders consult with qualified professionals to determine any legal, tax or estate planning consequences associated with account transfer requests.

Information regarding the transfer of accounts from IB LLC to IB Australia

Introduction

Following the establishment of Interactive Brokers Australia Pty Ltd (IB Australia), who holds an Australian Financial Services License, number 453554, Australian residents maintaining an account with Interactive Brokers LLC (IB LLC) will have their account transferred to IB Australia as IB LLC intends to cease business in Australia. Outlined below are the steps required to initiate the transfer and information regarding the account holder's relationship with IB Australia following the transfer.

How To Transfer Your Account To IB Australia

Moving your account to IB Australia is easy. The process is simple because we will use the information and documents we already have on file for you. The transfer process is initiated once you sign the online authorisation form. This form will be presented to you immediately upon log in to Account Management. Once the form has been signed your account will be scheduled for transfer, with the transfer typically taking effect over a weekend (with consideration given to weekends which coincide with option expiration processing).

Click Here to Authorise the Transfer of Your Account

We encourage you to complete the application to transfer to IB Australia as soon as possible.

Products offered by IB Australia

As a client of IB Australia, you will continue to be able to trade all of the exchange traded products you currently have access to (including local and global stocks, bonds, options, futures, etc.) through Interactive Brokers’ award winning trading platform and software. For further information on IB Australia's products and services, please see our website.

Australian regulatory status

Upon transfer of your account to IB Australia, you will automatically be designated as a retail client. However, if it appears that you may qualify as a wholesale investor or as a professional investor, or if you believe that you would qualify for either, you will have the option to complete and submit the required documentation for IB Australia to consider.

Offering margin under IB Australia

IB Australia have decided that they will not be offering margin accounts to a corporate entity which is designated as a retail client. As a result, if you currently have a margin account and you have not submitted the required documentation to allow IB Australia to categorize you as either a wholesale client or a professional investor, upon transfer of your account to IB Australia, you will not be able to use your margin account for any new purchases. If you think that you might qualify as either a wholesale client or a professional investor, and you would like to retain the benefits of a margin account with IB Australia, please ensure that you complete and submit the required documentation as soon as possible.

You should also note that IB Australia only offers risk based margin accounts, similar to our Portfolio Margin accounts under IB LLC. If you currently have a Reg T margin account and would like to simulate and review the margin changes after the migration, please login to our TWS trading platform, go to the Account window and select Margin Requirements then Portfolio Margin.

Client Money Considerations

Transfer Of Money From IB LLC To IB Australia: IB LLC and IB Australia are separate legal companies. When you complete the application to transfer your account to IB Australia, you will be directing IB LLC to close your account, transfer your positions, and pay to IB Australia all of the cash currently in your account. Upon receiving these funds, IB Australia will pay the funds into an IB Australia Client Money Account (discussed in more detail below). The actual transfer will occur as soon as practicable following the opening of your account with IB Australia.

Money To Be Held On Trust By IB Australia: IB Australia is required to handle all money that it receives from you or on your behalf in accordance with Part 7.8 of the Corporations Act. In other words, IB Australia is required to maintain one or more trust/segregated client money accounts (Client Money Accounts) with a bank for the holding of monies it receives for or from its clients. This money is held on trust for IB Australia's clients. IB Australia will initially only hold client money in Australian dollars (AUD), U.S. dollars (USD), British Pounds (GBP), or Euros (EUR).

For the purposes of this article, these currencies will be referred to as IBA supported currencies.

Conversion Or Withdrawal Of Non IBA supported currency Balances Before Transfer: You will be given a choice in the IB Australia application process as to which of these supported currencies you would like as your base currency. If you have cash balances in currencies other than IBA supported currencies (AUD, USD, GBP or EUR) these will to be converted into your nominated base currency upon the transfer of your account to IB Australia. The exchange rate that will apply to such a conversion will be the best rate that is reasonably available to IB LLC through its existing liquidity providers when it performs the conversion.

Client Assets And Positions – Transition

When you transfer your account to IB Australia, IB Australia will be your service provider, not IB LLC. When you trade through your IB Australia account, IB Australia will execute Australian market transactions for you, and will arrange for offshore brokers to execute transactions in offshore markets, including IB LLC and other Interactive Broker Group affiliates, as appropriate. In those markets, the offshore brokers will treat IB Australia as their client (and IB Australia will operate omnibus client accounts with those brokers to cover transactions for IB Australia's clients).

