ADR Conversion Process

An American Depository Receipt (ADR) is a physical certificate evidencing ownership of American Depository Shares (ADS). An ADS is a US dollar denominated form of equity ownership in a non-US company. The ADS represents the foreign shares of the company held on deposit by a custodian bank in the company's home country and carries the corporate and economic rights of the foreign shares, subject to the terms specified on the ADR certificate.

Holders of the underlying ordinary shares may request to convert these shares into an ADR. Similarly, holders of an ADR may request to convert to the underlying ordinary shares.

Interactive Brokers will offer this conversion for the shares listed here.

Submitting Shares for Conversion

In order to request a conversion, either underlying to ADR or ADR to underlying, account holders may utilize IBKR's Voluntary Election Tool.

To access the tool, an individual account holder may:

- Log in to Portal

- Click Help to the right of the Welcome avatar in the top right corner and click Support Center.

- Scroll down to the Information & Tools section and select Corporate Actions Manager.

- Select the Conversions tab from the table of corporate action types.

- From the table, locate the security you wish to act upon and select Allocate from the far right of the table

To access the tool, an institutional account holder may:

- Log in to Portal

- Click Help > Support > Corporate Actions Manager.

- Select the Conversions tab from the table of corporate action types.

- From the table, locate the security you wish to act upon and select Allocate from the far right of the table

Once selected, a new screen will launch which will provide information on the terms of the conversion offer. Once you have reviewed the terms, you may submit an election.

Please note: Fees will be assessed for an ADR conversion request. While the overview description will provide an estimate of the fees, the final amount the account will be charged is dependent on the processing fee assessed by the agent at the time of the action and therefore the estimate is subject to change.

Frequently Asked Questions

Is there a minimum value required for conversion?

IBKR does not require a minimum value of ADRs or underlying shares to proceed with a conversion.

I do not see my ADR/common shares in the list of positions available for conversion.

In the event the security is not listed within the table, clients may submit an Inquiry Ticket. Within the ticket, please indicate the security you wish to convert and the number of shares. Upon receipt, IBKR will review the request and provide information on whether the action will be made available.

When can I expect my new shares after I submit my conversion request?

Once the elected shares are settled in the account, a request will be forwarded to the processing agent. While many requests will be completed within 1 to 2 business days, as the processing is dependent third party agents in various regions this is an estimate only and a given conversion may take additional time. Upon receipt of the new shares, the position will be allocated to the account.

What will happen once I submit my election?

Once the election has been submitted, a request will be forwarded to the processing agent. The shares submitted for conversion will be moved to a contra-symbol in the account which is non-marginable and non-tradeable. The shares will remain in this location until the conversion has been completed. Account holders should review their accounts to ensure the account will remain in margin compliance during the processing.

How will I know the fee associated with the conversion?

Initially the estimated fee per share will be provided in the description of the conversion. Account holders will be responsible for calculating the fee themselves based on this information. All voluntary conversions will be charged a commission of USD 500, plus a pass thru of external costs. Conversions on programs that are terminating will be charged a commission of USD 500 plus a pass through of external costs up to the delisting date. For 30 days following delisting, the commission is USD 0 plus a pass through of external costs. The commission returns to USD 500 plus a pass through of external costs more than 30 days following a delisting.

I have negotiated a rate with the ADR issuer for conversion. How can I ensure that this is the fee I am charged?

In the event an account holder has negotiated a specific rate, please supply the details of the rate as well as a contact name and phone number within an Inquiry Ticket. IBKR will review the details and once confirmed, ensure that the applicable fee is deducted from the account.

Can I convert unsettled shares?

No. Only settled shares may be submitted to the processing agent for conversion.

Dividend withholding procedures for foreign stocks traded in Japan

Foreign stocks listed for trading in Japan which issue dividends will have the cash dividend allocation subject to an increased withholding tax rate. The tax will vary based on the domicile of the stock issuing the dividend; however in general the withholding rate will be the highest withholding rate applicable and will not incorporate a reduction based on prevailing tax treaties.

This treatment is due to the tax reporting status of Interactive Brokers's clearing agent. As our clearing agent is unable to process the relevant tax declaration documentation which would allow for the application of tax withholding at a reduced rate, shareholders will be subject to the highest rate.

