Monitoring Stock Loan Availability

IBKR provides a variety of methods to assist account holders engaged in short selling with monitoring inventory levels and borrow costs/rebates. The level of detail available, the time frame covered and the manner in which the information is accessed vary by method and a brief overview of each is provided below.

Public Website

Interested parties may query the IBKR website for stock loan data. To start, click here and scroll down to the section titled "Stocks Available". Click the section to expand it and select the country in which the stock is listed. If the number of available issues exceeds that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down. A quick search box allowing direct query for a given symbol is also provided. Query results include the product description, currency of denomination and a link titled “Check Availability” which displays the quantity of shares available to borrow upon entering your login credentials.

Public FTP

Windows

Windows Explorer

- Open windows explorer (Start > Computer)

- With "Computer" selected on the left, right click an empty space on the right side of the window and choose “Add a network location”

- When the wizard prompts for a network address, enter “ftp://shortstock: @ftp2.interactivebrokers.com” and press next

- Give the connection a name of your choosing and press next

- File explorer should now open and display all of the files in the ftp location.

Command Prompt

- Go to Start > Windows System > Command Prompt

- Type "ftp" and press enter (the prompt will change to an ftp> prompt)

- Type “open ftp2.interactivebrokers.com”

- When prompted, enter the username “shortstock” and leave the password empty.

- Use the “dir” command to show the files in the directory

- Use the “get filename.txt” to retrieve the desired file

MacOS

- Open Finder

- From the “Go” menu choose “Connect to Server”

- Enter “ftp://shortstock: @ftp2.interactivebrokers.com” and press the + button to add to your favorites.

- Click “Connect”

- If prompted, the username should be “shortstock” and the password should be left empty.

- Click "Connect"

- If all steps were done correctly the finder window should display all of the files in the ftp location.

Linux

Terminal

- Open a Terminal window

- Type “ftp shortstock@ftp2.interactivebrokers.com”

- When prompted for a password, press enter

- Type “ls” to list the contents of the ftp location

- Type “get filename.txt” to get the desired file.

- Type “bye” to end the ftp session

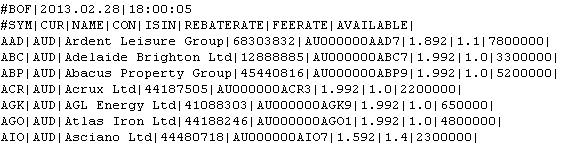

Outlined below is a snapshot of the sample file output which includes the stock symbol, currency of denomination, name, contract identifiers (IBKR’s and the ISIN), fee rates and shares available. This file may be also imported into applications such as Excel for sorting, filtering and analytical purposes.

