Cómo modificar el número de cuenta para una transferencia ACAT o ATON pendiente

Para garantizar que su transferencia ACAT o ATON se realice correctamente, su bróker debe validar el número de cuenta proporcionado en la solicitud. Si su número de cuenta no es válido, su bróker rechazará la solicitud. Con el fin de evitar dichos rechazos, IBKR puede retrasar la transmisión de su solicitud ACATS/ATON en caso de que el número de cuenta que ha proporcionado no coincida con el patrón alfanumérico que utiliza el bróker seleccionado. IBKR le enviará una notificación para que revise y corrija su número de cuenta.

Los pasos que debe seguir para actualizar el número de cuenta se especifican a continuación.

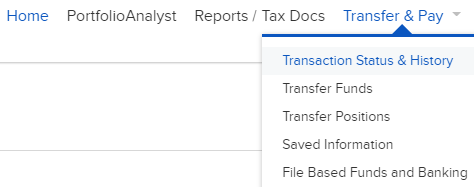

- En Client Portal, desde el menú "Transferencias y pagos", seleccione "Estado e historial de transacciones".

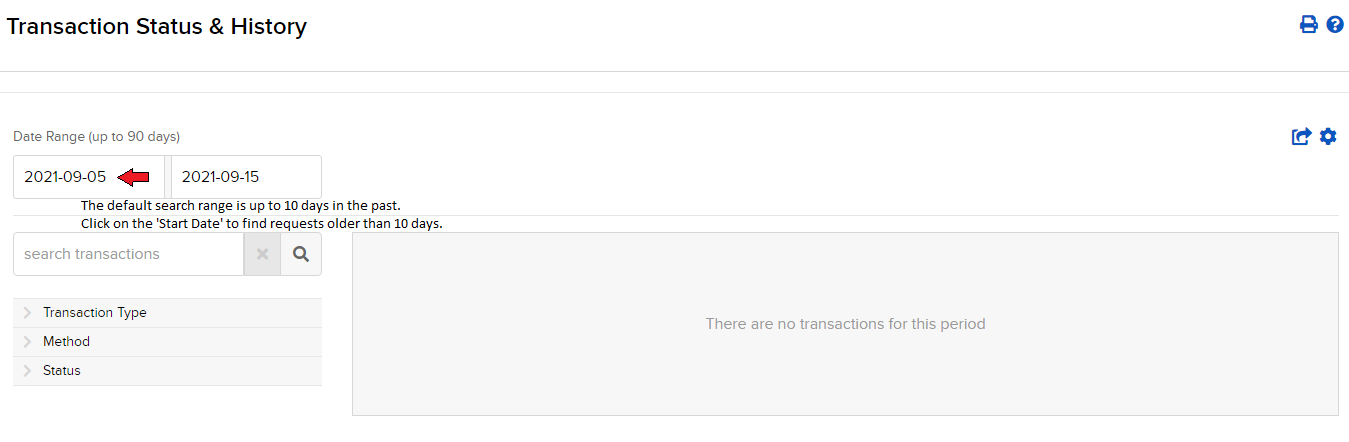

- Busque la solicitud de transferencia que se encuentra en estado pendiente y haga clic en ella. El rango de búsqueda predeterminado abarca los últimos 10 días; actualice la fecha de inicio según sea necesario.

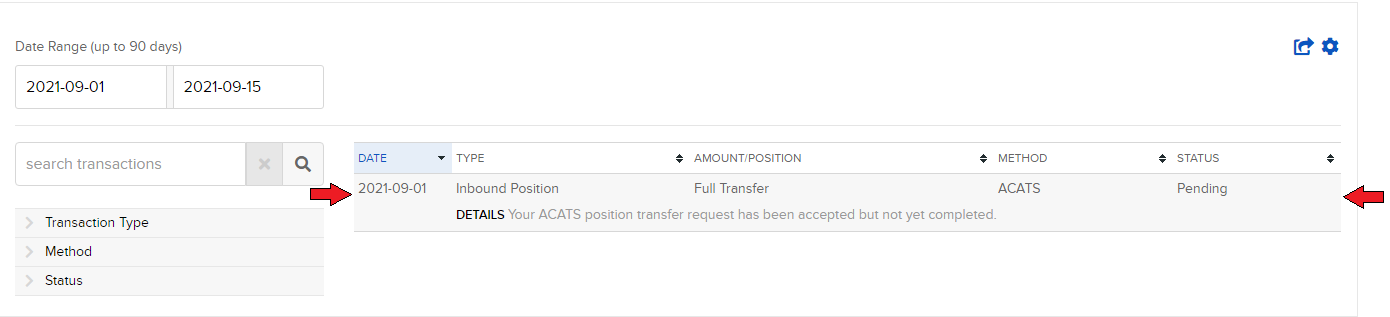

- Se abrirá una ventana emergente con un resumen de los detalles de la solicitud pendiente. En la parte inferior derecha de la ventana emergente seleccione el botón "Modificar".

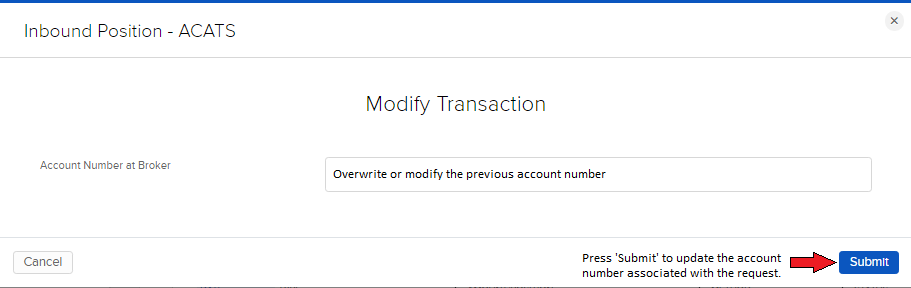

- Se abrirá otra ventana emergente en la que se muestra el número de cuenta actual asociado con la solicitud. Modifique el número de cuenta según corresponda.

- A continuación, seleccione "Enviar".

- La ventana emergente con el resumen de los detalles se mostrará nuevamente y podrá ver el valor actualizado para el "Número de cuenta en el bróker".

- Puede cerrar esta ventana si hace clic en la "x" en la esquina superior derecha.

Si actualiza con un número de cuenta válido se iniciará la transmisión de su solicitud al bróker encargado de la entrega. Si actualiza con un número de cuenta incorrecto no se realizará la transmisión y recibirá otra alerta por correo electrónico al día siguiente en la que se le requerirá que actualice nuevamente el número de cuenta.

Si considera que la solicitud está siendo retenida para su revisión incorrectamente, cree un tique en el sitio web para someterlo a una revisión más exhaustiva por parte de Interactive Brokers.