In order to avoid the application of the tax withholding on the dividends of foreign stocks, positions in such dividend paying stocks should be closed prior to the ex-dividend date.

We recommend that customers consult with their tax advisor for assistance in determining the eligibility, if any, for a tax credit on this withholding.

A list of foreign stocks and their applicable rates is provided below. Please be aware that the below is for informational purposes only and may not include all stocks which may be subject to the higher withholding rates.

| Stock Code | Stock Name | DividendTax Rate |

| 9399 | Xinhua Finance Limited | N/A |

Information Regarding IB's Corporate Action Notification Process

IB receives information regarding announced and effective mandatory and voluntary corporate actions from a number of external sources. IB employs the following steps when notifying customers:

Determine the type of corporate action - each action is consumed by our systems and will be determined to be either a mandatory event (those issues where no action is required from a shareholder) or a voluntary event (those actions where a shareholder may elect from a series of options).

Determine the method of notification based on the corporate action type

- Mandatory events - IB will send a general notification to any account holding a position in the stock, CFD, option or future in an effort to alert customers to upcoming mandatory events. Such mandatory events include stock split, acquisitions and stock and cash dividends.

- Voluntary events - IB will review the terms of the offer with the depository or processing agent. Once the terms have been confirmed, IB will make the offer available through the corporate action election tool available through Account Management (click here for additional information on using the Voluntary CA Election tool). At the time IB opens the election offer, a notification ticket will be sent to eligible shareholders. Customers may submit their election directly through Account Management once the election period has commenced. Note that CFD holders are not eligible to make elections for voluntary events. IB will determine corresponding adjustments for CFD holders based on its corporate action guidelines.

Note: The creation of the election overview may take additional time due to the manual processing involved.

Information Regarding Class Action Litigation

Interactive Brokers offers eligible clients the ability to enroll in the Securities Class Action Recovery Service. This is an automated service that removes the administrative burden of participating in a securities class action lawsuit. Information regarding this service including eligibility and enrollment procedures is available here.

For those clients not eligible to enroll in the Securities Class Action Recovery Service or for those securities not covered by the service, please be aware that due to the nature of Interactive Brokers' business model and our efforts to keep customer costs low, IB cannot monitor, on behalf of our clients, the status of class actions or other lawsuits against the thousands of corporations whose securities are traded by our clients or provide information to customers. Generally, if a class action lawsuit is successful or if there is a settlement, shareholders should receive a claim notice from the class action administrator. Any questions pertaining to class action lawsuits should be directed to the law firms representing the plaintiff(s).

General Information on Information Provided

Please know that notifications of upcoming and effective corporate actions are delivered as a courtesy in an effort to provide information which we believe may be of note to our customers. All information is supplied on a best-efforts basis and as such, IB cannot guarantee the timeliness nor accuracy of the information. At times, terms of an offer may change without new information being provided to customers. It is the customer's responsibility to ensure they have reviewed all corporate action terms with an external party, such as company websites or news releases, prior to making any trading decision.

Dividend withholding procedures for entities issuing dual-sourced income

U.S. persons holding securities issued by entities that are domiciled outside of the U.S., but which invest within the U.S. should pay particular attention to IB's tax withholding obligation in the event of a distribution by the issuer. These entities, which may include Canadian unit trusts, REITS, limited partnerships or other common shares, often distribute dividends and/or interest based on both the U.S. and non-U.S. sourced income. While U.S. persons reporting a valid taxpayer ID number on their Form W-9 are generally exempt from backup withholding on U.S. sourced income, the nature of the custodial arrangement for these particular securities is such that U.S persons may be subject to a withholding tax calculated at a fixed rate of 30% on that portion of the distribution associated with the US-sourced income. This is in addition to any withholding required to be applied to the non-U.S. sourced portion of the distribution as required by the relevant foreign taxing body.

It's important to note that these taxes will be withheld by the depository prior to remittance of the distribution to IB and the subsequent credit of the net distribution to the accounts of any U.S. persons. Accordingly, IB has no ability to reverse or reclaim the withholding on behalf of its clients. In addition, as IB does not remit the withholdings to the tax authority, we do not report such withholdings to either the tax authority or clients on their year-end tax forms.