Short Stock Availability (SLB) Tool

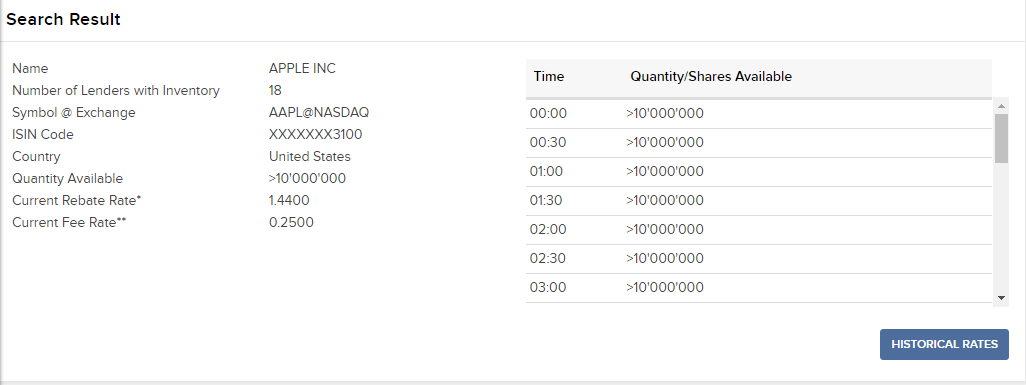

The SLB tool is available to IBKR account holders through Client Portal. Log in and select the Support section and then select Short Stock (SLB) Availability. This tool allows one to query information on a single stock as well as at a bulk level. Single stock searches can be performed by symbol/exchange, ISIN or CUSIP numbers. At the single security level, query results include the quantity available and number of lenders (note that a negative rebate rate infers a borrowing cost expressed as an annual percentage rate and, if positive, the interest rebate paid on cash proceeds securing the loan in excess of the minimum threshold). Information regarding the quantity of shares available to borrow throughout the day for the most current and past half hour increments is also made available.

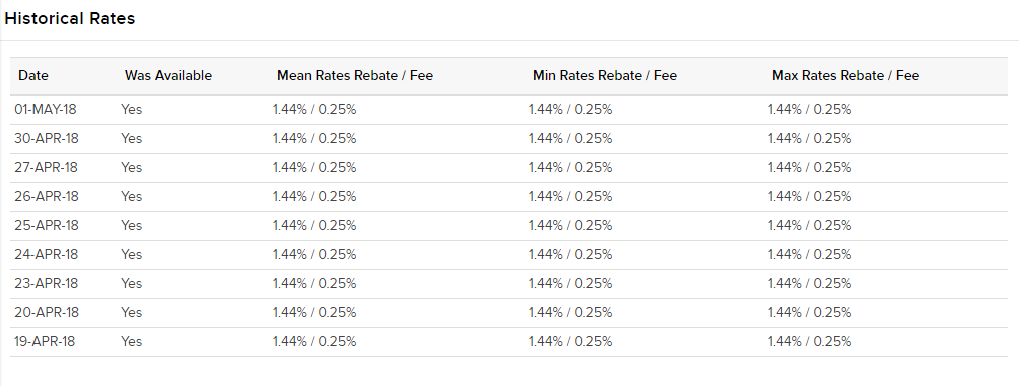

In addition, borrowers interested in the trend of rates over the prior 10 day period can view the minimum, maximum and mean rates for each day.

This tool also allows one to upload a text file (with symbol/exchange or ISIN detail) and search for availability of multiple stocks in bulk within a single query. These bulk requests will then generate a .CSV file similar to the sample file output made available through the public FTP site.

Hong Kong Short Reporting Obligations

Overview

- Hong Kong regulations now require beneficial owners of shares in selected HK listed stocks to report each week short positions that exceed the threshold of HKD 30 million or 0.02% of market capitalization on the constituent stocks of the Hang Seng Index, the Hang Seng China Enterprises Index and other financial companies specified by the SFC. A list of affected of stocks can be found here:

http://www.sfc.hk/sfc/html/EN/research/short-position-reporting/specified-shares.html

- Investors with applicable positions should register directly with the SFC. Registration and guidance on the registration process can be found here.

- Reporting is expected on a weekly basis, but the second business day of the following week.

- Links for the registering and reporting can be found here:

https://portal.sfc.hk/dsp/gateway/welcome?locale=en

Guidelines, Instructions and FAQ's:

SFC announcement with links to legislation

Short position forms, guidelines, reference material and list of specified shares

Link to subscribe to SFC alert service (choose Short Position Reporting Related Matters)

For further details, please refer to the SFC website: www.sfc.hk and/or contact them via email with specific questions at shortpositions@sfc.hk

IBKR Stock Yield Enhancement Program

PROGRAM OVERVIEW

The Stock Yield Enhancement Program provides the opportunity to earn extra income on the fully-paid shares of stock held in your account by allowing IBKR to borrow shares from you in exchange for collateral (either U.S. Treasuries or cash), and then lend the shares to traders who want to sell them short and are willing to pay interest to borrow them. For additional information on the Stock Yield Enhancement Program please see here or review the Frequently Asked Questions page.

