Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

U.S. Securities Options Exercise Limits

INTRODUCTION

Option exercise limits, along with position limits (See KB1252), have been in place since the inception of standardized trading of U.S. securities options. Their purpose is to prevent manipulative actions in underlying securities (e.g., corners or squeezes) as well as disruptions in option markets where illiquidity in a given option class exists. These limits serve to prohibit an account, along with its related accounts, from cumulatively exercising within any five consecutive business day period, a number of options contracts in excess of the defined limit for a given equity options class (i.e., option contracts associated with a particular underlying security). This includes both early exercises and expiration exercises.

OVERVIEW

U.S. securities option exercise limits are established by FINRA and the U.S. options exchanges. The exercise limits are generally the same as position limits and they can vary by option class as they take into consideration factors such as the number of shares outstanding and trading volume of the underlying security. Limits are also subject to adjustment and therefore can vary over time. The Options Clearing Corporation (OCC), the central clearinghouse for U.S. exchange traded securities options, publishes a daily file with these limits on its public website. The link is as follows: http://www.optionsclearing.com/webapps/position-limits. FINRA Rule 2360(b)(4) addresses exercise limits and can be found via the following website link: http://finra.complinet.com/en/display/display.html?rbid=2403&record_id=16126&element_id=6306&highlight=2360#r16126).

Note that exercise limits are applied based upon the the side of the market represented by the option position. Accordingly, all exercises of call options over the past five business days are aggregated for purposes of determining the limit for the purposes of purchasing the underlying security. Similarly, a separate computation whereby all put exercises over the past five business days are aggregated is required for purposes of determining sales of the underlying.

IMPORTANT INFORMATION

It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. This is because exercise limits are cumulative and one could conceivably purchase options up to the position limit, exercise those options and purchase additional options which, if allowed to be exercised within the five business day window, would exceed the limit.

Account holders are responsible for monitoring their cumulative options exercises as well as the exercise limit quantities to ensure compliance. In addition, IB reserves the right to prohibit the exercise of any options, regardless of their intrinsic value or remaining maturity, if the effect of that exercise would be to violate the exercise limit rule.

Liquidaciones relacionadas con vencimiento

Además de la política de liquidación forzosa de posiciones de clientes en caso de una deficiencia de margen en tiempo real, IB también liquidará posiciones con base en ciertos eventos relacionados con el vencimiento, los cuales crearían preocupaciones operativas o riesgo innecesarios. Ejemplos de estos eventos se indican a continuación.

Ejercicio de opciones

IB se reserva el derecho de prohibir el ejercicio de opciones sobre acciones o cerrar opciones cortas si el efecto del ejercicio/asignación fuera que la cuenta entrará en déficit de margen. Aunque la compra de una opción generalmente no requiere margen ya que la posición está pagada por completo, una vez ejercitada, el titular de la cuenta está obligado a pagar por completo la consiguiente posición larga en acciones (en caso de una cuenta Efectivo o acciones sujetas a margen 100%) o a financiar la posición larga/corta en acciones (en caso de una call/put ejercitada en una cuenta margen). Las cuentas que no tienen suficiente liquidez antes del ejercicio introducen un riesgo innecesario en caso de que se produjera un cambio de precio adverso en el subyacente a la entrega. Este riesgo sin cobertura puede ser especialmente pronunciado y puede exceder en gran medida cualquier valor en dinero que la opción larga pudiera haber tenido, en concreto al vencimiento, cuando las cámaras de compensación ejercitan las opciones automáticamente a niveles en dinero tan bajos como 0.01 USD por acción.