IB Australia will replace IB LLC as your custodian. IB Australia will hold all assets that you purchase through IB Australia on your behalf subject to IB Australia’s General Terms, which are available here.

Please refer to IB Australia’s Financial Services Guide, which provides important information about the custody services that IB Australia provides and the sub-custodians that IB Australia uses.

The following is a brief summary of the asset and position holding arrangements going forward:

| Assets/Positions | Past IB LLC Arrangement | Future IB Australia Arrangement |

| Australian securities | IB LLC as custodian (and IB Australia as sub-custodian and executing broker) |

IB Australia as custodian and BNP Paribas Securities Services (as sub-custodian and clearing participant) |

| Foreign securities | Foreign sub-custodian (including IB LLC affiliates) | IB Australia as custodian and IB LLC as sub-custodian. |

| Australian exchange traded derivatives |

IB Australia (clearing participant) | IB Australia (clearing participant) |

| International exchange traded derivatives |

Foreign broker/clearing participant in relevant market |

Foreign broker/clearing participant in relevant market |

| FX positions | Contract with IB LLC | Contract with IB Australia |

When you agree to transfer your account to IB Australia, you will be instructing and authorising IB Australia and IB LLC to do all things reasonably required to facilitate the transfer of all assets and positions from your IB LLC account to your new IB Australia account, including to amend their books and records to reflect the transition, and to give appropriate instructions and directions to sub-custodians, clearing participants and other external providers.

Please note that if you hold positions in products that IBA does not support, such as OTC Metals, these positions will be closed out prior to transfer by IBA at the prevailing price. It is recommended that you close these out prior to completing the transfer form.

In addition, if you participate in the Stock Yield Enhancement Program (SYEP), IB Australia does not as yet support this service. You will not be able to participate in this once your account is transferred to IB Australia.

In order to ensure continued compliance with our regulatory obligations, Interactive Brokers Australia has decided that we will NOT accept any other form of collateral except cash for the purposes of determining whether you can trade or hold ASX24 products. If the margin requirements of ASX24 products cannot be met using cash, an account will be subject to automated liquidation.

A new IB account number will be assigned and our deposit Instructions may change. Prior to making any new deposits, we ask that you obtain the new deposit instructions through Account Management.

The Insured Bank Deposit Sweep Program is available to only those non-U.S. residents whose account is carried with IBLLC, the U.S. broker, or IB-UK, the introducing broker. If your account was previously carried by IBLLC, but is now carried by IB Australia, your account is no longer eligible for the Insured Bank Deposit Sweep Program. Further information is available at this link:

What If I Choose Not To Transfer My Account To IB Australia or Don't Act?

You are not required to transfer your account to IB Australia but you will need to close or transfer you account ASAP as IB LLC intends to cease providing financial services in Australia very soon. This means IB LLC will cease offering financial services and products to Australian residents, including you. This will impact you as follows:

If your account remains open and you have not opened a new account with IB Australia before a

nominated date of which we will be informed, then IB LLC (U.S.) will, under the terms of its Customer

Agreement with you, impose trading restrictions on your account, including prohibiting you from

opening new positions and may transfer your account to IB Australia.

What Happens When IB LLC (U.S.) Transfers My Account To IB Australia?

Please note the following information is only relevant if you do not apply to transfer your Account(s) to IB Australia prior to a date we will inform you of.

If you have NOT applied to transfer your account(s) to IB Australia, then IB LLC (U.S.) will be forced to assign your account(s) to IB Australia. When this happens, IB Australia will be holding your account under the same agreement that you held the account with IB LLC (U.S.).

You will be prohibited from opening new positions until you accept the legal terms that govern and the disclosures that relate to IB Australia’s account offering; you can, however, apply to withdraw your funds and transfer positions to 3rd party brokers.

