Resumen del sistema de conexión segura

Tabla de contenidos

- Beneficios de registrarse

- Cómo registrarse

- Dispositivo perdido, dañado o temporalmente no disponible

- Tipos de dispositivos

- Límites de retirada

La seguridad de sus activos y su información personal es de la mayor importancia para nosotros y damos todos los pasos necesarios para asegurar la protección de su cuenta desde el momento en que la abre.

Beneficios de registrarse

- Mayores umbrales de retiradas tanto únicas como para periodos de cinco días.

- Posibilidad de cambiar sus instrucciones bancarias y dirección de correo electrónico sin necesidad de contactar con un miembro de nuestro equipo de seguridad.

- Posibilidad de efectuar transacciones de depósitos de fondos ACH y EFT por encima de los 20 000 USD iniciales de transacción de financiación

- La posibilidad de compartir un solo dispositivo entre varios nombres de usuario registrados con la misma persona.

Cómo registrarse

Dispositivo perdido, dañado o temporalmente no disponible

Tipos de dispositivos

- SMS: una manera fácil y rápida de completar la autenticación en dos factores mediante mensajes de texto (SMS) enviados a su número de móvil.

- IBKR Mobile: una aplicación móvil todo en uno que ofrece una solución digital conveniente para sus necesidades de autenticación en dos factores. El módulo de la autenticación a través de IBKR Mobile (IB Key) que se encuentra dentro de la aplicación es compatible con el reconocimiento dactilar/facial y la configuración del PIN1 y está disponible para móviles Android y iPhone.

- Digital Security Card+: para cuentas con un patrimonio de 1 millón USD o su equivalente. Tiene el mismo tamaño y la misma forma de una tarjeta de crédito, y es electrónica. Le exige al usuario ingresar el código PIN como una capa adicional de protección.

Nota:

Los usuarios de iPhone deberán tener Touch ID, Face ID o clave de acceso habilitados para (consultar: Configurar reconocimiento de huella (Touch ID) o Configurar reconocimiento facial (Face ID) para obtener instrucciones). Se recomienda Touch ID o Face ID. El PIN/la clave de acceso admite hasta 12 horas de acceso a la negociación, mientras que el reconocimiento de huella/facial le ofrece hasta más de 30 horas mientras realice la autenticación al menos una vez durante este periodo. Consulte nuestra guía de usuario para obtener más información sobre el acceso prolongado a la negociación.

Límites de retirada

Los clientes que participen en el Sistema de Acceso Seguro podrán disfrutar de mejores opciones de retirada de fondos, mientras que los clientes que no participen están sujetos a restricciones de retiradas diarias y semanales. La cantidad que un cliente participante pueda retirar o transferir en un periodo dado de uno o cinco días aumenta proporcionalmente con el valor de protección del dispositivo y se indica en la tabla siguiente.

| Dispositivo de seguridad | Retirada máxima por día | Retirada máxima en 5 días laborables |

|---|---|---|

| No | 50000 USD | 100000 USD |

| SMS | 200000 USD | 600000 USD |

| Autenticación a través de IBKR Mobile (IB Key) | 1 millón USD | 1 millón USD |

| Tarjeta de código de seguridad* | 200000 USD | 600000 USD |

| Tarjeta de seguridad digital* | 1 millón USD | 1.5 millones USD |

| Tarjeta de seguridad digital+ | Sin límite | Sin límite |

| Platino*/Oro* | Sin límite | Sin límite |

Información adicional

Informes de control y propiedad de CFTC

La Commodities Futures Trading Commission (CFTC) ha mantenido históricamente una normativa que requiere que los FCM informen sobre las posiciones mantenidas por sus clientes que sean iguale so que excedan los umbrales definidos (por ej. informes de Grandes Operadores). En noviembre de 2013, la CFTC adoptó una nueva normativa que amplía las normas anteriores sobre informes y que requiere la recopilación y creación de informes con información más completa sobre los propietarios y controladores de cuentas de negociación de productos de futuros sobre materias primas estadounidenses. Esta nueva normativa se llama Informes de control y propiedad (Ownership and Control Reporting - OCR) y a continuación se indican una serie de preguntas frecuentes en relación con esta norma.

Para cumplir con el requisito de que se informe a la CFTC sobre cualquier cuenta que alcance los umbrales de volumen o posiciones antes de las 09:00, hora de Nueva York, al día siguiente del día en que la cuenta se convierte en informable, IB requiere que todas las cuentas que operen en productos de futuros sobre materias primas estadounidenses proporcionen la información solicitada.

Se requiere la siguiente información de todos los propietarios y controladores de una cuenta:

• Nombre

• Dirección postal

• Dirección de correo electrónico

• Número de teléfono directo, incluido el código del país

• Identificador de entidad jurídica (LEI), si aplica.