Dónde encontrar su número de cuenta para transferencias ACAT

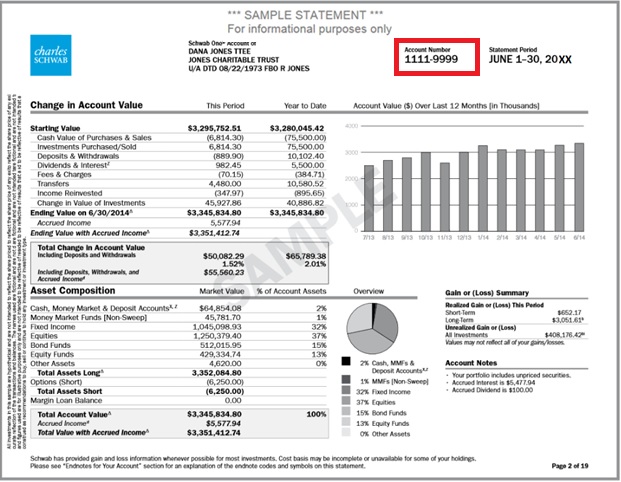

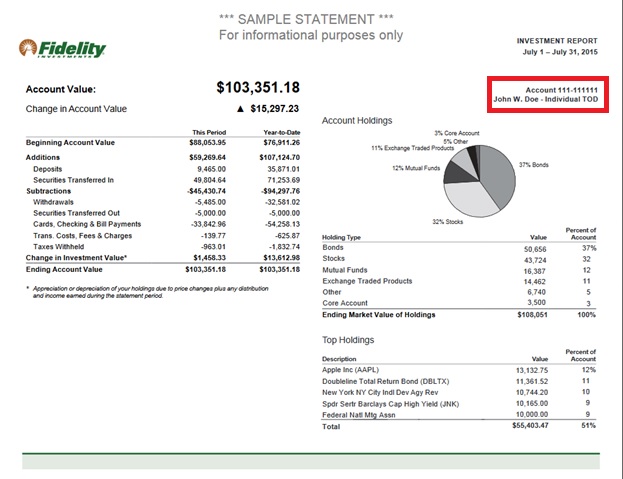

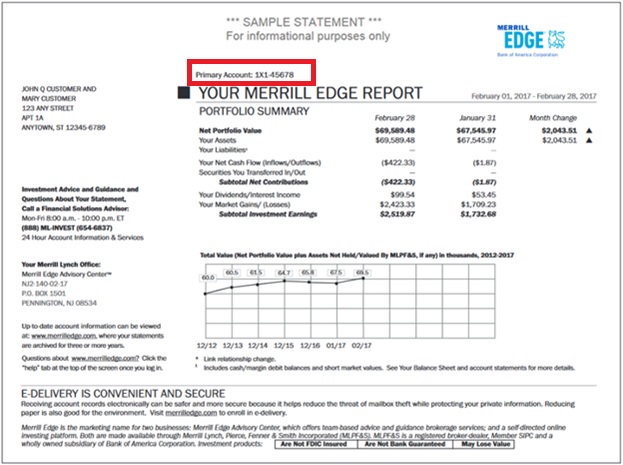

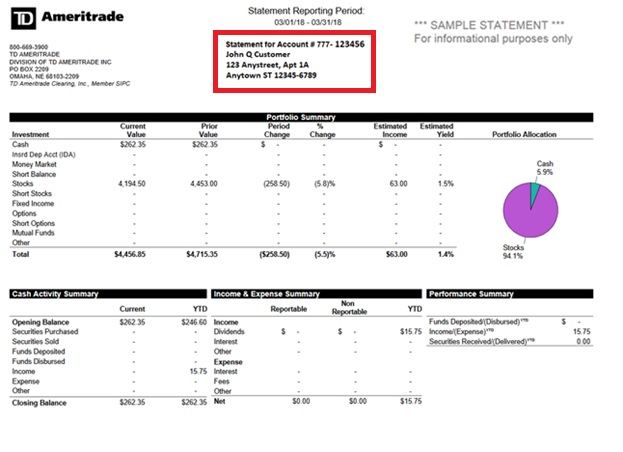

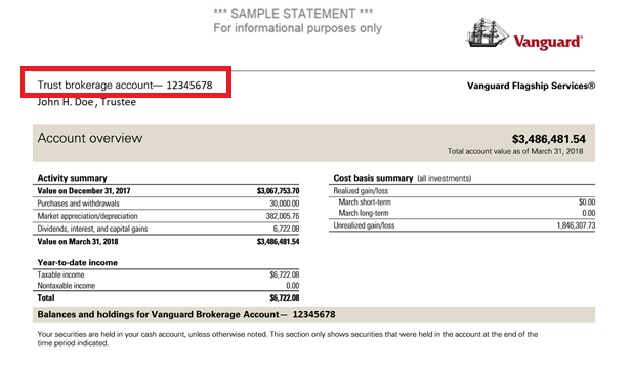

Para garantizar que su transferencia ACAT o ATON se realice correctamente, su bróker debe validar el número de cuenta proporcionado en la solicitud. Si su número de cuenta no es válido, su bróker rechazará la solicitud. IBKR recomienda que los clientes revisen una copia de su extracto de corretaje con el fin de confirmar su número de cuenta. A continuación se muestran ejemplos de extractos emitidos por algunos de los brókers más comunes y se ha resaltado dónde encontrar esta información.

Charles Schwab - Bróker #0164. La norma para el número de cuenta es 8 caracteres, todos numéricos.

Fidelity Investments - Emisión a través de National Financial Services, Bróker #0226. La norma para el número de cuenta es 9 caracteres, los 3 primeros alfanuméricos y los 6 últimos numéricos.

Merrill Edge - Bróker #0671. La norma para el número de cuenta es 8 caracteres en una combinación de caracteres alfanuméricos y numéricos.

TD Ameritrade - Bróker #0188. La norma para el número de cuenta es 9 caracteres, todos numéricos.

Vanguard- Bróker #0062. La norma para el número de cuenta es 8 caracteres, todos numéricos.

Nota: Este artículo contiene imágenes de ejemplos de extractos emitidos por brókers con un fin únicamente ilustrativo y pueden tener logotipos que siguen siendo propiedad de dichos brókers.

Modifying the account number for a pending ACAT or ATON transfer

In order for your ACAT or ATON transfer to be completed successfully, your broker must validate the account number provided on the request. If the account number is invalid, your broker will reject the request. To avoid such rejects, IBKR may delay the transmission of your ACATS/ATON request if the account number you have provided does not match the alpha-numeric pattern used by the selected broker. IBKR will send a notification for you to review and correct your account number.

Details for updating the account number are below.

- In Client Portal under the ‘Transfer & Pay’ menu, select “Transaction Status & History”.

- Locate the transfer request with a status of Pending and click on it. The default search range starts 10 days in the past; update the start date as necessary.

- A pop-up will appear with the summary details of the pending request. On the bottom right of the pop-up window, select the “Modify” button.

- A new pop-up will be presented that displays the current account number associated with the request. Modify the account number as appropriate.

- When done, select ‘Submit’.

- The summary detail pop-up will be re-displayed and you will now see the updated ‘Account Number at Broker’ value.

- You may close this will by clicking the ‘x’ at the top right.

An update to a valid account number will prompt the transmission of your request to the delivering broker. An update to an invalid account will not be transmitted and you will receive a new email alert the following day requesting additional account number updates.

If you determine the request is being held up for review incorrectly, please create a web ticket for further review by Interactive Brokers.

Restricciones sobre las acciones de microcapitalización estadounidenses

Introducción

Para cumplir con las normativas respecto de la venta de valores no registrados y para minimizar el procesamiento manual asociado con la negociación de acciones que no coticen públicamente, IBKR impone ciertas restricciones en las acciones de microcapitalización estadounidenses. A continuación, se proporciona una lista de estas restricciones, junto con otras preguntas frecuentes relacionadas con este tema.

Restricciones sobre las acciones de microcapitalización

- IBKR solo aceptará transferencias de bloques de acciones de microcapitalización estadounidenses de clientes elegibles. Los clientes elegibles incluyen cuentas que: 1) mantienen un patrimonio (antes o después de la transferencia) de al menos 5 millones USD, o clientes de asesores financieros con un total de activos gestionados de al menos 20 millones USD; y 2) tienen menos de la mitad de su patrimonio en acciones de microcapitalización estadounidenses.

- IBKR solo aceptará transferencias1 de bloques de acciones de microcapitalización estadounidenses en donde el cliente elegible pueda confirmar que las acciones se compraron en el mercado abierto o se registraron ante la SEC.

- IBKR no aceptará transferencias1 de ni órdenes de apertura para acciones de microcapitalización estadounidenses designadas por un mercado extrabursátil a riesgo del comprador o un mercado gris de ningún cliente. Los clientes que tengan posiciones existentes sobre estas acciones podrán cerrar las posiciones.

- IBKR no aceptará transferencias de acciones de microcapitalización estadounidenses para cubrir una posición corta establecida en IBKR.

- Los clientes de solo ejecución (p. ej., clientes que ejecutan negociaciones mediante IBKR pero las compensan en otro lado) no podrán negociar acciones de microcapitalización estadounidenses en su cuenta de IBKR. (IBKR podrá hacer excepciones para brókeres registrados en EE. UU.).

Preguntas frecuentes sobre la microcapitalización

¿Qué es una acción de microcapitalización estadounidense?

La expresión "acción de microcapitalización" se refiere a acciones: 1) negociadas en un mercado extrabursátil, o 2) cotizadas en Nasdaq y NYSE American que tengan una capitalización de mercado entre 50 millones USD y 300 millones USD, y que negocian a 5 USD o por debajo de esta cifra. A los fines de esta política, la expresión "acción de microcapitalización" incluirá las acciones de empresas estadounidenses que cotizan en bolsa y que tienen una capitalización de mercado de 50 millones USD o menos, a las cuales se refiere a veces como "acciones de nanocapitalización" o negociación en un mercado normalmente relacionado con acciones de microcapitalización.

Para evitar situaciones en donde las fluctuaciones menores a corto plazo en el precio de una acción ocasionen una reclasificación repetida, toda acción clasificada como de microcapitalización estadounidense permanecerá en esta clasificación hasta que su capitalización de mercado y cotización de las acciones excedan de los 300 millones USD y 5 USD, respectivamente, durante un periodo de 30 días naturales consecutivos.

Debido a que las acciones de microcapitalización a menudo tienen precios bajos, se refiere a este tipo de acción comúnmente como "penny stocks". IBKR podrá realizar excepciones, incluso para acciones negociadas a precios bajos que recientemente tenían una mayor capitalización de mercado. Además, IBKR no considerará los ADR en empresas no estadounidenses como acciones de microcapitalización.

¿En dónde se negocian las acciones de microcapitalización?

Las acciones de microcapitalización normalmente se negocian en el mercado extrabursátil, en lugar de en una bolsa de valores nacional. A menudo, los creadores de mercado las cotizan electrónicamente en sistemas extrabursátiles, como el OTC Bulletin Board (OTCBB) y los mercados administrados por el OTC Markets Group (p. ej., OTCQX, OTCQB y Pink). Además, en esta categoría se incluyen acciones que no puedan cotizarse en bolsa, y que se designan como a riesgo del comprador, otros mercados extrabursátiles o el mercado gris.

Asimismo, los reguladores estadounidenses también consideran a las acciones cotizadas en el Nasdaq o NYSE American que negocien a 5 USD o por debajo de esta cifra con una capitalización de mercado de 300 millones USD o menos como acciones de microcapitalización.

¿Qué sucede si IBKR recibe una transferencia de un cliente elegible en donde una o más de las posiciones transferidas es una acción de microcapitalización?

Si IBKR recibe una transferencia que contenga un bloque de acciones de microcapitalización, IBKR se reserva el derecho de restringir la venta de las posiciones sobre acciones de microcapitalización incluidas en la transferencia, a menos que el cliente elegible proporcione la documentación correspondiente que establezca que las acciones se compraron en el mercado abierto (es decir, en un mercado que cotiza en bolsa a través de otro bróker) o registrado ante la SEC conforme con una declaración de registro S1 o similar.