Tomemos, por ejemplo, una cuenta cuya liquidez el Día 1 consista exclusivamente de 20 opciones call largas a precio de ejercicio de 50 USD sobre una acción hipotética XYZ, la cual ha cerrado al vencimiento a 1 USD por contrato con el subyacente a 51 USD. En el Escenario 1, se asume que las opciones son todas autoejercitadas y que XYZ abre a 51 USD en el Día 2. En el Escenario 2, se asume que las opciones son todas autoejercitadas y que XYZ abre a 48 USD en el Día 2.

| Saldo de cuenta | Prevencimiento |

Escenario 1 - XYZ abre @ $51 |

Escenario 2 - XYZ abre a @ $48 |

| Efectivo |

$0.00 | ($100,000.00) | ($100,000.00) |

| Acciones largas |

$0.00 | $102,000.00 | $96,000.00 |

|

Opción larga* |

$2,000.00 | $0.00 | $0.00 |

| Liquidez de liquidación neta/(Déficit) | $2,000.00 | $2,000.00 | ($4,000.00) |

| Requisito de margen |

$0.00 | $25,500.00 | $25,500.00 |

| Exceso de margen/(Deficiencia) | $0.00 | ($23,500.00) | ($29,500.00) |

*La opción larga no tiene valor de préstamo.

Como protección frente a estos escenarios tal y como se aproxima el vencimiento, IB simulará el efecto de vencimiento asumiendo posibles escenarios de precio de subyacentes y evaluando la exposición de cada cuenta según la entrega de acciones. Si se considera que la exposición es excesiva, IB se reserva el derecho a: 1) liquidar opciones antes del vencimiento; 2) permitir que las opciones caduquen; o 3) permitir la entrega y liquidar el subyacente inmediatamente después. Además, podría restringirse a la cuenta la apertura de nuevas posiciones para evitar un aumento de exposición.

IB también se reserva el derecho de liquidar posiciones en la tarde previa a la liquidación si los sistemas de IB proyectan que el efecto de la liquidación tendría como resultado un déficit de margen. Como protección frente a estos escenarios, tal y como se aproxima el vencimiento, IB simulará el efecto del vencimiento asumiendo escenarios posibles de precio de subyacente y evaluando la exposición de cada cuenta tras la liquidación. Por ejemplo, si IB proyecta que las posiciones se eliminen de la cuenta como resultado de la liquidación (por ejemplo, si las opciones vencieran fuera de dinero o si las opciones liquidadas en efectivo vencieran en dinero) los sistemas de IB evaluarán el efecto del margen en dichos eventos de liquidación.

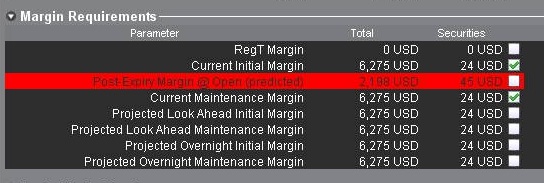

Si IB determina que la exposición es excesiva, puede liquidar posiciones en la cuenta para resolver la deficiencia de margen proyectada. Los titulares de cuenta pueden monitorizar esta exposición de margen relacionada con el vencimiento a través de la ventana Cuenta, que se encuentra en la TWS. El exceso de margen proyectado se mostrará en la línea "Margen postvencimiento" (ver abajo) la cual, si es negativa y está destacada en rojo, indica que su cuenta puede estar sujeta a liquidaciones de posiciones forzadas. Este cálculo de exposición se realiza 3 días antes del próximo vencimiento y se actualiza aproximadamente cada 15 minutos. Tenga en cuenta que ciertos tipos de cuenta que emplean una estructura jerárquica (por ejemplo, cuenta Límite de Negociación Independiente) solo tendrán esta información presentada a nivel de cuenta maestra, en donde se agregan los cálculos.

Tenga en cuenta que IB generalmente inicia liquidaciones relacionas con vencimientos 2 horas antes del cierre, pero se reserva el derecho a comenzar este proceso antes o después si lo requirieran las condiciones. Además, las liquidaciones se priorizan basadas en un número de criterios específicos de cuenta, que incluyen el Valor de Liquidación Neto, déficit postvencimiento proyectado y la relación entre el precio de ejercicio de la opción y el subyacente.