• Detalles de persona de contacto:

o Nombre

o Título laboral

o Relación con la entidad legal

o Número de teléfono directo, incluido código de país

• Relación de la persona física con el propietario de cuenta

• Título laboral de la persona física

• Nombre del empleador de la persona física

• Identificador de entidad jurídica (LEI) del empleador, si aplica.

Un "propietario de cuenta" incluye a cualquier persona física o jurídica que mantenga un interés propietario directo en la cuenta de negociación.

4. ¿Quién es un "controlador de cuenta" desde el punto de vista de OCR?

La CFTC define a un “controlador de cuenta” como “una persona natural con poder notarial o similar que dirige la negociación de una cuenta. Una cuenta de negociación puede tener más de un controlador.”

Esta definición puede encontrarse en 17 C.F.R. § 15.00(bb) (versión en inglés).

Un número que la asociación de futuros nacional (National Futures Organization - NFA) asigna a cada miembro registrado (por ejemplo, empresas y personas físicas tales como asesores de negociación de materias primas u operadores de consorcios de materias primas). La NFA mantiene un sistema de registro en línea (Online Registration System - ORS) a través del cual se proporcionan el registro y la asignación de ID. Puede consultar la página www.nfa.futures.org

Puede pedirle a su empleador que le proporcione esta información o puede buscar en alguna de las siguientes páginas web:

La normativa federal estadounidense requiere que todos los FCM, incluido IB, obtengan esta información de sus clientes. Este requisito es universal y se aplica a cualquier persona física o jurídica, sin importar su bróker.

Sí, si desea operar en productos de futuros sobre materias primas estadounidenses, debemos recopilar esta información sobre usted.

Estos datos se mantendrán de forma confidencial de acuerdo con la declaración de privacidad del Interactive Brokers Group. Consulte el enlace para más detalles: https://individuals.interactivebrokers.com/en/index.php?f=ibgStrength&p=priv

El texto completo de este cambio de normativa está disponible en la página web de la CFTC:

CFTC Ownership and Control Reporting

The Commodities Futures Trading Commission (CFTC) has historically maintained rules which require FCMs to report information relating to clients holding positions equal to or exceeding defined thresholds (e.g., Large Trader Reporting). In November 2013, the CFTC adopted a new rule which expands the prior reporting rules and which requires the collection and reporting of more comprehensive information on owners and controllers of accounts trading U.S. commodity futures products. This new rule is referred to as Ownership and Control Reporting (OCR) and outlined below are a series of FAQs relating to this rule.

In order to comply with the requirement that any account meeting the position or volume thresholds be reported to the CFTC by 09:00 ET on the day following the day in which the account becomes reportable, IB requires that all accounts trading U.S. commodity futures products provide the requested information.

The following information is required of all Owners and Controllers of an account:

• Name

• Street Address

• Email Address

• Direct Phone Number, Including Country Code

• Legal Entity Identifier (LEI), If Applicable

• Contact Person Details:

o Name

o Job Title

o Relationship to Legal Entity

o Direct Phone Number, Including Country Code

• Individual’s Relationship to Account Owner

• Individual’s Job Title

• Name of Individual’s Employer

• Employer’s Legal Entity Identifier (LEI), If Applicable

An "Account Owner" includes any individual or legal entity who holds a direct ownership interest in the trading account.

4. Who is an "Account Controller" for the purposes of OCR?

The CFTC defines an “Account Controller” as “a natural person who by power of attorney or otherwise actually directs the trading of an account. A trading account may have more than one controller.”

This definition can be found at 17 C.F.R. § 15.00(bb).

A number which the National Futures Organization assigns to each registrant (e.g., firms and individuals such as Commodity Trading Advisors and Commodity Pool Operators). The NFA maintains an Online Registration System (ORS) through which registration and assignment of the ID is provided. See www.nfa.futures.org

You may ask your employer to provide you with this information or search one of the following websies:

U.S. federal regulations require all FCMs, including IB, to obtain this information from its clients. The requirement is universal and applies to any individual or entity regardless of their broker.

Yes, if you wish to trade U.S. commodity futures products, we must collect this information from you.

This data will be kept confidential in accordance with the Interactive Brokers Group Privacy Statement. See link for details: https://individuals.interactivebrokers.com/en/index.php?f=ibgStrength&p=priv

The full text of this rule change is available on the CFTC website

Hong Kong - China Stock Connect

Hong Kong – China Stock Connect (“China Connect”) is a mutual market access program through which Hong Kong and international investors can trade shares listed on the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) via the Stock Exchange of Hong Kong (SEHK) and their existing clearinghouse. As a member of SEHK, IBKR provides you with direct access to trade with eligible listed products on the Shanghai and Shenzhen Stock Exchange. IBKR clients with China Connect trading permissions will be eligible to trade SSE/SZSE securities through Shanghai and Shenzhen - Stock Connect.

Among the different types of SSE/SZSE-listed securities, only A shares (shares in mainland China-based companies that trade on Chinese stock exchange) are included in the Shanghai and Shenzhen Stock Connect.