Please also note the following:

- If the base currency of your IB LLC (U.S.) is other than AUD, USD, GBP or EUR (IBA supported currencies), you will be provided the option to nominate one of these currencies as your base currency when you complete the transfer, otherwise we will default the base currency of the account prior to the transfer to IB Australia to AUD;

- Any currency balances currently held that are not denominated in either of the IBA supported currencies will be converted into your Base Currency at the prevailing exchange rate; and,

- If you close any open positions after the transfer and the settlement proceeds (if any) are in a currency other than the IBA supported currencies, IB Australia will convert the proceeds into the base currency of your account. If, at a later date, you still have not accepted IB Australia’s new legal terms and disclosures, then IB Australia may transfer out positions into issuer sponsored holdings (where it deems reasonable to do so) and liquidate any other open positions that you hold in the account and return the resulting funds to you. IB Australia will provide you notice should we decide to take this action.

Other

- For a full list of the disclosure documents and legal terms which govern the services IB Australia will make available please refer to the IB website.

- For further information on IB Australia, click on our Financial Services Guide.

- For more information or assistance, please contact IB Client Services.

Mobile Phone Verification during the account application

Introduction

IB requires that clients verify their mobile phone in order to receive account and trade related communication directly via SMS. Clients who fail to verify their phone will be subject to trade restrictions pending completion of this process. Verification is performed online and the steps for doing so are outlined below.

In case your account has been already opened but your mobile number has not been yet verified, please jump directly to KB2552 to complete the verification process.

Phone Verification

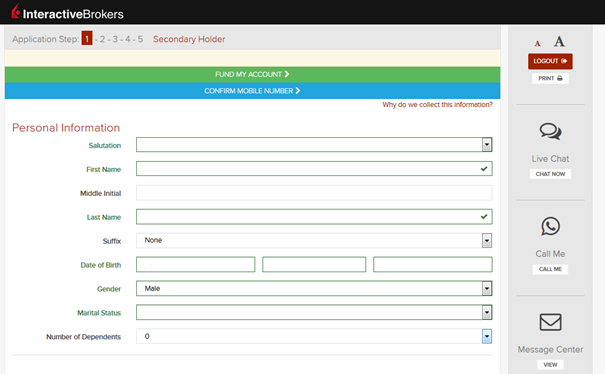

When completing your Interactive Brokers Account Application, you will see a blue bar at the top of the page that says "CONFIRM MOBILE NUMBER."

You can click on that bar any time during steps 1-4. Once you do, you will see this window:

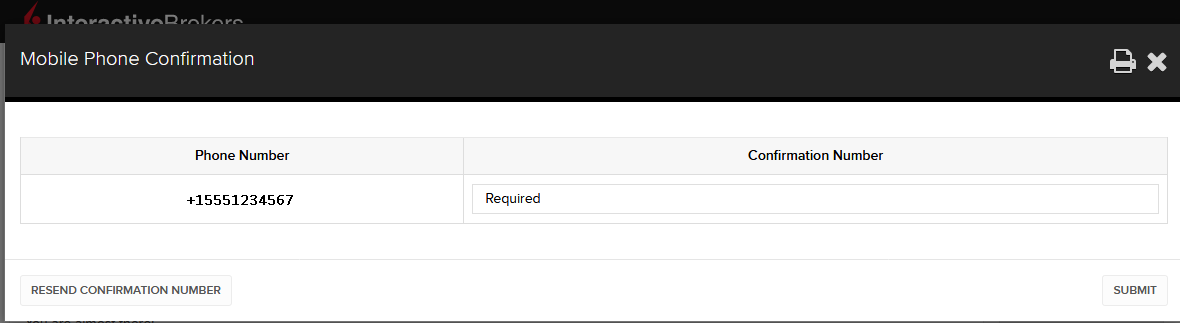

Once you have entered your full number, it will be recognized and a confirmation message is sent immediately. Validate your phone number by entering the SMS Code received in the Confirmation Code field and click Submit.

If you are unable to do this during the application process, you can always confirm it on the Application Status page

.png)

Please consider the following as certain restrictions may apply:

- SMS messages may be blocked if you participate in your Countries NDNC (National Do Not Call) registry.

- Due to fraud prevention measures, virtual number providers may be blocked.

- Some carriers may restrict the Hours of delivery for SMS messages.

Document Certification for Australian Residents

OVERVIEW

IB is required by regulation to verify the identity and address of each applicant and, where copies of physical documents are required, is often subject to local rules as to the type and form of documents which may be accepted. In the case of Australian residents, documents can only be accepted if certified as a true copy of the original by an approved individual. A list of such individuals along with other requirements and document submission instructions is outlined below.