Los clientes elegibles pueden demostrar que las acciones se adquirieron en el mercado abierto. Para esto, deberán proporcionar un extracto de corretaje o confirmación de la negociación de un bróker reconocido que refleje la compra de acciones en un mercado de valores. Los clientes elegibles pueden establecer que las acciones están registradas si proporcionan el número de registro ante la SEC (sistema Edgar) en el cual la empresa registró sus acciones (y todos los documentos necesarios para confirmar que las acciones son las cotizadas en el extracto del registro).

NOTA: todos los clientes pueden transferir libremente las acciones que hayamos restringido en cualquier momento.

¿Qué restricciones aplicará IBKR para las cuentas Prime?

Los clientes cuyas actividades incluyan servicios Prime se consideran clientes elegibles únicamente para aquellas negociaciones que IBKR hubiera acordado aceptar por parte de sus brókeres de ejecución. De todas formas, mientras que las cuentas Prime pueden compensar acciones de microcapitalización estadounidenses en IBKR, estas acciones estarán restringidas hasta que IBKR confirme que las acciones son elegibles para la reventa de acuerdo con los procedimientos que se indican arriba.

Para eliminar la restricción sobre las acciones adquiridas en el mercado abierto, solicite al bróker de ejecución que proporcione un carta firmada, en papel con membrete de la empresa, o un extracto de cuenta oficial en donde se declare que las acciones se adquirieron en el mercado abierto. Además, la carta o el extracto deberán incluir los criterios requeridos a continuación. Alternativamente, si las acciones se adquirieron mediante una oferta, la carta o el extracto deberán incluir los documentos o enlaces a la declaración de registro correspondiente e indicar que las acciones eran parte del mismo.

Criterios requeridos para la carta del bróker:

1) Número de cuenta con IBKR

2) Nombre de la cuenta con IBKR

3) Fecha de negociación

4) Fecha de liquidación

5) Símbolo

6) Lado

7) Precio

8) Cantidad

9) Hora de ejecución

10) Mercado

11) Debe estar firmada

12) Debe redactarse en papel con membrete oficial de la empresa

En resumen: las operaciones de venta en largo se aceptarán si la posición larga ya no se encuentra restringida. Se aceptarán operaciones de ventas en corto. Se aceptarán operaciones de compra en largo, y la posición se restringirá hasta que el departamento de cumplimiento normativo reciba la información necesaria para eliminar dicha restricción. No se aceptarán operaciones de compra cubiertas ni operaciones intradía de entrada y salida.

¿Qué sucede si la acción que adquiere se reclasifica como una acción del mercado gris o de riesgo del comprador?

Si adquiere una acción en su cuenta de IBKR que, posteriormente, se convierte en una acción clasificada como a riesgo del comprador o del mercado gris, se le permitirá mantener, cerrar o transferir la posición pero no podrá aumentar su posición.

¿cuáles son algunos de los motivos por los cuales la negociación de acciones de microcapitalización pueda estar restringida en mi cuenta?

Existen dos motivos principales por los cuales puede tener restricciones para negociar acciones de microcapitalización:

- Potencial afiliación al emisor: La norma 144 de la Comisión de Valores y Bolsa de EE. UU. ("SEC”) establece ciertas limitaciones para la negociación de acciones (lo que incluye acciones de microcapitalización) mediante una "filial" del emisor. Si IBKR observa actividad de negociación o tenencias en acciones de microcapitalización cercanas a los umbrales del volumen de negociación conforme con la norma 144 (los "Umbrales de la norma 144"), IBKR podrá restringir la negociación del cliente de acciones de microcapitalización hasta que se complete la revisión por parte del departamento de cumplimiento normativo.

- Transferencia de acciones de microcapitalización: si el cliente ha transferido recientemente una acción de microcapitalización en su cuenta de IBKR, IBKR podrá restringir la negociación de ese valor hasta que se complete le revisión por parte del departamento de cumplimiento normativo.

Si se aplica uno de los motivos anteriores, la negociación se restringirá para ese valor, y se enviará un aviso al centro de mensajes del cliente en Client Portal. Este aviso describirá el motivo de la restricción y los pasos que el cliente debe tomar antes de que IBKR considere eliminar la restricción.

¿Por qué considera IBKR que soy un afiliado potencial de un emisor de acciones de microcapitalización?

Un "afiliado" es una persona, como un director ejecutivo, un director o un accionista mayoritario en una relación de control con el emisor.

La norma 144 se aplica para todos los valores, e incluye a las acciones de microcapitalización. Sin embargo, dados los riesgos asociados ampliados con la negociación de acciones de microcapitalización, si la negociación o las tenencias en acciones de microcapitalización de un cliente se encuentran cercanos a los umbrales de la norma 144, IBKR restringirá la negociación del cliente de las acciones de microcapitalización. Esta restricción seguirá en vigor pendiente de la revisión por parte del departamento de cumplimiento normativo del estado potencial de afiliado del cliente.

Para la revisión de afiliado potencial, ¿por qué necesito solicitar una nueva revisión cada dos semanas?

El estado de afiliado de un cliente puede cambiar pronto luego de que IBKR complete la revisión de potencial afiliado a la que se refiere arriba. Como tal, IBKR cree que es adecuado actualizar la revisión de potencial afiliado cada dos semanas si la actividad de negociación o las tenencias de un cliente en acciones de microcapitalización se mantienen cercanas a los umbrales de la norma 144.

¿En dónde puedo encontrar una lista de acciones que IBKR haya designado como acciones de microcapitalización estadounidenses?

Encontrará una lista de las acciones designadas como acciones de microcapitalización estadounidenses compiladas por IBKR en el siguiente enlace: www.ibkr.com/download/us_microcaps.csv

Tenga en cuenta que esta lista se actualiza diariamente.

¿En dónde puedo encontrar información adicional sobre acciones de microcapitalización?

Puede encontrar más información sobre las acciones de microcapitalización en el siguiente enlace, e incluye los riesgos asociados con dichas acciones que puede encontrarse en la página web de la SEC: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1Incluye transferencias mediante cualquier método (p. ej., ACATS, DWAC, FOP), conversión de acciones que cotizan en bolsa en Canadá con sus equivalentes estadounidenses mediante transferencia "Southbound", transferencias para cubrir posiciones en corto existentes, clientes Prime de IB que ejecuten sus operaciones con otros brókeres y liquiden sus operaciones con IBKR, etc.

HK Stock Physical Certificate Deposit FAQ

HK Stock Physical Certificate Deposit FAQ

⦁ Does IBKR support HK stock physical certificate deposit?

Yes, we support stock physical certificate deposits for stocks trading on HKEX and available to trade at Interactive Brokers. We do not support physical withdrawals and reserve the right to reject any deposit.

⦁ Does Interactive Brokers Hong Kong charge any fees?

| Certificate Size | Processing Fee |

| HKD 500,000 or above (Full Service) | Free |

| Less than HKD 500,000 (Full Service) |

HKD 300.00/first stock certificate per day HKD 100.00/each additional certificate per day |

| Less than HKD 500,000 (Self Service) |

HKD 200.00/first stock certificate per day HKD 20.00/each additional certificate per day |

*A rejection fee of HKD 1,000 will be charged for any transaction rejected by the share registry. Additional fees may be imposed for submitting large volumes that are time consuming to process. Please contact Client Services via a web ticket for more information.

In addition to the above, there is also a fee of HKD 5 stamp tax per transfer form. Cash cannot be accepted. Please prepare a cheque for HKD 5 per transfer form payable to “The Stock Exchange of Hong Kong Limited”.

If a total of five certificates are to be deposited for stock A and stock B, a breakdown of the fees would be illustrated by the below examples:

Scenario (Full Service)

Stock A (Certificate 1 - Stock Value above 500K HKD) - Free

Stock A (Certificate 2 - Stock Value less than 500K HKD) - 300 HKD

Stock A (Certificate 3 - Stock Value less than 500K HKD) - 100 HKD

Stock B (Certificate 4 - Stock Value less than 500K HKD) - 100 HKD

Stock B (Certificate 5 - Stock Value less than 500K HKD) - 100 HKD

Scenario (Self Service)

Stock A (Certificate 1 - Stock Value above 500K HKD) - Free

Stock A (Certificate 2 - Stock Value less than 500K HKD) - 200 HKD

Stock A (Certificate 3 - Stock Value less than 500K HKD) - 20 HKD

Stock B (Certificate 4 - Stock Value less than 500K HKD) - 20 HKD

Stock B (Certificate 5 - Stock Value less than 500K HKD) - 20 HKD

⦁ How do I initiate a request?

Please compose a web ticket from the Client Portal under the category Funds & Banking > Position Transfer with all of the following information to avoid delays:

- Full Service or Self Service

- Company name/ stock ticker symbol

- Approximate value

- Number of certificates

Full Service

⦁ Make an appointment and deliver your physical certificate(s) to our office as follows:

Admiralty - Suite 1512, Two Pacific Place, 88 Queensway, Admiralty, Hong Kong SAR

Kwun Tong - Suite 3204-05, AIA Kowloon Tower, Landmark East, 100 How Ming Street, Kwun Tong, Hong Kong SAR

⦁ A cheque for HKD 5 payable to “The Stock Exchange of Hong Kong Limited” for each transfer

⦁ You will receive a receipt from IBKR within one business day.