Shanghai Connect includes all the constituent stocks of the SSE 180 Index, SSE 380 Index and all the SSE-listed A shares that have corresponding H shares listed on the SEHK.

Product List and Stock Codes for SSE

Shenzhen Connect includes all the constituent stocks of the SZSE Component Index, the SZSE Small/Mid Cap Innovation Index that have a market capitalization of not less than RMB 6 billion and all the SZSE-listed A shares that have corresponding H shares listed on SEHK.

Product List and Stock Codes for SZSE

IBKR Commission for Trading SSE/SZSE Securities

Same as trading Hong Kong stocks, IBKR charges only 0.08% of trade value as a commission with a minimum CNH 15 per order. Detailed fee rates can be found in the Hong Kong – China Stock Connect Northbound fee table.

Daily Quota

Trading under Shanghai Connect and Shenzhen Connect is subject to a Daily Quota. The Daily Quota is applied on a “net buy” basis. The Daily Quota limits the maximum net buy value of cross-boundary trades under Shanghai Connect and Shenzhen Connect each day.

If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected. Or if it happens during a continuous auction session or closing call auction session, no further buy orders will be accepted for the remainder of the day. SEHK will resume the Northbound buying service on the following trading day.

SEHK will also publish the remaining balance of the Aggregate Quota and Daily Quota.

For details, please refer to HKEX Stock Connect FAQ or HKEX Stock Connect Rule 1407

Trading Information of Shanghai and Shenzhen Connect

|

Trading currency |

RMB |

|

Order Type |

IBKR offers various order types but will stimulate the order into limit order for execution. More information can be referred to our website.

|

|

Tick Size / Spread |

Uniform at RMB 0.01 |

|

Board Lot |

100 shares (applicable for buyers only) |

|

Odd Lot |

Sell orders only (odd lot should be made in one single order) |

|

Max Order Size |

1 million shares |

|

Price Limit |

±10% on previous closing price (±5% for stocks under special treatment under risk alert, i.e. ST and *ST stocks) |

|

Day (Turnaround) Trading |

Not allowed |

|

Block Trade |

Not available |

|

Manual Trade |

Not available |

|

Order Modification |

IBKR will cancel and replace the order for any order modification |

|

Settlement cycle |

Securities: Settlement on T day Cash from China Connect trades: Settlement on T+1 day Forex*: Settlement on T+2 day |

*Due to the unsynchronized settlement cycle, clients who exchange CNH themselves should execute the Forex trade one day prior to the stock trade (T-1) to avoid the extra day’s interest payment (considering normal settlement without involving holidays).

Trading Hours

|

SSE/SZSE Trading Sessions |

SSE/SZSE Trading Hours |

|

Opening Call Auction |

09:15 - 09:25 |

|

Continuous Auction (Morning) |

09:30 – 11:30 |

|

Continuous Auction (Afternoon) |

13:00 – 14:57 |

|

Closing Call Auction |

14:57 – 15:00 |

Half-day Trading

If a Northbound trading day is a half-trading day in the Hong Kong market, it will continue until respective Connect Market is closed. Refer to the exchange website for holiday trading arrangements and additional information.

Disclosure Obligation

If client holds or controls up to 5% of the issued shares of China Connect, the client is required to report in writing to the China Securities Regulatory Commission (“CSRC”) and the relevant exchange, and inform the Mainland listed company within three working days of reaching 5%.

The client is not allowed to continue purchasing or selling shares in that Mainland listed company during the three days notification period. Visit the IBKR Knowledge Base for more information.

Shareholding Restriction

A single foreign investor’s shareholding in a Mainland listed company is not allowed to exceed 10% of the company’s total issued shares, while all foreign investors’ shareholding in the A shares of the listed company is not allowed to exceed 30% of its total issued shares. Visit the IBKR Knowledge Base for more information.

Forced-sale Arrangement

Each IBKR client is not allowed to hold more than a specific percentage of the China Connect listing company's total issued shares. HKEX requires the client to follow the forced-sell requirements if the shares exceed the limit:

|

Situation |

Shareholding (in a listed company) |

|

A single foreign investor |

> = 10% of the company’s total issued shares |

|

All foreign investors |

> = 30% of the company’s total issued shares |

Margin Financing

Margin trading in China Connect securities will subject to restrictions and only certain A shares will be eligible for margin trading. Eligible Securities, as determined by SSE and SZSE from time to time, are listed on the HKEX website.

According to the relevant rules of SSE and SZSE, either market may suspend margin trading activities in specific A shares when the volume of margin trading activities for a specific A share exceeds the prescribed threshold. The market will resume margin trading activities in the affected A share when its volume drops below a prescribed threshold.

Stock Borrowing and Lending (SBL)

SBL in China Stock Connect Securities is subject to restrictions set by the SSE or SZSE and stated in the Rules of the Exchange.