Futuros con entrega física

Con la excepción de ciertos contratos de futuros que tienen divisas como subyacentes, IB generalmente no permite que sus clientes hagan o reciban la entrega del subyacente para futuros liquidados físicamente o para contratos de opciones sobre futuros. Para evitar entregas de un contrato que venza, los clientes deben renovar el contrato o cerrar la posición antes de la fecha límite de cierre específica para ese contrato (puede consultarse una lista de estos en la página web, en las opciones de menú Negociación y luego Entrega, Ejercicio y Acciones).

Tenga en cuenta que es responsabilidad del cliente conocer la fecha límite de cierre y que los contratos con entrega física que no se hayan cerrado dentro del tiempo específico pueden ser liquidados por IB sin notificación previa.

Productos estructurados: enlaces de emisores

Pueden verse detalles importantes respecto a los términos y condiciones de los productos estructurados en las páginas web relevantes de los emisores. Los mercados indicados también proporcionan detalles y análisis de productos. Sin embargo, tenga en cuenta que solo puede contarse con las páginas web de los emisores para consultar detalles actualizados, así como los términos y condiciones relevantes y otro tipo de documentación legal.

Abajo se indican los enlaces a las páginas web de los mercados y emisores.

Enlaces a las páginas web de productos estructurados

Mercados

| Euronext |

http://www.euronext.com/trader/priceslists/newpriceslistswarrants-1812-E...

|

| Scoach Alemania |

http://www.scoach.de/EN/Showpage.aspx?pageID=8

|

| Scoach Suiza |

http://scoach.ch/EN/Showpage.aspx?pageID=8

|

| Bolsa de Stuttgart |

https://www.boerse-stuttgart.de/en/

|

Emisores (sitios mundiales)

| Barclays |

http://www.bmarkets.com/home.app

|

| BNP Paribas |

http://warrants.bnpparibas.com/

|

| CITI |

http://www.citiwarrants.com/EN/index.asp?pageid=31

|

| Commerzbank |

http://warrants.commerzbank.com/

|

| Credit Suisse |

https://derivative.credit-suisse.com/index.cfm?nav=jumper&CFID=10909284&...

|

| Deutsche Bank |

http://www.x-markets.db.com/EN/showpage.asp?pageid=33&blredirect=0

|

| Goldman Sachs |

http://www2.goldmansachs.com/services/investing/securitised-derivatives/...

|

| ING |

https://www.ingfm.com/spg/spg/shownews.do

|

| JP Morgan |

http://www.jpmorgansp.com/welcome/flash.html

|

| Macquarie Oppenheim |

http://www.macquarie-oppenheim.com/

|

| Merrill Lynch |

http://www.merrillinvest.ml.com/

|

| Morgan Stanley |

http://www.morganstanleyiq.com/showpage.asp

|

| Natixis |

http://www.natixis-direct.com/EN/showpage.asp?pageid=151

|

| Rabobank |

http://www.raboglobalmarkets.com/

|

| RBS |

http://markets.rbs.com/EN/Showpage.aspx?pageID=58

|

| Societe Generale |

|

| UBS |

|

| Zurcher Kantonalbank |

https://zkb.is-teledata.ch/html/search/simple/index.html

|

Emisores (sitios locales)

Consideraciones para ejercitar opciones call antes del vencimiento

INTRODUCCIÓN

El ejercicio de una opción call antes del vencimiento no proporciona, normalmente, un beneficio económico, ya que:

- Tiene como resultado la pérdida de cualquier valor temporal de la opción que quede;

- Requiere una mayor inversión de capital para el pago o financiación de la entrega de acciones; y

- Puede exponer al titular de la opción a un mayor riesgo de pérdida sobre la acción en relación con la prima de la opción.

Aún así, para titulares de cuenta que tengan la capacidad de cumplir los requisitos de préstamo o de aumento de capital y de hacer frente a un riesgo potencialmente mayor de caída del mercado, puede ser económicamente beneficioso solicitar un ejercicio temprano de una opción call de tipo americano para capturar un próximo dividendo.