LIST OF APPROVED CERTIFIERS

- Authorized/licensed/registered notary public

- Justice of the Peace with a registration number1

- A person who is enrolled on the roll of the Supreme Court of a State or Territory, or the High Court of Australia, as a legal practitioner (however described) (e.g. a solicitor or barrister)

- Manager of an Australian bank or credit union1

- A member of the Institute of Chartered Accountants in Australia, CPA Australia or the National Institute of Accountants with two or more years of continuous membership (e.g. an accountant)

- Officer of a company which holds an Australian financial services license or authorized representative of an Australian financial services licensee, having two or more continuous years of service with one or more licensees

- Dentist1

- Judges or masters of an Australian Federal, State or Territory court

- Medical Practitioners1

- Police officer in charge of police stations or of the rank of Sergeant or above1

- Agent of the Australian Postal Corporation who is in charge of an office supplying postal services to the public1

- Australian consular officer or an Australian diplomatic officer (within the meaning of the Consular Fees Act 1955) in Australia or overseas

1Person must be authorized/licensed/registered under Australian law.

OTHER REQUIREMENTS

Each page of the document being certified must contain the certifiers signature plus the following statement: "I certify this document to be a true and accurate copy of the original as sighted by me". Have the certifying party complete the Certified Copy Certificate Form for fastest processing. If you do not use the above form, ensure to include the following information on the first page of the document being certified:

- Full name of the certifier

- Signature of the certifier

- Date of certification

- Capacity of the certifier (e.g., Practicing solicitor, Justice of Peace, etc.)

- Registration number (if any) of the certifier's profession

- Number of pages if more than one

DOCUMENT SUBMISSION

Documents cannot be sent electronically and must be delivered to IB by mail or courier.

New Accounts Department

Interactive Brokers Australia Pty Ltd

P.O. Box R229

Royal Exchange, NSW 1225

Australia

Courier

New Accounts Department

Interactive Brokers Australia Pty Ltd

Level 40 Grosvenor Place

225 George Street, Sydney, NSW 2000

Australia

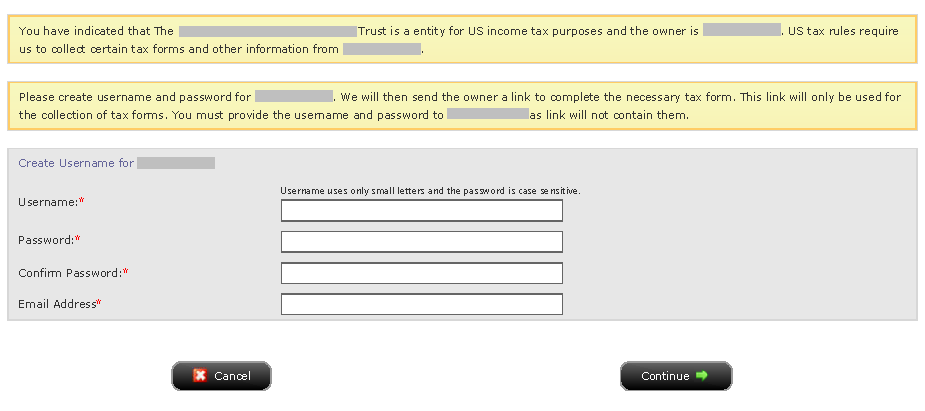

FATCA Procedures - Grantor Trust Tax Information Submission

Interactive Brokers is required to collect certain documentation from clients to comply with U.S. Foreign Account Tax Compliance Act (“FATCA”) and other international exchange of information agreements.

This guide contains instructions for a Trust to complete the online tax information and to electronically submit a W-9 or W-8BEN.

U.S. Tax Classification

Your U.S. income tax classification determines the tax form(s) required to document the account.