IBHK does not offer this service at the moment.

Eligible Short Selling Securities

SBL for the purpose of short selling will be limited to those China Stock Connect Securities that are eligible for both buy orders and sell orders through Shanghai and Shenzhen Connect (i.e., excluding Connect Securities that are only eligible for sell orders).

IBHK does not offer this service at the moment.

Trading Shenzhen ChiNext and Shanghai Star shares

Trading Shenzhen ChiNext and Shanghai Star shares are limited to institutional professional investors.

Holidays

Clients will only be allowed to trade China Connect on days where Hong Kong and Mainland markets are both open for trading and banking services are available in both Hong Kong and Mainland markets on the corresponding settlement days. This arrangement is essential in ensuring that investors and brokers will have the necessary banking support on the relevant settlement days when they will be required to make payments.

The following table illustrates the holiday arrangement of Northbound trading of SSE/SZSE Securities:

|

|

Mainland |

Hong Kong |

Open for Northbound Trading |

|

Day 1 |

Business Day |

Business Day |

Yes |

|

Day 2 |

Business Day |

Business Day |

No, HK market closes on money settlement day |

|

Day 3 |

Business Day |

Public Holiday |

No, HK market closes on trading day |

|

Day 4 |

Public Holiday |

Business Day |

No, Mainland market closes |

Severe Weather Conditions

Information on the trading arrangement available under severe weather conditions can found on the HKEx website.

Where to Learn More?

Please refer to the following exchange website links for additional information regarding Hong Kong China Stock Connect:

If you have any questions regarding Hong Kong-China Stock Connect, please contact IBKR Client Services for further information.

Foreign Acount Tax Compliance Act (FATCA)

What is FATCA?

The Foreign Account Tax Compliance Act (FATCA) represents the United States efforts to combat tax evasion and abuse by US persons holding investments outside of the United States. The Act establishes a new set of tax information reporting and withholding procedures. While not expressly aimed at non-US persons, the regulations do impose withholding taxes on certain non-US entities that decline to disclose their US investors or account holders.

Under FATCA, US persons must report to the US tax authority, Internal Revenue Service (IRS), their assets held in offshore accounts. In addition, the regulations seek to require non-US financial institutions to report to the US tax authority certain information about financial accounts of US or US-owned investors and account holders.

How does this impact US Brokers, including Interactive Brokers?

As a broker based in the United States, Interactive Brokers is required to report information and make payment of withholding taxes to the IRS, for all of our customers. FATCA simply creates additional practices and withholdings to the current requirements for all US brokers.

Interactive Brokers will comply with the new rules. This may require additional disclosures by investors during the account application process, as well as expanded tax reporting. For all US institutions, FATCA becomes effective January 1, 2013. Any FATCA tax withholding requirements begin on January 1, 2014.

Additional aspects of the regulations will be phased-in over the next few years, including an expansion of US brokers reporting on US source income to non-US accounts through Form 1042-S.

What action is required for US persons?

No additional action is required for US persons holding Interactive Brokers accounts. US persons, who include US citizens, Green Card holders and other legal residents, need only to complete Form W-9 during the account application process to certify their tax status.

Does FATCA affect non-US accounts?

Yes. FATCA requires foreign financial institutions (FFIs) to furnish certain data directly to the IRS about any of their US taxpayer accounts or foreign entity accounts in which US taxpayers hold a certain level of ownership. FFI compliance with the new regulations becomes effective July 1, 2013 with the submission of electronic FFI applications to the IRS. The application forms are scheduled to be available through the IRS in January 2013.

All non-US persons and entities applying for and maintaining Interactive Broker accounts will continue to be required to fully disclose and indentify the identity of their account's beneficial owner(s). Through the IRS Form W-8, our account holders certify the beneficial owner's country of tax residence. If you fail to provide a Form W-8, or do not resubmit a new W-8 when prompted upon the three-year expiration, additional withholding will apply.

Some entities not ordinarily considered to be financial institutions may be categorized under FATCA as an FFI. Therefore, it is important to review the details outlined by the IRS.

Is there a summary of FFI requirements?

While the regulations and compliance are far more complex than a brief FAQ can describe, the following offers a short summary of actions required by those defined foreign financial institutions.

- Identify US taxpayers. If US taxpayers refuse to waive your non-US country's privacy or secrecy rules, then the US taxpayer account must be closed.

- Report to the IRS on the related US taxpayer activity within defined financial accounts.

- Withhold 30% US tax on US source income against any US taxpayer or foreign entity failing to disclose information or comply with the FATCA regulations.

Additional Information & Resources

The IRS remains the most comprehensive and up-to-date resource about FATCA compliance, implementation, and document filing. The IRS continues to issue news releases and forms. Please feel free to visit the IRS FATCA Website for details.