TRASFONDO

Como trasfondo, el titular de una opción call no tiene derecho a recibir un dividendo de la acción subyacente ya que este dividendo solo se devenga para los titulares de acciones en la fecha de cierre de registro de su dividendo. En igualdad de condiciones, el precio de la acción debería decaer en una cantidad igual al dividendo en la fecha ExDividendo. Aunque la teoría del precio de opciones sugiere que el precio call reflejará el valor descontado de los dividendos esperados pagados durante su duración, es posible que decline en la fecha exdividendo. Las condiciones que convierten este escenario en más probable y que hacen más favorable la decisión de un ejercicio temprano son las siguientes:

1. La opción está muy en dinero y tiene una delta de 100;

2. La opción no tiene valor temporal o tiene muy poco;

3. El dividendo es relativamente elevado y su fecha ex precede a la fecha de vencimiento de la opción.

EJEMPLOS

Para ilustrar el impacto de estas condiciones sobre una decisión de ejercicio temprano, consideremos una cuenta que mantenga un saldo en efectivo largo de 9,000 USD y una posición de call larga en un valor hipotético “ABC”, con un precio de ejecución de 90.00 USD y un tiempo hasta vencimiento de 10 días. ABC, que actualmente opera a 100.00 USD, ha declarado un dividendo de 2.00 USD por acción, siendo mañana la fecha exdividendo. También asumiremos que el precio de opción y el precio de acción se comportan de forma similar y declinan según la cantidad de dividendo en la fecha ex.

Aquí, revisaremos la decisión de ejercicio con la intención de mantener la posición de delta de 100 y maximizar la liquidez total mediante dos asunciones de precio de opción; una en la que la opción se vende a la par y otra sobre la par.

ESCENARIO 1: precio de opción a la par - 10.00 USD

En el caso de una opción que opere a la par, el ejercicio temprano servirá para mantener la delta de la posición y evitar la pérdida de valor en la opción larga cuando la acción opere exdividendo. Aquí, el producto en efectivo se aplica en su totalidad a la compra de la acción al precio de ejercicio, la prima de la opción se pierde y la acción, neta de dividendo, y el dividendo pendiente de pago se acreditan en la cuenta. Si busca el mismo resultado al vender la opción antes de la fecha ex dividendo y comprar la acción, recuerde que debe factorizar las comisiones/diferenciales:

| ESCENARIO 1 | ||||

|

Componentes de cuenta |

Saldo inicial |

Ejercicio temprano |

No actuar |

Vender opción y comprar acción |

| Efectivo | $9,000 | $0 | $9,000 | $0 |

| Opción | $1,000 | $0 | $800 | $0 |

| Acción | $0 | $9,800 | $0 | $9,800 |

| Dividendo por cobrar | $0 | $200 | $0 | $200 |

| Liquidez total | $10,000 | $10,000 | $9,800 | $10,000 menos comisiones/diferenciales |

ESCENARIO 2: precio de opción sobre la par - 11.00 USD

En el caso de una opción que opere sobre la par, el ejercicio temprano para capturar el dividendo podría no ser económicamente beneficioso. En este escenario, el ejercicio temprano tendría como resultado una pérdida de 100 USD en valor temporal de la acción, mientras que la venta de la opción y la compra de la acción, después de pagar comisiones, podría ser menos beneficiosa que no realizar ninguna acción. En este escenario, la acción preferible habría sido No actuar.

| ESCENARIO 2 | ||||

|

Componentes de cuenta |

Saldo inicial |

Ejercicio temprano |

No actuar |

Vender opción y comprar acción |

| Efectivo | $9,000 | $0 | $9,000 | $100 |

| Opción | $1,100 | $0 | $1,100 | $0 |

| Acción | $0 | $9,800 | $0 | $9,800 |

| Dividendo pendiente de pago | $0 | $200 | $0 | $200 |

| Liquidez total | $10,100 | $10,000 | $10,100 | $10,100 menos comisiones/diferenciales |

![]() NOTA: los titulares de cuenta que mantengan una posición call larga como parte de un diferencial deberían prestar particular atención al riesgo de no ejercitar el tramo largo dada la posibilidad de que se asigne en el tramo corto. Hay que tener en cuenta que la asignación de una opción call corta tiene como resultado una posición corta en acciones y los titulares de posiciones cortas en acciones en la fecha de registro del dividendo están obligados a pagar el dividendo al prestador de las acciones. Además, el ciclo de procesamiento de la cámara de contratación para notificaciones de ejercicio no acepta entregas de notificaciones de ejercicio como respuesta a la asignación.

