How, under the Windows operating system, do I create a screen shot to send to IBKR?

For some support related issues, obtaining a screenshot may provide valuable information that will assist us with resolving the issue being experienced. The following page describes two different methods of creating a screenshot.

Manual Screenshot

For traders not using the TWS, the following describes the process of creating a screenshot and attaching it to a web ticket to submit to Client Service.

To provide an image of your full computer screen select and hold down the ‘Ctrl’ key and then the ’Print Screen‘ key (located in the upper right corner of the keyboard).

For an image of a single window within your screen select and hold down the ‘Alt’ key and then the ‘Print Screen’ key

Next, open a text or image editing program such as Microsoft Word to ‘paste’ and save the shot you’ve just created. Once the program has opened select and hold down the 'Ctrl' key and then hit the “V” key. Verify that this is the image you wish to send and then save the document to your computer. Log in to Advisor Portal and select the Message Center from where you can create a new web ticket and attach your document.

TWS Screenshot / Log File

Traders using the TWS software can use keyboard combinations to capture snapshots of their screen and upload them to assist with support issues.

To create a snapshot of the TWS screen and upload the log file please use the keyboard combination associated with the type of machine being used;

- All PC's except HP's: Ctrl+Alt+H

- Hewlet Packards (HP): Ctrl+Alt+Q

- Mac: Ctrl+Option+H

A window will appear allowing the trader to enter text and check the screenshot box to include an image of the computer screen.

.jpg)

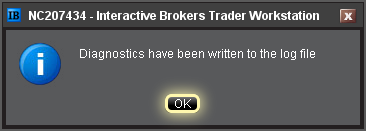

After pressing submit, the following window will appear to acknowledge that the files have been uploaded.

Notes:

- Client Service does not monitor these uploads during the day so be sure to communicate with the Client Service desk prior to uploading files relating to a current issue.

- Traders behind a firewall or proxy may be unable to upload log files and screenshots using the TWS method.

Can an advisor client account trade for himself/herself?

By default, client accounts do not have Trading Access and cannot sign into TWS or WebTrader. They are limited to Advisor Portal where they can view Statements and Trade Confirmations, as well as perform account administration tasks. However, there are occasionally requests by advisors that a client be given the ability to trade their own account.

Information:

There is a feature that allows the Advisor to give Trading Access to his Clients. This can be enabled by the Advisor in Advisor Portal in the Manage Clients section followed by Trading and Configuration. The Client would then need to subscribe to market data if they desire and would be able to trade only his/her own account.

Working orders would be accessible by either the client or the advisor.

How do I change the fees which I charge my clients?

Advisor accounts have the ability to configure the fees which they assess to their clients.

Information:

The procedure for changing fees for a client account is as follows. You must log in to Advisor Portal and select Manage Clients -> Fees -> Configure. You will need to change the fees in this section online, but you still must have the client sign the fee change form and submit to us for processing.

Please see the Advisor Client Fees page for additional information, such as the available billing methods and the fee caps currently in place.

Can I upgrade my individual account to an advisor account?

Clients often request that their individual accounts be converted to advisor accounts so they can take advantage of the advisor account structure.

Information:

Unfortunately, we cannot upgrade an Individual account to an Advisor Account. You must complete a new application, which can be accessed from our home page, by selecting Accounts -> New Accounts -> Advisor.

During the Advisor Account application, you will be given the opportunity to open a Trading Sub Account for yourself. If you do, and if you make sure that all aspects of this new Sub account (titles, tax IDs, trading permissions,e,mail addresses) match those of your existing individual account, you will be able to request a Positions and Funds move to your new account.

Please bear in mind:

- The Advisor Master account is only a shell account that is used to place trades on behalf of Advisor Client accounts.

- The Advisor Master account cannot hold positions.

- In order to trade, you must allocate trades to an Advisor Client account.

How do I move my current IBKR account underneath an advisor account?

There are two possible methods which can be used to move an existing IBKR account underneath an advisor structure, dependent upon the situation of the account being linked.