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

IRA: Retirement Account Resource Center

IMPORTANT NOTE: This article has been customized for use by self-directed Individual Retirement Account (IRA) owners for information purposes only. Persons are encouraged to consult a qualified tax professional with the investments and elections within the IRA. IB does not provide tax advice. For detailed information regarding IRAs, you may consult the IRS Publication 590-A about IRA contributions and the IRS Publication 590-B about IRA distributions.

This resource center provides a central reference point for information concerning the various IRA account types offered by IB.

Important Notice - Select IRA Tax Reporting for key information with transaction and tax reporting in your IRA.

Account Management IRA Reference

Beneficiary Options

Recharacterizations from a Roth IRA

Required Minimum Distributions

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

How to send documents to IBKR using your smartphone

Interactive Brokers allows you to send us a copy of a document even if you do not currently have access to a scanner. You can take a picture of the requested document with your smartphone.

Below you will find the instructions on how to take a picture and send it per email to Interactive Brokers with the following smartphone operating systems:

If you already know how to take and send pictures per email using your smartphone, please click HERE - Where to send the email to and what to include in the subject.

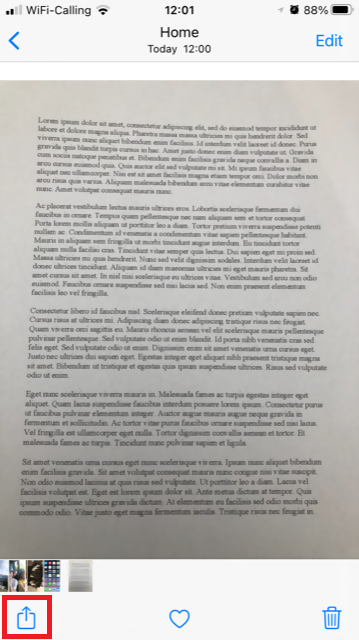

iOS

1. Swipe up from the bottom of your smartphone screen and tap the camera icon.

If you do not have the Camera icon, you can tap the Camera app icon from the home screen of your iPhone.