As IB does not provide tax advice or guidance, we recommend that you consult with your tax advisor for assistance in determining the eligibility, if any, for a tax credit on this withholding.

Below lists securities where this type of withholding has been applied previously. This list is for informational purposes only and may not include all securities.

| Symbol | Security Name |

| CHE.UN | Chemtrade Logistics Income Fund |

| CSH.UN | Chartwell Seniors Housing Real Estate Investment Trust |

| DR.UN | Medical Facilities Corp |

| EXE.UN | Extendicare real Estate Investment Trust |

| FCE.UN | Fort Chicago Energy Partnerships LP |

| HR.UN | H&R Real Estate Investment Trust |

| NFI.UN | New Flyer Industries Inc |

| UFS | Domtar Corp |

| UVI | Unilens Vision Inc |

Information Regarding IB's Handling of Short Positions in Subscription Rights

In the event an account is short the target security the day prior to the effective date of a subscription rights offering, the account will be allocated a short position in the subscription right security at a rate determined by the terms of the offer.

In the event the subscription rights are not listed for trading

Customers who are short the subscription rights may be held liable in the event the long holder submits a request to subscribe to the rights offer. Customers should be aware of the potential liability to the account based on all or a portion of the short rights position being subscribed to plus any over-subscription allocation. Customers should monitor their accounts in order to ensure they will be able to properly deliver any required shares if they are held liable.

IB will not know the liability for a given account until shortly after the close of the subscription rights offer.

In the event the subscription rights are listed for trading

Customers who are short the subscription rights may attempt to close their position by submitting an order through IB's Trader Workstation or IB's WebTrader. In the event a customer is unable to close the position through the placement of an order, the customer may contact the IB Trade Desk by telephone in order to request a closing transaction be placed on their behalf.

IB will set a close out deadline for the subscription rights offer. This close out date will typically, though not definitively, be set as follows:

(External processing deadline) - (Settlement period of the market + 1) business days

For example:

For a subscription rights offering with an external processing deadline of Thursday in the United States the close out date would typically be:

Thursday - (3 business days + 1) = the prior Friday

IB will attempt, on a best efforts basis, to close out any remaining short positions on the close out date (standard commission rates apply). IB does not guarantee the date, time, price, or ability to execute such a closing trade. In the event IB is unable to close out the remaining short positions, customers will be responsible for any associated liability in the event the long holder requests to subscribe to the rights offer.

Once IB executes a closing trade for the remaining short positions, a notification will be sent to the account holder indicating that a close out has been processed. IB will post the closing transaction to the account as soon as practical. IB may not be held liable in the event the notification is not delivered in a timely fashion. In the event a customer elects to close out a short rights position after the IB close out date without first confirming with IB regarding the status of the close out, such action may result in the account being long the rights position.

Information Regarding Restrictions on Voluntary Corporate Actions

A voluntary corporate action may have restrictions associated with it in terms of those shareholders considered eligible, either for notification or participation in a voluntary offer. Such restrictions may include, but are not limited to the following:

Residency restrictions - such a restriction, as set out in the voluntary offer documentation, will either include or exclude residents of specified countries from participating in an offer. The details of any residency restriction will be outlined in the offer documentation and may be verified with the company's Investor Relation department.

Citizenship restrictions - similar to residency restriction; however the restriction is based on the country of citizenship rather than the current residency of the account holder.

Qualified Investor restriction - a company may open an offer only to Qualified investors. This type of restriction will be outlined in the offer details and may be verified with the company's Investor Relation department. IB will not verify qualified investor status prior to the submission of instructions to the depository or agent. Customers are responsible for confirming they are eligible to participate in the offer should this restriction be in place.

Notification restriction - In certain instances, Interactive Brokers LLC may be restricted from providing notification of the complete offer details. In such a case, customers will be responsible for researching upcoming voluntary corporate actions through a third party. Any election to such an offer must be submitted to IB by creating a ticket in IB's Account Management Message Center. Instructions submitted in this manner are handled on a best-efforts basis.