NOTA: los titulares de cuenta que mantengan una posición call larga como parte de un diferencial deberían prestar particular atención al riesgo de no ejercitar el tramo largo dada la posibilidad de que se asigne en el tramo corto. Hay que tener en cuenta que la asignación de una opción call corta tiene como resultado una posición corta en acciones y los titulares de posiciones cortas en acciones en la fecha de registro del dividendo están obligados a pagar el dividendo al prestador de las acciones. Además, el ciclo de procesamiento de la cámara de contratación para notificaciones de ejercicio no acepta entregas de notificaciones de ejercicio como respuesta a la asignación.

Como ejemplo, consideremos un diferencial de opción call de crédito (bajista) para SPDR S&P 500 ETF Trust (SPY) que consista en 100 contratos cortos al precio de ejercicio de 146 USD en marzo de 2013 y 100 contratos largos al precio de ejercicio de 147 USD en marzo de 2013. El 14 de marzo de 2013, el SPY Trust declaró un dividendo de 0.69372 USD por acción, pagadero el 30 de abril de 2013 a los accionistas registrados a fecha del 19 de marzo de 2013. Dado el periodo de tres días hábiles para la liquidación para acciones estadounidenses, habría que haber comprado la acción el 14 de marzo de 2013 a más tardar, para recibir el dividendo, ya que al día siguiente la acción empezó a operar exdividendo.

El 14 de marzo de 2013, con un día de negociación previo al vencimiento, los dos contratos de opciones operaron a la par, lo que sugiere el riesgo máximo de 100 USD por contrato o 10,000 USD en la posición de100 contratos. Sin embargo, el no ejercitar el contrato largo para capturar el dividendo y protegerse frente a la probable asignación de los contratos cortos por parte de aquellos que buscaran el dividendo creó un riesgo adicional de 67.372 USD por contrato o 6,737.20 USD en la posición que represente la obligación de dividendo una vez asignadas todas las call cortas. Como se ve en la tabla siguiente, si el tramo de la opción corta no se hubiera asignado, el riesgo máximo cuando se determinaron los precios de liquidación del contrato final el 15 de marzo de 2013 habría permanecido en 100 USD por contrato.

| Fecha | Cierre SPY | Marzo '13, $146 Call | Marzo '13, $147 Call |

| 14 de marzo, 2013 | $156.73 | $10.73 | $9.83 |

| 15 de marzo, 2013 | $155.83 | $9.73 | $8.83 |

Por favor, tenga en cuenta que si su cuenta está sujeta a requisitos de retenciones fiscales bajo la norma 871(m) del Tesoro estadounidense, podría ser beneficioso cerrar una posición larga en opciones antes de la fecha exdividendo y reabrir la posición después de la fecha exdividendo.

Para más información sobre cómo enviar una notificación de ejercicio temprano, por favor haga clic aquí.

El artículo anterior se proporciona solo con propósitos informativos, y no se considera una recomendación, consejos operativos ni constituye una conclusión de que el ejercicio temprano tendrá éxito o será adecuado para todos los cliente so todas las operaciones. Los titulares de cuenta deberían consultar con un especialista fiscal para determinar las consecuencias fiscales, si las hubiere, de un ejercicio temprano y deberían prestar particular atención a los riesgos potenciales de sustituir una posición en opciones larga por una posición en acciones corta.