Self Service

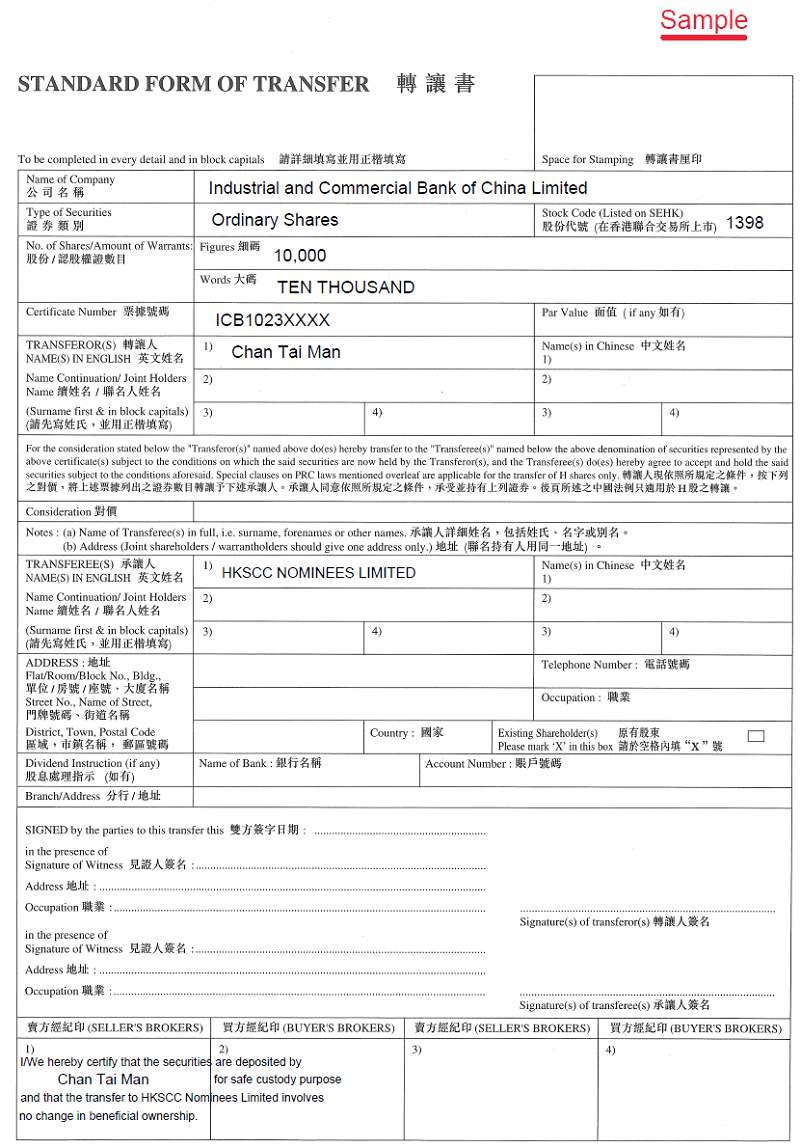

⦁ Our Client Service team will contact you by email and provide a “Standard Form of Transfer”;

⦁ Complete the “Standard Form of Transfer” by following below guidance.

⦁ Make an appointment and deliver your physical certificate(s) to our office as follows:

Admiralty - Suite 1512, Two Pacific Place, 88 Queensway, Admiralty, Hong Kong SAR

Kwun Tong - Suite 3204-05, AIA Kowloon Tower, Landmark East, 100 How Ming Street, Kwun Tong, Hong Kong SAR (Additional courier fees, to be quoted, will be passed on to client)

⦁ IBKR will counter sign the form and return to you for the delivery of all of the below documents to HKSCC. Address – 1/F, One & Two Exchange Square, Central, Hong Kong SAR.

⦁ The countersigned Standard Form of Transfer

⦁ CCASS Stock Deposit Form (Prepared by IBKR)

⦁ The physical certificate(s)

⦁ A cheque for HKD 5 payable to “The Stock Exchange of Hong Kong Limited” for each transfer

⦁ Provide a scanned copy of the receipt to IBKR.

⦁ When will the shares be credited to my IBKR account?

Typically, the shares will be reflected on your IBKR account within 3-4 business days. However, as the share registry has the right to reject deposits, IBKR will apply a 12 business day hold on the shares during which time you will not be able to sell nor withdraw the shares deposited.

⦁ Instruction and Sample – Standard Form of Transfer

.png)

How to Submit an Inbound or Outbound Position Transfer via DWAC

You can initiate a DWAC transfer request in Client Portal:

- DWAC fees are USD 100.00 per DWAC. The account must also ensure enough funds are available to absorb the fees prior to setting up a DWAC request.

- The IBKR cutoff time for transmitting a DWAC transfer is 3:15 PM EST

Preguntas frecuentes: migración de cuentas a IBIE en el contexto del Brexit

Este es un documento importante respecto de la transferencia propuesta de su cuenta de IBUK e IBLLC a IBIE que requiere de su atención. Lea el documento completo antes de tomar una decisión respecto de las cuestiones incluidas en la carta de presentación que se le envió por correo electrónico.

Lea las siguientes preguntas frecuentes cuidadosamente, ya que contiene un resumen de algunos de los cambios claves en el marco normativo vinculados a la Transferencia Propuesta (tal como de describe a continuación) y brinda respuestas a algunas de las interrogantes más generales que pueda tener. Estas preguntas deberían leerse junto con la carta de presentación y los documentos que le enviamos adjuntos a la carta de presentación. En caso de necesitar más información, contacte con nosotros utilizando la información de contacto proporcionada en la carta de presentación. Estas preguntas frecuentes reemplazan al artículo anterior puesto a su disposición bajo el título "Preguntas frecuentes: el Brexit y la migración de cuentas" (“preguntas frecuentes originales”) debido a que refleja información actualizada, y le pedimos que las lea detenidamente. Con el alcance de las posibles discrepancias entre estas preguntas frecuentes y las preguntas frecuentes originales, utilice como referencia la información contenida en estas preguntas.

Discusiones:

Estas preguntas frecuentes se dividen en tres partes.

- La Parte A establece la información clave con relación a la transferencia propuesta (tal como se indica a continuación).

- La Parte B cubre los aspectos legales y normativos claves como resultado de la transferencia propuesta (tal como se indica a continuación).

- La Parte C está destinada a responder otras preguntas que pueda tener, así como a proporcionar más información práctica con relación a lo que cambiará y lo que no luego de la Transferencia Propuesta (tal como se indica a continuación).

PARTE A: LA TRANSFERENCIA PROPUESTA

1. ¿Cuál es la situación actual y por qué deben realizarse cambios?

Como bien sabe, actualmente, su relación con Interactive Brokers se encuentra a cargo de nuestra entidad con sede en el Reino Unido, más concretamente Interactive Brokers (U.K.) Limited (“IBUK”) y los servicios que le proporcionamos son servicios de IBUK y, dependiendo del producto con el que opere, de nuestra filial en EE. UU., de Interactive Brokers LLC (“IBLLC”). Actualmente IBUK utiliza lo que se conoce como pasaporte de servicios financieros para poder cumplir con su parte de la provisión de servicios en Europa continental. Nuestra hipótesis de trabajo es que, al finalizar el periodo de transición del Brexit a fines de este año, IBUK perderá esta capacidad y, a partir del 1 de enero de 2021, Interactive Brokers deberá realizar algunos cambios con relación a la entidad legal con la que deberá operar.

2. ¿Cuáles son los "cambios" a los que se refiere el apartado anterior?

Hemos establecido una nueva entidad legal de Interactive Brokers en Irlanda, más concretamente, Interactive Brokers Ireland Limited (“IBIE”). La propuesta es transferir los negocios que mantiene actualmente con IBUK e IBLLC a IBIE. En otras palabras, nuestra intención es que todas sus cuentas, inversiones y servicios actualmente proporcionados por IBUK e IBLLC pasen a ser servicios que proporcione IBIE de manera singular (a fines prácticos, nos referiremos a esta migración como la “Transferencia Propuesta”).

3. ¿Cuándo tendrá lugar la Transferencia Propuesta?

Nos comunicaremos con usted por escrito nuevamente antes de la Transferencia Propuesta. Sin embargo, esto no sucederá a menos (y hasta) que IBIE se encuentre autorizada por el regulador de servicios financieros de Irlanda, el Banco Central de Irlanda.

4. ¿Quién es IBIE? ¿Qué tipo de empresa es?

A partir del 22 de diciembre de 2020, IBIE ha sido autorizada por el Banco Central de Irlanda como empresa de inversiones. Su estado normativo y perfil son muy similares al de IBUK. Esto se debe a que IBIE e IBUK están autorizadas conforme con la segunda Directiva sobre Mercados de Instrumentos Financieros (Directiva 2014/65/UE). Esta es una ley aplicable en toda la UE cuyo propósito es, en la mayor medida posible, armonizar el modo en el que se regulan las empresas de inversiones en la UE.

Esto no quiere decir que las normativas sean idénticas entre sí en lo que respecta a las normativas que se aplican para su relación actual con IBUK y las que se aplicarán una vez que se transfiera su cuenta a IBIE. Explicaremos estas cuestiones de manera más detallada en la Parte B de estas preguntas frecuentes.