Australian rights restrictions: IB does not support rounding up of fractional entitlements. For the purposes of calculating a client's rights entitlement to participate in rights issues, IB will round down fractional entitlements to, if less than 1, zero, and if greater than 1, the nearest whole number. For example, in a 1:10 rights issue, if a client holds less than 10 shares of the issuer, then when IB determines a client's rights entitlement it will round down to zero; if a client hods between 10 and 19, IB will round down to 1. To participate in a rights issue, elections must be submitted via the Account Management election tool.

In the event an account is unable to view the full details of a corporate action, but believes the offer should be open to the account please contact IB by creating a ticket through IB's Account Management Message Center. Therein, please detail the offer and the reason the account should be considered eligible and IB will investigate the issue.

How are Eligible Positions or Eligible Value for Voluntary Corporate Actions Determined?

The total number of shares eligible for a voluntary corporate action election is based on the following criteria:

If the ex-date (effective date) is in the future the eligible position will be either

- The current position in the account, includes unsettled trades

- Zero, in the event the account is ineligible for participation in the voluntary corporate action

If the ex-date (effective date) is in the past the eligible position will be either

- The position as of 20:20 ET the evening prior to the effective date, in the event the offer did not have associated rights which were listed for trading

- The current position in the account in the event the offer had associated rights which were listed for trading.

For Stock Purchase Plan (SPP) actions only, the corporate action election tool will reflect the maximum allowable stock value which a participant may purchase. This value is dependent on the terms of the offer.

In the event a customer sees a zero position and believes they should be eligible to participate in the voluntary corporate action, please contact Client Services.

Information Regarding Multi-Account Voluntary CA Elections

A tool is provided for accounts maintaining a master account/sub-account structure which accommodates bulk election decisions for voluntary corporate actions initiated by the master account on behalf of its sub-accounts. The account types provided with this tool include Financial Advisor, Non-Professional Advisor, Introducing Broker (undisclosed) and Separate Trading Limit. The following article provides step by step instructions for use of the tool along with a list of common FAQs.

Note

With respect to a Stock Purchase Plan (SPP) offer, the corporate action election tool will require the submission of a VALUE of stock to purchase in the offer. As such, the corporate action election tool will reflect the maximum allowable stock value to purchase rather than an eligible share quantity.

1. Accessing the Tool

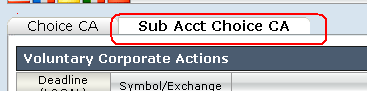

To access the Voluntary Corporate Action Election Tool, log into the Portal and click on the Tools icon located in the upper left hand corner of the screen. From the list of available tools, select Corp Actions. Then select the tab titled Sub Account Choice CA as depicted in the exhibit below.

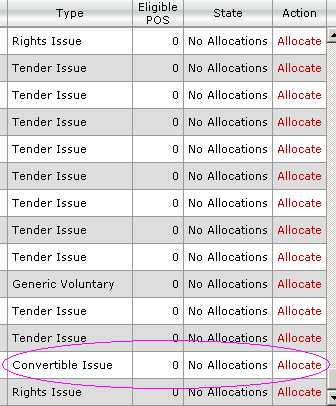

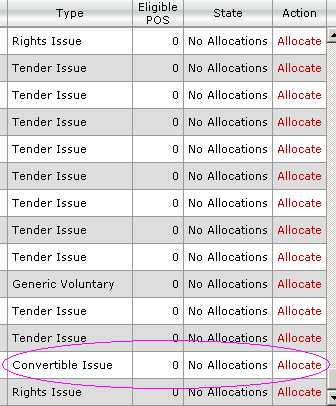

2. Selecting an Event

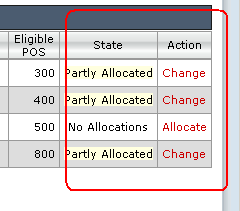

An event list window will appear detailing, by row, those voluntary corporate actions associated with positions maintained in a sub-account where the deadline for provided election instructions has not yet expired. Each event will reflect the deadline, eligible position and the state of election actions, if any, taken to-date (i.e., No Allocations, Partly Allocated, Allocated). To change an existing election action or to provide allocation instructions to an event not previously acted upon, click on the Change or Allocate link located in the Action column as displayed below