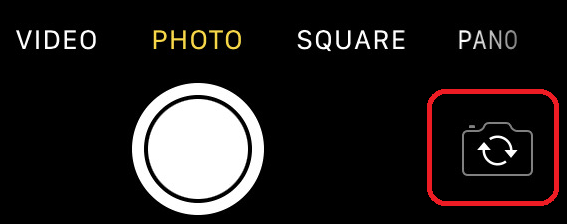

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

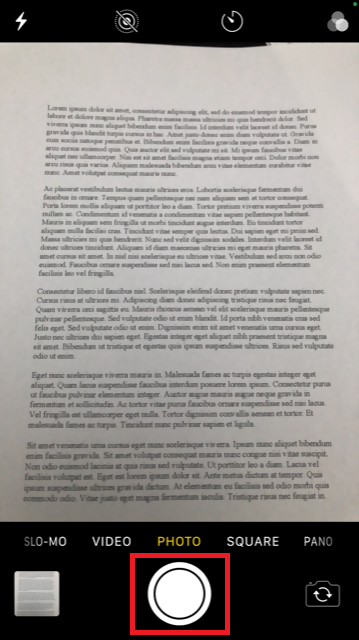

2. Place your iPhone above the document and frame the desired portion or page of the document.

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

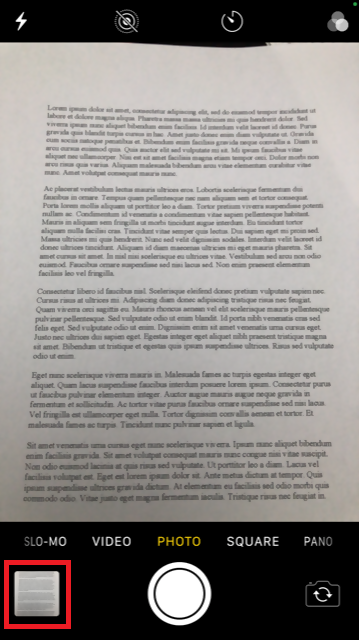

4. Tap the thumbnail image in the lower left-hand corner to access the picture you have just taken.

5. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

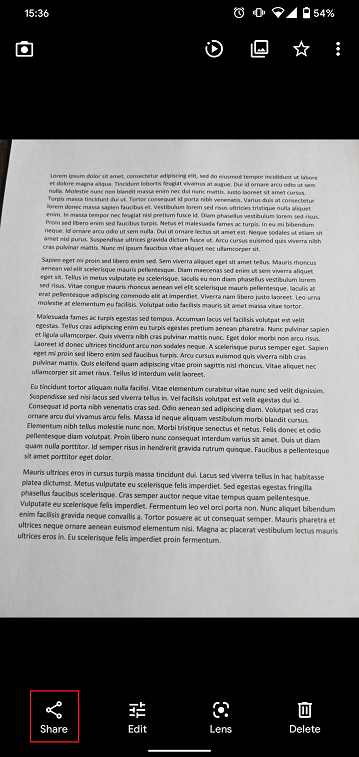

6. Tap the share icon in the lower left-hand corner of the screen.

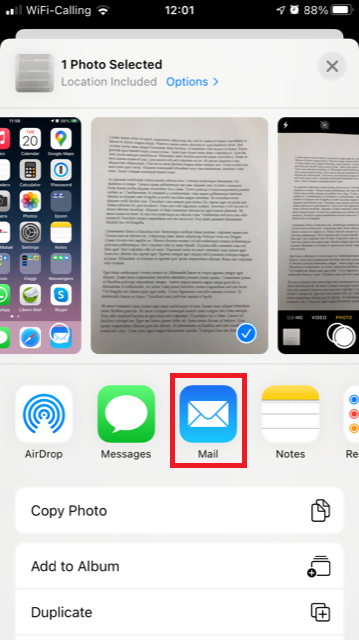

7. Tap the Mail icon.

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

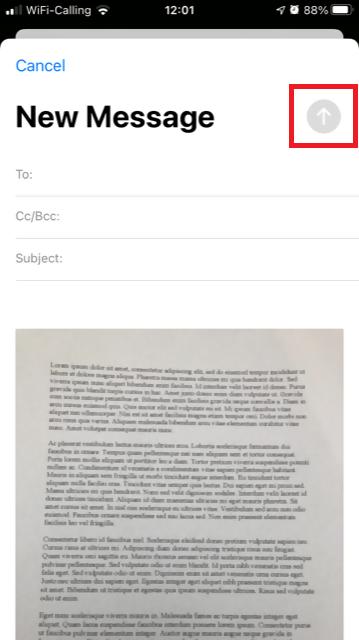

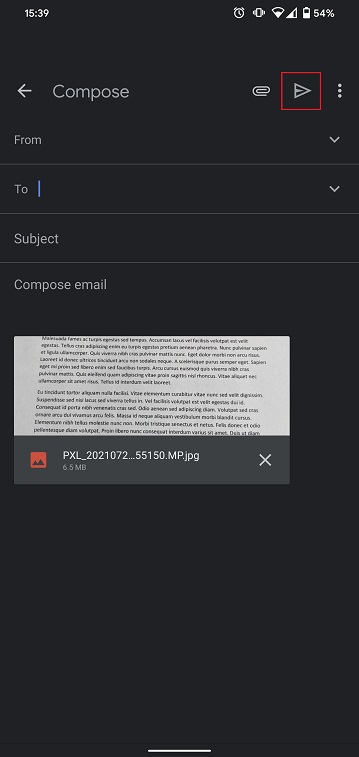

8. Please see HERE how to populate the To: and Subject: fields of your email. Once the email is ready, tap the up arrow icon on the top right to send it.

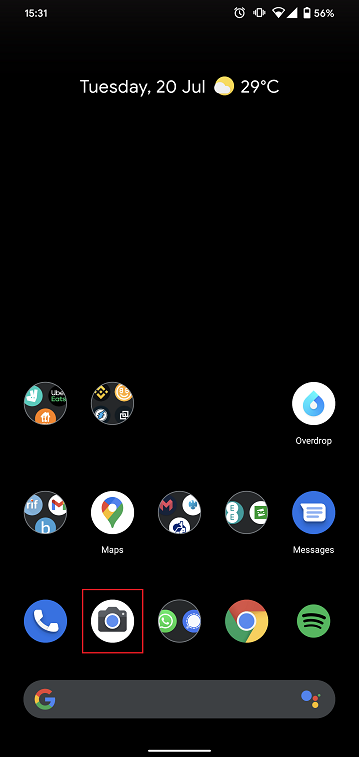

Android

1. Open your applications list and start the Camera app. Alternatively start it from your Home screen. Depending on your phone model, maker or setup, the app might be called differently.