5. ¿Cuál es la información legal sobre IBIE?

Interactive Brokers Ireland Limited es una sociedad limitada (número de registro 657406) y se encuentra registrada en el Registro de Sociedades de la Oficina del Registro de Sociedades de Irlanda. La dirección registrada es 10 Earlsfort Terrace, Dublín 2, D02 T380, Irlanda. Aún nos encontramos finalizando la información de contacto diario de IBIE y lo contactaremos con esta información en el debido momento.

6. ¿Quién regulará IBIE y cuál es su información de contacto?

Tal como se indica arriba, nuestra solicitud para que el Banco Central de Irlanda reconozca a IBIE como una empresa de inversión se encuentra pendiente. Una vez que la solicitud se apruebe tal como lo anticipamos, el Banco Central de Irlanda será el regulador competente para IBIE (del mismo modo en que la Financial Conduct Authority es el regulador competente para IBUK). A continuación se incluye la información de contacto del Banco Central de Irlanda:

Ubicación

Banco Central de Irlanda

New Wapping Street

North Wall Quay

Dublín 1

D01 F7X3

Números de contacto

Teléfono: +353 (0)1 224 6000

Fax: +353 (0)1 224 5550

Dirección de correo postal

Central Bank of Ireland

P.O. Box 559

Dublín 1

Línea de ayuda pública

Correo electrónico: enquiries@centralbank.ie

Llamadas internacionales económicas (Lo-Call): 1890 777 777

Teléfono: +353 (0)1 224 5800

7. ¿En dónde se ubica IBIE en Interactive Brokers Group?

IBIE es una subsidiaria de propiedad absoluta que forma parte de Interactive Brokers Group.

8. ¿Qué significa la Transferencia Propuesta para mí? ¿Se producirá un impacto significativo?

No anticipamos ningún impacto significativo para usted como resultado de la Transferencia Propuesta. Sin embargo, es muy importante que lea estas preguntas frecuentes y se asegure de entender los cambios.

9. ¿Qué debo hacer si deseo seguir operando con Interactive Brokers?

Si desea continuar operando con Interactive Brokers, necesitamos de su cooperación y participación.

Más concretamente, necesitamos que preste su consentimiento y acepte el acuerdo de cliente y demás documentos disponibles en la sección Información importante del proceso de la Trasferencia Propuesta, así como las cuestiones normativas que se detallan en la Carta de presentación, y en las secciones Información importante y Consentimiento del proceso de la Transferencia Propuesta. Puede hacer esto si sigue las instrucciones en la carta de presentación.

Para aclarar este asunto, no tiene que prestar su consentimiento para la Transferencia Propuesta si considera que la propuesta lo afecta negativamente. Sin embargo, en caso de que decida rechazarla, es posible que IBUK no pueda continuar prestando servicios para su cuenta una vez finalizado el periodo de transición del Brexit. En caso de que eso suceda, su cuenta quedará restringida para realizar nuevas operaciones o transferir nuevos activos. Siempre tiene la posibilidad de transferir su cuenta a otro bróker. Si desea rechazarla, siga las instrucciones que se indican en la carta de presentación.

En cualquier caso, le solicitamos que lea estas preguntas frecuentes y la carta de presentación antes de decidir aceptar o rechazar la Transferencia Propuesta.

10. ¿Qué sucede ahora?

Si presta su consentimiento para realizar la transferencia, complete todas las acciones que se indican en la carta de presentación y prepararemos su cuenta para la Transferencia Propuesta. Luego de la Transferencia Propuesta, IBIE se comunicará por escrito con usted para transmitirle la información acerca de su nueva relación.

PARTE B: CAMBIOS LEGALES Y NORMATIVOS QUE DEBERÍA CONSIDERAR

1. ¿Qué términos y condiciones regirán su relación con IBIE luego de la Transferencia Propuesta? ¿Son distintos de los términos y condiciones que se aplican actualmente?

Las negociaciones que realice luego de la Transferencia Propuesta se regirán por el nuevo acuerdo de cliente entre usted e IBIE. Tendrá una copia del nuevo acuerdo de cliente a su disposición en la sección Información importante del proceso de la Transferencia Propuesta. Consulte la pregunta A3 arriba con relación al periodo de la Transferencia Propuesta.

2. ¿Qué normas de conducta comercial (incluyendo mejor ejecución) se aplicarán para mi relación con IBIE? ¿Existen diferencias significativas que se apliquen para mi relación con IBIE en comparación con mi relación existente con IBUK?

Existen algunos cambios que debería considerar, los cuales explicaremos a continuación.

Si opera con IBUK sobre una base de "gestión" (en otras palabras, negocia opciones sobre índices, futuros y opciones sobre futuros e IBUK gestiona sus cuentas y custodia sus activos), las normas de conducta comercial de Financial Conduct Authority se aplican actualmente para su caso. Estas normas se basan principalmente en la segunda Directiva sobre Mercados de Instrumentos Financieros, la Directiva sobre mercados de Instrumentos Financieros y varias directivas y normas delegadas (conjuntamente, “MiFID”). Con relación a la mejor ejecución, cuando corresponda, IBUK deberá tomar los pasos necesarios para alcanzar el mejor resultado posible cuando ejecute su orden.

En caso de que actualmente realice negocios con IBUK sobre una base de "introducción" (en otras palabras, negocia productos fuera de aquellos mencionados en el apartado anterior y tiene una relación con IBUK y su filial en EE. UU., IBLLC), se aplicará en su caso una mezcla de normas de conducta comercial. Por ejemplo, respecto de la introducción de sus negocios con IBLLC, se aplicarán las normas de conducta comercial de Financial Conduct Authority (consultar arriba al respecto). Una vez que se introduzca a IBLLC, las normas y normativas de Securities and Exchange Commission de EE. UU. y Commodity Futures Trading Commission de EE UU. (entre otras) se aplicarán para la función de IBLLC (lo que incluye sus obligaciones con relación a la mejor ejecución y custodia).

Tenga en consideración que, en términos generales, es probable que sus negocios se dividan entre estos dos escenarios (en otras palabras, parte de sus negocios se realizan sobre una base de "gestión" mientras que parte de estos se realizan sobre una base de "introducción").

En adelante, la distinción entre negocios "gestionados" o de "introducción" no se aplicarán y, en cada caso indicado arriba, las normas de conducta comercial de Irlanda se aplicarán exclusivamente para su relación con IBIE. Al igual que las normas de Financial Conduct Authority del Reino Unido, las reglas de conducta comercial de Irlanda se fundamentan en las directivas MiFID, y las obligaciones de IBIE con relación a la mejor ejecución reflejan aquellas que se aplican actualmente a IBUK.

En nuestra opinión, mientras que las normas que se apliquen para nuestra relación cambien, no consideramos dichos cambios como cambios significativos o que puedan resultar en un menor grado de protección para usted.

3. ¿Cómo se mantendrán mis inversiones en custodia con IBIE desde una perspectiva legal o normativa? ¿Existen diferencias significativas que se apliquen para mi relación con IBIE en comparación con mi relación existente con IBUK?

Las normas que se aplican actualmente dependen de la naturaleza de sus negocios actualmente con IBUK (consulte la pregunta B2 arriba). Cuando realice negocios "gestionados" con IBUK, se aplicarán las normas de Financial Conduct Authority sobre activos de clientes (o "CASS"). Se basan principalmente sobre las directivas MiFID. Cuando realice negocios de "introducción" con IBUK e IBLLC, se aplicarán las normas de custodia de EE. UU. respecto de sus activos en custodia.

En adelante, tal como se indica arriba, la diferencia entre negocios "gestionados" y de "introducción" no se aplicará y, en cada caso indicado arriba, las normas de custodia de Irlanda se aplicarán exclusivamente a su relación con IBIE. Al igual que con las normas de Financial Conduct Authority del Reino Unido, estas se basan principalmente en las directivas MiFID. Consulte el documento de información sobre activos claves del cliente que se adjunta en la sección Información importante con relación el régimen de custodia de Irlanda.

4. ¿Cómo estoy protegido contra las pérdidas? ¿Existen diferencias significativas que se apliquen para mi relación con IBIE en comparación con mi relación existente con IBUK?

Actualmente, sus activos elegibles están protegidos contra pérdidas con Securities Investor Corporation de EE. UU. por un máximo de hasta 500 000 USD (condicionado a un sublímite de efectivo de 250 000 USD) o bien con Financial Services Compensation Scheme del Reino Unido por un máximo de hasta 50 000 GBP (el régimen que se aplique dependerá del segmento relevante de su cuenta IBUK. tal como se explica arriba en el apartado B2). Luego de la Transferencia Propuesta, el Sistema de indemnización de los inversores de Irlanda, el cual está administrado por The Investor Compensation Company DAC, protegerá sus activos contra pérdidas en caso de que IBIE no cumpla con sus obligaciones para con usted.

El sistema de indemnización de Irlanda es similar al sistema de indemnización al cual tiene acceso en el Reino Unido, aunque con un límite menor. El propósito del Sistema de indemnización de los inversores de Irlanda es pagarle una indemnización (condicionada a ciertos límites) si ha invertido dinero o tiene instrumentos de inversión en alguno de los siguientes casos:

- Una empresa cesa en sus operaciones comerciales y no puede devolverle sus inversiones o dinero; y

- Se ha dictado una decisión del Banco Central de Irlanda o una sentencia judicial conforme con la ley Investor Compensation Act de 1998;

The Investor Compensation Company DAC (ICCL) administra el programa. IBIE será un miembro del programa.