3. Submitting Instructions

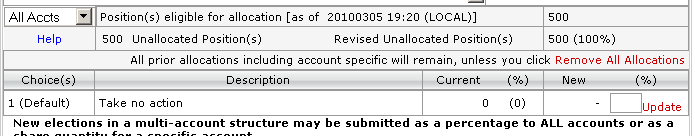

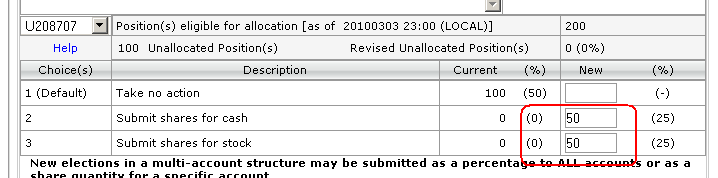

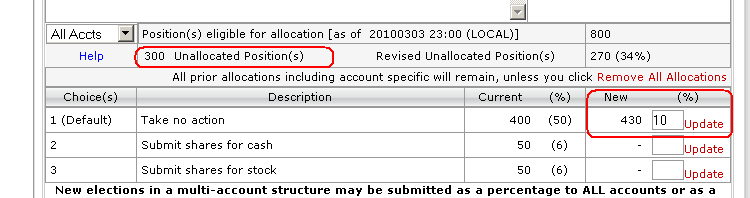

Once an action has been specified the election screen will appear, providing summary information regarding the nature of the event, the method for submitting elections and detail as to the effective date and deadline. Located below the event information is the position detail aggregated across all sub-accounts, including the following:

- Total position eligible for allocation

- Current unallocated position

- Revised unallocated position

The Voluntary Corporate Action Election Tool offers two methods for submitting election instructions:

- Submit a quantity of shares per specified account

- Submit a percentage of shares to allocate across all accounts

Examples for each of these methods are provided below:

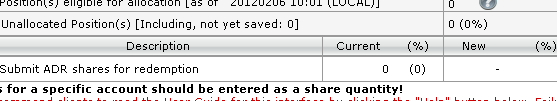

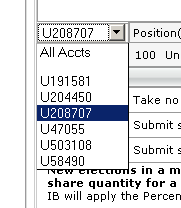

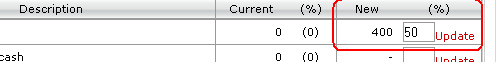

A. To submit shares or value for a specific account

Select the account from the drop-down selector located to the left of the Total eligible position detail

Under the column titled New, submit the specific number of shares you wish to submit to the given election for the selected account.

Submit Save

B. To submit a percentage of shares to allocate across all accounts

Select ALL from the drop-down selector located to the left of the Total eligible position detail

Under the column titled %, submit the percentage of shares you wish to submit to the given election

All new percentage allocations will be applied to the Revised Unallocated portion of the shares and will be added to any previous allocation.

Submit Save

IMPORTANT NOTE: If one submits shares using a combination of share quantity and then percentage, any accounts designated for allocation on a per share quantity will also then have their unallocated shares submitted on the same percentage basis as the remaining accounts. If this is not your intent you will need to revisit those accounts and adjust their share allocations accordingly.

To reduce a previously submitted percentage allocation

- Select "Remove All Allocations"

- Enter a new % allocation for All accounts

Note: If elections have been made on a per-account basis, selecting "Remove All Allocations" will remove all account-specific allocations as well.

Frequently Asked Questions

How do I know if the election has been accepted?

After an election has been submitted and the user selects "SAVE" from the election screen, the user will be given a confirmation screen for review. In the event the election is incorrect, a user may re-enter the election screen (prior to the deadline) in order to update the elections.

How is the percentage allocation processed?

Each account will have the entered allocation applied to the eligible, unallocated shares.

Assume there are 4 sub-accounts with the following holdings:

| Account | Eligible Shares | Unallocated Shares |

| A | 200 | 200 |

| B | 100 | 100 |

| C | 100 | 100 |

| D | 50 | 50 |

An election for 50% of the shares is submitted to tender shares to an offer. The allocation will be applied as follows:

| Account | Eligible Shares | Unallocated Shares | Allocated Shares |

| A | 200 | 100 | 100 |

| B | 100 | 50 | 50 |

| C | 100 | 50 | 50 |

| D | 50 | 25 | 25 |

Can both methods be used on the same voluntary offer?