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

2. Place your Android above the document and frame the desired portion or page of the document.

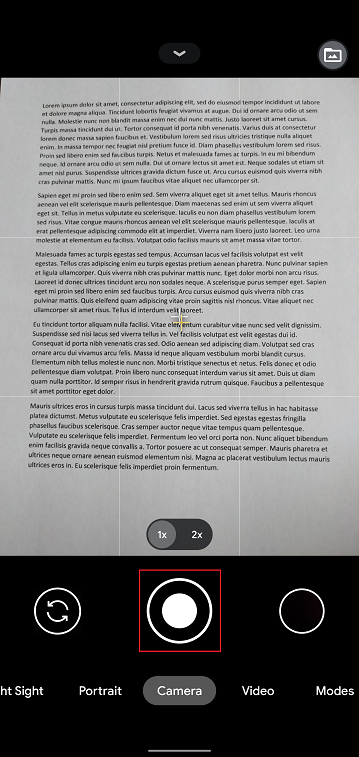

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

4. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

5. Tap the empty circle icon in the lower right-hand corner of the screen.

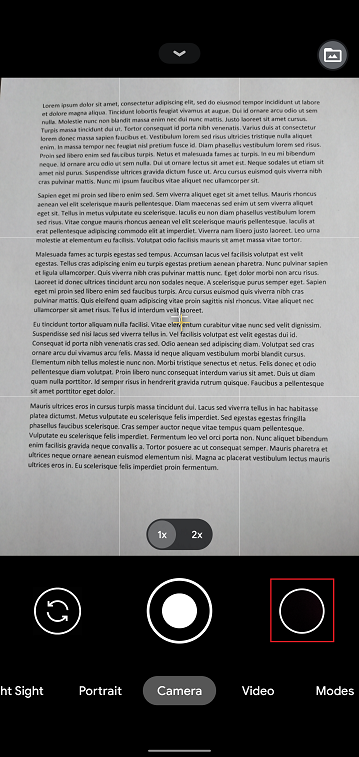

6. Tap the share icon in the lower left-hand corner of the screen.

7. In the sharing menu that will be displayed now tap the icon of the email client set up on your phone. In the example picture below, it is called Gmail but the name may vary according to your specific setup.

.png)

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

8. Please see HERE how to populate the To and Subject fields of your email. Once the email is ready, tap the airplane icon on the top right to send it.

WHERE TO SEND THE EMAIL AND WHAT TO INCLUDE IN THE SUBJECT

The email has to be created observing the below instructions:

1. In the field To: type:

- newaccounts@interactivebrokers.com if you are a resident of a non-European country

- newaccounts.uk@interactivebrokers.co.uk if you are a European resident

2. The Subject: field must contain all of the below:

- Your account number (it usually has the format Uxxxxxxx, where x are numbers) or your username

- The purpose of sending the document. Please use the below convention:

- PoRes for a proof of residential address

- PID for a proof of identity

Change Your Billable Account

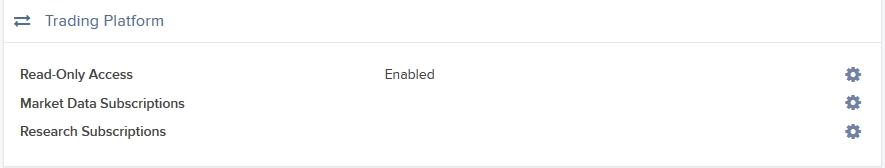

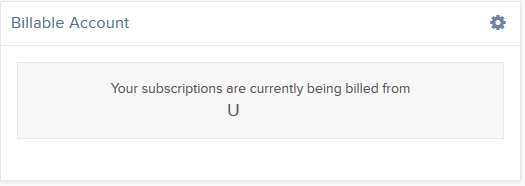

If you have additional linked, duplicate or consolidated accounts, the Billable Account section appears on the Market Data Subscriptions screen. Use the Billable Accounts panel to change the account that is currently being billed for market data.

To change your billable account

1. Click Settings > User Settings

2. In the Trading Platform panel, click the Configure (gear) icon for Market Data Subscriptions.

The Market Data Subscription screen opens.

3. Click the Configure (gear) icon in the Billable Account panel.

4. Select the account you want to be billed for market data, then click Save.

Beginning with the next billing cycle, your market data subscriptions will be billed to the account you selected.

Cost Basis Reporting

1099 Reporting

Statement and Year End Reporting for US persons and entities comprises the following:

1. Cost Basis: While the required reporting schedule was staggered, the primary cost basis that will be reported to the IRS includes equities bought and sold after December 31, 2010. This includes the adjusted cost basis resulting from wash sales and corporate actions.

The future phase-in period for broker reporting includes the assets sold on or after the following dates:

--- Mutual Funds and ETFS - 1/1/2012

--- Simple debt instruments (i.e. treasuries, fixed-rate bonds & municipal bonds) and options, - 1/1/2014

--- Other debt instruments - 1/1/2016

2. Tax Basis Method: Brokers are required to use the method first in, first out (FIFO), unless given other instructions by an investor. Changes to your tax basis method may be submitted through the Tax Optimizer. The Tax Optimizer is launched from within Account Management and is available for stock, option, bond, warrant and single-stock future trades.

IB offers multiple tax basis methods, including three basic options:

● First In, First Out (FIFO) - This is the default option. FIFO assumes that the oldest security in inventory is matched to the most recently sold security.

● Last In, First Out (LIFO) - LIFO assumes that the newest security acquired is sold first.

● Specific Lot - Lets you see all of your tax lots and closing trades, then manually match lots to trades. Specific Lot is not available as the Account Default Match Method.

Tax Optimizer also lets you select the following additional derivatives of the specific identification method.

● Highest Cost (HC), Maximize Long-Term Gain (MLTG), Maximize Long-Term Loss (MLTG), Maximize Short-Term Gain (MSTG), and Maximize Short-Term Loss(MSTL).