El sistema cubre productos de inversión, entre los que se incluyen:

- Acciones de empresas públicas y privadas

- Unidades en sistemas de inversión colectiva

- Pólizas de seguros de vida (incluye fondos vinculados a la unidad)

- Pólizas de seguros que no sean seguros de vida

- Bonos indexados

- Futuros y opciones

Normalmente, solo podrá realizar una reclamación luego de que una empresa cese en sus actividades comerciales y sus activos se hayan liquidado y distribuido entre sus acreedores. Verifique la información sobre los límites de los sistemas que pueden aplicarse; no todas las pérdidas podrán recuperarse, ya que existen niveles máximos establecidos para las indemnizaciones. El Sistema de indemnización de los inversores de Irlanda (ICCL) le pagará una indemnización del 90 % de la cantidad que haya perdido hasta un máximo de 20 000 €.

5. ¿Cómo realizo una queja sobre IBIE? ¿Existen diferencias significativas que se apliquen para mi relación con IBIE en comparación con mi relación existente con IBUK? ¿Qué sucede si mi queja se relaciona con algo que sucedió mientras era cliente de IBUK?

El nuevo acuerdo de cliente establece cómo presentar una queja ante IBIE. Los procedimientos de gestión de quejas son muy similares a aquellos que se aplican a su relación existente con IBUK. Si el sustento de su queja se relaciona con algo que sucedió antes de la Transferencia Propuesta, debería dirigir su queja a IBUK. IBUK seguirá estando autorizada como una empresa de inversión luego del Brexit. Su información de contacto actual seguirá siendo la misma en caso de que necesite contactar con IBUK.

6. Luego de la Transferencia Propuesta, ¿tendré aún acceso al Defensor de servicios financieros?

En caso de tener una reclamación, los inversores deberían seguir el procedimiento para reclamaciones que se indica en el acuerdo de cliente. Tal como se explicó en las preguntas frecuentes originales, una vez que la Transferencia Propuesta haya tenido lugar, el Defensor de servicios financieros del Reino Unido ya no tendrá jurisdicción sobre las reclamaciones que pueda tener respecto de IBUK. Sin embargo, tenga en cuenta que Irlanda tiene un programa de resolución de disputas en forma de Defensor de servicios financieros y jubilaciones (“FSPO”). Este organismo es un programa de resolución de disputas gratuito e independiente para servicios financieros. Puede ser elegible para presentar una queja ante el FSPO si se trata de una "queja elegible". Podrá encontrar más información acerca de las "quejas elegibles" en el siguiente sitio web: www.fspo.ie. Puede contactar con el FSPO a través de los siguientes medios:

Dirección de correo postal

Financial Services and Pensions Ombudsman

Lincoln House,

Lincoln Place

Dublín 2

D02 VH29

Teléfono

+353 (0)1 567 7000

Correo electrónico

7. ¿Cómo se procesarán y protegerán mis datos personales? ¿Existen diferencias significativas que se apliquen para mi relación con IBIE en comparación con mi relación existente con IBUK en este contexto?

Consulte las preguntas frecuentes originales para obtener más información. En resumen, no existirán cambios significativos.

PARTE C: OTRAS CUESTIONES PRÁCTICAS Y PASOS A SEGUIR

1. ¿A quién debería contactar antes de que tenga lugar la Transferencia Propuesta y luego de la transferencia si tengo dudas en algún momento?

Normalmente, debería contactar con IBUK en caso de tener dudas respecto de cuestiones anteriores a la Transferencia Propuesta y debería contactar con IBIE para todas las cuestiones que le sigan a la Transferencia Propuesta. Sin importar a quien contacte en Interactive Brokers, le aseguremos que su consulta se trate diligentemente y lo ayudaremos a conectarse con la persona o el departamento adecuados.

2. ¿El rango de productos ofrecido será el mismo?

Nuestras expectativas actuales son que IBIE le ofrezca el mismo rango de productos que IBUK.

Pueden existir restricciones en operaciones de divisas que podrían crear un saldo negativo o aumentar un saldo negativo preexistente en cualquiera de las divisas que lo componen. Sin embargo, los mismos pares de divisas pueden negociarse como CFD sobre fórex. Los contratos por diferencias son instrumentos complejos, y lo invitamos a leer cuidadosamente las advertencias sobre riesgos de CFD antes de negociar estos instrumentos luego de la transferencia de su cuenta.

Tenga en cuenta que IBIE ofrece financiación para valores y operaciones con productos básicos, pero no permitirá el retiro de fondos prestados. Podrá retirar el efectivo que no se necesite para mantener sus posiciones abiertas. En caso de desear retirar fondos adicionales, puede vender sus posiciones y retirar el producido.

3. Actualmente negocio derivados extrabursátiles con IBUK, ¿qué sucederá con mis posiciones abiertas?

Sus posiciones abiertas se transferirán a IBIE y se enfrentará a IBIE en lugar de IBUK. No tendrá ninguna relación legal con IBUK respecto de dichas posiciones. Le proporcionaremos un documento actualizado con información clave sobre el inversor (siga el enlace a la página de inicio del documento en PRIIPs en la carta de presentación).

4. ¿Qué sucede con los valores que le he concedido a IBUK/IBLLC como parte de un préstamo de margen?

Si le ha proporcionado un valor o garantía a IBUK/IBLLC, se transferirá a IBIE -la nueva entidad en Irlanda- luego de que tenga lugar la Transferencia Propuesta.

No anticipamos que necesite tomar pasos para reflejar el cambio de beneficiario, aunque es probable que debamos tomar pasos administrativos propios para actualizar los registros de seguridad con el cambio en los detalles. Sin embargo, esto no debería afectar nuestra prioridad ni afectar de otro modo la fecha a partir de la cual la garantía sea válida.

5. ¿Tendré acceso a la misma plataforma de negociación o estaré condicionado a cambios en el software luego de las migraciones?

La migración no tendrá un impacto sobre el software que utiliza para negociar o administrar su cuenta. La tecnología seguirá siendo la que usa hoy en día.

6. ¿Se transferirán todos los saldos en las cuentas al mismo tiempo?

Todos los saldos, con la excepción de los devengados (p. ej., intereses y dividendos) se transferirán al mismo tiempo. Una vez que los devengos se hayan publicado en efectivo, se transferirán automáticamente a la cuenta migrada.

7. ¿Qué sucederá en mi cuenta corriente luego de la migración?

Una vez que todos los devengos se hayan transferido, su cuenta corriente se cerrará y no podrá accederse a ella para negociar. Sin embargo, quedará accesible mediante un selector de cuenta de Client Portal a los fines de visualizar e imprimir extractos históricos.

8. ¿Cambiarán las comisiones y tarifas de IBKR cuando se migre mi cuenta?

No. Las comisiones y tarifas de IBKR no varían de acuerdo al bróker con el cual se mantiene su cuenta.

9. ¿Cambiarán mis permisos de negociación cuando se migre mi cuenta?

No. Sus permisos de negociación no cambiarán cuando se migre su cuenta.

10. ¿Se transferirán las órdenes abiertas (p. ej., Good-til-Canceled) cuando se migre mi cuenta?

Las órdenes abiertas no se transferirán a la nueva cuenta; sin embargo, le recomendamos a nuestros clientes que revisen sus órdenes inmediatamente luego de la migración para asegurarse de que las órdenes abiertas coincidan con sus intenciones de negociación.

11. ¿Estaré condicionado por la regla de negociación de patrón diario de EE. UU. una vez que se migre mi cuenta?

Las cuentas que se mantengan con IBUK están condicionadas a la regla de negociación de patrón diario de EE. UU. (PDT) debido a que IBLLC, un bróker estadounidense, es el que introduce y transfiere las cuentas. La regla PDT restringe las cuentas con patrimonios inferiores a 25 000 USD a no más de 3 negociaciones por día dentro de cualquier periodo de 5 días hábiles.

Todas las cuentas migradas a IBIE no se introducirán a IBLLC y, por lo tanto, no quedarán condicionadas a la regla PDT.

12. ¿Recibiré un único extracto de actividad anual combinado al finalizar el año?

No. Recibirá un extracto anual para su cuenta existente que cubrirá el periodo comprendido entre el 1 de enero de 2020 hasta la fecha de migración, y un segundo extracto anual para su nueva cuenta, el cual cubrirá el periodo comprendido entre la fecha de migración hasta finalizar el año.

13. ¿Se transferirá la base de coste actual de las posiciones cuando se migre mi cuenta?

Sí, esta migración no tendrá un impacto sobre la base del coste de sus posiciones.

14. ¿Retendrá la cuenta migrada la misma configuración que la cuenta actual?

La configuración de la cuenta luego de la migración coincidirá con la cuenta actual, dentro del alcance permitido por las leyes. Esto incluye atributos como la capacidad de margen, datos de mercado, usuarios adicionales y alertas. En ciertas instancias, una cuenta podrá migrarse a una jurisdicción en donde no pueda ofrecerse el alcance completo de la elegibilidad del producto. Los clientes que mantengan productos restringidos pueden migrarse y mantenerse, o pueden cerrar estas posiciones, pero no se les permitirá aumentar la posición.