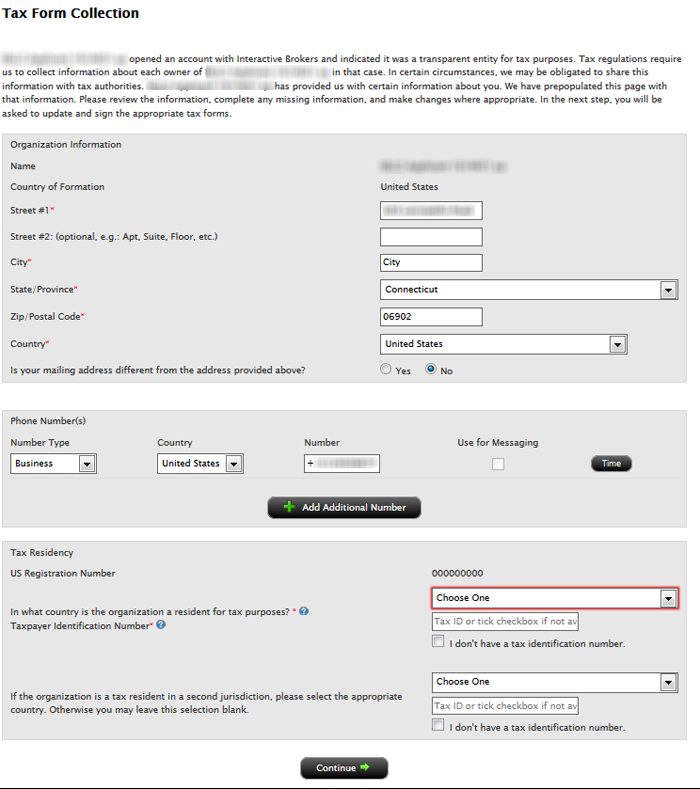

You must login to Account Management with the trust's primary username to access the Tax Form Collection page.

1. Tax Form Collection

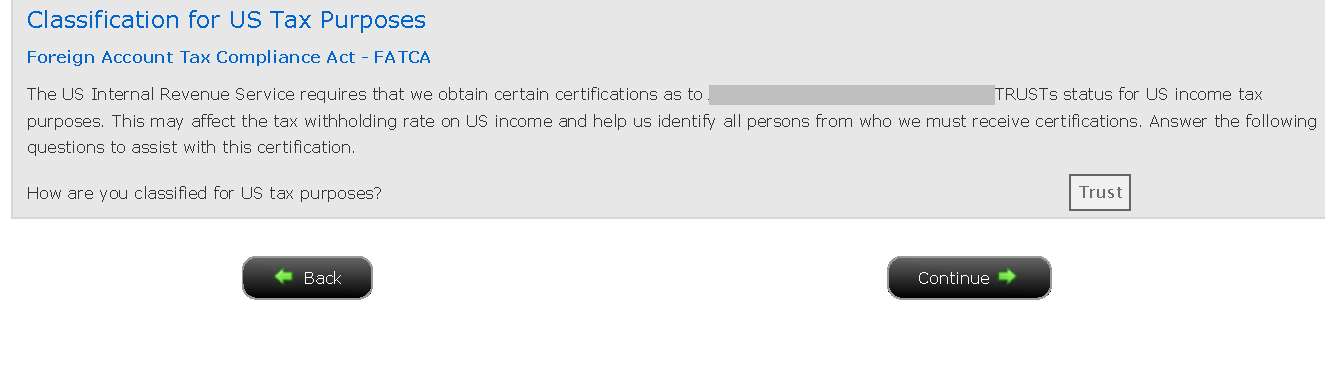

2. Classification for US Tax Purposes

3. Identify Grantors

a. Click Manage Account > Account Information > Tax Information > Tax Forms.

.png)

Can I have more than two individuals on a joint account?

IBKR offers three types of joint accounts: Tenants with Rights of Survivorship, Tenancy in Common and Community Property. Each of these joint account types is limited to two account holders.

Applicants interested in opening an account with multiple owners in excess of two may consider the corporate, partnership, limited liability company or unincorporated legal structure account types offered by IBKR. Note that documentation establishing proof of formation and address are generally required at the point of application.

Converting From a Single to Joint Account

The process of adding a second owner to an existing single account for purposes of converting to a joint account is outlined below:

市場數據非專業客戶問卷

如何完成最新的非專業客戶問卷。

紐約證券交易所(NYSE)及大多數美國的交易所均要求供應商在允許客戶接收市場數據前確認每個客戶接收市場數據的身份。未來,我們將使用非專業客戶問卷來識別及確認所有訂閱用戶的市場數據身份。根據交易所的要求,在未明確客戶為非專業人士之前,將默認客戶的市場數據接收身份為專業人士。該流程能夠保證所有新訂閱用戶的數據訂閱身份是準確的。若要獲取有關非專業人士定義的簡要指南,請見ibkb.interactivebrokers.com/article/2369。

您必須回答問卷上的所有問題,方可被定義為非專業人士。鑑於交易所要求供應商明確獲得客戶為非專業人士的證明,若問卷回答不完整或不清晰,客戶將被界定為專業投資者,直至其身份得到確認。

如您的身份有所變更,請聯繫幫助台。

問題解釋:

1) 商業及業務用途

a) 您是否出於業務需要、或代表其他商業實體接收財經信息(包括關於證券、商品及其他金融產品的新聞或價格數據)?