Link Account to Advisor/Broker:

Interactive Brokers allows existing accounts to request their full account be 'linked' to a Friends Advisor, Non-Professional Advisor, a Professional Financial Advisor or a Fully Disclosed Introducing Broker. These linkages include all cash and positions and are available to accounts which are not currently Advisor or Broker clients. There are a number of checks which are performed which may prevent the linking of an account, such as, but not limited to, trading permission incompatibilities between the Advisor or Broker Master and the client account, commission schedule1 differences, etc.

To use this functionality, the user on the account requesting to be linked will need to log in to Client Portal and choose the User menu (head and shoulders icon in the top right corner) option followed by Account Settings. In the Configuration section click the gear icon next to the words "Create, Move, Link or Partition an Account". You will be presented with a variety of options, one of which is "Move my entire account to an account managed by an Advisor/Broker". Check this option and click Continue.

You will be prompted to enter the account ID and the title of the Advisor or Broker which you are attempting to link to. After submitting this information, users will be presented with any applicable agreements and will need to confirm the request.

Once confirmed, the advisor or broker will receive an email notifying them of the requested link. They will need to log into Advisor Portal to either accept or reject the request. IBKR will process accepted requests at approximately 3:00 p.m. every Friday.

1 Please note, accounts which are configured with an unbundled commission schedule will not be allowed to link to an Advisor or Broker account, unless the commission schedule is changed to bundled. In the Advisor and Broker account structures, commission schedules cannot be defined for client accounts. If not properly configured at the master level, changing your commission schedule to bundled may result in higher commission charges.

Transfer of Assets to Another IBKR Advisor Managed Account

For those clients which have an attached or additional account, in order to move under an Advisor, you must first open a new account directly under the Advisor, which duplicates the existing account. It is important to ensure that all aspects of the new account (account titles, tax IDs, trading permissions, etc.) match the existing account exactly. Client accounts can be created by the Advisor through Advisor Portal (click here for detail). Once the new account has been approved, clients will be able to log into Client Portal and select the Internal Transfer option as the Transfer Method in the Transfer Positions section of Transfer & Pay. Please keep in mind the following:

- The Advisor Master account is only a shell account that is used to place trades on behalf of Advisor Client accounts.

- The Advisor Master account cannot hold positions.

- In order to trade, you must allocate trades to an Advisor Client account.

Notes

- Transfers are processed on a daily basis, with the exception of US option expiration Friday.

- The new account should be allowed to close positions on the first day of transfer but will not be allowed to open positions as the new account will not have a previous day Equity With Loan value.

- The Cost Basis cannot be manipulated for Internal transfers, only for ACATs from outside sources.

How do advisors open client or sub accounts?

There are two ways for an Advisor to open a client account. Both methods are initiated from within the Advisor Portal by navigating to Manage Clients -> Create and Link Accounts-> Create -> New.

Fully Electronic Invitation

With this method, the FA sends an invitation to the client. The client completes all information and submits for approval. The password is given to the client immediately.

Semi-Electronic Application

With this method, the FA completes the application on behalf of the client, then sends to the client for a signature. Once the account is approved, the password is mailed, via US Mail, to the client. While the application is pending, the FA can view and reprint from the Advisor Portal.

Note: If the FA Wants to open a sub account for himself

FAs are asked, when completing the FA application, if they would like to create a trading sub account for themselves. If they choose no, they may open an account at a later time, however they will be required to submit all new documents. They can submit a request to newaccounts@interactivebrokers.com to request that the documents used for the master account be applied to the sub account. To create a sub account they should complete an Electronic Invitation, accessible through the Advisor Portal. The trading sub account of the FA cannot be set up as an IRA account.

Why do certain cash deposit and withdrawal requests require that an instruction be created while others do not?