HOW TO ENROLL IN THE STOCK YIELD ENHANCEMENT PROGRAM

To enroll, please login to the Client Portal. Once logged in, click the User menu (head and shoulders icon in the top right corner) followed by Settings.

In the Trading section of the Settings page, click the link for the Stock Yield Enhancement Program. Select the checkbox on the next screen and click Continue. You will then be presented with the requisite forms and disclosures needed to enroll in the program. Once you have reviewed and signed the forms, your request will be submitted for processing. Please allow 24-48 hours for enrollment to become active.

.png)

.png)

India Intra-Day Shorting Risk Disclosure

Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. In accordance with IB’s intra-day shorting rules, traders are required to deliver shares sold or close short stock positions prior to the end of the trading session.

Should traders establish a short stock position intra-day and still hold the position ten minutes prior to the end of the trading session at 15:20 IST, Interactive Brokers may, on a best efforts basis, close the position on your behalf. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. Please note that prices in the auction market are highly variable and typically not favorable compared to the normal market.

It is important to note, IB will not take into consideration any closing orders for short stock positions placed by the customer which may still be working. If your account holds a short position ten minutes prior to the end of the trading session and you have placed working orders to close those positions, there is the possibility your closing order will execute and that IB will act to close out your short position. In this situation you will be responsible for both executions and will need to manage your long position accordingly.

A fee of INR 2,000 will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid this.

Reg. SHO Short Sale Bid Test

Effective November 10, 2010, an amendment to SEC Reg. SHO goes into effect which will place certain restrictions on short selling when a given stock is experiencing significant downward price pressure. This amendment, referred to as the alternative uptick rule (Rule 201) introduces a circuit breaker which takes effect wherever the primary listing market declares that a stock has declined 10% or more from the prior day’s closing price.

Once the circuit breaker has been triggered, a Price Restriction is imposed which prohibits the display or execution of a short sale transaction if the order price is at or below the current national best bid. As a result, short sellers will not be allowed to act as liquidity takers when the Price Restriction applies and can only participate as liquidity providers adding depth to the market. Individuals owning and attempting to sell a security subject to a Price Restriction (i.e., long sellers) are afforded a priority over short sellers in that while they are similarly prohibited from displaying or executing a sale transaction at a price below the current national best bid, they may display or execute orders at the bid. Accordingly, long sellers are allowed to act as liquidity takers.

The Price Restriction will apply to all short sale orders in that security for the remainder of the day as well as the following trading day. Note that while the Price Restriction can only be triggered during regular trading hours, the restriction itself extends beyond regular trading hours on both the first and second days. In addition, there is no limit on the number of consecutive days in which a primary listing market can trigger a Price Restriction. If a stock currently subject to a Price Restriction again declines 10% or more from the prior day’s closing price, the restriction will be re-triggered for the remainder of that day as well as the following trading day.

Rule 201 applies to all National Market System (NMS) securities; that is, stocks listed on a U.S. stock exchange whether traded on an exchange or in the over-the-counter market. It does not apply to stocks which are traded only on the OTCBB and/or PINK nor stocks of U.S. companies which are executed on a non-U.S. exchange.

Example: Assume hypothetical stock XYZ closed yesterday at $10.00 and today reports a trade at $8.99 (down 10.1%) with a NBBO of $8.98 x $9.00. As the stock has declined by greater than 10%, the primary listing market would trigger the circuit breaker, effectively prohibiting the display or execution of a short sale order at $8.98 or less even if the order was a market order or had a limit price below $8.98. The short sale order may only be displayed or executed at $8.99 or higher (assuming the stock trades in one penny increments). A long sale order could only be displayed or executed at $8.98 or higher. This Price Restriction would remain in effect for the remainder of today and tomorrow (assuming no subsequent price declines of 10% or more).

Why does the "price" on hard to borrow stocks not agree to the closing price of the stock?