"EMIR": Reporting to Trade Repository Obligations and Interactive Brokers Delegated Service to help meet your obligations

Determining Tick Value

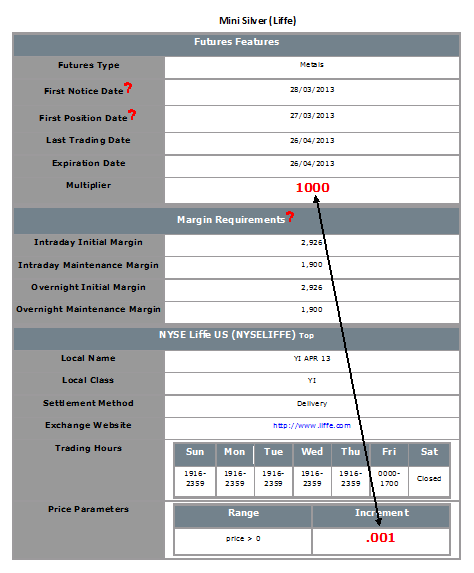

Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Tick values vary by instrument and are determined by the listing exchange. IB provides this information directly from the Contract Search tool on the website or via the Trader Workstation (TWS). To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. The contract specifications window for the instrument will then be displayed (Exhibit 1).

To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. As illustrated in the example below, the LIFFE Mini Silver futures contact has a tick value or minimum increment of .001 which, when multiplied by the contract multiplier of 1,000 ounces, results in a minimum tick value of $1.00 per contract. Accordingly, every tick change up or down results in a profit or loss of $1.00 per LIFFE Mini Silver futures contract.

Exhibit 1

Considerations for Exercising Call Options Prior to Expiration

INTRODUCTION

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:

- It results in a forfeiture of any remaining option time value;

- Requires a greater commitment of capital for the payment or financing of the stock delivery; and

- May expose the option holder to greater risk of loss on the stock relative to the option premium.

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

BACKGROUND

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:

1. The option is deep-in-the-money and has a delta of 100;

2. The option has little or no time value;

3. The dividend is relatively high and its Ex-Date precedes the option expiration date.

EXAMPLES

To illustrate the impact of these conditions upon the early exercise decision, consider an account maintaining a long cash balance of $9,000 and a long call position in hypothetical stock “ABC” having a strike price of $90.00 and time to expiration of 10 days. ABC, currently trading at $100.00, has declared a dividend of $2.00 per share with tomorrow being the Ex-Dividend date. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date.

Here, we will review the exercise decision with the intent of maintaining the 100 share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

SCENARIO 1: Option Price At Parity - $10.00

In the case of an option trading at parity, early exercise will serve to maintain the position delta and avoid the loss of value in long option when the stock trades ex-dividend, to preserve equity. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock (net of dividend) and dividend receivable are credited to the account. If you aim for the same end result by selling the option prior to the Ex-Dividend date and purchasing the stock, remember to factor in commissions/spreads:

| SCENARIO 1 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $0 |

| Option | $1,000 | $0 | $800 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,000 | $10,000 | $9,800 | $10,000 less commissions/spreads |

SCENARIO 2: Option Price Above Parity - $11.00

In the case of an option trading above parity, early exercise to capture the dividend may not be economically beneficial. In this scenario, early exercise would result in a loss of $100 in option time value, while selling the option and buying the stock, after commissions, may be less beneficial than taking no action. In this scenario, the preferable action would be No Action.

| SCENARIO 2 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $100 |

| Option | $1,100 | $0 | $1,100 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,100 | $10,000 | $10,100 | $10,100 less commissions/spreads |

![]() NOTE:

NOTE:

Options have two components that make up their total premium value - intrinsic value and time value. The intrinsic value is the amount by which the option is in-the-money, while the time value represents the possibility that the option could become even more profitable before expiration as the underlying asset price fluctuates while providing protection against adverse moves.

Many options are American-style, which means they can be exercised early, ahead of their expiration date. Early exercise of an option eliminates the remaining time value component from the option's premium, since the option holder loses protection against unfavorable movements in the underlying asset’s price.