解釋:除個人用途外,您是否代表公司或其他組織接收及使用本賬戶中的市場數據?

b) 您是否代表公司、合夥企業、專業信託機構、專業投資俱樂部或其他實體開展證券、商品或外匯交易?

解釋:您只代表個人交易,還是也代表機構(如,有限責任公司、有限責任企業、股份有限公司、公司、有限責任合夥企業等)交易?

c) 您是否就以下事項與其他實體或個人達成過協議:(a) 分享交易活動的盈利,或(b)獲取交易酬勞?

解釋:您是否通過交易獲得酬勞,或與第三方實體或個人分享交易活動的盈利?

d) 您是否通過交易換取辦公場所、設備或其他福利?或者,您是否擔任任意個人、企業或商業實體的財務顧問?

解釋:您是否以任意形式從第三方獲得交易的酬勞,該酬勞不一定以貨幣的形式支付。

2) 擔任職務

a) 目前您是否擔任任何投資顧問或經紀交易商的職務?

解釋:您是否通過管理第三方的資產或指導他人如何管理資產獲得酬勞?

b) 您是否擔任證券、商品或外匯方面的資產管理人?

解釋:您是否通過管理證券、商品或外匯資產獲得酬勞?

c) 目前您是否在工作中使用此類財經信息,或將其用於管理您的雇主或公司的資產?

解釋:您使用數據是否單純出於商業目的,即,用於管理您的雇主及/或公司的資產?

d) 您交易時是否使用了其他個人或實體的資金?

解釋:您的賬戶中除了您個人的資產,是否有其他實體的資產?

3) 向其他任意實體傳播、再發布或提供數據

a) 您是否以任意方式向任意第三方傳播、再傳播、發布或提供任何從服務中獲得的財經信息?

解釋:您是否以任意形式向其他實體發送您從我方獲得的任何數據?

4) 合資格的專業證券/期貨交易商

a) 目前,您是否為任意證券機構、商品或期貨市場的註冊或合資格的專業證券交易員,或為任意國家交易所、監管機構、專業協會或公認專業機構的投資顧問?i, ii

是☐ 否☐

i) 監管機構的例子包括但不限於:

- 美國證券交易委員會(SEC)

- 美國商品期貨交易委員會(CFTC)

- 英國金融服務局(FSA)

- 日本金融服務局(JFSA)

ii) 自律組織(SROs)的例子包括但不限於:

- 美國紐約證券交易所(NYSE)

- 美國金融業監管局(FINRA)

- 瑞士聯邦金融局(VQF)

Market Data Non-Professional Questionnaire

Insight into completing the new Non-Professional Questionnaire.

The NYSE and most US exchanges require vendors to positively confirm the market data status of each customer before allowing them to receive market data. Going forward, the Non-Professional Questionnaire will be used to identify and positively confirm the market data status of all customer subscribers. As per exchange requirements, without positively identifying customers as non-professional, the default market data status will be professional. The process will protect and maintain the correct market data status for all new subscribers. For a short guide on non-professional definitions, please see https://ibkr.info/article/2369.

Each question on the questionnaire must be answered in order to have a non-professional designation. As exchanges require positive confirmations of proof for non-professional designations, an incomplete or unclear Non-Professional Questionnaire will result in a Professional designation until the status can be confirmed.

If the status should change, please contact the helpdesk.

Explanation of questions:

1) Commercial & Business purposes

a) Do you receive financial information (including news or price data concerning securities, commodities and other financial instruments) for your business or any other commercial entity?

Explanation: Are you receiving and using the market data for use on behalf of a company or other organization aside from using the data on this account for personal use?

b) Are you conducting trading of any securities, commodities or forex for the benefit of a corporation, partnership, professional trust, professional investment club or other entity?