In determining the cash deposit required to collateralize a stock borrow position, the general industry convention is for the lender to require a deposit equal to 102% of the prior business day's** settlement price, rounded up to the nearest whole dollar and then multiplied by the number of shares borrowed. As borrow rates are determined based upon the value of the loan collateral, this convention impacts the cost of maintaining the short position, with the impact being most significant in the case of low-priced and hard-to-borrow shares. Note, for shares not denominated in USD the calculation will differ. Find below a table summarizing the calculations per currency:

| Currency | Calculation Method |

| USD | 102%; rounded up to the nearest dollar |

| CAD | 102%; rounded up to the nearest dollar |

| EUR | 105%; rounded up to the nearest cent |

| CHF | 105%; rounded up to the nearest rappen |

| GBP | 105%; rounded up to the nearest pence |

| HKD | 105%; rounded up to the nearest cent |

For US Treasuries and corporate bonds, the collateral amount on which the borrow fee is charged will include the accrued interest.

Account holders may view this adjusted price for a given transaction in the "Borrow Fee Details" section of the daily account statement. Two examples of this collateral calculation and its impact upon borrow fees are provided below.

Example 1

Sell short 100,000 shares of ABC at a price of $1.50

Short sale proceeds received = $150,000.00

Assume the price of ABC falls to $0.25 and the stock has a borrow fee rate of 50%

Short stock collateral value calculation

Price = 0.25 x 102% = 0.255; round up to $1.00

Value = 100,000 shares x $1.00 = $100,000.00

Borrow fee = $100,000 x 50% / 360 days in year = $138.89 per day

Assuming the account holder's cash balance does not include proceeds from any other short sale transaction then this borrow fee will not be offset by any credit interest on the short sale proceeds as the balance does not exceed the minimum $100,000 Tier 1 threshold necessary to accrue interest.

Example 2 (EUR denominated stock)

Sell short 100,000 shares of ABC at a price of EUR 1.50

Assume a prior business day's close price of EUR 1.55 and a borrow fee rate of 50%

Short stock collateral value calculation

Price = EUR 1.55 x 105% = 1.6275; round up to EUR 1.63

Value = 100,000 shares x 1.63 = $163,000.00

Borrow fee = EUR 163,000 x 50% / 360 days in year = EUR 226.38 per day

** Please note, Saturdays and Sundays are treated as a Friday and will use Thursday's settlement price to calculate the required deposit.

When I short a stock, when will the hard to borrow interest begin accruing?

Short positions will have a borrow interest/fee associated with them.

Borrow interest will begin being charged on a short position from short settlement date to buy-to-cover settlement date.

For example, you sell XYZ on Monday, and you close the position on Tuesday. Borrow interest would start to be charged upon Wednesday's settlement date (T+2). Interest would cease to be charged on Thursday, the settlement date (T+2) of the buy-to-cover order.

Overview of Short Stock Buy-Ins & Close-Outs

Introduction

Clients holding short stock positions (including short positions resulting from option assignments or exercises) are at risk of having these positions bought-in and closed out by us, with no advance notice. This is a risk which is inherent in short selling and generally outside the control of the client. “Buy-ins” are conducted in accordance with regulatory rules that dictate how and when buy-ins are processed.

While similar in their effect, the term “buy-in” refers to an action taken by a third party and a “close-out” refers to an action taken by us. These actions typically result from one of three events:

1. The shares required to be delivered when a short sale settles cannot be borrowed;

2. The shares which were borrowed and delivered at settlement are later recalled; or

3. A fail to deliver with the clearinghouse occurs.

An overview of each of these three events and their considerations is provided below.