15. ¿Cambiarán mis credenciales para el inicio de sesión?

No. Su nombre de usuario, contraseña y proceso de autenticación en dos factores existentes para su cuenta seguirán activos luego de la migración. Sin embargo, se le asignará un nuevo id. de cuenta para su cuenta migrada.

FAQS: IBIE Account Transfer

This is an important document regarding the proposed transfer of your account from IBUK and IBLLC to IBIE that requires your attention. Please read the entirety of this document ahead of taking any action referred to in the Covering Letter sent to you via email.

Please take time to read these FAQs, which summarise some of the key changes to the regulatory framework which will be brought about by the Proposed Transfer (as described below) and provide answers to some of the more general questions that you may have. The FAQs should be read in conjunction with the Covering Letter. If you require any further information, please get in touch with us using the contact details provided in the Covering Letter.

Discussion:

The FAQs are split into three parts.

- Part A sets out key information in relation to the Proposed Transfer (as described below).

- Part B covers key legal and regulatory topics that arise as a result of the Proposed Transfer (as described below).

- Part C aims to answer any other questions that you may have and provides some further and more practical information in relation to what will and will not be changing following the Proposed Transfer (as described below).

PART A – THE PROPOSED TRANSFER

1. What is the situation currently?

As you will be aware, at present, your relationship with Interactive Brokers is led by our entity based in the United Kingdom, specifically Interactive Brokers (U.K.) Limited (“IBUK”) and the services provided to you are provided by IBUK and, depending on the products you do business in, our US affiliate Interactive Brokers LLC (“IBLLC”).

2. What is Interactive Brokers requesting?

We are inviting all clients domiciled in the European Economic Area (“EEA”) to transfer their accounts to one of our brokers based in Europe.

We propose to transfer the relationship that you currently have with IBUK and IBLLC to Interactive Brokers Ireland Limited (“IBIE”), an Interactive Brokers investment firm located in Ireland. It is our intention that all of your accounts, investments and services currently provided to you by IBUK and IBLLC will instead be singularly provided by IBIE (for convenience we will refer to this as the “Proposed Transfer”).

3. Who is IBIE? What sort of a firm is it?

IBIE is an investment firm regulated by the Central Bank of Ireland and authorised pursuant to the second Markets in Financial Instruments Directive (Directive 2014/65/EU). IBIE is an affiliate of IBUK and IBLLC.

4. What are IBIE’s legal details?

Interactive Brokers Ireland Limited is registered as a private company limited by shares (registration number 657406) and is listed in the Register of Companies maintained by the Irish Companies Registration Office. Its registered address is 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. IBIE can be contracted by telephone at 00800-42-276537 or electronically through the IBIE website at www.interactivebrokers.ie.

5. Who regulates IBIE and what are their contact details?

As set out above the Central Bank of Ireland is the competent regulator for IBIE (in the same way that the Financial Conduct Authority is the competent regulator for IBUK). IBIE is included in the Central Bank of Ireland’s register of authorised firms under number 423427. The Central Bank of Ireland’s contact details are set out below:

Location

The Central Bank of Ireland

New Wapping Street

North Wall Quay

Dublin 1

D01 F7X3

Contact Numbers

Phone: +353 (0)1 224 6000

Fax: +353 (0)1 224 5550

Postal Address

Central Bank of Ireland

P.O. Box 559

Dublin 1

Public Helpline

E-mail: enquiries@centralbank.ie

Lo-Call: 1890 777 777

Phone: +353 (0)1 224 5800

6. Where does IBIE fit with respect to the broader Interactive Brokers group?

IBIE is a wholly-owned subsidiary that sits within the broader Interactive Brokers Group.

7. What does the Proposed Transfer mean for me? Will there be any material impacts?

We do not anticipate any material impacts for you as a result of the Proposed Transfer. Nonetheless, it is very important that you read these FAQs carefully and in full and make sure that you understand what the changes are for you.

8. What do I have to do if I want to continue doing business with Interactive Brokers?

If you would like to continue to do business with Interactive Brokers, we require your cooperation and action.

Specifically, we need you to consent and agree to the Customer Agreement and other Documents available under the Important Information section of the Proposed Transfer process and to the regulatory matters outlined in the Covering Letter, the Important Information and Consent sections of the Proposed Transfer process. You can do this by following the instructions in the Covering Letter.

To be clear, you do not have to consent to the Proposed Transfer if you feel that you may be adversely affected by it. You have the option of transferring your positions to another broker or closing your positions and transferring any cash balance to another account.

If you do not take action by December 7, 2022, your account will be restricted from opening new transactions or transferring in new assets. You always have the ability to transfer your account to another broker. If you wish to decline, please follow the instructions in the Covering Letter.

In either case, we ask that you read the entirety of this FAQs and the Covering Letter before deciding to consent to or decline the Proposed Transfer.

9. What happens next?

If you consent to the transfer, please complete all actions detailed in the Covering Letter and we will prepare your account to be transferred to IBIE. Once your account is transferred, IBIE will write to you with further information about your new relationship with them.

PART B – LEGAL AND REGULATORY CHANGES THAT YOU SHOULD BE AWARE OF

1. What terms and conditions will govern my relationship with IBIE following the Proposed Transfer? Are these different to the ones that currently apply?

Trades that you conduct after the Proposed Transfer will be governed by the new Customer Agreement between you and IBIE. A copy of the IBIE Customer Agreement is available in the Important Information section of the Proposed Transfer process.

2. What conduct of business rules (including best execution) will apply to my relationship with IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

There are some changes to be aware of, which we explain below.

If you do business with IBUK on a “carried” basis (in other words, you trade index options, futures and futures options and IBUK carries your account and custodies your assets) then the Financial Conduct Authority’s conduct of business rules currently apply to you. These rules are based heavily on the recast Markets in Financial Instruments Directive, the Markets in Financial Regulation and various delegated directives and regulations (collectively, “MiFID”). In relation to best execution, where it applies, IBUK must take all sufficient steps to achieve the best possible result for you when we execute your order.

If you currently do business with IBUK on an “introduced” basis (in other words, you trade products outside of those mentioned in the previous paragraph and you have a relationship with both IBUK and its US affiliate, IBLLC) a mix of conduct of business rules will currently apply to you. For instance, with respect to the introduction of your business to IBLLC, the Financial Conduct Authority’s conduct of business rules will apply (see above in relation to these). Once introduced to IBLLC, the relevant U.S. Securities and Exchange Commission and U.S. Commodity Futures Trading Commission rules and regulations (among others) will apply to IBLLC’s role (including its obligations in relation to best execution and custody).

Please note that it is of course possible that your business is split across these two scenarios (in other words some of your business is conducted on a “carried” basis while some of it is conducted on an “introduced” basis).

Going forward, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish conduct of business rules will exclusively apply to your relationship with IBIE. Similar to the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID and IBIE’s obligations in relation to best execution will largely mirror those that currently apply to IBUK.

In our view, while the rules that apply to our relationship will change, we do not consider such changes to be material or to result in a lesser degree of protection being afforded to you.

3. How will my investments that I custody with IBIE be held from a legal/regulatory perspective? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

The rules that currently apply depends on the sort of business that you presently have with IBUK (please see the response to Question B2 above). Where you conduct “carried” business with IBUK, the Financial Conduct Authority’s client asset (or “CASS”) rules will apply. These rules are based heavily on MiFID. Where you conduct “introduced” business with IBUK and IBLLC, the US custody rules will apply to your custody assets.

Going forward, as set out above, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish custody rules will exclusively apply to your relationship with IBIE. Like the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID. Please consult the Client Assets Key Information Document provided in the Important Information section in relation to the Irish custody regime.

4. How am I protected against loss? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

Currently, your eligible assets are protected from loss either under the US Securities Investor Protection Corporation at an amount of up to USD 500,000 (subject to a cash sublimit of USD 250,000) or the UK Financial Services Compensation Scheme at an amount up to GBP 50,000 (which regime applies depends on the relevant segment of your IBUK account, as explained in the response to Question B2 above). After the Proposed Transfer, the Irish Investor Compensation Scheme, which is administered by The Investor Compensation Company DAC, may protect your assets from loss should IBIE default and be unable to meet its obligations to you.

Ireland’s compensation scheme is similar to the compensation scheme you have access to in the UK, albeit with a lower limit. The purpose of the Irish Investor Compensation Scheme is to pay compensation to you (subject to certain limits) if you have invested money or investment instruments in either of the following cases:

- A firm goes out of business and cannot return your investments or money; and

- A Central Bank of Ireland determination or a court ruling has been made under the Investor Compensation Act 1998.

The Investor Compensation Company DAC (ICCL) administers the scheme. IBIE will be a member of the scheme.

The scheme covers investment products including:

- Public and private company shares

- Units in collective investment schemes

- Life insurance policies (including unit-linked funds)

- Non-life insurance policies

- Tracker bonds

- Futures and options

Usually, you can only make a claim after a firm goes out of business and its assets have been liquidated and distributed to those who are owed money. Please check the details of the schemes for any limits that apply – not all losses will be covered as there are maximum levels of compensation. The ICCL will pay you compensation for 90% of the amount you have lost, up to a maximum of €20,000.

5. How do I make a complaint to IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK? What if my complaint relates to something that happened while I was a customer of IBUK?