Yes. Both allocation methods may be used on the same offer. This will allow a user to easily allocate a percentage of all shares plus all eligible shares for a specific account.

If I submit an account specific election and a percentage allocation for all accounts, how will the election be made?

Percentage allocations are posted only to the eligible, unallocated share quantities. Therefore both the specific and percentage allocations will be allocated.

Assume there are four sub-accounts with the following holdings:

| Account | Eligible Shares | Unallocated Shares |

| A | 200 | 200 |

| B | 100 | 100 |

| C | 100 | 100 |

| D | 50 | 50 |

If an election is made to tender 50 shares in Account A the elections will be as follows:

| Account | Eligible Shares | Unallocated Shares | Allocated Shares |

| A | 200 | 150 | 50 |

| B | 100 | 100 | 100 |

| C | 100 | 100 | 100 |

| D | 50 | 50 | 50 |

If an election is then made to allocate 50% of ALL remaining shares, the elections will be as follows:

| Account | Eligible Shares | Unallocated Shares | Allocated Shares |

| A | 200 | 75 | 125 (50 + 75) |

| B | 100 | 50 | 50 |

| C | 100 | 50 | 50 |

| D | 50 | 25 | 25 |

How will fractional shares be treated as a result of using a percentage allocation?

If the election quantity is a fractional share as a result of the percentage allocation, then the fractional share will be truncated and submitted to the default allocation.

Assume there are 3 sub-accounts with the following holdings

| Account | Eligible Shares | Unallocated Shares |

| A | 100 | 100 |

| B | 100 | 100 |

| C | 75 | 75 |

If an election of 50% is submitted, each account will have 50% of the eligible, unallocated shares elected on.

| Account | Eligible Shares | Unallocated Shares | Allocated Shares |

| A | 100 | 50 | 50 |

| B | 100 | 50 | 50 |

| C | 75 | 38 | 37 (37.5 truncated to 37) |

Does it matter the order in which I allocate to the accounts?

If a user first allocates positions as a percentage using the All Accounts function and then selects an individual account, the user may override the percentage allocation for the individual account. In this manner, a user may elect 50% of all unallocated eligible shares to be allocated and subsequently reduce the election in Account A to fewer than 50% by making a change in the account specific allocation.

How to configure Client Services message delivery and notification

To configure your Message Center preferences:

1. Log in to Client Portal

2. Click the User menu (head and shoulders icon in the top right corner) followed by Secure Message Center.

3. Click on the Preferences (gear) icon next to the Compose button.

4. The message Preferences window will appear

5. Select a Primary and Secondary Preferred Language for messages using the drop-downs

6. Select your preferred delivery options in the Secure Message Delivery section.

7. Click SAVE to save your changes.

Please note, for security reasons, it is not possible to receive the entire message via E-mail or SMS/Text Message. It is only possible to receive a summary of the notification via E-mail or SMS/Text Message.

Find more information on Message Center preferences in the Client Portal Users' Guide.

What corporate action services does Interactive Brokers provide?

Interactive Brokers services relating to corporate actions are as follows:

1. The processing of mandatory corporate actions (e.g. prompt dividend recovery, spin-offs, stock splits, effective mergers and etc.) at no extra cost; and

2. Providing, on a best efforts basis, details of corporate action announcements associated with stock and option positions held in your account. These details are provided in the form of a web ticket posted to the Corporate Actions tab of your Message Center. Account holders may also elect to set their preferences so as to receive a copy of such details via email. Information provided includes

- Mandatory offers - general information regarding mandatory offers

- Voluntary offers - eligible account holders may submit elections directly through Account Management

IMPORTANT NOTE:

Interactive Brokers does not provide any guidance, consultation or advice regarding corporate actions to its customers. IB customers are solely responsible for the monitoring of the existence of a corporate action, understanding the rights and terms of any corporate action and providing timely and accurate instructions regarding the handling for any voluntary corporate action.