1. Short Sale Statement

When stock is sold short, the broker must arrange for the shares to be borrowed for delivery by the settlement date, which in the case of U.S. securities is the first business day following the date of the trade (T+1). Prior to executing the short sale, the broker must have reasonable grounds to believe that the security can be borrowed so that it can be delivered on the date delivery is due. This is accomplished by verifying the current availability of the shares for borrowing. Note that there is no assurance that shares available to borrow on the date of trade will remain available to borrow one day later for delivery at settlement, and the short sale may be subject to forced close-out if the shares can no longer be borrowed for delivery. If the client “pre-borrows” shares to deliver at settlement (i.e., actually borrows shares before selling short) the client will not be subject to a close-out as long as the borrowed shares remain available. The processing timeline for determination of a close-out is as follows:

T+1

If we are unable to borrow shares to deliver on settlement date (T+1), we have until market open of the following day, T+2, to cover the delivery obligation and prevent close-outs.

T+2

09:20 Eastern Time (ET)

If we were unable to borrow shares to meet settlement, a communication will be sent, on a best efforts basis, notifying the client that a close-out will occur.

09:30 Eastern Time (ET)

We initiate the close-out by placing an order prior to the open of regular trading hours. The close-out quantity will be reflected within the TWS Trades window. Since the final close-out price may not be known until the end of the day, the previous trading day’s closing price is used as a placeholder price on TWS. The placeholder price will be updated with the actual execution price upon completion of the close-out order.

It is possible that under certain circumstances, due to limited liquidity in the market, that the close-out order may not be executed or may be only partially executed. In that case, the initial close-out quantity will be corrected down to the executed quantity. The remaining quantity will remain subject to close-out at the start of regular trading hours the following business day.

2. Loan Recall

Once a short sale has settled (i.e., stock has been borrowed and used to deliver the shares sold short to the buyer), the lender of the shares reserves the right to request their return at any time. Should a recall occur, we will attempt to replace the recalled shares with those from another lender. If the recalled shares cannot be replaced within one or two days (depending on the time) of the recall notice, the lender can issue a formal Buy-In Warning which allows for a buy-in to take place that day. While the issuance of this formal warning provides the lender the option to buy-in, the proportion of recall notices that actually result in a buy-in are low (typically due to our ability to source shares elsewhere).

Once a counterparty issues a Buy-In Warning to us, the counterparty may buy-in the shares we are borrowing at any time for that trade date. In the event the recall results in a buy-in, the lender executes the buy-in transaction and notifies us of the execution price. We vet counterparty buy-in prices for appropriateness with the day's trading activity.

In turn, we allocate the buy-in to clients based upon their settled short stock position. Unsettled trades are not considered when determining liability. Recall buy-ins are viewable within the TWS Trades window once they are posted to the account by approximately 17:30 ET.

3. Fail to Deliver

A fail to deliver occurs when a broker has a net short settlement obligation with the clearinghouse and does not have the shares available within its own inventory or cannot borrow them from another broker in order to meet the delivery obligation. A fail to deliver can result from a long or short sale.

In the case of US stocks, brokers are obligated to close the fail position by no later than the start of regular trading hours on the day following the settlement day. This can be accomplished by delivering purchased or borrowed shares. If available stock borrow transactions prove insufficient to satisfy the delivery obligation, we will close-out clients holding short positions by placing an order prior to the open of regular trading hours. It is possible that under certain circumstances, due to limited liquidity in the market, that the close-out order may not be executed or may be only partially executed. In that case, the initial close-out quantity will be corrected down to the executed quantity. The remaining quantity will remain subject to close-out at the start of regular trading hours the following business day.

Net Purchase Requirement

Clients should note that on any day on which they have been closed out, they are required to end the day as a net purchaser—in aggregate across all of their accounts with the Firm—of at least the number of shares they were closed out on (in the security they were closed out on). As a result, for the remainder of the trading day on which a client was closed out, that client will not be permitted to (i) sell short the stock they were closed out in, (ii) write in-the-money call options on the stock they were closed out in, or (iii) exercise put options on the stock they were closed out in (the "Trading Restrictions"). If a client nevertheless does not end the day as a net purchaser of the required number of shares for the stock they have been closed out in (for example, as the result of being assigned on call options previously written)—in aggregate across all of the client's accounts with the Firm—the Firm will perform another close-out in the account on the next trading day for the number of shares that, when added to the client's aggregate net trading activity in such stock on the close-out date, would have been required to make the client a net purchaser of the required number of shares of such stock that day, and the client will again be required to remain a net purchaser across all of their accounts of that many shares and again subject to the Trading Restrictions for the remainder of that day.