Whether or not an instruction is required is a function of both the transaction type (i.e., deposit or withdrawal) and its underlying method (i.,e. check, ACH initiated at IBKR or wire). In general, if the deposit method dictates that IBKR pull funds directly from the client’s account or if the withdrawal method dictates that IBKR push funds directly to the client’s account, an instruction will be required in order to obtain the necessary account specific information and authorization to act. Outlined in the chart below are the possible scenarios.

|

INSTRUCTION REQUIREMENTS BY TRANSACTION TYPE & METHOD (Yes/No) |

|||||

|

|

Check |

ACH – at Bank |

ACH – at IBKR |

EFT |

Wire |

|

Deposit |

No |

No |

Yes |

Yes |

No |

|

Withdrawal |

No |

N/A |

Yes, if instruction is created as Debit/Credit, no if Credit only |

Yes |

Yes |

Are there any qualification requirements in order to receive Portfolio Margining treatment on US securities positions and how does one request this form of margin?

In order to enabled for portfolio margining an account must be approved for option trading and must have at least USD 110,000 in net liquidating equity (USD 100,000 to maintain, once enabled). Account holders will also be required to acknowledge and sign the Portfolio Margin Risk Disclosure document and be bound by its terms.

Portfolio margining may be requested through the on-line application phase (in the Account Configuration step) or after the account has been approved. To apply once the account has already been approved, log into Client Portal and select the Settings and Account Settings menu options. In the Configuration section, click the gear icon next to the words "Account Type". There you may choose the portfolio margin treatment which will initiate the approval process. Please note that requests are subject to review (generally a 1-2 day process) and may be declined for various reasons including a projected increase in margin upon upgrade from Reg T to Portfolio Margining.

How can I request for a replacement secure login device or temporary security code?

IBKR is committed to protecting your account and your account assets from fraudulent practices. The Secure Login System provides an extra layer of security to your account. For security purposes, all replacement security device requests must be addressed via telephone and only after the identity of the named account holder or authorized user has been verbally verified. For assistance in accessing your account immediately and obtaining a replacement security device, please contact IBKR Client Services via telephone to restore login access.

References

- See KB69 for information about Temporary passcode validity

- See KB1131 for an overview of the Secure Login System

- See KB2636 for information and procedures related to Security Devices

- See KB2481 for instructions about sharing the Security Login Device between two or more users

- See KB2545 for instructions on how to opt back in to the Secure Login System

- See KB975 for instructions on how to return your security device to IB

- See KB2260 for instructions on activating the IB Key authentication via IBKR Mobile

- See KB2895 for information about Multiple 2Factor System (M2FS)

- See KB1861 for information about charges or expenses associated with the security devices

How long does a Temporary Security Code last?

IBKR will issue a temporary passcode to Secure Login System participants in the event their security device has been misplaced, lost or damaged. The temporary passcode is intended to provide full access to both Client Portal and trading platforms for a period of 2 days. After 2 days, the temporary passcode may no longer be used to access the trading platforms but may be used to access Client Portal for an additional period of 8 days. Client Portal access, however, is limited solely for the purpose of printing or saving the Online Security Code Card.

The Online Security Code Card, in contrast, has a lifespan of 21 days, providing the account holder with an opportunity to locate the misplaced device or have continuous access in case the device is lost or damaged, and needs replacement. Account holders who remain without their physical security device and who are unable to log in using either the temporary passcode or Online Security Code Card will need to contact Client Services (ibkr.com/support) in order access their account.

The quickest solution to restore permanent access to your account, is to install and activate the IBKR Mobile authentication with IB Key. Details about the instant activation of the smartphone app can be found here.

IMPORTANT NOTICE

As a matter of policy, IBKR will not issue consecutive temporary passcodes to a given account, but rather will act to restore the account protection to the most secure level, which is provided by a physical security device.

References

- See KB70 for instruction for requesting a Temporary Passcode

- See KB1131 for an overview of the Secure Login System

- See KB2636 for information and procedures related to Security Devices

- See KB2481 for instructions about sharing the Security Login Device between two or more users

- See KB2545 for instructions on how to opt back in to the Secure Login System

- See KB975 for instructions on how to return your security device to IBKR

- See KB2260 for instructions on activating the IB Key authentication via IBKR Mobile

- See KB2895 for information about Multiple 2Factor System (M2FS)

- See KB1861 for information about charges or expenses associated with the security devices