This makes early exercise suboptimal in most situations, as the option holder is willingly forfeiting a portion of the option's value.

There are a few specific circumstances where early exercise could make sense, such as:

- For call options on a stock that will pay dividends soon, where the dividend amount exceeds the remaining time value (and only if the exercise will settle on or prior to the record date for the dividend).

- For deep in-the-money options where the time value is negligible compared to the intrinsic value, and the option is expected to drop in value due to interest rate effects (PUTS), or expected stock loan benefits (CALLS).

The first case, exercising an in the money call immediately ahead of a dividend payment, is the most common economically-sensible early exercise. In most cases, it is advisable to hold or sell the option instead of exercising it early, in order to capture the remaining time value. An option should only be exercised early after carefully considering all factors and determining that the benefits of early exercise outweigh the time value being surrendered.

Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

As example, consider a credit call (bear) spread on the SPDR S&P 500 ETF Trust (SPY) consisting of 100 short contracts in the March '13 $146 strike and 100 long contracts in the March '13 $147 strike. On 3/14/13, with the SPY Trust declared a dividend of $0.69372 per share, payable 4/30/13 to shareholders of record as of 3/19/13. Given the 3 business day settlement time frame for U.S. stocks, one would have had to buy the stock or exercise the call no later than 3/14/13 in order receive the dividend, as the next day the stock began trading Ex-Dividend.

On 3/14/13, with one trading day left prior to expiration, the two option contracts traded at parity, suggesting maximum risk of $100 per contract or $10,000 on the 100 contract position. However, the failure to exercise the long contract in order to capture the dividend and protect against the likely assignment on the short contracts by others seeking the dividend created an additional risk of $67.372 per contract or $6,737.20 on the position representing the dividend obligation were all short calls assigned. As reflected on the table below, had the short option leg not been assigned, the maximum risk when the final contract settlement prices were determined on 3/15/13 would have remained at $100 per contract.

| Date | SPY Close | March '13 $146 Call | March '13 $147 Call |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

Please note that if your account is subject to tax withholding requirements of the US Treasure rule 871(m), it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.

Why Do Commission Charges on U.S. Options Vary?

IBKR's option commission charge consists of two parts:

1. The execution fee which accrues to IBKR. For Smart Routed orders this fee is set at $0.65 per contract, reduced to as low as $0.15 per contract for orders in excess of 100,000 contracts in a given month (see website for costs on Direct Routed orders, reduced rates on low premium options and minimum order charges); and

2. Third party exchange, regulatory and/or transaction fees.

In the case of third party fees, certain U.S. option exchanges maintain a liquidity fee/rebate structure which, when aggregated with the IBKR execution fee and any other regulatory and/or transaction fees, may result in an overall per contract commission charge that varies from one order to another. This is attributable to the exchange portion of the calculation, the result of which may be a payment to the customer rather than a fee, and which depends upon a number of factors outside of IBKR's control including the customer's order attributes and the prevailing bid-ask quotes.

Exchanges which operate under this liquidity fee/rebate model charge a fee for orders which serve to remove liquidity (i.e., marketable orders) and provide a credit for orders which add liquidity (i.e., limit orders which are not marketable). Fees can vary by exchange, customer type (e.g., public, broker-dealer, firm, market maker, professional), and option underlying with public customer rebates (credits) generally ranging from $0.10 - $0.90 and public customer fees from $0.01 - $0.95.

IBKR is obligated to route marketable option orders to the exchange providing the best execution price and the Smart Router takes into consideration liquidity removal fees when determining which exchange to route the order to when the inside market is shared by multiple (i.e., will route the order to the exchange with the lowest or no fee). Accordingly, the Smart Router will only route a market order to an exchange which charges a higher fee if they can better the market by at least $0.01 (which, given the standard option multiplier of 100 would result in price improvement of $1.00 which is greater than the largest liquidity removal fee).

For additional information on the concept of adding/removing liquidity, including examples, please refer to KB201.