The new Customer Agreement sets out how to lodge a complaint with IBIE. The complaints handling procedures are materially similar to those that apply to your existing relationship with IBUK. If the substance of your complaint relates to something that happened prior to the Proposed Transfer, then you should address your complaint to IBUK. Its current contact information will stay the same and can be found at interactivebrokers.co.uk should you need to contact IBUK.

6. After the Proposed Transfer, will I still have access to the Financial Ombudsman Service?

In case of complaint, investors should follow the complaints procedure as referred to in the Customer Agreement. Once your account is transferred to IBIE, the UK Financial Ombudsman Service will cease to have jurisdiction over any complaints that you may have in respect of IBUK. However, please be aware that Ireland has a dispute resolution scheme in the form of the Financial Services and Pensions Ombudsman (“FSPO”). The FSPO is a free and independent statutory dispute resolution scheme for financial services. You may be eligible to make a complaint to the FSPO if you are an “eligible complainant”. Details of who are “eligible complainants” can be found on www.fspo.ie. The FSPO can be contacted at:

Postal Address

Financial Services and Pensions Ombudsman

Lincoln House,

Lincoln Place

Dublin 2

D02 VH29

Telephone

+353 (0)1 567 7000

Email

Info@fspo.ie

7. How will my personal data be processed and protected? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK in this context?

Your data will be processed and protected in accordance with the Interactive Brokers Group Privacy Policy which can be found at: https://www.interactivebrokers.com/en/index.php?f=305. There will be no material change.

PART C – OTHER PRACTICAL QUESTIONS AND NEXT STEPS

1. Who should I contact before the Proposed Transfer takes place and after the Proposed Transfer if I have any questions in the ordinary course?

Generally speaking, you should contact IBUK with any questions that you may have prior to the Proposed Transfer, and you should contact IBIE with any questions that you may have following the Proposed Transfer taking place. Regardless of who you contact at Interactive Brokers, we will ensure your query is promptly dealt with and we will help you to connect with the right person or department.

2. Will the range of products offered be the same?

Our current expectation is that the same range of products will be offered by IBIE as are offered by IBUK.

There might be a restriction on Foreign Exchange transactions that would create a negative balance or would increase a preexisting negative balance in either component currency. However, the same currency pairs can be traded as Forex CFD. Contracts For Difference are complex instruments, and we invite you to carefully review the CFD risk warnings before trading these instruments following the transfer of your account.

Please note that IBIE offers financing for securities and commodities trades but cannot support withdrawals of borrowed funds. You will be free to withdraw any free cash not needed to support your open positions. If you would like to withdraw additional funds, you can sell positions and withdraw the proceeds.

In limited instances where clients hold restricted products, clients may transfer and maintain or close such positions but won’t be allowed to increase the position.

3. I currently trade OTC derivatives with IBUK – what will happen to my open positions?

Your open positions will be transferred to IBIE and you will face IBIE rather than IBUK. You will no longer have any legal relationship with IBUK in relation to those positions. We will separately provide you with an updated Key Investor Information Document (please follow the link to the PRIIPs KID landing page in the Covering Letter).

4. What happens to any security I have granted to IBUK/IBLLC as part of a margin loan?

If you have granted security or collateral to IBUK/IBLLC this will transfer to IBIE upon the Proposed Transfer taking place.

We do not anticipate you needing to take any steps to reflect the change in beneficiary, although we may need to take some administrative steps of our own to update security registers with the change in details. This should, however, not affect our priority or otherwise affect the date from which the security is valid.

5. Will I have access to the same trading platform or be subject to any software changes following the transfer of my account?

The transfer of your account will have no impact upon the software you use to trade or administer your account. The technology will remain the same as it is today.

6. Will all account balances be transferred at the same time?

All balances, with the exception of accruals (e.g., interest, dividends) will be transferred at the same time. Once accruals have been posted to cash, they will automatically be swept to the transferred account.

7. What will happen to my current account following the transfer of my account?

Once all accruals have been swept, your current account will be closed and inaccessible for trading purposes. You will still be able to access this closed account via the Client Portal for purposes of viewing and printing archived activity and tax statements.

8. Will IBKR’s commissions and fees change when my account is transferred?

No. IBKR commissions and fees do not vary by the broker your account is maintained with.

9. Will my trading permissions change when my account is transferred?

No. Your trading permissions will not change when your account is transferred.

10. Will open orders (e.g., Good-til-Canceled) be carried over when my account is transferred?

Open orders will not be carried over to the new account, and we recommend that clients review their orders immediately following the transfer of their account to ensure that the open orders are consistent with their trading intentions.

11. Will I be subject to the U.S. Pattern Day Trading Rule if my account is transferred?

Accounts maintained with IBUK are subject to the U.S. Pattern Day Trading (PDT) rule as the accounts are introduced to and carried by IBLLC, a U.S. broker. The PDT rules restricts accounts with equity below USD 25,000 to no more than 3 Day Trades within any 5-business day period.

As accounts transferred to IBIE will not be introduced to IBLLC, they will not be subject to the PDT rule.

12. Will I receive a single, combined annual activity statement at year end?

No. You will receive an annual statement of your existing account which will cover the period starting 1 January 2022 through the date your account was transferred and a second annual statement for your new account which will cover the period starting from the transfer date through the end of the year.

13. Will the current cost basis of positions be carried over when my account is transferred?

Yes, the transfer of your account will have no impact upon the cost basis of your positions.

14. Will the transferred account retain the same configuration as the current account?

The configuration of the account following transfer will match that of the current account to the extent permissible by regulation. This includes attributes such as margin capability, market data, additional users, and alerts.

15. Will my login credentials change?

No. Your username, password, and any 2-factor authentication process in place for your existing account will remain active following transfer. You will, however, be assigned a new account ID for your transferred account.

Restricciones de cámaras de compensación para valores de cannabis

Boerse Stuttgart y Clearstream Banking han anunciado que ya no proporcionarán servicios para emisiones cuyo negocio principal esté conectado directa o indirectamente con el cannabis y otros productos narcóticos. En consecuencia, estos valores ya no operarán en las bolsas de Stuttgart (SWB) o Frankfurt (FWB). Con efecto al cierre del 19 de septiembre de 2018, IBKR llevará a cabo las siguientes acciones:

- Cierre forzoso de todas las posiciones impactadas para las que los clientes no hayan actuado para cerrarlas y que no sean eligibles para transferencia a una cotización estadounidenses; y

- Transferencia forzosa a un mercado estadounidenses de todas las posiciones impactadas para las que los clientes no hayan actuado para cerrarlas y que sean eligibles para dicha transferencia.

En la tabla siguiente se indican las emisiones afectadas según han anunciado Boerse Stuttgart y Clearstream Banking a fecha del 7 de agosto de 2018. Esta tabla incluye una nota indicando si las emisiones afectadas son elegibles para transferencia a un mercado estadounidense. Tenga en cuenta que las cámaras de compensación han indicado que esta lista podría no estar completa y se aconseja a los clientes que revisen sus páginas web respectivas para la información más actualizada.

| ISIN | NOMBRE | MERCADO | ¿ELEGIBLE PARA TRANSFERENCIA EE.UU.? |

SÍMBOLO EE. UU. |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | SÍ |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | SÍ |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | SÍ |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | SÍ |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | SÍ |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | SÍ |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | SÍ |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | SÍ |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | SÍ |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | SÍ |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | SÍ |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | SÍ |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | SÍ |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

NOTAS IMPORTANTES:

- Tenga en cuenta que las cotizaciones estadounidenses generalmente operan de forma extrabursátil (PINK) y están denominadas en USD, no EUR, lo cual le expone al riesgo de cambio de divisas, además del riesgo de mercado

- Los titulares de cuenta que mantengan valores PINK Sheet requieren permisos de negociación para Estados Unidos (Penny Stocks) para poder introducir órdenes de apertura.

- Todos los usuarios con cuentas que mantengan permisos de negociación para Estados Unidos (Penny Stocks) deben tener protección de 2 factores cuando se conecten a la cuenta.

Clearinghouse Restrictions on Cannabis Securities

Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Consequently, those securities will no longer trade on the Stuttgart (SWB) or Frankfurt (FWB) stock exchanges. Effective as of the 19 September 2018 close, IBKR will take the following actions:

- Force close any impacted positions which clients have not acted to close and that are not eligible for transfer to a U.S. listing; and

- Force transfer to a U.S. listing any impacted positions which clients have not acted to close and that are eligible for such transfer.

Outlined in the table below are impacted issues as announced by the Boerse Stuttgart and Clearstream Banking as of 7 August 2018. This table includes a notation as to whether the impacted issue is eligible for transfer to a U.S. listing. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information.

| ISIN | NAME | EXCHANGE | U.S. TRANSFER ELIGIBLE? | U.S. SYMBOL |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | YES |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | YES |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | YES |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | YES |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | YES |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | YES |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | YES |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | YES |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | YES |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | YES |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | YES |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | YES |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | YES |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

IMPORTANT NOTES:

- Note that the U.S. listings generally trade over-the-counter (PINK) and are denominated in USD not EUR thereby exposing you to exchange rate risk in addition to market risk.

- Account holders maintaining PINK Sheet securities require United States (Penny Stocks) trading permissions in order to enter opening orders.

- All users on accounts maintaining United States (Penny Stocks) trading permissions are required use 2 Factor login protection when logging into the account.