Explanation: Are you trading for yourself only or are you trading on behalf of an organization (Ltd, LLC, GmbH, Co., LLP, Corp.)?

c) Have you entered into any agreement to (a) share the profit of your trading activities or (b) receive compensation for your trading activities?

Explanation: Are you being compensated to trade or are you sharing profits from your trading activities with a third party entity or individual?

d) Are you receiving office space, and equipment or other benefits in exchange for your trading or work as a financial consultant to any person, firm or business entity?

Explanation: Are you being compensated in any way for your trading activity by a third party, not necessarily by being paid in currency.

2) Act in a capacity

a) Are you currently acting in any capacity as an investment adviser or broker dealer?

Explanation: Are you being compensated to manage third party assets or compensated to advise others on how to manage their assets?

b) Are you engaged as an asset manager for securities, commodities or forex?

Explanation: Are you being compensated to manage securities, commodities, or forex?

c) Are you currently using this financial information in a business capacity or for managing your employer’s or company’s assets?

Explanation: Are you using data at all for a commercial purposes specifically to manage your employer and/or company assets?

d) Are you using the capital of any other individual or entity in the conduct of your trading?

Explanation: Are there assets of any other entity in your account other than your own?

3) Distribute, republish or provide data to any other party

a) Are you distributing, redistributing, publishing, making available or otherwise providing any financial information from the service to any third party in any manner?

Explanation: Are you sending any data you receive from us to another party in any way, shape, or form?

4) Qualified professional securities / futures trader

a) Are you currently registered or qualified as a professional securities trader with any security agency, or with any commodities or futures contract market or investment adviser with any national or state exchange, regulatory authority, professional association or recognized professional body? i, ii

YES☐ NO☐

i) Examples of Regulatory bodies include, but are not limited to,

- US Securities and Exchange Commission (SEC)

- US Commodities Futures Trading Commission (CFTC)

- UK Financial Service Authority (FSA)

- Japanese Financial Service Agency (JFSA)

ii) Examples of Self-Regulatory Organization (SROs) include, but are not limited to:

- US NYSE

- US FINRA

- Swiss VQF

安全登錄系統概述

目錄

我們高度重視您的資産與個人信息安全,幷致力于采取必要措施確保您的賬戶自開立起便受到保護。

參與安全登錄系統的益處

- 單日及五日內的取款限額更高。

- 無需聯繫我司安全部門即可更改銀行指令和電子郵件地址。

- 能够在初次向賬戶注資2萬美元後,發起ACH和EFT資金轉帳。

- 同一個人注册的多個用戶名可共享一個安全設備。

如何參與

設備丟失、損壞或暫不可用

設備類型

- 手機短信 - 通過向您手機發送短信完成雙因素驗證,快速、簡便。

- 移動IBKR – 此移動應用程序提供了一種便捷的數字解决方案來滿足您的雙因素驗證需求。程序中集成的移動IBKR驗證程序(IB Key)支持指紋/人臉識別和PIN碼1,安卓手機和iPhone均可使用。

- 數碼安全卡+ - 適用于資産不低于100萬美元的賬戶。其外形與信用卡相同,爲電子卡片,需要使用者輸入PIN碼作爲額外保護。

注意:

iPhone用戶必須啓用Touch ID、 Face ID或鎖屏密碼(參見設置Touch ID或設置Face ID)。推薦使用Touch ID和Face ID。PIN碼/鎖屏密碼最長可支持12小時的交易訪問,而指紋/人臉識別最長支持超過30個小時。更多詳細信息請參見我們的用戶指南延長交易訪問。

取款限制

參與安全登錄系統的客戶取款更爲自由,而爲參加的客戶則與每日和每周取款限制。參與安全登錄系統的客戶單日和五日可取款或轉帳的金額隨設備的保護性能變化,詳情如下。

| 安全設備 | 單日最高取款限額 | 5個工作日內最高取款限額 |

|---|---|---|

| 無 | 50K USD | 100K USD |

| 手機短信 | 200K USD | 600K USD |

| 移動IBKR驗證程序(IB Key) | 1M USD | 1M USD |

| 安全代碼卡* | 200K USD | 600K USD |

| 數碼安全卡* | 1M USD | 1.5M USD |

| 數碼安全卡+ | 無限制 | 無限制 |

| 鉑金卡*/金卡* | 無限制 | 無限制 |