For complete instructions on using the Tax Optimizer and details on the lot-matching algorithms for each method, see the Tax Optimizer Users Guide.

Note: Changing your tax basis is effective immediately. The basis selected will be applied to all subsequent trades on the account statements and tax reports. Updates will not affect previously closed trades nor the TWS profit and loss data displayed.

3. Gain & Loss Categories: An additional requirement to the cost basis reporting is the capital gain or loss category. The gain or loss category of equities is determined by the length of time in which the security was held, known as the "holding period."

● Short-Term - Holding periods of one year or less are categorized as "short-term."

● Long-Term - Holding periods over one year are categorized as "long-term."

Year End Reports

The following statements and reports display cost basis information that will be reported on Form 1099-B for eligible accounts.

- Monthly Account Statements

- Annual Account Statements

- Worksheet for Form 8949

For a complete review of the tax information and year end reporting available, click here.

Note: Unlike the Account Statements, the Gain & Loss Worksheet for Form 8949 may consolidate sell trades. The cost basis will be adjusted, as required for 1099-B reporting.

Asset Transfers

U.S. legislation from 2008 included new guidelines for tax reporting by U.S. financial institutions. Effective January 2011, U.S. Brokers are required to report cost basis on sold assets, whether or not a gain/loss is short-term (held one year or less) or long-term (held more than one year). U.S. brokerage firms, Interactive Brokers LLC (IB) included, implemented changes to comply with the legislation.

For more information on cost basis with asset transfers, see Cost Basis & Asset Transfers.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

ACATS Transfer Guide (US brokerage account transfers)

ACATS Transfer Guide

Introduction

Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Through this article and other Knowledge Database resources, Interactive Brokers seeks to assist with your incoming and outgoing ACATS requests.

US brokerage firms utilize a standardized system to transfer customer accounts from one firm to another. Known as the Automated Customer Account Transfer Service or ACATS, the process allows assets to move seamlessly between brokerage firms in a unified time frame. ACATS transfers are facilitated by a third party, the National Securities Clearing Corporation (NSCC), to assist participating members with timely asset transfers.

ACATS Transfer Benefits

The majority of assets may be transferred between US brokerage firms and some banks through ACATS. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. Information on assets eligible for transfer is provided at "Assets Eligible..." Though impacted by multiple factors and time constraints, the accepted or rejected transfers finalize within 10 business days in most cases.

Navigating The Process

4 simple steps of the ACATS process will help you understand the flow and minimize delays. Familiarizing yourself with the transfer process helps to ensure a successful transition.

1. Incoming or Outgoing

Incoming ACATS Transfers

The financial institution that is receiving your assets and account transfer is known as the "receiving firm." Investors always work with and through the "receiving firm" to move full or partial account assets into a new broker.

Contact the "receiving firm" (Interactive Brokers) to review the firm's trading policies and requirements. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Not all ACATS transferable assets are acceptable for trading at every brokerage firm.

Outgoing ACATS Transfers

All outgoing ACATS transfers, full or partial, must be approved by the "delivering firm." Investors, however, should work with and through the "receiving firm" in order to begin the the transfer process or to status the progress of the request.

2. Initiating Your Transfer

Investors must always begin the ACATS transfer with the "receiving firm." An ACATS transfer form or Transfer Initiation Form (TIF) must be submitted. The "receiving firm" takes your reqeust and communicates with the "delivering firm" via ACATS. The process begins with this request for transfer of the account.

For your Interactive Brokers Account, the transfer is usually submitted online. Video instruction on submitting the transfer is provided at "How to deposit funds via a full ACATS/ATON Transfer." or through Step-by-step instructions.

Note: Outgoing account transfers from your IB account should be directed to the other broker. Your request will be submitted to IB from the other broker through the ACATS electronically.

3. What to Expect

Your Account

Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:

- Same Account Title

- Same Tax ID Number

- Same Account Type

Transfer Approval

Ultimately responsible for validating the transfer, the "delivering firm" may accept information from the "receiving firm" correcting data originally entered. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. Assets may not be accepted by the "receiving firm" for the following:

- Non-marginable or Margin (credit) violation

- Not Tradable

- DTC Chill

Note: The most common reasons for ACATS rejections are outlined by clicking here.

Processing Time-frame

The processing time for each transfer request is fixed. In general, approved transfers complete within 4 to 8 business days. Almost all transfers complete within 10 business days. Each firm is required to perform certain steps at specific intervals in the process. Feel free to review the Full ACATS transfer process flow.

Fees

While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge.

4. Who To Contact For Help

Interactive Brokers Customer Service stands poised to assist with your incoming ACATS transfer reqeust. Click here for Customer Service contact resources.

Note: Outgoing or ACATS transfers sending accounts to another broker should be directed to the "receiving firm." Their Account Transfer Group will work with Interactive Brokers directly to complete your outgoing request.