Note on Execution

Clients should be aware that based on the manner in which we are required to execute a close-out and a third party is allowed to execute a buy-in, significant differences between the price at which the transaction was executed and the prior day's close may result. These differences may be especially pronounced in the case of illiquid securities. Clients should be aware of these risks and manage their portfolio accordingly.

Why do I receive a notice of a potential buy-in of my short position when your Short Stock Availability List is showing shares available to borrow?

As background, the short stock availability list represents the inventory of shares which IBKR has available to lend and which other brokers have indicated that they have available to lend. While it is updated on a near real-time basis throughout the day for changes to IBKR's inventory and periodically throughout the day to reflect updates to the availability lists of other brokers, many brokers provide updates only once per day.

It should be noted that the purpose of the short stock availability list is to meet the broker's regulatory obligation that they have made a reasonable determination that a security can be borrowed in time for settlement three business days later. There is no regulatory requirement, in most instances, that the broker pre-borrow shares to effect delivery on a short sale prior to settlement and the requirement which this list serves to address is completely separate from the SEC rules which require that the broker force-close any short position having a delivery obligation subject to fail with the clearinghouse on any given day.

It is these rules which we are adhering to when we review your short positions relative to our settlement obligations with the clearinghouse each day. While the shares necessary to cover your short sale may have been available as of the date your trade took place and subsequently thereafter, there can be no assurance that those shares can be borrowed indefinitely. The inventory of available shares to borrow is dynamic and subject to change throughout a given day. When we believe that there is a reasonable chance that we will not be able to maintain your borrow position on a particular day, we will make every effort to provide you with a notice of those short positions which are likely to be bought in absent preemptive action on your part.

Understanding interest charges when the net cash balance is a credit

An account will be subject to interest charges despite maintaining an overall net long or credit cash balance under the following circumstances:

1. The account maintains a short or debit balance in a given currency.

For example, an account maintaining a net cash credit balance equivalent to USD 5,000 comprised of a long USD balance of 8,000 and a short EUR balance equivalent to USD 3,000 would be subject to an interest debit based upon the short EUR balance. There would be no offsetting credit on the long USD balance as it is less than the USD 10,000 Tier I level above which interest is earned.

Account holders should note that in the event they purchase a security which is denominated in a currency that they do not hold in their account, IBKR will create a loan in that currency in order to settle the trade with the clearinghouse. If one wishes to avoid such loans and their associated interest charges, they would need to either deposit funds denominated in that particular currency or convert existing cash balances via the Ideal Pro (for balances of USD 25,000 or above) or odd lot (for balances less than USD 25,000) venue prior to entering into your trade.

2. The credit balance is comprised principally of proceeds from the short sale of securities.

For example, an account maintaining a net cash credit balance of USD 12,000 which is comprised of a USD debit of 6,000 in the security sub-account (less the market value of any short stock positions) and a short stock market value credit of USD 18,000 would be charged interest on the Tier 1 debit of USD 6,000 and would earn no interest on the short stock credit as it falls below the USD 100,000 Tier I level.

3. The credit balance includes unsettled funds.

IBKR determines interest debits and credits solely based upon settled funds. Just as an account holder is not assessed interest charges on funds borrowed to purchase a security until such time that purchase transaction settles, the account holder will not receive an interest credit, or offset against a debit balance, on funds originating from the sale of a security until such time the transaction has settled (and IBKR has been credited funds by the clearinghouse).